- Home

- »

- Advanced Interior Materials

- »

-

Elevators Market Size, Share, Growth & Trends Report, 2030GVR Report cover

![Elevators Market Size, Share & Trends Report]()

Elevators Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Hydraulic, Traction), By Business (New Equipment, Maintenance, Modernization), By Application (Residential, Commercial), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-037-1

- Number of Report Pages: 152

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Elevators Market Summary

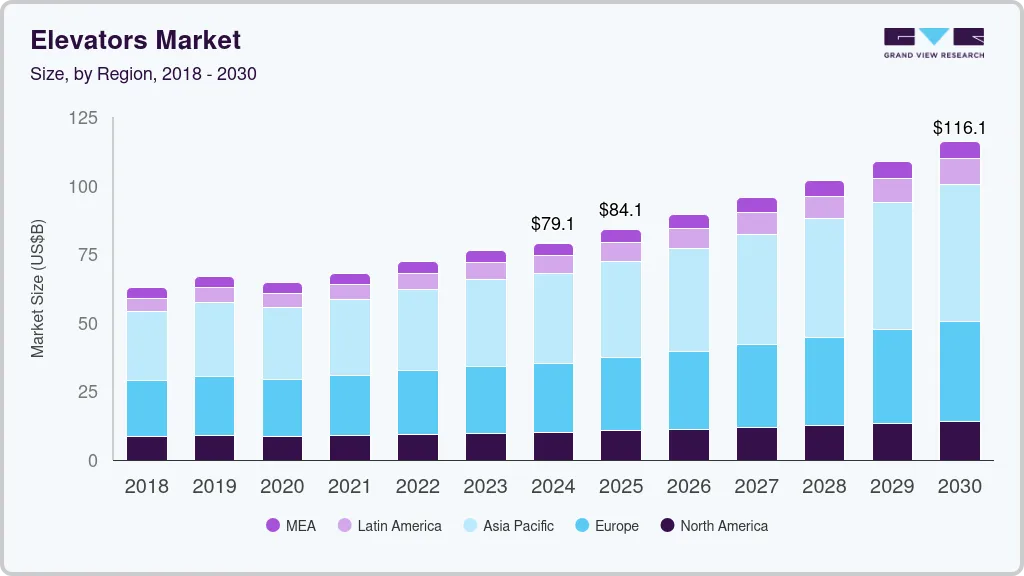

The global elevators market size was estimated at USD 79.06 billion in 2024 and is projected to reach USD 116.14 billion by 2030, growing at a CAGR of 6.7% from 2025 to 2030. The market is experiencing significant growth, driven by urbanization, infrastructure development, and technological advancements. As cities expand and populations increase, the demand for efficient vertical transportation solutions in residential, commercial, and industrial buildings has surged.

Key Market Trends & Insights

- North America elevators market accounted for 12.7% of the global elevator market share in 2024.

- The elevators market in the U.S. is expected to grow at a CAGR of 5.4% from 2025 to 2030.

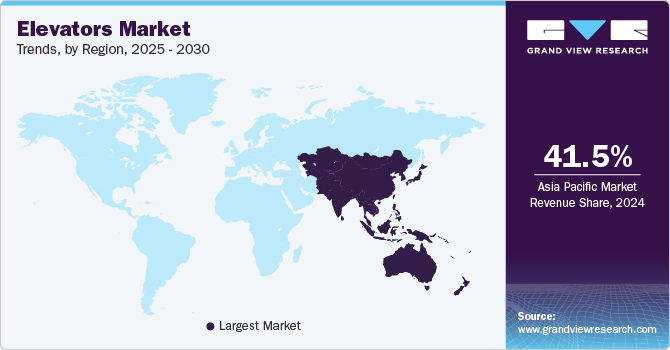

- The elevator market in Asia Pacific accounted for a market share of 41.5% in 2024.

- Based on type, the traction type segment led the market and accounted for 55.2% of the global revenue share in 2024.

- In terms of business, the new equipment business segment led the market and accounted for 47.7% of the global revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 79.06 billion

- 2030 Projected Market Size: USD 116.14 billion

- CAGR (2025-2030): 6.7%

- Asia Pacific: Largest market in 2024

- India: Fastest growing market

Moreover, the rise of smart buildings, which incorporate IoT and energy-efficient technologies, is further propelling the market. Modern elevators cater to a wide range of uses, including the movement of goods, people, as well as in ships, dams, and specialist structures like rocket launchers. Furthermore, in the coming years, demand for elevators will be driven by the development of collective operation, in which an elevator or group of elevators offers enhanced automatic operation and is popular in residential complexes and hospitals due to its affordability. One such company is Toshiba Johnson Elevators India (TJEI), which improves lives through technology and design.

