- Home

- »

- Medical Devices

- »

-

Electrophysiology Devices Market Size & Share Report, 2030GVR Report cover

![Electrophysiology Devices Market Size, Share & Trends Report]()

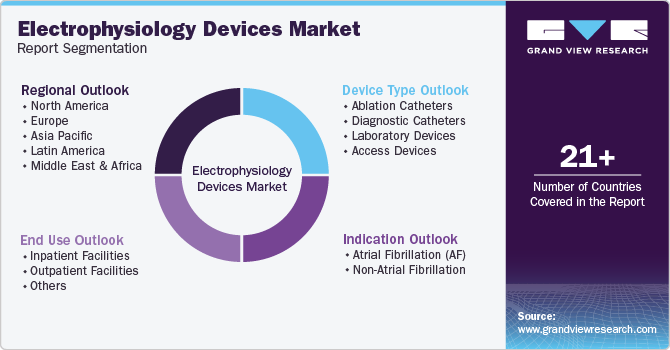

Electrophysiology Devices Market Size, Share & Trends Analysis Report By Device Type (Ablation Catheters, Diagnostic Catheters, Laboratory Devices, Access Devices), By Indication, By End-use, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-274-7

- Number of Pages: 145

- Format: Electronic (PDF)

- Historical Range: 2018 - 2022

- Industry: Healthcare

Electrophysiology Devices Market Trends

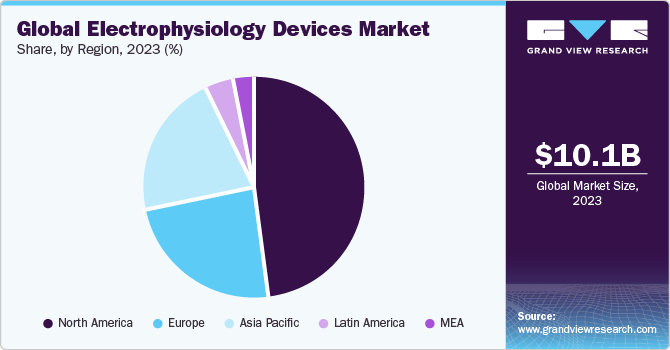

The global electrophysiology devices market size was estimated at USD 10.07 billion in 2023 and is expected to grow at a CAGR of 13.9% from 2024 to 2030. Increasing use of electrophysiology (EP) tests in the treatment and diagnosis of heart diseases, such as atrial fibrillation, growing demand for devices for cardiac rhythm management for constant monitoring, and increasing application of these devices in out-of-hospital settings are propelling the industry growth. The prevalence of heart failure, cardiac arrest, and atrial fibrillation among millennials is rising due to sedentary lifestyles, smoking, excessive alcohol consumption, and others. According to the CDC, approximately 12.1 million Americans will be suffering from atrial fibrillation by 2030.

The growing number of catheter ablation procedures is expected to positively impact the electrophysiology devices market. As the number of ablation procedures rises, a direct increase in demand for ancillary products is observed. Furthermore, electrophysiology devices include electrophysiology (EP) devices that enhance manoeuvrability for navigating complex anatomies, provide greater flexibility for reaching targeted areas, improve compatibility, and enhance visualization capability through integrated imaging capabilities. According to an article published by Elsevier Inc. in March 2023, the annual rate of cardiac electrophysiology procedures increased from 817.9 in 2013 to 1,089.68 per 100,000 beneficiaries in 2019 within the U.S.

The growing arrhythmia burden is expected to propel opportunities in the electrophysiology devices market. According to an article published by Johnson & Johnson Services, Inc. in 2021-22, the prevalence of atrial fibrillation (AFib) was over 7 million in the U.S., 20 million in Asia Pacific, 14 million in Europe, and nearly 2 million in Latin America. The European countries such as France, Germany, Italy, and the UK witness over 1 million AFib cases. Furthermore, the region has an aging population, leading to a projected 70% increase in AFib cases within the next few years (by 2030). By 2050, Europe is anticipated to witness the most significant rise in AFib cases globally. Consequently, AFib-related stroke events, hospitalizations, and outpatient visits are expected to surge substantially, creating an increased demand for electrophysiology devices.

