- Home

- »

- Research

- »

-

Electrotherapy Market Size & Share, Industry Report, 2033GVR Report cover

![Electrotherapy Market Size, Share & Trends Report]()

Electrotherapy Market (2025 - 2033) Size, Share & Trends Analysis Report By Therapy Type (TENS, IFT, NMES/FES), By Application (Nervous Disease, Muscle Injury, Inflammation), By Region, And Segment Forecasts

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Electrotherapy Market Summary

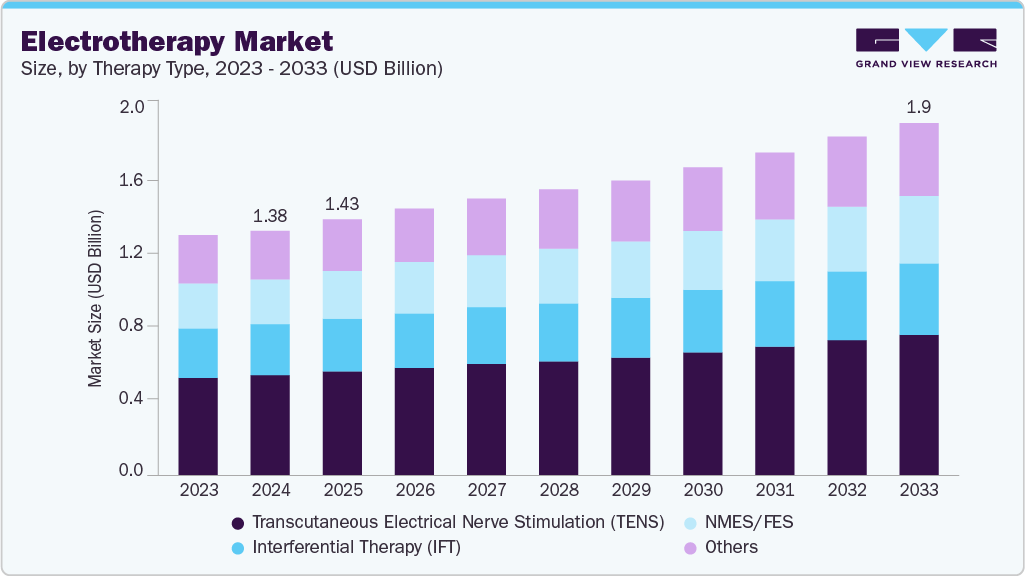

The global electrotherapy market size was estimated at USD 1.38 billion in 2024 and is projected to reach USD 1.98 billion by 2033, growing at a CAGR of 4.12% from 2025 to 2033. The market is primarily driven by the rising prevalence of chronic pain, musculoskeletal disorders, and neurological conditions, which increase the demand for effective, non-invasive treatment options.

