- Home

- »

- Medical Devices

- »

-

Endoscopic Hemostasis Devices Market Size Report, 2030GVR Report cover

![Endoscopic Hemostasis Devices Market Size, Share & Trends Report]()

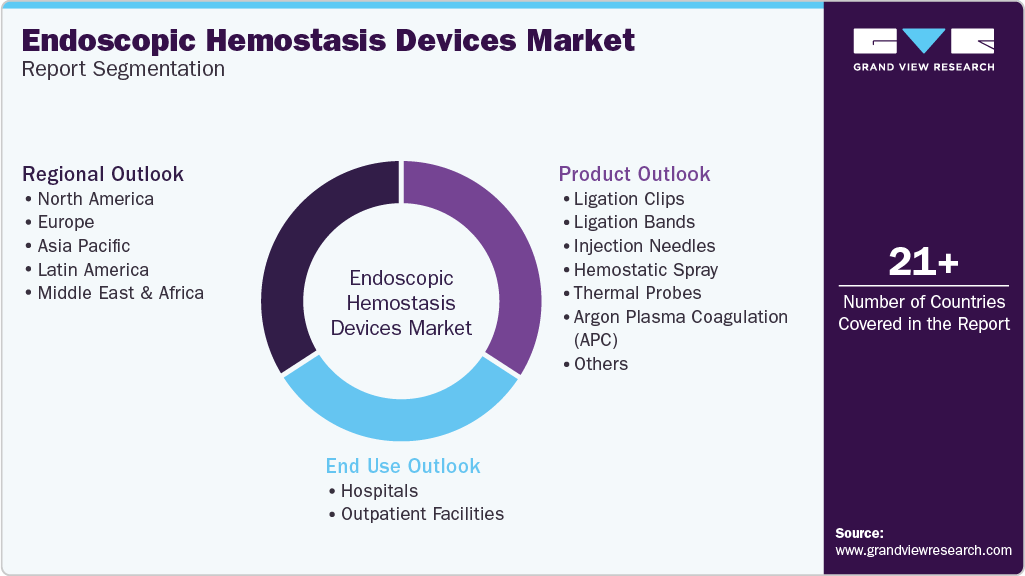

Endoscopic Hemostasis Devices Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Ligation Clips, Ligation Bands, Injection Needles, Hemostatic Spray), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-588-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

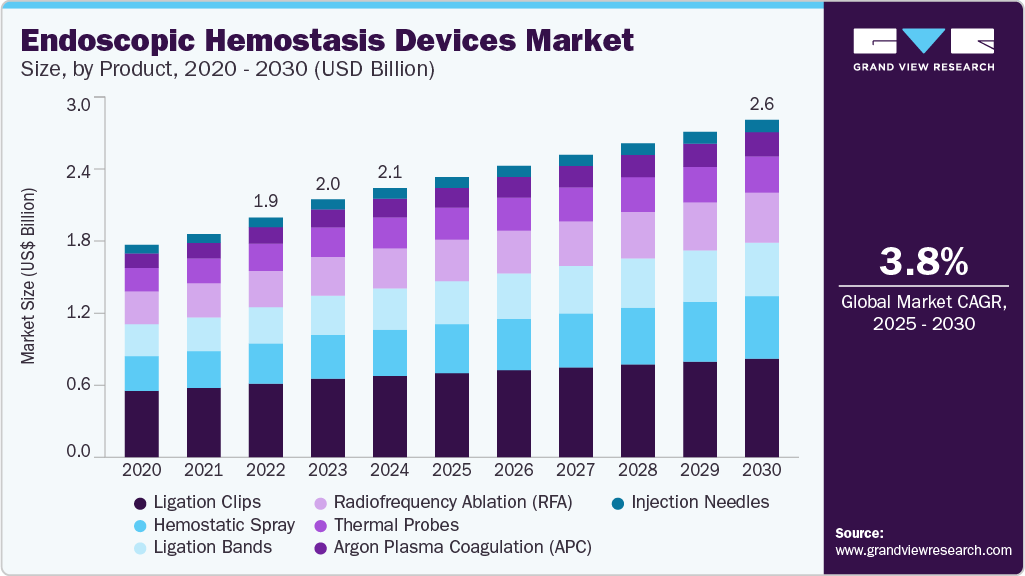

The global endoscopic hemostasis devices market size was estimated at USD 2.10 billion in 2024 and is expected to expand at a CAGR of 3.79% from 2025 to 2030. The growing prevalence of gastrointestinal disorders, including gastric varices, peptic ulcers, and gastrointestinal cancers, is leading to a higher demand for endoscopic hemostasis devices.

