- Home

- »

- Plastics, Polymers & Resins

- »

-

Electroactive Polymers Market Size, Industry Report, 2030GVR Report cover

![Electroactive Polymers Market Size, Share & Trends Report]()

Electroactive Polymers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Conductive, Inherently Conductive), By Application (ESD & EMI Protection, Antistatic Packaging), By Region, And Segment Forecasts

- Report ID: 978-1-68038-521-2

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electroactive Polymers Market Summary

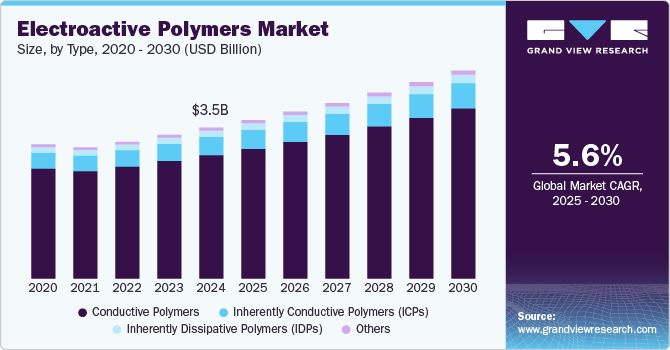

The global electroactive polymers market size was valued at USD 3.52 billion in 2024 and is projected to reach USD 4.85 billion by 2030, growing at a CAGR of 5.6% from 2025 to 2030. This growth is attributed to rapid industrialization and urbanization in developing regions are increasing demand from various end-use industries.

Key Market Trends & Insights

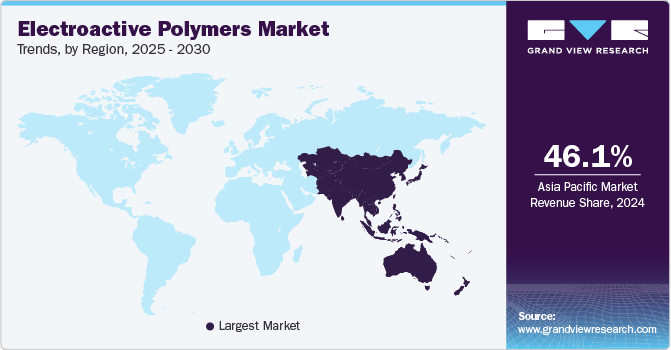

- Asia Pacific electroactive polymers market dominated the global market and accounted for the largest revenue share of 46.1% in 2024.

- Latin America electroactive polymers market is expected to grow at a CAGR of 6.2% over the forecast period.

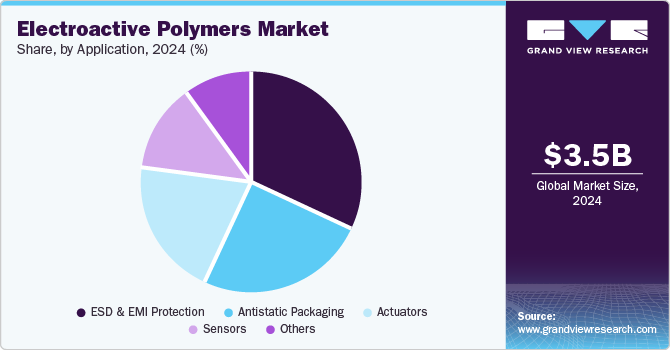

- Based on application, the ESD & EMI protection segment led the market and accounted for the largest revenue share of 32.2% in 2024.

- In terms of type, the conductive polymers dominated the global electroactive polymers industry and held the largest revenue share of 82.1% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 3.52 Billion

- 2030 Projected Market Size: USD 4.85 Billion

- CAGR (2025-2030): 5.6%

- Asia Pacific: Largest market in 2024

In addition, the growing applications of electroactive polymers in automotive and electronics sectors, due to their lightweight and durable properties, further propel market growth. Moreover, the rising importance of piezoelectric and ferromagnetic materials in electronic devices, along with advancements in conductive technologies, also significantly contribute to the market's expansion.

Electroactive Polymers (EAPs) are materials that alter their shape, size, or volume when exposed to an electric field. This transformation occurs as the electric field induces ion movement within the polymer membrane, causing it to expand or contract. These polymers are widely used in actuators and sensors for controlling mechanical systems due to their conductive and piezoelectric properties. Their flexibility, high capacity, and design adaptability also make them suitable for energy storage devices and lightweight components in various industries.

