- Home

- »

- Communications Infrastructure

- »

-

Enterprise Networking Market Size, Industry Report, 2030GVR Report cover

![Enterprise Networking Market Size, Share & Trends Report]()

Enterprise Networking Market (2025 - 2030) Size, Share & Trends Analysis Report By Equipment (Ethernet Switch, Enterprise Routers, WLAN, Network Security), By Infrastructure Type (In-house, Outsourced), By Region, And Segment Forecasts

- Report ID: 978-1-68038-828-2

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Networking Market Summary

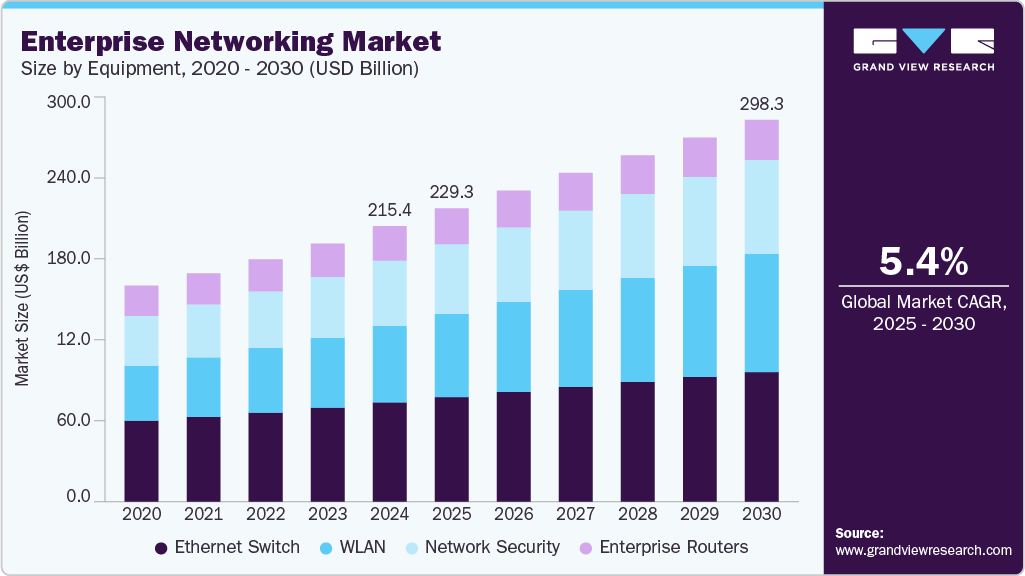

The global enterprise networking market size was estimated at USD 215.45 billion in 2024 and is projected to reach USD 298.30 billion by 2030, growing at a CAGR of 5.4% from 2025 to 2030. The increasing demand for network systems to connect, supply, and retrieve information among various companies is fueling the growth of the industry.