Key Highlights:

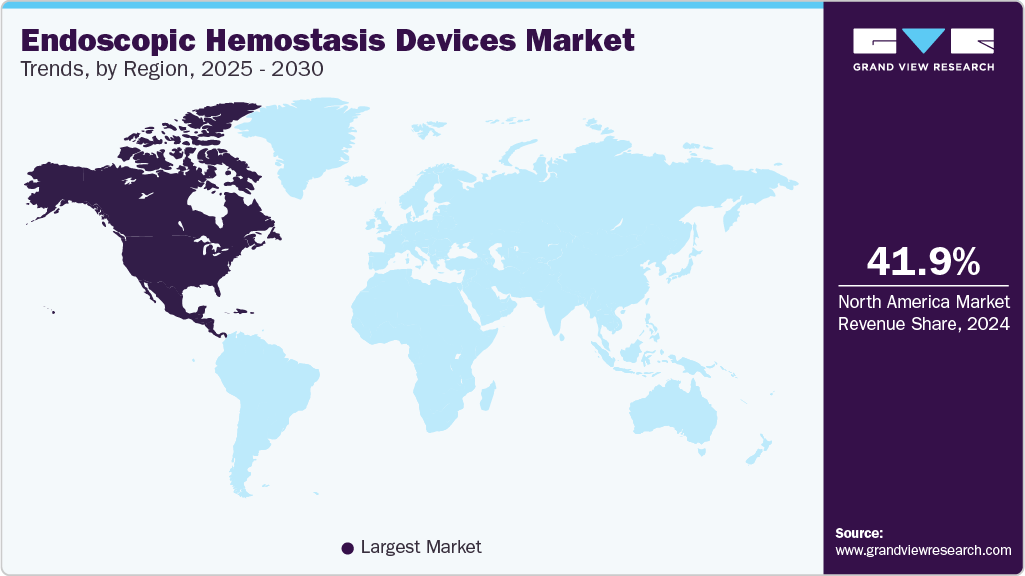

- North America dominated the endoscopic hemostasis devices market with a revenue share of 41.87% in 2024

- The U.S. dominated the endoscopic hemostasis devices market in the North America region in 2024

- By product, the ligation clips segment dominated the market with the largest revenue share of 30.20% in 2024

