- Home

- »

- Medical Devices

- »

-

Enzymatic Wound Debridement Market Size Report, 2030GVR Report cover

![Enzymatic Wound Debridement Market Size, Share & Trends Report]()

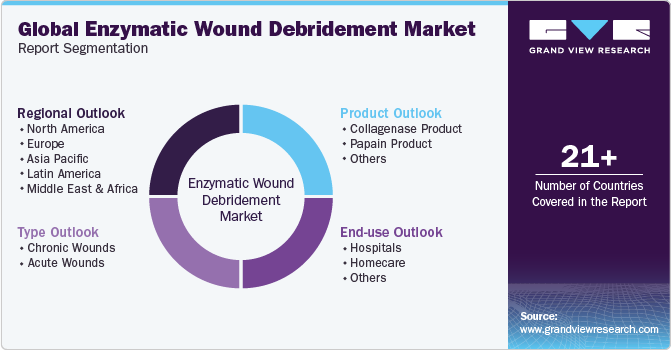

Enzymatic Wound Debridement Market (2023 - 2030) Size, Share & Trends Analysis Report By Type (Chronic Wounds, Acute Wounds), By Product (Papain Product, Collagenase Product, Others), By End-use (Hospitals, Homecare, Others), By Region, And Segment Forecasts

- Report ID: GVR-3-68038-259-4

- Number of Report Pages: 79

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

The global enzymatic wound debridement market size was valued at USD 864.2 million in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 6.2% from 2023 to 2030. The market demand is rising owing to an increase in the prevalence of chronic diseases such as diabetes, cancer, and other autoimmune diseases, a high number of accidents, and the introduction of technologically advanced products across the globe.As per the National Diabetes Statistic Report 2022 published by the CDC, more than 34 million people in America are living with diabetes. As per the International Diabetes Federation, the global prevalence of diabetes is expected to reach 700 million by 2045. Since prolonged diabetes may lead to diabetic foot, the rising incidence of diabetes is expected to drive growth.

According to the WHO, cancer is a leading cause of death globally and almost one in six deaths occurs due to cancer. Also, over 70% of cancer-related deaths occur in middle- and low-income countries. Cancer is a huge healthcare burden globally, as it is the second leading cause of death. According to the CDC, about 1,603,844 new cases of cancer were reported in the U.S. in 2020. Chronic diseases are also a major healthcare concern in the U.S., with over half of the adult population suffering from chronic diseases.

Collagenase- and papain-based products are majorly used for the treatment of diabetic foot ulcers, venous leg ulcers, and pressure ulcers. Collagenase-based enzymatic wound debridement products are mainly used to treat surgical wounds. Most surgical wounds after cancer surgery are relatively large and deep, producing exudate that requires regular management. Proper product usage helps in managing large wounds, which significantly reduces the risk of infection. Thus, the rising incidence of chronic diseases is anticipated to increase the demand for enzymatic wound debridement products, driving market growth.

An increasing prevalence of road accidents, as well as burn and trauma cases, across the globe is also anticipated to impel growth. According to the American Burn Association, nearly 450,000 individuals suffer burn injuries every year and they require proper medical care. Burn-related deaths in low- and middle-income countries account for the majority of the approximately 180,000 fatalities worldwide, according to the WHO.

Furthermore, as per a CDC report in 2022, around 1.35 million people died globally due to road accidents, accounting for deaths of around 3,700 people per day every year. Thus, a rise in the number of road accidents is expected to boost the demand for enzymatic wound debridement products, which is expected to lead to considerable market growth over the forecast period.

Type Insights

The acute wounds segment dominated the market in 2022. They include burns, abrasions, lacerations, incisions, and puncture wounds. An increase in the number of burn injuries across the globe is one of the major factors driving segment growth. Every year, around 50.0% of the population globally is at risk of fire-related traumas, of which 90.0% of the cases occur in moderate- and low-income countries. As per the WHO, annually, there are over 1,000,000 reported cases of moderate or severe burns in India. Thus, the segment is expected to grow at a significant rate over the forecast period.

