- Home

- »

- Next Generation Technologies

- »

-

Enterprise Network Infrastructure Market Size Report, 2030GVR Report cover

![Enterprise Network Infrastructure Market Size, Share & Trends Report]()

Enterprise Network Infrastructure Market Size, Share & Trends Analysis Report By Technology (Routers & Switches, Storage Area Network, Infrastructure Firewalls), By Industry, By Enterprise Size, By Region, And Segment Forecast, 2023 - 2030

- Report ID: GVR-4-68039-928-7

- Number of Report Pages: 117

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Technology

Market Size & Trends

The global enterprise network infrastructure market size was valued at USD 58.77 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.9% from 2023 to 2030, owing to the increased demand for network connectivity. Enterprises are adopting digital technology to improve business operations. With increasing digitalization, the importance of network infrastructure is increasing. Thus, the demand for network infrastructure is also growing. Additionally, enterprises are upgrading their network to support wireless networks and the growing need for bandwidth. Factors such as the growing adoption of mobile devices, increasing need for bandwidth, and technology shift to wireless are driving factors in the market. Besides, enterprises are increasing investments in upgrading the network to improve the speed, providing a cost-efficient solution with reliability, increasing performance, and saving energy. For instance, in March 2022, Hewlett Packard launched the HPE GreenLake cloud service. The new product would provide comprehensive, integrated on-premises storage, networking, and compute cloud services through HPE GreenLake solutions.

Enterprise network infrastructure is a significant component of high-speed internet and data transfer networks. OTN provides a standardized way of transmitting high-speed optical signals, such as those used for internet and data transfer, over optical fiber. OTN enables efficient, reliable, and secure transport of high-volume data traffic and provides essential functions such as multiplexing, forward error correction, and monitoring optical signals. OTN has become a critical component of modern telecommunications networks because of its ability to support high-speed data transmission over long distances and provide robust and reliable service even in the face of optical impairments, such as signal attenuation and dispersion.

With the growing demand for bandwidth-intensive applications such as video streaming, cloud computing, and online gaming, there is a need for reliable and fast communication networks. Enterprise network infrastructure, such as optical transceivers, optical amplifiers, and wavelength division multiplexers, play a vital role in enabling high-speed data transfer over long distances. As a result, the demand for these optical transport components is increasing, driving the growth of the market. Additionally, technological advancements, such as the development of 5G networks and the increasing deployment of data centers, are further fueling the demand for the market.

During the COVID-19 pandemic and lockdown situation, the governments of various countries restricted physical movement, and citizens preferred to stay at home as a precautionary measure. With short fall in revenue due to the disturbed supply chains. Enterprises allowed employees to work from home due to the pandemic lock situation and government restrictions. So, there was a sudden increase in demand for enterprise infrastructure hardware. But due to the pandemic situation, there were limitations on supply chains and economic disruptions. Thus, vendors are unable to satisfy the demand during a quarter. Thus, short term negative impact on the market revenue was observed in 2020. Additionally, the pandemic has highlighted the importance of network security, as businesses have become more vulnerable to cyberattacks due to the increased use of remote work. This has increased investment in security solutions such as intrusion detection, firewalls, prevention systems, and security information and event management (SIEM) tools.

Technology Insights

The routers & switches segment led the market in 2022, accounting for over 40% share of the global revenue. Routers transfer data packets along the network and are placed in conjunction with two or more networks. Thus, routers and switches are essential parts of the enterprise network, whereas switches connect devices on the network and employ packet switching to exchange data. The continuously increasing number of enterprise users and advanced broadband infrastructure are expected to drive this segment. Thus, demand for the router and switch segment is contributing to the market revenue. For instance, in July 2021, Edgecore Networks Corporation, which delivers wireless and wired networking solutions and products, launched an aggregation router solution for the following generation of service provider infrastructures. The AS7926-40XKFB 100G aggregation router allows users to upgrade their network infrastructure and address the challenges of 5G deployment and traffic growth from the network edge to the core.

The enterprise telephony segment is expected to showcase lucrative growth over the forecast period. Enterprise telephony is the transmission of voice, fax, and other information via an electronic medium with geographic business expansions across the globe by SMEs and large enterprises. Enterprise telephony ensures the smooth flow of communication and a socialized environment among employees from all industries. The adoption of enterprise telephony solutions is increasing to support the communication requirement of the enterprise. Thus, this segment contributes to the growth rate of the segment.

