- Home

- »

- Medical Devices

- »

-

End of Life Planning Market Size And Share Report, 2030GVR Report cover

![End of Life Planning Market Size, Share & Trends Report]()

End of Life Planning Market (2024 - 2030) Size, Share & Trends Analysis Report By Type, By Service (Funeral Services, Estate Planning, Digital Legacy Services, Grief Counseling and Support), By Area, By Demographic, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-207-3

- Number of Report Pages: 133

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

End Of Life Planning Market Summary

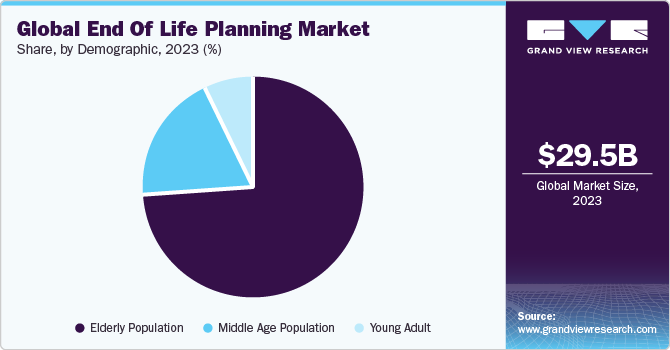

The global end of life planning market size was estimated at USD 29,517.1 million in 2023 and is projected to reach USD 45,166.3 million by 2030, growing at a CAGR of 6.3% from 2024 to 2030. Increased awareness and education about end-of-life options and the importance of planning ahead have contributed to the growth of this market.

Key Market Trends & Insights

- In terms of region, North America was the largest revenue generating market in 2023.

- Country-wise, Kuwait is expected to register the highest CAGR from 2024 to 2030.

- In terms of segment, estate planning accounted for a revenue of USD 8,482.3 million in 2023.

- Advanced Healthcare Directives is the most lucrative service segment registering the fastest growth during the forecast period.

Market Size & Forecast

- 2023 Market Size: USD 29,517.1 Million

- 2030 Projected Market Size: USD 45,166.3 Million

- CAGR (2024-2030): 6.3%

- North America: Largest market in 2023

Organizations, healthcare providers, and advocacy groups are actively promoting the importance of advance care planning and end-of-life decision-making.

Developing an end-of-life plan offers numerous benefits. Firstly, it guarantees the execution of your preferences in situations where you are incapable of articulating them. Moreover, it enables the appointment of a trusted individual to oversee medical and financial matters on your behalf in such circumstances. This designated person assumes responsibilities, including managing medical expenses, selecting appropriate healthcare facilities, and ensuring medical practitioners adhere to beneficiaries’ directives.Thus, aforementioned key benefit is anticipated to enhance penetration in the near future.

Furthermore, increasing old age population in various countries is expected to drive the market growth in the forecast period. For instance, by the year 2060, the U.S. is anticipated to witness a significant demographic shift, with the population aged 65 and older projected to surpass 98 million, more than doubling from the current figure of 46 million. With the projected increase in the aging population, there is a growing awareness of the need to plan ahead to alleviate potential burdens on loved ones and caregivers. By engaging in end-of-life planning, older individuals can proactively address issues such as healthcare preferences, asset distribution, and funeral arrangements, thereby easing the emotional and logistical burden on their families during an already challenging time.

Public awareness campaigns raise visibility around end-of-life planning issues and encourage individuals to engage in proactive planning. These campaigns may use various media channels, such as television, radio, social media, and print materials, to reach diverse audiences. For instance, the U.S. government has launched the "National Healthcare Decisions Day" campaign, occurring each year on April 16th. This campaign is designed to increase awareness surrounding advance directives and to prompt individuals to openly discuss and record their healthcare preferences.

Market Concentration & Characteristics

Market growth stage is medium, and pace of the market growth is accelerating. The market is characterized by a high degree of innovation. Technology plays a significant role in driving innovation in the end-of-life market. Digital platforms, mobile applications, and online tools are transforming how individuals plan for and manage end-of-life arrangements.

The market is also characterized by a medium level of merger and acquisition (M&A) activity by a key player. In the end-of-life market, there is a medium level of merger and acquisition (M&A) activity, with key players engaging in strategic transactions to expand their market presence, diversify their offerings, and achieve growth objectives.

Regulations have a significant impact on the end-of-life planning market, influencing various aspects such as service offerings, pricing structures, consumer protections, and industry standards Regulations require end-of-life planning service providers, such as funeral homes, crematoriums, and estate planning professionals, to obtain specific licenses or accreditations.

End-of-life planning market is characterized by a low impact of regional expansion. End-of-life planning services such as funeral homes, crematoriums, and estate planning firms often cater to local communities due to the personal and culturally sensitive nature of their services.

