- Home

- »

- Next Generation Technologies

- »

-

Enhanced Vision System Market Size & Share Report, 2030GVR Report cover

![Enhanced Vision System Market Size, Share & Trends Report]()

Enhanced Vision System Market (2024 - 2030) Size, Share & Trends Analysis Report By Component (Hardware, Software, Service), By Technology (Infrared, Synthetic Vision), By Application (Search & Rescue, General Aviation), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-252-9

- Number of Report Pages: 250

- Format: PDF

- Historical Range: 2017 - 2023

- Forecast Period: 2024 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enhanced Vision System Market Summary

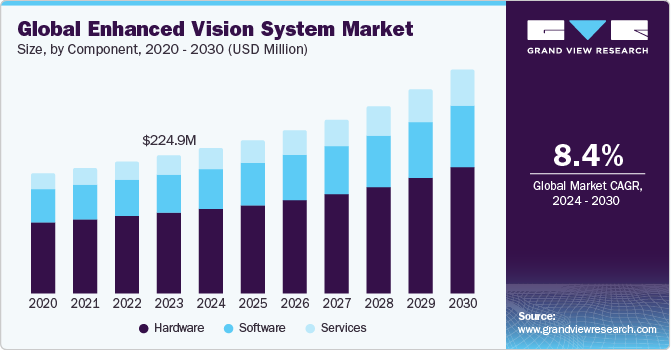

The global enhanced vision system market size was estimated at USD 224.9 million in 2023 and is projected to reach USD 364.5 million by 2030, growing at a CAGR of 8.4% from 2024 to 2030. The market’s growth is propelled by several factors, such as the growing demand for enhanced safety and situational awareness in aviation.

Key Market Trends & Insights

- North America asserted its dominance in 2023, capturing the largest revenue share at 36.1%.

- Asia Pacific is expected to record the fastest CAGR of 9.5% over the forecast period.

- Based on component, the hardware segment dominated the target market and accounted for the largest revenue share of 58.8% in 2023.

- Based on technology, the synthetic vision segment asserted its dominance in the EVS market claiming the largest revenue share of 30.6% in 2023.

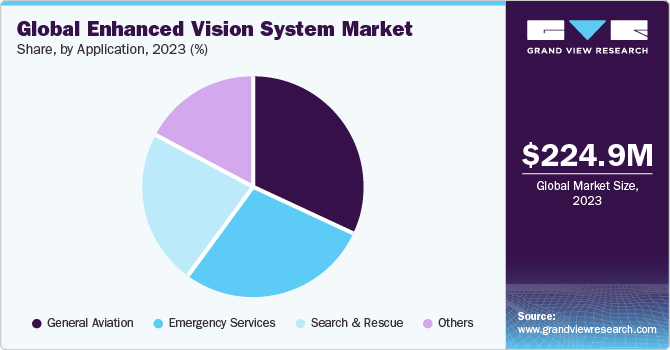

- Based on application, the general aviation segment accounted for the largest revenue share of 31.7% in 2023.

Market Size & Forecast

- 2023 Market Size: USD 224.9 Million

- 2030 Projected Market Size: USD 364.5 Million

- CAGR (2024-2030): 8.4%

- North America: Largest market in 2023

- Asia Pacific: Fastest growing market

The enhanced vision system (EVS) technologies enable pilots to navigate challenging weather conditions, low visibility scenarios, and complex terrains, thereby reducing the risk of accidents and enhancing overall flight safety. Secondly, increasing regulatory mandates regarding aviation safety and the adoption of advanced avionic systems contribute to the market's growth. Aviation authorities worldwide, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), emphasize the integration of cutting-edge technologies like EVS to meet stringent safety standards.

Another driving factor is the continuous technological advancements in sensors, imaging, and real-time data processing. These innovations lead to improved performance, higher resolution images, and expanded capabilities of EVS, making them more appealing to end-users. Moreover, the surge in global air travel and the expansion of the aviation sector contribute to the market's growth, as airlines and aircraft operators seek state-of-the-art solutions to enhance operational efficiency and maintain a competitive edge.

Enhanced vision systems find diverse applications across various sectors. In aviation, they are integral for commercial airlines, private aircraft, and military aviation. EVS aids pilots in take-offs, landings, and en-route navigation, ensuring safe and efficient flight operations. Beyond aviation, EVS technologies are increasingly utilized in Emergency Services and Search and Rescue operations, where visibility is critical for swift and effective responses. Furthermore, the adoption of EVS extends to specialized industries, including optical gas imaging, where the technology is employed to detect and visualize gas leaks. The adaptability of EVS across these sectors highlights its versatility and the broad spectrum of applications it offers.

