- Home

- »

- Next Generation Technologies

- »

-

Energy-efficient Industrial Cooling Systems Market Report, 2030GVR Report cover

![Energy-efficient Industrial Cooling Systems Market Size, Share & Trends Report]()

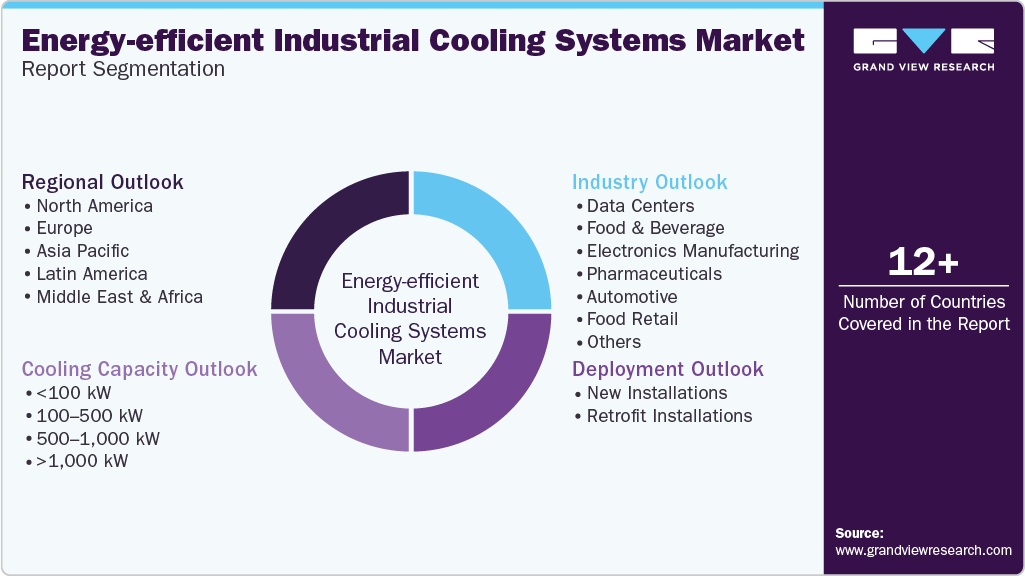

Energy-efficient Industrial Cooling Systems Market (2025 - 2030) Size, Share & Trends Analysis Report By Cooling Capacity (<100 kW, 100-500 kW), By Deployment (New Installations, Retrofit Installations), By Industry, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-583-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Energy-efficient Industrial Cooling Systems Market Summary

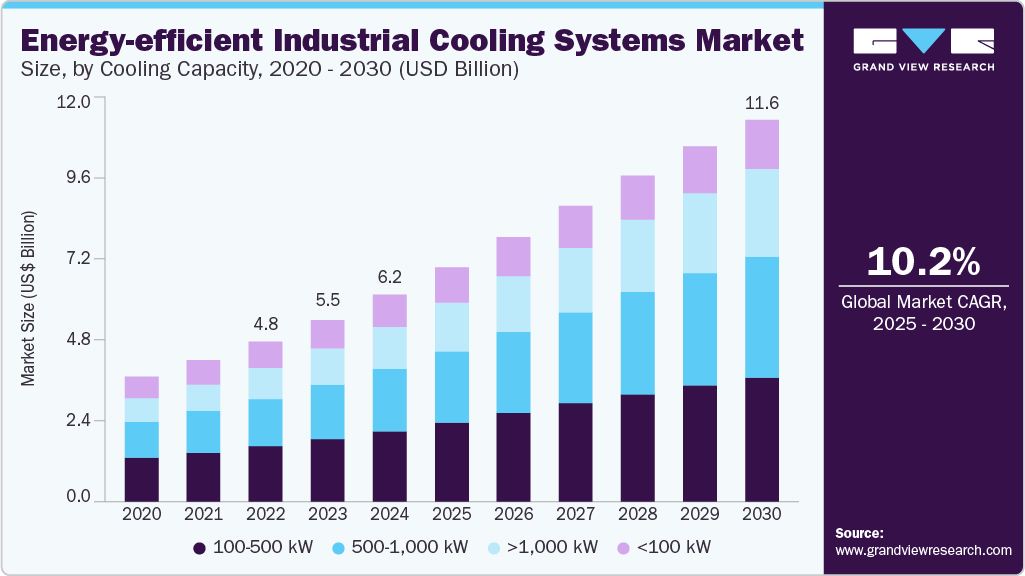

The global energy-efficient industrial cooling systems market size was estimated at USD 6,290.7 million in 2024 and is projected to reach USD 11,608.1 million by 2030, growing at a CAGR of 10.2% from 2025 to 2030. The market growth is primarily driven by the increasing demand for sustainable and cost-effective cooling solutions across energy-intensive industries.

