- Home

- »

- Pharmaceuticals

- »

-

Enzyme Replacement Therapy Market Size Report, 2030GVR Report cover

![Enzyme Replacement Therapy Market Size, Share & Trends Report]()

Enzyme Replacement Therapy Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Imiglucerase), By Therapeutic Condition (MPS), By Route Of Administration (Oral), By End-use, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-999-9

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

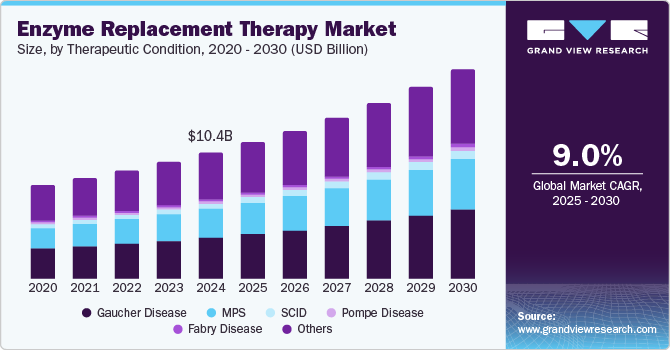

The global enzyme replacement therapy market size was valued at USD 10.37 billion in 2024 and is expected to grow at a CAGR of 9.0% from 2025 to 2030. This growth is attributed to the increasing prevalence of genetic disorders, particularly lysosomal storage diseases. In addition, advancements in biotechnology, including improved enzyme production techniques and genetic engineering, have facilitated the development of more efficient therapies. Furthermore, growing awareness and earlier diagnosis of these conditions also contribute to market growth. Emerging markets are also becoming significant as healthcare infrastructure improves, offering new opportunities for ERT accessibility and innovation.

Enzyme Replacement Therapy (ERT) is increasingly recognized for its vital role in treating genetic disorders, particularly lysosomal storage diseases. The market for ERT is experiencing significant growth due to several key factors. The rising incidence of genetic disorders has heightened the demand for effective treatments as awareness and diagnosis rates improve. In addition, advancements in biotechnological methods have enhanced enzyme production, making therapies more accessible.

Furthermore, emerging markets present substantial opportunities for ERT expansion as healthcare infrastructures develop and regulatory bodies become more supportive. This shift allows for increased patient access to innovative therapies. Moreover, ongoing research into improved delivery systems, including oral formulations and gene therapy combinations, offers new avenues for market growth.

However, challenges such as the high costs of treatments and potential infusion-related reactions could impede progress. Stringent regulatory environments and reimbursement issues in certain regions also pose barriers to market entry. To navigate these challenges, companies focus on personalized medicine approaches and developing biosimilars to lower costs and enhance accessibility. Research collaboration can leverage cutting-edge technologies such as CRISPR and artificial intelligence in drug development, further driving innovation.

Addressing these challenges while capitalizing on growth opportunities requires a strategic focus on expanding application pipelines and enhancing patient education and support networks. The ERT market is specialized and research-intensive, necessitating continuous investment in research and development to adapt to changing regulatory landscapes and ensure sustained growth.

Therapeutic Condition Insights

Gaucher disease held the dominant position in the market and accounted for the largest revenue share of 32.6% in 2024, driven by the increasing prevalence and awareness of the condition, leading to more patients being diagnosed and treated. Enzyme replacement therapy (ERT), particularly with imiglucerase, has established itself as a primary treatment, effectively managing symptoms and improving patients' quality of life. Furthermore, advancements in biotechnology have enhanced the production and delivery of these therapies, making them more accessible. Moreover, strong support from healthcare systems and ongoing research into new treatment options further contribute to market growth.

Mucopolysaccharidosis (MPS) therapeutics are expected to grow at a CAGR of 9.8% over the forecast period, owing to the rising recognition of these rare genetic disorders and the urgent need for effective treatments. Enzyme replacement therapy is crucial in managing MPS conditions and improving patient outcomes by addressing enzyme deficiencies. Furthermore, increased awareness among healthcare professionals and patients has led to earlier diagnoses, facilitating timely interventions. Moreover, advancements in research and development yield innovative therapies, while supportive regulatory frameworks enhance access to treatments, driving further growth in the MPS therapeutic market.