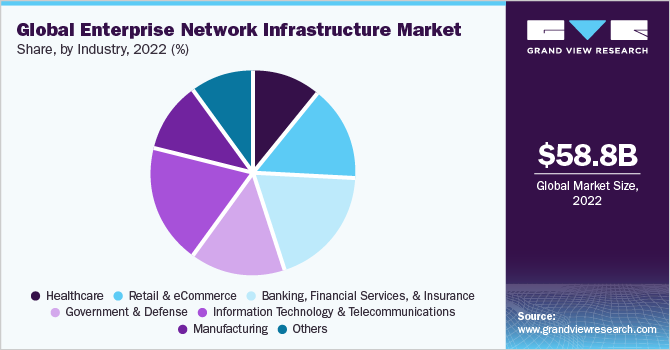

Industry Insights

The information technology & telecommunications segment dominated the market and accounted for more than 19% share of the global revenue in 2022. The startling increase in data traffic is projected to accelerate the expansion of IT and telecom infrastructure. Also, IT and telecom companies have been forced to build a robust IT and telecom infrastructure due to expanding smartphone penetration in rural regions and rising digital literacy, particularly in emerging and developing nations like China and India. An increasing number of mobile workers demand access to every networked and internet-based service using the most recent PC tablets, cellphones, and laptop PCs from anywhere.

The healthcare segment is anticipated to register the highest CAGR over the forecast period. Citizens are increasingly concerned about their health as public awareness of health issues grows. Healthcare institutions and businesses actively monitor and track their patients' health histories to provide patients with better health treatments and services. As a result, healthcare organizations and businesses are embracing digital platforms and utilizing enterprise networks for information sharing and collaboration. This will improve consumer support for their brand. Owing to this, businesses and health institutions are investing in enterprise network infrastructure. Cybercriminals increasingly target healthcare organizations due to the sensitive nature of the data they handle.

Enterprise Size Insights

The large enterprises segment led the market in 2022, accounting for over 71% share of the global revenue. Large enterprises include enterprises with revenues in billions and more than 1000 employees. Large enterprises increasingly invest in network security to protect themselves from cyber dangers. This requires installing intrusion detection and prevention systems, network segmentation, and multi-factor authentication. Major corporations are beginning to investigate the possibility of 5G networking, which provides faster speeds and lower latency than earlier generations of wireless technology. For instance, in November 2022, a digital infrastructure company, Equinix, Inc, expanded its international business exchange sites. The company has invested more than USD 1 billion in the digital infrastructure of the U.K.

The SMEs segment is predicted to foresee significant growth in the coming years. These enterprises have less than a billion in revenue and less than 1000 employees. The rising growth of this market is due to an increasing number of small and medium-sized businesses focusing on expansion, which encourages them to employ numerous innovative and novel solutions. These companies need more funding and more resources. On the other hand, governments support SMEs by offering tax benefits and other services.

Regional Insights

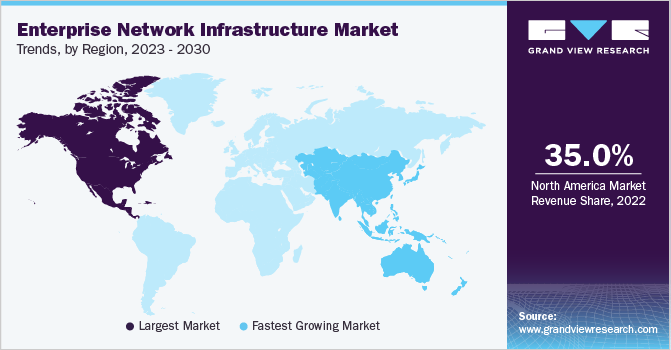

North America dominated the market and accounted for over 35% share of the global revenue in 2022, owing to the early and rapid adoption of advanced technologies across regional multinational companies. The emerging adoption of the work-from-home process is augmenting the growth of routers and switches, which is expected to expand and drive the growth of enterprise network infrastructure in North America. Demand for wireless access points also draws attention to business enterprises transforming their business infrastructure. For instance, in February 2022, the U.S. Department of Energy (DOE) announced USD 6 million in funding to advance 5G wireless networking for science applications for five research and development projects. The prominent evolution of enterprise network infrastructure has a wide range of technology and practices. The development involves integrating various software and hardware components, including routers, switches, firewalls, and other network devices. Moreover, the emerging use of cloud computing is augmenting market growth.

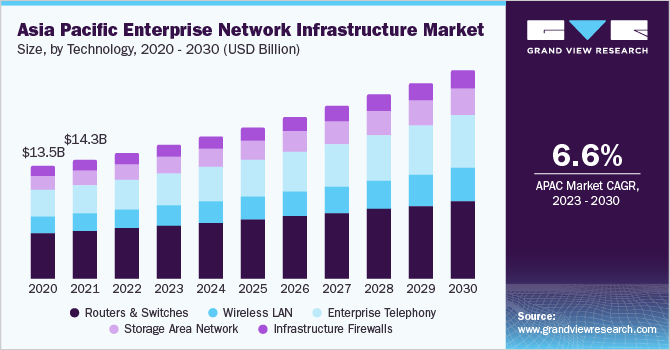

The Asia Pacific region is anticipated to witness significant growth in the enterprise network infrastructure owing to the presence of developing economies such as China, Japan India. The increased demand for high-bandwidth applications has prompted businesses to adopt advanced enterprise networking solutions to address current bandwidth shortage issues. Even in post-pandemic times, laptops, cellphones, and tablets have become more popular due to trends like BYOD (Bring Your Own Device), which is expected to drive the utilization of these devices in the region. Migration from rural to urban areas has increased megacities in Asia-Pacific. It is also driving the need for the government and public sector to digitalize and expand the solutions that address urban challenges and improve the quality of life for citizens.