Key Market Trends & Insights

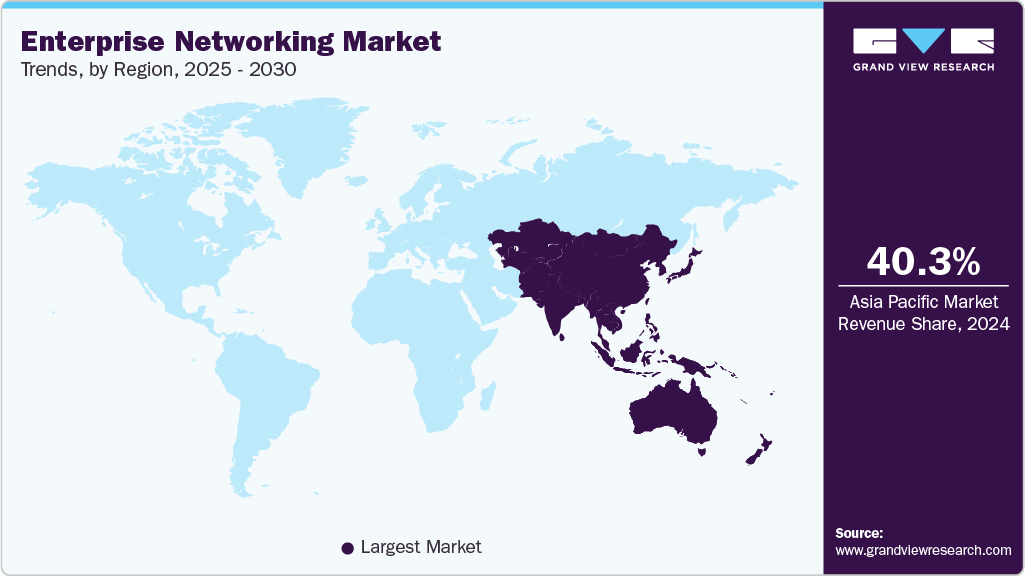

- The Asia Pacific enterprise networking market dominated the global industry with a revenue share of 40.3% in 2024.

- By equipment, the Ethernet switch segment accounted for the largest share of 37.3% in 2024.

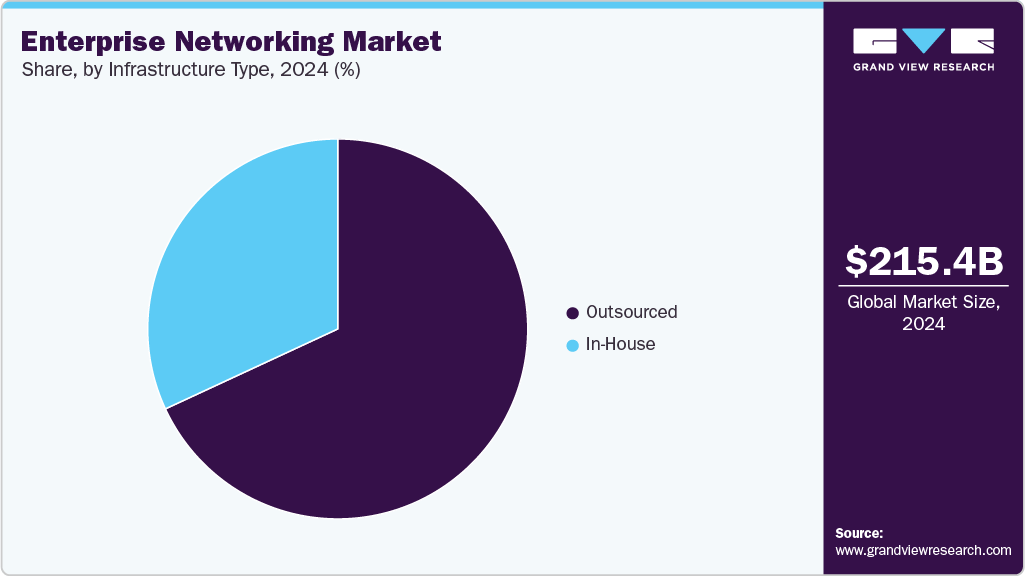

- By infrastructure type, the outsourced segment accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 215.45 Billion

- 2030 Projected Market Size: USD 298.30 Billion

- CAGR (2025-2030): 5.4%

- Asia Pacific: Largest market in 2024

The rising corporate need for comprehensive enterprise networking integration for mobile workforces, the internet of things (IoT), and cloud applications is projected to augment the growth in demand. As a result of the growing focus on greater bandwidth networks, network modernization of apps, and Wi-Fi expansion, many firms are also expected to accelerate advancements in their networking infrastructure.

Emerging technologies such as machine learning (ML) and artificial intelligence (AI), 5G, cloud computing, the Internet of Things (IoT), and edge computing are transforming the future of networking, with various effects on industry and society as a whole. One of the acute effects of these technologies is the increased complexity and expense of operating IT networks. Organizations adopting new technologies and applications must invest in new infrastructure, tools, and skills to manage and secure their networks effectively. It can lead to higher operating costs and greater demand on IT resources. On the other hand, these technologies also enable new applications and services that can significantly impact society. For example, smart city transportation systems can use IoT sensors and AI algorithms to optimize traffic flow, reduce congestion, and enhance safety.

