- Home

- »

- Distribution & Utilities

- »

-

Carbon Capture & Storage Market Size & Share Report, 2033GVR Report cover

![Carbon Capture & Storage Market Size, Share & Trends Report]()

Carbon Capture & Storage Market (2026 - 2033) Size, Share & Trends Analysis Report By Capture Technology (Post Combustion, Industrial Process, Pre-combustion, Oxy-Combustion), By Application (Power Generation, Oil & Gas), By Region, And Segment Forecasts

- Report ID: GVR-1-68038-216-7

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2026 - 2033

- Industry: Energy & Power

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Carbon Capture & Storage Market Summary

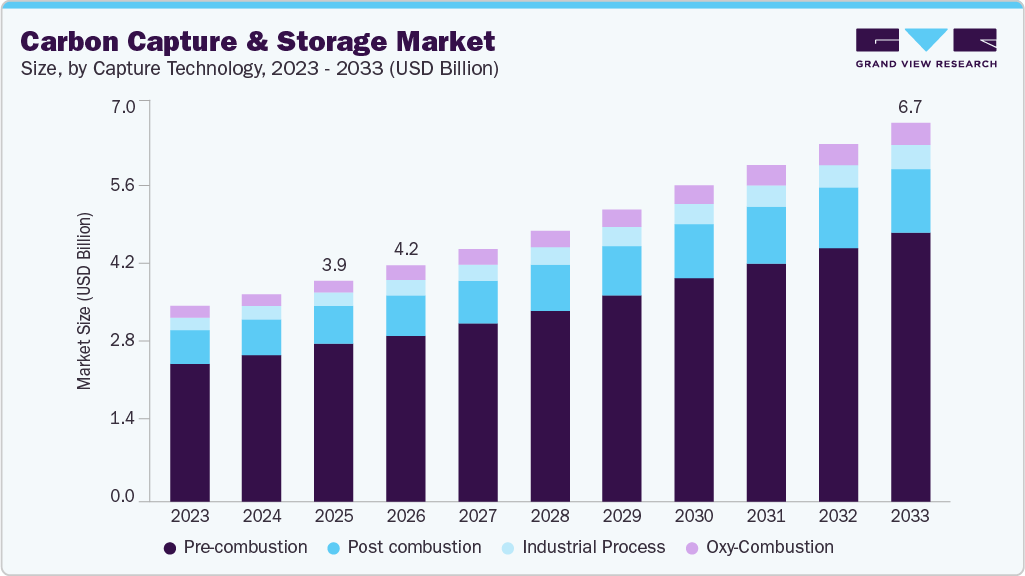

The global carbon capture & storage market size was valued at USD 3,921.55 million in 2025 and is projected to reach USD 6,719.31 million by 2033, growing at a CAGR of 7.0% from 2026 to 2033. The industry is driven by the rising global focus on decarbonization, stringent emission reduction mandates, and increasing investments in carbon mitigation technologies across industrial and power generation sectors.

