- Home

- »

- Renewable Energy

- »

-

Electrolyzer Market Size, Share And Growth Report, 2030GVR Report cover

![Electrolyzer Market Size, Share & Trends Report]()

Electrolyzer Market (2024 - 2030) Size, Share & Trends Analysis Report By Technology (Alkaline Electrolyzer, Proton Exchange Membrane, Solid Oxide Electrolyzer, Anion Exchange Membrane), By Application, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-417-4

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrolyzer Market Summary

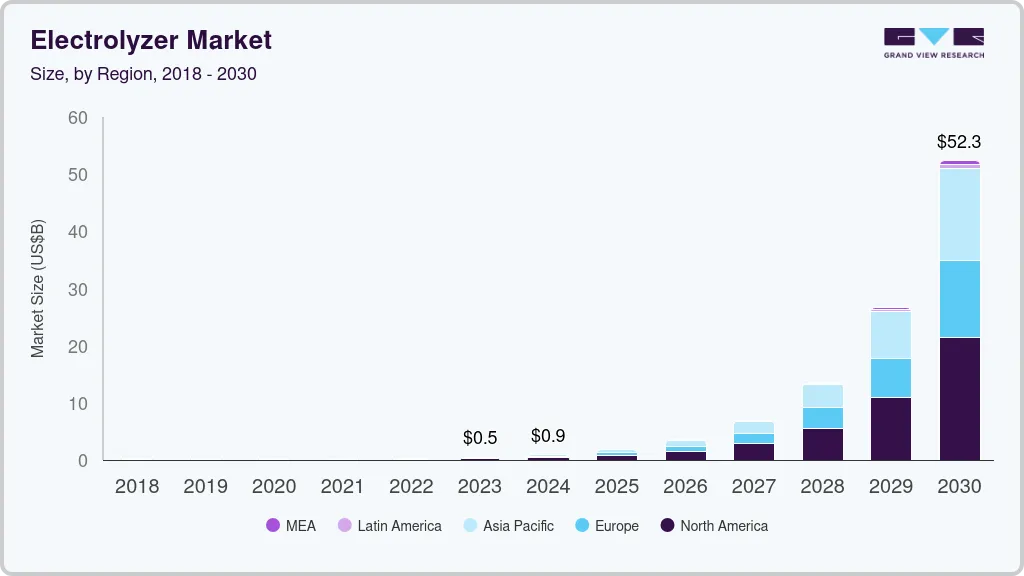

The global electrolyzer market size was estimated at USD 489.1 million in 2023 and is projected to reach USD 52,322.3 million by 2030, growing at a CAGR of 94.9% from 2024 to 2030. The market is driven primarily by the increasing demand for clean energy solutions and the global push toward decarbonization.

Key Market Trends & Insights

- North America electrolyzer market dominated the global industry and accounted for the largest revenue share of over 42.0% in 2023.

- The electrolyzer market in the U.S. is growing as the government has implemented supportive policies and incentives to accelerate the adoption of hydrogen technologies.

- By technology, the alkaline electrolyzers segment registered the largest market share of over 56.0% in 2023.

- By application, the power plant segment accounted for the highest market share of over 27.0% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 489.1 Million

- 2030 Projected Market Size: USD 52,322.3 Million

- CAGR (2024-2030): 94.9%

- North America: Largest market in 2023

As countries and industries strive to reduce their carbon footprint and meet ambitious climate targets, hydrogen produced through electrolysis is emerging as a versatile and environment-friendly energy carrier. This growing interest in green hydrogen is a major factor propelling the electrolyzer industry.Government policies and incentives are playing a crucial role in market expansion. For instance, the European Union's hydrogen strategy aims to install at least 6 GW of renewable hydrogen electrolyzers by 2024 and 40 GW by 2030. Similarly, countries such as Japan, South Korea, and Australia have implemented national hydrogen strategies that include substantial investments in electrolyzer technology. These supportive policies create a favorable environment for market growth and technological advancements in the market.