Key Market Trends & Insights

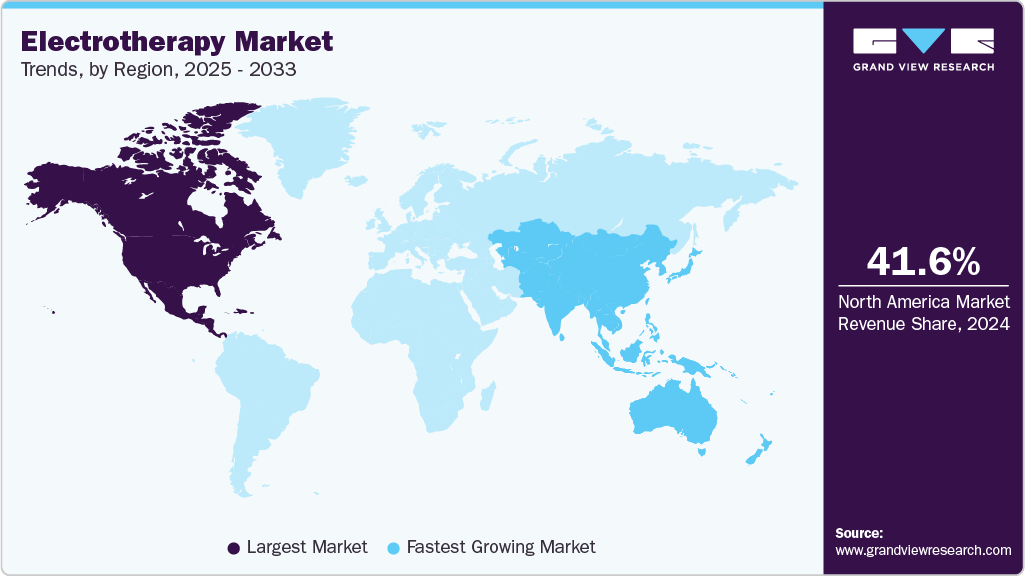

- North America dominated the electrotherapy market with the largest revenue share of 41.56% in 2024.

- The electrotherapy market in the U.S. accounted for the largest market revenue share of 83.49% in North America in 2024.

- Based on therapy type, the transcutaneous electrical nerve stimulation (TENS) segment led the market with the largest revenue share of 41.86% in 2024.

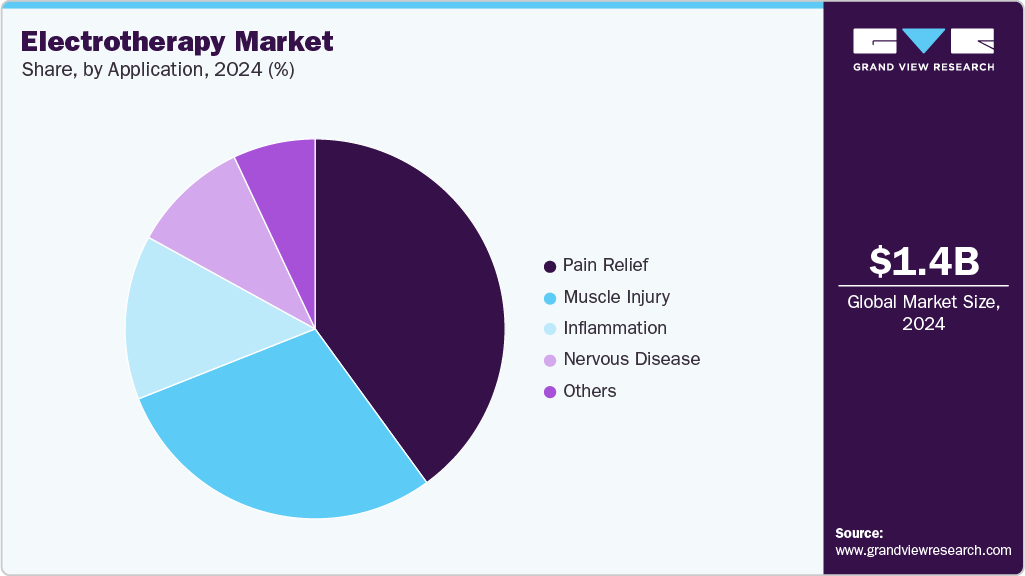

- Based on application, the pain relief segment led the market with the largest revenue share of 39.84% in 2024.

Market Size & Forecast

- 2024 Market Revenue: USD 1.38 Billion

- 2033 Projected Market Revenue: USD 1.98 Billion

- CAGR (2025-2033): 4.12%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Technological advancements in portable and user-friendly devices, such as TENS and EMS units, have enhanced accessibility and improved patient compliance. The growing preference for drug-free and non-surgical pain management solutions is fueling market adoption.

An aging population, more prone to chronic ailments, further supports demand. Meanwhile, increasing awareness of physical therapy and rehabilitation, along with supportive healthcare initiatives and investments, is driving global market growth.

