- Home

- »

- Electronic & Electrical

- »

-

Electric Rice Cooker Market Size, Industry Report, 2030GVR Report cover

![Electric Rice Cooker Market Size, Share & Trends Report]()

Electric Rice Cooker Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Standard, Multifunctional, Induction), By Application (Household, Commercial), By Distribution Channel, By Capacity (Small Volume, Medium Volume), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-168-9

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Rice Cooker Market Summary

The global electric rice cooker market size was estimated at USD 1.43 billion in 2023 and is projected to reach USD 4.60 billion by 2030, growing at a CAGR of 17.9% from 2024 to 2030. Growing demand for convenient kitchen appliances and a higher focus on health and dietary awareness driving the market growth.

Key Market Trends & Insights

- Asia Pacific electric rice cooker market dominated the market with a share of 60.5% in 2023.

- Japan electric rice cooker market is anticipated to grow rapidly in the coming years

- By application, the household segment dominated the market in 2023.

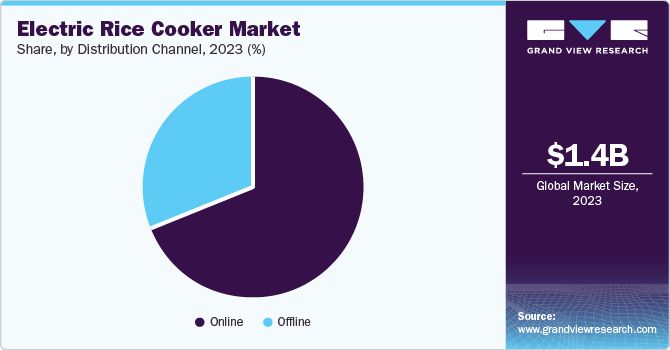

- By distribution channel, the online distribution channel dominated the market in 2023.

Market Size & Forecast

- 2023 Market Size: USD 1.43 Billion

- 2030 Projected Market Size: USD 4.60 Billion

- CAGR (2024-2030): 17.9%

- Asia Pacific: Largest market in 2023

Current lifestyles are becoming hectic, leading individuals to seek time-saving methods for food preparation. Electric rice cookers provide an easy and efficient method of cooking rice without continuous supervision. With the increase in urban migration, smaller living spaces are becoming more common. These home appliances are compact and can be used in small kitchens or apartments.Consumers become more conscious of energy consumption, and energy-efficient rice cookers have become popular. These cookers consume less energy while cooking, emit no greenhouse gases while preparing food, and keep the environment better, appealing to environmentally conscious buyers. Moreover, their advanced insulation and intelligent cooking features contribute to long-term cost savings.

Consumers become more conscious of energy consumption, and energy-efficient rice cookers have become popular. These cookers consume less energy while cooking, emit no greenhouse gases while preparing food, and keep the environment better, appealing to environmentally conscious buyers. Moreover, their advanced insulation and intelligent cooking features contribute to long-term cost savings.

The manufacturers of electric rice cookers are placing more emphasis on technological innovations and research & development of these appliances to expand their product range, enhance product designs, and cater to the variety of requirements of modern consumers. The technologically advanced electric rice cookers come with multiple functionalities such as a touch button on the panel, auto keep warm, timer, multi-function cooking by menu setting, auto safety function, and auto-off functions. These advancements in versatile functions cater to home and professional cooking requirements. Such innovations facilitate the expansion of a broader customer demographic, leading to the market's future development.

Product Insights

The standard electric rice cooker segment dominated the market with a share of 68.2% in 2023. This cooker focuses on simplicity and affordability, which attracts a large consumer base. It is easy to operate and helpful for people with busy schedules. A standard cooker with basic functionalities is energy efficient. Innovation in standard rice cookers, such as auto safety options, auto keep warm options and set-and-forget options, is driving the segment’s growth.

The multifunctional segment is expected to grow with the fastest CAGR of 18.4% during the forecast period. The use of multifunctional electric rice cookers is growing in the market as these cookers provide versatility to the user. It offers multiple functions, such as steaming, simmering soups, slow cooking, and baking. Multifunctional cookers are convenient to use. These cookers are compact and mitigate the need to purchase multiple appliances. Additionally, technological advancements in multifunctional cookers, such as temperature control, automated cooking, and non-stick cooking, are driving the market growth of these cookers.

Application Insights

The household segment dominated the market in 2023. Growing consumer demand for energy-efficient and convenient cooking appliances in the household is expected to drive market growth. Electric rice cookers are time-saving gadgets designed to cater to the needs of busy households. Additionally, electric rice cookers made the food preparation process easy by eliminating the need for constant monitoring, allowing users to focus on other tasks, which drives the market growth.

The commercial segment is expected to register the fastest CAGR over the forecast period. With the busy lifestyle and hectic schedules, people prefer to dine out or get takeout options more often. This factor drives the demand for effective and reliable electric rice cookers in professional kitchens. Additionally, modern electric rice cookers are created with energy-efficient features that attract budget-conscious commercial setups such as restaurants and hotels. The technological advancements in electric rice cookers, such as 3D heating technology for uniform cooking and large capacity models of cookers, enhance the appeal of electric rice cookers for commercial purposes.

Distribution Channel

The online distribution channel dominated the market in 2023. Online distribution channels are becoming popular due to their convenience in purchasing and wider variety. The availability of options such as free home delivery and next-day delivery is further increasing demand for these channels. Various online delivery channels, such as Amazon, Flipkart, Meesho, and others, provide heavy discounts, easy return policies, and EMI options, which drive sales of these appliances through online channels.