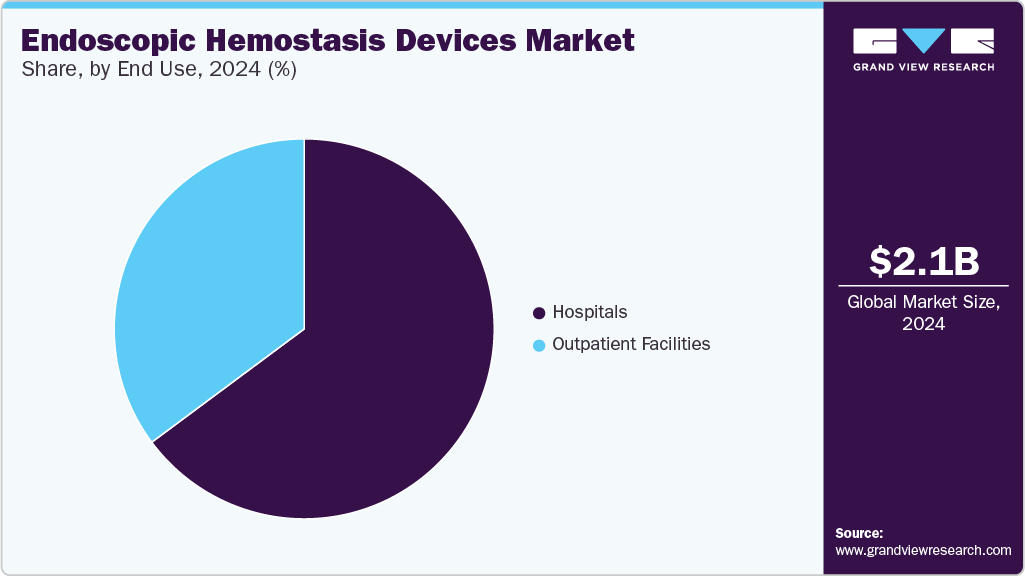

- By end use, the hospitals segment dominated the market with a revenue share of 64.83% in 2024

- By end use, the outpatient facilities segment is anticipated to grow at the fastest CAGR over the forecast period

For instance, the rise in peptic ulcer cases necessitates effective bleeding management during endoscopic procedures, which is contributing to market growth. As the prevalence of these conditions increases, the requirement for advanced hemostasis devices in general surgery will grow, driving further market growth.

Healthcare systems worldwide are increasingly incorporating endoscopic procedures into their cancer management protocols for early detection and treatment of cancer to improve survival rates. This trend and the rising global cancer burden are expected to boost endoscope demand, further driving market growth. Moreover, manufacturers in the market continuously innovate and expand their product lines to meet the growing clinical needs, aiming to equip them with the most advanced technology for effective cancer treatment.

Favorable government initiatives, including awareness campaigns and cancer screening programs, are expected to drive the demand for endoscopic hemostasis devices. For instance, the CDC reported that from July 2021 to June 2022, partner clinics in the Colorectal Cancer Control Program (CRCCP) screened nearly 198,000 individuals for colorectal cancer, marking a 35% increase (51,084 additional screenings) compared to the previous year. Some of the cancer screening programs are as follows:

Country

Program

Description

UK

NHS Lung Cancer Screening Programme

IT is being introduced for people at high risk of lung cancer. People are invited if they are 55-74 years old and currently smoke or used to smoke.

Germany

Cancer Screening Program

It includes stool test and colonoscopy examination for individuals from the age of 50

Furthermore, rapid technological advancements in endoscopic hemostasis devices improved patient safety and workflow management throughout the procedure. For instance, in March 2025, Olympus Corporation, a MedTech company, launched Retentia HemoClip , a new hemostasis clip. The product has the following features,

-

A compact tail length enhances the target area's visibility, allowing for the more easily placed placement of several clips than with longer tail lengths.

-

The available arm lengths of 9mm, 12mm, and 16mm cater to different closure needs.

-

The handle is designed for ease of use, allowing the clip to be deployed in a single step.

-

The sheath markings are designed to assist with insertion and extraction.

Moreover, favorable reimbursement policies for endoscopy procedures boost market growth. Reimbursements depend on fee schedules, as per the Current Procedural Terminology (CPT) code, and are directed by the American Medical Association (AMA). The CPT code set helps describe surgical, medical, and diagnostic services that deliver uniform information about medical services and procedures to coders, patients, physicians, & payers for financial, administrative & analytical purposes. Hospitals for outpatients get reimbursed by Medicare through Ambulatory Payment Classification Groups (APCs). The reimbursement process is done through the Medicare Severity Diagnosis-Related Group (MS-DRG) for inpatient hospitals.

