- Home

- »

- IT Services & Applications

- »

-

Enterprise Performance Management Market Report, 2033GVR Report cover

![Enterprise Performance Management Market Size, Share & Trends Report]()

Enterprise Performance Management Market (2025 - 2033) Size, Share & Trends Analysis Report By Offering, By Function (Finance, Human Resources), By Deployment (On-premises, Cloud), By Enterprise Size, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-257-6

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2024

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Enterprise Performance Management Market Summary

The global enterprise performance management market size was estimated at USD 6.73 billion in 2024 and is projected to reach USD 15.35 billion by 2033, growing at a CAGR of 10.0% from 2025 to 2033. The increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving market growth.

Key Market Trends & Insights

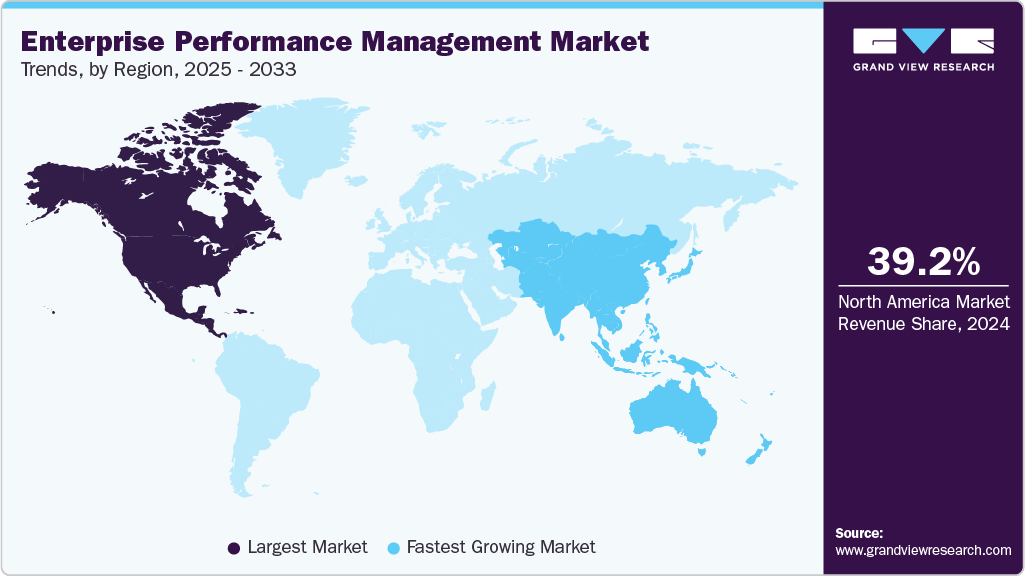

- North America held a 39.2% revenue share of the global enterprise performance management (EPM) market in 2024.

- In the U.S., regulatory compliance and corporate governance requirements are contributing to the growth of enterprise performance management market.

- By offering, the solution segment held the largest revenue share of 62.2% in 2024.

- By function, the supply chain segment held the largest revenue share in 2024.

- By deployment, the on-premises segment held the largest revenue share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 6.73 Billion

- 2033 Projected Market Size: USD 15.35 Billion

- CAGR (2025-2033): 10.0%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Enterprise performance management (EPM) helps effectively plan, measure, and manage an organization's performance to achieve its strategic goals. EPM's integrated approach combines various functional areas involving financial planning, budgeting, forecasting, performance reporting, and analytics to provide a holistic view of an organization's performance. For instance, in November 2023, Jedox, a globally renowned adaptable planning and performance management platform provider, entered into a strategic partnership with Fincons Group. The collaboration between both companies is expected to deliver innovative solutions to finance teams in countries such as Italy, Switzerland, France, Germany, Belgium, the UK, and the U.S. by fostering growth and profitability in these regions.

By aligning an organization's strategic objectives with its operational activities, EPM helps businesses make informed decisions, allocate resources optimally, and monitor performance against predefined targets. The other key offerings of enterprise performance management that are mainly considered are risk management and workforce planning.

Companies worldwide embrace digital transformation initiatives to enhance operational efficiency, streamline business processes, and gain a competitive edge. EPM solutions play a crucial role in this transformation by providing organizations with better visibility, control, and optimization of their financial and operational performance. The increasing volume and complexity of business data have led to a higher demand for advanced analytics capabilities in EPM solutions.

