- Home

- »

- Next Generation Technologies

- »

-

Employee Benefit Broker Market Size & Share Report, 2030GVR Report cover

![Employee Benefit Broker Market Size, Share & Trends Report]()

Employee Benefit Broker Market (2024 - 2030) Size, Share & Trends Analysis Report By Benefit Type, By Application (Healthcare, IT & Telecom), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-183-4

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Employee Benefit Broker Market Summary

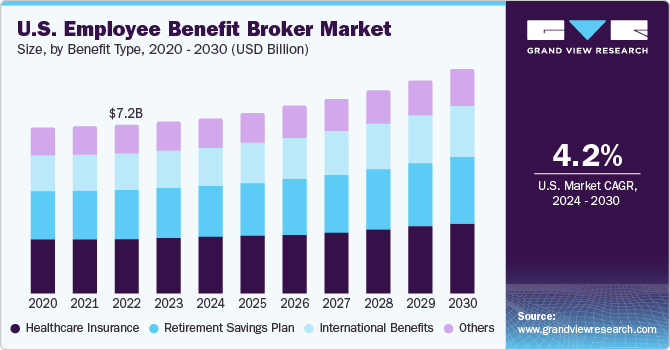

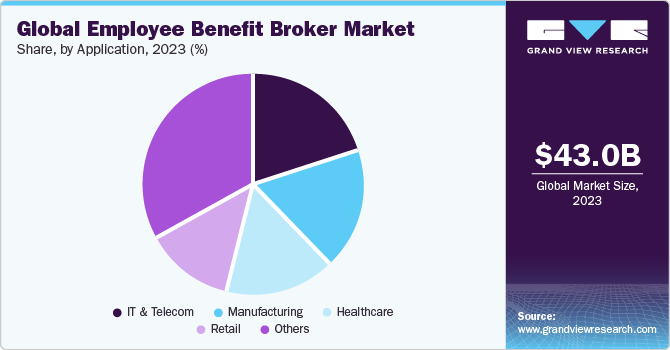

The global employee benefit broker market size was estimated at USD 43.01 billion in 2023 and is projected to reach USD 61.37 billion by 2030, growing at a CAGR of 5.5% from 2024 to 2030. The expansion of the employee benefits broker market can be attributed to various factors, including the intensely competitive talent landscape.

Key Market Trends & Insights

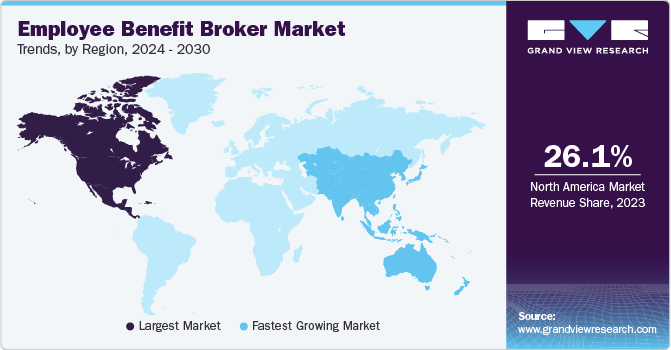

- North America dominated the market and held a share of over 26.1% in 2023.

- By benefit type, the healthcare insurance segment led the market and held 31.5% of the global revenue in 2023.

- By application, IT & telecom held the largest market revenue share of 20.2% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 43.01 Billion

- 2030 Projected Market Size: USD 61.37 Billion

- CAGR (2024-2030): 5.5%

- North America: Largest market in 2023

In a job market where attracting and retaining top-notch employees is paramount, companies offer increasingly enticing employee benefits to gain a competitive edge and secure the commitment of skilled professionals. Furthermore, retirement benefit packages, such as 401(k) plans or defined employee benefits plans, have become increasingly vital in the effort to attract and retain employees.