Key Market Trends & Insights

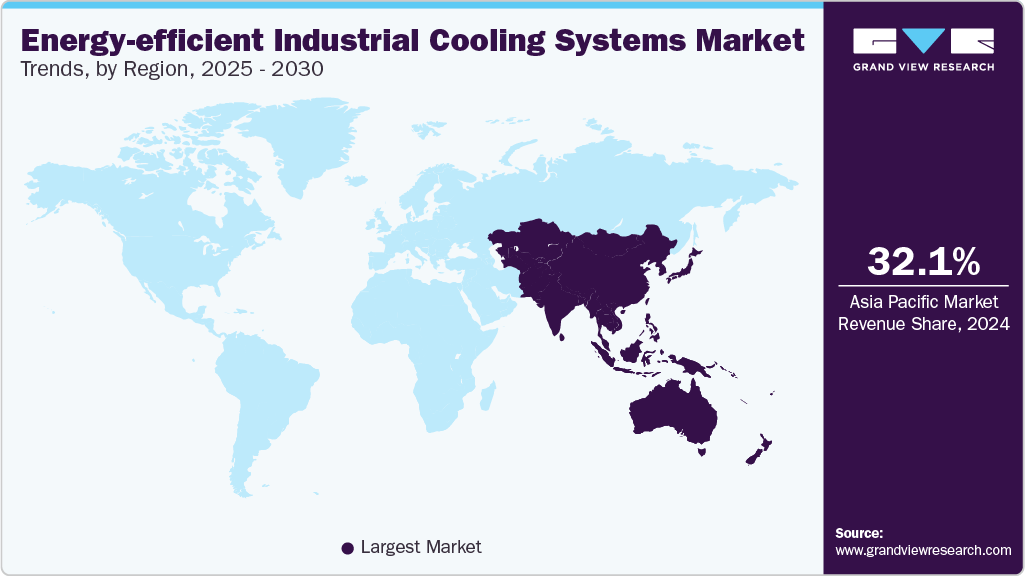

- Asia Pacific energy-efficient industrial cooling systems industry held a significant global market share of 32.1% in 2024.

- The U.S. energy-efficient industrial cooling systems industry is expected to grow at a CAGR of over 9% from 2025 to 2030.

- By cooling capacity, the 100-500 kW segment dominated the market with a market share of over 34% in 2024.

- By industry, the electronics manufacturing segment is expected to witness significant CAGR from 2025 to 2030.

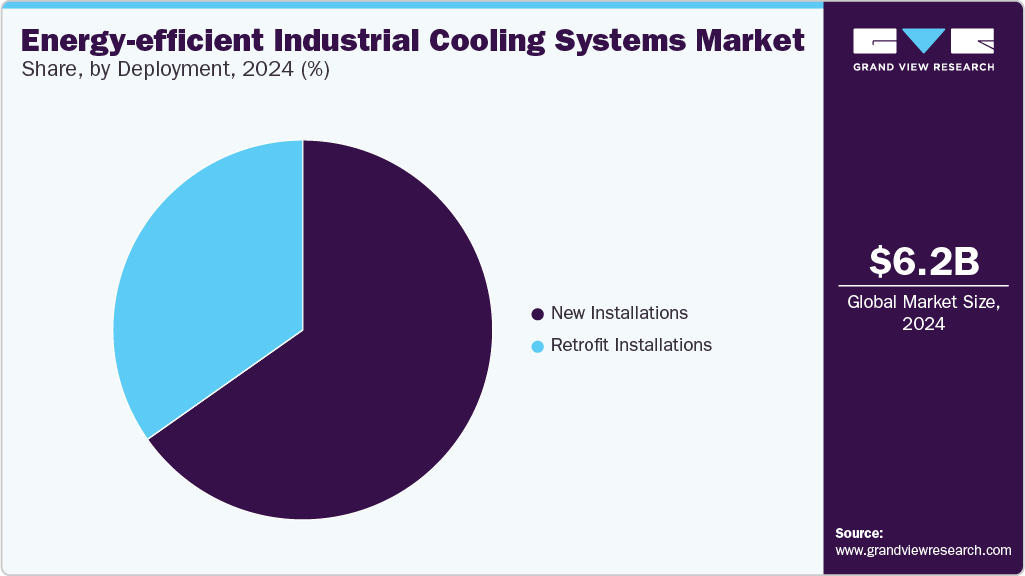

- By deployment, the new installations segment held the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6,290.7 Million

