- Home

- »

- Healthcare IT

- »

-

Emergency Department Information System Market Report 2030GVR Report cover

![Emergency Department Information System Market Size, Share & Trends Report]()

Emergency Department Information System Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Clinical Documentation, E-Prescribing), By Deployment (On-Premises, SaaS), By Software Type, By End-user, And Segment Forecast

- Report ID: GVR-4-68040-151-1

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global emergency department information system market size was estimated at USD 877.5 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 14.03% from 2024 to 2030. The growth of the market is attributed to factors, such as an increase in the use of data-driven technologies, a rise in patient flow at the emergency department, and increased adoption of emergency department information systems (EDIS). Hospital emergency departments offer treatment for a variety of medical conditions, including neurology, cardiology, infectious diseases, gastroenterology, and psychiatry. The rising prevalence of chronic and life-threatening illnesses among elderly demographic will ultimately result in hospitalizations. Conditions, such as cardiovascular disease, neurodegenerative disorders, and other ailments, are notably more prevalent in older individuals.

EDIS plays a vital role within hospital settings, as emergency departments often serve as primary entry points for patients seeking medical care. In October 2022, the World Health Organization published that one out of 6 people would age 60 years or more in the world by 2030. The population aged 60 years and above stands at 1 billion in 2020 and is projected to reach 1.4 billion. By 2050, the world population of individuals aged 60 years and older is projected to double up, reaching a staggering 2.1 billion. Therefore, the rising elderly population and increased hospital ED admissions are expected to drive the demand for information systems that efficiently manage data and streamline processes within hospital emergency departments.

Furthermore, there is a growing requirement for technology that supports data-driven decision-making. Due to numerous health challenges and fluctuations, the health insurance industry’s emergency creates promising opportunities in the future market. The emergency department information system sector seamlessly integrates with previous healthcare technologies and data collection systems. These methods include pulse-checking devices, automated vital sign monitoring, and heart rate tracking. There are several advantages associated with utilizing the agency's database. These benefits encompass data sharing and reliability, portability, scalability, and interoperability, all contributing to the market's growth.

The pandemic has positively influenced the market owing to the growing adoption of telemedicine and remote monitoring solutions, which EDIS systems often integrate with and enhance infection control measures within healthcare facilities. Moreover, the COVID-19 pandemic had a significant impact on the market owing to the sudden surge in patient volumes and the need for rapid triage and patient management. EDIS systems played a crucial role in helping hospitals and healthcare facilities adapt to these challenges by facilitating efficient patient intake, tracking, and care coordination. They were instrumental in managing patient data, including COVID-19 test results and vaccination records, ensuring accurate and timely information for healthcare providers.

Application Insights

Based on the application, the Computerized Physician Order Entry (CPOE) segment dominated the market with the largest revenue share of 38.79% in 2023. The continuous replacement of standard enlisting medicine orders, such as verbal communication, paper prescriptions, and fax by software tools, and rising cases of burns, traumas, and critical cases lead to necessitate emergency procedures. These factors supported the segment’s dominant share. The E-prescribing segment is projected to grow at the fastest CAGR during the forecast years. E-prescribing ensures patient safety and improved efficiency.

E-prescribing helps reduce medication errors by providing clinicians with real-time access to patient information, such as allergies and drug interactions. E-prescribing can also ensure that orders are complete and accurate by providing clinicians with prompts and checklists. The demand for e-prescribing is expected to increase due to a rise in government initiatives to improve healthcare efficiency and quality. The U.S. government mandates the use of electronic health records (EHRs) in hospitals, and e-prescribing is considered a key part of EHR systems. Increasing spending on research and new services development, strong government support, and strict regulatory guidelines are key factors driving the segment growth.