Key Companies & Market Share Insights

The presence of various well-established multinationals and several small and medium vendors characterizes the global enterprise network infrastructure market. Equipment vendors are focusing on research & development activities to launch the latest technology to improve the access speed and to enhance enterprise network infrastructure space. Moreover, these vendors are expanding their global reach to increase their market presence and revenues. This type of initiative is expected to boost the adoption rate of enterprise network infrastructure equipment.

The enterprise network infrastructure vendors are aggressively following organic and inorganic strategies to expand their footprints across the globe. For instance, in June 2022, Cisco Systems, Inc. and Kyndryl, an IT infrastructure services provider, established a partnership to aid enterprise clients in accelerating the transition of their companies into data-driven ones using Cisco solutions and Kyndryl managed services. This alliance will assist both firms in transforming their operations by adopting cloud-computing technologies that simplify complex hybrid IT management with greater visibility, manageability, and flexibility. Some prominent players in the global enterprise network Infrastructure market include:

-

ALE International, ALE USA INC

-

Aruba Networks, Inc.

-

Avaya Inc.

-

Broadcom

-

Cisco Systems, Inc.

-

Hewlett Packard Enterprise Development LP

-

Huawei Technologies Co., Ltd

-

Juniper Networks Inc

-

Nokia

-

ZTE Corporation

Enterprise Network Infrastructure Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 61.45 billion

Revenue forecast in 2030

USD 86.02 billion

Growth Rate

CAGR of 4.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Report updated

April 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, industry, enterprise size, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; MEA

Country scope

U.S.; U.K.; Germany; France; China; India; Brazil; South Africa

Key companies profiled

ALE International; ALE USA INC; Aruba Networks; Inc.; Avaya Inc.; Broadcom; Cisco Systems, Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd; Juniper Networks Inc; Nokia; ZTE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional, and segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

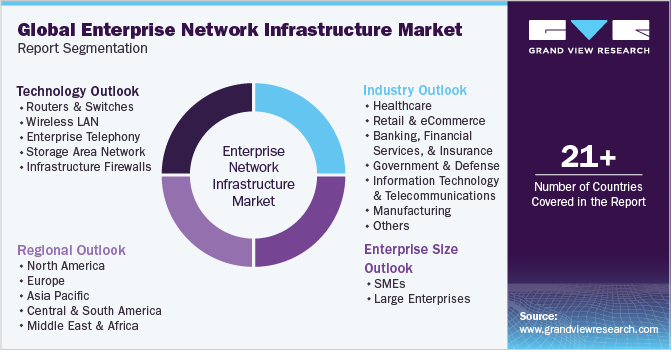

Global Enterprise Network Infrastructure Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global enterprise network infrastructure market report based on technology, industry, enterprise size, and region:

-

Technology Outlook (Revenue, USD Million, 2017 - 2030)

-

Routers & Switches

-

Wireless LAN

-

Enterprise Telephony

-

Storage Area Network

-

Infrastructure Firewalls

-

-

Industry Outlook (Revenue, USD Million, 2017 - 2030)

-

Healthcare

-

Retail & eCommerce

-

Banking, Financial Services, & Insurance

-

Government & Defense

-

Information Technology & Telecommunications

-

Manufacturing

-

Others

-

-

Enterprise Size Outlook (Revenue, USD Million, 2017 - 2030)

-

SMEs

-

Large Enterprises

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

U.K.

-

-

Asia Pacific

-

China

-

India

-

-

Central & South America

-

Brazil

-

-

Middle East & Africa

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise network infrastructure market size was estimated at USD 58.77 billion in 2022 and is expected to reach USD 61.45 billion in 2023.

b. The global enterprise network infrastructure market is expected to grow at a compound annual growth rate of 4.9% from 2023 to 2030 to reach USD 86.02 billion by 2030.

b. North America dominated the enterprise network infrastructure market with a share of 35.6% in 2022. This is attributable to the presence of well-established device manufacturing vendors and ease of availability of IT resources and related technological talents.

b. Some key players operating in the enterprise network infrastructure market include Cisco Systems, Inc.; Hewlett Packard Enterprise Company; Huawei Technologies Co. Ltd.; Juniper Networks Inc; ZTE Corporation; Alcatel–Lucent S.A.; Brocade Communications Systems Inc.; Avaya Inc.; Aruba Networks Inc.; and Bluecoat Systems Inc

b. Key factors that are driving the enterprise network infrastructure market growth include the growing adoption of mobile devices, increasing need for bandwidth, and technology shift to wireless.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."