- 2030 Projected Market Size: USD 11,608.1 Million

- CAGR (2025-2030): 10.2%

- Asia Pacific: Largest market in 2024

The growing emphasis on corporate sustainability goals and ESG (Environmental, Social, and Governance) compliance is accelerating the shift towards eco-friendly cooling systems. Technological advancements such as smart cooling systems integrated with IoT sensors and AI-based energy management platforms are optimizing performance and energy consumption. Government incentives and green building certifications are also encouraging industrial players to retrofit existing infrastructure with high-efficiency cooling solutions. The expansion of industrial automation and the proliferation of heat-intensive equipment further underline the need for reliable and efficient thermal management systems, significantly contributing to the expansion of the energy-efficient industrial cooling systems industry.

The increasing demand for energy-efficient solutions across industries significantly influences the growth of the energy-efficient industrial cooling systems industry. Rising energy costs and a global push towards sustainability mean that businesses are increasingly adopting advanced cooling technologies that minimize power consumption without compromising performance. This shift enables industries to reduce operational expenses while aligning with environmental regulations and carbon reduction goals, accelerating the adoption of energy-efficient cooling systems industry.

Stringent government regulations and environmental policies are propelling the market forward. Regulatory frameworks mandating the reduction of greenhouse gas emissions and energy usage in industrial operations are pushing companies to invest in next-generation cooling technologies. Incentives such as tax rebates, subsidies, and compliance benefits further encourage implementing eco-friendly cooling systems, creating a favorable market environment for energy-efficient industrial cooling systems.

Furthermore, the rapid growth of industrial automation and smart manufacturing is reshaping the cooling systems landscape. With the increasing integration of IoT, AI, and data analytics into industrial processes, cooling systems are becoming more intelligent and responsive. These advanced systems offer real-time monitoring, predictive maintenance, and adaptive cooling capabilities, enhancing operational efficiency and reducing downtime, improving overall productivity, and optimizing energy efficiency.

Moreover, the growing adoption of renewable energy and sustainable building practices presents valuable opportunities for energy-efficient cooling systems. With the industries’ move toward green infrastructure and low-carbon operations, there is a heightened focus on integrating Heating, Ventilation, and Air Conditioning (HVAC) and cooling systems that complement renewable power sources such as solar and wind. This alignment with sustainable energy goals is expected to remain a key driver of the energy-efficient industrial cooling systems industry in the coming years.

Cooling Capacity Insights

The 100-500 kW segment dominated the market with a market share of over 34% in 2024, owing to the growing need for medium capacity cooling solutions across industries such as manufacturing, data centers, pharmaceuticals, and food processing. This segment addresses the demand for systems that balance energy efficiency with performance in compact and mid-sized facilities. Stringent environmental regulations and the push for sustainable operations encourage companies to upgrade legacy systems with energy-efficient alternatives in the 100-500 kW range, solidifying this segment's dominance in the market.

The >1,000 kW segment is expected to witness a significant CAGR of over 5% from 2025 to 2030. This growth is driven by the increasing demand for large-scale cooling solutions in energy-intensive sectors like power generation and heavy manufacturing. With facilities scaling up operations and adopting more complex production processes, the need for high-capacity cooling systems that deliver both performance and energy efficiency becomes critical. The integration of smart controls, variable speed drives, and low-GWP refrigerants into these large-capacity systems helps organizations meet stringent energy regulations and sustainability targets. The trend toward industrial decarbonization and operational costs reduction through optimized thermal management is further propelling the demand for cooling systems exceeding 1,000 kW capacity.

Industry Insights

The data centers segment held the largest market share in 2024, driven by the escalating global demand for cloud computing, big data analytics, and digital services. Hyperscale and edge data centers continue to proliferate, and the need for advanced thermal management solutions has become critical to ensure operational reliability and energy efficiency. Growing environmental concerns and regulatory mandates are prompting data center operators to adopt sustainable cooling technologies, such as liquid cooling, adiabatic cooling, and smart monitoring systems. These trends significantly contribute to the dominance and expansion of the data centers segment.