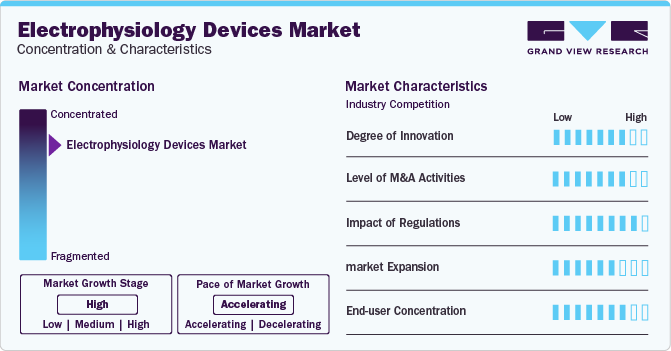

Market Characteristics & Concentration

The EP devices market is highly consolidated, with leading players introducing novel products. The market growth stage is high, and the pace of market growth is accelerating. For instance, in January 2024, GE HealthCare introduced the Prucka 3 Digital Amplifier as an innovative platform for innovation in EP. This next-generation system offers enhanced capabilities for diagnosing and treating heart rhythm disorders.

The market is witnessing continuous research and development, such as the adoption of 3D mapping systems, the production of wireless and wearable devices for continuous monitoring, and the integration of artificial intelligence (AI) in electrophysiology procedures. Manufacturers are focusing on introducing novel technologies to produce more accurate, cost-effective, and user-friendly EP devices.

The electrophysiology devices market is characterized by a high level of M&A activities. The main reason for the frequent acquisitions in this market is the technological soundness of small players with their robust product pipelines. It allows the key players to improve their market share, expand their product portfolio, and provide opportunities to be the first entrant into a niche market segment. For instance, in November 2022, the company completed the acquisition of Obsidio, Inc., a medical technology company. This acquisition was expected to boost the cardiac devices portfolio of the company.

The stringent regulatory framework for approval and commercialization of electrophysiology devices impedes market growth. Compliance with regulatory standards further often results in product recalls which reduces patient and healthcare participant confidence. For instance, in January 2024, Abbott was issued a Class II device recall notice by the U.S. FDA for its TactiFlex Ablation Sensor Enabled Ablation Catheter.

Key companies in the electrophysiology devices market are also focusing on market expansion. For instance, in February 2024, Terumo Corporation, a key med-tech player, announced the opening of its new manufacturing facility in Puerto Rico. The facility is close to 64,000 square feet.

Device Type Insights

The ablation catheters segment dominated the market with a revenue share of 45.6% in 2023 and is expected to grow at the fastest CAGR over the forecast period. An ablation catheter is used to control irregular heartbeats that cannot be treated with medication. The ablation catheter segment comprises radiofrequency (RF) ablation, cryoablation, and pulse field ablation. Growing heart failure and arrhythmia incidences, awareness regarding the electrophysiology procedures’ reliability, advancement in EP technologies, and increasing minimally invasive procedures are factors responsible for the segment's dominance. For instance, in January 2024, Boston Scientific Corporation received approval for the FARAPULSE Pulsed Field Ablation System. This system offers an innovative approach to performing cardiac ablation.

The diagnostic catheters segment is anticipated to register a significant CAGR during the forecast period. Diagnostic catheters are used to investigate and evaluate patients with suspected cardiovascular diseases. These comprise EP mapping devices, cardiac output catheters, and angiography catheters. In July 2023, Biosense Webster, Inc. launched a mapping catheter, OPTRELL. OPTRELL is a high-density diagnostic catheter that provides high-definition EP mapping of complex cardiac arrhythmias.

Indication Insights

The atrial fibrillation segment dominated the market in 2023 and accounted for the maximum revenue share of 62.2%. It is the most common type of arrhythmia associated with a high risk of stroke and blood clotting. According to the British Heart Association, in 2022, approximately 1.5 million of the UK population suffer from atrial fibrillation. In addition, an expected 270,000 individuals aged 65 years and above have undiagnosed atrial fibrillation in the country. The high prevalence of the disease is responsible for the prominent share of the segment.

In recent years, innovative smartphone applications have been introduced for arrhythmic patients that can connect them with healthcare professionals. Moreover, inpatient facilities and clinical settings are taking the initiative to involve arrhythmia care in their treatment routine.

End-use Insights

The inpatient facility segment accounted for the highest share of 81.7% of the global revenue in 2023. The adoption of technologically advanced cardiac rhythm management and EP systems by interventional cardiologists and the rising burden of cardiovascular disease (CVD) is responsible for the dominant share of the segment. The number of arrhythmia procedures in inpatient facilities is estimated to increase over the coming years owing to the availability of a skilled team of cardiologists and a well-equipped facility. Furthermore, a growing number of patients approach hospitals due to proper reimbursement facilities and accessibility to treatment, which drives the segment.

