- Home

- »

- Medical Devices

- »

-

Flexible Endoscopes Market Size, Industry Report, 2030GVR Report cover

![Flexible Endoscopes Market Size, Share & Trends Report]()

Flexible Endoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Bronchoscopes, Laparoscopes, Laryngoscopes, Otoscopes), By End Use (Hospitals, Outpatient Facilities), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-044-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Flexible Endoscopes Market Size & Trends

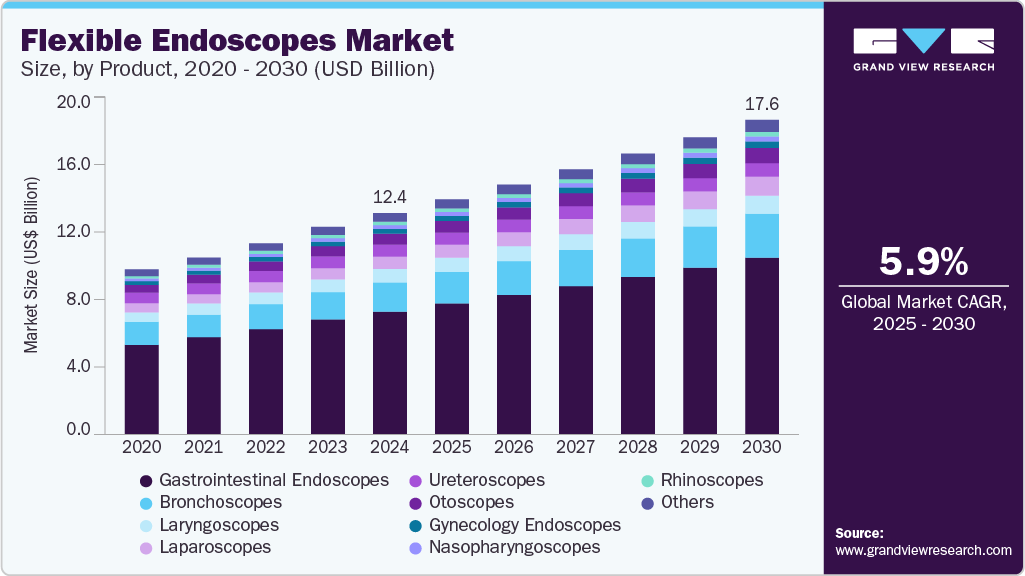

The global flexible endoscopes market size was estimated at USD 12.41 billion in 2024 and is projected to grow at a CAGR of 5.96% from 2025 to 2030. The increasing use of minimally invasive surgical procedures has led to a growing demand for various types of endoscopes and endoscopy devices in cystoscopy, bronchoscopy, arthroscopy, and laparoscopy surgeries.

Key Highlights:

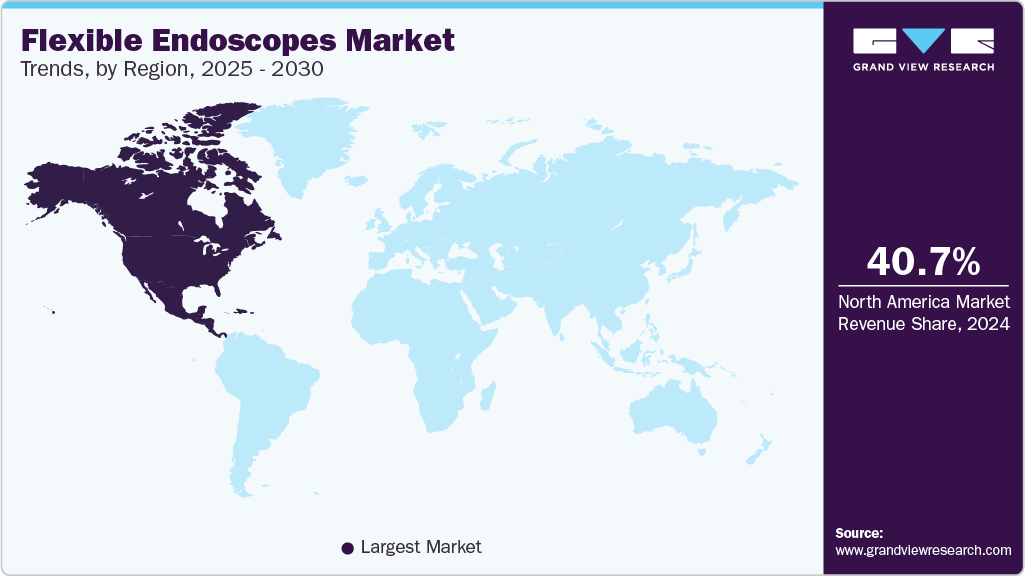

- North America dominated the flexible endoscopes industry with a revenue share of 40.69% in 2024

- The U.S. dominated the industry in North America region in 2024 due to growing product approval.