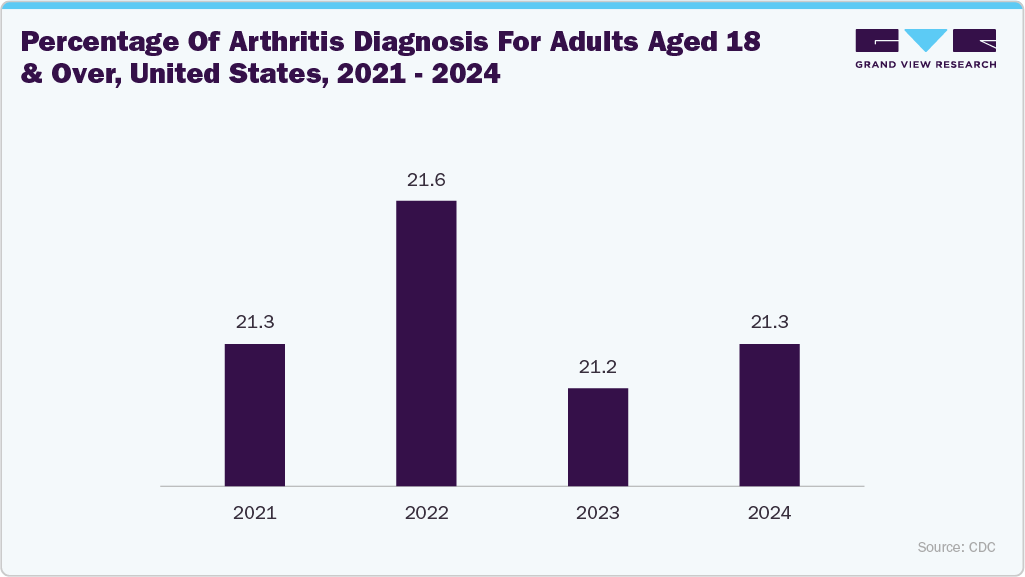

The growing prevalence of chronic diseases such as arthritis, diabetes, cardiovascular disorders, and chronic pain conditions is a major market driver. These long-term health issues often result in reduced mobility, muscle degeneration, and persistent pain, creating a strong demand for non-invasive and cost-effective therapeutic solutions. Electrotherapy modalities, including TENS, EMS, and NMES, are increasingly utilized to manage pain, improve muscle function, and enhance rehabilitation outcomes in patients with chronic conditions. The shift toward home-care and remote treatment options for chronic disease management further accelerates the adoption of portable and user-friendly electrotherapy devices worldwide.

The increasing burden of neurological disorders and musculoskeletal issues is one of the factors fueling the demand for electrotherapy devices. Conditions like stroke, spinal cord injuries, Parkinson’s disease, and neuropathic pain often lead to impaired nerve signaling and muscle weakness, where therapies like NMES, FES, and TENS play a crucial role in restoring functional movement and reducing pain. Musculoskeletal problems, including back pain, osteoarthritis, and tendon injuries, benefit from electrotherapy’s ability to enhance muscle activation, improve circulation, and accelerate tissue healing.

According to the WHO in October 2025, less than one in three countries worldwide has implemented a national policy to manage the escalating burden of neurological disorders, which are linked to more than 11 million deaths annually. The newly released Global Status Report on Neurology highlights that neurological conditions now impact over 3 billion people, more than 40% of the global population, underscoring the urgent need for improved prevention, care systems, and rehabilitation strategies.