Additionally, TJEI offers an extensive product offering of ultra-premium and premium-class elevators. SPACEL-III and High-end ELCOSMO-III are two products in this segment. The ELBRIGHT series of these elevators uses a small traction machine to save time and energy while cutting the machine room's size by up to 50%. These aforementioned factors will drive the demand for elevators in the coming years.

Drivers, Opportunities & Restraints

The rapid urbanization and growing population in urban areas are primary drivers of the elevator market. As cities become denser, the need for efficient vertical transportation systems in high-rise buildings and multi-story structures intensifies. This demand is further fueled by expanding commercial spaces, residential complexes, and infrastructural projects, leading to increased investments in elevator installations and upgrades.

One of the key restraints for the elevator market is the high initial installation and maintenance costs. The investment required for advanced technologies, particularly in smart and eco-friendly elevators, can be a barrier for smaller developers and property owners. Additionally, regulatory challenges and the lengthy approval processes for construction projects can delay installation timelines, hindering market growth.

There is a growing opportunity to integrate smart technologies within the elevator market. The increasing demand for IoT-enabled elevators, which offer features like predictive maintenance, energy efficiency, and enhanced user experience, presents significant potential for innovation. Moreover, as sustainability becomes a priority, there is an opportunity to develop and promote green elevator solutions that reduce energy consumption and environmental impact, appealing to eco-conscious consumers and investors alike.

Type Insights

“The demand for the machine room-less traction type segment is expected to grow at a significant CAGR of 7.5% from 2025 to 2030 in terms of revenue.”

The traction type segment led the market and accounted for 55.2% of the global revenue share in 2024. Traction elevators are frequently used in industrial and commercial structures. Additionally, the expansion of infrastructure projects for commercial buildings, including offices, malls, and retail centers, is expected to fuel the market demand. Furthermore, the global market will have profitable growth prospects due to favorable government measures supporting the building sector.

The demand for machine room-less (MRL) traction elevators is on the rise, driven by several factors. MRL elevators offer space-saving benefits, as they eliminate the need for a separate machine room, allowing for more usable building space and flexibility in design. This is particularly appealing in urban environments where maximizing floor area is crucial. Additionally, MRL elevators are often more energy-efficient, contributing to lower operational costs and reduced environmental impact, which aligns with the growing emphasis on sustainability in construction.

Business Insights

“The demand for the maintenance business segment is expected to grow at a significant CAGR of 7.4% from 2025 to 2030 in terms of revenue.”

The new equipment business segment led the market and accounted for 47.7% of the global revenue share in 2024. The demand for elevators in the new equipment type business is gaining momentum, largely driven by the rapid expansion of urban infrastructure and the increasing complexity of modern buildings. As developers seek innovative solutions to enhance building functionality, elevators are evolving into sophisticated systems that integrate smart technology, energy efficiency, and improved safety features.

Rising technological developments aimed at raising maintenance standards for elevators at different low-rise construction sites have been a significant factor in the market's increased domination of elevators. Elevator maintenance enhances machine functionality and, when paired with automatic actions such as door closing and opening without the pressing of buttons, contributes to high demand in low-rise building operations. The need for elevator maintenance business will increase as a result of the aforementioned issues in the coming years.

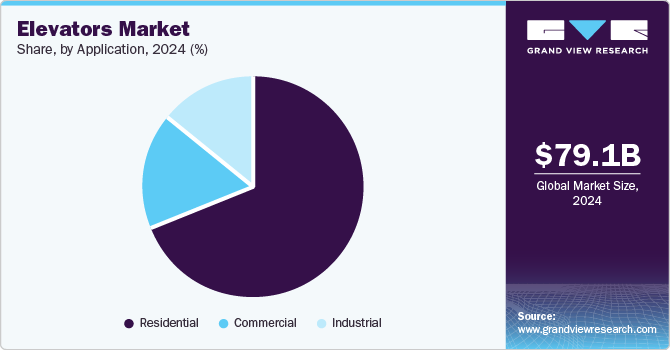

Application Insights

“The demand for the residential application segment is expected to grow at a significant CAGR of 7.0% from 2025 to 2030 in terms of revenue.”

