- Home

- »

- Medical Devices

- »

-

Endoscopy Devices Market Size And Share Report, 2030GVR Report cover

![Endoscopy Devices Market Size, Share, And Trends Report]()

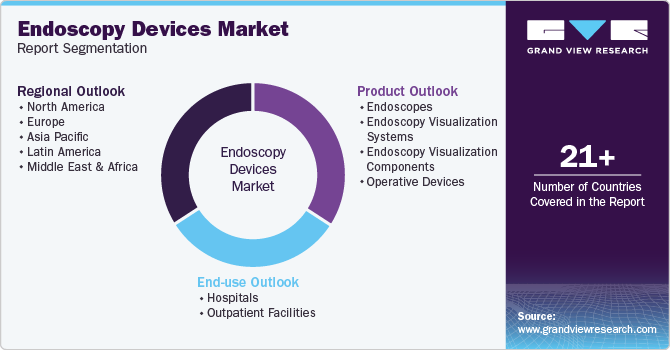

Endoscopy Devices Market (2025 - 2030) Size, Share, And Trends Analysis Report, By Product (Endoscopes, Endoscopy Visualization Systems, Endoscopy Visualization Components, Operative Devices), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-468-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopy Devices Market Summary

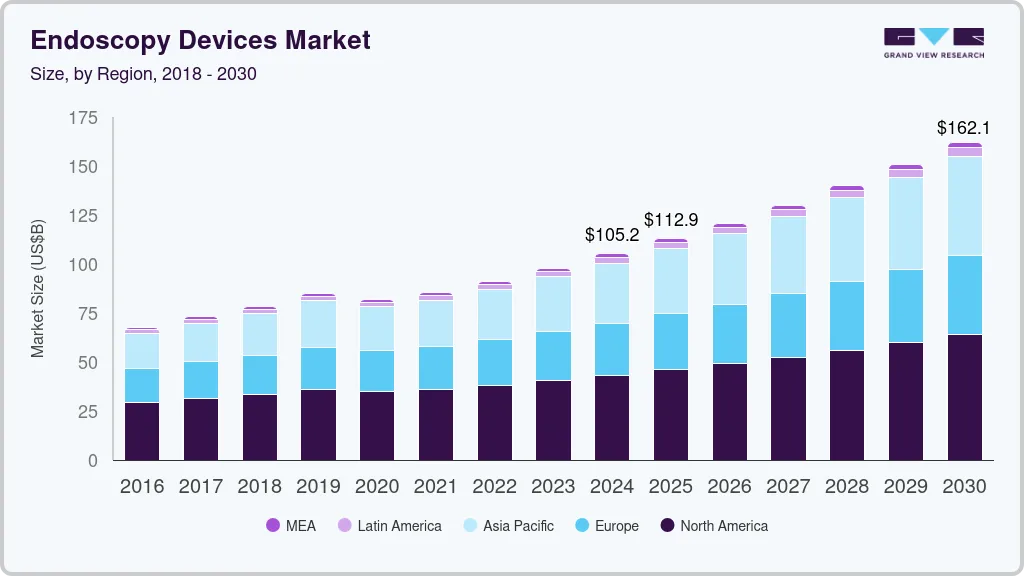

The global endoscopy devices market size was estimated at USD 61.06 billion in 2024 and is projected to reach USD 76.55 billion by 2030, growing at a CAGR of 3.79% from 2025 to 2030. The less invasive properties and affordable post and pre-procedure cost of endoscopy devices are the major factors anticipated to boost the market growth over the forecast period.

Key Market Trends & Insights

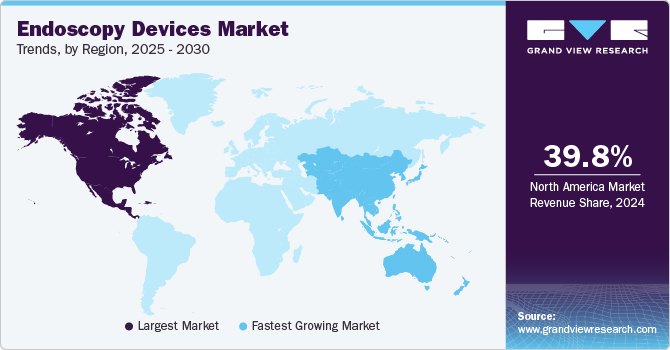

- The North America endoscopy devices market dominated the global market with a share of 39.8% in 2024.