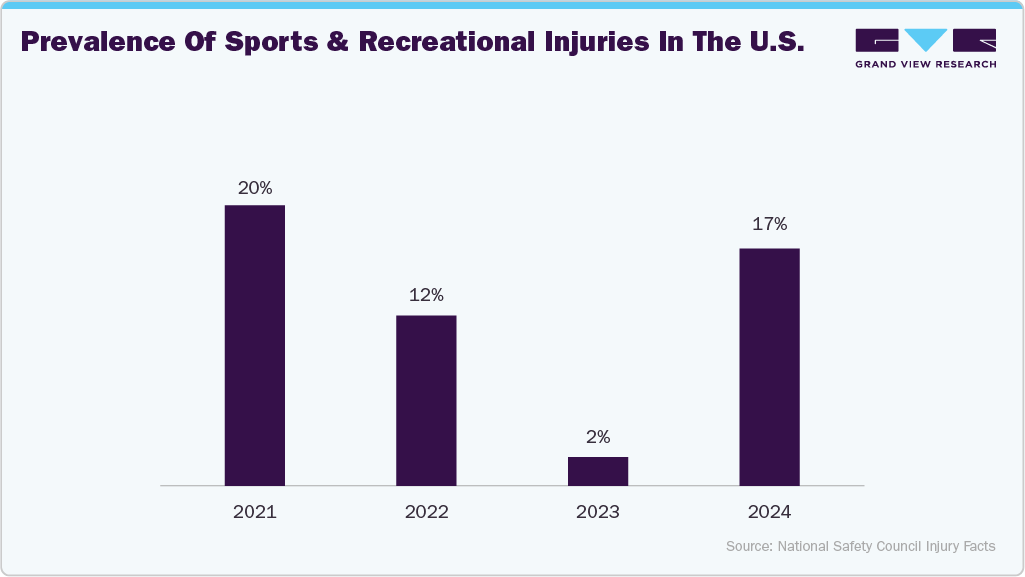

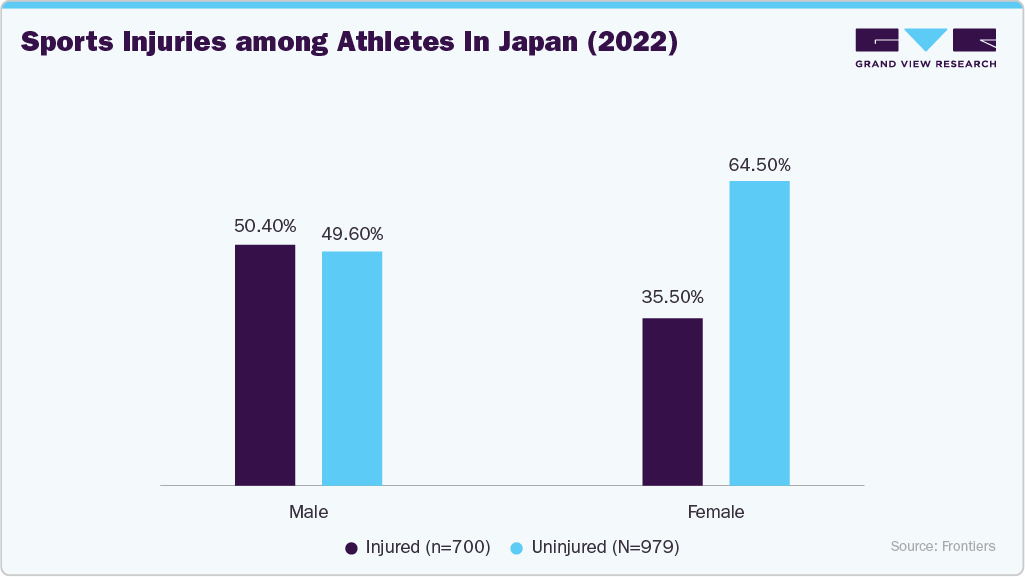

The rising incidence of sports-related injuries is significantly driving market growth. Athletes and physically active individuals frequently require targeted pain management, muscle recovery, and rehabilitation interventions, making electrotherapy a preferred option due to its rapid and non-invasive therapeutic benefits. Modalities such as EMS, NMES, and IFC therapy are widely used to accelerate muscle healing, reduce inflammation, and prevent long-term functional impairments. Moreover, increased investments in sports medicine, along with the expansion of training facilities and awareness of injury prevention, continue to boost demand for advanced and portable electrotherapy technologies across professional and recreational sports environments.

