- Home

- »

- Electronic Devices

- »

-

Electric Vehicle Traction Motor Market Size Report, 2030GVR Report cover

![Electric Vehicle Traction Motor Market Size, Share & Trends Report]()

Electric Vehicle Traction Motor Market (2025 - 2030) Size, Share & Trends Analysis Report By Vehicle (BEV, PHEV), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts

- Report ID: GVR-3-68038-922-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electric Vehicle Traction Motor Market Summary

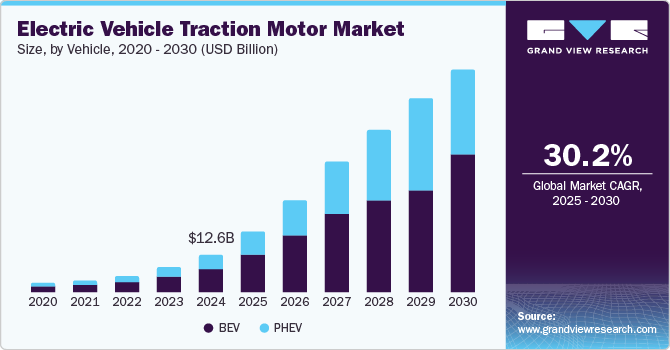

The global electric vehicle traction motor market size was valued at USD 12.57 billion in 2024 and is projected to grow at a CAGR of 30.2% from 2025 to 2030. Rising investments in the manufacturing of electric vehicles (EVs) due to their widespread adoption, along with growing demand for motors with high energy efficiency, are major market drivers.

Key Market Trends & Insights

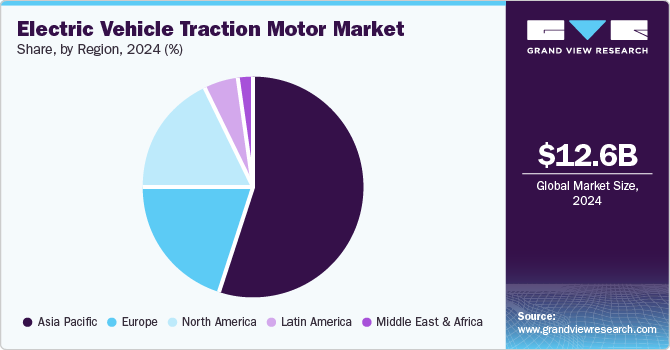

- Asia Pacific electric vehicle traction motor market accounted for the largest revenue share of 54.6% globally in 2024.

- By vehicle, the BEV segment accounted for the largest revenue share of 62.8% in the global electric vehicle traction motor industry in 2024.

Market Size & Forecast

- 2024 Market Size: USD 12.57 Billion

- 2030 Projected Market Size: USD 74.17 Billion

- CAGR (2025-2030): 30.2%

- Asia Pacific: Largest market in 2024

Traction motors consume substantially lower amounts of power and offer high efficiency, which has made them a critical aspect of the electric mobility industry. Furthermore, stringent regulations and emission guidelines to ensure environmental sustainability have been driving the popularity of EVs, thus creating favorable conditions for expansion of the electric vehicle traction motor industry.

The demand for traction motors in the automotive industry corresponds directly to sales of electric vehicles. As per the Global EV Outlook 2024 report published by the International Energy Agency (IEA), around 14 million new electric cars were sold globally in 2023, with an increase of 3.5 million witnessed over 2022 sales figures. Moreover, EV sales accounted for approximately 18% of overall vehicle sales in the year, rising from 14% in 2022 and just 2% in 2018. As manufacturers face increasing demands for performance-efficient and economical vehicles, the choice of components such as traction motors has become very crucial, driving competition in the electric vehicle traction motor industry. Traction motors are designed to be highly efficient, meaning they can convert a greater portion of the electrical energy stored in the battery into mechanical energy to propel the vehicle. This results in better overall performance and a longer driving range.

Traction motors enable EVs to optimize their acceleration performance, as the ability to instantly access maximum torque from a standstill allows vehicles to accelerate smoothly and rapidly. These solutions tend to be more compact and lightweight when compared to internal combustion engines. The reduced weight helps improve the vehicle’s efficiency and range, as less energy is needed to move the vehicle. Automakers are launching vehicles that use multiple traction motors to allow torque vectoring, which is the ability to precisely control the distribution of torque between wheels. This improves vehicle stability, traction, and handling, particularly in adverse conditions such as slippery roads or sharp corners.