- The endoscopy devices market in the U.S. held the largest share in 2024.

- Based on product, the endoscopes segment dominated the market with a revenue share of 41.1% in 2024.

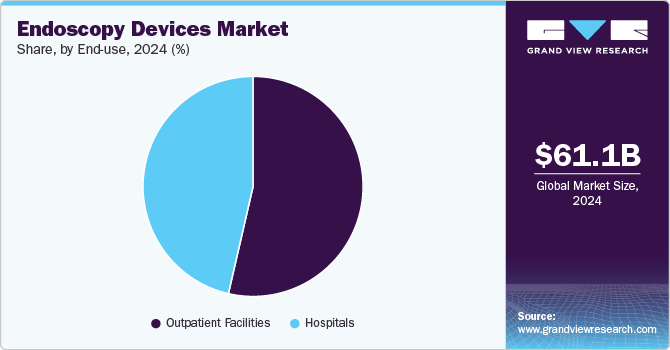

- Based on end-use, the outpatient facilities segment dominated the market with a share of 53.6% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 61.06 Billion

- 2030 Projected Market Size: USD 76.55 Billion

- CAGR (2025-2030): 3.79%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Furthermore, a shift in trend to use disposable endoscopic components to minimize the procedure cost as well as the chance of cross-contamination is also expected to accelerate market growth over the years. In addition, the growing chronic disease burden and increasing geriatric population all over the globe are also anticipated to fuel the adoption of advanced endoscopic devices such as wireless capsule endoscopy and high-definition camera & camera systems during the coming years. Moreover, growing medical conditions due to the increasing geriatric population often require endoscopic intervention such as liver abscess, gall stones, endometriosis, and intestinal perforation, which in turn anticipated to drive the market for endoscopy devices over the forecast years. For instance, as per the Administration on Aging (AoA) of the U.S. Department of Health and Human Services report, about 16% of the population were aged above 65 years during 2019. This number is expected to increase to 21.6% by 2040.

In addition, increasing preference by medical professionals to use technologically advanced endoscopy devices equipped with a high-definition camera and light sources to help physicians analyze internal organs of interest also drives the market. For example, Stryker, Olympus Corporation, Fujifilm Holdings Corporation are some of the key pioneers in high-definition camera systems. The shift of preference towards minimally invasive surgical procedures than traditional surgeries to reduce hospital stay and minimize post-procedure complications are the major factors anticipated to fuel the demand for endoscopy devices. Hence, factors such as higher patient satisfaction, increased economic viability, and lesser hospital stay are expected to increase the demand for minimally invasive endoscopic interventions in the coming years, thereby accelerating market growth.

Furthermore, the growing burden of cancer all over the world also fuels the adoption of endoscopy devices for the early diagnosis and treatment of the disease. For instance, according to the Cancer Progress Report 2023 released by the American Cancer Society, in 2023, around 2.0 million new cancer cases were diagnosed in the U.S., and 609,820 individuals succumbed to it. Projections indicate that by 2040, the number of new cancer cases could reach 2.3 million. In addition, the increasing preference for biopsies for diagnosis and detection of cancer in recent years is also likely to increase the adoption of endoscopic devices, which in turn is anticipated to drive the market for endoscopy devices over the years.

Technological advancement to develop innovative endoscopic devices is also anticipated to accelerate market growth during forecast periods. The key manufacturers are continuously looking forward to innovating advanced endoscopic solutions for better treatment and diagnosis of several chronic disorders. For instance, in August 2021, Fujifilm Holdings Corporation announced the commercial launch of the ELUXEO 7000X endoscopic Imaging System. This advanced imaging system enables real-time visualization of hemoglobin oxygen saturation (StO2) levels in tissue during laparoscopic and/or endoluminal imaging procedures.

