- Home

- »

- Medical Devices

- »

-

Endoluminal Suturing Devices Market Size Report, 2030GVR Report cover

![Endoluminal Suturing Devices Market Size, Share & Trends Report]()

Endoluminal Suturing Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Bariatric Surgery, Gastrointestinal Surgery), By End-use (Hospitals), By Region, And Segment Forecasts

- Report ID: GVR-4-68038-569-4

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoluminal Suturing Devices Market Summary

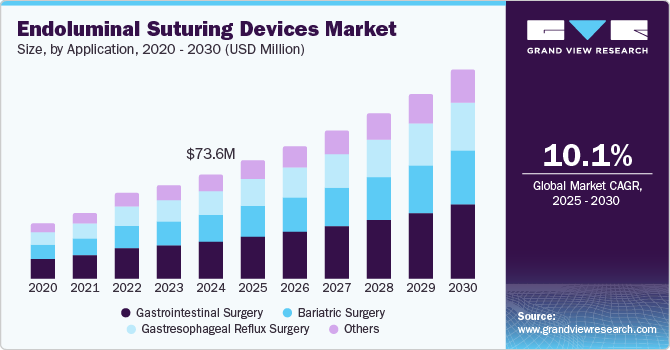

The global endoluminal suturing devices market size was valued at USD 73.6 million in 2024 and is projected to reach USD 147.2 million by 2030, growing at a CAGR of 10.1% from 2025 to 2030. The increasing demand for minimally invasive surgical techniques is driving the growth as these techniques reduce recovery times and lower complication rates to improve patient outcomes.

Key Market Trends & Insights

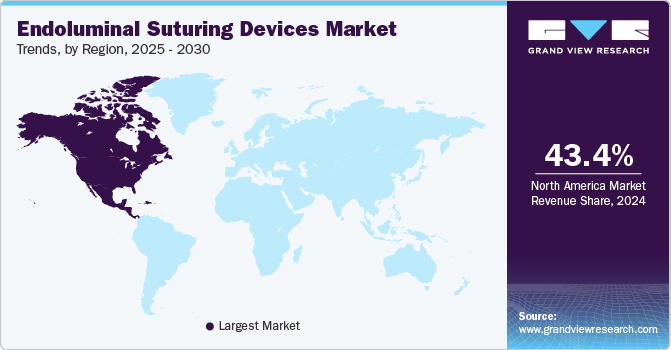

- North America endoluminal suturing devices market accounted for the largest revenue share of 43.4% in 2024.

- Asia Pacific endoluminal suturing devices market is expected to advance at the fastest CAGR from 2025 to 2030.

- Based on application, the gastrointestinal surgery segment accounted for a dominant revenue share of 35.2% in 2024.

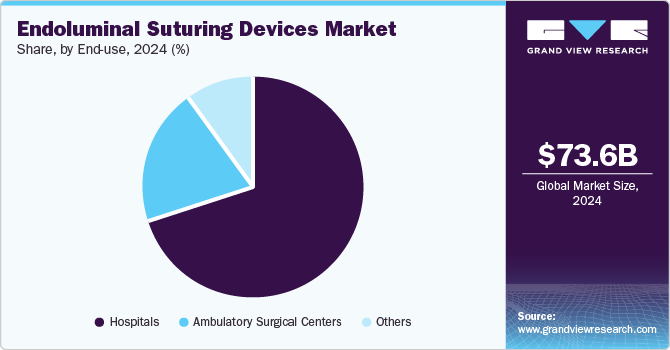

- Based on end use, the hospitals segment accounted for the largest revenue share in the global market in 2024.

Market Size & Forecast

- 2024 Market Size: USD 73.6 Million

- 2030 Projected Market Size: USD 147.2 Million

- CAGR (2025-2030): 10.1%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Endoluminal suturing devices are useful in endoscopic resections and bariatric surgery procedures, where they perform stitching within the gastrointestinal tract and other luminal organs.The need for advanced surgical solutions is driven by the frequency of gastrointestinal disorders, including obesity and colorectal cancer. Many patients opt for bariatric surgery to manage obesity, which eventually requires effective suturing tools, increasing the importance of modern surgical device practices. Technological innovations such as integrated robotic assistance allow greater precision in suturing, making complex procedures more manageable, with advancements designed to promote better tissue healing and minimize infection risk, enhance the efficiency of these devices, optimize surgical performance, and encourage wider adoption among surgeons to improve health care.