The electronics manufacturing segment is expected to witness significant CAGR from 2025 to 2030, as companies in this industry increasingly adopt energy-efficient industrial cooling systems supporting high-performance production environments. The miniaturization of electronic components and the proliferation of smart devices have intensified the need for cleanroom compatible and energy optimized cooling solutions. Integrating IoT-enabled monitoring and predictive maintenance capabilities enhances operational continuity, making advanced cooling technologies critical to sustaining competitiveness in the global electronics manufacturing sector.

Deployment Insights

The new installations segment held the largest market share in 2024, primarily driven by the growing demand for energy-efficient solutions across newly constructed industrial facilities. New installations allow organizations to implement state-of-the-art technologies such as variable speed drives, smart controls, and low-GWP refrigerants without the limitations of legacy infrastructure. The global push toward greenfield industrial projects, particularly in sectors such as manufacturing, data centers, and power generation, is fueling the adoption of high-efficiency cooling systems. These factors collectively support the dominance of the new installations segment in the energy-efficient industrial cooling systems industry.

The retrofit installations segment is expected to witness the fastest CAGR from 2025 to 2030. Aging infrastructure and the increasing demand for energy optimization are driving industries to upgrade existing systems rather than invest in entirely new installations. Retrofit solutions offer a cost-effective approach to improving operational efficiency, reducing carbon emissions, and complying with evolving environmental regulations. Advancements in smart control systems and modular components make retrofitting more accessible and less disruptive to ongoing operations.

Regional Insights

North America energy-efficient industrial cooling systems industry held a significant global market share of over 30% in 2024, primarily driven by its strong industrial base, including manufacturing, chemical processing, and data centers. The region's strict energy efficiency regulations and government incentives are accelerating the adoption of energy-efficient industrial cooling systems. Growing investment in smart factories and automation has increased demand for intelligent cooling technologies that enhance operational efficiency. The rapid expansion of data centers across the region is fueling the need for advanced cooling solutions with low energy consumption. Integrating renewable energy and smart grid infrastructure further supports market growth in the region.

U.S. Energy-efficient Industrial Cooling Systems Market Trends

The U.S. energy-efficient industrial cooling systems industry is expected to grow at a CAGR of over 9% from 2025 to 2030, driven by the country's strong emphasis on technological innovation and modernization of industrial infrastructure. Federal and state-level energy efficiency mandates, carbon reduction goals, and financial incentives are encouraging industries to adopt advanced, energy-saving cooling technologies. The expanding footprint of data centers and high-tech manufacturing facilities further amplifies demand for systems that offer reliable thermal management with minimal energy consumption. The combination of regulatory support, industrial demand, and economic incentives is expected to sustain robust market growth.

Europe Energy-efficient Industrial Cooling Systems Market Trends

The Europe energy-efficient industrial cooling systems industry is expected to grow at a CAGR of over 8% from 2025 to 2030. In Europe, this growth is driven by the region’s commitment to carbon neutrality and the enforcement of EU directives to reduce industrial energy consumption. Industries such as pharmaceuticals, data centers, and food processing are increasingly investing in sustainable cooling technologies to meet operational and regulatory demands. The rise of smart factories, supported by the European Commission’s Industry 5.0 agenda, is fueling demand for intelligent and adaptive cooling systems. Rising energy prices across Europe are compelling manufacturers to seek high-efficiency systems to lower utility costs and improve long-term competitiveness.

The UK energy-efficient industrial cooling systems industry is expected to grow significantly in the coming years. The country has aggressive decarbonization goals and a commitment to achieving net-zero emissions. The growth of data centers, coupled with rising energy prices, is also prompting the adoption of high-efficiency cooling systems to ensure operational stability and cost control. This evolving industrial landscape, supported by policy incentives and sustainability initiatives, continues to strengthen demand for energy-efficient cooling systems industry across the country.

The Germany energy-efficient industrial cooling systems industry is fueled by the country’s strong commitment to energy transition policies and environmental sustainability targets. Initiatives like the “Energiewende” in Germany promote reduced energy consumption and lower carbon emissions across all industrial operations, spurring demand for high-efficiency cooling technologies. Germany’s robust investment in research and development fosters continuous innovation in thermal management systems tailored to local energy standards. Energy costs remain high, industrial stakeholders are increasingly prioritizing efficient cooling systems to ensure cost-effective and compliant operations.