The global electroactive polymers industry is expanding due to increasing industrialization and urbanization, particularly in developing regions. In addition, the rising demand from the automotive and electronics sectors further accelerates growth. The advancements in nanotechnology and the growing production of electronics in regions such as China, Japan, and Taiwan are significant contributors. Furthermore, the importance of biomimetic applications in healthcare and the use of these polymers in corrosion-resistant coatings, protective fabrics, and metamorphic biomaterials drive market demand.

The development of new conductive technologies and the rising importance of piezoelectric substances in electronics provide further growth potential. Electroactive polymers' lightweight nature, durability, and superior conductive properties continue to attract interest across industries.

Type Insights

The conductive polymers dominated the global electroactive polymers industry and held the largest revenue share of 82.1% in 2024. This growth is attributed to the increasing demand from various industries, particularly electronics and energy storage. In addition, their unique properties, such as flexibility, lightweight nature, and excellent conductivity, make them suitable for applications in sensors, actuators, and biomedical devices. Furthermore, the rising need for advanced materials that can replace traditional metals enhances their market appeal, contributing to a robust growth trajectory.

The inherently conductive polymers (ICPs) are expected to grow at a CAGR of 6.4% over the forecast period, owing to their ability to provide bulk conductivity and their versatility in various applications. In addition, the demand for ICPs is bolstered by ongoing research and development efforts aimed at exploring new applications in robotics, artificial muscles, and medical devices. Furthermore, their cost-effectiveness and favorable electrical properties compared to conventional conductive materials further support their adoption across multiple sectors, driving significant market expansion.

Application Insights

The ESD & EMI protection segment led the market and accounted for the largest revenue share of 32.2% in 2024, primarily driven by the increasing demand for protection against electrostatic discharge and electromagnetic interference in electronic devices. In addition, as consumer electronics proliferate, the need for materials that can safeguard sensitive components from damage is critical. Furthermore, the adoption of polyaniline and carbon black-filled polymers enhances the effectiveness of ESD and EMI shielding, driving significant investment and innovation in this area.

The antistatic packaging segment is projected to grow at the fastest CAGR of 6.0% from 2025 to 2030, owing to the rising use of materials such as polyethylene and polypropylene in packaging solutions for medical devices and electronic components. In addition, the increasing focus on product safety and integrity during transportation and storage has led to heightened demand for antistatic packaging solutions. Furthermore, favorable regulatory frameworks and advancements in packaging technologies are contributing to the expansion of this segment, making it essential for various industries to adopt effective antistatic measures.

Regional Insights

Asia Pacific electroactive polymers market dominated the global market and accounted for the largest revenue share of 46.1% in 2024. This growth is attributed to the rapid industrialization and urbanization in the region. In addition, the increasing production of electronic devices, coupled with a rising middle-class population, is boosting demand for advanced materials. Furthermore, the region's strong manufacturing base and government initiatives supporting research and development also enhance market prospects. Moreover, the diverse applications of electroactive polymers in sectors such as automotive, healthcare, and consumer electronics are also contributing to the region's dominance in this market.

China Electroactive Polymers Market Trends

The electroactive polymers market in China led the Asia Pacific market and accounted for the largest revenue share in 2024, primarily driven by its position as the world's largest electronics manufacturing hub. The country's robust production capabilities and export-oriented economy drive substantial demand for electroactive polymers in various applications. Furthermore, favorable regulatory support and significant investments in technology development are fostering innovation within the sector. Moreover, as consumer preferences shift towards advanced electronic products, the demand for electroactive polymers is expected to grow steadily, reinforcing China's critical role in the global market.

North America Electroactive Polymers Market Trends

The electroactive polymers market in North America is expected to witness substantial growth over the forecast period, due to a strong emphasis on innovation and technological advancements. In addition, the presence of key players in the electronics and automotive sectors drives demand for advanced materials that enhance product performance. Furthermore, the growing medical device industry necessitates high-quality electroactive polymers for applications such as sensors and actuators. Moreover, increased investment in research and development further supports market growth, positioning North America as a significant player in the global landscape.

The U.S. electroactive polymers market led the North American market and held a significant revenue share in 2024, driven by advancements in technology and a thriving medical device sector. In addition, with a projected rise in healthcare expenditures and an increasing focus on developing innovative medical solutions, the demand for electroactive polymers is set to escalate. Furthermore, the U.S. government's support for research initiatives and sustainable practices promotes the adoption of these materials across various industries. This environment fosters growth opportunities for electroactive polymers, solidifying their importance in the U.S. economy.