The outpatient facilities segment is projected to grow at the fastest CAGR during the forecast period. A shift towards minimally invasive outpatient procedures and significant cost savings are augmenting the segment's growth. For instance, a study by Health Affairs revealed that ASC procedures are cost and time-effective. It takes around 25% less time compared to the inpatient facilities, with USD 360 to 1,000 savings per patient owing to the lesser fixed costs. Furthermore, government initiatives to reduce the cost of treatment and favourable reimbursement policies are propelling segment growth. The Centers for Medicare & Medicaid Services (CMS) extended ambulatory surgical coverage for cardiac interventional procedures, such as pacemaker implants, endovenous ablation, and catheterization procedures.

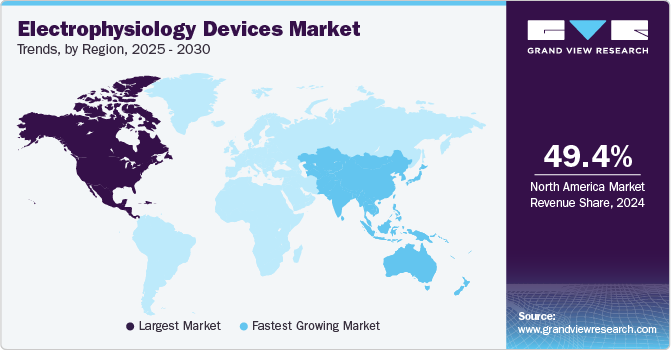

Regional Insights

North America electrophysiology (EP) devices market dominated and accounted for 48.3% of the total market share in 2023. The rising incidence of cardiovascular disease, advanced healthcare infrastructure, and the presence of key players are the major drivers of the growth in this region. In addition, the increasing number of patients undergoing surgeries and the rising awareness about minimally invasive surgeries are expected to propel market growth in North America.

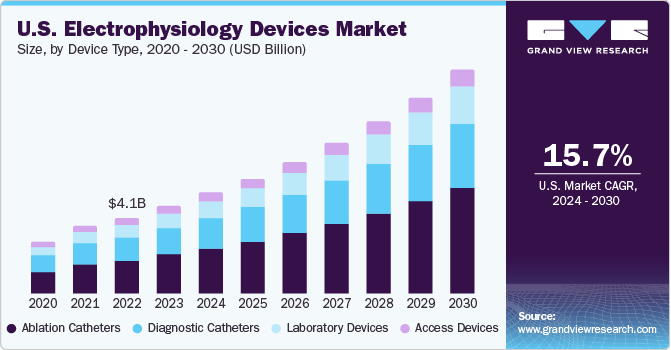

U.S. Electrophysiology Devices Market Trends

U.S. electrophysiology devices market dominated the market with a revenue share of 91.2% in 2023 and is expected to grow at the fastest CAGR during the forecast period. In the U.S., advanced healthcare infrastructure the growing patient pool, and the increasing number of new product launches are some of the major factors expected to propel market growth over the forecast period.

Europe Electrophysiology Devices Market Trends

Electrophysiology devices market in Europe held the second-largest revenue market share during the year 2023.Europe has a robust healthcare system, witnessing a shift from in-patient to out-patient care due to the growing presence of several medical equipment companies offering catheters in the region.

Germany electrophysiology devices market dominated the market with the highest revenue share of 27.72% in 2023. The increasing prevalence of cardiac disorders is expected to improve the demand for catheters in treating narrowing arteries in patients.

Electrophysiology devices market in the UK held the third-largest revenue share in 2023. The prevalence of cardiovascular diseases, such as coronary artery disease, ischemic heart disease, and other heart-related disorders in the UK is expected to increase the demand for EP devices.

France electrophysiology devices market is anticipated to witness a significant CAGR of 13.9% during the forecast period. Growth in France is likely to be driven by the rising incidence of cardiovascular diseases, a growing number of hospitals & clinics, and lifestyle changes in the population.

Asia Pacific Electrophysiology Devices Market Trends

Asia Pacific electrophysiology devices market is projected to register the fastest CAGR of 14.8% during the forecast period. The increasing health awareness, a developing private hospital sector, growing government support & spending, the rising prevalence of cardiovascular diseases, and the growing availability of insurance policies are likely to contribute to market growth over the coming decade.

Electrophysiology devices market in China held the largest revenue market share of 32.3% in 2023. The increasing prevalence of cardiovascular disease in China due to high blood pressure, unhealthy lifestyle, aging population, urbanization, and high cholesterol levels are anticipated to boost the market.

Japan electrophysiology devices market held the second largest market share in the Asia Pacific region. Japan is considered a major market for electrophysiology devices in the Asia Pacific. Cardiovascular disorders, including heart diseases such as atrial fibrillation and stroke, have a considerable impact on Japan’s life expectancy and medical costs.The growing prevalence of cardiovascular diseases is anticipated to drive market growth in Japan.

