- Home

- »

- Medical Devices

- »

-

Endoscopic Probe Disinfection Market, Industry Report, 2033GVR Report cover

![Endoscopic Probe Disinfection Market Size, Share & Trends Report]()

Endoscopic Probe Disinfection Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Endoscopic Probes [Ultrasound (EUS)], Products), By End-use (Hospitals, Ambulatory Surgical Centers (ASCs)), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-720-3

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopic Probe Disinfection Market Summary

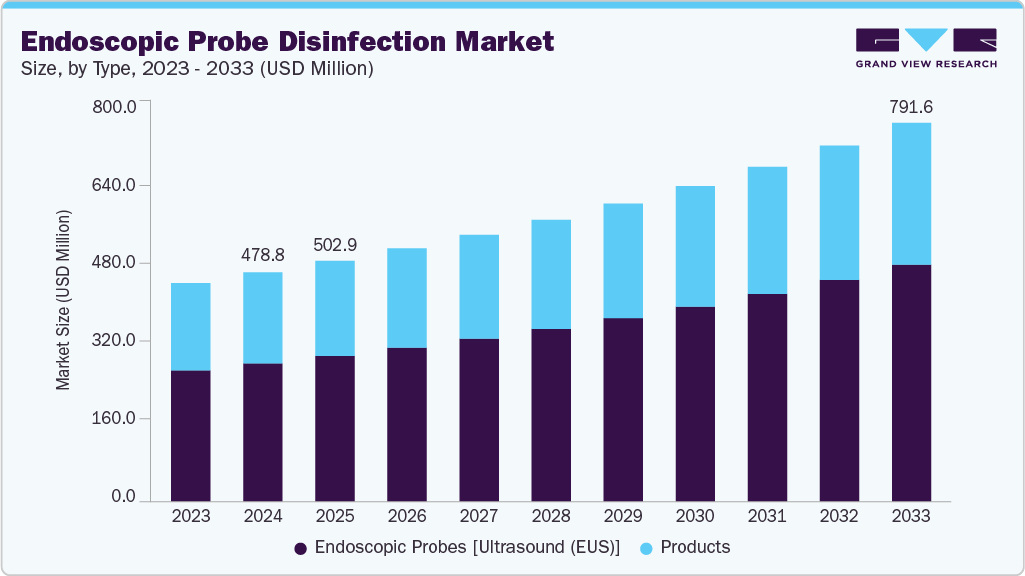

The global endoscopic probe disinfection market size was estimated at USD 478.78 million in 2024 and is projected to reach USD 791.62 million by 2033, growing at a CAGR of 5.84% from 2025 to 2033. Rising burden of healthcare-associated infections (HAIs) is anticipated to significantly contribute to the growth of the endoscopic probe disinfection market.

