- Home

- »

- Conventional Energy

- »

-

Global Enhanced Oil Recovery Market Size Report, 2030GVR Report cover

![Enhanced Oil Recovery Market Size, Share & Trends Report]()

Enhanced Oil Recovery Market Size, Share & Trends Analysis Report By Technology (Thermal, CO2 Injection, Chemical), By Application (Onshore, Offshore), By Region, And Segment Forecasts, 2022 - 2030

- Report ID: 978-1-68038-343-0

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2019 - 2020

- Forecast Period: 2022 - 2030

- Industry: Energy & Power

Report Overview

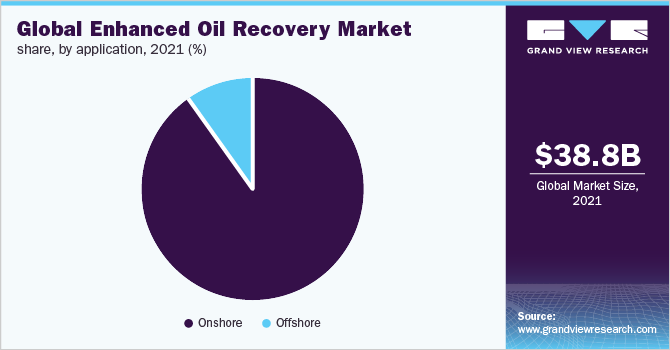

The global enhanced oil recovery market size was valued at USD 38.83 billion in 2021 and is expected to expand at a compound annual growth rate (CAGR) of 7.8% from 2022 to 2030. An increasing number of aged wells, along with decreasing production from existing oilfields, is expected to drive the market demand over the forecast period.

Enhanced oil recovery (EOR) technology enhances oil production from mature and aged oil fields, by almost 10 to 20 percent when compared to conventional oil extraction methods. Mature wells are those oil reserves where production has reached its peak and has started to decline owing to poor permeability or exhibiting heavy oil. Technically, EOR increases the permeability of the reservoir so that hydrocarbons can flow through the pathways easily and into the targeting producing well.

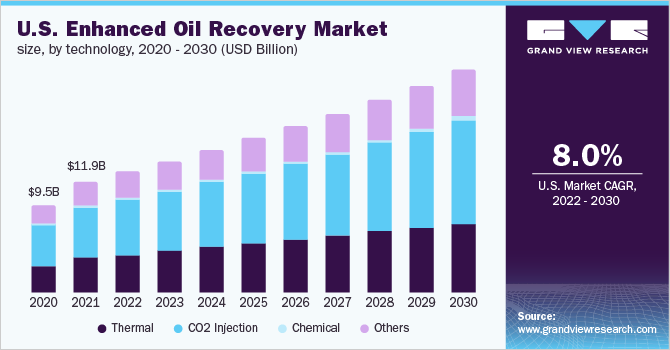

The U.S. market is anticipated to witness significant growth on account of the growing exploration of unconventional oil and gas resources. Furthermore, government funding aimed at commercializing the EOR technology is anticipated to positively influence the industry landscape. For instance, the U.S. Department of Energy (DoE) provides funding to private companies and universities in order to carry out research for advancements in EOR technologies

Further, a number of CO2 injection-based EOR projects started from 2017 to 2020 in the U.S., which resulted in the dominating share of CO2 injection technology over other available technologies in the country. For instance, the oil production in the Permian Basin has shown a significant rise in oil production by the use of CO2-EOR technology. These market developments are expected to boost the growth of the market in the U.S. in the forecast period

Falling crude oil prices are expected to have a negative impact on the oil and gas industry and may restrain the market growth over the forecast period. The COVID-19 pandemic led to a drastic drop in oil prices in 2020. This resulted in reductions in planned capital expenditure and the implementation of cost-cutting actions by oil players across the globe, which is expected to hinder the growth of the market.

However, a rise in environmental concerns regarding carbon emissions has resulted in enhancing the demand for carbon capture and storage (CCS), which has emerged as a viable solution to limit carbon emissions. These factors are expected to positively impact the market growth as captured carbon in CCS projects is usually utilized by oil and gas companies for CO2 injection EOR technology.

Technology Insights

The thermal segment occupied the largest revenue share of over 35.0% in 2021. The method entails the application of heat to the oil wells for lowering the oil viscosity and increasing its mobility ratio. It is mostly applied in shallow wells with higher viscosity, for instance, heavy oil and tar sand. This technology is being utilized in countries such as the U.S., Canada, Oman, and Russia

CO2 injection technology injects CO2 into the rock pores to recover the crude oil. CO2 is miscible with crude oil and is comparatively less expensive than other similar miscible fluids used for these applications, making it a preferred choice for EOR applications. In addition, this method provides highly significant environmental benefits, thereby driving the demand for CO2 injection technology in the market in the forecast period.

Further, stringent government regulations regarding emission reduction from the oil industry activities are resulting in the improved adoption of CCS technology, wherein the carbon released from refineries is captured and injected into depleting oilfields for the EOR process. These factors will boost the growth of CO2 injection technology in the future.

Chemical EOR technology involves the use of polymers and surfactants, which are injected into the oil well, which reduces interfacial pressure and enhances flooded viscosity, thereby increasing the production from the oil well. Chemical-based EOR technology is being utilized in countries such as China, Russia, Colombia, and Canada.

