- Home

- »

- Next Generation Technologies

- »

-

Endpoint Detection And Response Market Size Report, 2030GVR Report cover

![Endpoint Detection And Response Market Size, Share & Trends Report]()

Endpoint Detection And Response Market (2023 - 2030) Size, Share & Trends Analysis Report By Solution (Software, Service), By Endpoint Device, By Deployment, By Enterprise Size, By Vertical, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-073-0

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Endpoint Detection & Response Market Summary

The global endpoint detection and response (EDR) market size was evaluated at USD 2.87 billion in 2022 and is projected to reach USD 16.89 billion by 2030, growing at a CAGR of 24.9% from 2023 to 2030. EDR solutions have become vital in enabling organizations to manage and secure these devices, ensuring that employees can work from anywhere without compromising security.

Key Market Trends & Insights

- North America held the largest share of 32.4% of the target market in 2022.

- The U.S. is expected to hold the largest share of the market during this period.

- Based on solution, the software segment accounted for the largest share of 64.5% in 2022.

- Based on deployment, the cloud-based segment accounted for a market share of 54.8% in 2022.

- By endpoint device, the network devices & servers segment accounted for the share of 32.4% in 2022.

Market Size & Forecast

- 2022 Market Size: USD 2.87 Billion

- 2030 Projected Market Size: USD 16.89 Billion

- CAGR (2023-2030): 24.9%

- North America: Largest market in 2022

- Asia Pacific: Fastest growing market

The growing adoption of remote working across industries has empowered employees to execute their responsibilities from different locations and devices. The COVID-19 pandemic has significantly impacted the market, as it has accelerated the adoption of personal devices to perform official tasks due to remote work scenarios. With the pandemic forcing employees to work remotely, adopting these devices has become even more critical. Endpoint detection and response (EDR), also called endpoint detection and threat response (EDTR), is an endpoint security solution used to manage end-user devices continuously to identify and acknowledge cyber-attacks such as malware and ransomware.

Increasing concern for data security owing to the rising popularity of remote working is one of the major market drivers for endpoint detection and response (EDR) solutions. With the rising trend of remote working, there has been an increase in the threat of data breaches and malware attacks. This has been a growing concern for data security, as the devices can be stolen, lost, or hacked, potentially leading to a breach of sensitive corporate data.

EDR solutions can help address these cybersecurity concerns by providing security features such as real-time behavioral analysis of events, as well as historical visibility of memory, disks, and devices. In addition, many industries have regulatory requirements that dictate how data should be handled and secured. EDR solutions can help organizations meet these requirements and ensure compliance, further driving their demand.

Additionally, the Bring Your Own Device (BYOD) trend is promoting the growth of the Endpoint Detection and Response (EDR) market. It refers to the practice of employees using their personal devices for work-related activities, which has become increasingly common in recent years. This trend has led organizations to focus on managing and securing these devices, and EDR solutions provide an effective way to do so.

EDR solutions allow organizations to set policies and control access to corporate data on employee-owned devices. This includes enforcing security policies such as password requirements, encryption, and remote wipe capabilities to protect against data breaches and other security threats. EDR also allows IT administrators to manage devices, applications, and data from a centralized platform, enabling them to ensure compliance with regulations and corporate policies.

However, complexity is one of the key restraints to the growth of the endpoint detection and response market. EDR solutions can be complex to implement and manage, requiring significant IT expertise. This can be a challenge for smaller organizations that may need more resources or expertise to manage these solutions. Additionally, as the number of applications and devices that need to be managed surges, the complexity of EDR solutions can also increase. This can lead to increased expenses, longer implementation periods, and a greater probability for errors.

To address this complexity, many EDR vendors are focusing on developing user-friendly and intuitive interfaces that make it easier for organizations to manage their devices and applications. Thus, while complexity is a significant restraint for the endpoint detection and response (EDR) market, there are extensive efforts underway to make these solutions more accessible and manageable for organizations of all sizes.

Solution Insights

The software segment accounted for the largest market share of 64.5% in 2022. EDR software provides the highest level of protection features, such as behavioral protection, threat insight and intelligence, cloud-based endpoint detection, and a variety of security analytics techniques. IT administrators can set up security policies and protocols to ensure that all devices are compliant with security standards. Additionally, it also helps organizations ensure compliance with various regulatory standards, such as HIPAA, PCI DSS, and GDPR, by enforcing security policies and providing audit trails.

This helps enterprises avoid consequences and reputational damage resulting from non-compliance. Overall, EDR software offers numerous benefits to organizations, ranging from enhanced real-time security and compliance to increased productivity and better user experience. These benefits are driving the increasing adoption of EDR software by organizations of all sizes and in all industries, boosting the market growth for endpoint detection and response (EDR).