- In terms of product segment, the gastrointestinal endoscopes segment held a significant revenue share of 55.59% in 2024

- In terms of product segment, the laparoscopes segment is anticipated to grow at the fastest CAGR over the forecast period

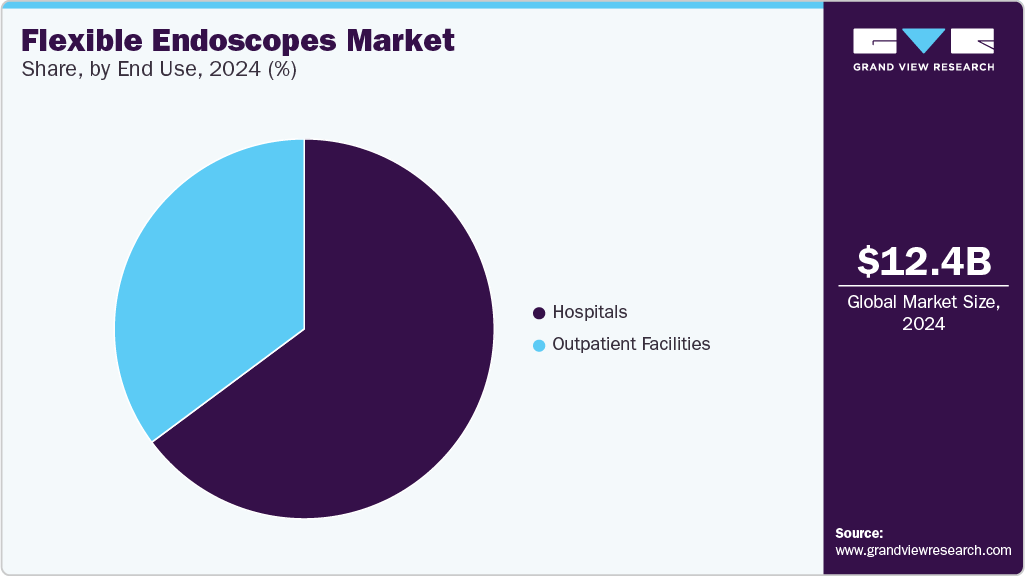

- In terms of end use segment, the hospitals segment dominated the market with a revenue share of 64.83% in 2024

This shift towards minimally invasive surgeries over traditional surgeries is attributable to multiple reasons such as cost-effectiveness, higher patient satisfaction, shorter hospital stays, and fewer post-surgical complications.

The increasing prevalence of various chronic diseases, such as inflammatory bowel diseases (IBD), stomach cancer, colon cancer, and respiratory infections, significantly fuels the demand for these devices used in diagnostics. For instance, according to the American Cancer Society, in 2023 there were 153,030 cancer cases in the U.S. In addition, the American Lung Association projected around 236,000 new lung cancer cases in the country for 2021. Furthermore, the American Lung Association estimated that 236,000 people in the U.S. were diagnosed with lung cancer in 2021, while the American College of Gastroenterology reports that 10-15% of adults suffer from irritable bowel syndrome symptoms in the country. The rising incidence and prevalence of these diseases contribute to the growing need for flexible endoscopes, thereby driving the expansion of the market.

Technological advancements in endoscope equipment. These advancements have led to improvements in imaging quality, procedural efficiency, and the development of new types of endoscopes. For instance, in January 2023, EndoTheia announced that it has been granted priority status by the FDA through the receipt of a Breakthrough Device designation for its technology. This technology is designed to radically improve minimally invasive flexible endoscopic surgery. The company noted that its device is only the seventh in the category of Ear Nose and Throat (ENT) devices to ever receive this specific designation. Robert J. Webster, III, PhD, Co-Founder and President of EndoTheia, said:

“EndoTheia was founded in 2018 to develop the next generation of medical devices for flexible endoscopy with the goal of increasing effectiveness through added flexibility and dexterity.”

