- Home

- »

- Medical Devices

- »

-

Electrosurgical Generators Market Size & Share Report, 2030GVR Report cover

![Electrosurgical Generators Market Size, Share & Trends Report]()

Electrosurgical Generators Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Monopolar, Bipolar, Hybrid), By Product (Radiofrequency, Ultrasonic, Argon Plasma), By Application, By End Use, By Region, And Segment Forecast

- Report ID: GVR-4-68040-509-5

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrosurgical Generators Market Summary

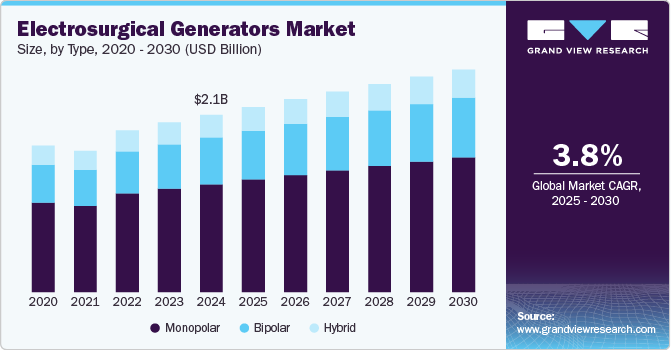

The global electrosurgical generators market size was estimated at USD 2,118.2 million in 2024 and is projected to reach USD 2,659.2 million by 2030, growing at a CAGR of 3.8% from 2025 to 2030. The electrosurgical generator industry is primarily driven by several key factors, including the increasing prevalence of chronic diseases such as cancer, cardiovascular conditions, and neurological disorders, which often require surgical intervention.

Key Market Trends & Insights

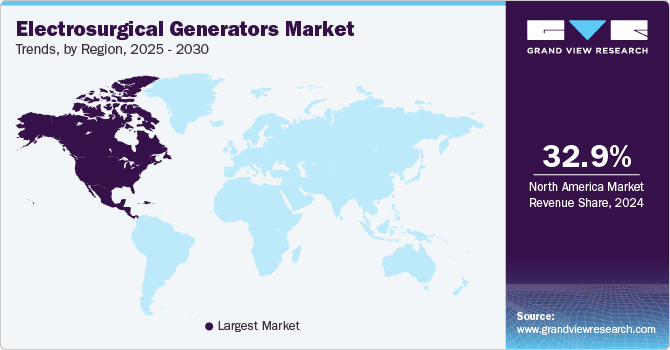

- North America dominated the electrosurgical generators market with the largest revenue share of 32.91% in 2024.

- Based on application, the general surgery segment led the market with the largest revenue share of 24.92% in 2024.

- Based on type, the monopolar segment accounted for the largest market revenue share in 2024.

- Based on product, the radiofrequency segment accounted for the largest market revenue share in 2024.

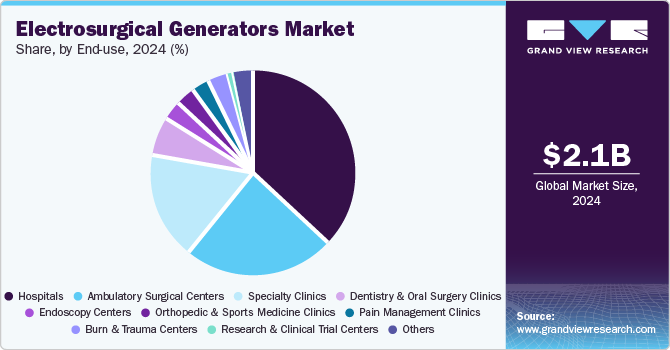

- Based on end use, the hospitals segment accounted for the largest market revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,118.2 Million

- 2030 Projected Market Size: USD 2,659.2 Million

- CAGR (2025-2030): 3.8%

- North America: Largest market in 2024

In addition, the rising demand for minimally invasive procedures is fueling market growth, as electrosurgical generators enable more precise surgeries with smaller incisions, resulting in faster recovery times and reduced complications.