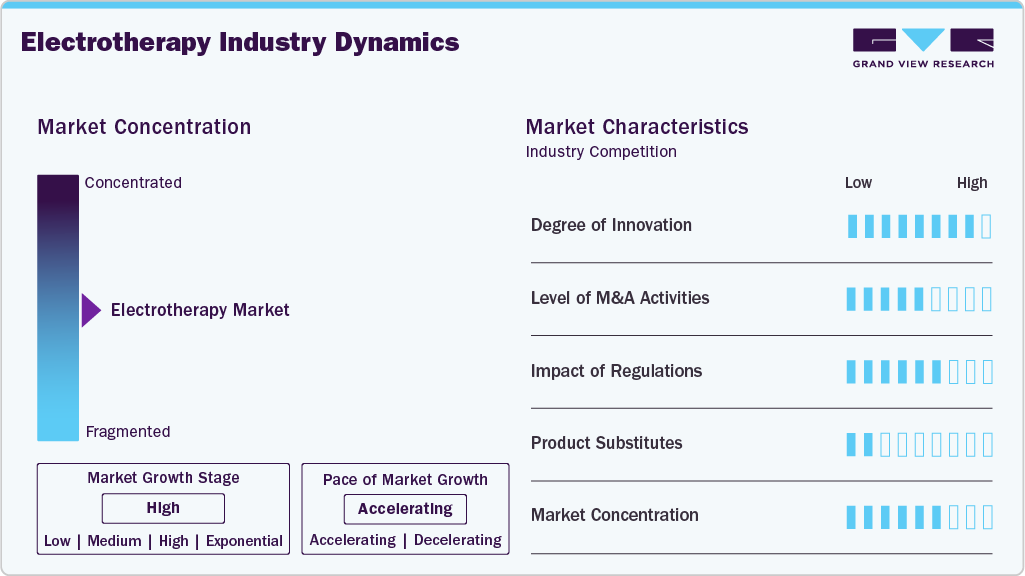

Market Characteristics

The electrotherapy industry exhibits a high degree of innovation, driven by advancements in smart wearable technologies, miniaturized devices, and AI-enabled personalized therapy. Emerging solutions focus on real-time parameter optimization, remote connectivity, and improved user interfaces to enhance treatment adherence and outcomes. In October 2025, Nature published an article detailing a breakthrough electrotherapy platform designed without electronic components, relying instead on printed, abundant, and eco-friendly materials. Activated upon body contact, this discreet single-use system regulates therapy dose through a flexible 3D electrochemical architecture, eliminating the need for power sources and electronics. Scalable additive manufacturing enables low-cost, pharmacy-style distribution, opening broad clinical applications from neuromodulation and wound healing to transcutaneous drug delivery and bioelectronic medicine.

Regulations play a critical role in shaping the electrotherapy industry by ensuring device safety, clinical efficacy, and standardized product performance. Stringent approval pathways from authorities such as the FDA and CE marking requirements can extend product development timelines, but also build greater trust among healthcare providers and patients. As electrotherapy expands into home-care and wearable applications, evolving regulatory frameworks are increasingly emphasizing cybersecurity and remote monitoring compliance. In addition, harmonization of global standards supports international commercialization, while reimbursement-related guidelines significantly influence market adoption and accessibility.

The electrotherapy industry is experiencing a moderate to high level of mergers and acquisitions as companies aim to strengthen their technological capabilities and broaden their therapeutic portfolios. Key players are actively acquiring innovative startups specializing in wearable stimulation, digital health integration, and home-based rehabilitation solutions. These strategic consolidations help accelerate market expansion, enhance R&D pipelines, and improve global distribution networks. Partnerships between medical device firms and tech companies are becoming more common to advance AI-enabled and connected electrotherapy platforms.

The electrotherapy industry faces competition from several product substitutes that offer alternative approaches to pain relief and rehabilitation. These include pharmacological treatments such as analgesics and anti-inflammatory drugs, as well as non-electrical therapies like manual physiotherapy, ultrasound therapy, and heat/cold therapy. In addition, emerging technologies such as regenerative medicine, laser therapy, and wearable biomechanical devices are gaining traction as non-invasive options. The availability of diverse substitutes can influence patient and clinician preferences, particularly when electrotherapy outcomes are inconsistent or require longer treatment durations.

