- Home

- »

- Medical Devices

- »

-

Endoscopy Procedures Estimates Market Size Report, 2030GVR Report cover

![Endoscopy Procedures Estimates Market Size, Share & Trends Report]()

Endoscopy Procedures Estimates Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Gastrointestinal Endoscopy, Other Endoscopy), By Region, And Segment Forecasts

- Report ID: GVR-4-68039-915-0

- Number of Report Pages: 130

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endoscopy Procedures Estimates Market Summary

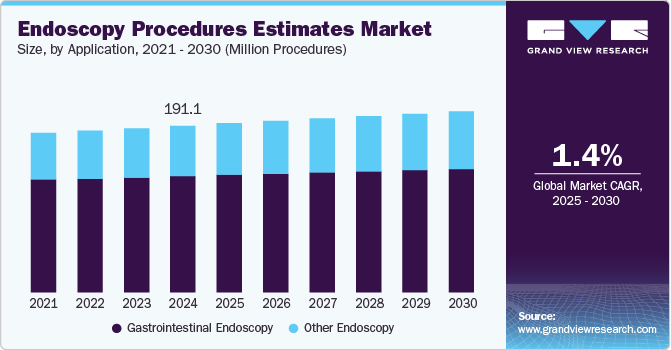

The global endoscopy procedures estimates market size was estimated at 191.1 million procedures in 2024 and is projected to reach 207.5 million procedures by 2030, growing at a CAGR of 1.38% from 2025 to 2030. Factors such as the growing adoption of elective endoscopic procedures, improved healthcare expenditures, and the increasing geriatric population are expected to propel market growth.

Key Market Trends & Insights

- Asia Pacific dominated the endoscopy procedures estimates market in 2024.

- India endoscopy procedures estimates market held the significant share in 2024.

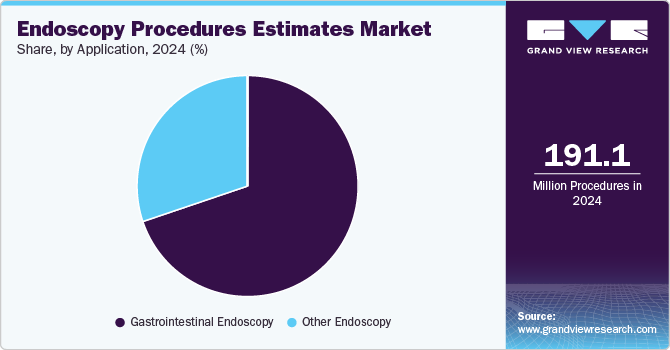

- By application, the gastrointestinal endoscopy segment accounted for the largest volume share of 69.8% in 2024.

Market Size & Forecast

- 2024 Market Size: 191.1 Million Procedures

- 2030 Projected Market Size: 207.5 Million Procedures

- CAGR (2025-2030): 1.38%

- Asia Pacific: Largest market in 2024

According to an article published by John Wiley & Sons, Inc., in August 2023, the total number of endoscopic procedures performed in 2022 was 5904 in Australia. The endoscopy procedures market is witnessing growth due to the increasing preference for minimally invasive or keyhole surgeries worldwide. Surgeons opt for endoscopic and robotic-assisted procedures as alternatives to traditional open surgeries. These minimally invasive approaches offer several advantages, including reduced risk of postoperative complications, shorter hospital stays & recovery time, and decreased blood loss during surgeries. Moreover, they provide economically viable options compared to open surgeries.

Furthermore, technological advancements continue to shape the field of minimally invasive surgeries, propelling the demand for endoscopy procedures. For instance, in September 2023, With the CE mark approval, Ambu launched a larger-sized gastroscopy solution, the Ambu aBox 2, and Ambu aScope Gastro Large, expanding the company’s gastroenterology offerings.

The development of advanced technologies, such as capsule endoscopes and robot-assisted endoscopy, has contributed to the market's growth. These technologies enable precise visualization and control, enhancing the accuracy and efficiency of procedures. Moreover, introducing new products, especially endoscopic visualization systems, drives market growth. For instance, in January 2024, AnX Robotica received a U.S. FDA for its AI-integrated small bowel capsule endoscopy.

Many players in the market are increasingly investing in developing new products and continuously improving existing products. For instance, in October 2023, Foresight Group (Foresight), an investment company, announced USD 6.61 million investment along with USD 1.65 million from Clydesdale Bank in Clearview Endoscopy Limited. This company repairs, services, and maintains flexible endoscopes and offers its services to customers across Ireland and the UK.