Electrophysiology devices market in India is expected to grow at the fastest CAGR of 16.1% during the forecast period. The increasing prevalence of coronary artery disease is expected to boost the need for interventional ablation procedures, which is anticipated to drive the market in India. In addition, an increasing number of private players and hospitals run by government organizations are providing cardiovascular disease treatment procedures, which is anticipated to propel market growth.

Latin America Electrophysiology Devices Market Trends

Latin America electrophysiology devices market is expected to witness lucrative growth during the forecast period. Cardiovascular diseases (CVD) is one of the leading causes of death in Latin American countries.Atrial fibrillation (AFib) is estimated to be amongst the top four cardiovascular diseases in the region.

The electrophysiology devices market in Mexico is expected to grow due to various factors, such as the high incidence of chronic heart diseases, improved medical facilities, and favourable regulatory policies. According to an article published by Johnson and Johnson, AFib affects nearly 417,000 people in the country.

MEA Electrophysiology Devices Market Trends

MEA electrophysiology devices market is expected to grow at a lucrative growth. This region is one of the significant developing markets for medical devices. Increased prevalence of ischemic heart disease, vascular disease, and coronary artery disease, as well as a rise in public awareness about the need for prompt diagnosis & usage of advanced devices, are projected to be the main factors driving market demand over the forecast period.

South Africa electrophysiology devices market held the largest revenue share of 22.5% during 2023. Technology is altering the delivery of healthcare in Africa, allowing more people in distant locations and around the world to receive better care. Moreover, South Africa serves as a key geographic location for the rest of African countries to undergo ablation procedures which drives growth.

Key Electrophysiology Devices Company Insights

Leading companies in the EP devices market are enhancing their offerings and incorporating new technologies to expand their customer reach, secure a greater market share, and diversify their application range. For example, Medtronic announced the expansion of its product application line, Freezor and Freezor Xtra Cardiac Cryoablation Focal Catheters. These products were granted expanded FDA approval to treat atrioventricular nodal re-entrant tachycardia (AVNRT).

Key Electrophysiology Devices Companies:

The following are the leading companies in the electrophysiology devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corp.

- Medtronic

- Abbott

- Biosense Webster (Johnson & Johnson Services, Inc.)

- Biotronik

- General Electric Company

- Siemens Healthcare AG

- MicroPort Scientific Corporation

- Koninklijke Philips N.V.

Recent Developments

-

In August 2023, Biosense Webster received approval for various atrial fibrillation ablation products that can be utilized in a workflow without fluoroscopy during catheter ablation procedures.

-

In May 2023, Abbott obtained approval from the U.S. Food and Drug Administration (FDA) for TactiFlex Ablation Catheter, Sensor Enabled, the first ablation catheter with contact force technology and a flexible tip. The TactiFlex catheter can treat atrial fibrillation (AFib) with reduced procedure times and better safety than previous-generation catheters.

-

In February 2022, Boston Scientific Corp. acquired Baylis Medical Company Inc., specializing in advanced transseptal solutions for the left side of the heart in catheter-based procedures.

Electrophysiology Devices Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.48 billion

Revenue forecast in 2030

USD 25.00 billion

Growth rate

CAGR of 13.9% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Device type, indication, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corp.; Medtronic; Abbott; Biosense Webster (Johnson & Johnson Services, Inc.); Biotronik; GE HealthCare; Siemens Healthcare AG; MicroPort Scientific Corporation; Koninklijke Philips N.V.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrophysiology Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrophysiology devices market report based on device type, indication, end-use, and region:

-

Device Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Ablation Catheters

-

Radiofrequency (RF) Ablation

-

Cryoablation

-

Pulse Field Ablation

-

-

Diagnostic Catheters

-

Laboratory Devices

-

Access Devices

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Atrial Fibrillation

-

Non-Atrial Fibrillation

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Inpatient Facilities

-

Outpatient Facilities

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

Middle East & Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrophysiology devices market size was estimated at USD 10.7 billion in 2023 and is expected to reach USD 11.48 billion in 2024

b. The global electrophysiology devices market is expected to grow at a compound annual growth rate of 13.9% from 2024 to 2030 to reach USD 25.00 billion by 2030

b. North America dominated the electrophysiology devices market with a share of 48.3% in 2023. This is attributable to the high patient base of cardiac arrhythmia resulting from unhealthy lifestyle habits and favorable reimbursement policies in the region

b. Some key players operating in the electrophysiology devices market include Boston Scientific Corporation, Medtronic, Abbott, Biosense Webster, Inc. (Johnson & Johnson), Biotronik SE & Co. KG., GE Healthcare, and Siemens Healthineers AG

b. Key factors that are driving the electrophysiology devices market growth include growing demand for cardiac rhythm management devices for continuous monitoring and the increasing use of these devices in out-of-hospital settings

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."