According to NIH, lung cancer was the most common type of cancer in males, while breast cancer was the leading type in females. In children aged 0-14 years, lymphoid leukemia was the most prevalent cancer, with an incidence of 29.2% in boys and 24.2% in girls. The overall incidence of cancer cases is projected to rise by 12.8% in 2025 compared to 2020.

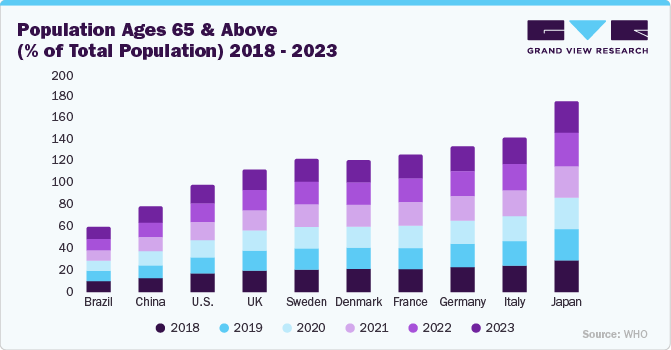

The aging population is a major driver of the electrosurgical generator industry. As the global population ages, the incidence of age-related diseases and conditions increases, boosting the demand for surgical interventions where electrosurgical equipment is critical. Older adults are more experienced with health issues that require surgical intervention, and electrosurgical generators play a key role in performing a wide range of procedures with precision, safety, and minimal invasiveness. As people age, they become more susceptible to chronic conditions such as cardiovascular diseases, cancer, diabetes, neurological disorders, and musculoskeletal problems. These diseases often require surgical treatments, many of which use electrosurgical generators for cutting, coagulation, and tissue ablation. The rise in the prevalence of these age-related diseases drives the demand for electrosurgical equipment to treat these conditions. As per the WHO, by 2030, 1 in 6 people worldwide will be aged 60 years or over.

The graph below shows an increase in the aging population from 2018 to 2023 across both developed and emerging countries, reflecting a growing need for surgical procedures due to aging populations and improved healthcare access. Developed countries like Japan, Italy, and Germany report the highest values, aligning with their rapidly aging demographics and advanced healthcare systems, which drive consistent demand for electrosurgical generators.

Technological innovations in electrosurgical generators have significantly enhanced their precision, safety, efficiency, and ease of use, transforming the landscape of surgical procedures. These innovations have been crucial in meeting the increasing demand for minimally invasive and highly precise surgeries. Modern electrosurgical generators integrate smart feedback and monitoring systems, such as those from Valleylab FT10 (by Medtronic) and ESG-400 (by Bovie Medical). These systems automatically adjust power delivery based on real-time tissue impedance. The feedback ensures optimal cutting and coagulation, enhancing the efficiency and safety of surgeries. Incorporating real-time tissue impedance monitoring minimizes the risk of thermal injury to surrounding tissues, providing safer outcomes, especially in delicate surgeries such as neurosurgery or laparoscopic procedures.

The increasing prevalence of neurological disorders is a key driver of growth in the electrosurgical generator industry, particularly in the neurological surgery segment. With the rising incidence of conditions such as epilepsy, brain tumors, Parkinson’s disease, spinal cord injuries, and neurovascular disorders, the demand for electrosurgical equipment used in neurosurgical procedures has significantly increased. Electrosurgical generators are crucial in these surgeries as they provide high-precision cutting, coagulation, and tissue removal capabilities, which are essential in delicate neurological procedures. In July 2024, an article from the American Academy of Neurology, published, estimated that between 1.6 and 3.8 million sports-related concussions occur annually in the U.S. Various sports, including basketball, football, baseball, field hockey, ice hockey, lacrosse, rugby, softball, volleyball, and wrestling, are identified as common contributors to concussions.

The American Cancer Society’s estimates for brain and spinal cord tumors in the U.S. for 2025 include adults and children.

-

About 24,820 malignant tumors of the brain or spinal cord (14,040 in males and 10,780 in females) will be diagnosed. These numbers would be much higher if benign (non-cancer) tumors were also included.

-

About 18,330 people (10,170 males and 8,160 females) will die from brain and spinal cord tumors.