The enzymatic wound debridement market is segmented into acute and chronic wounds, based on type. The chronic wounds segment is anticipated to witness the fastest growth over the forecast period. Chronic wounds include diabetic foot ulcers, venous leg ulcers, and pressure ulcers. The pressure ulcers segment, among other chronic wounds, is anticipated to witness the fastest growth over the forecast period. Pressure ulcers are also known as bed sores and usually occur due to prolonged intense pressure on the skin.

Prolonged hospital stay is the most common cause of such ulcers. They are common in the geriatric population and generally occur in bony areas such as ankles, hips, and tailbone. The rising geriatric population across the globe is a major factor aiding segment growth. Moreover, an increase in the number of surgeries and a rise in the prevalence of various diseases that require prolonged hospital stay are among factors expected to drive segment growth in the coming years.

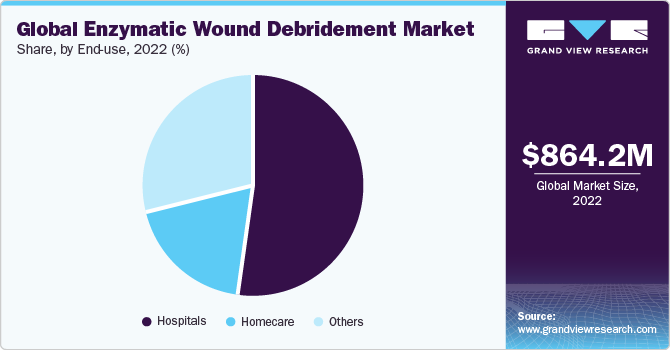

End-use Insights

The hospital segment held the largest market share of 52.8% in 2022. This is attributed to the rising incidence of chronic wounds globally. Besides, increasing cases of diabetic foot ulcers and venous leg ulcers are major factors driving segment growth. Moreover, the increasing incidence of surgical wounds due to a rise in the number of surgeries is also boosting segment expansion. Enzymatic wound debridement is also used for healing surgical site infections. Thus, these factors may fuel segment growth over the forecast period.

Based on end-use, the market for enzymatic wound debridement is classified into hospitals, home care, and others. The homecare segment is expected to witness the fastest growth rate of 6.6% over the forecast period. Most surgeries require a prolonged recovery period, leading to frequent changing of dressings. Thus, the demand for wound debridement products in home healthcare settings is increasing. Moreover, the geriatric & bariatric population, as well as patients suffering from chronic wounds, prefer homecare over hospital stay.

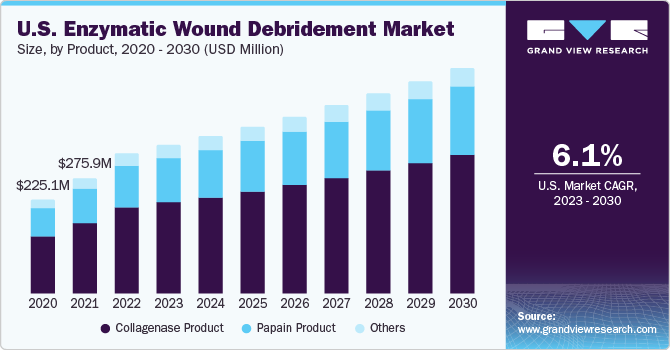

Product Insights

Based on product, the collagenase-based segment held the dominant share in the global market for enzymatic wound debridement products. Collagenase-based ointments, creams, and gels are some of the enzymatic debridement products used for debridement of necrotic tissue from venous leg ulcers, pressure ulcers, burn wounds, & partial-thickness burns. These products enable rapid healing and are also effective in the treatment of diabetic foot ulcers.

Collagenase-based enzymatic wound debridement products are easily available and are commonly used by medical professionals. Rising prevalence of pressure ulcers, diabetic foot ulcers, and venous leg ulcers is anticipated to contribute to segment growth. These ulcers majorly occur over the heels or sacrum. Also, as per NCBI, venous leg ulcers are common in several countries, especially in the U.S. and Northern Europe. Therefore, this segment is expected to exhibit significant growth over the forecast period. Collagenase SANTYL ointment is one of the most used enzyme debridement products offered by Smith & Nephew.