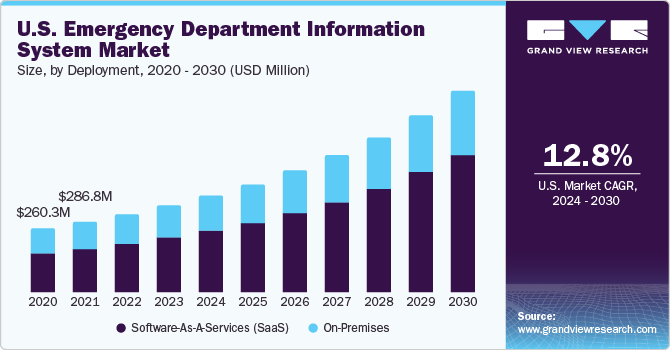

Deployment Insights

Based on deployment, the market is bifurcated into on-premises and Software-As-A-Services (SaaS). The Software-As-A-Services (SaaS) segment accounted for the largest revenue share of 62.39% in 2023 and is expected to grow at the fastest CAGR from 2024 to 2030. The growth of this segment is attributed to features, such as SaaS systems gathering expertise by automatically scheduling clients and services while issuing warning alerts to specific administrative staff.

SaaS solutions offer cost-efficiency, scalability, and rapid implementation, making them a practical choice for healthcare facilities seeking streamlined emergency care management. Their accessibility, automatic updates, and robust data security measures ensure efficient and secure operations. In addition, the pay-as-you-go model and interoperability of SaaS systems further support their widespread adoption, contributing to the overall market expansion.

Software Type Insights

Based on software type, the Best of Breed (B.O.B.) solutions segment held the largest revenue share of 55.64% in 2023. The growth of this segment is attributed to factors, such as improvement of physician productivity, enhanced interoperability, and diagnostic enhancement. Moreover, the presence of existing information systems like EHRs drives a shift toward best-of-breed EDIS software. These solutions offer easy integration with current systems, require minimal training, and are tailored for specific functions within ED, making them a preferred choice for streamlined implementation and specialized tasks.

The enterprise solution segment is projected to witness the fastest CAGR from 2024 to 2030. The rising number of patients with chronic conditions and more complex medical treatments are driving the demand for solutions that can help hospitals manage the complex needs of their patients. For instance, in January 2022, Aidoc announced a partnership with Novant Health. The partnership aims to integrate with Aidoc's AI platform, which encompasses seven FDA-cleared solutions designed to assist in the rapid assessment and alerting of patients with acute medical conditions; the Omicron variant's resource limitations, in particular, Novant Health, is proactive steps to enhance patient outcomes and shorten stays in the ED.

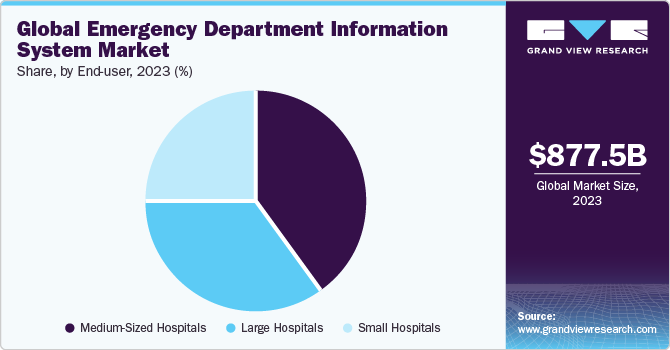

End-user Insights

Based on end-user, the market is segmented into small hospitals, medium-sized hospitals, and large hospitals. The medium-sized hospitals captured the highest market share of 40.15% in 2023. The rising geriatric population and improved life expectancy are driving the demand for healthcare services that help improve efficiency and reduce costs. This, in turn, is expected to support segment growth.

The medium-sized hospitals segment is projected to witness the fastest CAGR from 2024 to 2030. The scalability to accommodate growth, seamless integration with existing healthcare IT infrastructure, compliance with healthcare regulations, robust data analytics capabilities, and tools for clinical decision support are driving the segment's growth.

