- Home

- »

- Advanced Interior Materials

- »

-

Electric AC Motors Market Size, Share, Industry Report, 2030GVR Report cover

![Electric AC Motors Market Size, Share & Trends Report]()

Electric AC Motors Market (2024 - 2030) Size, Share & Trends Analysis Report By Type (Synchronous AC Motor, Induction AC Motor), By Power Output (Integral HP Output, Fractional HP Output), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-2-68038-241-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric AC Motors Market Size & Trends

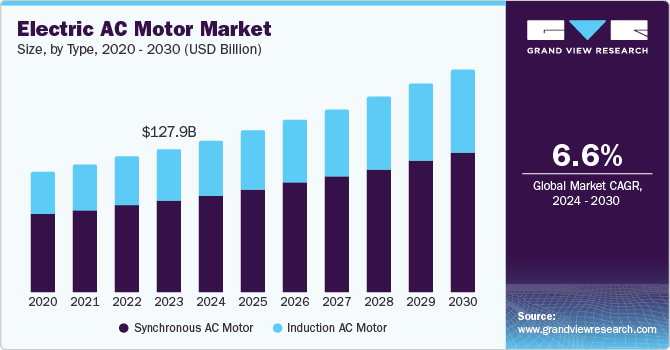

The global electric AC motors market size was valued at USD 127.9 billion in 2023 and is projected to grow at a CAGR of 6.6% from 2024 to 2030.The increasing demand for HVAC equipment is projected to drive the electric AC motors market over the forecast period. The growing acceptance of electric cars, automation, industrial equipment such as conveyor belts and fixed cranes has increased the demand for efficient AC motors. Furthermore, advancements in technologies and increasing industrial applications in developing countries are anticipated to propel market growth. Innovations in motor technologies, such as smart motors with IoT integration, and government initiatives promoting green energy are also contributing to the market expansion.

The adoption of electric AC motors in household appliances is anticipated to drive market growth. Increasing energy conservation consciousness among the purchasers and their increasing requirement for energy-saving products, including washing machines, fridges, and air conditioning systems, contribute to the popular demand for electric AC motors. Manufacturers are developing motors that use less power yet produce high output to save on energy consumption. This trend is generally seen in the developed regions, where energy efficiency standards are being implemented, thus putting pressure on manufacturers to utilize efficient AC motor technologies and adopt promotional strategies. Thereby positively impacting the growth of the market over the forecast period. For instance, ABB introduced a new package for electric buses, which includes the AMXE250 motor and HES580 inverter. The latest propulsion system, created to operate together for a better, more dependable, and easily accessible solution for the sector, representing a major step towards cleaner, more sustainable transportation choices.

Furthermore, higher demand for electric AC motors in renewable power solutions, including wind mills and solar power stations, is generally observed in recent times. As the world is moving towards the use of renewable energy sources and requires motors that work under diverse conditions and generate power efficiently. Additionally, electric AC motors are also used in smart grids where they play a crucial role in managing the load and supply in order to maintain stability. Advanced features of digital technologies such as IoT and AI are being incorporated into AC motors, making them smart and allowing efficient predictive maintenance. Such advancements in technology are enhancing the prospects of electric AC motors in the global market to appeal to several industries. Thereby boosting the growth of the electric AC motor market positively.

Type Insights

Induction AC motor dominated the market and accounted for a market share of 64.0% in 2023 attributed to their robustness, cost-effectiveness, and low maintenance requirements. Their simple design and reliability make them highly suitable for a wide range of industrial applications, from manufacturing to transportation. Additionally, the growing demand for energy-efficient solutions and advancements in motor technologies, such as variable frequency drives (VFDs), have further propelled the adoption of induction AC motors globally, which has impacted the growth of the market positively.

Synchronous AC motor is expected to grow at a significant rate of 7.2% CAGR during the forecast period owing to their high efficiency and precise control of speed and position, making them ideal for applications requiring consistent performance, such as robotics and automation. In addition, increasing adoption of renewable energy sources, where synchronous motors are used in wind turbines and hydroelectric generators, is anticipated to drive the market growth. Furthermore, technological advancements, such as the integration of smart motor technologies and IoT capabilities, enhance their functionality and appeal, contributing to their rising demand in various industries. Thereby boosting the electric AC motor market over the forecast period.

Power Output Insights

The Fractional HP output segment dominated the market and accounted for a market share of 84.9% in 2023 attributed to the increasing demand for compact and efficient motors in consumer electronics and household appliances. Their widespread use in applications such as fans, pumps, and compressors in residential and commercial settings drives this segmental growth. Additionally, the trend towards energy efficiency in electronics and appliances further boosts the adoption of fractional HP motors, as they provide the necessary power while maintaining low energy consumption and space efficiency.