Key Market Trends & Insights

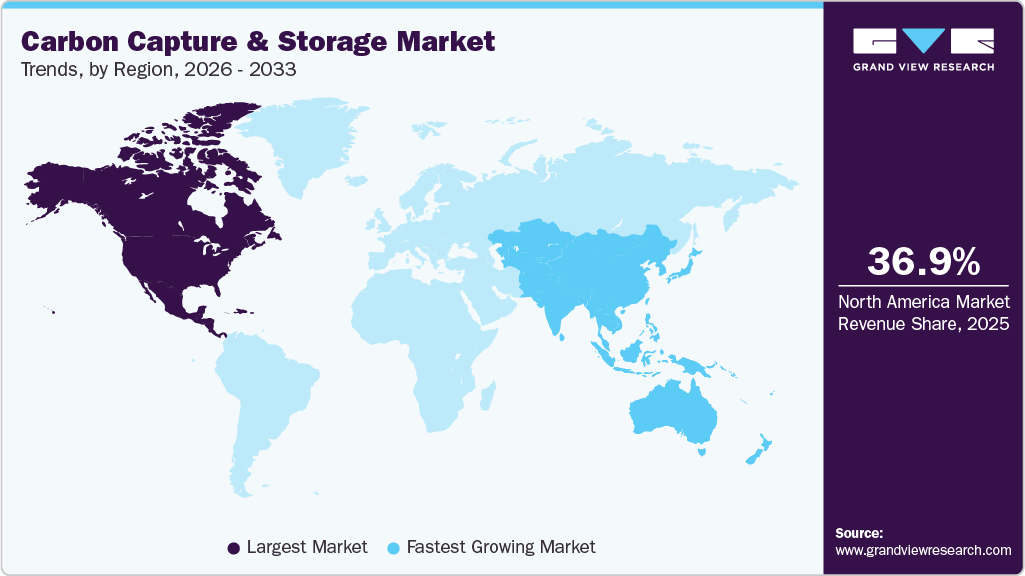

- North America carbon capture & storage market held the largest share of 36.89% of the global market in 2025.

- The carbon capture & storage market in the U.S. is expected to grow significantly over the forecast period.

- By capture technology, pre-combustion held the highest market share of 71.80% in 2025.

Market Size & Forecast

- 2025 Market Size: USD 3,921.55 Million

- 2033 Projected Market Size: USD 6,719.31 Million

- CAGR (2026-2033): 7.0%

- North America: Largest market in 2025

- Asia Pacific: Fastest growing market

CCS systems, encompassing carbon capture, transportation, utilization, and storage, play a vital role in reducing CO₂ emissions from energy-intensive industries such as cement, steel, and oil & gas. Continuous technological advancements in capture efficiency, coupled with growing deployment of carbon utilization projects and enhanced oil recovery applications, are further accelerating adoption. Moreover, supportive government policies, tax incentives, and funding for large-scale demonstration projects are enhancing market development, positioning CCS as a critical enabler in achieving long-term net-zero and climate sustainability goals.

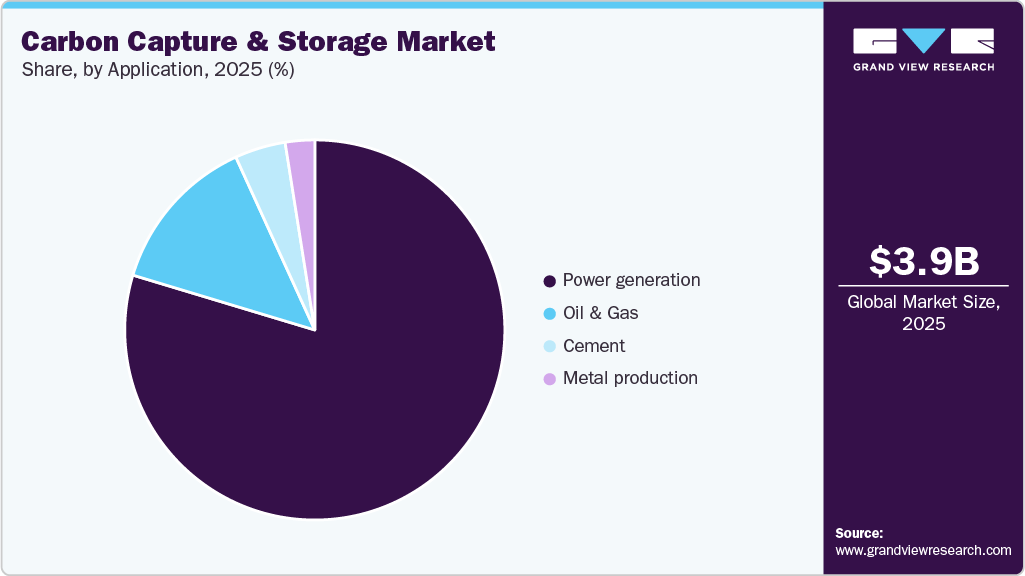

The global CCS market is dominated by the power generation sector, which accounts for a significant share of deployment. Coal- and gas-fired power plants remain major CO₂ emitters, and CCS technologies are increasingly implemented to meet stringent emission reduction targets and regulatory requirements. Capturing carbon from power generation facilities not only helps reduce greenhouse gas emissions but also supports the transition to low-carbon energy systems while allowing continued use of existing infrastructure. Integration of CCS with advanced power generation technologies, such as integrated gasification combined cycle (IGCC) and combined heat and power (CHP) plants, enhances overall system efficiency and positions CCS as a critical enabler in decarbonizing the electricity sector globally.