These capabilities help organizations make data-driven decisions, improve forecasting accuracy, and identify areas for optimization and cost reduction. Further, businesses operating in highly regulated industries such as finance and IT & Telecom need robust EPM solutions to ensure compliance with various regulatory requirements. EPM systems help organizations maintain regulatory compliance by automating processes, providing real-time monitoring, and generating accurate reports.

Moreover, EPM relies heavily on accurate and reliable data. In case the data used for performance measurement and decision-making needs to be completed, consistent, or accurate, the insights generated are expected to be misleading, leading to incorrect decisions and poor performance outcomes. The EPM often involves collecting, storing, and analyzing sensitive data, which probablyincreases the risk of cyber threats involving data breaches or cyberattacks. Inadequate security measures are expected to compromise the confidentiality, integrity, and availability of critical data, potentially leading to severe consequences for the organization.

Cloud adoption is also fueling market growth by making EPM solutions more accessible, scalable, and cost-effective for businesses of all sizes. Traditional on-premise EPM systems were often expensive, complex to implement, and difficult to update. Cloud-based EPM platforms, in contrast, offer lower upfront costs, faster deployment, and seamless upgrades, which make them particularly attractive to small and medium-sized enterprises (SMEs) as well as large corporations. These platforms also provide advanced capabilities such as artificial intelligence, machine learning, and natural language processing, which help improve forecasting accuracy, automate repetitive tasks, and enhance user experience. As businesses look to modernize their financial systems and become more agile, cloud-native EPM solutions are becoming the preferred choice.

Furthermore, the increased emphasis on performance transparency and accountability within organizations is reinforcing the demand for EPM solutions. Stakeholders, including investors, board members, and internal management, are seeking greater visibility into how resources are being allocated and how performance aligns with long-term goals. EPM tools provide dashboards, scorecards, and customizable reports that help track KPIs and link operational actions to strategic outcomes. This visibility is essential not only for internal governance but also for engaging external stakeholders and building trust. By fostering a performance-driven culture, EPM solutions help organizations improve alignment, accountability, and strategic execution across all levels of the business.

Offering Insights

The solution segment dominated the market with a market share of 62.2% in 2024. The growing focus on strategic agility and performance transparency in today’s competitive landscape is pushing organizations to adopt more dynamic and flexible EPM solutions. EPM solutions provide these capabilities through advanced data visualization, drill-down analytics, and scenario modeling. By integrating with ERP, CRM, and business intelligence platforms, modern EPM solutions enable holistic views of performance across the enterprise. This real-time visibility empowers organizations to pivot strategies quickly in response to market changes, competitive pressures, or internal challenges, further validating the importance of the solution segment in the broader EPM market.

The services segment is projected to register the fastest CAGR, from 2025 to 2033. Many organizations operate in complex IT environments with several solution functions and platforms. The services segment in enterprise performance management encompasses a wide array of offerings designed to support organizations in optimizing their business operations and enhancing decision-making capabilities. These services typically include consulting, implementation, integration, and support solutions tailored to address the unique challenges faced by companies operating in complex IT environments.

Function Insights

The supply chain segment dominated the industry in 2024. The integration of supply chain data with financial performance management drives EPM adoption in this segment. Businesses need to understand how supply chain inefficiencies, such as excess inventory, delayed shipments, or supplier variability, impact financial metrics like revenue, margin, and cash flow. EPM platforms bridge this gap by combining supply chain analytics with budgeting, planning, and forecasting functions. This integrated approach allows finance and supply chain leaders to collaboratively adjust procurement strategies, manage production schedules, and reallocate resources based on real-time performance and financial goals.

The sales and marketing segment is projected to grow significantly over the forecast period, owing to increasing competition among the enterprises in the market. EPM solutions enable sales and marketing teams to set performance targets, track progress, and measure the effectiveness of their strategies. It helps identify areas for improvement and make data-driven decisions to achieve their goals, such as increasing revenue or market share. The EPM solutions streamline the process of managing sales incentives and commissions, ensuring fair compensation for sales representatives while aligning their efforts with business goals.

Deployment Insights

The on-premises segment dominated the market in 2024. The on-premises segment in enterprise performance management refers to deploying and managing EPM solutions within an organization’s infrastructure, typically on-site at their premises. The on-premises EPM systems allow organizations to tailor their solutions according to their specific needs. This seamless integration with existing IT infrastructure and other business functions ensures a cohesive and efficient workflow.