The growing adoption of minimally invasive surgery (MISs) is expected to boost the global flexible endoscopes industry over the forecast period. Key advantages include high patient acceptance rates, reduced pain, cost-effectiveness, and lower chances of complications. NIH data from January 2023 indicates an increasing trend of ambulatory minimally invasive procedures in the U.S., which raises the demand for these devices in these settings. In addition, the demand for these products in hospitals & diagnostic centers devices in ENT, bronchoscopy, & dentistry procedures are expected to drive market growth over the forecast period.

Moreover, industry growth is largely driven by the unique advantages offered by these devices over rigid endoscopes and other medical instruments. The exceptional adjustability that optical fibers provide, allowing products to navigate through complex anatomical structures with ease. This adaptability expands their scope of application, enabling use in various medical fields, such as gastroenterology, pulmonology, and urology. In addition, the ability of the devices to change direction enhances the precision of diagnoses and interventions. This leads to increased patient comfort and reduced recovery times, as less invasive procedures can be performed. As healthcare professionals continue to prioritize minimally invasive techniques, the demand for industry is projected to rise, further propelling market growth.

The miniaturization of components has led to the development of smaller, more versatile devices, making it easier to access narrow and complex anatomical areas. Moreover, advancements in materials and manufacturing techniques led to the production of flexible endoscopes that are cost-effective, reliable, & safe for patients. Thus, such factors are expected to boost market growth over the forecast period. Furthermore, with new technologies and methods being developed and introduced regularly, the flexible endoscope market is expected to grow significantly over the forecast period. For instance, the application of AI in many gastroenterology fields is becoming more widespread, especially in endoscopic image processing.

Case Study

Below is the study published by Springer Nature in July 2022, with the aim to consider flexible endoscopy as a routine practice for postoperative follow-up in patients with maxillary sinus lesions due to its superior ability to visualize complex anatomical structures compared to traditional rigid scopes.

Overview of the Study:

The study titled "Flexible endoscopy in the visualization of 3D-printed maxillary sinus and clinical application" investigates the effectiveness of the devices compared to rigid endoscopes in visualizing the maxillary sinus (MS) during postoperative follow-up. The research is motivated by the limitations of traditional imaging techniques like CT and MRI, which often fail to provide clear insights into small lesions due to postoperative changes such as mucosal edema.

Methods:

The researchers followed up with 70 patients who had undergone surgery for lesions in the MS. They employed both rigid (0°, 45°, and 70°) and flexible endoscopes to assess their respective visual ranges. To quantify these ranges, a 3D model of the MS was created using thin-slice CT images, which were then printed in three dimensions. The inner surfaces were marked with grid papers to facilitate measurement.

Results:

The findings indicated that flexible endoscopy significantly outperformed rigid endoscopy in terms of visual range:

-

Overall Visibility: Flexible endoscopy provided a total visible area of 34.25 cm² (66.18% of total area), while the best-performing rigid scope (70°) only revealed 26 cm² (50.24%).

-

Specific Wall Observations: The flexible scope excelled particularly in viewing areas that were difficult for rigid scopes, such as the anterior wall, medial wall, and inferior wall.

-

Clinical Cases: Two illustrative cases demonstrated how flexible endoscopy could detect lesions that were missed by rigid scopes, emphasizing its utility in clinical practice.