In addition to power generation, industrial applications-including oil & gas, metal production, cement, and other heavy industries-represent significant growth opportunities for the CCS market. In the oil & gas sector, captured CO₂ is often utilized for enhanced oil recovery (EOR), providing both economic value and emission reduction benefits. Industries such as cement and steel face inherent process emissions that cannot be fully mitigated through renewable energy, making CCS a vital tool for achieving net-zero goals. Furthermore, emerging applications in chemicals, bioenergy, and hydrogen production are driving diversification within the market. Across these sectors, ongoing investments in pilot projects, technological advancements, and supportive policies are fostering broader adoption, positioning CCS as an essential solution for industrial decarbonization and sustainable development.

Drivers, Opportunities & Restraints

The global carbon capture and storage (CCS) industry is primarily driven by the rising emphasis on decarbonization, stringent emission reduction mandates, and the growing need to mitigate industrial greenhouse gas emissions. Increasing CO₂ emissions from sectors such as power generation, cement, steel, and oil & gas have accelerated the deployment of CCS technologies that capture, transport, and store carbon dioxide from large point sources. These systems play a critical role in achieving net-zero targets and maintaining energy security while enabling continued use of fossil-based assets in a low-carbon framework. Supportive government policies, tax incentives, and funding for pilot and large-scale CCS projects further strengthen market growth. Moreover, advancements in capture technologies-including solvent-based, membrane, and adsorption methods-along with the integration of CCS in hydrogen and bioenergy production, are enhancing process efficiency and reducing overall operational costs, positioning CCS as a key component of global climate mitigation strategies.

Opportunities in the CCS market are expanding as industries and governments prioritize carbon management solutions to meet sustainability and climate commitments. The growing focus on carbon utilization-where captured CO₂ is converted into value-added products such as synthetic fuels, chemicals, and construction materials-offers new commercial avenues. Increased collaboration through public-private partnerships and cross-border CO₂ transport infrastructure development supports large-scale deployment. Emerging economies are also exploring CCS's potential to decarbonize heavy industries while maintaining economic growth. Additionally, the integration of CCS with direct air capture (DAC) and carbon capture, utilization, and storage (CCUS) clusters presents opportunities for regional carbon hubs and circular carbon economies. The rise in corporate net-zero pledges and the emergence of carbon credit trading mechanisms further accelerate investments and innovation within the market.

However, the CCS industry faces several restraints, including high capital and operating costs, technological complexity, and uncertainties surrounding long-term storage integrity. Limited CO₂ transport and storage infrastructure, coupled with the need for extensive geological assessments, hampers widespread adoption. Public acceptance issues and environmental concerns related to potential leakage risks also challenge project implementation. Moreover, the absence of uniform carbon pricing mechanisms and policy inconsistencies across regions limit the pace of deployment. Developing scalable business models and risk-sharing frameworks, along with continued R&D to enhance capture efficiency and cost-effectiveness, will be essential to overcoming these barriers and unlocking the full potential of carbon capture and storage in achieving global emission reduction goals.

Capture Technology Insights

The pre-combustion segment held the largest revenue share of 71.80% in 2025, dominating the capture technology landscape of the global carbon capture & storage market. This dominance is primarily attributed to its high efficiency in capturing CO₂ before fuel combustion, making it particularly suitable for large-scale industrial and power generation applications. The process enables effective separation of carbon dioxide from hydrogen and other gases, supporting both emission reduction and clean fuel production.

Growing adoption of integrated gasification combined cycle (IGCC) plants and the rising focus on low-carbon hydrogen (blue hydrogen) production have further fueled the demand for pre-combustion technology. Its ability to deliver high capture rates at lower energy penalties compared to post-combustion methods continues to strengthen its market position, especially across regions with established carbon-intensive industries and supportive carbon reduction frameworks.

