- Home

- »

- Electronic Devices

- »

-

Inkjet Printers Market Size & Share, Industry Report, 2030GVR Report cover

![Inkjet Printers Market Size, Share & Trends Report]()

Inkjet Printers Market (2025 - 2030) Size, Share & Trends Analysis Report By Type, By Technology (Continuous Inkjet, Drop on Demand, UV Inkjet, Others), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68038-747-6

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2025 - 2030

- Industry: Semiconductors & Electronics

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Inkjet Printers Market Summary

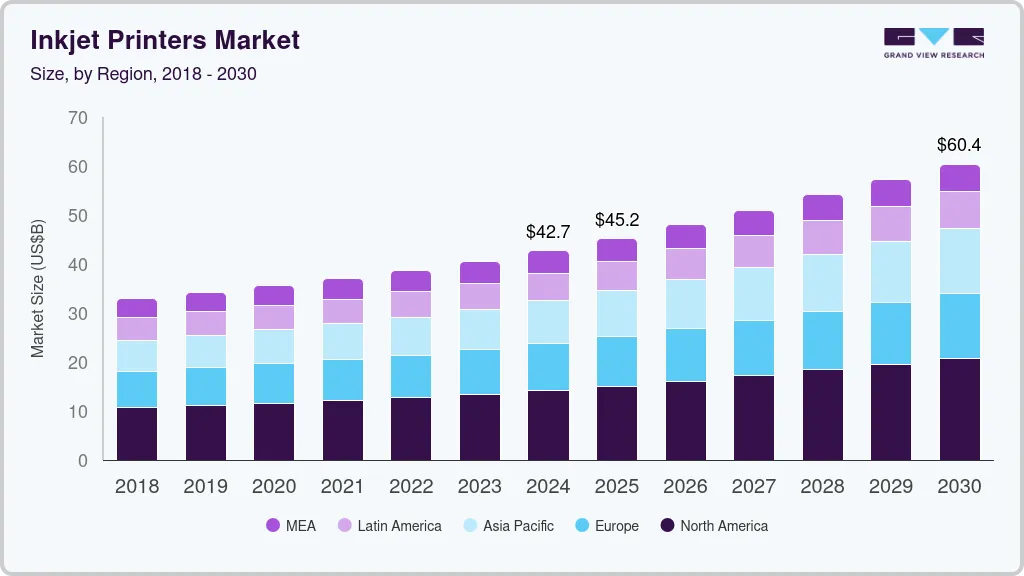

The global inkjet printers market size was estimated at USD 42.7 billion in 2024 and is projected to reach USD 60.35 billion by 2030, growing at a CAGR of 6.0% from 2025 to 2030. Inkjet printers are well-regarded for their affordability and multifunctionality, making them highly useful in both personal applications as well as in businesses and educational institutions.

Key Market Trends & Insights

- The North America inkjet printers market accounted for the largest revenue share of 33.3% globally in 2024.

- The U.S.inkjet printers market accounted for a dominant revenue share in the regional market in 2024.

- Based on type, the multifunctional printer segment accounted for the largest revenue share of 26.8% in the global inkjet printers industry in 2024.

- Based on technology, the continuous inkjet segment accounted for the largest revenue share in the global inkjet printers industry in 2024.

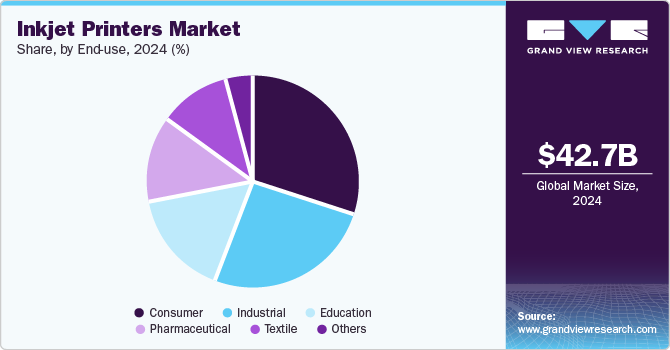

- Based on end use, the consumer segment accounted for the largest revenue share in the global market for inkjet printers in 2024.

Market Size & Forecast

- 2024 Market Size: USD 42.7 Billion

- 2030 Projected Market Size: USD 60.35 Billion

- CAGR (2025-2030): 6.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

They offer user-friendly controls that make it extremely easy to print high-quality photos and documents, driving their deployment in homes and offices. Furthermore, inkjet printing is a widely used tool in the packaging industry, where factors concerning efficiency, customization, traceability, and sustainability in processes have highlighted its importance. As a result, a wide range of applications for this technology has enabled strong growth prospects for the inkjet printers industry.