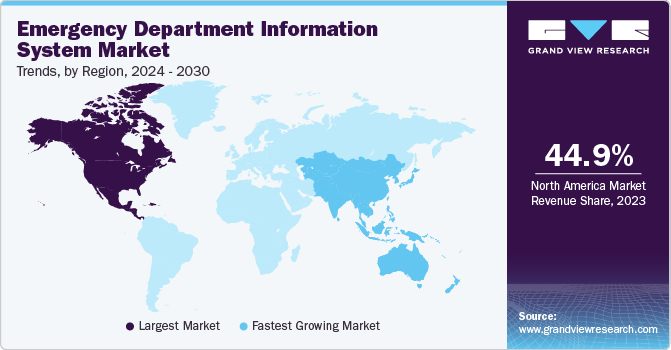

Regional Insights

North America accounted for the largest revenueshare of 44.95% in 2023. Major factors contributing to this growth include a well-established healthcare infrastructure, the presence of major medical EDIS providers, and a substantial rise in patient visits to EDs. In addition, stringent regulations, particularly in countries like the United States, that require the implementation of EHRs within hospital EDs have created substantial demand for EDIS.

Asia Pacific, on the other hand, is expected to grow at a significant CAGR over the forecast period. This growth can be attributed to the swift proliferation of healthcare institutions and the dynamic transformations within the healthcare industry. Furthermore, increasing reliance on IT specialists in healthcare settings, which offers significant opportunities, contributes to the expansion of the global market. Notably, China currently holds the largest market share in the EDIS sector, while India is expected to exhibit steady growth and expansion within the AsiaPacific region from 2024 to 2030.

Key Companies & Market Share Insights

The market is highly fragmented owing to the presence of several key players. New product launches, partnerships, and mergers & acquisitionsare some of the major strategies undertaken by key players to increase their market share. For instance, in March 2022, HeartBeam, Inc. entered a Clinical Trial Agreement (CTA) and a Business Associate Agreement (BAA) with Phoebe Putney Health System. This partnership aimed to initiate a pilot study focused on assessing the effectiveness of HeartBeam's Myocardial Infarction (MI) software product in an ED setting.

Key Emergency Department Information System Companies:

- Oracle (Cerner)

- EMIS Group plc.

- Epic Systems Corporation

- Evident Software

- Logibec Inc.

- MEDHOST

- Medical Information Technology, Inc.

- Medsphere Systems Corporation

- The T System, Inc.

- Veradigm LLC

Emergency Department Information System Market Report Scope

Report Attribute

Details

The market size value in 2024

USD 988.5 million

The revenue forecast in 2030

USD 2,173.2 million

Growth rate

CAGR of 14.03% from 2024 to 2030

The base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, deployment, software type, end-user, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; UK; Spain; France; Italy; Sweden; Norway; Denmark; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; UAE; Saudi Arabia; Kuwait

Key companies profiled

Oracle (Cerner); EMIS Group plc.; Epic Systems Corp.; Evident Software; Logibec Inc.; MEDHOST; Medical Information Technology, Inc.; Medsphere Systems Corp.; The T System, Inc.; Veradigm LLC

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail of customized purchase options to meet your exact research needs. Explore purchase options

Global Emergency Department Information System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global emergency department information system market report based on application, deployment, software type, end-user, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Computerized Physician Order Entry (CPOE)

-

Clinical Documentation

-

Patient Tracking & Triage

-

E-Prescribing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

On-Premises

-

Software-As-A-Services (SaaS)

-

-

Software Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Enterprise Solutions

-

Best of Breed (B.O.B.) Solutions

-

-

End-user Outlook (Revenue, USD Million, 2018 - 2030)

-

Small Hospitals

-

Medium-Sized Hospitals

-

Large Hospitals

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global emergency department information system market size was estimated at USD 877.5 million in 2023 and is expected to reach USD 988.5 million in 2024.

b. The global emergency department information system market is expected to grow at a compound annual growth rate of 14.03% from 2024 to 2030 to reach USD 2,173.2 million by 2030.

b. North America dominated the emergency department information system market with a share of 44.95% in 2023. Major factors contributing to the growth of this region include a well-established healthcare infrastructure, the presence of major medical emergency department information system providers, and a substantial rise in patient visits to emergency departments.

b. Some key players operating in the emergency department information system market include Oracle (Cerner), EMIS Group plc., Epic Systems Corporation, Evident Software, Logibec Inc., MEDHOST, Medical Information Technology, Inc., Medsphere Systems Corporation, The T System, Inc., and Veradigm LLC.

b. Key factors that are driving the market growth include an increase in the use of data-driven technologies, a rise in patient flow at the emergency department, and increased adoption of emergency department information systems.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.