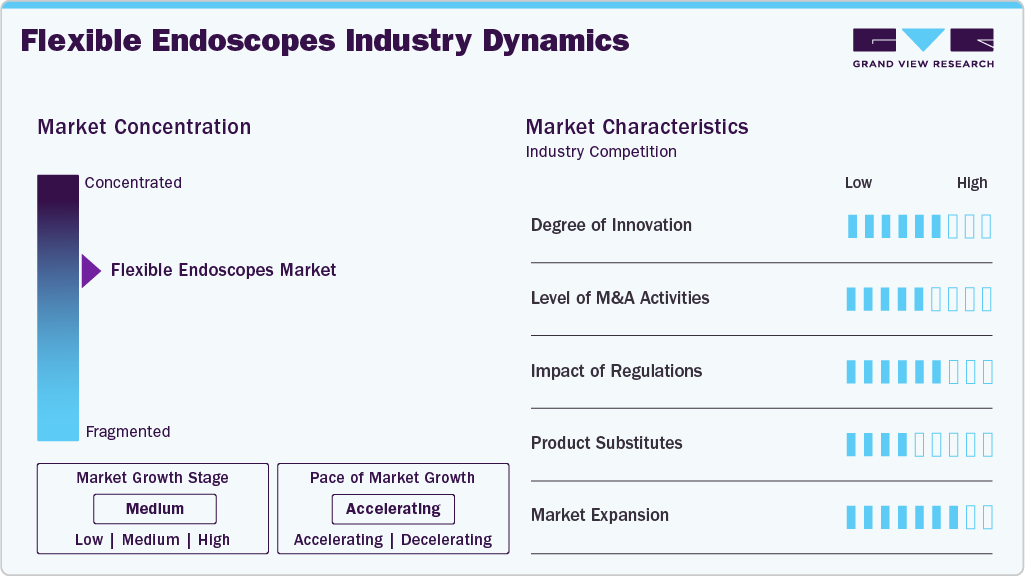

Market Concentration & Characteristics

Degree of Innovation: The global market is characterized by a high degree of innovation, with new technologies and methods being developed and introduced regularly. Companies continually introduce advanced technologies to enhance diagnostic and therapeutic capabilities. Advanced features, such as improved imaging and ergonomic designs, characterize the latest flexible endoscope models. In May 2024, Lynmou Medical received product certification for its VC-1600 series of full HD electronic endoscopy systems and gastrointestinal endoscopes in April and May 2024. They introduced "Full-Scenario Imaging" with four specialized light modes HLI, SVI, TCI, and DHI designed to meet diverse clinical imaging needs, enhancing the process of screening, diagnosing, and treating early gastrointestinal cancers.

The market is characterized by a high level of merger and acquisition (M&A) activity by the leading players, owing to several factors, including the desire to expand the business to cater to the growing demand for flexible endoscopes and to maintain a competitive edge. In December 2024, HOYA Corporation announced its acquisition of the remaining shares of PLASMABIOTICS. This strategic move is significant for both companies as it consolidates HOYA's position in the medical technology sector, particularly in the field of endoscope reprocessing.

Companies actively invest resources in clinical trials and regulatory submissions to obtain regulatory approval for novel products. This may result in increasing the cost of developing novel endoscopic technologies. For instance, the European Union (EU) has recently imposed laws and guidelines that can affect Endoscopists and patients. The new regulations raise the requirement for clinical trials and observational studies for both new and existing endoscopic device uses to assure therapeutic benefit and minimize patient damage.

The degree of product substitutes in the flexible endoscope market is moderate to high, influenced by various factors such as technological advancements, patient preferences, and regulatory frameworks. Traditional reusable endoscopes serve as primary substitutes; however, their associated risks of cross-contamination and infection have led to a growing preference for rigid and single-use devices. The COVID-19 pandemic further accelerated this shift, highlighting the need for safer options that minimize infection risks.

Several market players are expanding their business by entering new regions and launching facilities to strengthen their market position and expand their product and service portfolio. In September 2024, Olympus launched its first flexible endoscope sterilization facility, named "Sapphire," in Melbourne, Australia. This facility is part of the newly launched Olympus On-Demand solution, designed to reduce the risks, costs, and complexities associated with managing an endoscopy service.

Product Insights

By product, the gastrointestinal endoscopes segment held a significant revenue share of 55.59% in 2024. This is attributed to the increasing prevalence of gastrointestinal disorders, such as colorectal cancer, inflammatory bowel disease, and other chronic conditions, necessitates regular diagnostic procedures. For instance, according to the American Cancer Society, approximately 26,500 new cases of stomach cancer were expected in 2023 alone, highlighting the urgent need for effective diagnostic tools such as endoscopes. Moreover, the growing awareness of the benefits of flexible gastroscopes grows, fueled by such research initiatives, their adoption is expected to significantly enhance market growth.

The laparoscopes segment is anticipated to grow at the fastest CAGR over the forecast period, owing to the increasing prevalence of conditions requiring laparoscopic procedures, such as obesity and various gastrointestinal disorders, has heightened the need for effective diagnostic and surgical tools. Moreover, growing investments and advancements in technology have led to improved imaging capabilities and functionality of flexible laparoscopes, making them more appealing to healthcare providers. The cost-effectiveness associated with these devices plays a crucial role; procedures utilizing laparoscopes are significantly less expensive than those involving reusable instruments when considering sterilization costs and potential complications from infections. For instance, in April 2023, Xenocor, a medical device company, raised USD 10 million in Series A funding led by GenHenn Venture Fund I and others such as Patel Family Investment, Barvest Ventures, Inc., and Baranco Investments, Inc.