Inkjet printers typically have a lower upfront cost compared to laser printers, making them an attractive option for consumers and businesses with limited budgets. Newer inkjet models, such as those with refillable ink tanks (Epson EcoTank, Canon MegaTank), are further driving product sales due to the reduced cost per page they offer. These models lower the frequency of ink cartridge replacements, reducing long-term operational costs and making them attractive for both consumers and small businesses with higher printing volumes.

Moreover, the emergence of multifunction inkjet printers, which combine printing, scanning, copying, and occasionally faxing, has been another market driver. These all-in-one devices are very popular in home offices, small businesses, and educational institutions, as they offer a wide range of features while being economical and space-efficient. The increasing use of Internet of Things (IoT) devices and smart home systems has driven demand for printers seamlessly integrating with other smart technologies. Printers that can communicate with other devices have become significantly appealing to customers as they ensure a more efficient workflow.

Over the past few years, major brands such as Epson, Xerox, and Canon have shifted towards the launch of solutions that can address consumers' environmental and sustainability concerns. For example, printers with refillable ink tanks or eco-friendly inks and energy-efficient designs attract environmentally conscious buyers. Printer manufacturers have also made significant strides in offering recycling programs for ink cartridges, which is popular among consumers who wish to reduce their environmental footprint. This has helped promote eco-friendly models and support customer loyalty. Soy-based, water-based, and vegetable-based inks are becoming highly popular for printing purposes due to their lower VOC emissions, biodegradability, and the lower level of harm they pose to both human health and the environment.

For instance, in May 2023, KYOCERA announced the launch of the FOREARTH sustainable inkjet printer for the textile sector. The product aims to eliminate or minimize water usage in the fabric printing category, ultimately lowering the fashion business's environmental impact. This multifunctional printing solution utilizes a proprietary pigment ink, a finishing agent, and pre-treatment liquid, which are continuously discharged from the inkjet head in the same order. The innovative system thus eliminates the need for pre-and post-processing in traditional dye printing and lowers water consumption in the textile printing space by 99%. Similar innovations by other companies in terms of product build or print technologies are expected to ensure healthy growth of the inkjet printers market in the coming years.

Type Insights

The multifunctional printer segment accounted for the largest revenue share of 26.8% in the global inkjet printers industry in 2024. These printers, also known as all-in-one printers, combine a range of functions, including printing, scanning, and copying, into a single device. This leads to several advantages, such as space efficiency, cost savings, productivity gains, and streamlined workflows. Multifunctional printers (MFPs) also generally use fewer consumables than separate devices, resulting in the utilization of fewer consumables, easier management, and lower operational costs.

The growing adoption of digital workflows by companies further boosts the demand for MFPs due to their ability to integrate with cloud services and enterprise document management systems. For instance, in October 2024, FUJIFILM Business Innovation Asia Pacific announced the launch of three new A3 digital color multifunction printers to support digital transformation for businesses. The three products, part of the company’s Apeos series, connect the collected information through scanning or printing with different cloud services, which include accounting and document management systems.

The industrial inkjet printers segment is expected to advance at a substantial CAGR from 2025 to 2030. The continued global expansion of the e-commerce, packaging, and textile industries has resulted in significant sales of these printing solutions. Packaging is vital for printing barcodes, lot numbers, expiration dates, product details, and other important information directly on primary packaging, such as bottles, cans, cartons, and flexible pouches. Meanwhile, they are also used to print labels for different products, particularly cosmetics, healthcare, and food items. These labels often contain regulatory information, product descriptions, safety instructions, and barcodes. The flexibility of industrial inkjet printers makes it easy to print high-quality labels on different materials, such as paper, plastic, or metal. Inkjet printers are additionally ideal for printing high-resolution barcodes and QR codes for product tracking, inventory management, and consumer engagement.

Technology Insights

The continuous inkjet segment accounted for the largest revenue share in the global inkjet printers industry in 2024. This is one of the most widely used forms of industrial inkjet printing, particularly in high-speed and high-volume environments. The continued demand for high precision and speed during printing processes on a variety of substrates, including packaging, products, and materials, enables segment growth. Continuous inkjet printers are designed for fast-paced production environments, offering speeds ranging from 100 to over 1,000 meters per minute, depending on the application and substrate. Moreover, they are well-suited for the real-time printing of variable data, including batch numbers, dates, barcodes, and logos, directly onto products or packaging as they move through production lines. The lack of physical contact with the printing surface, a notable feature of this technology, further helps eliminate wear and tear on the printhead and reduces the risk of damage to delicate or irregular surfaces.