The offline distribution channel is projected to grow at the fastest CAGR over the forecast period. The offline distribution channel caters to a diverse customer base, including customers prefer a hand-picked buying experience. Offline channels include physical retail outlets, appliance stores, and supermalls and marts, allowing customers to inspect the product physically before purchasing. Furthermore, in-person assistance and advice from sales representatives help customers make better purchase decisions.

Capacity Insights

The small volume segment dominated the market in 2023. The growing demand for portable and convenient rice cookers among consumers is expected to drive the segment’s growth. This cooker has a capacity of 1 to 3 cups of uncooked rice. It offers efficient rice portions for small families, which attracts customers to purchase small volume rice cookers.

The large volume segment is anticipated to account fastest CAGR during the forecast period. The growing demand for these cookers in commercial use such as restaurants, café, and hotels owing to have a capacity of 5 to 6 liters. These cookers are ideal for big families and the ample capacity offers effortless rice preparation.

Regional Insights

North America electric rice cooker market was identified as a lucrative region in 2023. The rising demographics of Asian communities in the North American region fuel the demand for rice and increase the need for appliances that efficiently cook rice. The innovations in rice cookers are equipped with additional functions beyond cooking rice. Electric rice cookers can steam vegetables, slow cook, and bake items, making them a good purchase for health-conscious customers.

U.S. Electric Rice Cooker Market Trends

The U.S. electric rice cooker market dominated the North America market in 2023 owing to solid retail infrastructure for kitchenware and appliances. This allows easy access to electric rice cookers and promotes brand awareness. America's fast-paced lifestyle drives the need for convenient kitchen solutions such as electric rice cookers.

Europe Electric Rice Cooker Market Trends

Europe electric rice cooker market is anticipated to grow at the fastest rate of CAGR of 18.4% during the forecast period. The growing popularity of ethnic cuisines, specifically Asian cuisines, among European consumers is driving the growth of electric rice cookers in the region. Electric rice cookers offer a convenient and hassle-free method for cooking rice, which resonates with Europeans' hectic lifestyles, further propelling the market growth.

The UK electric rice cooker market is expected to grow rapidly in the coming years due to the rise in the UK's multicultural population, growing interest in Asian cuisine, and the increasing trend of convenient cooking methods are influencing factors.

Asia Pacific Electric Rice Cooker Market Trends

Asia Pacific electric rice cooker market dominated the market with a share of 60.5% in 2023. Rice is the most fundamental part of the diet in many Asian countries such as Japan, China, India, and South Korea. Customers are demanding more features from these appliances. The manufacturers are continuously innovating electric rice cooker appliances such as smart cookers, which are controlled by apps, multifunctional electric cookers, and compact designs of cookers for modern needs. Asia Pacific region has a growing population, and household appliances such as electric cookers have a larger market to grow.

Japan electric rice cooker market is anticipated to grow rapidly in the coming years. Japan has a deeply ingrained rice culture, which leads to a greater demand for good-quality rice cookers. Also, Japan is a technologically advanced nation known for its innovations and features.

Key Electric Rice Cooker Company Insights

Some of the key companies in the electric rice cooker market are Wonderchef Home Appliances Pvt. Ltd, TTK Prestige Ltd., Koninklijke Philips N.V., Breville Pty Ltd, AB Electrolux. Organizations focus on increasing their customer base by innovating and introducing new features. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions and partnerships with other major companies.

-

TTK Prestige Ltd is a manufacturer of kitchen appliances, cookware, and home appliances. It is one of the most trusted and desired brands in the Indian cookware market. They deal in various products such as electric cookers, pressure cookers, gas stoves, mixer grinders, cookware, electric grills, and electric kettles.

-

Wonderchef Home Appliances Pvt. Ltd is an Indian brand that designs and manufactures kitchen products. Wonderchef offers a wide range of kitchen appliances, including pressure cookers, stainless steel pans, non-stick cookware, appliances, cooktops, chimneys, kitchen tools, flasks, bakeware, and more.

Key Electric Rice Cooker Companies:

The following are the leading companies in the electric rice cooker market. These companies collectively hold the largest market share and dictate industry trends.

- TTK Prestige Ltd.

- Wonderchef Home Appliances Pvt. Ltd

- Koninklijke Philips N.V.

- Breville Pty Ltd

- AB Electrolux

- Bajaj Electricals Ltd

- Newell Brands

- Groupe SEB

- Ali Group Worldwide

- Panasonic Corporation

Recent Developments

-

In August 2023, Wonderchef, the famous Indian cookware and high-quality kitchen appliance company, launched its 26th dedicated store in Mumbai, India. By 2025, the company aims to open 50 exclusive stores across the country.

Electric Rice Cooker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.71 billion

Revenue forecast in 2030

USD 4.60 billion

Growth rate

CAGR of 17.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, Application, Distribution Channel, Capacity, Region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, South Africa

Key companies profiled

TTK Prestige Ltd.; Wonderchef Home Appliances Pvt. Ltd; Koninklijke Philips N.V.; Breville Pty Ltd; AB Electrolux; Bajaj Electricals Ltd; Newell Brands; Groupe SEB; Ali Group Worldwide; Panasonic Corporation

Customization scope

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Rice Cooker Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric rice cooker market report based on product, application, distribution channel, capacity, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard

-

Multifunctional

-

Induction

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household

-

Commercial

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Offline

-

Online

-

-

Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Volume

-

Medium Volume

-

Large Volume

-

Extra Large Volume

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

South Africa

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.