- Home

- »

- Medical Devices

- »

-

Endoscopic Submucosal Dissection Market Size Report, 2030GVR Report cover

![Endoscopic Submucosal Dissection Market Size, Share & Trends Report]()

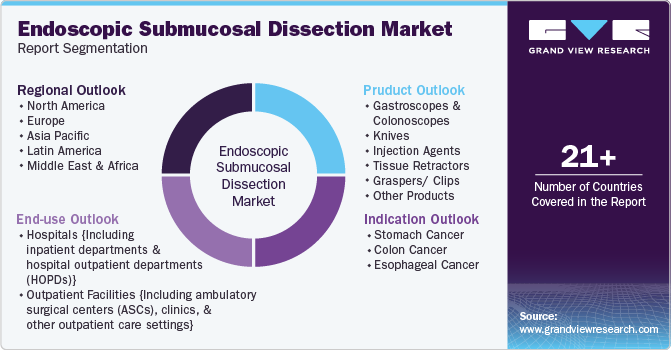

Endoscopic Submucosal Dissection Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Gastroscopes & Colonoscopes, Knives), By Indication (Stomach Cancer, Colon Cancer, Esophageal Cancer), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-352-2

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopic Submucosal Dissection Market Summary

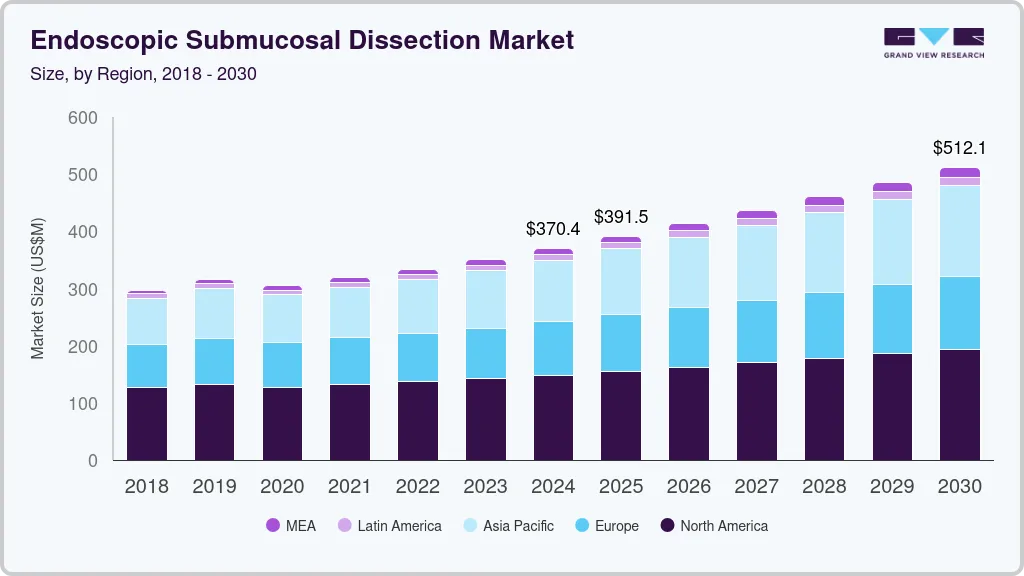

The global endoscopic submucosal dissection market size was estimated at USD 370.4 million in 2024 and is projected to reach USD 512.0 million by 2030, growing at a CAGR of 5.5% from 2025 to 2030. The increasing prevalence of gastrointestinal cancers and other related disorders and advancements in endoscopic technology & instrumentation drive the demand for diagnostic and therapeutic procedures such as ESD.

Key Market Trends & Insights

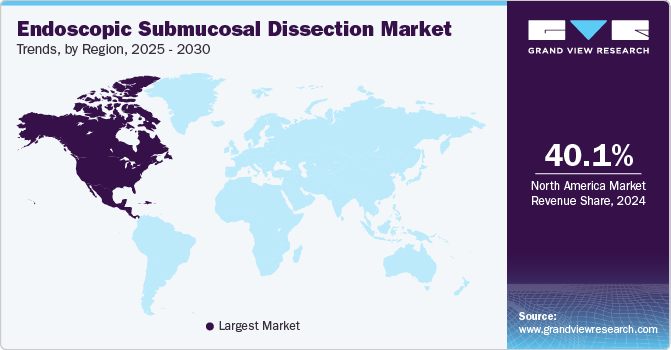

- North America endoscopic submucosal dissection market dominated the global industry with a revenue share of 40.1% in 2024.