The Drop on Demand (DOD) inkjet technology is expected to witness the fastest growth in the market during the forecast period. Unlike Continuous Inkjet (CIJ), where ink flows continuously through the printhead, DOD systems generate ink droplets only when needed, meaning that ink is ejected from the printhead in discrete bursts. This results in the creation of droplets that are precise and well-controlled for each print job. Moreover, as the ink is only ejected when needed, this printing technique is more ink-efficient than continuous systems, making it a cost-effective solution for applications involving smaller print runs or variable data. In December 2023, FUJIFILM Integrated Inkjet Solutions introduced the FUJIFILM 46kUV Inkjet Printbar System, an integrated solution for industrial production operations to print on a range of packaging materials and labels. The new product features a DOD design that offers fast printing speeds of up to 500 feet per minute and ensures streamlined workflow for customers.

End Use Insights

The consumer segment accounted for the largest revenue share in the global market for inkjet printers in 2024. These accessories are widely popular among students, creatives, home offices, and general consumers, as they can produce high-quality prints for a wide range of personal applications, including documents, photos, and creative projects. Inkjet printers often use a combination of cyan, magenta, yellow, and key (black) ink (CMYK) to produce a wide color gamut, ensuring accurate color reproduction for photographs, presentations, and art prints. The affordability and wide availability of printers, enabled by rising consumer demand and increasing competition among leading brands, have led to several positive advancements in the market.

The industrial segment in the inkjet printers industry is expected to advance at the highest CAGR from 2025 to 2030. This segment includes several major applications, such as packaging, publishing, and photography, where inkjet printing technologies are extensively used. These printers allow businesses to print custom designs, QR codes, or personalized branding directly onto packaging. This is particularly useful for brands that want to personalize products or respond to the growing demand for short-run packaging for limited-edition products. Meanwhile, the need for food & beverage and pharmaceutical manufacturers to adhere to various regulatory standards and provide clear product and ingredient descriptions to ensure transparency is another major avenue for market expansion. Inkjet printing is used to print security features such as holograms, microtexts, and watermarks that are difficult to reproduce, preventing product counterfeiting, especially in high-value goods such as electronics or pharmaceuticals.

Regional Insights

The North America inkjet printers market accounted for the largest revenue share of 33.3% globally in 2024 on account of the widespread presence of business establishments that utilize printing solutions and technological advancements in this industry. Furthermore, these printers are popular stationery for home use, particularly among families, students, and remote workers. They are being increasingly favored for their relatively low initial cost and the ability to print high-quality color images and documents. The rapid expansion of the e-commerce industry in the region has highlighted the need for high-resolution printing, which can be achieved using these printers.

U.S. Inkjet Printers Market Trends

The U.S.inkjet printers market accounted for a dominant revenue share in the regional market in 2024. The continued strengthening of the supply chain infrastructure in the economy and the need for industries to comply with various regulations has resulted in a healthy growth of this market, as inkjet printers prove to be essential for product serialization and packaging purposes. Moreover, the continued adoption of hybrid working models and online learning for students has led to strong sales of inkjet printers for personal uses. The education sector in the country continues to be a significant end-user of this product. For instance, schools, colleges, and universities leverage inkjet printers for a wide range of applications, from printing assignments and educational materials to producing colorful posters and projects.

Europe Inkjet Printers Market Trends

Europe inkjet printers market accounted for a substantial revenue share in the global market in 2024 due to the growing adoption of inkjet printers by small businesses and educational institutions across regional economies. Moreover, European consumers and commercial firms are becoming increasingly environmentally conscious, which significantly impacts printer preferences. Many consumers prefer eco-friendly inkjet printers that use refillable ink tanks, energy-efficient designs, and recyclable or reusable ink cartridges. As a result, notable manufacturers such as Epson, Canon, and HP are responding to these demands by promoting sustainability in their products and services. The regional market is also witnessing substantial expansion through the industrial segment, as these solutions are extensively utilized in manufacturing, packaging, and labeling, along with the electronics and automotive industries.

Asia Pacific Inkjet Printers Market Trends

The Asia Pacific region is anticipated to advance at the highest CAGR from 2025 to 2030. The region includes a number of fast-growing economies such as India, China, and other Southeast Asian countries where rising disposable incomes, industrialization, and increasing presence of small businesses have driven a substantial demand for personal and business printers. The exponential growth of the e-commerce sector and rapidly improving supply chain infrastructure have also created growth avenues for inkjet printer manufacturers and distributors. Product sales have further increased through the educational and commercial end-use areas. Regional economies are increasingly investing in improving their educational infrastructure and offering access to quality education. This has resulted in schools, universities, and tutoring centers purchasing cost-effective printing solutions for educational materials, projects, and assignments.

