- Home

- »

- Conventional Energy

- »

-

Enhanced Oil Recovery Market Size And Share Report, 2030GVR Report cover

![Enhanced Oil Recovery Market Size, Share & Trends Report]()

Enhanced Oil Recovery Market Size, Share & Trends Analysis Report, By Technology (Thermal, CO2 Injection, Chemical), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-343-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Energy & Power

Enhanced Oil Recovery Market Trends

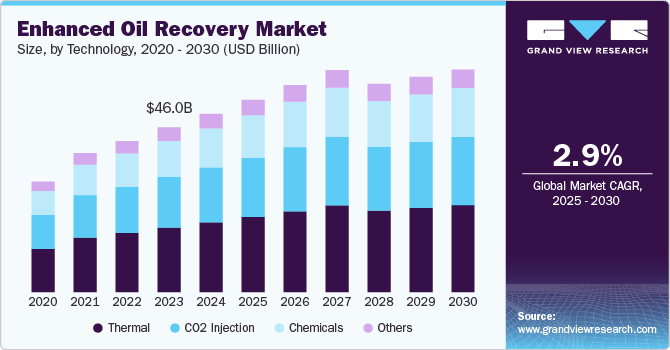

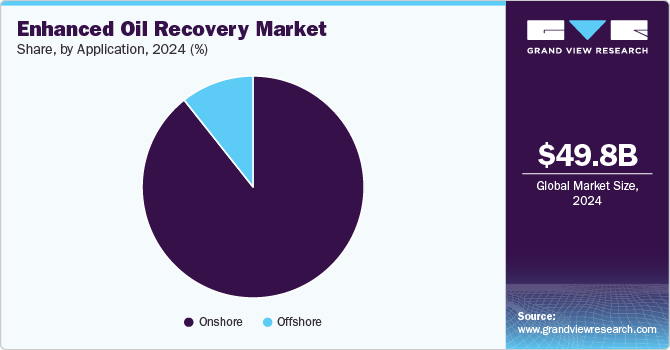

The global enhanced oil recovery market size was estimated at USD 49,835.3 million in 2024 and is projected to grow at a CAGR of 2.9% from 2025 to 2030. The enhanced oil recovery (EOR) market is primarily driven by the increasing global demand for oil and gas, particularly as conventional reserves dwindle. As mature oilfields, which account for approximately 70% of global production, face depletion, companies are increasingly focusing on EOR techniques to extend their lifespan and boost output.

This trend is particularly evident in North America, where a significant number of mature oil fields are located, necessitating advanced extraction methods to recover billions of barrels of trapped oil123. Technological advancements in EOR processes, including gas injection and thermal recovery methods, also propelling the market growth by enhancing extraction efficiency and reducing operational costs.

Drivers, Opportunities & Restraints

The rise in environmental concerns regarding carbon emissions has resulted in an enhanced demand for the carbon capture and storage (CCS) market, which has emerged as a viable solution to limit carbon emissions. These factors are expected to positively impact EOR market as captured carbon in CCS projects are usually utilized by oil & gas companies for CO2 injection EOR technology.

The enhanced oil recovery (EOR) market presents significant opportunities driven by the growing global demand for energy, particularly in emerging economies like China and India, necessitates increased oil production from existing reserves, making EOR a viable solution to maximize output from mature fields.

The enhanced oil recovery (EOR) market faces several significant restraints that hinder its growth. One of the primary challenges is the high investment costs associated with EOR technologies, which often require substantial capital for infrastructure, specialized equipment, and advanced materials. These costs can strain the financial resources of oil companies, particularly in a volatile economic environment.

Technology Insights & Trends

Thermal held the market with the largest revenue share of 39.1% in 2024. The thermal enhanced oil recovery (EOR) market is a crucial segment of the broader EOR industry, characterized by its application of heat to improve oil extraction from reservoirs, particularly those containing heavy oil.

The global thermal EOR market is projected to grow significantly, driven by the depletion of conventional oil reserves and the increasing demand for energy across emerging economies, particularly in Asia-Pacific regions like China and India. This growth is supported by ongoing advancements in thermal technologies, including steam injection and in-situ combustion methods, which are essential for maximizing recovery from mature and heavy oil fields

Application Insights & Trends

Offshore segment held the largest revenue share of 89.2% in 2024. The onshore enhanced oil recovery (EOR) market is a vital segment within the global EOR landscape, characterized by its focus on extracting additional oil from mature onshore fields. This segment is expected to dominate the market, driven by the significant presence of aging oil reserves, particularly in regions like North America, the Middle East, and Africa.