- The endoscopic submucosal dissection market in the U.S. held the largest share

- By product, the knives segment held the largest market share of 32.0% in 2024.

- By indication, the stomach cancer segment held the largest market share of 48.2% share in 2024.

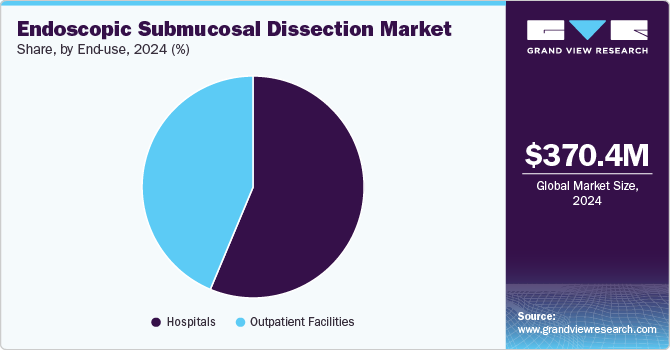

- By end use, the hospitals segment held the largest market share of 56.3% in 2024

Market Size & Forecast

- 2024 Market Size: USD 370.4 Million

- 2030 Projected Market Size: USD 512.0 Million

- CAGR (2025-2030): 5.5%

- North America: Largest market in 2024

For instance, the American Cancer Society estimates that in 2024, there will be 26,890 new cases of stomach cancer, with 10,730 cases in women and 16,160 cases in men. As esophageal, gastric, and colorectal cancer rates continue to rise globally, the need for advanced procedures, such as ESD, is increasing.Furthermore, the aging population worldwide is boosting the demand for ESD. As the global population ages, age-related gastrointestinal conditions, including cancers, are expected to rise. According to the American Cancer Society, gastric cancer predominantly affects older individuals, with an average age of 68 when diagnosed, and 6 out of 10 diagnosed annually are 65 or older. Many older patients also have other health conditions, which make traditional surgery riskier, further contributing to the rising demand for ESD procedures.

The development of high-definition endoscopes, improved electrosurgical knives, and enhanced imaging techniques have significantly increased the precision and safety of ESD procedures. These technological innovations have improved the efficacy of the treatment and expanded the indications for ESD, allowing it to be used for a broader range of lesions. Moreover, integrating artificial intelligence and machine learning in endoscopic procedures enhances diagnostic accuracy and procedural outcomes, further propelling market growth. For instance, in September 2024, Odin Medical Ltd. (Olympus Corporation company) obtained U.S. FDA 510(k) clearance for its CADDIE computer-aided detection (CADe). It is a cloud-based AI technology developed to help gastroenterologists to detect colorectal polyps during colonoscopy procedures.

The growing awareness and training programs for healthcare professionals in ESD techniques contribute to market growth. The proficiency of gastroenterologists and surgeons in ESD has been increasing, enhancing both the reach and feasibility of this advanced procedure, particularly in areas that previously had limited access to such treatments. Various medical organizations offer specialized training and certification programs, which are important in gaining knowledge and expertise in ESD. For instance, in April 2024, FUJIFILM Healthcare Europe GmbH introduced EndoGel, an innovative training model designed for performing Peroral Endoscopic Myotomy (POEM) and Endoscopic Submucosal Dissection (ESD) procedures. This simulator is available in two versions such as EndoGel for ESD/POEM and EndoGel for ESD. It is designed to be cost-effective for endoscopy professionals and healthcare institutions, aiming to enhance proficiency and patient outcomes through realistic simulation training.