The residential application segment led the market and accounted for 69.1% of the global revenue share in 2024. The demand for elevators is expected to rise in the next few years due to the rising urbanization and a rising standard of living in developing nations such as China and India. As a result, the development of high-rise structures, many of which have smart elevators, will further fuel the market for elevators used in residential applications. Additionally, rising investment in residential construction will fuel the market growth.As highlighted in the April 2023 report from the International Trade Administration (ITA), China is the global leader in the construction market, boasting a remarkable urbanization rate of 64.7% in 2022. This substantial urbanization reflects notable growth across commercial, industrial, and residential construction sectors.

Elevators are typically put at locations including train stations, apartment buildings, hospitals, metro stations, shopping centers, business buildings, schools, and airports. Commercial elevators are often larger than residential elevators since they are required to business more people at once, in addition to needing to meet minimum size and weight criteria. Over the anticipated timeframe, the aforementioned causes will fuel demand for elevators utilized for commercial applications.

Regional Insights

“India to witness fastest market growth at 9.9% CAGR”

North America elevators market accounted for 12.7% of the global elevator market share in 2024. The elevator market in North America is poised for substantial growth, driven by urbanization, infrastructure investments, and advancements in technology. As cities expand and populations increase, there is a rising demand for efficient vertical transportation solutions in both commercial and residential sectors.Additionally, a growing focus on smart building technologies and sustainability encourages the adoption of innovative elevator systems, further stimulating market growth across the region.

U.S. Elevator Market Trends

The elevators market in the U.S. is expected to grow at a CAGR of 5.4% from 2025 to 2030. The elevator market is experiencing robust growth, supported by significant investments in commercial real estate, healthcare facilities, and residential high-rises. The push for modernization of existing buildings, coupled with a strong emphasis on energy efficiency and sustainability, is driving demand for advanced elevator systems, including machine room-less and smart elevators. Moreover, regulatory requirements for accessibility in public spaces are also boosting the need for new installations and upgrades.

The elevators market in the Canada is expected to grow at a CAGR of 5.8% from 2025 to 2030. Canada's elevator market is expanding due to urban development and a booming construction industry. As cities like Toronto and Vancouver continue to grow, there is an increasing need for efficient vertical transportation solutions in high-rise buildings and commercial complexes. The government’s focus on infrastructure projects and green building initiatives further supports market growth. Additionally, the rising trend of smart technology integration in elevators is attracting investments and enhancing the user experience, positioning Canada for a positive outlook in the elevator sector.

Mexico elevators market is expected to grow at a CAGR of 7.1% from 2025 to 2030. In Mexico, the elevator market is experiencing a surge fueled by rapid urbanization and an expanding middle class that demands modern infrastructure. The government’s investment in urban development projects, particularly in metropolitan areas, is driving the need for efficient elevator systems in residential and commercial buildings. Furthermore, the increasing focus on safety regulations and accessibility standards is prompting upgrades and new installations.

Europe Elevators Market Trends

The elevator market in Europe held a share of 31.9% in 2024. The European building market is experiencing growth due to government initiatives investing in housing infrastructure and providing homes for disadvantaged groups. In December 2021, the Dutch government, for instance, allocated USD 253 million to construct 44,277 new homes, with 64% designated as affordable housing. This substantial investment, driven by demand in the region's residential sector, is expected to drive the demand for the elevator market in Europe over the forecast period.

Germany elevators market held 18.2% share in the European market. Germany's elevator market is witnessing steady growth, driven by the country’s robust construction sector and the increasing demand for modernization in existing buildings. With a strong focus on energy efficiency and sustainability, there is a rising preference for advanced elevator systems integrating smart technology and eco-friendly designs.

Elevators market in UK held 16.7% share in the Europe market. In the UK, the elevator market is experiencing significant growth, largely due to the revitalization of urban areas and a surge in high-rise construction projects. The government’s commitment to improving infrastructure and promoting green building practices is driving the adoption of innovative elevator technologies, such as machine room-less and smart elevators. Additionally, the increasing focus on accessibility in public and commercial buildings further enhances demand for new installations and upgrades. As the market evolves, the integration of IoT and energy-efficient solutions is expected to play a crucial role in shaping the future of the elevator industry in the UK.