Application Insights

The onshore segment occupied the largest revenue share of over 90.0% in 2021 owing to the significant presence of onshore exploration and production projects across the world. Lower conventional extraction costs for onshore oilfields, when compared to offshore oilfields, will result in the growth of the onshore application segment in the future. EOR techniques are being deployed in conventional onshore basins, witnessing declining production levels across Saudi Arabia, Russia, and China. These factors are expected to positively influence the growth of the segment in the forecast period.

The steady development of the existing offshore wells, particularly in the South China Sea, the Persian Gulf, the North Sea, and the Gulf of Mexico, is expected to drive the offshore segment over the forecast period. Further, operators such as BP, Statoil, and Repsol are testing the techno-economic feasibility of EOR in offshore oil fields.

However, the offshore oil industry is expected to witness sluggish growth due to high capital investments and operating costs, coupled with the pandemic impact. These factors will cause hindrance in the growth of the offshore oil industry. However, the ongoing technological advancements in the offshore segment are anticipated to boost the growth of the offshore segment in the forecast period

Regional Insights

North America dominated the market and accounted for a revenue share of more than 35.0% in 2021. The U.S. is the major contributor to the regional market growth. The growth can be attributed to the presence of several unconventional oil and gas resources and matured fields in the country, requiring advanced extraction techniques to boost production from existing wells. Further, leading oil and gas exploration companies in Canada are utilizing EOR technology to efficiently recover the oil from fields.

Increasing government funding for EOR projects is expected to further commercialize the technology. For instance, in 2019, U.S. DoE announced USD 40 million in funding for research and development activities aimed at reducing the technical risk in enhanced oil recovery while simultaneously expanding EOR applicability across conventional and unconventional reservoirs.

The Asia Pacific is anticipated to witness the highest growth over the forecast period, with China occupying the largest share across the region. Rising oil and gas demand from major economies including China and India, along with the increased deployment of EOR in aged wells to meet the production targets, is estimated to bolster the market demand in the Asia Pacific.

The market in the Middle East and Africa was dominated by Oman in 2021 and it is expected to maintain its lead in the forecast period. However, new EOR projects are expected to come online in countries such as Saudi Arabia, UAE, Qatar, and Kuwait in the forecast period, which will result in boosting the growth of the market in the region in the forecast period.

Key Companies & Market Share Insights

The EOR market is highly competitive and moderately consolidated with the presence of giant, multinational, and experienced players. Oil and gas exploration companies procure raw materials such as polymer, carbon dioxide, nitrogen, and others from specialized vendors. The technologies used in EOR are usually in-housed by the oil and gas exploration companies.

Market players are venturing toward extracting oil from existing reserves to maximize their production targets. Moreover, increasing investments in R&D activities in order to develop cost-effective oil recovery technology is expected to fuel the industry's growth. Some prominent players in the global enhanced oil recovery market include:

-

BP plc

-

Cenovus Energy, Inc.

-

Chevron Corporation

-

Equinor ASA

-

ExxonMobil Corporation

-

LUKOIL

-

Petróleo Brasileiro S.A.

-

Total SA

Enhanced Oil Recovery Market Report Scope

Report Attribute

Details

Market size value in 2022

USD 42.24 billion

Market size value in 2030

USD 76.78 billion

Growth rate

CAGR of 7.8% from 2022 to 2030

Base year for estimation

2021

Historical data

2019 - 2020

Forecast period

2022 - 2030

Quantitative units

Volume in million bbl, revenue in USD million/billion, and CAGR from 2022 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Technology, application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

U.S.; Canada; Russia; U.K.; China; India; Brazil; Oman; Saudi Arabia

Key companies profiled

ExxonMobil Corporation; BP plc; China Petroleum & Chemical Corporation; Total SA; Royal Dutch Shell plc; Chevron Corporation; Petróleo Brasileiro S.A.; LUKOIL; Cenovus Energy, Inc.; Equinor ASA

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the Report

This report forecasts volume and revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2019 to 2030. For the purpose of this study, Grand View Research has segmented the global enhanced oil recovery market report on the basis of technology, application, and region:

-

Technology Outlook (Volume, Million bbl; Revenue, USD Million, 2019 - 2030)

-

Thermal

-

CO2 Injection

-

Chemical

-

Others

-

-

Application Outlook (Volume, Million bbl; Revenue, USD Million, 2019 - 2030)

-

Onshore

-

Offshore

-

-

Regional Outlook (Volume, Million bbl; Revenue, USD Million, 2019 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Russia

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

Oman

-

Saudi Arabia

-

-

Frequently Asked Questions About This Report

b. The global enhanced oil recovery market size was estimated at USD 38.83 billion in 2021 and is expected to reach USD 42.24 billion in 2022.

b. The global enhanced oil recovery market is expected to witness a compound annual growth rate of 7.8% from 2022 to 2030 to reach USD 76.78 billion by 2030.

b. Onshore was the largest application segment accounting for 90.10% of the total market in 2021 owing to a large number of matured onshore oil fields.

b. Some key players operating in the enhanced oil recovery market include ExxonMobil Corporation, BP plc, China Petroleum & Chemical Corporation, Total SA, Royal Dutch Shell plc, Chevron Corporation, and others.

b. Key factors driving the growth of the enhanced oil recovery market include the development of advanced technologies along with favorable government plans and policies.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."