Latin America Electroactive Polymers Market Trends

Latin America electroactive polymers market is expected to grow at a CAGR of 6.2% over the forecast period, owing to increasing investments in infrastructure and technology. Furthermore, the rising adoption of electronic devices and advancements in manufacturing processes are creating opportunities for electroactive polymers across various industries. Moreover, government initiatives aimed at promoting sustainable technologies are encouraging the use of eco-friendly materials.

Europe Electroactive Polymers Market Trends

The growth of the electroactive polymers market in Europe is expected to be driven by stringent regulations promoting energy efficiency and sustainability across industries. In addition, the increasing focus on reducing carbon footprints has led to heightened interest in lightweight materials that offer enhanced performance. Furthermore, advancements in nanotechnology and material science are paving the way for innovative applications of electroactive polymers in sectors such as automotive, aerospace, and healthcare.

Key Electroactive Polymers Company Insights

Key players in the global electroactive polymers industry include Solvay S.A., AGFA-Gevaert N.V., Merck Group, and others. These companies are employing various strategies to enhance their market presence. Expansion initiatives involve increasing production capacities and entering emerging markets to capitalize on growing demand. In addition, merger and acquisition activities focus on consolidating resources and technologies, enabling companies to enhance their product offerings. Furthermore, these firm are focusing on partnerships with research institutions and other entities to facilitate innovation and the development of advanced materials.

-

Parker Hannifin Corporation specializes in motion and control technologies, leveraging electroactive polymer technology to enhance product performance across various applications, including medical devices and industrial systems. The company’s innovative solutions cater to sectors requiring ultra-low power, lightweight, and efficient materials, positioning the company as a leader in providing cutting-edge electroactive polymer-based products.

-

Solvay S.A. is engaged in developing specialty polymers known for their conductivity and durability, which are crucial in sectors such as electronics, automotive, and healthcare. The company’s expertise in polymer chemistry enables it to create innovative solutions that meet the growing demand for efficient and sustainable materials, reinforcing its position as a key player in the global electroactive polymers landscape.

Key Electroactive Polymers Companies:

The following are the leading companies in the electroactive polymers market. These companies collectively hold the largest market share and dictate industry trends.

- 3M Company

- Parker Hannifin Corporation

- Solvay S.A.

- AGFA-Gevaert N.V.

- Merck Group

- Heraeus Holding GmbH

- The Lubrizol Corporation

- PolyOne Corporation (now Avient Corporation)

- RTP Company

- Kenner Material & System Co., Ltd.

Recent Developments

- In January 2024, Datwyler announced a collaboration to advance the production of Dielectric Elastomer Actuators (DEAs) utilizing electroactive polymers (EAP). This partnership aims to transition EAP technology from research to serial production by mid-2024, enhancing applications in energy-efficient and sustainable actuators. The initiative includes a development kit unveiled at CES 2024, covering the entire value chain from raw materials to integrated control modules, facilitating continuous optimization and integration into various industries, including automotive and medical sectors.

Electroactive Polymers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3.70 billion

Revenue forecast in 2030

USD 4.85 billion

Growth rate

CAGR of 5.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, region

Regional scope

North America, Asia Pacific, Europe, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, UK, Germany, France, Italy, Spain, Russia, Denmark, Sweden, Norway, China, India, Japan, Australia, South Korea, Indonesia, Vietnam, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

3M Company; Parker Hannifin Corporation; Solvay S.A.; AGFA-Gevaert N.V.; Merck Group; Heraeus Holding GmbH; The Lubrizol Corporation; PolyOne Corporation (now Avient Corporation); RTP Company; Kenner Material & System Co., Ltd.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electroactive Polymers Market Report Segmentation

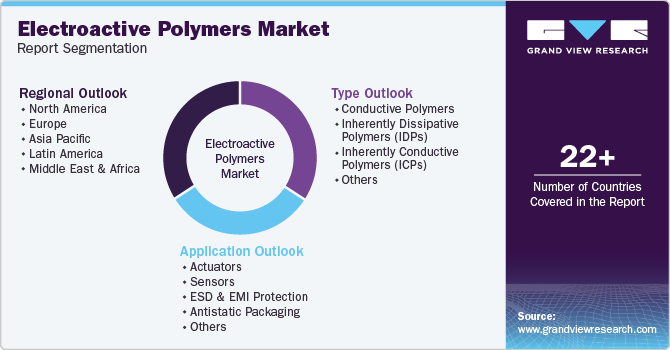

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global electroactive polymers market report based on type, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Conductive Polymers

-

Inherently Dissipative Polymers (IDPs)

-

Inherently Conductive Polymers (ICPs)

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Actuators

-

Sensors

-

ESD & EMI Protection

-

Antistatic Packaging

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Russia

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Indonesia

-

Vietnam

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.