Asia Pacific Elevators Market Trends

The elevator market in Asia Pacific accounted for a market share of 41.5% in 2024. The need for elevators in APAC has increased because of the building industry's strong expansion and rising outputs in nations like India, China, and South Korea, and among others. Due to the rapid population growth, rural emigration, and industrial growth in recent years, the regional elevator market has seen tremendous growth. For instance, according to the American Institute of Architects Shanghai, China will have developed the coequal of around 10 New York-sized cities by 2025. The market will grow as a result of the ongoing improvement in socioeconomic conditions in countries like China, Indonesia, and other Southeast Asian markets.

China elevators market held over 70.6% share in the Asia Pacific market. China stands as the global leader in the construction market, boasting a remarkable urbanization rate of 64.7% in 2022. This substantial urbanization reflects notable growth across commercial, industrial, and residential construction sectors. Notably, the Chinese government, as outlined during the 2020 National People's Congress, has initiated impactful strategies such as Made in China 2025 and China Standards 2035. These aforementioned factors are anticipated to drive the demand for elevator market.

The elevators market in the India is expected to grow at a CAGR of 9.9% from 2025 to 2030. India's elevator market is experiencing remarkable growth, driven by rapid urbanization, increasing construction activities, and a burgeoning middle class that demands modern infrastructure. The rise of high-rise buildings in urban centers, such as Mumbai and Bengaluru, has created a significant demand for efficient vertical transportation solutions. For instance, projects like the Palais Royale in Mumbai, one of the tallest residential towers in India, showcase the integration of advanced elevator systems to accommodate the growing population and enhance user experience.

Middle East & Africa Elevators Market Trends

The elevator market in the Middle East and Africa is poised for significant growth, fueled by rapid urbanization, infrastructural development, and an increasing focus on smart city initiatives. In particular, countries like Saudi Arabia are investing heavily in mega-projects, which is driving demand for advanced elevator systems. For example, the King Abdullah Financial District in Riyadh is a prime illustration of this trend, featuring state-of-the-art skyscrapers that require high-capacity, efficient elevators to manage the flow of residents and workers.

Latin America Elevators Market Trends

The elevator market in Latin America accounted for a market share of 8.0% in 2024. The elevator market in Latin America is on an upward trajectory, driven by urbanization, economic development, and increased investment in infrastructure. With a growing urban population, there is a heightened demand for modern vertical transportation solutions in both residential and commercial buildings. The rise of high-rise constructions in major cities, along with government initiatives to improve urban infrastructure, is stimulating the elevator market.

Brazil elevators market held 43.0% share in Central & South America elevator market. In Brazil, the elevator market is experiencing robust expansion, largely fueled by significant investments in real estate and infrastructure projects. Major cities like São Paulo and Rio de Janeiro are seeing a surge in high-rise developments, creating a strong demand for efficient and reliable elevator systems. For example, the ongoing construction of the São Paulo Corporate Towers highlights the need for advanced elevators capable of handling increased foot traffic. Furthermore, Brazil's focus on sustainable construction practices is driving the adoption of energy-efficient elevator technologies, contributing to a positive growth outlook for the market.

Key Elevators Company Insights

Some of the key players operating in the elevator market include TK Elevator, Schindler, and KONE Corporation.

-

TK Elevator, a global leader in the elevator and escalator industry, is renowned for its innovative solutions and commitment to quality and safety. Originally part of Thyssenkrupp AG, TK Elevator became an independent entity in 2020 and has since focused on enhancing mobility in urban environments. The company offers a wide range of products, including elevators, escalators, and moving walkways, designed for both residential and commercial applications. With a strong emphasis on sustainability, TK Elevator integrates advanced technologies such as smart building solutions and energy-efficient systems, aiming to create safer, more accessible, and environmentally friendly transportation options.

-

Schindler Group is a prominent player in the elevator and escalator industry, with a rich history dating back to 1874. Headquartered in Switzerland, Schindler operates in over 100 countries, providing a comprehensive range of mobility solutions that cater to various sectors, including residential, commercial, and industrial. The company is recognized for its innovative technology and commitment to enhancing urban mobility, offering products that prioritize safety, efficiency, and sustainability. Schindler's dedication to digital transformation is evident in its smart solutions that leverage IoT and data analytics to optimize maintenance and improve user experience, positioning the company as a forward-thinking leader in the industry.

Electra Elevators, and CANNY ELEVATOR CO, LTD. are some of the emerging players in the elevator market.