Key Market Trends & Insights

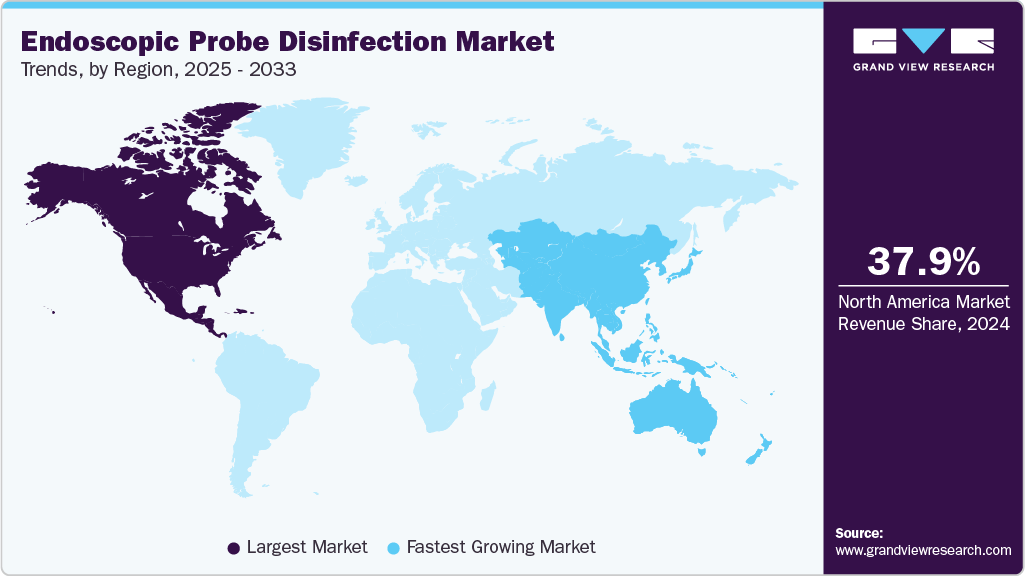

- The North America endoscopic probe disinfection market dominated the global market in 2024, accounting for the largest revenue share of 37.91%.

- The endoscopic probe disinfection market in the U.S. held the largest share, 81.66%, in 2024.

- In terms of type, the Endoscopic Probes [Ultrasound (EUS)] segment held the largest revenue share in 2024.

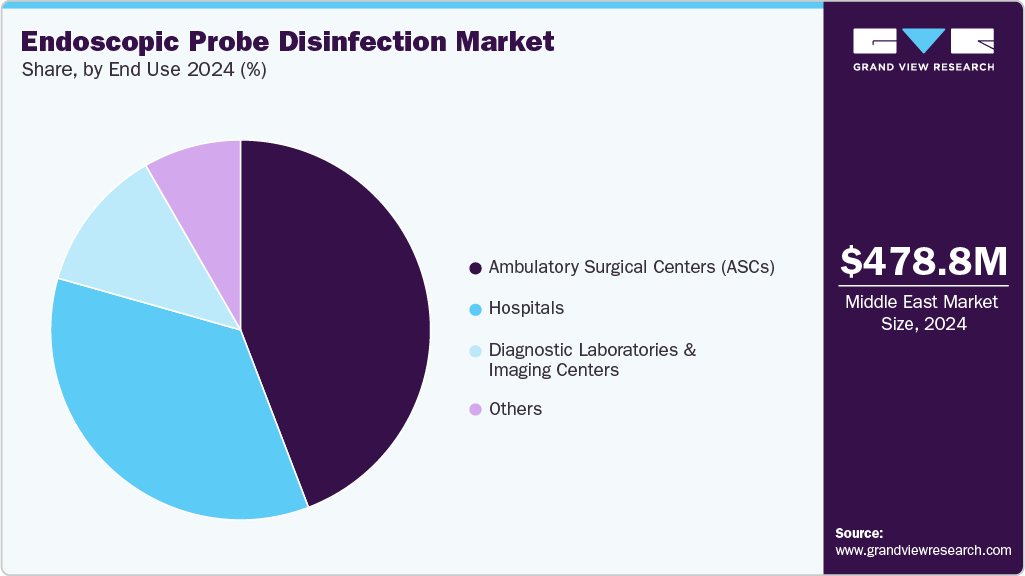

- In terms of the end use, the ambulatory surgical centers (ASCs) segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 478.78 Million

- 2033 Projected Market Size: USD 791.62 Million

- CAGR (2025-2033): 5.84%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

According to data released by the European Centre for Disease Prevention and Control (ECDC), in May 2024, it was reported that around 4.3 million hospitalized patients in the EU and European Economic Area experience healthcare-associated infections (HAIs) each year. These figures highlight the persistent challenge of infection transmission within clinical environments, where reusable medical instruments, such as endoscopes, play a critical role. This has intensified regulatory pressure on healthcare facilities to adopt more advanced, validated disinfection and sterilization practices. Subsequently, the rising burden of HAIs directly strengthens demand for reliable endoscopic probe disinfection technologies, positioning them as key tools in safeguarding patient safety and reducing hospital infection rates.