Furthermore, machine learning (ML) and artificial intelligence (AI) offer various possible real-time applications in fields including smart cities, transportation, security, and networking. The potential advantages and capacities of AI and ML are rising exponentially in line with the technological breakthroughs that are currently being observed. Also, this indicates a rise in security risks and potential malware attacks. Businesses strive hard to become intelligent, which helps quickly resolve various networking and business issues.

Equipment Insights

The Ethernet switch segment accounted for the highest revenue share of 37.3% in 2024. Ethernet switches connect devices by relaying Ethernet frames between devices connected to the switches. Increasing demand for high-speed Ethernet switches is expected to open up new growth prospects for market participants in the coming years. Government attempts to speed up digital transformation have also increased demand for switches, routers, and wireless LAN networks, which is expected to propel market expansion in the future.

The WLAN segment is estimated to grow significantly over the forecast period. The increasing density effect in the enterprise area of the users and the equipment is magnified by the extended usage of the over-IP audio and video applications on mobile equipment. One for wireless localization - for the companies that allow access to resources and applications only if the user is present in a strict and limited perimeter of the collaborative work solutions, with a large volume of file sharing, etc. The mentioned types of applications require more extensive bandwidths, resulting in the congestion of the WLAN networks, which decreases the level of performance. This standard also supports bandwidth-related telepresence applications such as web conferencing and video. Enterprises are ripe for the deployment of 802.11ac, which is expected to increase demand for the new WLAN equipment.

Infrastructure Type Insights

The outsourced segment accounted for the largest market share in 2024. The rising demand for corporate networking outsourcing is driven by enterprises' need to cut costs, improve performance, get access to knowledge, focus on core competencies, and maintain business continuity while taking advantage of the latest technology and industry trends. Furthermore, outsourcing can help organizations focus on their core competencies by allowing them to offload the management and maintenance of their networks to external providers. It frees internal resources to focus on strategic initiatives that drive business growth and innovation.

The in-house segment is projected to grow significantly over the forecast period. In-house networking product production can save on management costs associated with outsourcing. There is complete control over the product output when in-house manufacturing is used. Moreover, production spikes can be planned with enough labor and equipment to meet demand. The quality of in-house networking products can be better controlled, and quality control is critical for businesses, which leads to the growing use of the in-house segment.

Regional Insights

North America enterprise networking market accounted for a 27.5% share in 2024. The North American market is experiencing significant growth due to the widespread adoption of cutting-edge technologies such as Software-Defined Networking (SDN), Software-Defined Wide Area Networking (SD-WAN), and AI-driven automation, which enhance network agility and security. The rise in hybrid and multi-cloud deployments, along with the expansion of remote work and IoT applications, is fueling the need for fast, dependable connectivity. The region benefits from strong IT infrastructure and a strong presence of major tech firms, fostering innovation and early technology adoption. Furthermore, the ongoing digital transformation, 5G implementation, and increasing emphasis on cybersecurity are key factors driving the market forward.

U.S. Enterprise Networking Market Trends

The enterprise networking market in the U.S. is driven by cloud adoption and the shift toward remote and hybrid work models, driving the need for fast, secure network connections. Significant investments in technologies like SD-WAN, 5G, and network automation are improving scalability and operational efficiency. Rising data usage, increasing IoT deployment, and heightened cybersecurity challenges are prompting continued upgrades to network infrastructure. Additionally, digital transformation efforts are a major contributor to the market’s ongoing expansion.

Asia Pacific Enterprise Networking Market Trends

The enterprise networking market in Asia Pacific dominated the global industry in 2024. The significant transition across many regional nations and their propensity to use cloud services is a factor in the region's growth. Additional evidence of a growing demand for top-notch precision equipment in this area comes from the continually expanding manufacturing activity. However, the Asia-Pacific market is also growing due to the region's strong IT sector and enormous demand for advanced technology, particularly in China and India.