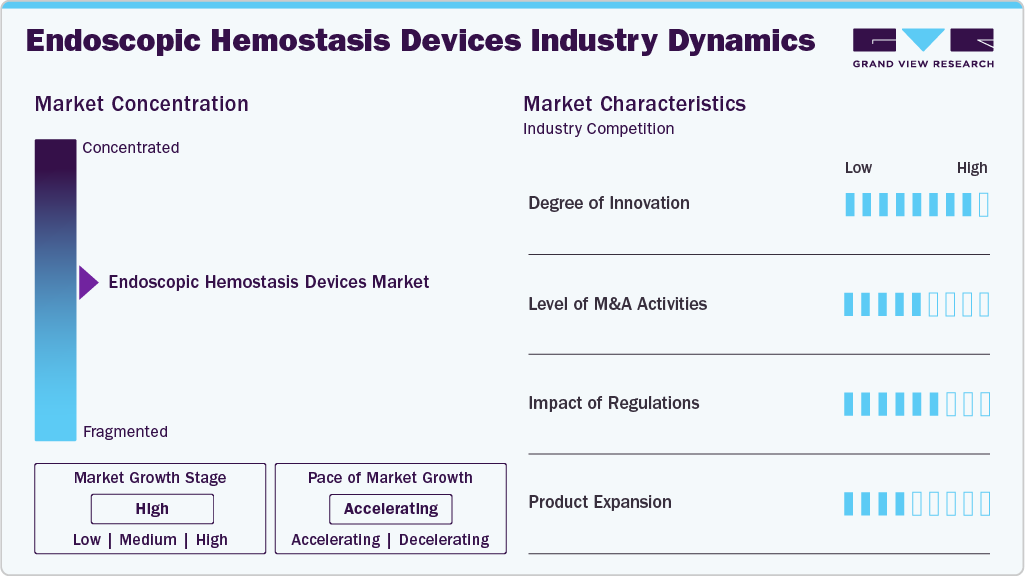

Market Concentration & Characteristics

The global endoscopic hemostasis devices market is characterized by a moderate degree of innovation, owing to growing research activities and rising investments. Companies introduce advanced technologies to enhance diagnostic and therapeutic capabilities. For instance, in August 2020, Micro-Tech Endoscopy USA introduced the In-Sight Multi-Band Ligator. It is an easy, one-step, single-handed device for treating internal hemorrhoids in ambulatory surgery centers.

The endoscopic hemostasis devices market is characterized by medium merger and acquisition activity, owing to several factors, including the desire to expand the business to cater to the growing demand for advanced solutions to maintain a competitive edge and to gain access to new technologies. For instance, in November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. for USD 10 per share, valuing the enterprise at USD 615 million. Through this acquisition, the company would fully control the endoluminal surgery product portfolio, further enhancing its resources in the endoscopy business division.

Regulations play an essential role in shaping the global market and ensuring the efficacy, safety, and quality of endoscopic hemostasis devices available to patients. For example, in Australia, the guidelines for Standards for Endoscopic Facilities and Services were developed by a joint committee of the Gastroenterological Nurses College of Australia, Inc., and the Gastroenterological Society of Australia. These guidelines are outlined in the third edition of “Gastrointestinal Endoscopy: Good Practice Guidelines for the Delivery of Endoscopic Services.”

Market players are expanding their business by entering new geographical regions and launching new tools to strengthen their market position and expand their product portfolio. For instance, in July 2020, Olympus Corporation launched the EZ Clip endotherapy device. This hemostasis clip is rotatable and reloadable, designed for controlling bleeding and closing defects in gastrointestinal endoscopy procedures requiring multiple clips.

Product Insights

By product, the ligation clips segment dominated the market with the largest revenue share of 30.20% in 2024. Endoscopic ligation clips are tiny, non-absorbable clips used in minimally invasive surgeries, such as laparoscopy, to close off blood vessels or other tubular structures. They are common in many surgical procedures, from gastrointestinal to gynecological surgeries. These clips are designed to be placed around the targeted tissue and then closed by a specialized applicator, effectively occluding the vessel or structure. For instance, the LIGACLIP Endoscopic Rotating Multiple Clip Applier is offered by Ethicon US, LLC (Johnson & Johnson Inc.). It is designed for application on tubular structures or vessels requiring a metal ligating clip. The tissue must be ligated to match the size of the clip.

The hemostatic spray segment is anticipated to grow at the fastest CAGR over the forecast period. The market for endoscopic hemostatic sprays is driven by the increasing incidence of gastrointestinal bleeding and the need for effective and minimally invasive treatments. The growing popularity of minimally invasive endoscopic procedures and the demand for safe and efficient hemostasis are fueling market growth. For instance, in September 2022, Medtronic received U.S. FDA clearance for its Nexpowder endoscopic hemostasis system. It is developed independently by NEXTBIOMEDICAL CO., LTD (Korea) and distributed globally by Medtronic.