The increasing global burden of cancer and related mortality is significantly influencing the demand for advanced diagnostic and treatment modalities, including endoscopic procedures. According to the American Cancer Society article published in January 2025, the U.S. will face about 2.04 million new cancer diagnoses along with more than 618,000 related deaths in 2025, reflecting the growing burden of the disease. This rising incidence is expected to fuel the use of endoscopic procedures, which remain key to the early detection, staging, and monitoring of various cancers, particularly colorectal and gastrointestinal types. With higher procedural volumes, effective reprocessing endoscopic probes becomes even more key to minimizing infection risks and ensuring safe patient care. As a result, the anticipated increase in cancer cases directly boosts the demand for advanced endoscopic probe disinfection technologies, aligning them as essential in maintaining safety and efficiency within expanding oncology diagnostic services.

Cervical Cancer in the U.S. (2025)

Metric

Value (2025 Estimate)

Annual new cases (invasive)

13,360

Annual deaths

Approximately 4,320

Median age at diagnosis

~ 50 years

Incidence proportion of total cancers

~ 0.7%

Age-adjusted incidence rate (women)

~ 7.7 per 100,000 women/year

Source: U.S. Department of Health and Human Services & GVR

The increasing number of healthcare centers, including hospitals, oncology specialty clinics, and diagnostic centers, significantly drives the demand for endoscope probe disinfection solutions. While endoscopic procedures grow globally, reliable, efficient, and compliant reprocessing workflows are required to prevent cross-contamination and healthcare-associated infections (HAIs). With the rise in hospital infrastructure across various regions such as the U.S., UK, Italy, Spain, China, India, Brazil, South Africa, and the UAE, the procedures using both flexible and rigid endoscopes are increasing. According to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, Canada had 1,300 hospitals in 2021, and the European Union hosts around 15,000 hospitals. As of August 2023, the UK had 1,148 hospitals. This expanding hospital network necessitates a significant increase in disinfection and reprocessing devices.

Government authorities' growing number of regulations and guidelines regarding the disinfection of ultrasound probes is expected to create significant opportunities for market players to develop innovative disinfection products that align with these standards. For instance, in April 2024, the Association for the Advancement of Medical Instrumentation (AAMI) released a recommendation document that outlines sterile processing procedures for ultrasound probes in healthcare settings. This document provides essential guidelines for their disinfection. The increased availability of such documents from governmental and non-profit organizations is expected to boost market growth over the forecast period, offering critical information for effective probe disinfection.

Furthermore, regulatory bodies such as the FDA (Food and Drug Administration) and CDC (Centers for Disease Control and Prevention) have established strict guidelines and standards for endoscopic probe disinfection to minimize the risk of patient infections linked to inadequate reprocessing. Compliance with these protocols has become a major driver for adopting advanced disinfection technologies. In January 2025, Olympus issued a safety advisory concerning its reusable MAJ-891 Forceps/Irrigation Plug, warning that incomplete or improper cleaning of the probe channel could result in contamination. The advisory highlighted that one patient death had been linked to lapses in disinfection practices and urged healthcare providers to either transition to validated alternative accessories or rigorously follow enhanced disassembly and probe disinfection procedures to ensure patient safety. This instance emphasizes the increasing regulatory scrutiny over endoscopic probe disinfection and reinforces the market’s movement toward safer, more reliable, fail-safe reprocessing solutions.

Market Concentration & Characteristics

The endoscopic probe disinfection market has witnessed notable innovation in recent years, primarily driven by the need to enhance patient safety and address infection control challenges. Traditional manual cleaning methods are being replaced with automated probe disinfection systems that ensure standardized and reproducible outcomes. Newer technologies integrate low-temperature sterilization, UV-C irradiation, and advanced chemical disinfectants to achieve high-level disinfection while preserving probe integrity. In addition, smart disinfection units are being developed with digital tracking, cycle validation, and IoT connectivity, enabling hospitals to monitor compliance in real time and reduce the risk of cross-contamination.

The endoscopic probe disinfection market is witnessing significant M&A activity as key players aim to strengthen their positions in infection prevention and endoscope reprocessing solutions. In July 2023, Capsa Healthcare completed the acquisition of MASS Medical Storage, a company recognized for its expertise in advanced medical storage solutions and endoscope cabinet drying systems. This strategic move enabled Capsa to broaden its product portfolio while strengthening its global position as a leading provider of workflow solutions for hospitals, clinics, and surgical centers. With this acquisition, Capsa gained access to MASS Medical’s well-regarded range of products, including medical carts, storage cabinets, and specialized closed units designed to support infection control in healthcare settings.