In addition, favorable reimbursement policies and government initiatives boost market growth. As per the 2022 Gastrointestinal Endoscopy Coding and Reimbursement Guide, outpatient hospitals receive the highest reimbursement of USD 3,135.9 for diagnostic therapy, as per CPT code 43260. This reimbursement is the National Medicare Average. In addition, the reimbursement for a facility for the ambulatory surgery center is USD 1,400.9. The increase in reimbursement from 2019 to 2022 signifies better reimbursement frameworks for GI endoscopy, along with an increasing number of patients opting for the same.

Application Insights

By application, the gastrointestinal endoscopy segment dominated the market in 2024 and accounted for the largest volume share of 69.8%. Factors such as the increasing number of gastroscopies, the rising adoption of endoscopes for diagnosing and treating GI diseases, and the availability of advanced gastroscopy products are some of the factors driving the gastrointestinal (GI) endoscopy segment. For instance, according to the American Academy of Family Physicians, 1 out of 12 people in the U.S. were diagnosed with gastric ulcers in 2023. This significant rise in gastric ulcers drives the adoption of gastroscopies for diagnosis.

Other endoscopy procedures estimates segment in endoscopes market is anticipated to register the fastest growth over the forecast period. Neuro or spinal endoscopy, cardiovascular endoscopy, rectoscopy, and rhinoscopy are among the various specialized areas where endoscopic techniques are utilized for diagnostic and therapeutic purposes. The market is driven by an increase in the geriatric population, a growing burden of chronic diseases, a rising number of accidental injuries affecting the central nervous system, and a surging preference for minimally invasive procedures. In addition, the growing demand for microsurgical procedures among healthcare professionals to treat neurological disorders is expected to influence the market positively.

Regional Insights

The North America endoscopy procedures estimates market is expected to witness significant growth over the forecast period. Growing demand for minimally invasive surgeries with faster recovery, precision, and accuracy and fewer post-surgery infections and complications is positively impacting the market growth. Moreover, the trend of hand-assisted endoscopy and robotic surgery, which offers faster recovery, reduced pain, minimized collateral tissue damage, & fewer postsurgical infections is expected to gain momentum over the forecast period.

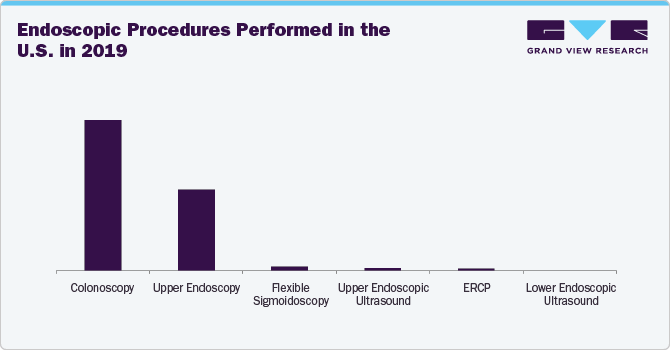

U.S. Endoscopy Procedures Estimates Market Trends

The endoscopy procedures estimates market in the U.S. held the largest share in 2024. Factors such as the increasing prevalence of gastrointestinal disorders and cancer and favorable government initiatives propel market growth. The development of national cancer screening programs, such as the American Cancer Society's Return To Screening initiative launched in February 2021, contributes to the increased demand for endoscopies and revenue generation in the sector. The presence of organizations like the American Society for Gastrointestinal Endoscopy, dedicated to patient care and digestive health, promotes innovations and excellence in endoscopy. Thus, such factors boost market growth.

Europe Endoscopy Procedures Estimates Market Trends

Europe endoscopy procedures estimates market is anticipated to register considerable growth during the forecast period. Technological advancements in endoscopy and increased demand for minimally invasive procedures propel the region's market growth. Favorable macroenvironment factors drive key players to revise their market entry strategies through mergers & acquisitions and technological collaborations to expand their footprint.

UK endoscopy procedures estimates market is anticipated to register a considerable growth rate during the forecast period. The increasing prevalence of cancer and chronic diseases and the growing geriatric population fuel the market's growth in the country. Initiatives such as the National Awareness and Early Diagnosis Initiative have contributed to early cancer detection and improved access to optimal treatment, which is crucial in driving the market's growth.

Denmark endoscopy procedures estimates market is anticipated to register a considerable growth rate during the forecast period. The high prevalence of cancer in Denmark and the proactive approach of the Danish Healthcare System in implementing screening programs have significantly influenced the demand for endoscopy procedures. These procedures are essential for diagnosing, treating, and managing various cancers. As the country continues its efforts to combat cancer and enhance the well-being of its population, the endoscopy procedures market in Denmark is expected to experience sustained growth.