Therapy Type Insights

The transcutaneous electrical nerve stimulation (TENS) segment accounted for the largest revenue market share in 2024, driven by its widespread adoption for effective and non-invasive pain relief. TENS devices are widely used in hospitals, physiotherapy clinics, and home care settings due to their ease of use, affordability, and proven effectiveness in alleviating both acute and chronic pain conditions. The rising prevalence of musculoskeletal disorders and increased preference for drug-free pain management solutions have further boosted demand for TENS technology. Advancements in portable and wearable TENS devices with digital connectivity continue to enhance patient convenience and support the segment’s dominant market position. For instance, in January 2025, the National Library of Medicine highlighted the need for stronger evidence supporting the use of TENS in chronic pain management due to methodological inconsistencies. While TENS and EMS show promise for pain relief and neuromuscular rehabilitation, future innovations must prioritize personalized parameter optimization, remote monitoring, and standardized study protocols to maximize therapeutic outcomes and accessibility.

The NMES/FES segment is expected to register the highest CAGR in the market from 2025 to 2033, driven by the rising prevalence of neurological disorders, increased rehabilitation needs following stroke and spinal cord injuries, and strong clinical adoption in post-surgical muscle recovery. Technological advancements, such as wearable and home-based NMES/FES systems, are improving patient accessibility and convenience. Integration with digital health platforms supports real-time therapy monitoring and personalized treatment. Growing investments in research and favorable reimbursement policies in developed regions are further accelerating demand for NMES/FES devices across both clinical and home-care settings.

Application Insights

The pain relief segment holds the largest market share in 2024. Driven by the rising prevalence of chronic pain conditions such as arthritis, back pain, and neuropathy. The growing preference for non-invasive, drug-free pain management solutions, especially amid concerns over opioid dependency, has significantly boosted demand for electrotherapy devices like TENS and interferential therapy systems. The increased adoption in both home care settings and physiotherapy clinics further supported the segment’s strong market share, as patients seek convenient and effective methods to manage pain and improve their quality of life.

The muscle injury segment is expected to be the fastest-growing in the market during the forecast period, fueled by increasing sports activities, fitness trends, and a rising incidence of muscle strains and soft tissue injuries. Electrotherapy devices such as EMS and therapeutic ultrasound are widely adopted in rehabilitation centers and sports medicine clinics to promote muscle recovery, reduce inflammation, and enhance mobility. The growing awareness of early injury management and the shift toward non-invasive therapeutic solutions further support the rapid expansion of this segment.

Regional Insights

North America dominated the electrotherapy market with the largest revenue share in 2024. The growth is driven by a high incidence of chronic pain, sports injuries, and neurological disorders, which drive demand for effective rehabilitation therapies. Strong healthcare infrastructure and rapid adoption of advanced medical technologies support consistent market expansion. The increasing preference for home-based care has also boosted the use of portable electrotherapy devices across the region. The aging population and focus on non-opioid, non-invasive pain management continue to fuel market growth. Supportive clinical guidelines and ongoing investments in physiotherapy and rehabilitation services strengthen market presence in both the U.S. and Canada.

U.S. Electrotherapy Market Trends

The electrotherapy market in the U.S. is expanding steadily, driven by the growing prevalence of chronic pain, arthritis, and sports-related injuries that require rehabilitation and pain management solutions. The strong adoption of advanced medical technologies and high awareness of physiotherapy benefits support the demand for electrotherapy devices. The shift toward home healthcare, along with the availability of portable and user-friendly devices, further accelerates market growth. The aging population and continued emphasis on non-opioid, drug-free pain management strategies encourage broader usage. Investments in research and supportive clinical guidelines also contribute to the evolving market landscape in the United States.

Europe Electrotherapy Market Trends

The electrotherapy market in Europe is growing steadily due to the high prevalence of chronic pain, orthopedic disorders, and age-related mobility issues across the region. Strong healthcare infrastructure, widespread adoption of physiotherapy, and established reimbursement systems support the consistent use of electrotherapy in both clinical and home settings. Technological advancements, such as connected and portable devices, are increasing patient accessibility and convenience. The region also benefits from the presence of leading medical device manufacturers and ongoing investments in rehabilitation technologies. In addition, growing awareness of non-pharmacological pain management strategies continues to drive market expansion throughout Europe.