End Use Insights

By end use, the hospitals segment dominated the market with a revenue share of 64.83% in 2024. Favorable reimbursement scenario, high number of hospitals performing endoscopic procedures, and high preference of hospitals for minimally invasive procedures are the factors responsible for high revenue growth of the hospital segment. In addition, higher adoption of single use endoscopes in hospitals to reduce the chances of infection and leakage is also catering segment demand. Moreover, technological advancements coupled with high sensitivity of flexible endoscopes are providing momentum to the segment expansion. The number of hospitals is increasing in most countries, including Canada, the U.S., the UK, Spain, Italy, India, China, Japan, Thailand, Brazil, South Africa, UAE, and Argentina. According to the American Hospital Association, there were 6,120 hospitals in the U.S. in 2024. Similarly, in 2021, there were 1,300 hospitals in Canada. The European Union has around 15,000 hospitals.

The outpatient facilities is anticipated to grow at a fastest CAGR over the forecast period. Increasing number of outpatient facilities performing endoscopic procedures is the crucial factor driving the segment demand. Moreover, certain benefits such as easy accessibility of outpatient facilities, and cost-effective services are supporting market expansion. Furthermore, government initiatives to strengthen healthcare infrastructure are projected to fuel segment growth over the forecast period.

Regional Insights

North America dominated the flexible endoscopes industry with a revenue share of 40.69% in 2024 owing to the presence of large number of key players and various strategic initiatives undertaken by them. Within North America, U.S. is the largest market as majority of players initially sought U.S.FDA approval to launch their product in the country. Moreover, increasing awareness about cost-effective devices and high per capita health expenditure is another factor fueling the region’s growth. Furthermore, advanced healthcare infrastructure, supportive government initiatives and optimum treatment coverage are also responsible for the growth of the North America region.

U.S. Flexible Endoscopes Market Trends

The U.S. dominated the industry in North America region in 2024 due to growing product approval. For instance, in July 2022, Zsquare received FDA 510(k) clearance to market its first product, the Zsquare ENT-Flex Rhinolaryngoscope, which is a high-performance single-use endoscope designed for diagnostic procedures in the ear, nose, and throat (ENT) field. The endoscope aims to enhance patient comfort and improve diagnostic quality. The company plans to pilot launch this product in leading hospitals and physician offices across the U.S. This milestone is seen as a pivotal step towards transforming the endoscopy market by promoting affordable and effective flexible endoscopes across various medical indications.

Europe Flexible Endoscopes Market Trends

The Europe flexible endoscopes market is expected to grow fastest over the forecast period. Growing preference to minimize the risk of infection and maximize better clinical outcomes has increased the adoption of flexible endoscopes and their accessories in Europe. Furthermore, the growing incidence of functional gastrointestinal disorders and several other chronic diseases such as diabetes, cancer, and cardiovascular disorders, has increased the diagnosis rate over the years, which, in turn, is anticipated to boost market growth. For instance, according to an article published by the European Commission in January 2024, in 29 European countries, an estimated 23.7 million individuals faced a cancer diagnosis in their lifetime.

The UK flexible endoscopes market is expected to grow significantly during the forecast period. The high prevalence of cancer & chronic diseases and the growing geriatric population are expected to drive market growth in the country. According to Macmillan Cancer Support, in October 2022, there were approximately 3 million patients suffering from cancer in the UK, and 5.3 million patients are expected to be diagnosed with cancer in the country by 2040. The introduction of the National Awareness and Early Diagnosis Initiative has facilitated early diagnoses of cancer and increased access to optimal treatment, thereby playing a vital role in driving the market.

Asia Pacific Flexible Endoscopes Market Trends

The Asia Pacific flexible endoscopes industry is expected to witness a significant CAGR growth throughout the forecast period. This growth is attributed to the high burden of target diseases, and a large patient population is expected to provide traction for the region's expansion. The improving healthcare infrastructure and rising investments from market players, owing to the flourishing demand for medical devices in the APAC region, have propelled the region's growth to a certain extent. Furthermore, the region's greater transition from reusable to flexible endoscopes and increased epidemiological factors hold high promise for the region's growth.