Technological advancements in EOR methods, such as thermal and chemical techniques, are enhancing recovery rates and operational efficiency. Furthermore, favorable regulatory environments and government support for energy security are fostering investments in onshore EOR projects. Overall, the onshore EOR market is poised for significant growth as it addresses the challenges of declining production while contributing to global energy needs.

Regional Insights & Trends

North America enhanced oil recovery market accounted for largest revenue share of over 38.1% in 2024. The North America enhanced oil recovery (EOR) market is a dominant force in the global landscape, primarily driven by the extensive oil reserves and advanced extraction technologies available in the region. The U.S. being the major contributor in the region due to its mature oil fields and unconventional resources to implement various EOR techniques, such as thermal recovery and gas injection, which significantly enhance oil production from aging reservoirs. In addition, regional growth can be attributed to the presence of several unconventional oil and gas resources and matured fields in the country, require advanced extraction techniques to boost production from existing wells. Further, leading oil & gas exploration companies in Canada are also utilizing EOR technology to efficiently recover the oil from fields.

U.S. Enhanced Oil Recovery Market Trends

The U.S. enhanced oil recovery (EOR) market is a critical component of the energy sector, characterized by its innovative techniques aimed at maximizing oil extraction from mature fields. As conventional oil reserves decline, EOR technologies such as thermal recovery, gas injection, and chemical flooding are increasingly employed to enhance production efficiency and extend the life of aging reservoirs.

Europe Enhanced Oil Recovery Market Trends

Europe enhanced oil recovery market is primarily driven by several key factors. Aging oilfields and reservoir depletion are significant challenges, prompting operators to adopt EOR techniques to revitalize mature fields and maximize hydrocarbon extraction. Technological advancements play a crucial role, enabling companies to optimize EOR methods and improve reservoir characterization, which enhances overall recovery rates.

The enhanced oil recovery (EOR) market in the UK is experiencing growth driven by several key factors. Aging oilfields, particularly in the North Sea, are prompting operators to adopt EOR techniques to maximize extraction from these mature reservoirs, which have seen declining production rates over the years. The UK government’s commitment to energy security and environmental sustainability is fostering a favorable regulatory environment that encourages investment in EOR technologies.

Russia enhanced oil recovery (EOR) market is driven by several critical factors that underscore its importance in the global energy landscape. A primary driver is the country's substantial reliance on oil and gas exports, which necessitates the optimization of production from existing fields to maintain revenue levels. As many of these fields age and conventional reserves decline, EOR techniques, particularly gas injection methods like water alternating gas (WAG) and chemical processes such as polymer flooding, are increasingly adopted to maximize extraction efficiency.

Asia Pacific Enhanced Oil Recovery Market Trends

The enhanced oil recovery (EOR) market in the Asia Pacific region is experiencing significant growth, driven by a combination of increasing energy demand and the need to optimize production from aging oil fields. Rapid industrialization and urbanization in countries like China and India are leading to higher oil consumption, creating a pressing requirement for advanced recovery techniques.

China Enhanced Oil Recovery Market is actively witnessing initiatives taken by the the Chinese government to supports EOR industry through various policies, incentives, and regulatory frameworks designed to encourage oil operators to adopt advanced recovery technologies. This backing facilitates investment and fosters collaborations with international oil companies to enhance domestic capabilities and expertise. Additionally, the increasing energy demand driven by rapid industrialization and urbanization further propels the need for efficient oil recovery methods. As conventional oil reserves face depletion, EOR technologies become essential for maximizing output from existing fields, aligning with China’s broader energy security goals. Overall, these factors collectively contribute to the robust growth of the EOR market in China, reflecting its strategic importance in meeting both domestic and global energy needs.

The enhanced oil recovery (EOR) market in India is poised for significant growth, driven by several key factors that reflect the country's evolving energy landscape. As domestic energy demand continues to rise due to rapid industrialization and urbanization, there is an increasing need to optimize oil production from existing fields, particularly those that are aging and experiencing declining output.