The following table highlights the top 15 U.S. states with the highest percentage death rates, alongside the corresponding number of PD cases. The data provides insights into regional variations, helping to identify states with the most significant prevalence and healthcare demand.

Top 15 U.S. States Based on the Death Rate (%) Due to PD, for 2022

Rank

State

Death Rate

Number of Cases

1

Utah

12.40%

343

2

Kansas

11.50%

423

3

Nebraska

11.40%

275

4

Tennessee

11.20%

957

5

New Hampshire

11.10%

218

6

Texas

11.10%

3,091

7

Oregon

11.00%

626

8

Alaska

10.90%

62

9

Indiana

10.90%

904

10

Vermont

10.90%

105

11

Idaho

10.80%

243

12

Colorado

10.70%

665

13

Iowa

10.70%

466

14

Alabama

10.70%

696

15

Georgia

10.30%

1,168

Source: CDC

The data below shows that the majority of U.S. adults with active epilepsy are between 18-64 years old (over 80%), and slightly more are women (55.1%). This demographic trend supports the growing demand for electrosurgical generators, particularly in neurological procedures related to epilepsy. As younger patients are more likely to undergo surgical treatment, and with the rise of outpatient care in ASCs, there is an increased need for advanced, portable electrosurgical units tailored for epilepsy surgeries and neurology departments.

Numbers and Percentages of U.S. Adults with Active Epilepsy

Main group

Subgroup

Number of Adults

Percent

Age group

18-44

1,384,682

44.6

45-64

1,124,876

36.2

65-79

473,292

15.2

80 and over

123,852

4

Sex

Men

1,405,474

44.9

Women

1,724,012

55.1

Source: CDC

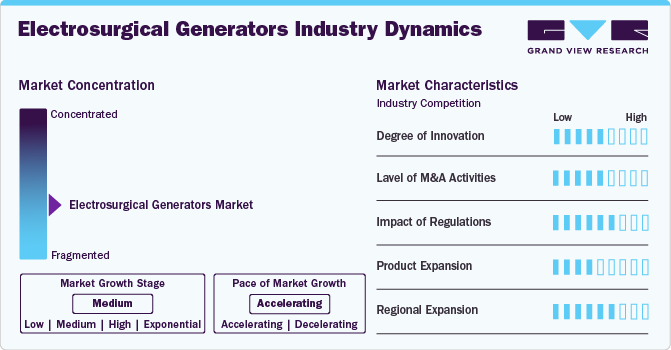

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The electrosurgical generators industry is characterized by a high degree of growth due to the increasing government funding propels scientific advancements and encourages collaboration between researchers, medical professionals, and technology developers.

The degree of innovation in the electrosurgical generators industry is a key factor influencing market growth and competition. Ongoing technological advancements in electrosurgical systems, such as integrating robot-assisted surgery, innovative technology, and AI-based feedback systems, are improving electrosurgical procedures' precision, safety, and efficiency. Innovations in bipolar and monopolar systems, such as better energy delivery, improved handpieces, and reduced tissue damage, are driving the adoption of these devices across a wide range of surgical specialties.

The impact of regulations on the electrosurgical generators industry is significant, as electrosurgical product development, approval, and distribution are subject to strict regulatory requirements set by agencies such as the FDA (U.S.), CE (Europe), and Health Canada. These regulations ensure the safety, efficacy, and quality of electrosurgical devices, which is critical for patient safety and the reputation of manufacturers.

Mergers and acquisitions (M&A) activities in the electrosurgical generators industry drive significant consolidation as more prominent players seek to expand their portfolios and market presence. Through strategic acquisitions, leading companies can acquire innovative technologies, enhance their product offerings, and expand into new markets. M&A activities also allow companies to enter underdeveloped markets, leveraging established local networks. This level of consolidation is expected to intensify during the forecast period, enabling greater competition and accelerating technological advancements in the market.