The UK electrotherapy market is witnessing steady growth driven by increasing demand for non-invasive pain management solutions and rehabilitation therapies. The country has a strong emphasis on physiotherapy services within its healthcare system, which supports broader adoption of electrotherapy devices. Technological advancements in portable and wearable pain management solutions are also contributing to higher usage in home healthcare settings. The rising elderly population with chronic pain and mobility impairments is fueling market demand. Continued investments in healthcare innovation, along with supportive clinical guidelines, further encourage market expansion.

Asia Pacific Electrotherapy Market Trends

The electrotherapy market in the Asia Pacific is experiencing robust growth, driven by a rise in cases of musculoskeletal disorders, sports injuries, and chronic pain conditions across the region. The rapid expansion of healthcare infrastructure, particularly in countries like China and India, is enhancing access to advanced rehabilitation therapies. The rising awareness of non-invasive pain management and the growing adoption of home healthcare devices are further supporting market demand. The presence of cost-effective local manufacturers enhances affordability and accelerates market penetration. Government initiatives promoting physiotherapy services and aging population trends also contribute significantly to the region’s expanding market.

China electrotherapy market is expanding rapidly due to increasing healthcare spending, a rising aging population, and growing cases of chronic pain and orthopedic disorders. Technological advancements in wearable and home-use electrotherapy devices are further driving consumer adoption. Moreover, favorable government initiatives and the strong presence of domestic manufacturers are enhancing market competitiveness and accessibility. The growing popularity of physical therapy and rehabilitation centers is also boosting device utilization. In addition, rising awareness of non-invasive and drug-free pain management options continues to support market growth.

Latin America Electrotherapy Market Trends

The electrotherapy market in Latin America is experiencing significant growth due to an increasing focus on physical rehabilitation and a rising prevalence of musculoskeletal disorders across the region. Expanding access to healthcare services and greater acceptance of non-invasive pain management therapies are supporting market adoption. Furthermore, the emergence of local manufacturers offering cost-effective devices is helping to boost usage in hospitals and home care settings.

Middle East Africa Electrotherapy Market Trends

The electrotherapy market in the Middle East and Africa is experiencing gradual growth driven by rising investments in healthcare infrastructure and increasing awareness of non-invasive pain management solutions. The prevalence of chronic conditions and sports-related injuries is encouraging the adoption of electrotherapy in physiotherapy and rehabilitation centers. In addition, government initiatives aimed at improving access to advanced medical technologies are supporting market expansion, particularly in the Gulf Cooperation Council (GCC) countries.

Key Electrotherapy Company Insights

The market is moderately competitive, with several established medical device manufacturers focusing on innovation, product quality, and global distribution networks to maintain their market position. Leading companies continually invest in advanced technologies, including portable and connected devices, while expanding their presence in emerging regions to capture a larger market share. With these strategic initiatives, the market is expected toexperience significant growth over the forecast period.

Key Electrotherapy Companies:

The following are the leading companies in the electrotherapy market. These companies collectively hold the largest Market share and dictate industry trends.

- Zynex Medical

- BTL Group of Companies

- Omron Healthcare, Inc.

- NeuroMetrix, Inc.

- GymnaUniphy

- Enovis Corporation

- Medtronic

- Omron Healthcare, Inc.

- Stymco

- RS Medical

- Orthofix Medical

- Haifu

Recent Developments

-

In June 2025, MellingMedical announced a new strategic partnership with Zynex Medical, a leading innovator in non-invasive medical devices for pain management and rehabilitation. This collaboration capitalizes on MellingMedical’s status as an SBA-verified Service-Disabled Veteran-Owned Small Business (SDVOSB) to deliver Zynex’s advanced pain management solutions to federal healthcare providers serving America’s military personnel, Department of Defense, and veterans.

-

In March 2024, Zynex Inc., a medical technology company specializing in non-invasive devices for pain relief and rehabilitation, announced that its latest TensWave device had received FDA clearance.