Central & South America Enhanced Oil Recovery Market Trends

The enhanced oil recovery (EOR) market in Central and South America is poised for growth, driven by several influential factors. The region boasts significant oil reserves, particularly in countries like Brazil and Argentina, where aging fields require advanced recovery techniques to maintain production levels. The increasing demand for energy, fueled by economic development and industrialization, compels operators to optimize existing resources through EOR methods.

Middle East & Africa Enhanced Oil Recovery Market Trends

The enhanced oil recovery (EOR) market in the Middle East and Africa is experiencing notable growth, driven by several key factors. The region's vast oil reserves, particularly in countries like Saudi Arabia, Oman, and the UAE, necessitate advanced recovery techniques to optimize production from aging fields. As many of these reservoirs face declining output, EOR methods such as thermal and chemical techniques are increasingly adopted to enhance extraction efficiency

Enhanced Oil Recovery Market Company Insights

The enhanced oil recovery (EOR) market features a competitive landscape dominated by several key players who drive innovation and growth within the industry. Major companies such as ExxonMobil, Chevron, BP, and Shell are at the forefront, leveraging advanced technologies and extensive resources to optimize oil extraction from mature fields. These firms are increasingly focusing on adopting various EOR techniques, including thermal recovery, gas injection, and chemical methods, to enhance production efficiency and extend the life of existing reservoirs.

Key Enhanced Oil Recovery Companies:

The following are the leading companies in the enhanced oil recovery market. These companies collectively hold the largest market share and dictate industry trends.

- BP plc

- Cenovus Energy, Inc.

- Chevron Corporation

- Equinor ASA

- ExxonMobil Corporation

- LUKOIL

- Petróleo Brasileiro S.A.

- Total SA

Recent Developments

-

In May 2024, Dow and the University of Wyoming launched the Wyoming Gas Injection Initiative (WGII) to enhance oil recovery from existing fields in Wyoming. This program will conduct field pilot tests using advanced methods like foam-assisted gas injection with recovered hydrocarbon gases and carbon dioxide. The initiative aims to improve oil productivity while also addressing greenhouse gas emissions.

-

In May 2024, ICM partnered with Western New York Energy to implement its proprietary FOT Oil Recovery technology at WNYE's facility in Medina, New York. Under this agreement, ICM will manage the engineering, equipment procurement, and installation of the system, marking the sixth commercial deployment of this innovative oil recovery technology.

Enhanced Oil Recovery Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 53,777.2 million

Revenue forecast in 2030

USD 62,173.9 million

Growth rate

CAGR of 2.9% from 2025 to 2030

Historical data

2018 - 2023

Base Year

2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD Million, Volume in Million BBL, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, Volume forecast, competitive landscape, growth factors and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Mexico; Germany; France; UK; Italy; Spain; Russia; China; India; Japan; Australia; Brazil; Argentina; Saudi Arabia; South Africa; UAE

Key companies profiled

ExxonMobil Corporation; BP plc; China Petroleum & Chemical Corporation; Total SA; Royal Dutch Shell plc; Chevron Corporation; Petróleo Brasileiro S.A.; LUKOIL; Cenovus Energy, Inc.; Equinor ASA

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enhanced Oil Recovery Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented enhanced oil recovery Market report based on technology, application, and region:

-

Technology Outlook (Volume, Million bbl; Revenue, USD Million, 2018 - 2030)

-

Thermal

-

CO2 Injection

-

Chemical

-

Others

-

-

Application Outlook (Volume, Million bbl; Revenue, USD Million, 2018 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Volume, Million bbl, Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

Italy

-

Spain

-

France

-

Russia

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

-

Frequently Asked Questions About This Report

b. The global enhanced oil recovery market size was estimated at USD 49,835.3 million in 2024 and is expected to reach USD 53,777.2 million in 2025.

b. The global enhanced oil recovery market is expected to witness a compound annual growth rate of 2.9% from 2025 to 2030 to reach USD 62,173.9 million by 2030.

b. Onshore was the largest application segment accounting for 89.33% of the total market in 2024 owing to a large number of matured onshore oil fields.

b. Some key players operating in the enhanced oil recovery market include ExxonMobil Corporation, BP plc, China Petroleum & Chemical Corporation, Total SA, Royal Dutch Shell plc, Chevron Corporation, and others.

b. Key factors driving the growth of the enhanced oil recovery market include the development of advanced technologies along with favorable government plans and policies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."