Product Insights

Imiglucerase dominated the market and accounted for the largest revenue share of 20.2% in 2024, owing to the rising prevalence of Gaucher disease, which necessitates effective treatment options. In addition, as awareness and diagnosis rates improve, more patients are being identified, increasing demand for imiglucerase. Its established efficacy in managing hematological and visceral symptoms has also solidified its position as a leading therapy. Moreover, the product's successful track record, strong reimbursement support, and ongoing clinical research further drive its adoption and market expansion.

Agalsidase beta is expected to grow at a CAGR of 9.8% over the forecast period. This growth is attributed to its effectiveness in treating Fabry disease, a rare genetic disorder. In addition, the growing recognition of Fabry disease and advancements in diagnostic capabilities have led to earlier detection and treatment initiation, boosting demand for agalsidase beta. Furthermore, the increasing availability of treatment options and supportive healthcare policies enhance patient access. Moreover, ongoing research into combination therapies and potential new formulations also presents opportunities for market growth, catering to evolving patient needs and improving therapeutic outcomes.

Route of Administration Insights

The parenteral route of administration dominated the market and accounted for the largest revenue share of 80.9% in 2024. This growth is attributed to its ability to facilitate rapid absorption and effective drug delivery. In addition, this method allows for intravenous infusions, which are essential for delivering large molecules such as enzymes directly into the bloodstream, ensuring immediate therapeutic effects. Furthermore, the convenience of pre-measured doses and the non-invasive nature of certain parenteral formulations enhance patient compliance. Moreover, established protocols and widespread acceptance among healthcare providers further support the growth of this segment.

The oral route of administration is expected to grow at a CAGR of 7.1% from 2025 to 2030. This growth is driven due to its convenience and ease of use. Patients prefer oral medications due to their noninvasive nature, simplifying treatment regimens and enhancing adherence. In addition, innovations in drug formulation, such as sustained-release and targeted delivery systems, improve the efficacy of oral ERT by ensuring consistent enzyme levels in the body. Furthermore, the increasing availability of oral therapies such as Zavesca for Gaucher disease reflects a growing trend towards patient-centric approaches, driving demand for this administration route.

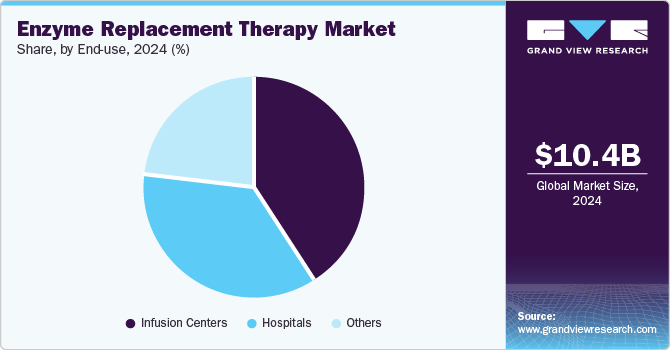

End-use Insights

Infusion centers led the market and accounted for the largest revenue share of 40.8% in 2024, driven by their specialized focus on intravenous treatments. These centers provide a controlled environment for administering ERT, ensuring patient safety and comfort during infusions. In addition, as the demand for enzyme replacement therapies increases, infusion centers offer convenience and accessibility, allowing patients to receive treatment without needing hospitalization. Furthermore, the ability to provide personalized care and monitor patients closely enhances treatment outcomes, making infusion centers a preferred choice for many patients with rare genetic disorders.

Hospitals are expected to grow at a CAGR of 9.1% over the forecast period, owing to their comprehensive healthcare services and advanced medical infrastructure. They are equipped with skilled healthcare professionals capable of effectively managing complex ERT protocols and monitoring potential side effects. In addition, the critical nature of conditions treated by ERT, such as Gaucher disease, often requires extensive medical oversight that hospitals can provide. Furthermore, hospitals facilitate immediate access to emergency care and additional medical resources, ensuring that patients receive holistic treatment, which drives their continued prominence in the ERT landscape.