In addition, the endoscopy devices market has been significantly impacted by the COVID-19 pandemic. The reduction and postponement of elective surgeries due to the fear of COVID-19 infection have negatively impacted the growth of the market for endoscopy devices. In addition, supply chain disruptions and changing regulations for surgical procedures are some of the factors also hampered market growth in 2020. For instance, according to an international study published in the Arab Journal of Gastroenterology, Elsevier in 2020, the endoscopic procedure volume was reduced by over 50% of the 85% of the responded countries all over the world during the COVID-19 pandemic.

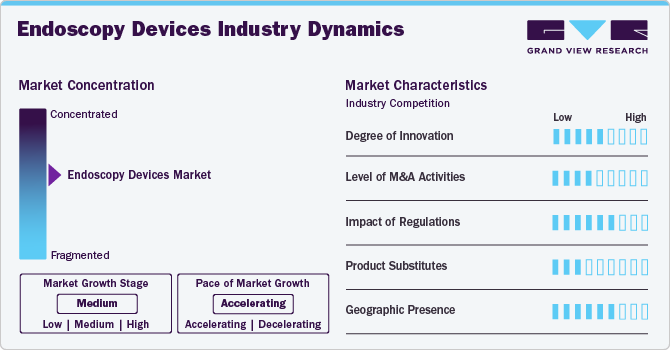

Market Concentration & Characteristics

The global endoscopy devices market is characterized by rapid innovation, with advanced technologies and methods being introduced. For instance, the application of artificial intelligence (AI) in many gastroenterology fields is becoming more widespread, especially in endoscopic image processing. These significant technological advancements are anticipated to bolster the endoscopic market growth rate.

Several key market players are devising business growth strategies in the form of mergers and acquisitions. Through M&A activity, these companies can expand their business geographies. For instance, in October 2023, Ambu announced the CE mark approval and launch of its aScope 5 Cysto HD, an HD cystoscope, combined with the Ambu aView 2 Advance, a full-HD endoscopy system.

Companies actively invest resources in clinical trials and regulatory submissions to obtain regulatory approval for novel products. This may result in increasing the cost of developing novel endoscopic technologies. For instance, the European Union (EU) has recently imposed laws and guidelines that can affect Endoscopists and patients. The new regulations raise the requirement for clinical trials and observational studies for both new and existing endoscopic device uses to assure therapeutic benefit and minimize patient damage.

A wide range of product substitutes are available, as endoscopic devices are a rapidly evolving field in healthcare. For instance, the conventional endoscope can be replaced by an innovative capsule endoscopy technology. Three technological developments have been necessary for the development of the capsule endoscope are powerful, compact camera systems that are only a few millimeters in size, wireless technology that allows camera images to be transmitted in real-time, and sensor or actuator systems that allow intuitive control of the capsule inside the body.

Several market players are expanding their business by entering new geographical regions to strengthen their market position and expand their product portfolio. Rising funding creates more opportunities for market players to enter new regions. In July 2024, FUJIFILM India expanded its service network by inaugurating its second-largest service center in Mumbai. This new center focuses on expediting the repair of its bronchoscopes, high-end processors, and gastroscopes, leading to faster turnaround times & better service throughout India.

Product Insights

The product segment comprises of endoscopes, endoscopy visualization systems, endoscopy visualization components, and operative devices. The endoscopes segment dominated the market in 2024 and accounted for the largest revenue share of 41.1% and is also anticipated to register the fastest growth rate over the forecast period. Growing awareness and rising adoption rate of endoscopes across various diagnostic and therapeutic procedures is driving the market growth of endoscopes. In addition, endoscopes aid in diagnosis of complex disease conditions such as cancer, GI disorders, urinary disorders, and lung disorders.

This high growth rate is attributed due to the increasing number of endoscopic procedures coupled with the high adoption of endoscopes to perform surgeries and biopsies for better diagnosis and treatment. The flexible endoscopes segment dominated the endoscopes segment and accounted for high revenue share in 2023, owing to its high preference of use by medical professionals and its advantages such as safety, increased efficiency, and enhanced ergonomics as compared to rigid endoscopes.

