- Home

- »

- Automotive & Transportation

- »

-

Electric Vehicle Battery Thermal Management Systems Market Report 2030GVR Report cover

![Electric Vehicle Battery Thermal Management Systems Market Size, Share & Trends Report]()

Electric Vehicle Battery Thermal Management Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By System (Active, Passive), By Application (Passenger Vehicles, Commercial Vehicles), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-876-3

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Battery Thermal Management Systems Market Summary

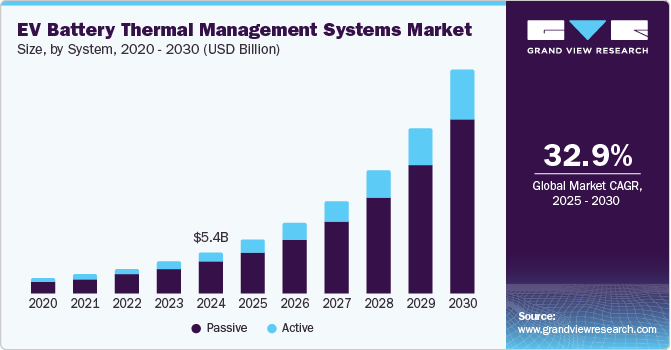

The global electric vehicle battery thermal management systems market size was estimated at USD 5.41 billion in 2024 and is projected to reach USD 29.09 billion by 2030, growing at a CAGR of 32.9% from 2025 to 2030. The substantial growth in popularity and adoption of electric vehicles (EVs) globally has driven the demand for thermal management solutions that can enhance the performance, safety, and lifespan of their batteries.

Key Market Trends & Insights

- Asia Pacific electric vehicle battery thermal management systems market held the largest revenue share of 41.4% globally in 2024.

- Based on system, the passive segment accounted for a dominant revenue share of 78.2% in 2024.

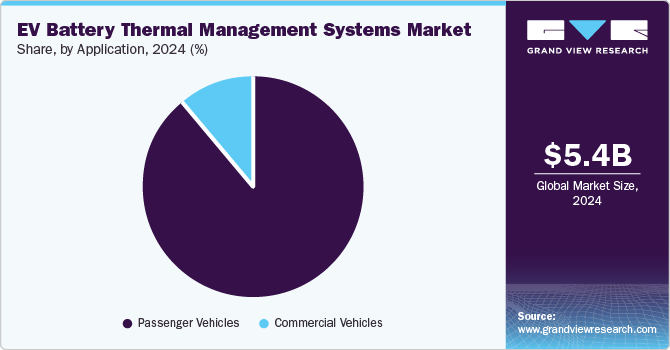

- Based on application, the passenger vehicle segment accounted for a dominant revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 5.41 Billion

- 2030 Projected Market Size: USD 29.09 Billion

- CAGR (2025-2030): 32.9%

- Asia Pacific: Largest market in 2024

An increase in awareness regarding the environmental benefits of EVs has boosted their production, particularly in emerging economies such as India and China, leading to a corresponding growth in manufacturing advanced battery systems. This has led to significant progress in the EV battery thermal management systems industry.

Electric vehicle batteries, especially lithium-ion batteries, perform optimally within a specific temperature range, which is generally around 68-86°F. A battery thermal management system (BTMS) ensures that the battery temperature stays within this range by cooling or heating the battery as required. This helps maintain consistent energy output levels and charging/discharging efficiency, positively impacting the vehicle's driving range and performance. With increasing sales of EVs, the need for efficient and reliable battery thermal management systems has risen significantly to ensure that these vehicles perform optimally in all conditions. According to BloombergNEF (BNEF), electric vehicle sales are expected to reach 16.7 million units in 2024, growing from 13.9 million in 2023. Automakers are moving toward increasing the driving range of EVs, resulting in the development of larger and higher-capacity batteries. Such batteries generate more heat during charging and discharging, creating greater thermal management challenges. This has resulted in a strong demand for active and passive BTM systems.