Europe Enterprise Networking Market Trends

The enterprise networking market in Europe is experiencing growth due to the adoption of next-generation wireless technologies such as Wi-Fi 6 and Wi-Fi 7, which enable support for high-bandwidth applications. Government-led digitalization and cybersecurity initiatives are driving the need for more secure network solutions. The rise of managed IT services, network automation, and efforts to reduce operational costs are also key contributors. Moreover, expanding internet access and a growing emphasis on energy-efficient networking solutions are further accelerating market development.

Key Enterprise Networking Market Company Insights

Key players operating in the enterprise networking market are undertaking various initiatives to strengthen their presence and increase the reach of their products and services. Strategies such as expansion activities and partnerships are key in propelling the market growth.

Key Enterprise Networking Companies:

The following are the leading companies in the enterprise networking market. These companies collectively hold the largest market share and dictate industry trends.

- A10 Networks, Inc.

- ALE International, ALE USA Inc.

- Broadcom

- Cisco Systems, Inc.

- Dell Inc.

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Juniper Networks, Inc.

- Riverbed Technology

- ZTE Corporation

Recent Developments

-

In March 2025, Broadcom launched VeloSky, a unified platform that integrates wired, 5G, and satellite networks to provide seamless, AI-enhanced performance and built-in security for service providers. VeloSky supports the prioritization of critical business traffic, adaptive bandwidth allocation, and robust security capabilities, which are all accessible through a single, user-friendly interface. Designed to simplify network operations and lower costs, this advanced solution equips service providers to meet the growing enterprise need for dependable, high-speed connectivity.

-

In February 2025, Cisco introduced its latest global Wi-Fi 7 access points, enhancing its 6 GHz wireless portfolio to support robust, scalable, and future-ready enterprise networks. These new access points enable smooth user onboarding, smart network management, and streamlined licensing, making deployment and administration easier across on-premises, cloud, or hybrid setups. Equipment enhanced security, data speeds up to four times faster than Wi-Fi 6, and AI-powered insights, Cisco’s Wi-Fi 7 solutions help businesses build intelligent, secure, and cutting-edge digital environments.

Enterprise Networking Market Report Scope

Report Attribute

Details

Market size in 2025

USD 229.26 billion

Revenue forecast in 2030

USD 298.30 billion

Growth rate

CAGR of 5.4% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, infrastructure type, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; KSA; UAE; South Africa

Key companies profiled

A10 Networks, Inc.; ALE International, ALE USA Inc.; Broadcom; Cisco Systems, Inc.; Dell Inc.; Hewlett Packard Enterprise Development LP; Huawei Technologies Co., Ltd.; Juniper Networks, Inc.; Riverbed Technology; ZTE Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Networking Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enterprise networking market report based on equipment, infrastructure type, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Ethernet Switch

-

Enterprise Routers

-

WLAN

-

Network security

-

-

Infrastructure Type Outlook (Revenue, USD Million, 2018 - 2030)

-

In-House

-

Outsourced

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise networking market size was estimated at USD 215.45 billion in 2024 and is expected to reach USD 229.26 billion in 2025.

b. The global enterprise networking market is expected to grow at a compound annual growth rate of 5.4% from 2025 to 2030 to reach USD 298.31 billion by 2030.

b. Asia Pacific dominated the enterprise networking market with a share of 40.3% in 2024. This is attributable to the growing outsourcing of manufacturing activities to low-cost developing countries.

b. Some key players operating in the enterprise networking market include A10 Networks Alation Inc., ALE International, Broadcom Inc., Cisco Systems, Inc., Dell Inc., Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Juniper Networks, Riverbed Technology, Inc., ZTE Corporation.

b. Key factors that are driving the enterprise networking market growth include the increasing need for enterprises to become digital and the growing upgradation of networks to increase wireless capacity.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.