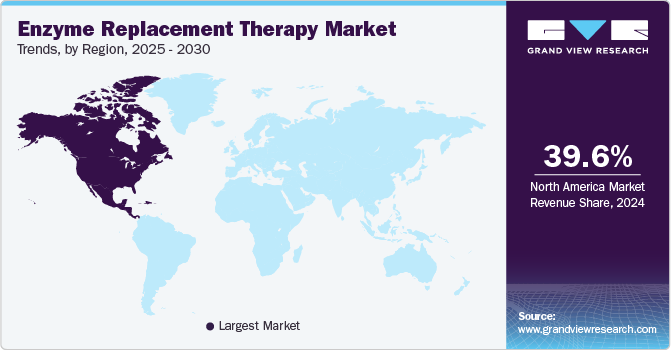

Regional Insights

North America enzyme replacement therapy market dominated the global market and accounted for the largest revenue share of 39.6% in 2024 attributed to a high prevalence of rare genetic disorders and robust healthcare infrastructure. The region benefits from significant investment in research and development, fostering innovation in ERT products. In addition, supportive government policies and funding initiatives enhance access to advanced therapies. Furthermore, major pharmaceutical companies and specialized treatment centers strengthen the market, ensuring that patients receive timely and effective treatments for conditions such as Gaucher and Fabry.

U.S. Enzyme Replacement Therapy Market Trends

The enzyme replacement therapy market in the U.S. dominated the North American market and accounted for the largest revenue share in 2024, driven by a strong emphasis on patient-centric approaches and advanced medical technologies. In addition, high healthcare expenditure facilitates access to cutting-edge treatments, while extensive insurance coverage supports patient affordability. Furthermore, the growing awareness of rare diseases among healthcare professionals and the public leads to earlier diagnosis and intervention, driving demand for ERT. Moreover, the country's commitment to improving rare disease management through regulatory support and innovative clinical trials contributes significantly to the growth of the ERT market.

Asia Pacific Enzyme Replacement Therapy Market Trends

Asia Pacific enzyme replacement therapy market is expected to grow at a CAGR of 10.3% over the forecast period, owing to increasing healthcare investments and rising disposable incomes. Countries such as China and India are witnessing a surge in the diagnosis of rare genetic disorders, leading to greater demand for effective treatments. Furthermore, biotechnology advancements have improved ERT products' availability, while government initiatives to enhance healthcare access further stimulate market growth. Moreover, the region's diverse population presents unique opportunities for tailored therapeutic approaches in enzyme replacement therapy.

The enzyme replacement therapy market in Japan held the dominant position within the Asia Pacific market and accounted for the largest revenue share in 2024. This growth is attributed to its advanced healthcare system and strong focus on research and development. The country has seen significant regulatory support for new ERT approvals, enhancing treatment options for patients with rare diseases such as Gaucher disease. In addition, technological advancements in drug formulation and delivery systems also play a crucial role in market growth. Furthermore, Japan's aging population increases the prevalence of genetic disorders, creating a higher demand for effective enzyme replacement therapies.

Europe Enzyme Replacement Therapy Market Trends

Europe enzyme replacement therapy market is expected to grow significantly over the forecast period, owing to supportive regulatory frameworks facilitating access to innovative treatments for rare diseases. Countries such as Germany have implemented national health programs that reimburse ERT costs, encouraging patient uptake. In addition, the region's strong emphasis on research collaboration among pharmaceutical companies, academic institutions, and healthcare providers fosters innovation in ERT products. Furthermore, increasing awareness of rare diseases among healthcare professionals contributes to early diagnosis and treatment initiation, driving market growth across Europe.

The growth of the enzyme replacement therapy market in Germany is fueled by a well-established healthcare infrastructure that supports advanced medical treatments. The country's commitment to addressing rare diseases through comprehensive health policies enhances patient access to ERT. In addition, a strong pharmaceutical industry presence fosters innovation and the development of new therapies tailored to specific genetic disorders. Moreover, ongoing clinical trials and research initiatives focused on improving treatment outcomes further drive the growth of the enzyme replacement therapy market in Germany, ensuring that patients receive effective care for their conditions.