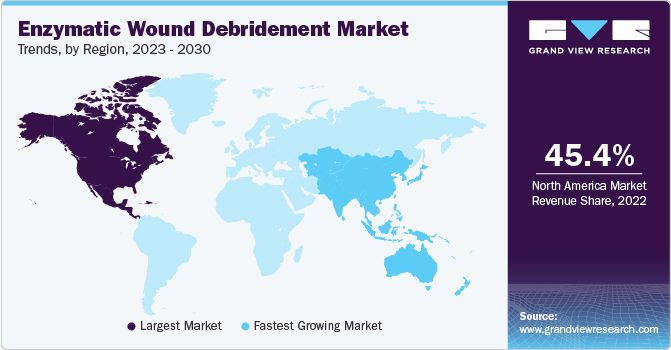

Regional Insights

North America led the market with the highest revenue share of 45.4% in 2022. An increase in prevalence of sports injuries & road accidents and the presence of several key players are factors anticipated to drive the market in North America. Also, the availability of skilled professionals and improvements in the healthcare infrastructure are expected to help the market expand positively over the forecast period. The U.S. held the dominant revenue share in North America.

Asia Pacific is anticipated to witness the fastest growth over the forecast period. The rising incidence of chronic wounds, such as diabetic ulcers and pressure ulcers, in the aging population of the region is likely to fuel the demand for advanced wound care solutions such as enzymatic debridement. Increasing healthcare expenditure in countries, including China, India, Japan, and Australia, is leading to improved healthcare facilities and infrastructure, thereby driving the regional adoption of advanced wound care techniques.

Key Companies & Market Share Insights

Product launches, approvals, strategic acquisitions, and innovations are just a few of the important business strategies used by market participants to maintain and expand their global reach. For instance, in February 2023, SERDA Therapeutics announced its submission of an Investigational New Drug Application (IND) to the U.S. FDA for its new product, the novel enzymatic wound debriding gel SN514 hydrogel. This hydrogel is intended to quickly and effectively remove eschar from chronic ulcers and severe burn wounds, including venous leg ulcers (open leg), pressure injury ulcers, and diabetic foot ulcers.

Key Enzymatic Wound Debridement Companies:

- Convatec Inc.

- Smith & Nephew

- Mölnlycke Health Care AB

- Integra LifeSciences

- SOLASCURE Limited

- B. Braun

Enzymatic Wound Debridement Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 915.0 million

Revenue forecast in 2030

USD 1,391.8 million

Growth rate

CAGR of 6.2% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

December 2023

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, product, end-use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; UK; Germany; France, Italy; Spain; Denmark; Sweden; Norway; Japan; China; India; Australia; Thailand; South Korea; Mexico; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Convatec Inc.; Smith & Nephew; Mölnlycke Health Care AB; B. Braun; Integra LifeSciences; SOLASCURE Limited

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enzymatic Wound Debridement Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global enzymatic wound debridement market report based on type, product, end-use, and region:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Chronic Wounds

-

Diabetic Foot Ulcers

-

Pressure Ulcers

-

Venous Leg Ulcers

-

-

Acute Wounds

-

Burn

-

Other Acute Wounds

-

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Collagenase Product

-

Papain Product

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Homecare

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Norway

-

Denmark

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

Thailand

-

South Korea

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global enzymatic wound debridement market size was estimated at USD 864.24 million in 2022 and is expected to reach USD 915.02 million in 2023.

b. The global enzymatic wound debridement market is expected to witness a compound annual growth rate of 6.2% from 2023 to 2030 to reach USD 1,391.8 million by 2030.

b. North America dominated the enzymatic wound debridement market in 2022 with a market share of more than 45.44%. Increasing sports injuries, road accidents, and presence of several key players is anticipated to drive the market.

b. Some key players operating in the enzymatic wound debridement market include ConvaTec, Smith & Nephew, Mölnlycke Health Care, B.Braun, and Integra Lifesciences.

b. Key factors that are driving the market growth include increasing prevalence of chronic diseases, rising cases of accidents, and the introduction of technologically advanced products across the globe.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.