The cloud segment is expected to grow at a significant CAGR over the forecast period. The scalability of cloud-based EPM systems with growing business needs and without significant investment in hardware installation is one of the key factors driving the segment's growth. Organizations can avoid high upfront costs associated with on-premise solution and hardware installations by utilizing a cloud-based solution. For instance, according to BI-Surveys, 89% of Oracle Cloud EPM users are planning users, notably higher than the overall survey average of 69%. It suggests that Oracle Cloud EPM provides extensive planning capabilities and a range of functions catering to various EPM processes.

Enterprise Size Insights

The large enterprise segment dominated the market in 2024. In large enterprises, EPM is vital in streamlining operations, enhancing decision-making, and ensuring compliance. Large enterprises often deal with a higher level of complexity, including diverse business units, multiple geographies, a wide range of products or services, and dynamic regulatory challenges. The regulatory landscapes are becoming increasingly complex and require compliance adherence, which poses substantial challenges for organizations. Compliance management functions within enterprise performance management are crucial in addressing these challenges by offering features such as compliance monitoring, regulatory intelligence, and automated compliance assessments. These functions enable organizations to evaluate their compliance position, identify potential gaps and weaknesses, and implement necessary controls and measures to rectify compliance shortcomings and manage associated risks more efficiently. The EPM solutions offer scalability and adaptability to cater to these complexities, providing a unified view of the organization's performance.

The small & medium enterprises segment is projected to be the fastest-growing segment from 2025 to 2033. EPM solutions can bring numerous advantages to SMEs, including improved financial management, enhanced decision-making, scalability, better resource allocation, streamlined operations, and increased competitiveness. With the adoption of EPM, SMEs can optimize their performance and drive growth in a dynamic business environment, eventually contributing to market growth over the forecast period.

End Use Insights

The IT & telecom segment dominated the market in 2024. EPM solutions enable IT and telecom companies to set performance targets, track progress, and measure the effectiveness of their strategies. This helps identify areas for improvement and make data-driven decisions to achieve their goals, such as improving customer satisfaction or expanding market share, ultimately contributing to the expansion of the enterprise performance management industry.

The healthcare segment is projected to be the fastest-growing segment from 2025 to 2033. By leveraging EPM, Healthcare companies are able to allocate resources, improve product quality, and maintain a competitive edge in their respective markets. EPM plays a crucial role in the Healthcare industry by optimizing operational efficiency, enhancing decision-making, and driving overall business performance. EPM involves the integration of various processes, such as planning, budgeting, forecasting, and performance analysis, to help manufacturers streamline their operations and achieve their strategic goals.

Regional Insights

North America enterprise performance management industry dominated globally with a market share of 39.2% in 2024, owing to the evolving regulatory compliance requirements, rising data-driven decision-making, and increasing adoption of digital transformation initiatives. The businesses facing numerous regulatory compliance requirements related to financial reporting, risk management, and data privacy are efficiently managed by EPM solutions, driving the regional market growth.

U.S. Enterprise Performance Management Market Trends

The U.S. enterprise performance management industry dominated the North American region in 2024. The rise of hybrid and remote work models across the U.S. has also significantly impacted the EPM market. As organizations adapt to a distributed workforce, there is a pressing need for centralized platforms that can unify performance data across departments and geographies. EPM solutions meet this demand by enabling collaborative planning and real-time data sharing between finance, operations, sales, and HR teams.

Asia Pacific Enterprise Performance Management Market Trends

The Asia Pacific enterprise performance management industry is expected to be the fastest-growing segment, with a CAGR of 10.2% over the forecast period. The Asia Pacific enterprise performance management market encompasses a variety of tools and solutions designed to help organizations in this region optimize their financial and operational performance. These tools assist companies in streamlining their business processes, enhancing decision-making capabilities, and improving overall efficiency. The market caters to the unique needs of Asia Pacific enterprises, providing tailored solutions to address their specific challenges and requirements.

The enterprise performance management industry in China has been growing significantly during the forecast period, owing to the integration of AI and big data and a focus on cybersecurity. Integrating AI and Big Data technologies with EPM solutions is expected to drive innovation and provide Chinese organizations with advanced analytics capabilities, enabling them to make data-driven decisions and optimize performance. As cyber threats evolve, Chinese organizations increasingly prioritize cybersecurity in their EPM systems, leading to the growth of specialized EPM solutions that address cybersecurity concerns.