-

Electra Elevators is a prominent player in the elevator industry, specializing in the design, manufacturing, installation, and maintenance of elevator systems. Based in Israel, the company has established a strong reputation for its innovative solutions and commitment to safety and reliability. Electra offers a diverse range of products, including residential, commercial, and industrial elevators, tailored to meet the specific needs of its clients. With a focus on advanced technology and energy efficiency, Electra Elevators aims to provide sustainable mobility solutions that enhance user experience and operational efficiency in various building types.

-

CANNY ELEVATOR CO., LTD. is a leading manufacturer of elevators and escalators based in China, recognized for its commitment to quality and innovation. Established in 1993, CANNY has rapidly grown to become a major player in the global elevator market, offering a wide range of products, including passenger elevators, freight elevators, and escalators. The company emphasizes research and development, continuously integrating cutting-edge technology to enhance safety, efficiency, and user comfort. With a strong focus on international expansion, CANNY Elevator is dedicated to providing customized solutions and exceptional service to clients worldwide, positioning itself as a competitive force in the industry.

Key Elevators Companies:

The following are the leading companies in the elevators market. These companies collectively hold the largest market share and dictate industry trends.

- TK Elevator

- Schindler

- KONE Corporation

- Hitachi Ltd.

- HYUNDAIELEVATOR CO.,LTD.

- Mitsubishi Electric Corporation

- Toshiba Group

- FUJITEC CO., LTD.

- Aritco Lift AB

- EMAK

- Sigma Elevator Company

- Schumacher Elevator Company

- ESCON Elevators Pvt Limited

- Electra Elevators

- CANNY ELEVATOR CO, LTD.

Recent Developments

-

In August 2024, Otis introduced its Gen3 connected elevator platform during the 'Platform for Possibility' launch event in Bangkok. This new platform merges the established technology of Otis' popular Gen2 elevator with the Otis ONE IoT digital platform. It enhances the passenger experience through features like Ambiance aesthetics, Pure fixtures, eView infotainment, and air purification technology.

-

In January 2024, TK Elevator unveiled its new home elevator concept, ‘enta villa.’ This design is tailored specifically for multi-floor residences and villas in India, the company’s home market, where there is a rapidly increasing demand for luxury housing and lifestyle products.

Elevators Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 84.13 billion

Revenue forecast in 2030

USD 116.14 billion

Growth rate

CAGR of 6.7% from 2025 to 2030

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, business, application, region

Country scope

U.S.; Canada; Mexico; Germany; France; Italy; Spain; U.K.; China; Japan; India; South Korea; Australia; Malaysia; Indonesia; Brazil; Argentina; Saudi Arabia; UAE; South Africa

Key companies profiled

TK Elevator; Schindler; KONE Corporation; Hitachi Ltd.; HYUNDAIELEVATOR CO.,LTD.; Mitsubishi Electric Corporation; Toshiba Group; FUJITEC CO., LTD.; Aritco Lift AB; EMAK; Sigma Elevator Company; Schumacher Elevator Company; ESCON Elevators Pvt Limited; Electra Elevators; CANNY ELEVATOR CO, LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Elevators Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global elevators market based on type, business, application, and region:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hydraulic

-

Traction

-

Machine Room-Less Traction

-

Others

-

-

Business Outlook (Revenue, USD Billion, 2018 - 2030)

-

New Equipment

-

Maintenance

-

Modernization

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

Italy

-

Spain

-

U.K.

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

Malaysia

-

Indonesia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global elevator market size was estimated at USD 79.06 billion in 2024 and is expected to reach USD 84.13 billion in 2025.

b. The elevator market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.7% from 2025 to 2030 to reach USD 116.14 billion by 2030.

b. The traction type segment led the market and accounted for 55.2% of the global revenue share in 2024. Traction elevators are frequently used in industrial and commercial structures. Additionally, the expansion of infrastructure projects for commercial buildings including offices, malls, and retail centers will further fuel market demand.

b. Some of the key players operating in the elevator market include TK Elevator; Schindler; KONE Corporation; Hitachi Ltd.; HYUNDAIELEVATOR CO.,LTD.; Mitsubishi Electric Corporation; Toshiba Group; FUJITEC CO., LTD.; Aritco Lift AB; EMAK; Sigma Elevator Company; Schumacher Elevator Company; ESCON Elevators Pvt Limited; Electra Elevators; CANNY ELEVATOR CO, LTD. among others.

b. The elevator market is experiencing significant growth, driven by urbanization, infrastructure development, and advancements in technology. As cities expand and populations increase, the demand for efficient vertical transportation solutions in residential, commercial, and industrial buildings has surged.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.