Application Insights

The power generation segment held the largest revenue share of 70.11% in 2025, leading the application landscape of the global carbon capture & storage market. This dominance is largely driven by the significant carbon emissions produced by coal- and natural gas-fired power plants, prompting utilities to integrate carbon capture technologies to comply with tightening environmental regulations and decarbonization targets. The ability of carbon capture systems to substantially reduce greenhouse gas emissions while maintaining a baseload power supply has reinforced their adoption across large-scale power facilities.

Increasing investments in retrofitting existing power plants with capture systems, along with the development of new low-emission thermal plants, have further accelerated segment growth. Supportive government policies, carbon pricing mechanisms, and funding for clean energy infrastructure continue to encourage deployment in the power sector. Moreover, the growing need for reliable electricity alongside the global transition toward net-zero emissions is expected to sustain the segment’s leadership, particularly in regions heavily dependent on fossil fuel-based power generation.

Regional Insights

The North America carbon capture & storage market held the largest share of approximately 36.89% in 2025. This dominance is driven by the region’s early adoption of CCS technologies, well-established industrial infrastructure, and supportive regulatory frameworks aimed at reducing carbon emissions. Significant investments in large-scale pilot and commercial CCS projects, particularly in the United States and Canada, have strengthened market growth. The presence of favorable policies, tax credits such as the 45Q in the U.S., and growing corporate sustainability commitments further accelerate deployment. Additionally, advanced research initiatives and strategic collaborations with technology providers enhance North America’s position as a key hub for CCS development and innovation.

U.S. Carbon Capture & Storage Market Trends

The carbon capture & storage market in the United States is the largest single-country market globally. Strong federal incentives, such as the 45Q tax credit, grants, and public funding programs, have accelerated the deployment of CCS projects across power generation, oil & gas, and industrial sectors. Large-scale pilot and commercial facilities, including enhanced oil recovery (EOR) projects, drive adoption, while ongoing R&D in capture technologies, storage solutions, and direct air capture (DAC) enhances operational efficiency. With abundant geological storage potential, mature infrastructure, and robust policy support, the U.S. is expected to remain a leading and dynamic CCS market throughout the forecast period.

Europe Carbon Capture & Storage Market Trends

The carbon capture & storage market in Europe represents a significant portion of the global CCS market, with countries like Norway, the U.K., Germany, and the Netherlands leading deployment. Ambitious climate targets, stringent emission regulations, and supportive policy frameworks underpin market growth. Investments in industrial CCS projects, offshore CO₂ transport infrastructure, and storage hubs, along with R&D in advanced capture technologies, drive adoption. European initiatives, such as cross-border carbon transport networks and public-private partnerships, reinforce the region’s role as a key contributor to global CCS deployment and technological innovation.

Asia Pacific Carbon Capture & Storage Market Trends

The carbon capture & storage market in Asia Pacific is emerging rapidly, with China, Japan, South Korea, and Australia leading adoption. China, in particular, is investing heavily in large-scale industrial CCS projects, including coal-fired power plants, steel, and cement industries, driven by ambitious national emission reduction targets. Japan and South Korea focus on advanced capture technologies, carbon utilization, and pilot DAC projects. Supportive government policies, R&D funding, and international collaborations promote market expansion, while the region’s growing industrial base and need for emission mitigation create significant long-term potential.

Latin America Carbon Capture & Storage Market Trends

The carbon capture & storage market in Latin America is gradually expanding, with Brazil, Mexico, and Argentina spearheading regional deployment. Industrial applications in cement, steel, and energy sectors are the primary focus, with pilot and demonstration projects helping reduce carbon emissions. Policy support, international collaborations, and incentives for sustainable industrial practices encourage CCS adoption. Though the market is at an early stage compared to North America and Europe, increasing environmental awareness and the potential for geological storage present opportunities for growth in the industrial and energy sectors.

Middle East & Africa Carbon Capture & Storage Market Trends

The carbon capture & storage market in the Middle East & Africa (MEA) is witnessing steady growth, led by countries such as the UAE, Saudi Arabia, and Oman. Heavy reliance on oil and gas, coupled with decarbonization commitments, has spurred investments in CCS projects for enhanced oil recovery and industrial emission reduction. Smaller-scale pilot projects in Sub-Saharan Africa focus on demonstration and capacity building. Government initiatives, international funding, and public-private partnerships support regional development, with gradual adoption expected across power generation and energy-intensive industries.