Asia Pacific Energy-efficient Industrial Cooling Systems Market Trends

The Asia Pacific energy-efficient industrial cooling systems industry is expected to grow at a CAGR of over 12% from 2025 to 2030, driven by accelerating industrialization, urban expansion, and rising environmental awareness across key economies. The region’s expanding manufacturing base, particularly in sectors such as automotive, electronics, and pharmaceuticals, is driving the demand for efficient cooling solutions to support continuous high-performance operations. Technological advancements, including adopting IoT-enabled cooling systems and AI-based energy management platforms, further enhance system efficiency and operational control. These combined factors position Asia Pacific as a critical growth hub for the energy-efficient industrial cooling systems industry.

The Japan energy-efficient industrial cooling systems industry is gaining traction, driven by the country’s advanced technological capabilities and strong industrial base. Japan’s commitment to sustainable manufacturing practices, particularly in sectors like automotive, electronics, and heavy industries, is propelling the demand for energy-efficient cooling systems. The country’s focus on reducing energy consumption and lowering carbon footprints is further accelerating the adoption of these solutions. With industries increasingly prioritizing eco-friendly operations and compliance with stringent environmental standards, the demand for energy-efficient industrial cooling systems is expected to rise in the coming years.

The China energy-efficient industrial cooling systems industry is rapidly expanding and is expected to grow over the forecast period. China's push for green manufacturing and its efforts to meet international environmental standards create a favorable market environment for energy-efficient solutions. The rise of smart manufacturing technologies and increased automation in Chinese industries also contributes to the demand for intelligent cooling systems that optimize energy use. China continues to focus on reducing carbon emissions and enhancing energy efficiency.

Key Energy-efficient Industrial Cooling Systems Company Insights

Some of the key players operating in the market include Johnson Controls and Carrier, among others.

-

Johnson Controls is a global leader in building technologies and industrial solutions, offering a broad portfolio of energy-efficient products and services. With a strong commitment to sustainability and innovation, the company delivers advanced industrial cooling systems under its YORK® brand, which are widely recognized for their superior efficiency and environmental performance. Johnson Controls integrates smart controls, AI-driven automation, and IoT technologies into its cooling solutions, enabling real-time performance optimization, energy savings, and predictive maintenance.

-

Carrier is a multinational corporation specializing in high-performance heating, ventilation, air conditioning (HVAC), and refrigeration systems, with a strong emphasis on energy-efficient industrial cooling technologies. Known for its extensive product range, including chillers, cooling towers, and air-handling units, Carrier develops and delivers cutting-edge cooling solutions that align with global sustainability and energy-saving initiatives. Carrier’s industrial cooling systems are widely used across food and beverage, pharmaceuticals, manufacturing, and data centers.

Rittal Pvt. Ltd. and Baltimore Aircoil Company, Inc. are some of the emerging market participants in the energy-efficient industrial cooling systems industry.

-

Rittal Pvt. Ltd. is a globally recognized provider of industrial and IT infrastructure solutions, with a strong specialization in energy-efficient enclosure and cooling technologies. The company focuses on delivering highly efficient thermal management systems, such as its Blue e+ cooling units. Rittal’s solutions are designed to support digital transformation in industrial environments by offering intelligent, IoT-enabled cooling that ensures optimal equipment performance, extended component life, and reduced energy costs. Its commitment to innovation and sustainability makes Rittal a strategic partner for manufacturers, data centers, and automation facilities aiming to improve operational efficiency and environmental compliance.

-

Baltimore Aircoil Company, Inc. (BAC) is a manufacturer of innovative evaporative cooling and heat rejection equipment, playing a critical role in advancing energy-efficient industrial cooling systems. The company offers a wide portfolio of cooling towers, hybrid coolers, and adiabatic systems that are designed to minimize energy and water usage while delivering superior performance in a wide range of climates. Integrating smart controls, variable frequency drives, and water-efficient designs, BAC helps clients achieve significant reductions in operating costs and environmental impact, positioning it as an emerging force in the sustainable industrial cooling landscape.

Key Energy-eficient Industrial Cooling Systems Companies:

The following are the leading companies in the energy-efficient industrial cooling systems market. These companies collectively hold the largest market share and dictate industry trends.

- Johnson Controls.