The services segment is projected to expand at 25.8% CAGR through 2030. EDR services offer a comprehensive solution to manage & secure end-user devices used for work-related tasks. These services are designed to enable organizations to increase productivity, enhance security, and ensure compliance while providing employees with the flexibility and convenience of using their personal devices for work. Professional services are gaining popularity as they help organizations fix vulnerabilities, reduce additional data losses, and take preemptive measures to protect against future cyber threats.

Deployment Insights

The cloud-based segment accounted for a market share of 54.8% in 2022. Cloud-based EDR solutions are hosted and managed in the cloud. Rather than installing and running EDR software on-premise, organizations can access EDR functionality over the internet via a web-based interface. Cloud-based EDR solutions offer a convenient and cost-effective way for organizations to manage and secure their devices, disks, and memory storage. By leveraging the scalability, accessibility, and security features of cloud-based solutions, organizations can improve productivity, reduce costs, and enhance their overall endpoint detection and response capabilities.

The on-premise segment is anticipated to advance at a CAGR of 23.2% during the forecast period. On-premise EDR solutions provide organizations with complete control over their endpoint detection and response infrastructure, allowing them to tailor the solution to their specific needs and requirements. While they may require more upfront investment and IT resources to implement and maintain, on-premise EDR solutions can offer a higher level of security, compliance, and data privacy than cloud-based solutions.

Endpoint Device Insights

The network devices & servers segment accounted for the highest market share of around 32.4% in 2022. Network devices, including switches, routers, and firewalls, are critical components in the IT infrastructure of different enterprises. They are mainly exposed to cyber threats, making it essential for end-users to shield them from ransomware and malware. Similarly, servers, which are primarily used to store data, are also critical to an organization’s IT infrastructure. EDR solutions help organizations to provide real-time visibility into network devices & servers and help detect and respond to advanced threats.

The Point of Sale (POS) devices segment is expected to expand at a CAGR of 26.9% during the forecast period. Point-of-sale devices are frequent targets for cyber threats, and an EDR solution can provide improved threat detection features to these devices. Furthermore, the growing necessity among enterprises to improve compliance with regulatory requirements such as PCI DSS has further surged the demand for the market.

Enterprise Size Insights

The large enterprise segment accounted for the dominant market share of 53.1% in 2022. Large enterprises are increasingly using EDR solutions to prevent devices from cyber threats. They offer multiple benefits to large-scale enterprises, such as increased productivity, improved security, and cost savings. They provide end-to-end visibility into the activities performed on servers, desktops, and laptops. Large enterprises are increasingly turning to EDR solutions to manage and secure devices efficiently and cost-effectively while ensuring compliance with industry regulations and data protection laws.

The SMEs segment is expected to expand at the highest CAGR of 25.6% during the forecast period. SMEs need a huge amount of IT budgets and resources, making it difficult to secure and offer real-time threat detection capabilities to their devices adequately. As SMEs have limited budgets, EDR solutions can help detect threats and secure the devices at an early stage, nullifying the need for an IT team to manage distinct devices and enhance their life expectancy by confirming they are up-to-date and well-maintained.

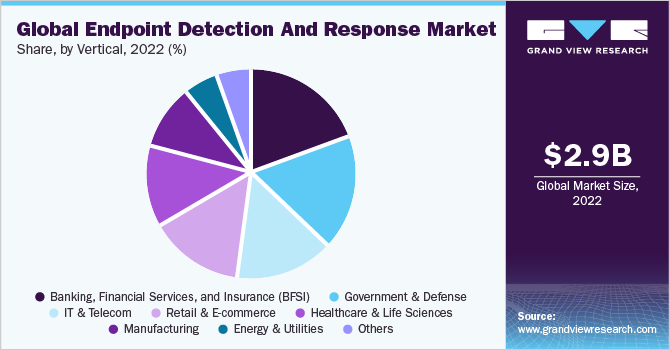

Vertical Insights

The BFSI segment accounted for the largest market share of 19.5% in 2022. The segment is highly vulnerable to cyber threats owing to the high amount of sensitive data they handle, making it critical to have robust security in one place. EDR solutions offer an extra layer of protection by detecting threats that cannot be identified through traditional antivirus software solutions. Further, the solution also offers insights into endpoint activity, enabling the BFSI sector to detect potential security gaps and proactively address cyber issues.

The retail & e-commerce segment is anticipated to expand at the fastest CAGR of 28.3% during the forecast period. The retail industry has been using EDR solutions to provide real-time visibility into endpoint activities and enable identification and security of the devices from advanced threats such as ransomware, malware, and cyber threats. By leveraging EDR solutions, retailers can gain a competitive advantage through enhanced threat detection and response time, reduced data breach risk, and real-time data visibility.

Regional Insights

North America held the largest share of 32.4% of the target market in 2022. The endpoint detection and response market in North America is driven by the increasing adoption of servers, desktops, and mobile devices, the rise in Bring Your Own Device (BYOD) trend, and the need for data security. The U.S. is expected to hold the largest share of the market during this period due to the high adoption of these devices and the presence of major EDR vendors in the region.