India flexible endoscopes market is anticipated to register considerable growth due to the increasing product developments and innovation in the country. For instance, in July 2024, FUJIFILM India expanded its healthcare offerings by opening a new endoscopy center in Mumbai. This development is part of the company's efforts to enhance its presence in the Indian healthcare market, particularly in the field of medical devices and diagnostic imaging. The establishment of this endoscopy center is expected to increase access to advanced diagnostic and therapeutic procedures for patients in and around Mumbai.

Latin America Flexible Endoscopes Market Trends

The Latin America flexible endoscopes industry is expected to witness considerable growth over the forecast period due to the overall increase in healthcare expenditure and investments in medical infrastructure within Latin American countries, which supports the adoption of advanced medical technologies, including flexible endoscopes. As hospitals seek to enhance patient safety and improve clinical outcomes, the shift towards these solutions is expected to drive growth in this medical device market segment.

The flexible endoscopes marketin Brazil is anticipated to register considerable growth during the forecast period due to continuous product developments being done in the country. For instance, in September 2024, the latest-generation Olympus endoscopy system, known as the EVIS X1, launched in Brazil. This advanced system represents Olympus' most sophisticated technology for gastrointestinal endoscopy to date. The EVIS X1 system is equipped with two compatible gastrointestinal endoscopes: the GIF-1100 for upper digestive tract examinations and the CF-HQ1100DL/I for lower digestive tract procedures. The ergonomic design of these endoscopes aims to enhance user comfort and improve procedural efficiency.

Middle East and Africa Flexible Endoscopes Market Trends

The Middle East and Africa flexible endoscopes market is expected to witness considerable growth over the forecast period. The market is driven by theincreasing prevalence of chronic diseases, particularly gastrointestinal disorders and cancers, which necessitate more diagnostic procedures that utilize endoscopy. The focus on infection control and reducing the risk of virus transmission has led to a greater preference for single-use devices, including endoscopes. A survey conducted by the Scientific Commission of the Brazilian Society of Digestive Endoscopy (SOBED) in 2020 revealed that around 90% of respondents stated that endoscopic activity was necessary only for urgent procedures during the pandemic.

South Africa flexible endoscopes market is anticipated to register considerable growth. The South African healthcare sector is evolving, with a strong focus on providing high-quality services and accurate diagnoses. Medical device industry in this region is highly influenced by the African National Congress (ANC) and government policies concerning National Health Insurance (NHI). The presence of companies such as Olympus Corporation; Fujifilm Holdings Corporation; HOYA Corporation; Advanced Sterilization Products Services, Inc.; and KARL STORZ GmbH & Co. KG provides this region with future growth opportunities.

Key Flexible Endoscopes Company Insights:

Key players are adopting strategies such as new product development, merger & acquisition, and partnership to increase their market share. Market players such as Ambu A/S, Boston Scientific Corporation, obp Surgical Corporation, COOPERSURGICAL, INC., and others are actively involved in the development of novel endoscopes. For instance, In May 2020 Ambu A/S announced its plans to launch “Ambu aView 2 Advance display” unit for use with endoscopes in U.S. and Europe.

Key Flexible Endoscopes Companies:

The following are the leading companies in the flexible endoscopes market. These companies collectively hold the largest market share and dictate industry trends.

- Olympus Corporation

- Ethicon Endo-surgery, LLC

- FUJIFILM Holdings Corporation

- Stryker Corporation

- Boston Scientific Corporation

- Karl Storz GmbH & Co. KG.

- Smith & Nephew Inc.

- Richard Wolf GmbH

- Medtronic Plc (Covidien)

- Ambu A/S, PENTAX Medical

- Machida Endoscope Co., Ltd.

Recent Developments

-

In May 2025, FUJIFILM Healthcare Europe launched the ELUXEO EG-840T and the specially designed narrow EG-840TP, as part of the new 800 Series ELUXEO Endoscopes. These endoscopes are the second release under the 'WELCOME, FUTURE' initiative, following the ELUXEO 8000 system. This device is made for observation & diagnosis and for advanced endoscopic treatment, particularly supporting procedures such as endoscopic mucosal resection (EMR) and endoscopic submucosal dissection (ESD) for early-stage gastrointestinal cancers.