Asia Pacific Endoscopy Procedures Estimates Market Trends

Asia Pacific dominated the endoscopy procedures estimates market in 2024 and is anticipated to grow at the fastest CAGR over the forecast period. Growth is expected to be driven by favorable initiatives undertaken by private players, such as training healthcare professionals and increasing R&D investments to develop advanced endoscopes. For instance, Olympus Corporation opened the Thai Training and Education Centre to increase awareness about surgical & Gastrointestinal (GI) endoscopes and train healthcare professionals in Southeast Asia.

India endoscopy procedures estimates market held the significant share in 2024. Continuous advancements in endoscopic technologies and techniques and the launch of new products propel the market growth. For instance, in July 2022, FUJIFILM Corporation launched two NURA cancer and lifestyle disease screening centers in India (Gurugram & Mumbai). These centers would utilize AI-powered technological solutions to enhance the accuracy and precision of cancer diagnosis.

Latin America Endoscopy Procedures Estimates Market Trends

Latin America endoscopy procedures estimates market is anticipated to register considerable growth during the forecast period. The growing preference for minimally invasive surgeries over traditional open surgeries and increasing awareness regarding the benefits of endoscopy for various diagnostic and therapeutic procedures drive the market growth. This region presents significant growth opportunities for the medical device industry, supported by a fragmented distribution network comprising numerous small distributing companies. This accessibility to endoscopy devices contributes to the widespread adoption of these procedures.

Argentina endoscopy procedures estimates market is anticipated to register a considerable growth during the forecast period. The availability of training centers for educating healthcare professionals about recent advancements in endoscopes is boosting market growth. For Instance, the training center at La Plata by the World Gastroenterology Organization provides endoscopy training for upper endoscopic surgery, interventional EUS, therapeutic endoscopy, ERCP, and enteroscopy.

Middle East & Africa Endoscopy Procedures Estimates Market Trends

MEA endoscopy procedures estimates market is anticipated to register significant growth during the forecast period. Government initiatives to increase reimbursement coverage are key factors anticipated to fuel market growth over the forecast period. Moreover, the growing disease burden, increasing healthcare expenditure, and expanding healthcare privatization are expected to drive market growth.

UAE endoscopy procedures estimates market is anticipated to register a considerable growth rate during the forecast period. The increasing prevalence of cancer and favorable reimbursement policies in the country propel the market growth. In addition, the Health Authority-Abu Dhabi (HAAD) provided recommendations for treating colorectal cancer, which is expected to drive demand for endoscopy procedures.

Endoscopy Procedures Estimates Market Report Scope

Report Attribute

Details

Market size value in 2025 (Volume)

193,860,821 units

Volume forecast in 2030 (Volume)

207,586,953 units

Growth Rate

CAGR of 1.38% from 2025 to 2030

Actual data

2021 - 2024

Forecast data

2025 - 2030

Quantitative units

Volume in units and CAGR from 2025 to 2030

Report coverage

Volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; Spain; Italy; France; Norway; Denmark; Sweden; Japan; China; India; Australia; Thailand; South Korea; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endoscopy Procedures Estimates Market Report Segmentation

This report forecasts volume growth at global, regional, and country level and provides an analysis on industry trends in each of the sub segments from 2021 to 2030. For this study, Grand View Research, Inc. has segmented the endoscopy procedures estimates market report on the basis of application and region:

-

Application Outlook (Volume Units, 2021 - 2030)

-

Gastrointestinal Endoscopy

-

Gastroscopy

-

Colonoscopy

-

Sigmoidoscopy

-

Duodenoscopy

-

Enteroscopy

-

-

Other Endoscopy

-

Laparoscopy

-

Bronchoscopy

-

Cystoscopy

-

Others

-

-

-

Regional Outlook Volume, Units, 2021 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global endoscopy procedures market volume was estimated at 191.12 million procedures in 2024 and is expected to reach 193.86 million procedures in 2025.

b. The global endoscopy procedures estimates market is expected to grow at a compound annual growth rate of 1.38% from 2025 to 2030 to reach 207.59 million procedures by 2030.

b. Gastrointstinal endoscopy by application dominated the endoscopy procedures estimates with a share of 69.8% in 2024. This is attributable to an increase in endoscopic surgeries for the diagnosis of the upper digestive tract or esophagus.

b. This report doesn't require the key player's information.

b. Key factors that are driving the endoscopy procedures estimate market growth include the growing prevalence of chronic diseases increases the adoption of minimally invasive endoscopic surgeries to diagnose, treat, and prevent the internal organ complications associated with these diseases.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.