Regulatory standards are vital in endoscopic probe disinfection to ensure patient safety and device effectiveness. Due to their complex design and direct contact with patients, probes require strict protocols for cleaning, high-level disinfection, drying, and traceability. Guidelines from agencies such as the FDA, CDC, and ISO drive the adoption of automated reprocessing systems and advanced storage solutions to maintain compliance and reduce infection risks.

Product substitutes refer to single-use or disposable probes that eliminate the need for complex cleaning and disinfection procedures. These alternatives reduce the risk of cross-contamination and simplify workflow for healthcare providers. However, their higher cost and environmental concerns may limit widespread adoption compared to traditional reprocessing methods.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and product portfolio. Key players are widening their footprint to meet infection-prevention demand, especially probe high-level disinfection. In 2024, Tristel’s entry into the U.S. following FDA clearance of its Tristel ULT high-level disinfectant for endocavity ultrasound probes, the company reported its first U.S. sales and active North American roll-out in FY2024, marking a significant geographic expansion in probe disinfection.

Type Insights

By type, the endoscopic probes [Ultrasound (EUS)] segment dominated the endoscopic probe disinfection market in 2024 and accounted for the largest revenue share of 60.29%. Endoscopic ultrasound (EUS) probes are semi‑critical medical devices that combine endoscopic access with high-frequency ultrasound imaging to evaluate internal structures adjacent to the gastrointestinal tract, such as lymph nodes, pancreas, and liver. Recent developments signal a transition toward automated and UV‑based disinfection systems for enhanced consistency and safety. ANSI/AAMI ST91:2021 and emerging TIR99 guidance discourage manual soak-based HLD due to variability and staff exposure risks, favoring validated automated reprocessing platforms. Moreover, in September 2024, Germitec’s Chronos UV‑C high-level disinfection chamber became the first FDA-cleared, enabling rapid (~90-second), chemical-free HLD with documented efficacy against bacteria, viruses (including HPV), mycobacteria, and spores. The automated monitoring, traceability features, and elimination of toxic chemicals significantly advance safe, efficient EUS probe reprocessing.

The products segment in the endoscopic probe disinfection market is anticipated to witness the fastest CAGR over the forecast period. The segment, which includes instruments and consumables, is crucial in ensuring the effectiveness of medical device reprocessing and infection control. Companies such as Ecolab and STERIS are prominent players in this segment, offering various solutions to streamline the cleaning, disinfection, and sterilization processes. Through its Anios brand, Ecolab provides a wide range of detergents and disinfectants to clean medical devices effectively. For example, Aniosgel 85 NPC is an alcohol-based gel for hygienic and surgical hand disinfection, ensuring medical professionals maintain high hygiene standards. Similarly, STERIS offers Revital-Ox enzymatic detergents, designed specifically for cleaning flexible and rigid endoscopes, with biodegradable ingredients that provide superior cleaning power while being gentle on sensitive instruments.

End Use Insights

Ambulatory Surgical Centers (ASCs) facilities segment dominated the endoscopic probe disinfection market in 2024 with a revenue share of 44.18%. Outpatient settings, including ASCs, are experiencing an increasing demand for outpatient procedures and an emphasis on minimally invasive surgeries. ASCs typically handle a high volume of endoscopic procedures, such as colonoscopy, gastroscopy, and bronchoscopy, where the risk of infection is a primary concern. This drives the need for efficient and reliable endoscope probe disinfection systems, including high-level disinfectants, and drying/storage units to ensure proper cleaning, disinfection, and safe transport of endoscopes.

Top 5 U.S. States by Number of Ambulatory Surgical Centers (ASCs) in 2024

Sr.

State

Number of ASCs

1

California

894

2

Florida

509

3

Texas

488

4

Georgia

419

5

Maryland

348

The hospitals segment of the endoscopic probe disinfection market is anticipated to register a significant growth rate over the forecast period. This growth is driven by the increasing volume of endoscopic and ultrasound procedures performed in hospital settings, where strict infection control measures are essential. Hospitals continue to prioritize patient safety and regulatory compliance, leading to higher adoption of advanced disinfection technologies. Additionally, the rising burden of hospital-acquired infections encourages healthcare facilities to invest in automated and standardized probe reprocessing solutions, further supporting segment growth.