End-of-life planning market is characterized by a high impact of service expansion.As the population ages, there's a growing demand for end-of-life services. Baby boomers, in particular, are reaching an age where they're increasingly concerned about end-of-life planning, including funeral arrangements, wills, and estate planning.

Demographic Insights

Based on demographic, the elderly population segment led the market in 2023 with the largest revenue share of 73%. Estate planning becomes increasingly important as individuals age and accumulate wealth. Elderly individuals may have more complex estate planning needs, including considerations for asset distribution, tax planning, trusts, and inheritance issues. Consequently, they are more likely to seek out professional guidance and services in this area.

The middle age population segment is expected to have significant CAGR during the forecast period. Middle-aged individuals are often in the midst of raising families and may have dependent children or aging parents to care for. This dual responsibility highlights the importance of estate planning, including guardianship arrangements for minor children and providing for the financial needs of elderly parents or relatives.

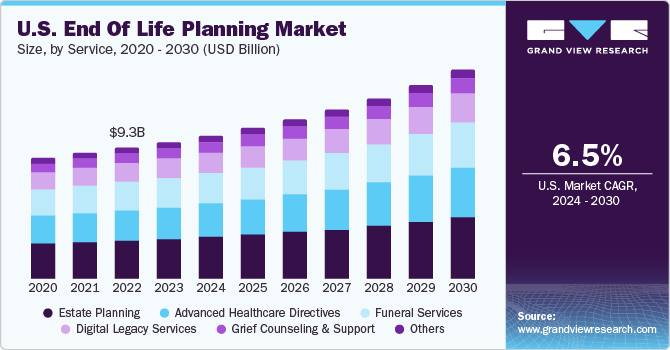

Service Insights

Based on service, the estate planning segment led the market with the largest revenue share of 28.74% in 2023. The segment is expected to maintain its position over the forecast period. With increasing life expectancy and wealth accumulation, more individuals and families recognize the importance of estate planning to ensure their assets are managed and distributed according to their wishes after their passing. This heightened awareness has led to a surge in demand for estate planning services.

The advanced healthcare directives segment is expected to grow at a significant CAGR over the forecast period. There is a growing emphasis on patient autonomy and empowerment in healthcare decision-making. Advanced healthcare directives, such as living wills and healthcare proxies, allow individuals to express their treatment preferences and appoint trusted agents to make medical decisions on their behalf if they become incapacitated.

End-use Insights

Based on end-use, the urban segment dominated the market with the largest revenue share in 2023. The segment is expected to maintain its position over the forecast period. Urban areas tend to have better access to a wide range of end-of-life planning services, including funeral homes, estate planning firms, crematoriums, and legal services. The proximity of these service providers makes it more convenient for urban residents to engage in end-of-life planning activities.

The rural segment is expected to witness the fastest CAGR of 6.59% over the forecast period.Advances in technology, such as telemedicine and online platforms, are making it easier for rural residents to access end-of-life planning services remotely. Digital solutions for will-writing, estate planning, and healthcare directives enable individuals in rural areas to overcome geographical barriers and obtain the necessary assistance more conveniently, contributing to the segment's growth.

Regional Insights

North America dominated the market with the largest revenue share of 35% in 2023. North America has well-established legal frameworks and regulations governing estate planning, healthcare directives, and funeral industry practices. This provides clarity and stability for individuals seeking end-of-life planning services and fosters trust in the industry.

U.S. End of Life Planning Market Trends

The end-of-life planning market in the U.S. held the largest share in North America. The U.S. has a large and aging population, with a significant proportion of individuals reaching retirement age and beyond. As people age, they become more aware of the importance of end-of-life planning, leading to increased demand for services such as estate planning, funeral arrangements, and healthcare directives.

Asia Pacific End of Life Planning Market Trends

The end-of-life planning market of Asia Pacific is expected to witness a fastest CAGR of 6.80% over the forecast period. Economic growth in many Asia-Pacific countries has led to a rise in wealth and affluence among middle-class and affluent individuals. As disposable incomes increase, there is greater capacity and willingness to invest in comprehensive end-of-life planning services to ensure financial security and peace of mind for oneself and future generations.

The China end of life planning market held the largest share in Asia Pacific. Traditionally, discussing death and end-of-life matters was considered taboo in Chinese culture. However, there has been a gradual shift in cultural attitudes, with more openness towards discussing and planning for end-of-life care and funeral arrangements. This cultural shift has increased demand for end-of-life planning services in China.

The end of life planning market in India is expected to grow at a significant CAGR over the forecast period. India is experiencing rapid urbanization, with a significant portion of the population migrating to cities in search of better economic opportunities. Urban areas tend to have higher demand for end-of-life planning services due to greater awareness, accessibility of services, and financial stability among urban residents.