The presence of product substitutes in the electrosurgical generators industry can influence the market dynamics by providing alternatives to traditional electrosurgery. Laser surgery, cryosurgery, and radiofrequency ablation offer similar tissue cutting, coagulation, and ablation functions. These alternatives can offer specific benefits, such as reduced thermal damage, fewer complications, or more precise targeting in specific procedures.

Regional expansion plays a crucial role in the growth of the electrosurgical generators industry. As healthcare infrastructure improves in developing regions, such as Asia-Pacific, Latin America, and parts of Africa, there is an increased demand for advanced medical technologies, including electrosurgical devices. These regions are experiencing growing healthcare investments, rising disposable incomes, and greater access to modern surgical facilities, which drive the adoption of electrosurgical generators.

Type Insights

Based on type, the monopolar segment accounted for the largest market revenue share in 2024, due to several advantages that make them the preferred choice in a wide range of surgical procedures. Monopolar electrosurgery is highly versatile and used in various surgical specialties, including general surgery, gynecology, urology, dermatology, and neurological surgery. These generators are essential for cutting, coagulation, and tissue removal, making them a staple in many surgeries. Monopolar electrosurgical generators are well-known and widely used in routine surgeries due to their simplicity and ease of use. Surgeons are highly familiar with monopolar technology, making it a comfortable choice for many surgical procedures. This widespread familiarity has made monopolar devices a dominant force in the market.

The bipolar segment is expected to grow at the fastest CAGR during the forecast period. Bipolar electrosurgery offers enhanced precision and safety compared to monopolar systems. In bipolar systems, the electrical current is confined to the tissue between the two electrodes at the tips of the instrument, reducing the risk of damage to surrounding tissues. This makes bipolar generators particularly suitable for delicate surgeries, such as those involving neurovascular tissues, spinal surgeries, and gynecology, where precision is critical. One significant advantage of bipolar electrosurgery is the minimal thermal spread beyond the targeted tissue. This is especially important in microsurgery and minimally invasive procedures, where surrounding tissues must be preserved to avoid complications. Bipolar generators' ability to deliver focused energy allows for safer procedures with reduced collateral damage, driving their adoption.

Product Insights

The radiofrequency segment accounted for the largest market revenue share in 2024. Due to their versatility, precision, and broad application across various surgical specialties such as general surgery, gynecology, dermatology, ENT, and neurological surgery. These generators are essential for cutting and coagulation, making them ideal for minimally invasive, laparoscopic, and robot-assisted surgeries, where precision is crucial. They offer enhanced safety features, such as automatic tissue impedance monitoring and electrical isolation, which reduce the risk of complications and improve patient outcomes. With technological advancements, RF generators are more compact, energy-efficient, and user-friendly, making them cost-effective for healthcare facilities and increasingly popular in routine and elective surgeries. Their ability to provide consistent energy delivery with minimal tissue damage further contributes to faster recovery times and better surgical results, which is their dominance in the market.

The ultrasonic segment is expected to grow at the fastest CAGR during the forecast period. Ultrasonic electrosurgery generators use high-frequency sound waves to cut and coagulate tissue. This technology offers superior precision, minimizing thermal damage to surrounding tissues and reducing the risk of complications such as infection, scarring, and necrosis. The ability to work with high accuracy in delicate tissues makes ultrasonic generators increasingly popular in oncological procedures, head and neck surgeries, and soft tissue resections. Due to their vibration-based energy transfer, ultrasonic devices offer better control over tissue cutting and coagulation. This control translates to faster and more efficient surgeries, with surgeons able to operate with less force, reducing patient trauma. These benefits drive the growth of ultrasonic electrosurgical systems in fields where precision and efficiency are paramount, such as plastic surgery, vascular surgery, and laparoscopic procedures.

Application Insights

Based on application, the general surgery segment led the market with the largest revenue share of 24.92% in 2024. General surgery encompasses various procedures, such as appendectomies, hernia repairs, gallbladder removal, and colon resections. These surgeries often require electrosurgical generators for tasks such as cutting through tissues and achieving hemostasis, which increases the overall demand for these devices. Electrosurgical generators are used extensively in open, laparoscopic, and robot-assisted surgeries across general surgery. They are versatile tools essential for various surgical techniques, including tissue dissection, coagulation, and sealing. The ability to precisely control tissue and bleeding in various surgical procedures has cemented their role in this specialty. Laparoscopic (minimally invasive) surgeries, a key part of general surgery, rely heavily on electrosurgical generators. These procedures use smaller incisions requiring advanced instruments, including electrosurgical generators for cutting and coagulation. The rise of minimally invasive techniques has increased the demand for electrosurgical generators in general surgery.