Regional Insights

North America dominated the endoscopic probe disinfection market in 2024 and accounted for the largest revenue share of 37.91% owing to a well-established healthcare infrastructure and high healthcare expenditure. Additionally, regulatory support drives the adoption of novel technologies in endoscopic probe disinfection. In a significant move to enhance reprocessing standards, for instance, in March 2025, North American regulatory authorities approved the CORIS System. This novel technology is the first fully automated cleaner specifically designed to target internal channels of flexible endoscopes. This area is notoriously difficult to clean and prone to harboring biofilm. The CORIS System addresses a significant limitation in traditional reprocessing by improving the mechanical cleaning step before high-level disinfection, thus enhancing the overall efficacy of the process.

U.S. Endoscopic Probe Disinfection Market Trends

The endoscopic probe disinfection market in the U.S. held the largest share, 81.66%, in 2024. The growing incidence of stomach cancer in the U.S., particularly among older adults, is contributing to the rising demand for upper gastrointestinal endoscopic procedures. These procedures rely on flexible endoscopes that require thorough reprocessing and disinfection to ensure patient safety. According to an article published by the American Cancer Society, Inc. in January 2025, data show that stomach cancer is most commonly diagnosed around the age of 68, with nearly 60% of cases occurring in individuals aged 65 and older. This demographic trend aligns with the broader aging population in the U.S., which continues to drive the volume of diagnostic endoscopic interventions.

Canada endoscopic probe disinfection market is anticipated to register the fastest growth rate during the forecast period. The increasing demand for endoscopic procedures is being influenced by the rising incidence of stomach cancer, which drives the growth of the market. According to the Canadian Cancer Society article published in May 2024, approximately 4,000 new cases of the disease were diagnosed in 2024, and the need for accurate diagnostic and treatment interventions through endoscopy is growing. This trend fuels demand for endoscopic probe disinfection solutions, as healthcare facilities must ensure strict infection prevention standards when performing higher volumes of procedures. The emphasis on patient safety and compliance with infection control protocols will drive greater adoption of advanced probe disinfection technologies across Canadian hospitals and clinics.

Europe Endoscopic Probe Disinfection Market Trends

Europe endoscopic probe disinfection market is anticipated to register the significant growth rate during the forecast period. Rising product approval and launches in the region is accelerating the market growth. In June 2023, under the HOYA Group, PENTAX Medical Europe launched an innovative brushless automated system designed for pre-cleaning endoscopes. The solution, named AquaTYPHOON, aims to enhance cleaning efficiency while reducing manual handling in the reprocessing workflow.

Germany endoscopic probe disinfection market is anticipated to register a considerable growth rate during the forecast period. Increasing rectal cancer incidence in Germany drives the growth of the market. According to an onkopedia article published in February 2025, in Germany, nearly 20,000 new cases of rectal cancer are reported annually, with approximately 12,000 men and 7,000 women affected each year. These figures account for about 4.3% of all malignant tumors in men and 3.0% in women, underscoring the significant burden of this disease across the country. These aspects drive the growth of the market.

UK endoscopic probe disinfection market is anticipated to register a considerable growth rate during the forecast period. The growing number of cancer cases in the UK is expected to influence demand within the endoscopic probe disinfection market significantly. According to the Macmillan Cancer Support article published in 2022, around 3 million individuals are living with cancer in the country, a figure projected to rise to 3.5 million by 2025, 4 million by 2030, and approximately 5.3 million by 2040. This rising prevalence directly correlates with increased diagnostic and treatment procedures, including endoscopic examinations for cancer detection, staging, and monitoring.