Europe End of Life Planning Market Trends

The end of life planning market in Europe is expected to grow notably due to growing awareness among Europeans regarding the importance of end-of-life planning. This includes aspects such as wills, funeral arrangements, and healthcare directives. As people become more conscious of the need to plan for their end-of-life affairs, the demand for related services has been on the rise.

The UK end-of-life planning market held the largest share in Europe. Consumers in the country are increasingly seeking personalized and customized end-of-life arrangements that reflect their values, beliefs, and preferences. This includes personalized funeral services, eco-friendly burial options, and alternative memorialization choices.

Latin America End of Life Planning Market Trends

The end-of-life planning market in Latin America is expected to witness a significant CAGR over the forecast period. With changing demographics and an aging population, there has been a growing demand for pre-need services in Latin America. Consumers are increasingly interested in planning and arranging their funeral and burial arrangements in advance, leading to the growth of pre-need planning services.

The Mexico end of life planning market is expected to grow at a significant CAGR over the forecast period. Mexico has seen advancements in legal and regulatory frameworks related to estate planning and healthcare directives. Clearer laws and regulations governing wills, trusts, and advanced healthcare directives provide individuals with greater confidence and certainty when planning for their end-of-life preferences.

Key End of Life Planning Company Insights

The key companies are undertaking various market strategies, such as merger & acquisition, collaboration, regional expansion, service portfolio expansion, and competitive pricing, to sustain in the competitive environment and acquire a higher market share. For instance, in November 2023, USAA Life Insurance Company partnered with Trust & Will, a distinguished digital estate planning and settlement platform. This strategic collaboration aims to offer discounted estate planning and probate services tailored to the specific needs of their members. Through this partnership, USAA members will gain access to Trust & Will's efficient and simplified approach to estate planning, ensuring they can effectively manage and organize their affairs with ease and convenience.

Key End of Life Planning Companies:

The following are the leading companies in the end of life planning market. These companies collectively hold the largest market share and dictate industry trends.

- Everplans

- Cake

- TrustandWill

- Funeralocity

- Gathered Here Pty Ltd.

- Sue Mackey

- Dignity

- Service Corporation International (SCI)

- Death with Dignity

- Eterneva

Recent Developments

-

In June 2023, Service Corporation International (SCI) has joined forces with the Tragedy Assistance Program for Survivors (TAPS) to provide assistance to individuals mourning the loss of a military loved one. This marks SCI's third consecutive year as an official partner of TAPS, with their cumulative contributions now totaling USD 750,000.

-

In January 2022, Aledade has announced its acquisition of Iris Healthcare, a leading provider of Advance Care Planning (ACP) solutions serving tens of thousands of patients nationwide. This strategic move is geared towards enhancing Aledade's mission of ensuring patients receive care aligned with their values, preferences, and the latest clinical evidence.

End of Life Planning Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.93 billion

Revenue forecast in 2030

USD 45.17 billion

Growth rate

CAGR of 6.52% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, area, demographic, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; India; Japan; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; Saudi Arabia; UAE; South Africa, Kuwait

Key companies profiled

Everplans; Cake; TrustandWill; Funeralocity; Gathered Here Pvt Ltd.; Sue Mackey; Dignity; Service Corporation International (SCI); Death with Dignity; Eterneva

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Global End of Life Planning Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global end of life planning market report based on the service, area, demographic, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Funeral Services

-

Estate Planning

-

Digital Legacy Services

-

Grief Counseling and Support

-

Advanced Healthcare Directives

-

Others

-

-

Area Outlook (Revenue, USD Million, 2018 - 2030)

-

Urban

-

Rural

-

-

Demographic Outlook (Revenue, USD Million, 2018 - 2030)

-

Elderly population

-

Middle age population

-

Young adult

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global end of life planning market size was estimated at USD 29.52 billion in 2023 and is expected to reach USD 30.93 billion in 2024.

b. The global end of life planning market is expected to grow at a compound annual growth rate of 6.52% from 2024 to 2030 to reach USD 45.17 billion by 2030.

b. North America dominated the end of life planning market with a share of 35.72% in 2023. North America has well-established legal frameworks and regulations governing estate planning, healthcare directives, and funeral industry practices. This provides clarity and stability for individuals seeking end-of-life planning services and fosters trust in the industry.

b. Some key players operating in the end of life planning market include Everplans, Cake, TrustandWill, Funeralocity, Gathered Here Pty Ltd., Sue Mackey, Dignity, Service Corporation International (SCI), Death with Dignity.

b. Key factors that are driving the market growth include Increased awareness and education about end-of-life options and the importance of planning ahead have contributed to the growth of this market. Organizations, healthcare providers, and advocacy groups are actively promoting the importance of advance care planning and end-of-life decision-making.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.