Reusable Endoscopes

Disposable Endoscopes

The demand for MISs is on the rise across the globe. These procedures are preferred due to their benefits, such as faster wound healing and reduced hospital visits, as they involve smaller incisions and fewer stitches compared to traditional open surgeries, which require longer incisions through the muscles and take longer to heal. This factor plays a significant role in driving the demand for endoscopy procedures. In addition, rigid endoscopes are highly sought after for MISs as they provide high-definition images of organs, contributing to segment growth

The disposable endoscope segment is driven by the increasing demand for single-use endoscopes to mitigate the risk of device-related infections.Factors such as patient preference for minimally invasive procedures, supportive regulatory frameworks, and favorable reimbursement policies in developed countries also contribute to market growth. Furthermore, the segment is benefiting from investments, funds, and grants from governments and organizations to improve healthcare infrastructure and advance research in the endoscopy field.

The segment’s growth is driven by the rising occurrence of chronic diseases impacting internal body systems and the superior benefits of flexible endoscopes compared to other devices. There is a growing awareness of the importance of early diagnosis in conditions such as Inflammatory Bowel Diseases (IBD), stomach & colon cancers, respiratory infections, and tumors, leading to a higher demand for flexible endoscopes for diagnostic purposes. For instance, according to the American Cancer Society, Inc., approximately 106,180 cases of colon cancer, 44,850 cases of rectal cancer, and 26,380 cases of stomach cancer were estimated to have occurred in the U.S. in 2022

Furthermore, the escalating burden of gastrointestinal disorders such as IBS and functional dyspepsia, coupled with the increasing adoption of endoscopic procedures for diagnosing these conditions, is fueling market growth. A multinational study published in the Gastroenterology journal in 2021 revealed that over 40% of individuals across the globe have functional gastrointestinal disorders, highlighting the significant burden of GI diseases. This has prompted manufacturers to introduce novel endoscope devices into the market. For instance, in February 2022, Ambu announced the U.S. FDA clearance of Ambu aScope Gastro and Ambu aBox 2, strengthening its presence in the GI space

The endoscopy visualization systems are anticipated to register lucrative growth rate over the forecast period.

Reusable Endoscopy Visualization Systems

The preference for 3D visualization systems over 2D systems for laparoscopic surgeries is mainly due to the various advantages of 3D systems, such as surgery’s short Turnaround Time (TAT), enhanced visibility, high image quality, and maneuverability. According to a comparative study published by NCBI in October 2023, the anterior skull base and endonasal surgeries done by 3D endoscope were more accurate & significantly faster, with fewer intraoperative complications than cases done using a 2D endoscope.

Furthermore, technological advancements and the integration of systems are expected to boost the market. For instance, the MonoStereo 3D system developed by Medispar NV enhances and integrates the 2D endoscope systems into 3D to offer healthcare practitioners with depth perception, which is lacking in traditional MIS surgery.

The endoscopy visualization components are anticipated to register the significant growth rate over the forecast period.

Reusable Endoscopy Visualization Components

Disposable Endoscopy Visualization Components

Technological advancements in visualization components, such as camera heads, light sources, and HD monitors, are among the key factors boosting the use of endoscopy devices in surgeries and thereby fueling market growth. Moreover, with an increase in the geriatric population and the rise in demand for minimally invasive procedures, the usage of endoscopy visualization components is expected to grow over the forecast period

Launching new products and increasing investments by market players in R&D to develop next-generation visualization systems are some of the major factors propelling the market growth over the forecast period. Moreover, key players are adopting various strategies, such as mergers & acquisitions and business integration, to increase their market share in the endoscopy devices market, which is further expected to fuel market growth. Key players include Olympus Corporation, Stryker Corporation, Fujifilm Corporation, and Karl Storz SE & Co. KG

The operative devices are anticipated to grow positively over the forecast period.

Reusable Endoscopy Visualization Components

Disposable Endoscopy Visualization Components

The growing awareness and the rising adoption rate of endoscopes across various therapeutic & diagnostic procedures are expected to propel segment growth. Another major factor expected to propel segment growth is the growing number of endoscopic procedures and the high adoption of endoscopes to perform biopsies & surgeries for better diagnosis and treatment.