Enhanced vision system manufacturers globally are strategically directing substantial investments towards the development and integration of Artificial Intelligence (AI)-related technologies within the EVS market. This strategic move is fueled by the recognition that AI can significantly enhance the capabilities of EVS, contributing to improved safety, navigation, and operational efficiency in various applications. Manufacturers are channeling resources into AI algorithms and machine learning models to advance object recognition, terrain mapping, and real-time data analysis within EVS.

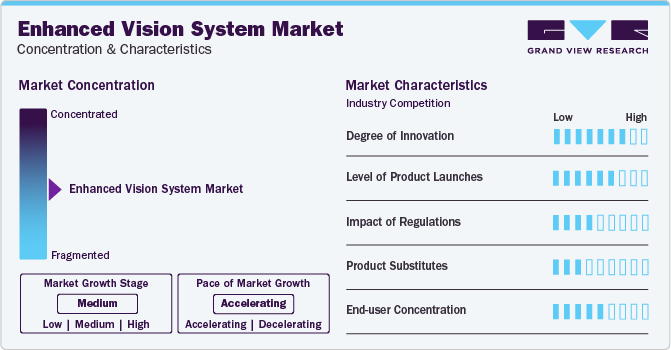

Market Concentration & Characteristics

The EVS market has witnessed a high degree of innovation in recent years, with advancements in sensor technologies, image processing algorithms, and integration capabilities. Manufacturers are continually enhancing sensor resolutions, expanding the field of view, and improving low-light performance to provide pilots with better situational awareness. Innovations in EVS also involve integration with other avionic systems, such as head-up displays (HUDs) and navigation systems, contributing to a more comprehensive and integrated cockpit experience. The development of real-time image processing and synthetic vision technologies further demonstrates the high level of innovation in the EVS market, aiming to enhance pilot decision-making capabilities.

The enhanced vision system market has experienced a significant level of product launches in recent years, with several manufacturers introducing new and advanced solutions. These launches often involve upgraded hardware components, software enhancements, and improved features to meet evolving industry demands and regulatory requirements. Companies in the EVS industry frequently showcase their commitment to innovation through the introduction of state-of-the-art technologies, contributing to a competitive landscape. The pace of product launches reflects a dynamic market where companies strive to stay at the forefront of technological advancements.

The impact of regulations is high. Regulation plays a crucial role in shaping the enhanced vision system market, with stringent aviation standards and safety requirements influencing the development and adoption of EVS technologies. Regulatory bodies, such as the Federal Aviation Administration (FAA) and the European Union Aviation Safety Agency (EASA), establish certification criteria for EVS products, ensuring they meet strict performance and reliability standards. Compliance with these regulations is a significant factor affecting market entry and product acceptance. The impact of regulation is particularly high in the EVS market due to the stringent safety measures and certification processes required for aviation technologies. Manufacturers must navigate and adhere to these regulations to ensure the successful integration and widespread adoption of their enhanced vision systems.

The market faces a low impact from product substitutes as there are limited alternatives that offer similar capabilities for improving visibility and situational awareness in aviation. While traditional vision systems exist, they often lack the advanced features and real-time data integration provided by EVS technologies. The specialized nature of EVS, tailored for aviation safety and navigation, makes it challenging for generic substitutes to match its functionalities. The unique requirements of the aerospace industry contribute to the limited availability of substitutes that can effectively replace enhanced vision systems.

End-user concentration in the EVS market is moderate. End-users within the EVS market span various sectors and applications, including commercial airlines, private aircraft operators, military organizations, emergency services, search and rescue operations, and specialized applications such as optical gas imaging. These diverse entities leverage EVS technologies to enhance visibility, safety, and operational efficiency within their specific domains. Commercial airlines and private aircraft operators utilize EVS for improved pilot visibility during flights, ensuring safer operations. Military organizations integrate EVS into aircraft for enhanced tactical awareness and mission success. Emergency services and search and rescue operations benefit from EVS in critical situations, aiding swift and effective response efforts. The collective impact of these end-users is considered moderate, as their assorted requirements and applications drive ongoing advancements and widespread adoption in the EVS market.