The growing popularity and implementation of fast-charging networks, which can charge EV batteries rapidly, leads to excessive heat generation in these components. Efficient BTMS solutions are crucial to handle such thermal loads, ensuring safe and quick charging without damaging the battery. Governments across developed economies are implementing fast-charging networks for consumer convenience. According to the Global EV Outlook 2024 report by the International Energy Agency (IEA), there was an increase of over 40% in the public charging stock worldwide in 2023, with the expansion rate of fast chargers outpacing that of slow chargers. Fast chargers accounted for more than 35% of the public charging stock in 2023 and are expected to maintain a positive growth trend in the coming years. However, their high power delivery generates substantial heat due to internal resistance and electrochemical reactions, which can lead to thermal runaway, reduced battery efficiency, and shortened battery lifespan in vehicles. Manufacturers in the electric vehicle battery thermal management systems industry are thus focused on developing solutions that can address this issue conveniently.

System Insights

The passive segment accounted for a dominant revenue share of 78.2% in the global EV battery thermal management systems industry in 2024. Passive systems witness a healthy demand in the automotive sector, as they are cost-effective and simple to install. With the rising popularity of budget-friendly EV models and two-wheelers, particularly in emerging economies where affordability is a priority, manufacturing passive solutions is expected to remain strong in the coming years. These systems rely on heat sinks, phase-change materials (PCM), and natural convection, which require minimal maintenance compared to active system components. Such simplicity appeals to manufacturers looking for low-maintenance solutions in smaller or lower-power EVs. PCMs, particularly those having a solid-liquid phase change, have been studied extensively in recent years for their application in this market.

The active segment is expected to grow at the highest CAGR during the forecast period due to the growing popularity of high-performance EVs that necessitate optimal battery performance and longevity. These vehicles, which include sports cars, SUVs, and trucks, are increasingly equipped with high-capacity batteries to improve their driving range. High energy density generates more heat during operation and charging processes, making active thermal management critical for maintaining temperature within safe limits. Moreover, active systems offer precise temperature control, ensuring consistent battery performance in varying climatic conditions. This is essential for improving energy efficiency and extending battery life, which is critical for reducing the total cost of ownership and increasing customer satisfaction. Innovations such as integrated liquid cooling, refrigerant-based systems, and phase-change materials are becoming more cost-effective and scalable, aiding segment expansion.

Application Insights

The passenger vehicle segment accounted for a dominant revenue share in the global EV battery thermal management systems market in 2024. The widespread availability of passenger electric vehicles globally and the increasing pace of government initiatives to boost consumer product awareness have aided market growth. The global shift toward sustainable transportation is driving the demand for these vehicles, which rely heavily on efficient BTMS to ensure battery performance, safety, and longevity. Consumers expect passenger EVs to deliver longer ranges, faster charging, and improved safety. These demands necessitate a robust thermal management system to address the excessive heat generated during high power output and rapid charging cycles. Furthermore, governments and international organizations have introduced regulations mandating thermal safety, battery efficiency, and environmental compliance. These standards compel automakers to invest in advanced BTMS for passenger EVs.

The commercial vehicles segment is anticipated to grow at a substantial CAGR from 2025 to 2030 in the electric vehicle battery thermal management systems industry. The demand for these solutions in commercial electric fleets has witnessed healthy growth, driven by the electrification of transportation, the need for operational efficiency, enhanced safety, and regulatory compliance. As commercial fleets continue to expand and diversify, the role of BTMS has become increasingly critical in ensuring electric vehicles' performance, reliability, and sustainability. Commercial fleets benefit from fast-charging capabilities to minimize downtime, where thermal management is essential to manage the increased heat generated during rapid charging, ensuring battery health and safety. Urban fleets, such as delivery vans and buses, require BTMS that can handle frequent stops and starts, while long-haul electric trucks need systems that manage sustained high loads over extended periods.

Regional Insights

The Asia Pacific electric vehicle battery thermal management systems market held the largest revenue share of 41.4% globally in 2024, owing to the extensive adoption of passenger and commercial electric vehicles among regional consumers. Additionally, economies such as China, Japan, and India have become major manufacturing hubs in the electric mobility space, enabling the large-scale production of efficient thermal management systems for EV batteries. Leading EV manufacturers and battery producers in these countries drive the need for advanced BTMS to ensure performance, safety, and compliance. The deployment of fast-charging stations due to rapid urbanization and the increasing use of EVs for ride-hailing and delivery services further fuel the adoption of fast-charging-compatible BTMS in Asia Pacific.