The endoluminal suturing devices market is poised for continued growth, driven by an aging population and increasing awareness of the benefits of minimally invasive procedures. Ongoing research into new suturing techniques and device designs will also contribute to market expansion. As healthcare providers increasingly prioritize patient safety and improved surgical outcomes, the adoption of endoluminal suturing devices is expected to rise, ensuring a promising future for this market segment.

Application Insights

The gastrointestinal surgery segment accounted for a dominant revenue share of 35.2% in 2024, primarily due to the use of endo-fluid pumping devices in various surgical procedures, such as laparoscopic resection, gastric bypass surgery, and endoscopic mucosal resection involved in abdominal suturing in bariatric surgery. Therefore, these devices are important in ensuring optimal healing and risk reduction. The increasing demand for gastrointestinal diseases such as obesity and colorectal cancer is driving the demand for advanced surgical instruments, as they are more efficient and safer.

The gastroesophageal reflux surgery segment is expected to advance at the fastest CAGR of 10.8% during the forecast period, driven by the rising prevalence of gastroesophageal reflux disease (GERD), which affects the global population the greater part A procedure such as fundoplication, in which the upper part of the stomach is connected to the lower esophagus, prevents acid reflux, relies heavily on this device for secure lines and it is accurate Improvements in equipment and innovations have helped in many different ways, such as laparoscopic fundoplication Success rates improves.

End-use Insights

The hospitals segment accounted for the largest revenue share in the global market in 2024, as they are equipped with advanced surgical facilities and a diverse range of specialists, making them the primary locations for complex surgeries requiring endoluminal suturing. Procedures such as bariatric surgeries, colorectal resections, and gastroesophageal reflux surgeries are performed in hospitals, where the availability of state-of-the-art technology and trained medical personnel enhances patient outcomes.

The ambulatory surgical centers segment is estimated to witness the fastest growth over the forecast period due to several transformative trends in healthcare. ASCs offer a variety of surgical procedures that are simply hostile and offer cost-effective and efficient alternatives to traditional hospital settings. In addition, the ASCs segment is contributed by value-based care, focusing on high-quality care at lower costs while minimizing overhead expenses and maintaining high standards of patient care. Advanced technologies, such as robotic-assisted surgical systems and innovative endoluminal suturing devices, are enhancing the capabilities of ASCs.

Regional Insights

North America endoluminal suturing devices market accounted for the largest revenue share of 43.4% in 2024 due to well-established healthcare infrastructure and high demand for advanced surgical technologies. The region's hospitals and surgical centers are equipped with state-of-the-art facilities, enabling the adoption of minimally invasive techniques that require specialized suturing devices. For instance, laparoscopic procedures, including gastric bypass surgeries and endoscopic mucosal resections, are commonly performed in this region, significantly increasing the utilization of endoluminal suturing devices.

U.S. Endoluminal Suturing Devices Market Trends

The U.S. endoluminal suturing devices market dominated North America in terms of revenue share in 2024, fueled by several key factors driving the rise in the use of these devices in surgery. One of the most important factors in the U.S. market is technological innovations in the endoluminal suture industry. Companies are developing sophisticated devices that promote advanced imaging, automated sewing capabilities, advanced packaging, and other features that promote better treatment. In addition, ongoing clinical research and trial trends expand these devices' use, furthering market growth.

Asia Pacific Endoluminal Suturing Devices Market Trends

Asia Pacific endoluminal suturing devices market is expected to advance at the fastest CAGR from 2025 to 2030, driven by rising healthcare investments and growing awareness of advanced surgical techniques. Countries such as China and India significantly enhance their healthcare, resulting in greater use of new medical technologies. As surgical centers take less invasive approaches to treat gastrointestinal diseases, a collaboration between localization and global medical device companies supports innovation and expands supply chains, ensuring security that the market can meet the needs of both patients and providers.