Component Insights

The hardware segment dominated the target market and accounted for the largest revenue share of 58.8% in 2023. The demand for advanced sensors and imaging devices, such as infrared cameras and high-resolution displays, is driving growth in the hardware segment. These components are essential for EVS to provide enhanced visibility and situational awareness. The ongoing technological advancements in hardware, including the development of lightweight, compact, and high-performance components, contribute to the segment's dominance. Thirdly, the aviation and automotive industries, key users of EVS, prioritize investments in robust hardware to ensure the safety and efficiency of their vehicles. Additionally, stringent regulatory requirements and standards for hardware reliability and performance further propel the hardware segment's growth.

The service segment is expected to register the highest CAGR of 10.8% over the forecast period. As EVS technology evolves rapidly, there is a growing need for specialized services such as system integration, maintenance, and training to ensure optimal performance. The end-users across industries recognize the importance of continuous support and customization to adapt EVS solutions to their specific requirements. Furthermore, the complexity of EVS implementations, especially in sectors like general aviation and defense, necessitates ongoing services for troubleshooting, updates, and system enhancements. As EVS becomes more prevalent globally, there is an increased demand for consulting services to guide organizations in selecting and implementing the most suitable solutions. Moreover, the services segment benefits from the shift towards outsourcing non-core functions, allowing companies to focus on their core competencies while relying on specialized service providers for EVS-related support.

Technology Insights

The synthetic vision segment asserted its dominance in the EVS market claiming the largest revenue share of 30.6% in 2023. Synthetic vision technology provides a comprehensive and intuitive display of the surrounding environment using computer-generated imagery, significantly enhancing pilot situational awareness. This capability is especially crucial in low-visibility conditions, making synthetic vision systems a preferred choice for aviators. The continuous advancements in graphics processing and display technologies have led to the development of more realistic and detailed synthetic vision displays, further driving their adoption. The emphasis on reducing pilot workload and enhancing safety in aviation has propelled the demand for synthetic vision systems, as they offer a simplified and easy-to-interpret visual representation of the flight environment. The integration of synthetic vision with other avionics systems, such as navigation and terrain awareness, makes it an integral component of modern cockpit solutions, leading to its high revenue share in the EVS market.

The infrared segment is expected to register the highest CAGR of 9.6% over the forecast period. Infrared technology offers superior capabilities in low-light and adverse weather conditions, providing enhanced visibility beyond the capabilities of visible light imaging. This makes infrared sensors crucial for improving situational awareness, especially during nighttime operations or in challenging environments. Secondly, the increasing adoption of EVS across diverse industries, including defense, aviation, and automotive, amplifies the demand for advanced infrared solutions to address unique operational needs. The ongoing technological advancements in infrared sensors, such as higher resolution and improved sensitivity, are contributing to their wider acceptance and integration into EVS applications. Moreover, the cost-effectiveness of infrared technology compared to some alternative solutions is driving its popularity, particularly in price-sensitive markets.

Application Insights

The general aviation segment accounted for the largest revenue share of 31.7% in 2023. As smaller aircraft are more prevalent in general aviation, the cost of EVS implementation is relatively lower compared to larger commercial or military aircraft. This affordability makes EVS more accessible to a broader range of general aviation users. Secondly, the increased focus on safety in general aviation, especially during adverse weather conditions, has prompted a higher adoption of EVS to enhance visibility and situational awareness. Regulatory bodies have recognized the safety benefits of EVS, leading to supportive policies and mandates that encourage its integration in general aviation aircraft. The versatility and adaptability of EVS technology to different types of general aviation aircraft contribute to its widespread adoption. The competitive landscape within the general aviation sector drives manufacturers and operators to invest in advanced technologies such as EVS to maintain a competitive edge.

The search and rescue segment is expected to grow at the fastest CAGR of 9.7% over the forecast period. The heightened emphasis on improving emergency response capabilities has driven increased adoption of EVS in search and rescue operations. EVS technology significantly enhances visibility in challenging environments, such as low-light conditions or adverse weather, enabling quicker and more effective search and rescue missions. Additionally, the demand for advanced surveillance and reconnaissance capabilities in both maritime and land-based search and rescue activities is propelling the adoption of EVS. Moreover, ongoing advancements in EVS solutions, including thermal imaging and real-time data analytics, are further boosting their effectiveness in search and rescue scenarios.