The neurological surgery segment is expected to grow at the fastest CAGR during the forecast period. Neurological conditions, such as brain tumors, epilepsy, spinal disorders, Parkinson's disease, and neurovascular diseases, are rising globally due to aging populations and lifestyle changes. As the number of patients requiring surgical intervention increases, the demand for electrosurgical generators used in neurological surgeries, including tumor resection, spinal surgeries, and deep brain stimulation procedures, is also growing. According to the Parkinson's Foundation, nearly one million people in the U.S. are living with Parkinson's disease (PD). This number is expected to rise to 1.2 million by 2030. Parkinson's is the second-most common neurodegenerative disease after Alzheimer's disease. Nearly 90,000 people in the U.S. are diagnosed with PD each year.

End Use Insights

Based on end use, the hospitals segment accounted for the largest market revenue share in 2024, due to their extensive surgical volume, advanced infrastructure, and wide range of medical specialties requiring electrosurgical procedures. As primary healthcare providers, hospitals conduct many surgeries daily, including general, laparoscopic, gynecological, gastrointestinal, ENT, pulmonary, and oncological procedures, all of which rely on electrosurgical generators for precise tissue cutting, coagulation, and hemostasis. The presence of well-equipped operating rooms, high patient admission rates, and the availability of skilled surgeons and support staff drive the demand for these devices in hospitals. In addition, hospitals have the financial capacity to invest in high-end electrosurgical equipment, ensuring continuous upgrades to meet technological advancements and improve patient outcomes. The increasing preference for minimally invasive and robotic-assisted surgeries, which require advanced electrosurgical generators, further strengthens hospital dominance in this market. Moreover, hospitals adhere to stringent safety and regulatory standards, necessitating high-quality electrosurgical devices to enhance procedural efficiency and reduce surgical risks. In the U.S., the number of surgeries performed in hospitals each year is estimated to be around 40-50 million.

The ambulatory surgical centers (ASCs) segment is expected to grow at the fastest CAGR during the forecast period. This growth is primarily driven by the increasing shift toward outpatient surgeries due to their cost-effectiveness, shorter recovery times, and lower risk of hospital-acquired infections. ASCs are increasingly adopting advanced electrosurgical technologies to support a wide range of minimally invasive procedures, further fueling market demand. In addition, supportive reimbursement policies and technological advancements in portable electrosurgical units make them highly suitable for ASC environments, reinforcing this segment’s rapid expansion.

Regional Insights

North America dominated the electrosurgical generators market with the largest revenue share of 32.91% in 2024. The region benefits from well-established healthcare infrastructure, high adoption rates of advanced medical technologies, and a growing preference for minimally invasive procedures. The increasing prevalence of chronic diseases such as cancer and cardiovascular disorders has further fueled the demand for electrosurgical devices in surgical interventions. Favorable reimbursement policies and significant healthcare expenditures contribute to market growth.

U.S. Electrosurgical Generators Market Trends

The electrosurgical generators market in the U.S.held a significant share of the market in 2024, primarily driven by the country's advanced healthcare infrastructure, high adoption of innovative medical technologies, and the increasing prevalence of chronic disease. The aging population in the U.S. has led to a higher incidence of chronic diseases, necessitating more surgical interventions and thereby driving the demand for electrosurgical devices. In addition, significant investments in healthcare infrastructure facilitate the adoption of advanced medical technologies, including electrosurgical generators. Moreover, the U.S. is home to leading manufacturers and suppliers of medical devices, which boosts the availability and innovation of electrosurgical generators. The growing focus on patient safety, comfort, and minimally invasive procedures further drives the demand for these systems.