End Use Insights

By end use, the hospitals segment dominated the market with a revenue share of 64.83% in 2024. Hospitals, particularly large academic and teaching hospitals, are often at the forefront of adopting new and innovative medical technologies, including endoscopic hemostasis devices. They recognize the potential benefits of these advanced devices in improving patient outcomes, enhancing diagnostic accuracy, and streamlining clinical workflows. Furthermore, the rise in the number of hospitals boosts market growth. For instance, according to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, the UK had 1148 hospitals as of August 2023.

The outpatient facilities segment is anticipated to grow at the fastest CAGR over the forecast period. The convenience and cost-effectiveness of endoscopy procedures in outpatient settings drive healthcare providers to invest in these devices for their facilities. For instance, the NIH report published in 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., with ambulatory MIS procedures showing growth of 16.9%, 17.4%, and 18%. Thus, such factors are anticipated to boost the market growth over the forecast period.

Regional Insights

North America dominated the endoscopic hemostasis devices market with a revenue share of 41.87% in 2024. The high prevalence of several diseases, such as Gastrointestinal (GI) disorders, respiratory conditions, urological problems, gynecological issues, and cancer, is increasing the need for endoscopic procedures for diagnosis & treatment in North America. The market is fueled by rapid technological advancements, leading to the development of new and innovative endoscopic hemostasis devices.

U.S. Endoscopic Hemostasis Devices Market Trends

The U.S. dominated the endoscopic hemostasis devices market in the North America region in 2024. An advanced healthcare infrastructure, high investments by market players, hospitals promoting the use of novel endoscopy hemostasis equipment, and a rising number of FDA approvals are among the factors expected to drive market growth in the U.S. For instance, in February 2021, EndoClot Plus, Inc. received U.S. FDA approval for its EndoClot Polysaccharide Hemostatic System (EndoClot PHS), a device that assists gastroenterologists in stopping bleeding rapidly and reliably.

The endoscopic hemostasis devices market in Europe is expected to grow significantly over the forecast period due to factors such as the increasing incidence of cancer, a growing emphasis on early detection, technological advancements, and supportive government initiatives. According to a report published by the European Commission in March 2024, the European Cancer Information System recorded approximately 361,986 cases of colon cancer in Europe in 2022, accounting for about 13% of total cancer cases in the region.

The endoscopic hemostasis devices industry in the Italy is expected to grow significantly during the forecast period. Italy has one of the highest geriatric populations in Europe, which is expected to drive the endoscopic hemostasis devices market due to the significant burden of chronic diseases among the elderly. Moreover, the acceptance and success rates of minimally invasive surgeries have contributed to the increased adoption of endoscopes in Italy. As people become more aware of the benefits of these techniques, there is a growing preference for minimally invasive procedures, further driving the market growth.

Asia Pacific Endoscopic Hemostasis Devices Market Trends

The Asia Pacific endoscopic hemostasis devices industry is expected to register the fastest growth rate over the forecast period, owing to its rapidly improving healthcare infrastructure, a less stringent regulatory framework, and economic development attracting foreign investments. India and China are considered the most populous countries, providing a large patient pool and elderly population, especially in China. The growing patient pool in these countries is expected to boost the market.

The Australia endoscopic hemostasis devices market is anticipated to register considerable growth during the forecast period. The endoscopic hemostasis devices market in Australia is primarily driven by the increased prevalence of cancer and various initiatives promoting the importance of cancer screening. According to the AIHW Australian Cancer Database 2020, the expected cancer incidence in 2024 is approximately 141.1 cases per 100,000 people.

Latin Endoscopic Hemostasis Devices Market Trends

The Latin America endoscopic hemostasis devices industry is anticipated to witness considerable growth over the forecast period, due to the overall increase in healthcare expenditure and investments in medical infrastructure within Latin American countries, which supports the adoption of advanced medical technologies, including disposable endoscopes. As hospitals seek to enhance patient safety and improve clinical outcomes is expected to drive market growth.

Brazil endoscopic hemostasis devices industry is anticipated to register considerable growth during the forecast period. The market is driven by technological advancements, reductions in healthcare costs, and the growth of the aging population. The presence of organizations, such as the Argentine Federation of Digestive Endoscopy (FAAED) and the Argentine Society of Gastroenterology (SAGE), which are dedicated to generating awareness about endoscopy techniques, is increasing the demand for endoscopic hemostasis devices.