Modern employees seek comprehensive and adaptable benefit packages that encompass perks, including wellness programs, flexible work arrangements, and avenues for professional development. This diversity in employee demands necessitates a multifaceted approach to benefits that can appeal to a broad demographic, from millennials to baby boomers, further fueling market growth. However, these benefits are to be paid by the companies to retain their employees, as it is harder to retain employees in the same company. For instance, according to a survey, 63.3% of companies say retaining employees is actually harder than hiring them.

Technological advancements in the areas of high internet speed and digitalization across industries have played a pivotal role in the growth of the market. These technologies have enabled employers to streamline benefits administration and offer convenient access through online platforms and mobile applications. Furthermore, employers are adopting digital channels to enhance communication and employer benefit support. For instance, according to a report in 2023 by Marsh McLennan, an insurance company, 69% of HR employees are planning to increase investment in digital benefit platforms for supporting benefit administration and communication in the next one to three years.

The legal requirements play a pivotal role in stimulating the expansion of the market. Across several jurisdictions, employers are legally obligated to provide specific benefits to their workforce, such as health insurance or retirement savings plans. For instance, in the U.S., The U.S. Department of Labor's Employee Benefits Security Administration is responsible for administering and enforcing the provisions of ERISA (Employee Retirement Income Security Act). Furthermore, these regulations necessitate compliance, which, in turn, contributes to the growth of the market.

While the employee benefits broker market is poised for growth from 2024 to 2030, it does face certain challenges. These obstacles involve the rising cost of providing comprehensive benefits packages. Furthermore, employers must grapple with the increasing expenses associated with health insurance, retirement plans, and other benefits, which can strain their budgets. In addition, balancing cost containment with the desire to offer competitive benefits becomes a complex task. However, with a strategic goal and providing work-life balance, companies can overcome these challenges and improve employee retention rates.

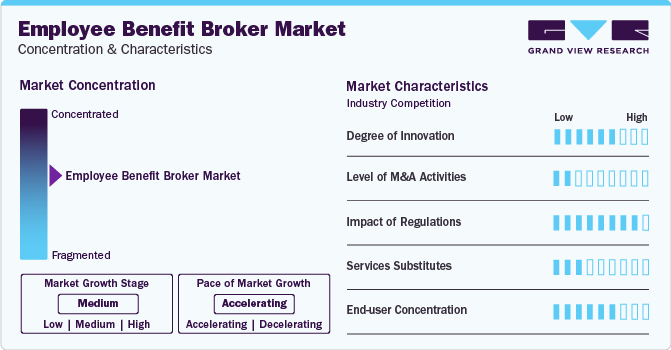

Market Concentration & Characteristics

The market growth stage is medium, and the pace of the market growth is accelerating. The employee benefits broker market is characterized by innovation propelled by evolving workplace dynamics, technological advancements, and shifting employee needs. With the integration of advanced tools, data insights, and tailored solutions, this sector is continuously reshaping employer offerings and fostering market growth.

The market experiences a moderate level of merger and acquisition (M&A) activity among key players. These activities are driven by various factors, including the pursuit of new expertise, expansion of service offerings, and adapting to the evolving landscape while strategically positioning within the industry's growth trajectory.

The employee benefits broker market faces substantial regulatory scrutiny owing to concerns surrounding consumer protection, data privacy, and fair practices. Governments globally are actively formulating stringent regulations to govern this sector, aiming to ensure ethical conduct, safeguard consumer interests, and shape the evolution and adoption of benefit-related technologies and services. Such regulations are significantly influencing the market.

In the employee benefit broker market, there are very few things that can directly replace the services they provide. While some technologies, like basic automation or rule-based systems, can do similar tasks in certain cases, they usually can't match the effectiveness and flexibility of dedicated employee benefit broker services.

End-user concentration plays a pivotal role in the market. Specific industries drive substantial demand for benefit solutions, presenting opportunities for companies specializing in these sectors. However, this concentration also poses challenges for firms seeking to compete amidst intense market competition within these limited end-user industries.