China accounted for a leading revenue share in the regional market in 2024, aided by the rapid economic growth in the country, government initiatives for educational establishments, and the rising rate of technological adoption among businesses and individual end-users. The economy’s rapidly expanding middle-class demographic is a major factor enabling market expansion. As disposable incomes rise, more consumers and small businesses are purchasing personal printers for home offices, educational purposes, and general use. Moreover, the widespread penetration of mobile and internet services across the country has led to the increasing popularity and adoption of wireless printing solutions, providing opportunities for market players to launch innovative offerings.

Key Inkjet Printers Company Insights

Some of the leading companies involved in the global inkjet printers industry include Videojet Technologies, Canon, and Xerox, among others.

-

Videojet Technologies specializes in developing coding and marking solutions, with notable products including continuous inkjet printers, laser marking solutions, thermal inkjet, thermal transfer, case coders, and label applicators. These products cater to several major industries, including automotive & aerospace, baked goods and cereals, beverages, dairy, cosmetics and home care, and pharmaceuticals and medical.

-

Canon is a Japanese multinational corporation specializing in printing, imaging, medical, and industrial solutions such as printers, scanners, cameras, lenses, medical equipment, and semiconductor manufacturing equipment. Under the printing division, the company offers products such as laser printers, inkjet printers, laser multifunction printers, and image scanners. Other notable offerings include digital continuous feed presses, digital sheet-fed presses, large format printers, document solutions, and calculators, and others.

Key Inkjet Printers Companies:

The following are the leading companies in the inkjet printers market. These companies collectively hold the largest market share and dictate industry trends.

- Videojet Technologies Inc.

- Pannier Corporation

- Canon Inc.

- HP Development Company, L.P.

- Xerox Corporation

- Brother Industries, Ltd.

- KEYENCE CORPORATION

- Konica Minolta, Inc.

- Seiko Epson Corporation

- Mimaki

- InkJet, Inc.

- CONTROL PRINT LTD.

Recent Developments

-

In September 2024, Mimaki USA unveiled the TS330-3200DS dual-capability digital textile printer at the PRINTING United Expo event held in Las Vegas. The product has been designed for high-value textile use cases, where it can function as a sublimation unit for printing to transfer paper, as well as a direct-to-textile unit to print on polyester fabrics. The printer can be used to create various digital textile solutions, including SEG frame printing, backlit fabric displays, theatrical backdrops, flags, POP displays, and interior décor, among others.

-

In April 2024, Videojet Technologies, which develops marking, coding, and printing solutions, launched a new ink formulated with advanced properties aimed at the pharmaceutical sector. The innovative V4234 ink has been developed to be used in the current line of Videojet SIMPLICiTY continuous inkjet printers, which includes the Videojet 1880 Series range, to apply dates, codes, and other vital information on products during the packaging stage. The ink is ideal for printing codes on medical and pharmaceutical packaging, such as flexible film, blister packs, plastic bottles, aluminum vial closures, plastic caps, glass vials, and steel and paper cartons.

-

In April 2024, Epson announced the launch of the AM-C400 and AM-C550 multifunction printers, part of the company’s A4 inkjet range, which leverage the company’s Heat-Free Line Inkjet technology. The products have been indicated for customers with higher print volumes, offering high scan and print speeds of up to 100ipm and 55ppm, respectively. Furthermore, these printers feature high paper capacities as well as high-yield ink cartridges (maximum 31,500 pages), which help improve productivity. The use of Epson Heat-Free inkjet technology ensures substantial waste reduction and lower energy consumption, supporting the company’s sustainability initiatives.

Inkjet Printers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 45.17 billion

Revenue forecast in 2030

USD 60.35 billion

Growth Rate

CAGR of 6.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2017 - 2023

Forecast period

2025 - 2030

Report updated

January 2025

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, technology, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, China, Japan, India, Australia, South Korea, Brazil, UAE, Saudi Arabia, South Africa

Key companies profiled

Videojet Technologies Inc.; Pannier Corporation; Canon Inc.; HP Development Company, L.P.; Xerox Corporation; Brother Industries, Ltd.; KEYENCE CORPORATION; Konica Minolta, Inc.; Seiko Epson Corporation; Mimaki; InkJet, Inc.; CONTROL PRINT LTD.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Inkjet Printers Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global inkjet printers market report based on type, technology, end use, and region:

-

Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Multifunctional Printers

-

Desktop Printers

-

Large Format Printers

-

Inkjet Press

-

Industrial Inkjet Printers

-

Textile Printers

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Continuous Inkjet

-

Drop on Demand

-

UV Inkjet

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2017 - 2030)

-

Consumer

-

Education

-

Industrial

-

Packaging

-

Publishing

-

Photography

-

-

Textile

-

Pharmaceutical

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.