Key Enzyme Replacement Therapy Company Insights

Some of the key companies in the market include Shire Plc; Sanofi S.A., Biomarin Pharmaceutical Inc., AbbVie, and others. These companies adopt various strategies to enhance their competitive edge. Strategic partnerships are formed to leverage complementary strengths, facilitating research and development and expanding market access. In addition, new product launches are prioritized to address unmet medical needs, ensuring a diverse therapeutic portfolio. Furthermore, mergers and acquisitions are pursued to consolidate resources, enhance innovation capabilities, and broaden geographical reach. Moreover, companies focus on improving patient education and support programs to foster adherence and optimize treatment outcomes in enzyme replacement therapy.

-

BioMarin Pharmaceutical Inc. specializes in developing and commercializing innovative biopharmaceuticals for rare genetic disorders. The company manufactures therapies for conditions such as phenylketonuria (PKU) and mucopolysaccharidosis (MPS), focusing on enzyme replacement and substrate reduction therapies. Operating primarily in the biotechnology segment, BioMarin emphasizes research and development to address unmet medical needs, providing effective treatments that improve patients' quality of life.

-

AbbVie develops and manufactures innovative therapies for conditions such as Fabry and Gaucher, utilizing advanced biotechnology to create effective enzyme replacement solutions. Operating within the pharmaceutical segment, AbbVie is committed to addressing complex health challenges through rigorous research and development efforts. Their extensive portfolio of therapies underscores their dedication to improving patient outcomes in the field of rare genetic disorders.

Key Enzyme Replacement Therapy Companies:

The following are the leading companies in the enzyme replacement therapy market. These companies collectively hold the largest market share and dictate industry trends.

- Shire Plc;

- Sanofi S.A.

- Biomarin Pharmaceutical Inc.

- AbbVie

- Alexion Pharmaceuticals Inc.

- Allergan plc

- Horizon Pharma Public Limited Company

- Actelion (Janssen)

- Recordati Rare Diseases

- Protalix Biotherapeutics

- Amicus Therapeutics, Inc.

Recent Developments

-

In January 2024, JR-441, an experimental ERT for Sanfilippo syndrome type A, received an Orphan Drug Designation from the FDA. Developed by JCR Pharmaceuticals, this designation accelerates clinical development for rare diseases affecting fewer than 200,000 people in the U.S. JR-441 aims to replace the deficient heparan N-sulfatase enzyme, which is crucial for breaking down heparan sulfate. A Phase 1/2 trial in Germany seeks to improve safety and tolerability while addressing significant neurological symptoms.

-

In September 2023, Amicus Therapeutics received FDA approval for its two-component therapy, Pombiliti (cipaglucosidase alfa) and Opfolda (miglustat), aimed at treating adults with Pompe disease who are not improving on their current enzyme replacement therapy (ERT). This innovative combination therapy enhances enzyme uptake and stabilizes enzyme activity in the blood, addressing a critical need in the Pompe community.

Enzyme Replacement Therapy Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.23 billion

Revenue forecast in 2030

USD 17.26 billion

Growth Rate

CAGR of 9.0% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, therapeutic condition, route of administration, end use, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; Sweden; Denmark; Norway; China; India; Japan; South Korea; Australia; Thailand; Brazil; Argentina; South Africa; UAE; Kuwait; Saudi Arabia

Key companies profiled

Shire Plc; Sanofi S.A.; Biomarin Pharmaceutical Inc.; AbbVie; Alexion Pharmaceuticals Inc.; Allergan plc; Horizon Pharma Public Limited Company; Actelion (Janssen); Recordati Rare Diseases; Protalix Biotherapeutics; Amicus Therapeutics, Inc.

Customization scope

Free report customization (equivalent to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Enzyme Replacement Therapy Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the global enzyme replacement therapy market report based on product, therapeutic condition, route of administration, end-use, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Imiglucerase

-

Agalsidase Beta

-

Alglucosidase Alfa

-

Taliglucerase

-

Velaglucerase Alfa

-

Pegademase

-

Laronidase

-

Pancreatic Enzymes

-

Idursulfase

-

Galsulfase

-

Others

-

-

Therapeutic Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Gaucher Disease

-

MPS

-

SCID

-

Pompe Disease

-

Fabry Disease

-

Others

-

-

Route of Administration Condition Outlook (Revenue, USD Million, 2018 - 2030)

-

Parenteral

-

Oral

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Infusion Centers

-

Hospitals

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.