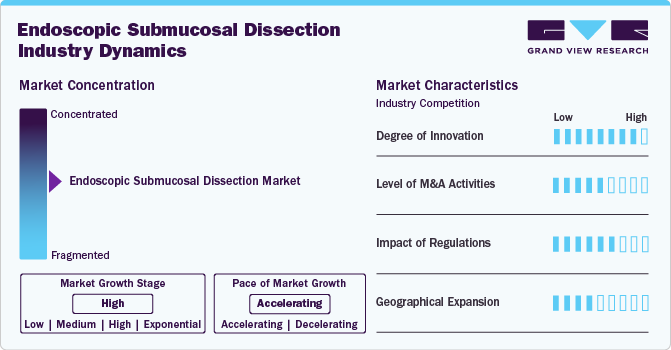

Market Concentration & Characteristics

The ESD industry is characterized by a high degree of innovation, owing to rising investments and growing research activities to advance research in the endoscopy field. Moreover, the application of artificial intelligence (AI) in many gastroenterology fields is becoming more widespread, especially in endoscopic image processing. These significant technological advancements are anticipated to bolster market growth.

The ESD industry is characterized by medium merger and acquisition activity. For instance, in June 2021, STERIS plc acquired Cantel Medical, a provider of infection prevention services and products to life sciences, dental, endoscopy, & dialysis customers.

Endoscopic instruments must meet strict regulatory requirements to ensure high quality, safety, and effectiveness standards, positively impacting market growth. For instance, In the U.S., the FDA regulates the endoscopic instruments used in ESD, including the endoscope, knives, and injectors.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Increased funding opens up more opportunities for market participants to expand into new regions. For instance, in November 2021, Richard Wolf GmbH, a MedTech company in Germany, launched several new subsidiaries across Spain (Richard Wolf Endoscopia Iberica S.L.) in Madrid and one in Deutsches Haus Ho Chi Minh City in Vietnam.

Product Insights

By product, the knives segment held the largest market share of 32.0% in 2024 and is expected to grow at the fastest CAGR during the forecast period. The market growth is attributed to their essential role in the precision and accuracy of sample preparation and handling during chromatographic procedures. Moreover, the increasing investment in research and development across various industries supports the adoption of advanced chromatographic tools, including knives. As laboratories seek to enhance their analytical capabilities and efficiency, the demand for high-performance knives continues to rise. For instance, in August 2023, Erbe Elektromedizin launched the HYBRIDknife flex, a CE-marked instrument designed for colorectal endoscopic submucosal dissection.

The gastroscopes and colonoscopes segment is expected to grow at a significant CAGR during the forecast period. Technological advancements have significantly impacted the field of endoscopic devices, driving innovation and enhancing patient care. For instance, in January 2024, Docrates Cancer Center, a private cancer clinic in Helsinki, strengthened its early cancer detection and diagnostics service package by introducing stomach, esophagus, and colon endoscopy services at its own premises. Moreover, several industry players in the market are increasingly funding the development of new products and continuously improving existing products.

Indication Insights

The stomach cancer segment held the largest market share of 48.2% share in 2024. The growing prevalence of stomach cancer and the rising awareness and early detection of conditions globally have necessitated the development and adoption of advanced treatment techniques such as ESD, which allows for the precise removal of cancerous lesions from the stomach lining with minimal invasiveness. For instance, Guts UK Charity, a non-profit organization in the UK that works to treat digestive diseases, reported that around 6,700 individuals (approximately one individual in every 10,000 people) in the UK are diagnosed with stomach cancer annually.

The colon cancer segment is expected to grow at the fastest CAGR during the forecast period. The incidence of colon cancer is increasing globally, mainly due to factors such as aging populations, lifestyle changes, and dietary habits such as high consumption of processed meats, obesity, smoking, and excessive alcohol intake. For instance, colorectal cancer is projected to be the fourth most frequently diagnosed cancer in Australia in 2024. In 2024, there is an estimated risk that 1 in 21 people are expected to be diagnosed with colorectal cancer by the time they are 85 (1 in 23 for females and 1 in 19 for males).

End Use Insights

By end use, the hospitals segment held the largest market share of 56.3% in 2024 and is expected to grow at the fastest CAGR during the forecast period. Hospitals generally have the advanced infrastructure and cutting-edge medical equipment necessary for complex procedures such as ESD. This encompasses high-definition endoscopic systems, advanced imaging techniques, and specialized surgical instruments, all of which are necessary to ensure ESD's accuracy and effectiveness. They provide extensive healthcare services, access to advanced technologies, collaborative care teams from various disciplines, inpatient monitoring facilities, multidisciplinary care teams, and a supportive environment for research and innovation. This enables them to deliver high-quality, specialized care that enhances patient outcomes and contributes to segment growth.