-

In October 2024, Lumicell announced that it is developing a novel flexible endoscope for the detection of precancerous and early-stage esophageal adenocarcinoma (EAC) in patients with Barrett's esophagus. This development is supported by a Phase I Small Business Innovation Research (SBIR) contract awarded by the National Cancer Institute (NCI) of the National Institutes of Health (NIH).

-

In August 2024, KARL STORZ U.S. and FUJIFILM Healthcare Americas Corporation entered a strategic relationship to provide comprehensive solutions for endoscopists and surgeon. The core of the partnership involves the companies jointly marketing Fujifilm’s flexible gastrointestinal (GI) endoscopes along with KARL STORZ’s Operating Room (OR) integration solutions.

-

In April 2024, Olympus received U.S. FDA 510(k) clearance for its first single-use flexible ureteroscope system, named RenaFlex. This innovative device is designed to assist healthcare professionals in diagnosing and treating urinary diseases and disorders, such as kidney stones. The RenaFlex system allows for visualization of the urinary tract, including the urethra, bladder, ureter, calyces, and renal papillae, through both transurethral and percutaneous access routes.

Flexible Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 13.20 billion

Revenue forecast in 2030

USD 17.63 billion

Growth rate

CAGR of 5.96% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Olympus Corporation; Ethicon Endo-surgery, LLC.; FUJIFILM Holdings Corporation; Stryker Corporation; Boston Scientific Corporation; Karl Storz GmbH & Co. KG.; Smith & Nephew Inc.; Richard Wolf GmbH; Medtronic Plc (Covidien); Ambu A/S; PENTAX Medical; Machida Endoscope Co., Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Flexible Endoscopes Market Report Segmentation

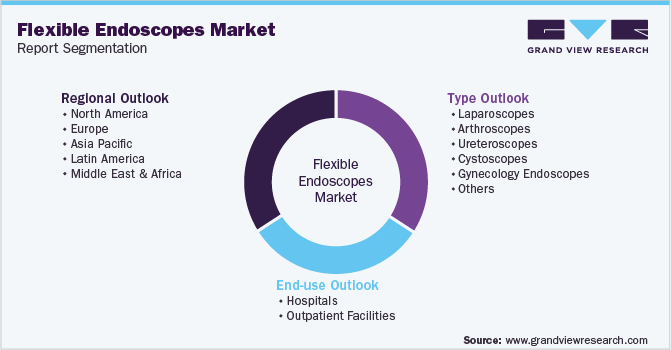

This report forecasts revenue growth and provides at global, regional, and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the global flexible endoscopes market report based on product, end use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bronchoscopes

-

Laparoscopes

-

Laryngoscopes

-

Otoscopes

-

Ureteroscopes

-

Cystoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Arthroscopes

-

Neuroendoscopes

-

Hysteroscopes

-

Gynecology Endoscopes

-

Gastrointestinal Endoscopes

-

Colonoscope

-

Gastroscope (Upper GI Endoscope)

-

Duodenoscope

-

Enteroscope

-

Sigmoidoscope

-

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient Facilities

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global flexible endoscopes market was valued at USD 12.41 billion in 2024 and is expected to reach USD 13.20 billion by 2025

b. The global flexible endoscopes market is expected to grow at a compound annual growth rate (CAGR) of 5.96% from 2025 to 2030 to reach USD 17.63 billion by 2030.

b. In 2024, based on product, the gastrointestinal endoscopes segment held a significant revenue share of 55.59% in 2024. This is attributed to the increasing prevalence of gastrointestinal disorders, such as colorectal cancer, inflammatory bowel disease, and other chronic conditions, which necessitate regular diagnostic procedures.

b. Some of the key players operating in the market are Olympus Corporation, Ethicon Endo-surgery, LLC., FUJIFILM Holdings Corporation, Stryker Corporation, Boston Scientific Corporation, Karl Storz GmbH & Co. KG., Smith & Nephew Inc., Richard Wolf GmbH, Medtronic Plc (Covidien), Ambu A/S, PENTAX Medical, Machida Endoscope Co., Ltd.

b. The increasing use of minimally invasive surgical procedures has led to a growing demand for various types of endoscopes and endoscopy devices in surgical interventions, such as cystoscopy, bronchoscopy, arthroscopy, and laparoscopy. This shift towards minimally invasive surgeries over traditional surgeries is attributable to multiple reasons such as cost-effectiveness, higher patient satisfaction, shorter hospital stays, and fewer post-surgical complications.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.