-

In February 2024, Zynex, Inc., an innovative medical technology company focused on the development and distribution of non-invasive devices for pain management, rehabilitation, and patient monitoring, announced today that it has received FDA clearance for its next-generation M-Wave Neuromuscular Electrical Stimulation (NMES) device.

Electrotherapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.43 billion

Revenue forecast in 2033

USD 1.98 billion

Growth rate

CAGR of 4.12% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Therapy type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; Kuwait; UAE

Key companies profiled

Zynex Medical; BTL Group of Companies; Omron Healthcare, Inc.; NeuroMetrix, Inc.; GymnaUniphy; Enovis Corporation; Medtronic; Omron Healthcare, Inc.; Stymco; RS Medical; Orthofix Medical; Haifu

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Electrotherapy Market Report Segmentation

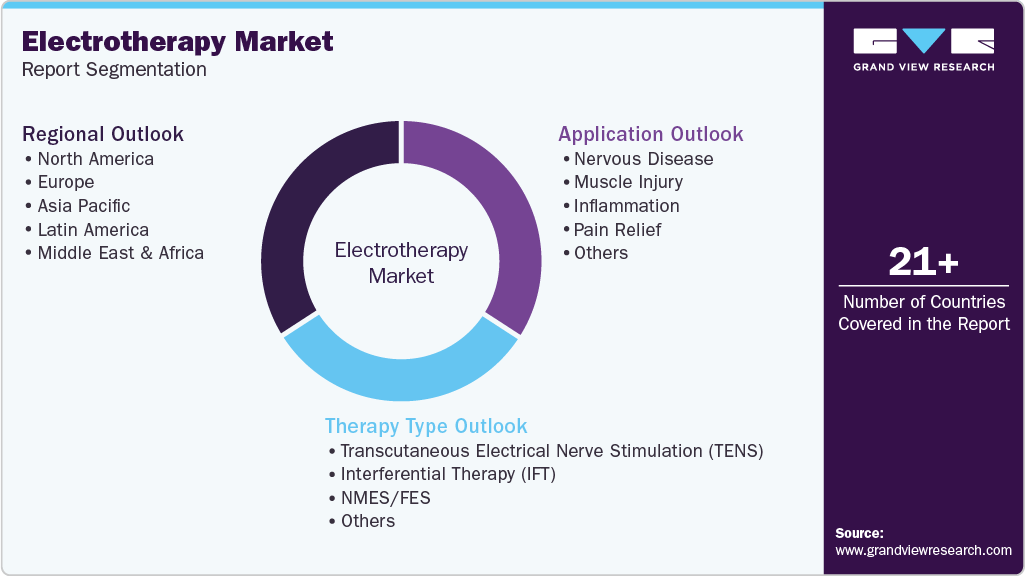

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global electrotherapy market report based ontherapy type, application, end use, and region

-

Therapy Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Transcutaneous Electrical Nerve Stimulation (TENS)

-

Interferential Therapy (IFT)

-

NMES/FES

-

Others

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Nervous Disease

-

Muscle Injury

-

Inflammation

-

Pain Relief

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global electrotherapy market size was estimated at USD 1.38 billion in 2024 and is projected to reach USD 1.43 billion by 2025.

b. The global electrotherapy market is expected to grow at a CAGR of 4.12% from 2025 to 2033 to reach USD 1.98 billion by 2033.

b. The transcutaneous electrical nerve stimulation (TENS) segment accounted for the largest revenue share of 41.86% in the electrotherapy market in 2024 driven by its widespread adoption for effective and non-invasive pain relief.

b. Some of the key players operating in the market include Zynex Medical, BTL Group of Companies, Omron Healthcare, Inc, NeuroMetrix, Inc., GymnaUniphy, Enovis Corporation, Medtronic, Omron Healthcare, Inc., Stymco, RS Medical, Orthofix Medical, and Haifu, among others.

b. The electrotherapy market is primarily driven by the rising prevalence of chronic pain, musculoskeletal disorders, and neurological conditions, which increase the demand for effective, non-invasive treatment options.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.