Investments in endoscopic surgeries, their respective diagnostic equipment, and acquisition strategies are expected to boost the segment growth over the forecast period. For instance, in November 2022, Boston Scientific Corporation entered into a definitive agreement to acquire Apollo Endosurgery, Inc. to expand its endoluminal surgery portfolio and enhance technologies for endobariatric procedures.

End Use Insights

The outpatient facilities’ segment dominated the market in 2024 and accounted for the largest revenue share of 53.6%. The outpatient facilities are also anticipated to register the fastest growth over the forecast period. Outpatient facilities such as ambulatory surgery centers and diagnostic clinics are expected to witness lucrative growth owing to growing preference for minimally invasive procedures to lower overall cost and reduce the number of days of hospital stays are some of the major factors expected to drive the growth of the segment. In addition, faster recovery time, and minimal discomfort due to the use of less invasive keyhole endoscopic procedures also accelerates the adoption of endoscopy devices in outpatient facilities, which in turn is anticipated to propel segment growth over the forecast period.

Hospitals segment in endoscopy devices market is anticipated to register a significant growth over the forecast period. Advances in technology, including improved imaging systems and the development of more sophisticated and precise instruments, are enhancing the efficacy and safety of endoscopic procedures. In addition, the rising prevalence of chronic diseases and the aging population are contributing to a higher volume of diagnostic and therapeutic endoscopic procedures, thereby fostering segmental growth. Furthermore, increasing adoption of robotic endoscopy procedures in hospitals is driving market growth. In January 2024, the Emirates Health Services (EHS) announced the launch of a novel robotic endoscopy method to treat hiatal hernia in two hospitals. The EHS, the healthcare service regulator in the Northern Emirates, stated that this method could potentially revolutionize the treatment of patients suffering from Gastroesophageal Reflux Disease (GERD).

Regional Insights

North America Endoscopy Devices Market Trends

The North America endoscopy devices market dominated the market and accounted for the largest revenue share of 39.8% in 2024. The high prevalence of several diseases, such as Gastrointestinal (GI) disorders, respiratory conditions, urological problems, gynecological issues, and cancer, is increasing the need for endoscopic procedures for diagnosis & treatment in North America. For instance, according to a report by ResearchGate, it is projected that there will be 2.0 million new cases of cancer and 611,720 cancer-related deaths in the U.S. in 2024. Hence, the growing need for accurate and minimally invasive diagnostic tools is driving the adoption of endoscopes and endoscopy devices.

U.S. Endoscopy Devices Market Trends

The endoscopy devices market in the U.S. held the largest share in 2024. The growing preference for minimally invasive procedures across various medical specialties in the U.S., including gastroenterology, pulmonology, urology, gynecology, and otolaryngology, is driving the demand for endoscopes. Furthermore, the rising prevalence of cancer, the growing geriatric population, which is susceptible to chronic illnesses requiring endoscopic procedures, and the increasing importance of timely disease diagnosis & early interventions are driving the demand for endoscopes. According to the American Cancer Society, approximately 26,890 new cases of stomach cancer and around 10,880 stomach cancer-related deaths are expected to be reported in 2024.

Canada endoscopy devices market is anticipated to register the fastest growth during the forecast period. The surgical community in Canada recently witnessed significant advancements in endoscopy surgery, showcasing new approaches and novel procedures for treating GI tract disorders. This development is anticipated to fuel the demand for endoscopes and endoscopy devices in Canada. The increasing preference for minimally invasive surgeries for faster recovery, enhanced precision, & accuracy, and reduced post-surgery infections & complications is positively impacting market growth. For instance, endoscopic ear surgery is gaining immense traction in Canada following its UBC Behavioral Research Ethics Board approval.

Europe Endoscopy Devices Market Trends

Europe endoscopy devices market is anticipated to register considerable growth during the forecast period. Ongoing technological advancements in endoscopy and a rise in demand for minimally invasive procedures are among the factors driving the Europe endoscopes market. Favorable macro environment factors are driving key players to revise their market entry strategies through mergers & acquisitions and technological collaborations to expand their footprint. For instance, in June 2023, Pentax Medical introduced its latest products, the Inspira premium video processor and the i20c video endoscope series, in Dublin.