- ABB

- ALFA LAVAL

- Baltimore Aircoil Company, Inc.

- Carrier.

- Schneider Electric

- Danfoss A/S

- SPX Cooling Tech, LLC

- Trane Technologies plc

- Rittal Pvt. Ltd.

Recent Developments

-

In April 2025, Alfa Laval unveiled the TS25 semi-welded heat exchanger, designed to enhance energy efficiency across clean energy and heavy process industries. The TS25 is specifically engineered for high-performance applications such as electrolyser cooling, sulphuric acid production, and industrial heat pumps, delivering superior cooling and heat recovery while minimizing pressure drop. Advanced sealing technology, compact design, and improved durability, the new heat exchanger supports cleaner hydrogen production and lowers the levelized cost of energy. This launch reinforces Alfa Laval’s commitment to supporting the evolving energy landscape with scalable and efficient thermal solutions.

-

In February 2025, Baltimore Aircoil Company, Inc. showcased its latest sustainable cooling innovations at the AHR Expo 2025 in Orlando, Florida. The company unveiled its newly released immersion cooling tank, which reduces overall energy consumption by 51% and cooling energy by 95%, addressing the rising demands of data center thermal management. BAC also introduced its TrilliumSeries® adiabatic cooler with a smart water management system and up to 20% energy savings, and the AI-powered Loop™ platform designed for real-time system optimization and predictive maintenance. These launches reflect BAC’s continued commitment to advancing energy-efficient cooling solutions.

-

In February 2025, SPX Cooling Tech, LLC announced the launch of its next-generation factory-assembled cooling towers, designed to significantly enhance deployment speed and operational efficiency. The new models can be delivered up to 60% faster and installed 80% quicker compared to traditional field-erected towers. This development aims to support HVAC and industrial facilities in accelerating project timelines, reducing labor costs, and improving overall energy efficiency. The innovation reflects SPX's continued commitment to advancing sustainable cooling solutions across critical infrastructure sectors.

Energy-efficient Industrial Cooling Systems Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 7,133.6 million

Revenue forecast in 2030

USD 11,608.1 million

Growth Rate

CAGR of 10.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Cooling capacity, deployment, industry, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; South Africa; UAE; Saudi Arabia

Key companies profiled

Johnson Controls.; ABB; ALFA LAVAL; Baltimore Aircoil Company, Inc.; Carrier; Schneider Electric; Danfoss A/S; SPX Cooling Tech, LLC; Trane Technologies plc; Rittal Pvt. Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Energy-Efficient Industrial Cooling Systems Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest technological trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global energy-efficient industrial cooling systems market report based on cooling capacity, deployment, industry, and region:

-

Cooling Capacity Outlook (Revenue, USD Million, 2018 - 2030)

-

<100 kW

-

100-500 kW

-

500-1,000 kW

-

>1,000 kW

-

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

New Installations

-

Retrofit Installations

-

-

Industry Outlook (Revenue, USD Million, 2018 - 2030)

-

Data Centers

-

Food & Beverage

-

Electronics Manufacturing

-

Pharmaceuticals

-

Automotive

-

Food Retail

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

UAE

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global energy-efficient industrial cooling systems market size was estimated at USD 6,290.7 million in 2024 and is expected to reach USD 7,133.6 million in 2025.

b. The global energy-efficient industrial cooling systems market is expected to grow at a compound annual growth rate of 10.2% from 2025 to 2030 to reach USD 11,608.1 million by 2030.

b. Asia Pacific accounted for the largest share of over 32% in 2024 primarily driven by accelerating industrialization, urban expansion, and rising environmental awareness across key economies. The region’s expanding manufacturing base, particularly in sectors like automotive, electronics, and pharmaceuticals, is driving the demand for efficient cooling solutions to support continuous high-performance operations.

b. The key players in the energy-efficient industrial cooling systems market include Johnson Controls., ABB, ALFA LAVAL, Baltimore Aircoil Company, Inc., Carrier., Schneider Electric, Danfoss A/S, SPX Cooling Tech, LLC, Trane Technologies plc, Rittal Pvt. Ltd.

b. Key factors driving market growth include rising energy costs, strict environmental regulations, and corporate sustainability goals. Advances in technologies like IoT and variable speed drives enhance efficiency, while industries replace aging infrastructure. Demand from data centers and temperature-sensitive sectors, along with government incentives, further boosts adoption of low-energy, resource-efficient cooling solutions.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.