The Integral HP output segment is projected to grow at a CAGR of 7.5% over the forecast period owing to the rising demand for high-power motors in industrial and heavy-duty applications, such as manufacturing, mining, and construction. Additionally, the ongoing industrial automation trend requires robust and powerful motors to enhance production efficiency and reliability. Furthermore, advancements in motor technologies, including the integration of IoT and AI for predictive maintenance and improved performance, further contribute to the growing adoption of integral HP motors in various industries.

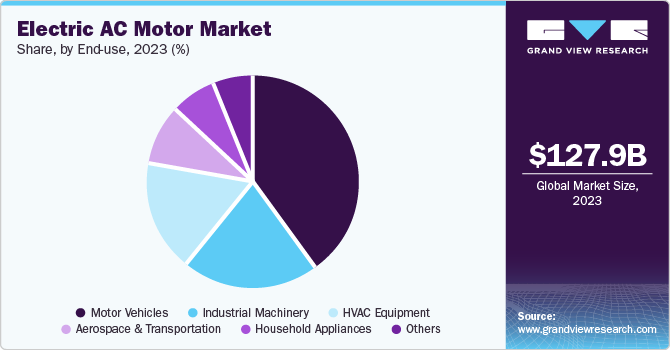

End Use Insights

The motor vehicles segment dominated the market and accounted for a market share of 39.9% in 2023 attributed to the rapid expansion of the electric vehicle (EV) market, which relies heavily on electric AC motors. Additionally, increasing consumer demand for eco-friendly transportation solutions, coupled with stringent government regulations on emissions, has accelerated the adoption of EVs globally. Furthermore, advancements in motor efficiency and battery technology, and significant investments by automotive manufacturers in electric mobility, is anticipated to further propel the market growth in this segment.

The HVAC equipment segment is projected to grow at a CAGR of 7.3% over the forecast period attributed to the increasing need for energy-efficient heating, ventilation, and air conditioning systems in residential, commercial, and industrial buildings. In addition, growing urbanization and infrastructure development, particularly in emerging economies, are boosting the demand for modern HVAC systems. Furthermore, technological advancements in smart HVAC solutions, which integrate AC motors for enhanced performance and energy savings is anticipated to further drive the market growth.

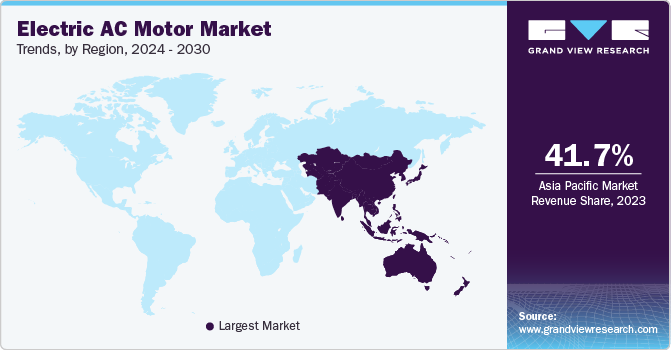

Regional Insights

Asia Pacific electric AC motors dominated the global electric AC motor market share 41.7% in 2023 pertaining to the rapid technological development and urbanization throughout the region, which have led to the exploration of various applications of AC devices. Additionally, government policies promoting energy efficiency have created favorable conditions for these devices, which are known for their low power consumption. Furthermore, the presence of several leading AC equipment manufacturers in the region has created a competitive environment for innovation and cost-effectiveness. These combined forces have made Asia Pacific a dominant player in the global electrical AC motor market.

China electric AC motor market dominated the global electric AC motor market with a share of 13.6% in 2023 owing to the factors such as China’s rising young population and a strong export sector with a potential consumer base. The promotional strategies adopted by market players have played a major role in driving the market growth over the forecast period. For instance, in July 2023, Volkswagen announced it would invest USD 700 million in Chinese EV maker Xpeng to boost sluggish sales.

Europe Electric AC Motors Market Trends

Europe electric AC motors market was identified as a lucrative region in 2023. This surge was fueled by stringent emission regulations and government incentives aimed at promoting electric vehicles. In addition, Europe's growing focus on renewable energy sources is creating a strong market for energy-efficient technologies, propelling the demand for efficient AC motors across various industries.

The UK electric AC motors market is expected to grow at a significant rate in the coming years. It can be attributed to the development of Industry 4.0, stressing automation and smart manufacturing, growth in AC motors for robotics and automation. Additionally, the world’s surge in demand for energy-efficient types of motors where many service sectors have been investing in recent times. Furthermore, increased governmental spending on health care and other infrastructural programs would drive the demand of AC motors within these sectors.