Germany endoscopy devices market is anticipated to register a considerable growth rate during the forecast period. The adoption of endoscopes and endoscopy devices in Germany is expected to be driven by the increasing prevalence of chronic diseases and growing awareness regarding the usage of disposable endoscopy devices. For instance, according to an NIH report, in 2022, there were 18.6 million individuals in Germany who were 65 years old and above, with 6.1 million being 80 years or older. These figures apply to European countries. According to an article published by NCBI in February 2024, 46% of the adult population reported at least one chronic health condition in Germany.

UK endoscopy devices market is anticipated to register a considerable growth rate during the forecast period. The high prevalence of cancer & chronic diseases and the growing geriatric population are expected to drive the UK endoscopes market. According to Macmillan Cancer Support, in October 2022, there were approximately 3 million patients suffering from cancer in the UK, and 5.3 million patients are expected to be diagnosed with cancer in the country by 2040. The introduction of the National Awareness and Early Diagnosis Initiative has facilitated early diagnoses of cancer, along with increased access to optimal treatment, thereby playing a vital role in driving the market.

Asia Pacific Endoscopy Devices Market Trends

Asia Pacific is anticipated to be the fastest-growing region in the market owing to its rapidly improving healthcare infrastructure, a less stringent regulatory framework, and economic development attracting foreign investments. Key market players are developing strategies to expand their business in this region. Market growth is expected to be driven by favorable initiatives undertaken by private players, such as training healthcare professionals and increasing R&D investments to develop advanced endoscopes.

China endoscopy devices market held the largest share in 2024. China has the world’s largest population and is one of the fastest-growing economies. Increasing collaborations among market players to develop advanced endoscopes is one of the key factors driving market growth. For instance, in July of 2023, HOYA Group and PENTAX Medical announced the opening of a new facility in Shanghai, China. This center would focus on manufacturing, R&D, and servicing endoscopes for the Chinese market under PENTAX Medical Shanghai Co., Ltd. The facility would produce PENTAX Medical’s endoscopic solutions tailored to the Chinese market.

India endoscopy devices market is anticipated to register a significant growth during the forecast period. The endoscopes market in India is primarily driven by the increased preference for minimally invasive surgeries, the availability of favorable reimbursement plans by private insurance companies and rising disposable income. Furthermore, the high burden of chronic diseases in India and the availability of cancer screening programs are expected to impact market growth positively.

Latin America endoscopy devices market is anticipated to register the considerable growth during the forecast period. Growing preference for minimally invasive surgeries over open surgeries and increasing awareness about the use of endoscopy for various diagnostic & therapeutic procedures are expected to drive the market. The distribution network of the medical device industry in Latin America is highly fragmented, with multiple small distributing companies providing easy accessibility to endoscopy devices.

Brazil endoscopy devices market is anticipated to register a considerable growth during the forecast period. Brazil is an emerging economy with high growth potential for medical devices and is the largest economy in Latin America. The increasing geriatric population and rising prevalence of various chronic diseases, such as GI disorders, cardiac valve disorders, sinusitis, and gynecological disorders, are anticipated to propel market growth. As per the GVR Internal Database, in 2023, the number of breast cancer cases in Brazil was 469,925.

MEA Endoscopy Devices Market Trends

MEA endoscopy devices market is anticipated to register the fastest growth during the forecast period. Increase in geriatric population & prevalence of cancer and growing demand for early disease diagnosis are key factors boosting the market. MEA is a key economic and technologically advanced region with a high per capita disposable income. Government initiatives to increase reimbursement coverage are a key factor expected to boost market growth during the forecast period. Moreover, the Gulf Corporation Council (GCC) is growing at a rapid pace, which indicates the development of technologically advanced medical devices and healthcare infrastructure.

The endoscopy devices market in South Africa is experiencing rapid growth during the forecast period. South Africa has a well-developed healthcare sector focused on providing advanced medical services and technologies to its population. The need to deliver high-quality healthcare services, accurate diagnoses, and minimally invasive treatments is increasing the demand for endoscopes in South Africa. In addition, the growing burden of bacterial infections resulting from increasing colonoscopy procedures is expected to drive the demand for disposable endoscopes in South Africa.