Regional Insights

North America asserted its dominance in 2023, capturing the largest revenue share at 36.1%. The region is home to a robust aviation industry with a high concentration of major aircraft manufacturers, contributing to the widespread adoption of advanced technologies such as enhanced vision systems. Secondly, stringent safety regulations and the constant emphasis on improving aviation safety in North America have driven the demand for cutting-edge solutions such as enhanced vision systems. Thirdly, major players in the aerospace industry, such as Boeing and Lockheed Martin Corporation, are headquartered in North America, influencing market dynamics and fostering innovation in EVS technologies. Additionally, the region's well-developed infrastructure, including modern airports and advanced air traffic management systems, facilitates the integration and utilization of enhanced vision systems. Moreover, the presence of a large number of private and commercial aircraft operators in North America, including major airlines and business aviation companies, has contributed to the substantial market share.

U.S. Enhanced Vision System Market Trends

The enhanced vision system market in the U.S. held the largest revenue share of 71.4% in 2023 and is experiencing substantial growth, propelled by a heightened emphasis on aviation safety and the integration of cutting-edge technologies to enhance pilot situational awareness. With increased investments in modern avionics and a dynamic aviation industry, the demand for advanced enhanced vision systems continues to surge in the U.S.

Asia Pacific Enhanced Vision System Market Trends

Asia Pacific is expected to record the fastest CAGR of 9.5% over the forecast period. The flourishing aviation industry in the region, driven by increasing air travel demand and economic growth, has led to a higher adoption of advanced avionics technologies, including EVS. The need for improved safety measures in aviation, particularly in challenging weather conditions prevalent in the region, has fueled the demand for EVS solutions to enhance situational awareness for pilots. The supportive government initiatives and regulatory frameworks emphasizing the adoption of modern avionics technologies have facilitated the widespread integration of EVS in Asia Pacific. Additionally, the expanding defense budgets of several countries in the region have contributed to the growth of EVS applications in military aviation. Moreover, the rapid development of emerging economies and increased infrastructure investments further propel the demand for EVS across various sectors.

The enhanced vision system market in China is growing due to the increasing emphasis on aviation safety and efficiency. Chinese airlines, such as Air China and China Southern Airlines, are investing in advanced avionics technologies, including enhanced vision systems, to enhance pilot situational awareness and reduce the risk of accidents during adverse weather conditions. Government initiatives, like the Civil Aviation Administration of China's (CAAC), focus on modernizing aviation infrastructure, drive the demand for enhanced vision systems in the country.

Europe Enhanced Vision System Market Trends

The growth of the enhanced vision system market in Europe is driven by increasing demand for advanced avionics technology in commercial and military aircraft. EVS enhances pilot visibility in challenging weather conditions, reducing the risk of accidents and improving overall flight safety. Europe has seen advancements in technology adoption in various applications, such as search and rescue (SAR) and emergency services, to enhance response capabilities. The integration of cutting-edge tools such as drones, thermal imaging systems, and communication devices has improved the efficiency and effectiveness of search and rescue missions. The demand for innovative solutions in emergency services is likely to drive market growth as the region prioritizes upgrading its capabilities to handle crises and disasters effectively.

The enhanced vision system market in the UK is growing due to an increasing demand for advanced aviation technologies. For instance, major airlines such as British Airways and Virgin Atlantic are investing in enhanced vision systems to enhance pilot visibility in challenging weather conditions, thereby improving overall flight safety. Additionally, the adoption of these systems by private and business aircraft operators is further fueling market growth in the UK.

Key Enhanced Vision System Company Insights

Some of the key companies operating in the market include United Technologies Corporation and Honeywell International, Inc.

-

United Technologies Corporation (UTC) is a key player in the aerospace industry and a provider of advanced technologies, including those related to enhanced vision systems. The company is a leading provider of innovative avionics solutions, particularly contributing to the EVS market. The company focuses on improving pilot visibility and navigation, ultimately enhancing safety and efficiency in flight operations.

-

Honeywell International, Inc. is a multinational company that plays a significant role in the enhanced vision system industry. The company offers a range of avionics solutions, including advanced EVS technologies. Honeywell International Inc.'s EVS solutions leverage infrared imaging to enhance situational awareness for pilots, particularly during low-visibility conditions. These systems contribute to improved safety and operational efficiency across various aircraft platforms.

Opgal and MBDA are some of the emerging companies in the target market.

-

Opgal specializes in thermal imaging solutions, a crucial component of enhanced vision systems. The company's thermal cameras and sensors are applied across various industries, including aviation. Opgal's expertise in infrared technology contributes to the development of EVS solutions, providing enhanced vision capabilities in both civil and military aviation applications.