Benefit Type Insights

The healthcare insurance segment led the market and held 31.5% of the global revenue in 2023. The growth of the healthcare insurance segment can be attributed to rising demand for healthcare insurance from both employers and employees as a fundamental benefit type of their benefit packages. In addition, the COVID-19 pandemic underscored the critical importance of healthcare access and coverage, further amplifying the demand for health insurance benefits. Employees increasingly value health-related perks, making comprehensive healthcare insurance a powerful tool for attracting and retaining top talent.

The retirement savings plan segment is anticipated to register the fastest growth over the forecast period. With the aging of the workforce and a growing awareness of the importance of financial preparedness for retirement, employees increasingly prioritize retirement savings as a critical benefit. Furthermore, employers recognize the value of offering retirement savings plans, such as 401(k) plans or defined contribution plans, to attract and retain talent, enhance employee loyalty, and bolster overall financial wellness. In addition, some governments offer tax incentives and regulatory support for retirement savings plans, further incentivizing their adoption and hence driving the growth of the segment.

Application Insights

IT & telecom held the largest market revenue share of 20.2% in 2023. The IT & telecom segment growth can be attributed to the rising demand for tech talent, which has led companies to offer compelling benefits to attract and retain skilled professionals. These benefits encompass traditional offerings, such as health insurance and retirement plans, as well as innovative perks, such as flexible work arrangements, catering specifically to the preferences of IT professionals. Moreover, the tech-driven nature of the sector has resulted in the adoption of cutting-edge benefits administration tools and digital platforms, enhancing employee experience and engagement. The shift towards remote work during the COVID-19 pandemic has also prompted IT & telecom companies to adapt benefits packages to accommodate remote employees, reflecting the sector's adaptability and forward-thinking approach.

The retail segment is expected to witness the fastest growth over the forecast period. Retail companies, faced with a competitive labor market, increasingly recognize the importance of offering attractive benefit packages to attract and retain talent. With a diverse and often hourly workforce, retail employers are tailoring their benefits to cater to the specific needs of their employees, including healthcare coverage, flexible scheduling options, and even educational assistance programs. Furthermore, as e-commerce continues to reshape the industry, retailers are embracing technology to administer and communicate benefits more efficiently, reflecting a commitment to meeting the evolving needs of their workforce. In addition, many retailers have enhanced their benefits by providing pandemic-related support, such as paid sick leave and hazard pay, which has amplified the value of these offerings.

Regional Insights

North America dominated the market and held a share of over 26.1% in 2023. The regional market growth can be ascribed to prominent market players such as Evconnect, Chargepoint, and Chargelab, among others. Also, in a fiercely competitive labor market, particularly in industries such as technology and finance, companies strive for top-tier talent by offering attractive benefit schemes. This competitive environment fosters continuous innovation and expansion in employee benefits. North America's well-established regulatory frameworks, including healthcare mandates such as the Affordable Care Act, establish a foundation of requisite benefits, underpinning market growth.

Asia Pacific is anticipated to grow at the fastest CAGR over the forecast period. The regional market's growth is ascribed to the upsurge in e-commerce activities. This region encompasses diverse and rapidly growing economies, including China, India, Japan, and South Korea, where businesses are increasingly recognizing the strategic importance of offering attractive benefit packages to remain competitive and retain top talent. Furthermore, Asian countries are becoming more conscious of the value of comprehensive benefits, including health insurance, retirement plans, and work-life balance perks, fueling the demand for such offerings. Moreover, the Asia Pacific region is witnessing regulatory developments that promote the expansion of employee benefits, as governments in various countries introduce reforms and incentives to encourage employers to provide more extensive benefits to their workforce.

Key Companies & Market Share Insights

Some of the key players operating in the market include Marsh & McLennan, Willis Towers Watson, and AON.

-

Marsh & McLennan is a global professional services firm excelling in risk, strategy, and people. Their expertise in brokering employee benefits, strategic consulting, and innovative solutions has enabled them to secure a substantial stake in the market

-

Willis Towers Watson, a prominent global advisory, broking, and solutions company, specializes in risk management, insurance brokerage, and human capital consulting. Their expertise in navigating complex risk landscapes, offering comprehensive insurance services, and providing innovative human capital solutions has solidified their significant standing in the market

-

Arthur J. Gallagher, Hub International, Brown & Brown, and USI are some of the emerging market participants in the employee benefit broker market.