Europe Electrosurgical Generators Market Trends

The electrosurgical generators market in Europe is experiencing significant growth. Europe's growing elderly population has led to a higher incidence of chronic diseases, necessitating more surgical interventions and thereby driving the demand for electrosurgical devices. Significant investments in healthcare infrastructure across European countries facilitate the adoption of advanced medical technologies, including electrosurgical generators. While the market is expanding, stringent EU regulations for medical devices can pose challenges, potentially affecting the approval and adoption of new electrosurgical products.

The UK electrosurgical generators marketis expected to grow at a significant CAGR during the forecast period. The rising prevalence of neurological disorders such as epilepsy and dementia is driving the demand for advanced diagnostic tools, including electrosurgical generators, in hospitals and diagnostic centers. In 2024, dementia was a major health concern in the UK, with a record number of people diagnosed with the disease. The NHS is working to improve diagnosis rates and provide support for people living with dementia. As of January 2024, 477,623 people in the UK had a dementia diagnosis. The UK's healthcare system is adopting minimally invasive procedures, which rely on electrosurgical generators for brain monitoring. The aging population, more susceptible to neurological conditions, further fuels the need for these systems.

Asia Pacific Electrosurgical Generators Market Trends

The electrosurgical generators market in Asia Pacificis experiencing rapid growth. With significant advancements in healthcare infrastructure, particularly in countries such as Japan, South Korea, and India, the market for electrosurgical generators in Asia is set for substantial expansion. Increased focus on patient safety, hygiene, and infection control also contributes to the growth of electrosurgical generators across the region. These factors indicate that the Asia Pacific market will continue to grow rapidly, driven by technological innovations and the expanding demand for quality healthcare services.

The China electrosurgical generators market is expected to grow at a lucrative CAGR during the forecast period. The Chinese government's substantial investments in healthcare infrastructure have established new hospitals and medical facilities, boosting the adoption of advanced medical equipment, including electrosurgical generators. China's rapidly aging population has led to an increase in age-related health issues, necessitating a higher volume of surgical interventions where electrosurgical generators are utilized.

Latin America Electrosurgical Generators Market Trends

The electrosurgical generators market in Latin America is rising. Many Latin American governments are investing in modernizing healthcare systems and promoting the adoption of electrosurgical devices in public hospitals. Countries such as Brazil, Mexico, and Colombia are becoming medical tourism hubs, leading to increased demand for advanced surgical technologies, including electrosurgical generators.

Middle East and Africa Electrosurgical Generators Market Trends

The electrosurgical generators market in MEA is experiencing growth driven by technological advancements in electrosurgical devices have enhanced precision and safety, making them more effective for various surgical procedures. In addition, there is a rising demand for minimally invasive surgeries, which often utilize electrosurgical techniques due to their reduced recovery times and lower risk of complications. The region’s increasing prevalence of chronic diseases has led to a higher volume of surgical interventions, further propelling the market.

The Saudi Arabia electrosurgical generators marketis driven by Saudi Arabia's investment in modernizing its healthcare infrastructure, particularly under its Vision 2030 plan, which significantly contributes to the market expansion. The growing prevalence of neurological disorders, such as epilepsy, stroke, and Alzheimer's disease, is increasing the demand for precise diagnostic tools such as electrosurgical generators, which are essential for brain monitoring procedures such as electroencephalography (EEG).

Key Electrosurgical Generators Company Insights

Key players operating in the electrosurgical generators industry are undertaking various initiatives to strengthen their market presence and increase the reach of their product types and services. Strategies such as expansion activities and partnerships play a key role in propelling market growth.

Key Electrosurgical Generators Companies:

The following are the leading companies in the electrosurgical generators market. These companies collectively hold the largest market share and dictate industry trends.

- MedGyn Products, Inc.

- MEDICHEM ELECTRONICS PVT LTD.

- B. Braun Melsungen AG

- Telea Electronic Engineering S.r.l.

- Ackermann Instrumente GmbH

- Ethicon (Johnson & Johnson)

- Olympus

- CONMED Corporation

- Integra LifeSciences Corporation

- MATRIX MEDICALS.