-

MBDA is a European multinational company that primarily focuses on missile systems, but its involvement in defense technologies extends to avionics and enhanced vision systems. MBDA contributes to the development of cutting-edge technologies that enhance the capabilities of military aircraft, including advanced sensors and vision systems that improve mission success and pilot situational awareness.

Key Enhanced Vision System Companies:

The following are the leading companies in the enhanced vision system market. These companies collectively hold the largest market share and dictate industry trends.

- Astronics Corporation

- Collins Aerospace (Part of UTC)

- Elbit Systems Ltd.

- Esterline Technologies Corporation

- Honeywell International, Inc.

- L-3 Communications Holdings, Inc.

- MBDA

- Opgal

- Thales Group

- United Technologies Corporation

Recent Developments

-

In February 2024, the joint venture Collins Elbit Vision Systems, formed by Elbit Systems, Ltd. and Collins Aerospace, revealed the delivery of the F-35 Helmet Mounted Display System (HMDS) to the Joint Strike Fighter. The F-35 Gen III HMDS, a state-of-the-art HMDS, offers pilots intuitive access to essential flight, tactical, and sensor information, marking a milestone with over 20,000 systems supplied to warfighters and accumulating 1 million flight hours across different fighter aircraft platforms.

-

In June 2023, Honeywell International, Inc. agreed to acquire heads-up-display (HUD) assets from Saab, aiming to integrate the technology into its avionics offerings. Furthermore, Saab would be partnering with Honeywell International, Inc. to develop the HUD product line further to improve situational awareness and enhance flight safety.

Enhanced Vision System Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 236.4 million

Revenue forecast in 2030

USD 364.5 million

Growth rate

CAGR of 8.4% from 2024 to 2030

Actual data

2017 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Component, technology, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France; China; Japan; India; South Korea; Australia; Mexico; Brazil; KSA: UAE; South Africa

Key companies profiled

Astronics Corporation; Collins Aerospace (Part of UTC); Elbit Systems Ltd.; Esterline Technologies Corporation; Honeywell International, Inc.; L-3 Communications Holdings, Inc.; MBDA; Opgal; Thales Group; United Technologies Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

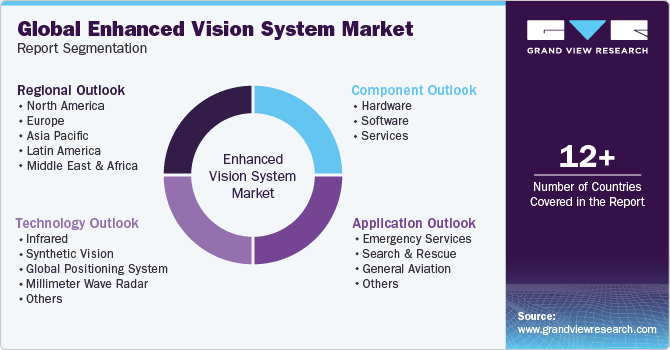

Global Enhanced Vision System Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global enhanced vision system market report based on component, technology, application, and region:

-

Component Outlook (Revenue, USD Million, 2017 - 2030)

-

Hardware

-

Software

-

Services

-

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Infrared

-

Synthetic Vision

-

Global Positioning System

-

Millimeter Wave Radar

-

Others

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Emergency Services

-

Search & Rescue

-

General Aviation

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Mexico

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enhanced vision system market size was estimated at USD 224.9 million in 2023 and is expected to reach USD 236.4 million in 2024.

b. The global enhanced vision system market is expected to grow at a compound annual growth rate of 8.4% from 2024 to 2030 to reach USD 364.5 million by 2030.

b. The hardware segment dominated the target market and accounted for the largest revenue share of over 58.8% in 2023. The demand for advanced sensors and imaging devices, such as infrared cameras and high-resolution displays, is driving growth in the hardware segment.

b. Some prominent players in the Enhanced Vision System Market include Astronics Corporation, Collins Aerospace (Part of UTC), Elbit Systems Ltd., Esterline Technologies Corporation, Honeywell International, Inc., L-3 Communications Holdings, Inc., MBDA, Opgal, Thales Group, and United Technologies Corporation.

b. The enhanced vision system (EVS) market is propelled by several driving factors, such as the growing demand for enhanced safety and situational awareness in aviation. Another driving factor is the continuous technological advancements in sensors, imaging, and real-time data processing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.