The outpatient facilities segment is expected to grow at the fastest CAGR during the forecast period, owing to the increasing demand for outpatient procedures and patient preference for less invasive treatments. Outpatient facilities align with the growing preference for patient-centric care models, prioritizing convenience and minimizing daily life disruption. Patients prefer outpatient procedures because they typically involve shorter waiting times, reduced hospital stays, and lower costs than inpatient care.

Regional Insights

North America endoscopic submucosal dissection market dominated the global industry with a revenue share of 40.1% in 2024 owing to the advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation. The region benefits from a large patient pool with a high prevalence of gastrointestinal disorders and cancers, which necessitates advanced diagnostic and therapeutic procedures. Moreover, collaborations between healthcare providers, research institutions, and industry players promote continuous advancements in surgical techniques. For instance, in February 2022, Medtronic collaborated with the American Society for Gastrointestinal Endoscopy (ASGE) to offer AI-powered colonoscopy technology for colorectal cancer screening in underserved communities of the U.S.

U.S. Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection market in the U.S. held the largest share owing to the rising prevalence of gastrointestinal cancers, such as stomach and colorectal cancers, which increases the demand for ESD. Moreover, an advanced healthcare infrastructure, high investments by market players and hospitals promoting the use of novel endoscopy equipment, and favorable reimbursement policies for various endoscopic procedures are among the factors expected to drive market growth in the U.S.

Europe Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection market in Europe is anticipated to register considerable growth during the forecast period. Rapid technological advancements, leading to the development of new and innovative endoscopic devices and accessories, are fueling the market. In addition, the rising preference for minimally invasive surgeries fuels market growth.

The UK endoscopic submucosal dissection market is anticipated to register considerable growth during the forecast period. The increasing number of patients suffering from chronic diseases that require minimally invasive surgical procedures for diagnosis & treatment is contributing to market growth in the country. Key players are undertaking various initiatives to strengthen their market presence. For instance, in July 2023, Penlon Limited launched a new endoscopic accessories division in the UK, partnering with Vedkang Medical to provide clinicians with high-quality products for Endoscopic Submucosal Dissection (ESD), Endoscopic Mucosal Resection (EMR), and Gastrointestinal (GI) tract endoscopic treatments.

Asia Pacific Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection market in Asia Pacific is anticipated to witness the fastest growth over the forecast period, owing to rising healthcare expenditures, a less stringent regulatory framework, and economic development that attracts foreign investments. Moreover, changes in lifestyle and demographics and a growing geriatric population suffering from chronic diseases, such as cancer and GI disorders, are factors driving the market.

The endoscopic submucosal dissection market in Thailand is anticipated to register considerable growth during the forecast period. Market growth in the country is expected to be driven by favorable initiatives undertaken by private players, such as training healthcare professionals and increasing R&D investments to develop advanced endoscopes. For instance, Olympus Corporation started the Thai Training and Education Centre in Thailand to increase awareness about surgical & Gastrointestinal (GI) endoscopes and provide training to healthcare professionals in Southeast Asia.

Latin America Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection market in Latin America is anticipated to witness considerable growth over the forecast period. Growing preference for minimally invasive surgeries over open surgeries and increasing awareness about the use of endoscopy for various diagnostic and therapeutic procedures are expected to drive the market. The rising disposable income, rapid technological advancements in endoscopes, and implementation of pivotal screening programs for effective cancer diagnosis are key factors promoting market growth.

Argentina endoscopic submucosal dissection market is anticipated to witness the fastest growth over the forecast period. The presence of organizations, such as the Argentine Federation of Digestive Endoscopy (FAAED) and the Argentine Society of Gastroenterology (SAGE), dedicated to generating awareness about endoscopy techniques drives market growth.