The North American market is dominated by several key players, including Palo Alto Networks, SentinelOne, and Broadcom, Inc. These companies offer various EDR solutions that help organizations to perform effective security measures to secure their data, network, and systems from cyber threats.

On the other hand, Asia Pacific is anticipated to emerge as the fastest-developing regional market at a CAGR of 27.2%. Asia Pacific has seen a rapid increase in the Bring Your Own Device (BYOD) trend, and the growing government initiatives to support cybersecurity compliances in order to protect data from threats have resulted in the need for EDR solutions at a faster rate in recent years.

Moreover, the demand for cloud-based EDR solutions is expected to boost the growth of the Asia Pacific market for Endpoint Detection and Response (EDR), as organizations look for scalable and cost-effective solutions. The government, BFSI, and retail sectors are expected to be the major end-users of EDR solutions in the Asia Pacific region due to the high demand among vendors to protect their endpoints from cyber-attacks.

Key Companies & Market Share Insights

The key players operating in the global endpoint detection and response market are broadening their product offerings and utilizing a variety of inorganic growth tactics, such as partnerships, and mergers & acquisitions. In March 2023, Palo Alto Networks announced a product development of its Cortex XSIAM Platform - an EDR with the integration of AI Technology. The AI-driven identity threat detection and response solution enables clients to ingest behavior data and user information in a short time. Some of the prominent players dominating the global endpoint detection and response (EDR) market include:

-

Bitdefender

-

Broadcom, Inc.

-

Cisco Systems

-

CrowdStrike

-

ESET

-

FireEye

-

Fortinet

-

Kaspersky

-

McAfee

-

Microsoft Corporation

-

Palo Alto Networks

-

SentinelOne

-

Sophos

-

Trend Micro

-

VMware Carbon Black

Recent Developments

-

In July 2021, Bitdefender revealed eXtended EDR (XEDR), the next evolution of endpoint detection and response solutions to increase security efficacy for combating the spread of attacks, and advanced persistent threats on business operations

-

In June 2021, Cisco acquired Kenna Security, Inc. to create the most significant endpoint security footprint of the industry

Endpoint Detection And Response (EDR) Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.55 billion

Revenue forecast in 2030

USD 16.89 billion

Growth rate

CAGR of 24.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2023 to 2030

Report updated

May 2023

Report coverage

Revenue forecast, company market share, competitive landscape, growth factors, and trends

Segments covered

Solution, endpoint device, deployment, enterprise size, vertical, region

Regional scope

North America; Europe; Asia Pacific; Middle East & Africa; Latin America

Country scope

U.S.; Canada; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Australia; Brazil; Mexico; Argentina; UAE; Saudi Arabia; South Africa

Key companies profiled

Bitdefender; Broadcom, Inc.; Cisco Systems; CrowdStrike; ESET; FireEye; Fortinet; Kaspersky; McAfee; Microsoft Corporation; Palo Alto Networks; SentinelOne; Sophos; Trend Micro; VMware Carbon Black

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Endpoint Detection And Response (EDR) Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global endpoint detection and response (EDR) market report based on solution, endpoint device, deployment, enterprise size, vertical, and region:

-

Solution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Service

-

Professional Services

-

Managed Services

-

-

-

Endpoint Device Outlook (Revenue, USD Billion, 2018 - 2030)

-

Network Devices & Servers

-

Mobile Devices

-

Point Of Sale (POS) Devices

-

Others

-

-

Deployment Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cloud

-

On-premise

-

-

Enterprise Size Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small & Medium-sized Enterprises

-

Large Enterprises

-

-

Vertical Outlook (Revenue, USD Billion, 2018 - 2030)

-

Banking, Financial Services, and Insurance (BFSI)

-

Healthcare & Life Sciences

-

Government & Defense

-

Retail & E-commerce

-

IT & Telecom

-

Energy & Utilities

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global endpoint detection and response (EDR) market size was estimated at USD 2.87 billion in 2022 and is expected to reach USD 3.55 billion by 2023.

b. The global endpoint detection and response (EDR) market is expected to grow at a compound annual growth rate of 24.9% from 2023 to 2030 to reach USD 16.89 billion by 2030.

b. Software dominated the endpoint detection and response market with a share of 64.3% in 2022. This is attributable to increasing concern for data security owing to the growing popularity of remote working across regions.

b. Some key players operating in the endpoint detection and response (EDR) market include Bitdefender, Broadcom, Inc., Cisco Systems, CrowdStrike, ESET, FireEye, Fortinet, Kaspersky, McAfee, and Microsoft Corporation.

b. Key factors that are driving the endpoint detection and response (EDR) market growth include, the growing adoption of remote working across industries has empowered employees to execute their responsibilities from different locations and devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.