China electric vehicle battery thermal management systems market accounted for a dominant revenue share in the regional market in 2024, aided by favorable government initiatives, the exponential growth of the automotive and EV sectors, and several major global battery manufacturers. The country is the leading adopter of electric vehicles, with consumers becoming more aware of their role in environmental protection. According to a report by the IEA, China contributed to around 80% of the global sales growth of EVs during the first half of 2024. As a result, the demand for efficient battery thermal management solutions can also be expected to witness a noticeable boost during the forecast period.

Europe Electric Vehicle Battery Thermal Management Systems Market Trends

Europe accounted for a substantial revenue share in the global market in 2024, as the region is well-known for the large-scale adoption of electric mobility solutions, both in the personal vehicle and commercial fleet segments. The demand for EVs spans passenger cars, electric buses, logistics vans, and long-haul electric trucks, each requiring efficient BTMS customized per operational requirements. Furthermore, establishing seamless charging networks across regional economies boosts the demand for thermal management systems to ensure consistent battery performance under diverse conditions. Leading automotive manufacturers and regional authorities are constantly looking for ways to boost EV performance to increase customer satisfaction while ensuring adherence to environmental norms. In June 2024, the 2nd European EV Thermal Management Summit 2024 event was held in Frankfurt, Germany. The summit discussed emerging trends and cutting-edge technologies in integrated and efficient thermal management systems that fall under the region’s net zero and sustainability objectives. Such initiatives are expected to bring positive advancements in the European market.

North America Electric Vehicle Battery Thermal Management Systems Market Trends

North America electric vehicle battery thermal management systems market is expected to advance at a significant CAGR in the market from 2025 to 2030. The presence of a strong electric mobility economy in the U.S. and Canada and the region’s reputation as a technological hub are expected to bring major developments in this industry in the coming years. Companies such as Tesla, Rivian, Lucid Motors, and legacy automakers such as GM and Ford are constantly expanding their EV portfolios, driving BTMS integration. Moreover, the adoption of electric vehicles has steadily grown in the region, owing to initiatives such as the U.S. EV tax credit under the Inflation Reduction Act (IRA) and Canada’s subsidies for EV purchases. Increased funding for charging infrastructure expansion, including fast-charging networks, has further driven the need for effective BTMS to manage heat generated during high-speed charging.

U.S. Electric Vehicle Battery Thermal Management Systems Market Trends

The U.S. electric vehicle battery thermal management systems market dominant revenue share in the North American market in 2024. The presence of large-scale manufacturing facilities for batteries and the growing presence of commercial electric fleets on roads have led to continued developments in this market. A report published by S&P Global Mobility in August 2024 stated that between January and June, the number of passenger vehicles and light trucks in the country grew by around 1.8 million units, of which 1.6 million (89%) came from EVs and hybrid EVs. The strengthening of road transportation and the e-commerce industry in the U.S. has further resulted in the extensive electrification of commercial fleets, such as buses and delivery vehicles. These vehicles operate intensively, necessitating the deployment of robust thermal management systems to manage high thermal loads and prolonged operational cycles.

Key Electric Vehicle Battery Thermal Management Systems Company Insights

Some of the major companies involved in the global electric vehicle battery thermal management systems industry include GENTHERM, Robert Bosch, and Dana Limited, among others.

-

GENTHERM specializes in thermal management technologies by developing heating and cooling solutions within the automotive and medical sectors. In the automotive segment, the company develops climate and comfort solutions, fluid systems, ClimateSense, WellSense, and battery performance solutions. GENTHERM also develops battery heating and battery air cooling systems, as well as thermoelectric heating and cooling for hybrid EVs. The company has further collaborated with the Israeli developer Carrar to launch the direct evaporation liquid technology that addresses safety and reliability concerns in battery systems.