China endoluminal suturing devices market has a significant revenue share in the regional market driven by rapidly expanding healthcare services and increased investments in medical technology The country’s healthcare reform prioritizes the availability of advanced surgical solutions, and it has led to increased demand for less invasive procedures has strongly encouraged innovation in the medical device industry, which has ensured that It turns out that healthcare providers are prepared to take this technology go this face will work well.

Key Endoluminal Suturing Devices Company Insights

Key companies involved in the endoluminal suturing devices market include Medtronic Plc, Ethicon Endo Surgery (J&J), Apollo Endosurgery Inc., Braun Melsungen, Terumo Corporation, Boston Scientific and others. These companies utilize various strategies to maintain competitive advantage, with developments in innovative surgical products to enhance their devices' functionality. By actively participating in clinical trials and engaging with medical communities, they aim to demonstrate the clinical benefits of their products. Moreover, many of these firms are exploring digital health solutions to streamline surgical workflows and improve patient outcomes, ultimately positioning themselves as leaders in endoluminal suturing.

-

Medtronic plc offers endoluminal suturing devices that enhance surgical precision and improve patient outcomes in gastrointestinal procedures. Through continuous research and development, Medtronic focuses on advancing surgical techniques and aims to support healthcare providers in delivering high-quality care.

-

Ethicon Endo Surgery, a subsidiary of Johnson & Johnson, specializes in developing advanced technologies that enhance the efficacy and safety of minimally invasive procedures. Its extensive portfolio includes a range of endoluminal suturing devices. Ethicon's products are widely used in bariatric surgery and colorectal procedures, highlighting their versatility and reliability in clinical applications.

Key Endoluminal Suturing Devices Companies:

The following are the leading companies in the endoluminal suturing devices market. These companies collectively hold the largest market share and dictate industry trends.

- Medtronic Plc

- Ethicon Endo Surgery (J&J)

- Apollo Endosurgery Inc.

- Richard Wolf GmbH

- Karl Storz GmbH

- Olympus Corporation

- Teleflex Corporation

- Braun Melsungen

- Terumo Corporation

- Boston Scientific

Recent Developments

-

In November 2023, Johnson & Johnson MedTech company Ethicon announced the launch of ETHIZIA Hemostatic Sealing Patch, a supportive hemostatic solution designed to effectively manage difficult-to-control bleeding situations. This innovative patch utilizes unique synthetic polymer technology, making it the first and only hemostatic matrix that is equally active and effective on both sides. The patch has received CE Mark approval for use on internal organs, excluding cardiovascular and neurological applications.

Endoluminal Suturing Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 82.5 million

Revenue forecast in 2030

USD 147.2 million

Growth rate

CAGR of 10.1% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

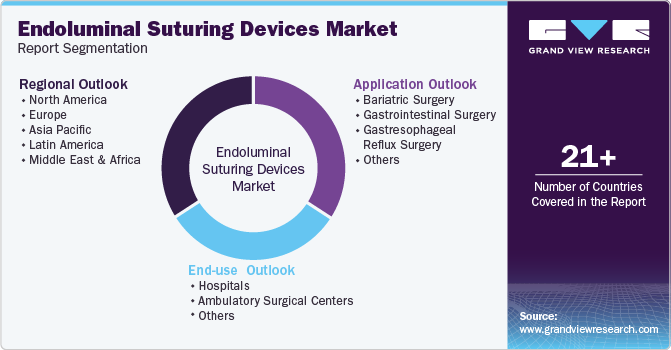

Application, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Mexico; UK; Germany; France; Italy; Spain; Norway; Sweden; Denmark; Japan; China; India; Australia; South Korea; Thailand; Brazil; Argentina; Colombia; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Apollo Endosurgery, Inc.; Johnson & Johnson; Medtronic plc; Endo Tools Therapeutics S.A.; ErgoSuture; Sutrue Ltd.; Cook Medical; Ovesco Endoscopy; USGI Medical

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoluminal Suturing Devices Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endoluminal suturing devices market report based on application, end-use, and region:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Bariatric Surgery

-

Gastrointestinal Surgery

-

Gastresophageal Reflux Surgery

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Ambulatory Surgical Centers

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Norway

-

Sweden

-

Denmark

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.