Key Carbon Capture & Storage Company Insights

Some of the key players operating in the global carbon capture & storage market include Shell PLC; Aker Solutions; Equinor ASA; Dakota Gasification Company; Linde plc; Siemens Energy; Fluor Corporation; Sulzer Ltd.; Mitsubishi Heavy Industries Ltd. (MHI); Japan CCS Co. Ltd; Carbon Engineering Ltd; LanzaTech. These companies focus on the development, deployment, and management of carbon capture, transportation, utilization, and storage solutions. Their activities include industrial-scale CCS projects, enhanced oil recovery applications, direct air capture systems, and integration with hydrogen and bioenergy facilities, driving technological advancement and market growth across all regions.

Key Carbon Capture & Storage Companies:

The following key companies have been profiled for this study on the carbon capture & storage market.

- Aker Solutions

- Dakota Gasification Company

- Equinor ASA

- Fluor Corporation

- Japan CCS Co. Ltd

- Linde plc

- Mitsubishi Heavy Industries Ltd. (MHI)

- Shell PLC

- Siemens Energy

- Sulzer Ltd.

Recent Developments

-

In March 2025, Equinor, Shell, and TotalEnergies announced a USD 714 million investment to expand the Northern Lights CCS project. This expansion aims to increase CO₂ storage capacity from 1.5 million to over 5 million tons annually by 2028.

-

In February 2025, Carbfix hf. announced an expansion in its global footprint by launching a new carbon capture plant in Iceland. This plant is expected to capture 3,000 tons of carbon annually.

Carbon Capture & Storage Market Report Scope

Report Attribute

Details

Market size value in 2026

USD 4,187.82 million

Revenue forecast in 2033

USD 6,719.31 million

Growth rate

CAGR of 7.0% from 2026 to 2033

Base year for estimation

2025

Historical data

2021 - 2024

Forecast period

2026 - 2033

Quantitative units

Volume in million tons; revenue in USD million/billion, and CAGR from 2026 to 2033

Report coverage

Volume & revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Capture technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Norway; China; India; Japan; South Korea; Australia; Argentina; Brazil; Saudi Arabia; UAE; South Africa

Key companies profiled

Shell PLC; Aker Solutions; Equinor ASA; Dakota Gasification Company; Linde plc; Siemens Energy; Fluor Corporation; Sulzer Ltd.; Mitsubishi Heavy Industries Ltd. (MHI); Japan CCS Co. Ltd

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Carbon Capture & Storage Market Report Segmentation

This report forecasts volume & revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global carbon capture & storage market report on the basis of capture technology, application, and region.

-

Capture Technology Outlook (Volume in Million Tons; Revenue, USD Million, 2021 - 2033)

-

Post combustion

-

Industrial Process

-

Pre-combustion

-

Oxy-Combustion

-

-

Application Outlook (Volume in Million Tons; Revenue, USD Million, 2021 - 2033)

-

Power generation

-

Oil & Gas

-

Metal production

-

Cement

-

Others

-

-

Regional Outlook (Volume in Million Tons; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. Some key players operating in the carbon capture and storage market include Shell CANSLV, AkerSolutions, Statoil, Linde Engineering, Mitsubishi Heavy Industries, and Sulzer.

b. Key factors driving the growth of the carbon capture and storage market include increasing the application of enhanced oil recovery (EOR) technologies and increasing emissions of carbon dioxide globally.

b. The global carbon capture and storage market size was estimated at USD 3.68 billion in 2024 and is expected to reach USD 3.92 billion in 2025.

b. The global carbon capture and storage market is expected to witness a compound annual growth rate of 7.0% from 2025 to 2033 to reach USD 6.72 billion by 2033.

b. Pre-combustion capture technologies for carbon dioxide constituted the largest share, accounting for over 70.95% in 2024. Increased energy generation, newly developed advanced amine systems, and heat integration systems are expected to be the main factors driving its demand over the forecast period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.