Moreover, the falling costs of renewable energy, particularly solar and wind power, are also contributing to the electrolyzer market's growth. As the price of electricity from these sources continues to decrease, the production of green hydrogen becomes more economically viable. This trend is encouraging industries such as steel manufacturing, chemical production, and transportation to explore hydrogen as an alternative to fossil fuels. For example, companies such as ThyssenKrupp in Germany are implementing hydrogen-based steel production processes, while automakers such as Toyota and Hyundai are investing heavily in fuel cell electric vehicles, further driving demand for electrolyzers.

Technology Insights

Based on the technology, the market is segmented into alkaline electrolyzer, proton exchange membrane (PEM), solid oxide electrolyzer (SOE), and anion exchange membrane (AEM). Alkaline electrolyzers registered the largest market share of over 56.0% in 2023. Alkaline electrolyzers are known for their relatively low cost, long lifetime, and ability to produce large volumes of hydrogen. However, they have slower response times and lower efficiency compared to some other types.

PEM electrolyzers operate at lower temperatures (50-80°C) and can handle higher current densities, resulting in more compact designs. It offers quick start-up times, high efficiency, and excellent dynamic response, making it suitable for coupling with renewable energy sources. However, they are generally more expensive due to the use of precious metal catalysts.

AEM technology is a newer development in electrolyzers. It combines some advantages of both alkaline and PEM systems. AEM electrolyzers can potentially use less expensive materials than PEM systems while offering good efficiency and flexibility. However, this technology is still in the earlier stages of development and commercialization compared to the others.

Moreover, SOEs can produce both hydrogen and syngas, making them versatile for various applications. However, they face challenges related to material durability and thermal cycling.

Application Insights

Based on the application, the market is segmented into power plants, energy storage or fueling for FCEVs, industrial gases, power to gas, steel plants, electronics & photovoltaics, and other applications. The power plant segment accounted for the highest market share of over 27.0% in 2023. Electrolyzers are used in power plants to produce hydrogen, which can be used as a clean fuel source or energy storage medium. This application helps balance grid loads, especially when integrated with renewable energy sources such as wind and solar. Hydrogen produced during off-peak hours can be stored and used to generate electricity during peak demand periods.

Electrolyzers are used to produce high-purity hydrogen and oxygen for various industrial processes. These gases are essential in industries such as chemicals, pharmaceuticals, and food processing. On-site hydrogen production via electrolysis can be more cost-effective and environmentally friendly than traditional methods of gas supply.

In steel plants, electrolyzers are used in steel production as part of efforts to decarbonize the industry. Hydrogen produced by electrolysis can replace coal and natural gas in the steel-making process, significantly reducing carbon emissions. This application is gaining traction as steel manufacturers seek to meet stricter environmental regulations.

Regional Insights

North America electrolyzer market dominated the global industry and accounted for the largest revenue share of over 42.0% in 2023. The growing focus on clean energy and decarbonization efforts across the region is triggering the growth of the market. The U.S. and Canada have set ambitious targets to reduce greenhouse gas emissions, with hydrogen seen as a crucial element in achieving these goals. This has spurred investment in electrolyzer technology, which is essential for producing green hydrogen from renewable energy sources.

U.S. Electrolyzer Market Trends

The electrolyzer market in the U.S. is growing as the government has implemented supportive policies and incentives to accelerate the adoption of hydrogen technologies. The Inflation Reduction Act of 2022, for instance, includes significant tax credits for clean hydrogen production, which has spurred interest in electrolyzers. Additionally, the Department of Energy's Hydrogen Shot initiative aims to reduce the cost of clean hydrogen by 80% within a decade, further stimulating investment and innovation in the sector.

Europe Electrolyzer Market Trends

The electrolyzer market in the European countries benefits from a well-developed industrial base and technological expertise in the field. Companies such as Siemens, Nel Hydrogen, and ITM Power are major manufacturers of electrolyzer technology, giving the region a competitive edge. These firms have been investing heavily in research and development, resulting in more efficient and cost-effective electrolyzer designs.

Asia Pacific Electrolyzer Market Trends

Many countries in the region have set ambitious goals for hydrogen production and utilization as part of their energy transition strategies. China, Japan, and South Korea have announced national hydrogen roadmaps with significant targets. For example, China aims to have 1 million fuel cell vehicles on the road by 2030, while Japan plans to establish a "hydrogen society" by 2050. These goals are driving substantial investments in electrolyzer technology and manufacturing capacity.