- Medtronic

Recent Developments

-

In January 2025, Medtronic entered a U.S. distribution agreement with Contego Medical, enhancing its presence in the carotid and peripheral vascular disease markets. This partnership could contribute to the market expansion of electrosurgical generators, particularly in vascular and minimally invasive surgeries.

-

In September 2024,Mindray, a medical equipment manufacturer, introduced the UP700 Electrosurgical Diathermy Generator Unit at the 27th International Federation for the Surgery of Obesity and Metabolic Disorders (IFSO) World Congress in Melbourne, Australia.

-

In January 2024, Olympus announced the full market availability of its redesigned ESG-410 Surgical Energy Platform, a comprehensive energy solution for various surgical specialties. The ESG-410 supports multiple energy modes, including monopolar, bipolar, advanced bipolar, ultrasonic, and hybrid energy, catering to diverse surgical needs.

-

In June 2023, Olympus introduced the ESG-410 Electrosurgical Generator, a next-generation device designed to enhance the treatment of non-muscle-invasive bladder cancer and benign prostatic hyperplasia.

Electrosurgical Generators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.21 billion

Revenue forecast in 2030

USD 2.66 billion

Growth rate

CAGR of 3.76% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue, competitive landscape, growth factors, and trends

Segment Scope

Product, type, application, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; & MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

MedGyn Products, Inc.; MEDICHEM ELECTRONICS PVT LTD.; B. Braun Melsungen AG; Telea Electronic Engineering S.r.l.; Ackermann Instrumente GmbH; Ethicon (Johnson & Johnson); Olympus; CONMED Corporation; Integra LifeSciences Corporation; MATRIX MEDICALS.; Medtronic

Customization scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrosurgical Generators Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global electrosurgical generators market report based on the product, type, application, end use, and region:

-

Type Outlook (Revenue USD Million; 2018 - 2030)

-

Monopolar Electrosurgical Generators

-

Bipolar Electrosurgical Generators

-

Hybrid Electrosurgical Generators

-

-

Product Outlook (Revenue USD Million; 2018 - 2030)

-

Radiofrequency Electrosurgery Generators

-

Ultrasonic Electrosurgery Generators

-

Molecular Resonance Electrosurgery Generators

-

Argon Plasma Electrosurgery Generators

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

General Surgery

-

Gynecological Surgery

-

Cardiovascular Surgery

-

Orthopedic Surgery

-

Neurological Surgery

-

ENT Surgical

-

Urological Surgery

-

Other

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Specialty Clinics

-

Dermatology Clinics

-

Urology Clinics

-

Gynecology Clinics

-

ENT (Ear, Nose, and Throat) Clinics

-

Plastic Surgery Clinics

-

-

Dentistry & Oral Surgery Clinics

-

Oral Surgery Practices

-

Periodontics Clinics

-

-

Endoscopy Centers

-

Orthopedic & Sports Medicine Clinics

-

Pain Management Clinics

-

Burn & Trauma Centers

-

Research & Clinical Trial Centers

-

Others (e.g., Veterinary Clinics, Hospices)

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

Denmark

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrosurgical generators market size was estimated at USD 2.12 billion in 2024 and is expected to reach USD 2.21 billion in 2025.

b. The global electrosurgical generators market is expected to grow at a compound annual growth rate of 3.76% from 2025 to 2030, reaching USD 2.66 billion by 2030.

b. North America dominated the electrosurgical generators market, with a share of 32.91% in 2024. It has a well-established healthcare system, with a large number of hospitals and surgical centers equipped with advanced medical technologies, including electrosurgical generators.

b. Some of the key players in the market are MedGyn Products, Inc., MEDICHEM ELECTRONICS PVT LTD., B. Braun Melsungen AG, Telea Electronic Engineering S.r.l., Ackermann Instrumente GmbH, Ethicon (Johnson & Johnson), Olympus, CONMED Corporation, Integra LifeSciences Corporation, MATRIX MEDICALS., Medtronic

b. The rise in the number of surgeries worldwide, including minimally invasive and outpatient procedures, boosts the demand for electrosurgical generators.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.