In recent years, the growing need to cater to diverse consumer requirements has encouraged EV manufacturers to invest in research & development initiatives to introduce more effective solutions. For instance, development of motors that reduce or eliminate the reliance on rare earth materials such as neodymium and dysprosium has gathered pace, enabling companies to address supply chain and environmental concerns. Axial flux designs have become increasingly common as they offer higher power density and reduced size compared to traditional radial flux motors. These solutions are being integrated into performance and luxury EVs due to their superior torque and efficiency. Other advancements such as permanent magnet synchronous motors (PMSMs), switched reluctance motors (SRMs), and integrated motor-drive systems are expected to further aid in positively shaping the global market during the forecast period.

Vehicle Insights

The BEV segment accounted for the largest revenue share of 62.8% in the global electric vehicle traction motor industry in 2024. The demand for traction motors in Battery Electric Vehicles has increased significantly in recent years, aided by the global push for clean energy, the rapid growth of the broader EV market, and advancements in motor technology. Increasing sales of BEVs have encouraged companies to develop traction motors on a larger scale, aiding market expansion. For instance, a report by EV VOLUMES published in January 2024 stated that 10 million battery EVs were sold in 2023, with major markets witnessing a substantial rise in the adoption of these vehicles. Traction motors are critical to BEVs’ efficiency, performance, and driving range. Technological innovations, such as the development of permanent magnet synchronous and induction motors, have helped improve motor efficiency, power density, and durability.

The PHEV segment in the electric vehicle traction motor industry is expected to advance at the fastest CAGR from 2025 to 2030. The PHEV market has been steadily growing, driven by government incentives, stricter emissions regulations, and consumers seeking a balance between the electric driving range and the convenience of an internal combustion engine (ICE) for longer journeys. PHEVs combine an ICE with an electric motor and a battery, indicating traction motors are essential to the vehicle’s operation, enabling electric-only driving and enhancing fuel efficiency in hybrid driving modes. Integrating high-performance power electronics and developing more efficient inverters and controllers are further driving the efficiency of traction motors in hybrid drivetrains. This helps PHEVs provide better fuel economy and reduce emissions.

Regional Insights

The Asia Pacific electric vehicle traction motor market accounted for the largest revenue share of 54.6% globally in 2024, aided by the sharp growth in sales of EVs in the region and the implementation of positive initiatives to encourage regional demand. Asia Pacific is one of the largest and fastest-growing markets for electric vehicles, and this trend is leading to increasing demand for traction motors, which are critical components of electric vehicle powertrains. The rising popularity of these vehicles has compelled global automakers such as Volkswagen, BMW, Ford, and General Motors to increase their EV production in this region. These companies are boosting their local manufacturing capabilities and targeting Asian markets with affordable EVs, thus elevating the production output of traction motors.

China Electric Vehicle Traction Motor Market Trends

China accounts for a dominant revenue share in the regional market, as the economy is well-known as a global leader in EV production and sales. The country witnessed sales of over 8 million electric vehicles in 2023, accounting for around 60% of global sales, as per a report by the International Energy Agency. Moreover, China is expected to continue leading the global EV market, with projections suggesting that sales could exceed 10 million units annually by 2030. The Chinese government has been instrumental in this growth through policies such as the New Energy Vehicle mandate, which has necessitated manufacturers to produce a specific percentage of electric or hybrid vehicles. China also provides significant subsidies and tax incentives for EV buyers, further driving their adoption. This widespread popularity has created a substantial demand for traction motors. The government has set ambitious targets to achieve carbon neutrality by 2060 with peak emissions by 2030, accelerating the demand for zero-emission vehicles (ZEVs) and, subsequently, for traction motors.

North America Electric Vehicle Traction Motor Market Trends

The North American market for EV traction motors is expected to grow at a significant CAGR during the forecast period. The U.S. and Canada have become major hubs for EV manufacturing due to the localized presence of automakers such as Tesla, Ford, and General Motors, as well as the availability of notable solution providers, including ABB, Robert Bosch, and Continental. Motor and drivetrain technologies are becoming more advanced, emphasizing improving efficiency, power density, thermal management, and lightweight construction. Automakers in this region are increasingly adopting solutions such as permanent magnet motors (PMSMs), induction motors, and axial flux motors, all of which are used in EVs and PHEVs to improve their efficiency and performance. As the U.S. and Canada aim to decarbonize transportation and meet stricter emissions standards, the demand for electric vehicle components, including traction motors, is expected to continue increasing.

The U.S. accounted for a dominant revenue share in the North American market in 2024. The increasing adoption of electric vehicles, government policies promoting electrification, steadily rising automaker investments in EV production, and advancements in motor technologies have created a healthy environment for market growth. Although not as strong as China, the country remains one of the largest markets for electric mobility, with new EV sales reaching 1.4 million units in 2023. More electric vehicle models are being introduced across different segments, such as sedans, SUVs, and trucks, requiring traction motors with varying power capacities, efficiencies, and performance characteristics. Additionally, initiatives such as federal incentives, Zero-Emission Vehicle (ZEV) mandates, and the Bipartisan Infrastructure Law (2021) are expected to strengthen further the production of EV traction motors in the country.