Key Electrolyzer Company Insights

The market is characterized by intense competition and rapid technological advancements. Major players include established industrial gas companies, renewable energy firms, and specialized electrolyzer manufacturers, all vying for market share in a growing industry. Competition focuses on improving efficiency, reducing costs, and scaling up production capacity. Emerging partnerships between electrolyzer manufacturers and energy companies are becoming increasingly common as the industry seeks to create integrated hydrogen production solutions. As the market expands, new entrants are also challenging incumbents with innovative designs and business models, further intensifying the competitive landscape.

-

In May 2024, Nel Hydrogen Electrolyzer AS, a fully owned subsidiary of Nel ASA entered into a technology licensing agreement with Reliance Industries Limited (RIL). The agreement provides RIL with an exclusive license for Nel’s alkaline electrolyzers in India and also allows RIL to manufacture Nel’s alkaline electrolyzers for captive purposes globally.

-

In May 2024, The Japanese technology company Asahi Kasei opened a new hydrogen pilot plant in Kawasaki, Japan. Operation start of this commercial-scale facility was in March 2024. The trial operation of four 0.8 MW modules is another milestone toward the realization of a commercial multi-module 100 MW-class alkaline water electrolysis system for green hydrogen production. Construction and operation of the pilot plant are supported by the Green Innovation Fund2 of Japan’s New Energy and Industrial Technology Development Organization (NEDO).

Key Electrolyzer Companies:

The following are the leading companies in the electrolyzer market. These companies collectively hold the largest market share and dictate industry trends.

- Siemens AG

- Cummins Inc.

- ITM Power plc

- Nel ASA

- Plug Power Inc.

- John Cockerill Group

- Enapter AG

- Haldor Topsoe A/S

- Bloom Energy Corporation

- thyssenkrupp AG

- Sunfire GmbH

- Electric Hydrogen Co.

- Ecolectro Inc.

- Ohmium International

- ACME Group

Electrolyzer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 945.82 million

Revenue forecast in 2030

USD 52.32 billion

Growth rate

CAGR of 95.2% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America, Middle East & Africa

Country Scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Saudi Arabia

Key companies profiled

Siemens AG; Cummins Inc.; ITM Power plc; Nel ASA; Plug Power Inc.; John Cockerill Group; Enapter AG; Haldor Topsoe A/S; Bloom Energy Corporation; thyssenkrupp AG; Sunfire GmbH; Electric Hydrogen Co.; Ecolectro Inc.; Ohmium International; ACME Group

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrolyzer Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrolyzer market report on the basis of technology, application, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Alkaline Electrolyzer

-

Proton Exchange Membrane (PEM)

-

Solid Oxide Electrolyzer (SOE)

-

Anion Exchange Membrane (AEM)

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Power Plants

-

Energy Storage or Fueling for FCEV's

-

Industrial Gases

-

Power to Gas

-

Steel Plant

-

Electronics & Photovoltaics

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global electrolyzer market was estimated at USD 489.12 million in 2023 and is expected to reach USD 945.82 million in 2024.

b. The global electrolyzer market is expected to grow at a compound annual growth rate of 95.2% from 2024 to 2030, reaching around USD 52.32 billion by 2030.

b. The alkaline electrolyzer technology segment registered the largest revenue market share of over 56.0% in 2023. Alkaline electrolyzers are known for their relatively low cost, long lifetime, and ability to produce large volumes of hydrogen. However, they have slower response times and lower efficiency compared to some other types.

b. Key players in the market include Siemens AG; Cummins Inc.; ITM Power plc; Nel ASA; Plug Power Inc.; John Cockerill Group; Enapter AG; Haldor Topsoe A/S; Bloom Energy Corporation; thyssenkrupp AG; Sunfire GmbH; Electric Hydrogen Co.; Ecolectro Inc.; Ohmium International; and ACME Group.

b. The global electrolyzer market is driven primarily by the increasing demand for clean energy solutions and the global push towards decarbonization. As countries and industries strive to reduce their carbon footprint and meet ambitious climate targets, hydrogen produced through electrolysis is emerging as a versatile and environmentally friendly energy carrier.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.