The enterprise performance management industry in Japan has been growing significantly during the forecast period, due to government initiatives and increased focus on compliance. The Japanese government is promoting digital transformation across various industries through initiatives involving the Society 5.0 vision and the Digital Japan strategy. These initiatives are expected to increase investments in technology and the adoption of EPM solutions to improve organizational performance and efficiency. Furthermore, the stringent regulatory requirements and the need for transparency in various industries are pushing Japanese organizations to adopt EPM systems to ensure compliance and maintain a robust governance structure.

Europe Enterprise Performance Management Market Trends

The enterprise performance management industry in Europe is anticipated to register considerable growth from 2025 to 2033, due to the increasing digital transformation of SMEs and large enterprises and the growth of digital ecosystems in the region. The market expansion is also propelled by organizations' growing reliance on digital technologies. These technologies are being utilized to foster innovation, revolutionize business operations, and deliver novel products and services to customers. Consequently, organizations are transforming their processes and strategies, driving the market's growth.

The enterprise performance management industry in the UK is growing significantly during the forecast period, due to the rising emphasis on strategic planning and performance improvement and cloud-based EPM adoption driving the adoption of EPM. UK businesses recognize the value of EPM in enhancing their strategic planning and performance management capabilities. By leveraging EPM tools, organizations are aligning their strategies, budgets, and operations, ultimately driving growth and efficiency. The adoption of cloud-based EPM solutions is rising in the UK due to their scalability, flexibility, and cost-effectiveness. Cloud-based EPM systems enable organizations to access advanced performance management tools and technologies without significant upfront investments in hardware and infrastructure.

The enterprise performance management industry in Germany is growing significantly during the forecast period, owing to cost reduction optimization and collaboration and integration by the organizations. The German companies are seeking ways to reduce costs and improve operational efficiency. The EPM solutions are helping them identify areas for cost savings, streamline processes, and optimize resource allocation, leading to enhanced profitability. EPM solutions in Germany often focus on fostering collaboration and integration across various departments and functions. By breaking down silos and promoting cross-functional communication, EPM systems help organizations make more informed decisions and drive better overall performance.

Middle East & Africa Enterprise Performance Management Market Trends

The Middle East & Africa enterprise performance managemenhelpustry helps businesses streamline their operations, make informed decisions, and boost overall efficiency. The market caters to the diverse needs of enterprises across the region, providing customized solutions that address their distinct challenges and demands. For instance, as per Oracle Customer References, the MTN Group, a prominent telecommunications company, serves approximately 300 million customers by providing cellular, internet, and mobile money transfer services across 23 African and Middle Eastern nations. Through its adoption of Oracle Cloud, the enterprise has successfully reduced the time required for budget preparation by half, significantly enhancing its operational efficiency.

The Saudi Arabia enterprise performance management industry is expected to grow significantly over the forecast period due to the increasing competition among organizations and government initiatives. The highly competitive business environment in Saudi Arabia is turning enterprises to EPM solutions to gain a competitive edge by improving operational efficiency, reducing costs, and enhancing their overall performance. For instance, the Saudi Arabian government's Vision 2030 initiative aims to diversify the economy and reduce the country's dependence on oil. It has led to increased investments in technology and the adoption of EPM solutions to improve organizational performance and efficiency across various sectors.

Key Enterprise Performance Management Company Insights

Some of the key companies operating in the market include Oracle Corporation, IBM Corporation, among others are some of the leading players.

-

Oracle Corporation is a multinational computer technology corporation providing the Oracle EPM suite of Solution solutions with some popular Oracle EPM Solution products, including Oracle Hyperion, Oracle Planning and Budgeting Cloud Service, and Oracle Enterprise Performance Reporting Cloud Service.

-

IBM Corporation is a multinational organization that provides diverse products and services, including EPM Solution solutions involving IBM Planning Analytics, IBM Enterprise Cost Management, IBM Profitability and Cost Management, IBM Profitability and Resource Optimization, IBM Business Process Management, and IBM Operational Decision Management.

OneStream Solution and Workday, Inc. are some of the emerging market participants in the target market.

-

OneStream Solution is one of the major leading modern, intelligent Corporate Performance Management (CPM) solutions provider. OneStream EPM Solution solutions include OneStream XF Platform, OneStream XF MarketPlace, OneStream XF Workflow, OneStream XF Data Quality, OneStream XF Financial Data Quality Management (FDQM), and OneStream XF Disclosure Management.