North America Electric AC Motors Market Trends

North America electric AC motors market is anticipated to witness significant growth in the forecast period due to the increasing demand for electric motors in the electric vehicle (EV’s) market in the region. The governmental strategies to implement energy saving and use of eco-friendly technologies will have a positive impact on AC motors which are more energy efficient than other types of motors. Furthermore, increasing industrialization and use of automatic systems in manufacturing industries, production processes, and other application areas including healthcare is anticipated to drive the market growth.

The U.S. electric AC motor is expected to grow at a significant rate during the forecast period owing to the increasing consciousness among customers about eco-friendly vehicles, particularly electric vehicles. Additionally, the government is offering rewards for adopting electric vehicles (EVs) due to their lack of carbon emissions, which is helping to boost market expansion. The electric motor technology has seen various improvements, including the introduction of superior insulation materials that boost operational efficiency and extend product lifespan, thereby driving market expansion. Furthermore, the market is experiencing growth due to the adoption of promotional initiatives by companies. For instance, In January 2024, the strategic merger of WorldWide Electric with North American Electric, Inc. brings together two top customer-focused companies to enhance the customer experience in the industrial electric motors, motor controls, gear reducers, and generators market.

Key Electric AC Motors Market Company Insights

Some key companies in the global electric AC motors include ABB, TOSHIBA CORPORATION, Siemens, Johnson Electric Holdings Limited., AMETEK, Inc., and others. Vendors in the market are focusing on increasing their customer base to gain a competitive edge in the industry. These companies are growing their market revenue by launching new products, collaborations and adopting various other strategies.

-

ABB is a manufacturer of electric AC motors, known for their reliability and energy efficiency. Their product range includes various types of motors designed for diverse industrial applications. The different types of ABB electric AC motors include Baldor-Reliance Motors, Synchronous Reluctance Motors (SynRM) and others. ABB's electric AC motors are designed to meet the demands of modern industry while promoting energy efficiency and sustainability.

-

Johnson Electric Holdings Limited designes electric motors, actuators, control systems, and flexible interconnects. Their clients spread across various industries such as automotive, medical, industrial sectors, and their products cover literally every application from DC micro motors to motorized systems for vehicles.

Key Electric AC Motors Companies:

The following are the leading companies in the electric AC motors market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- TOSHIBA CORPORATION

- Siemens

- Johnson Electric Holdings Limited.

- Allied Motion, Inc

- Rockwell Automation

- AMETEK, Inc.

Recent Developments

-

In January 2024, Johnson Electric partnered with SUPPLIERASSURANCE to improve the sustainability of their supply chains. This collaboration will enable suppliers to monitor and improve the environment in which they operate, making their entire production environment more environmentally friendly. Johnson Electric is committed to significantly reducing carbon emissions and this partnership is an important step towards achieving that goal.

-

In September 2023, Rockwell Automation and Infinitum entered into an agreement to provide energy-intensive industries with energy-efficient, low-voltage drives and motors. Its purpose is to integrate innovative motor technology from Infinitum with Rockwell Automation’s advanced control systems to improve energy efficiency and sustainability in industries. This joint venture will help reduce industrial consumers’ energy usage significantly which will lead to the growth of renewable practices across this sector.

Electric AC Motors Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 135.7 billion

Revenue forecast in 2030

USD 199.6 billion

Growth Rate

CAGR of 6.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, power output, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, France, Italy, Spain, UK, Japan, China, India, South Korea, Australia, Brazil, Argentina, Saudi Arabia, UAE, South Africa

Key companies profiled

ABB, TOSHIBA CORPORATION, Siemens, Johnson Electric Holdings Limited., Allied Motion, Inc, Rockwell Automation , AMETEK, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

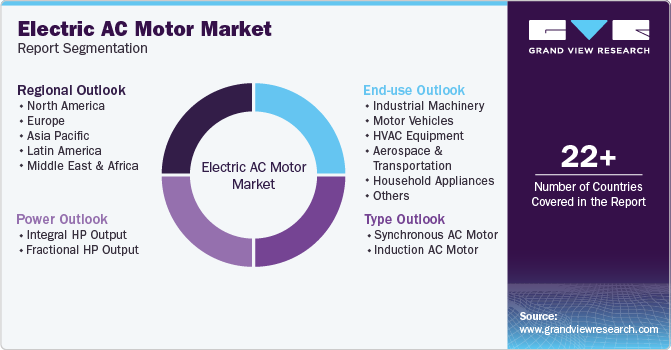

Global Electric AC Motor Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric AC motors market report based on type, power output, end use, and region.

-

Type Outlook (Revenue, USD Billion, 2018 – 2030)

-

Synchronous AC Motor

-

Induction AC Motor

-

-

Power Output Outlook (Revenue, USD Billion, 2018 - 2030)

-

Integral HP Output

-

Fractional HP Output

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Industrial Machinery

-

Motor Vehicles

-

HVAC Equipment

-

Aerospace & Transportation

-

Household Appliances

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

UK

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.