MEA Endoscopic Submucosal Dissection Market Trends

The endoscopic submucosal dissection market in the Middle East & Africa is anticipated to witness considerable growth over the forecast period. The increase in the geriatric population & the prevalence of cancer and the growing demand for early disease diagnosis are key factors boosting the market. Government initiatives to increase reimbursement coverage are one of the key factors expected to boost market growth during the forecast period.

South Africa endoscopic submucosal dissection market is anticipated to witness the fastest growth over the forecast period. South Africa has a well-developed healthcare sector focused on providing advanced medical services and technologies to its population. The need to deliver high-quality healthcare services, accurate diagnoses, and minimally invasive treatments is increasing the market growth in South Africa.

Key Endoscopic Submucosal Dissection Company Insights

Key participants in the endoscopic submucosal dissection market are focusing on devising innovative business growth strategies in the form of partnerships & collaborations, product portfolio expansions, mergers & acquisitions, and geographical expansions.

Key Endoscopic Submucosal Dissection Companies:

The following are the leading companies in the endoscopic submucosal dissection market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co. KG

- Micro-Tech Endoscopy

- Medtronic

- CONMED Corporation

- STERIS plc.

- Cook Group

- Creo Medical

Recent Developments

-

In April 2024, Fujifilm launched Tracmotion, an endoscopic submucosal dissection (ESD) device, at a gastroenterology event. The device, designed for single-operator use, has a 360° rotatable retraction capability, allowing precise tissue manipulation.

-

In October 2023, Olympus unveiled its latest advancement in gastrointestinal endoscopy by introducing the EVIS X1 system, accompanied by the CF-HQ1100DL/I and GIF-1100 series compatible endoscopes. This next-generation system incorporates Color Enhancement Imaging technology, enhancing image color and texture to improve lesion and polyp visibility during endoscopic screenings.

-

In January 2023, Fujifilm India introduced two innovative endoscopy solutions: the FushKnife and ClutchCutter. These innovative tools are designed for use with compatible endoscopes, enabling clinicians to perform precise incision, dissection, and coagulation during endoscopic submucosal dissection (ESD) and EMR procedures.

Endoscopic Submucosal Dissection Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 391.5 million

Revenue forecast in 2030

USD 512.0 million

Growth Rate

CAGR of 5.5% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, indication, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, Spain, Italy, France, Norway, Denmark, Sweden, Japan, China, India, Australia, Thailand, South Korea, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

Olympus Corporation, Boston Scientific Corporation, PENTAX Medical (Hoya Corporation), FUJIFILM Holdings Corporation, Karl Storz GmbH & Co. KG, Micro-Tech Endoscopy, Medtronic, CONMED Corporation, STERIS plc., Cook Group, Creo Medical

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopic Submucosal Dissection Market Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global endoscopic submucosal dissection market report on the basis of product, indication, end use, and regions.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Gastroscopes and Colonoscopes

-

Knives

-

Injection Agents

-

Tissue Retractors

-

Graspers/ Clips

-

Other Products

-

-

Indication Outlook (Revenue, USD Million, 2018 - 2030)

-

Stomach Cancer

-

Colon Cancer

-

Esophageal Cancer

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals {Including inpatient departments and hospital outpatient departments (HOPDs)}

-

Outpatient Facilities {Including ambulatory surgical centers (ASCs), clinics, and other outpatient care settings}

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopic submucosal dissection market size was estimated at USD 370.4 million in 2024 and is expected to reach USD 391.5 million in 2025.

b. The global endoscopic submucosal dissection market is expected to grow at a compound annual growth rate of 5.5% from 2025 to 2030 to reach USD 512.0 billion by 2030.

b. North America dominated the market with a revenue share of over 40.1% in 2024 owing to the advanced healthcare infrastructure, high healthcare expenditure, and a strong focus on technological innovation.

b. Some key players operating in the market include Olympus Corporation; Boston Scientific Corporation; FUJIFILM Holdings Corporation; Creo Medical; Medtronic PLC ; HOYA Corporation; KARL STORZ SE & Co. KG; CONMED Corporation; Steris PLC; Taewoong Medical; Micro-tech Endoscopy; Cook Group

b. The increasing prevalence of gastrointestinal cancers and other related disorders and advancements in endoscopic technology & instrumentation drive the demand for diagnostic and therapeutic procedures such as ESD

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.