Spain endoscopic probe disinfection market is anticipated to register a significant growth rate during the forecast period. Increasing colorectal cancer cases in Spain drive the growth of the market. According to the Spanish Network of Cancer Registries article published in March 2025, an estimated 44,500 new cases are projected in 2025. The disease shows a higher prevalence among men, with a ratio of three male cases for every two in women. Despite a stable incidence trend, colorectal cancer continues to be the second leading cause of cancer-related deaths in the country, accounting for over 15,000 fatalities in 2022, approximately 13.7% of all cancer deaths. This significant burden highlights the vital role of early detection and intervention through endoscopic procedures. These aspects drive the growth of the market.

Asia Pacific Endoscopic Probe Disinfection Market Trends

Asia Pacific endoscopic probe disinfection market is projected to experience the fastest growth during the forecast period, supported by advancements in healthcare infrastructure, comparatively flexible regulatory policies, and increasing foreign investments driven by economic progress. Leading companies are actively implementing strategies to strengthen their presence in the region. In addition, market expansion is fueled by supportive initiatives from private stakeholders, including training programs for medical professionals and greater R&D spending focused on developing advanced endoscopic technologies.

Japan endoscopic probe disinfection market is anticipated to register a significant growth rate during the forecast period. The rising cases of chronic illnesses and ongoing innovations in endoscopic technology are expected to boost the demand for endoscopy procedures and support market expansion. For instance, in July 2024, Olympus revealed plans to transition from being primarily an endoscope producer to positioning itself as a diagnostic platform provider. The company intends to integrate AI to enhance clinical decision-making. It will launch a European pilot project to test a cloud-based system that links hospital endoscopes with its digital software platform.

China endoscopic probe disinfection market is anticipated to register a significant growth rate during the forecast period. Growing partnerships among industry players aimed at advancing endoscopic technologies are significantly driving market expansion. For instance, in July 2023, HOYA Group and PENTAX Medical established a new facility in Shanghai, China. This center is dedicated to manufacturing, research, and development, providing service support for endoscopes in the region. Operating under PENTAX Medical Shanghai Co., Ltd., the facility is designed to deliver endoscopic solutions specifically adapted to meet the needs of the Chinese market.

India endoscopic probe disinfection market is anticipated to register a significant growth rate during the forecast period. The emerging scope of medical tourism in India has transformed the country’s healthcare system. Furthermore, increasing strategic initiatives that key market players adopt are fostering market growth. In July 2024, FUJIFILM India expanded its service network by inaugurating its second-largest service center in Mumbai. This new center focuses on expediting the repair of its bronchoscopes, high-end processors, and gastroscopes, leading to faster turnaround times & better service throughout India.

Latin America Endoscopic Probe Disinfection Market Trends

Latin America endoscopic probe disinfection market is anticipated to witness steady growth over the forecast period, supported by the rising adoption of minimally invasive procedures and the growing recognition of endoscopy as a vital tool for diagnostic and therapeutic purposes. This trend creates a stronger demand for reliable and efficient reprocessing solutions to ensure patient safety and infection control throughout the region.

Brazil endoscopic probe disinfection market is growing over the forecast period. Brazil, the largest economy in Latin America, holds significant growth opportunities for the endoscopic probe disinfection market. The expanding elderly population, coupled with a rising burden of chronic conditions such as gastrointestinal disorders, cardiac valve diseases, sinus issues, and gynecological problems, is fueling the need for advanced reprocessing systems. According to the Brazilian National Cancer Institute (INCA), the country could see around 704,000 new cancer cases between 2023 and 2025, further highlighting the increasing reliance on endoscopic procedures for both diagnostic and therapeutic care.

Middle East & Africa Endoscopic Probe Disinfection Market Trends

MEA endoscopic probe disinfection market is projected to expand steadily over the forecast period. The region presents economic diversity, with GCC nations standing out due to their strong per capita incomes and advanced healthcare infrastructure. In addition, supportive government measures to broaden reimbursement policies are anticipated to accelerate market adoption further in the forecast period.

Saudi Arabia endoscopic probe disinfection market is growing over the forecast period. In recent years, there has been a significant focus on developing and expanding endoscopy services in Saudi Arabia. Hospitals and healthcare providers in the country actively invest in endoscopy equipment and facilities, leading to an increased demand for endoscopes. For instance, in April 2025, Al-Dawadmi Hospital, part of Saudi Arabia’s Third Health Cluster, inaugurated a new Outpatient Clinics and Endoscopy Department, reinforcing regional capacity for diagnostic and therapeutic endoscopy procedures. This development illustrates growing investment in endoscopic services, supporting a corresponding increase in demand for endoscopic probe disinfection solutions to ensure efficient patient care and maintain safety standards.