Europe Electric Vehicle Traction Motor Market Trends

Europe accounted for the second-largest revenue share in the global EV traction motor market in 2024. The European Union's ambitious decarbonization goals, the presence of a strong regulatory framework promoting electrification, and widespread consumer awareness regarding vehicle emissions have led to healthy sales of EVs in regional economies. For instance, in 2023, electric vehicle sales in Europe, including battery electric vehicles (BEVs) and plug-in hybrid vehicles (PHEVs), reached around 1.9 million units, representing nearly 15-20% of total vehicle sales. Moreover, by 2030, Europe is projected to account for more than 30% of global EV sales, exponentially driving the production of components such as traction motors essential for vehicle propulsion. The presence of automakers such as BMW, Mercedes-Benz, and Stellantis has led to significant investments in fleet electrification, which, in turn, results in a substantial increase in the production of traction motors.

Key Electric Vehicle Traction Motor Company Insights

Some of the major companies involved in the global electric vehicle traction motor industry include ABB, Robert Bosch GmbH, and Valeo, among others.

-

ABB is a multinational electrical engineering organization specializing in developing electrification and automation technologies. The company offers a comprehensive range of traction motors specifically designed for electric vehicles and rail applications, focusing on efficiency, performance, and sustainability. ABB’s AMXE series of traction motors are utilized extensively in trains, buses, and industrial vehicles that are used in construction, mining, material handling, marine, and public transportation sectors.

-

Robert Bosch GmbH, generally known as Bosch, is a German multinational engineering and technology company. It functions primarily in four sectors, including mobility solutions, consumer goods, industrial technology, and energy & building technology. Through the mobility solutions division, Bosch focuses on automotive components and systems, including powertrain solutions, vehicle safety systems, and connected mobility technologies. The company develops traction motors that are integral to various applications, including passenger cars, commercial vehicles, and hybrid systems.

Key Electric Vehicle Traction Motor Companies:

The following are the leading companies in the electric vehicle traction motor market. These companies collectively hold the largest market share and dictate industry trends.

- ABB

- PARKER HANNIFIN CORP

- AB SKF

- ZF Friedrichshafen AG

- Robert Bosch GmbH

- Valeo

- CONTINENTAL ENGINEERING SERVICES

- Hitachi, Ltd.

- Turntide

- YASA Limited

- NIDEC CORPORATION

Recent Developments

-

In October 2024, Nidec Motor Corporation and Ashok Leyland, an Indian commercial vehicle maker, announced a partnership agreement to accelerate the electrification of commercial vehicles in India. The initiative involves providing Nidec’s electric motor-controller system, E-Drive, to Ashok Leyland. It would further allow the companies to develop cutting-edge E-Drives for commercial vehicle programs launched by Ashok Leyland and its subsidiaries.

-

In May 2024, ABB introduced an advanced package designed for electric buses, constituting the HES580 inverter and AMXE250 motor. The package, which includes a 3-level inverter, allows for a greater lifespan and substantial efficiency gains, as well as up to 12% reduction in motor losses on conventional drive cycles, compared to 2-level inverters. The motor offers high torque density, leading to optimized dynamic performance and quieter operations for better passenger comfort.

-

In September 2023, ZF announced the development of a magnet-free electric motor, called the I2SM (In-Rotor Inductive-Excited Synchronous Motor), for electric vehicles. The solution presents a viable alternative option to permanent magnet synchronous motors that are presently the most used form in EVs and offers a unique compactness while ensuring maximum power and torque density. The lack of rare earth metals that are otherwise extensively used in conventional motors is also expected to bring about increased sustainability in electric motor manufacturing, as well as improve operational efficiency.

Electric Vehicle Traction Motor Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 19.82 billion

Revenue forecast in 2030

USD 74.17 billion

Growth Rate

CAGR of 30.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Norway, Netherlands, Sweden, China, Japan, India, South Korea, Brazil

Key companies profiled

ABB; PARKER HANNIFIN CORP; AB SKF; ZF Friedrichshafen AG; Robert Bosch GmbH; Valeo; CONTINENTAL ENGINEERING SERVICES; Hitachi, Ltd.; Turntide; YASA Limited; NIDEC CORPORATION

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electric Vehicle Traction Motor Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electric vehicle traction motor market report based on vehicle and region:

-

Vehicle Outlook (Revenue, USD Million, 2018 - 2030)

-

BEV

-

PHEV

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

Norway

-

Netherlands

-

Sweden

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.