-

Robert Bosch offers advanced technological solutions and services to customers, operating through four major segments - Mobility Solutions, Industrial Technology, Consumer Goods, and Energy & Building Technology. Under the Mobility division, the company is involved in researching and producing different thermal management system components. These include the electric refrigerant compressor, the electric coolant pump PCE 2.0, the electric coolant pump PDE, the GBB air conditioning blower motor and module, and EC motors for electric cooling fans.

Key Electric Vehicle Battery Thermal Management Systems Companies:

The following are the leading companies in the electric vehicle battery thermal management systems market. These companies collectively hold the largest market share and dictate industry trends.

- Robert Bosch GmbH

- GENTHERM

- Valeo

- Dana Limited

- MAHLE GmbH

- Hanon Systems

- VOSS Automotive, Inc

- 3M

- Grayson Automotive Services Limited

- Polymer Science, Inc.

- PARKER HANNIFIN CORP

- NeoGraf

Recent Developments

-

In October 2024, at the Paris Motor Show, Valeo and TotalEnergies announced an extension of their partnership, initiated in 2022 by creating a novel cooling solution for electric vehicle batteries. The companies have been conducting field trials for this immersive cooling system (liquid dielectric) that helps maintain the battery's optimal temperature, lowers its carbon footprint, improves its autonomy, and offers protection against fire hazards. The partnership further aims to develop a fluid system that can optimize and enhance the performance of next-gen EVs.

-

In October 2024, Hanon Systems, which develops and supplies thermal management solutions for electric mobility, unveiled a new manufacturing facility in Ontario, Canada. This would be the company’s first plant in North America to manufacture electric scroll compressors, which form a vital component for optimal thermal management in battery and hybrid EVs. Production at this location is expected to begin in 2025, with the facility offering a capacity of 900,000 electric compressors. The company has four facilities similar to those in Korea (Pyeongtaek), China (Changchun and Dalian), and Portugal.

-

In January 2024, Grayson Thermal Systems announced that it had received substantial funding from HSBC UK. This investment would enable the company to build three production lines at its Tyseley facility in Birmingham, England, which includes a battery thermal management system line and two heat pump lines. Moreover, the funding would be utilized to modernize Grayson’s fabrication facility to increase production output and boost efficiency.

Electric Vehicle Battery Thermal Management Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7.02 billion

Revenue forecast in 2030

USD 29.09 billion

Growth Rate

CAGR of 32.9% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

System, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, U.K., France, China, Japan, India, Australia, South Korea, Brazil, UAE, South Africa, Saudi Arabia

Key companies profiled

Robert Bosch GmbH; GENTHERM; Valeo; Dana Limited; MAHLE GmbH; Hanon Systems; VOSS Automotive, Inc; 3M; Grayson Automotive Services Limited; Polymer Science, Inc.; PARKER HANNIFIN CORP; NeoGraf

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Battery Thermal Management Systems Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle battery thermal management systems market report based on system, application, and region:

-

System Outlook (Revenue, USD Million, 2018 - 2030)

-

Active

-

Passive

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Passenger Vehicles

-

Commercial Vehicles

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

MEA

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global electric vehicle battery thermal management system market size was estimated at USD 1.67 billion in 2019 and is expected to reach USD 2.1 billion in 2020.

b. The global electric vehicle battery thermal management system market is expected to grow at a compound annual growth rate of 28.5% from 2020 to 2027 to reach USD 12.1 billion by 2027.

b. The Asia Pacific dominated the electric vehicle battery thermal management system market with a share of 44.6% in 2019. This is attributable to the higher adoption of electric vehicles in Asia Pacific countries, especially China.

b. Some key players operating in the electric vehicle battery thermal management system market include Robert Bosch GmbH, Gentherm Incorporated, Valeo, Hanon Systems, Mahle GmbH, Dana Limited, Voss Automotive GmbH, Grayson, 3M, Polymer Science, Inc., and Lord Corporation.

b. Key factors that are driving the market growth include the increasing adoption rate of the electric vehicle across the globe and the growing need to develop fast-charging batteries that generate more heat.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.