Middle East and Africa Endoscopic Hemostasis Devices Market Trends

The Middle East and Africa endoscopic hemostasis devices market is anticipated to witness considerable growth over the forecast period. The MEA region is economically significant and technologically sophisticated, boasting a high per capita disposable income. Government initiatives aimed at expanding reimbursement coverage are anticipated to play a crucial role in driving market growth over the forecast period. The Gulf Cooperation Council (GCC) is experiencing rapid growth, highlighting advancements in medical devices and healthcare infrastructure.

Saudi Arabia endoscopic hemostasis devices industry is anticipated to register considerable growth during the forecast period. In recent years, there has been a significant focus on developing and expanding endoscopy services in Saudi Arabia. In addition, initiatives are undertaken to train healthcare professionals in advanced endoscopy techniques. As part of the Saudi-Japan 2030 initiative, a collaboration between the governments of Saudi Arabia and Japan, medical training for endoscopy techniques is included, supporting the advancement of the market.

Key Endoscopic Hemostasis Devices Company Insights

Key participants in the endoscopic hemostasis devices industry are focusing on devising innovative business growth strategies, such as expanding their product portfolios, partnerships and collaborations, mergers and acquisitions, and expanding their business footprints.

Key Endoscopic Hemostasis Devices Companies:

The following are the leading companies in the endoscopic hemostasis devices market. These companies collectively hold the largest market share and dictate industry trends.

- Boston Scientific Corporation

- CONMED Corporation

- Olympus Corporation

- STERIS

- Medtronic

- MICRO-TECH (Nanjing) Co., Ltd.

- B. Braun SE

- Diversatek, Inc.

- Cook

- Duomed

Recent Developments

- In May 2024, Galvanize Therapeutics, Inc., a biomedical platform company, received U.S. FDA 510(k) regulatory clearance for its INUMI Flex endoscopic needle to be used with the Aliya PEF System for soft tissue ablation. This advancement allows for minimally invasive endoscopic delivery, enhancing the functionality of the previously approved percutaneous needle.

Endoscopic Hemostasis Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.18 billion

Revenue forecast in 2030

USD 2.63 billion

Growth Rate

CAGR of 3.79% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, and region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; Spain; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Boston Scientific Corporation, CONMED Corporation, Olympus Corporation, STERIS, Medtronic, MICRO-TECH (Nanjing) Co., Ltd., B. Braun SE, Diversatek, Inc., Cook, Duomed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Hemostasis Devices Market Report Segmentation

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global endoscopic hemostasis devices market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Ligation Clips

-

Ligation Bands

-

Hemorrhoidal

-

Esophageal

-

-

Injection Needles

-

Hemostatic Spray

-

Thermal Probes

-

Contact Probes

-

Noncontact Probes

-

-

Argon Plasma Coagulation (APC)

-

Radiofrequency Ablation (RFA)

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic hemostasis devices market size was estimated at USD 2.10 billion in 2024 and is expected to reach USD 2.18 billion in 2025.

b. The global endoscopic hemostasis devices market is expected to grow at a compound annual growth rate of 3.79% from 2025 to 2030 to reach USD 2.63 billion by 2030.

b. North America dominated the endoscopic hemostasis devices market with a share of 41.87% in 2024. TThe market is fueled by rapid technological advancements, leading to the development of new and innovative endoscopic hemostasis devices.

b. Some key players operating in the endoscopic hemostasis devices market include Boston Scientific Corporation, CONMED Corporation, Olympus Corporation, STERIS, Medtronic, MICRO-TECH (Nanjing) Co., Ltd., B. Braun SE, Diversatek, Inc., Cook, and Duomed.

b. The growing prevalence of gastrointestinal disorders, including gastric varices, peptic ulcers, and gastrointestinal cancers, is leading to a higher demand for endoscopic hemostasis devices. For example, the rise in peptic ulcer cases necessitates effective bleeding management during endoscopic procedures, which is contributing to market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.