-

Workday, Inc. is a cloud-based Enterprise Performance Management (EPM) Solution solution provider. Some key Workday EPM Solution solutions include Workday Adaptive Planning, Workday Financial Management, Workday Project Management, Workday Workforce Planning, and Workday Reporting and Analytics.

Key Enterprise Performance Management Companies:

The following are the leading companies in the enterprise performance management market. These companies collectively hold the largest market share and dictate industry trends.

- Acterys

- Anaplan, Inc.

- Epicor Solution Corporation

- IBM Corporation

- Jedox

- OneStream

- Oracle Corporation

- Prophix Solution Inc.

- SAP SE

- SAS Institute Inc.

- Unicorn Systems a.s.

- Wolters Kluwer N.V.

- Workday, Inc.

Recent Developments

-

In April 2025, Oracle NetSuite launched NetSuite Enterprise Performance Management (EPM) in Singapore. This new solution enables organizations to boost visibility, make smarter decisions using AI-driven insights, and accelerate growth by unifying key financial functions such as planning, budgeting, forecasting, account reconciliation, financial close, and reporting across the entire enterprise.

-

In September 2024, IBM Corporation acquired Accelalpha, a global provider of Oracle services, to strengthen its Oracle consulting capabilities across key areas such as supply chain and logistics, finance, enterprise performance management, and customer transformation. As Oracle functions have evolved with deeper functionality, organizations are increasingly seeking strategic service partners to drive their digital transformation initiatives.

-

In April 2024, Board International partnered with Wipro to support the modernization of enterprise planning and finance and accounting operations. As strategic partners, Board and Wipro collaborate to drive comprehensive financial transformation for organizations across a wide range of industries, including Financial Services, Energy, Utilities, Healthcare, BFSI, and Consumer sectors.

Enterprise Performance Management Market Report Scope

Report Attribute

Details

Market Size Value in 2025

USD 7.16 billion

Revenue Forecast in 2030

USD 15.35 billion

Growth rate

CAGR of 10.0% from 2025 to 2033

Actual data

2021 - 2024

Forecast Period

2025 - 2033

Quantitative Units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report Coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments Covered

Offering, function, deployment, enterprise size, end use, region

Regional Scope

North America; Europe; Asia Pacific; Latin America; MEA

Country Scope

U.S.; Canada; Mexico; UK; Germany; France; China; Japan; India; South Korea; Australia; Brazil; Kingdom of Saudi Arabia (KSA); UAE; South Africa

Key Companies Profiled

Oracle Corporation; SAP SE; IBM Corporation; SAS Institute Inc.; Anaplan, Inc.; Unicorn Systems a.s.; Epicor Solution Corporation; Workday, Inc.; OneStream; Wolters Kluwer N.V.; Jedox; Prophix Solution Inc.; Acterys

Customization Scope

Free report customization (equivalent to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and Purchase Options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enterprise Performance Management Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global enterprise performance management market report based on offering, function, deployment, enterprise size, end use, and region.

-

Offering Outlook (Revenue, USD Million, 2021 - 2033)

-

Solution

-

Services

-

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Finance

-

Human Resources

-

Supply Chain

-

Sales and Marketing

-

Others

-

-

Deployment Outlook (Revenue, USD Million, 2021 - 2033)

-

On-Premises

-

Cloud

-

-

Enterprise Size Outlook (Revenue, USD Million, 2021 - 2033)

-

Small & Medium Enterprises

-

Large Enterprise

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

BFSI

-

Retail

-

Healthcare

-

IT & Telecom

-

Government & Education

-

Manufacturing

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa

-

UAE

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global enterprise performance management market size was estimated at USD 6.73 billion in 2024 and is expected to reach USD 7.16 billion in 2025

b. The global enterprise performance management market is expected to grow at a compound annual growth rate of 10.0% from 2025 to 2033 to reach USD 15.35 billion by 2033.

b. The solution segment held the largest revenue share of 62.2% in 2024 and is expected to retain its dominance over the forecast period. The exponential growth in data volume and complexity is driving the demand for enterprise performance management solution

b. Some key players operating in the enterprise performance management market include Oracle; SAP; IBM Corporation; SAS Institute Inc.; Anaplan, Inc., Unicorn Systems a.s., Epicor Software Corporation, Workday, Inc., OneStream, Board International, Wolters Kluwer N.V.

b. The increasing adoption of digital transformation initiatives and the rising volume and complexity of business data are the key factors driving market growth.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.