Key Endoscopic Probe Disinfection Company Insights

Key participants in the endoscopic probe disinfection market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Endoscopic Probe Disinfection Companies:

The following are the leading companies in the endoscopic probe disinfection market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- STERIS plc

- GE Healthcare

- Philips Healthcare

- Chison Medical Imaging

- CS Medical LLC

- CIVCO Medical Solutions

- Tristel Plc

- Germitec

- Nanosonics

Recent Developments

-

In March 2025, the FDA has cleared the CORIS system by Nanosonics, designed to clean the complex inner channels of flexible endoscopes-key sources of hospital-acquired infections. The automated device targets biofilm buildup inside narrow endoscope channels, which manual brushing often misses. These residues, formed from patient cells, can develop resistance to high-level disinfection over multiple cleaning cycles.

-

In January 2025, SCOPE-Flush from Amity Ltd. is a hands-free, automated flushing system that replaces manual syringe flushing. It delivers a combination of detergent, water, and air to endoscope channels and is compatible with all flexible endoscopes. This innovation ensures more consistent cleaning, reduces manual handling errors, and bolsters compliance with disinfection standards.

-

In November 2024, Nanosonics, Inc., a recognized global infection prevention technology provider, introduced a new reusable accessory for the U.S. and Canadian markets, the Trophon Wireless Ultrasound Probe Holder. Developed in response to the growing adoption of wireless ultrasound devices, this accessory is designed to help healthcare facilities maintain high-level disinfection (HLD) standards.

Endoscope Probe Disinfection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 502.88 million

Revenue forecast in 2033

USD 791.62 million

Growth rate

CAGR of 5.84% from 2025 to 2033

Actual data

2021 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue & Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; STERIS plc; GE Healthcare; Philips Healthcare; Chison Medical Imaging; CS Medical LLC; CIVCO Medical Solutions; Tristel Plc; Germitec; Nanosonics

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Probe Disinfection Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and analyzes industry trends in each sub-segment from 2021 to 2033. For this study, Grand View Research, Inc. has segmented the global endoscopic probe disinfection market report based on type, end use, and region:

-

Type Outlook (Revenue USD Million, 2021 - 2033)

-

Endoscopic Probes [Ultrasound (EUS)]

-

Convex Probes

-

Linear Probes

-

Transesophageal (TEE) Probes

-

-

Products

-

Instruments

-

Consumables

-

-

-

End Use Outlook (Revenue USD Million, 2021 - 2033)

-

Hospitals

-

Ambulatory Surgical Centers (ASCs)

-

Diagnostic Laboratories and Imaging Centers

-

Others

-

-

Regional Outlook (Revenue USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic probe disinfection market size was estimated at USD 478.78 million in 2024 and is expected to reach USD 502.88 million in 2025.

b. The global endoscopic probe disinfection market is expected to grow at a compound annual growth rate of 5.84% from 2025 to 2033 to reach USD 791.62 million by 2033.

b. North America dominated the endoscopic probe disinfection market with a share of 37.91% in 2024, owing to a well-established healthcare infrastructure and high healthcare expenditure. Additionally, regulatory support drives the adoption of novel technologies in endoscopic probe disinfection.

b. Some key players operating in the endoscopic probe disinfection market include Olympus Corporation, STERIS plc, GE Healthcare, Philips Healthcare, Chison Medical Imaging, CS Medical LLC, CIVCO Medical Solutions, Tristel Plc, Germitec, and Nanosonics.

b. The increasing global burden of cancer and related mortality is significantly influencing the demand for advanced diagnostic and treatment modalities, including endoscopic procedures. According to the American Cancer Society article published in January 2025 , the U.S. will face about 2.04 million new cancer diagnoses along with more than 618,000 related deaths in 2025, reflecting the growing burden of the disease.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.