Key Endoscopy Devices Company Insights

Key participants in the endoscopy devices market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key Endoscopy Devices Companies:

The following are the leading companies in the endoscopy devices market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

Recent Developments

-

In March 2023, AIG Hospitals in Hyderabad launched a Center of Excellence (CoE) in collaboration with Boston Scientific Corporation. This collaboration aims to enhance healthcare services by providing advanced treatment options and expertise in various medical fields. The CoE would focus on cardiology, gastroenterology, urology, & endoscopy, leveraging Boston Scientific’s innovative medical technologies and AIG Hospitals’ commitment to delivering high-quality patient care. The partnership between AIG Hospitals and Boston Scientific is expected to bring significant advancements and improved outcomes for patients in Hyderabad & the surrounding regions.

-

In August 2024, Ambu received CE mark approval for its new-generation duodenoscopy solutions, Ambu aBox 2 and Ambu aScope Duodeno 2, for ERCP procedures.

-

In November 2023, Ambu received 510(k) regulatory clearance from the U.S. FDA for its ureteroscopy solution, which includes aScope 5 Uretero (single-use ureteroscope), aBox 2, and a full-HD endoscopy system.

-

In February 2022, Medtronic collaborated with the American Society for Gastrointestinal Endoscopy (ASGE) to offer AI-powered colonoscopy technology for colorectal cancer screening in underserved communities of the U.S.

Endoscopy Devices Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 63.56 billion

Revenue forecast in 2030

USD 76.55 billion

Growth rate

CAGR of 3.79% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada, Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Mexico; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options. Global Endoscopy Devices Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the endoscopy devices market report on the basis of product, end use, and region:

-

Product Outlook (Revenue USD Million, 2018 - 2030)

-

Endoscopes

-

Reusable Endoscopes

-

Rigid Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Pharyngoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

-

-

Flexible Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Sinuscopes

-

Otoscopes

-

Pharyngoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

Capsule Endoscopes

-

Robot- Assisted Endoscopes

-

-

Disposable Endoscopes

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

-

Endoscopy Visualization Systems (Reusable Endoscopy Visualization Systems)

-

Standard Definition (SD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

High Definition (HD) Visualization Systems

-

2D Systems

-

3D Systems

-

-

-

Endoscopy Visualization Components

-

Reusable Endoscopy Visualization Components

-

Camera Heads

-

Insufflators

-

Light Sources

-

High-Definition Monitors

-

Suction Pumps

-

Video Processors

-

-

Disposable Endoscopy Visualization Components

-

Camera Heads

-

Insufflators

-

Light Sources

-

Suction Pumps

-

-

-

Operative Devices

-

Reusable Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

Disposable Operative Devices

-

Energy Systems

-

Access Devices

-

Suction & Irrigation Systems

-

Hand Instruments

-

Wound Retractors

-

Snares

-

-

-

-

End use Outlook (Revenue USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient facilities

-

-

Regional Outlook Revenue USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

UK

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Mexico

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopy devices market size was estimated at USD 61.06 billion in 2024 and is expected to reach USD 63.6 billion in 2025.

b. The global endoscopy devices market is expected to grow at a compound annual growth rate of 3.8% from 2024 to 2030 to reach USD 76.6 billion by 2030.

b. Endoscopes dominated the endoscopy devices market with a share of 41.1% in 2024. This is attributable to the growing awareness and rising adoption rate of endoscopes across various diagnostic and therapeutic procedures.

b. Some key players operating in the endoscopy devices market include Olympus Corporation; Fujifilm Holdings Corporation; Ethicon Endo-Surgery, LLC; Stryker Corporation; Richard Wolf GmbH; Boston Scientific Corporation; and Karl Storz.

b. Key factors that are driving the endoscopy devices market growth include a significant increase in the prevalence of age-related diseases, a rise in demand for endoscopy devices in diagnostic & therapeutic procedures, and increasing adoption of minimally invasive surgeries.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.