-

Arthur J. Gallagher is a growing name in employee benefits, specializing in insurance brokerage and risk management. Their customer-centered approach and innovative solutions are fueling their prominence within the market.

- Brown & Brown is a notable player in the market, renowned for their expertise in insurance brokerage and risk management. Their tailored solutions and client-focused strategies underline their prominence in this sector.

Key Employee Benefit Broker Companies:

- AON

- Marsh & McLennan

- Willis Towers Watson

- Arthur J. Gallagher

- NFP

- Hub International

- USI

- Lockton

- Brown & Brown

- OneDigital Health and Benefits

Recent Developments

-

In October 2023, Standard Insurance Company, a financial protection products and services provider, announced its partnership with Alight, Inc. as part of the Carrier Partner Program. As a result of this partnership, the integration between Standard Insurance Company and Alight, Inc. improved the mutual client experience and provided seamless benefits administration for both employers and employees.

-

In February 2023, Trim Willis Towers Watson, a global advisory company, introduced a pooled employer plan (PEP) named LifeSight PEP for simplifying 401(k) plan sponsorship for employers and bettering the outcomes for their employees. This launch was aimed at helping employers to address the increasing complexities of sponsoring a defined contribution plan.

Employee Benefit Broker Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 44.53 billion

Revenue forecast in 2030

USD 61.37 billion

Growth rate

CAGR of 5.5% from 2024 to 2030

Base year of estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Benefit type, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Germany; U.K.; France; China; India; Japan; South Korea; Australia; Brazil; Mexico; The Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key companies profiled

AON; Marsh & McLennan; Willis Towers Watson; Arthur J. Gallagher; NFP; Hub International; USI; Lockton; Brown & Brown; OneDigital Health and Benefits

Customization scope

Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

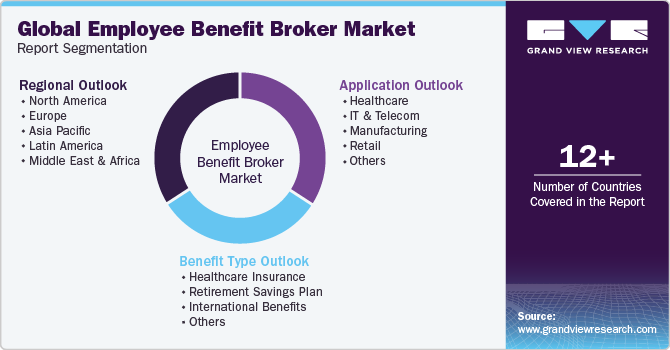

Global Employee Benefit Broker Market Report Segmentation

The report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global employee benefit broker market report based on benefit type, application, and region:

-

Benefit Type Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare Insurance

-

Retirement Savings Plan

-

International Benefits

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

IT & Telecom

-

Manufacturing

-

Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East & Africa

-

The Kingdom of Saudi Arabia (KSA)

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global employee benefit broker market size was estimated at USD 43.01 billion in 2023 and is expected to reach USD 44.53 billion in 2024.

b. The global employee benefit broker market is expected to grow at a compound annual growth rate of 5.5% from 2024 to 2030 to reach USD 61.37 billion by 2030.

b. North America dominated the employee benefit broker market with a share of 26.13% in 2023. The regional market growth can be ascribed to prominent market players such as Evconnect, Chargepoint, and Chargelab, among others.

b. Some key players operating in the employee benefit broker market include AON; Marsh & McLennan; Willis Towers Watson; Arthur J. Gallagher; NFP; Hub International; USI; Lockton; Brown & Brown; OneDigital Health and Benefits.

b. Key factors that are driving the market growth include the favorable regulatory framework and the employers striving to retain their employees.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.