- Home

- »

- Healthcare IT

- »

-

ePharmacy Market Size, Share & Trends Report, 2030GVR Report cover

![ePharmacy Market Size, Share & Trends Report]()

ePharmacy Market Size, Share & Trends Analysis Report By Drug Type (Prescription Drug, OTC Drug), By Region (North America, Europe, Asia Pacific, Latin America, Middle East & Africa), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-2-68038-262-4

- Number of Pages: 150

- Format: Electronic (PDF)

- Historical Range: 2017 - 2021

- Industry: Healthcare

Report Overview

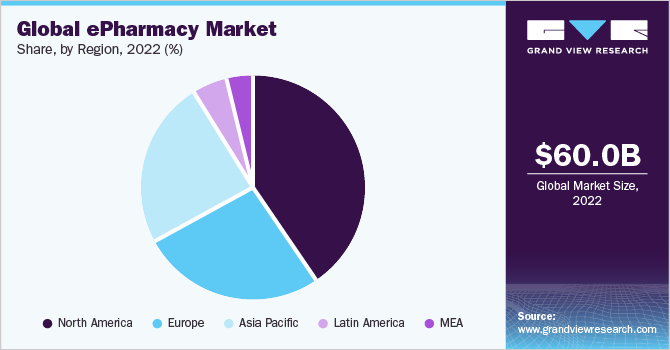

The global ePharmacy market size was valued at USD 60.0 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 20.4% from 2023 to 2030. Rising penetration of the internet across the globe, improving digitalization of healthcare services, and an increasing number of tech-savvy consumers are the key factors boosting the market growth. Rising consumer preference for online purchases with an increased focus on convenience is also aiding the growth. The increasing adoption of digital technologies and e-commerce in the healthcare sector is anticipated to propel overall growth. In January 2022, Mark Cuban, the venture capitalist, launched a digital pharmacy that sells more than 100 generic pharmaceuticals at a low cost, to be radically transparent. ePharmacy offers easier access that significantly benefits chronic elderly patients from nuclear families, as well as patients that are not in a condition to go out.

Increasing penetration of smartphones is further aiding the market growth. As per The Mobile Economy 2020, smartphone penetration was 65.0% in 2019 and is expected to reach 80.0% by 2025. The boom in the healthcare sector coupled with high operational costs has created the need to cut operational costs with the implementation of ePharmacy solutions. The increasing prevalence of chronic conditions is leading to a rise in the demand for various healthcare products, including drugs. This signifies the increasing penetration of online modes of drug procurement across the globe.

The pandemic has transformed the priorities of health systems worldwide. It has encouraged developing economies to rethink their infrastructure priorities in urban centers. Many countries faced the challenge of tackling the pandemic while making progress on other healthcare goals. Countries including India are rendering the urgency to combat the spread of COVID-19 into opportunities to make more resilient health systems. Increasing government focus on advancement and improvement in the overall healthcare system can contribute to market growth.

Although medical stores were classified as vital services, online pharmacies emerged as one of the largest beneficiaries of the pandemic-induced lockdown, as individuals preferred to buy medicines online to avoid the risk of disease spreading. In March 2022, Walgreens and Labcorp, a prominent global life sciences firm introduced Pixel by Labcorp, its (COVID-19 at-home collection kit), PCR test. Moreover, many communities can obtain easy testing services owing to Walgreens' inclusion of the kits, which are supplied in conjunction with the US Department of Health and Human Services (HHS).

The ePharmacy market increased by 38.0% from 2019 to 2020. High caseloads in countries coupled with regional lockdown had pushed consumers to adopt the ePharmacy platforms to order medicines online from the comfort of their homes, rather than visiting offline pharmacies and diagnostic centers. ePharmacy has gained significant growth during the pandemic owing to a rise in the number of government initiatives supporting the adoption of online purchase of medicines. The COVID-19 pandemic has led to an increase in the strategic initiatives by many market players.

The market will continue to grow post-pandemic, mainly owing to increasing adoption among consumers due to the convenience, affordability, and accessibility offered by these platforms. Increasing digitization and benefits associated with the adoption of ePharmacy over traditional pharmacies are anticipated to drive market growth in the coming years. Moreover, the second wave of the COVID-19 epidemic has prompted a spike in demand for medical gadgets, personal protective equipment (PPE), as well as health supplements, and frequently accessible medications in the ePharmacy market. High caseloads in cities, along with regional lockdowns, have prompted customers to purchase online rather than visit offline pharmacies and diagnostic centers, especially in big metros.

Furthermore, the increasing geriatric population is expected to fuel the growth of the market. Ease of operation, increasing digitalization, and rising number of beneficiaries registering under Medicare are some of the factors supporting the growth. For instance, according to the data published by Kaiser Family Foundation in June 2021, the total enrollment in a Medicare Advantage plan is over 26 million people, accounting for 42.0% of the total Medicare population. In addition, high funding, increasing investments, and rising strategic initiatives being undertaken by several funding agencies, governments, and companies are contributing to the market growth.

However, the presence of some illegitimate online pharmacies is limiting the growth of the market. These unlicensed pharmacies sell medicines that have not been authorized by the FDA, which, in turn, increases the possibility of obtaining counterfeit and adulterated medications with incorrect active ingredients from these pharmacies. For instance, as per a warning issued by the FDA in 2020, some online pharmacies were caught to be engaged in illegal activity and violating the U.S. Federal Food, Drug, and Cosmetic Act, which included some points, such as the sale of unapproved prescription drugs, sale of prescription drugs without prescription, inadequate explanation of directions for safe use of some prescription drugs, etc. In addition, in June 2021, the FDA also published a list of illegally operating online pharmacies (not all-inclusive), such as Buy Pharma, Rx 2 Go Pharmacy, Pharmacy Geoff’ and Sandra Pharma, that have been issued warning letters.

Regional Insights

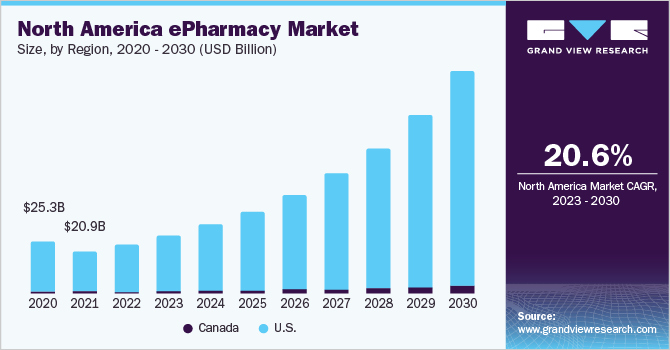

North America accounted for the largest market share of over 40.4%% in 2022. Rising adoption of e-commerce, growing geriatric population, increasing online sales, developed healthcare infrastructure, and positive attitude towards the adoption of new technologies are some of the major factors contributing to the regional market growth. Moreover, nearly 80% population of the U.S. is connected to ePharmacy and the shifting trend toward the direct-to-patient model.

The digital world has opened doors to consumer-friendly online experiences and other advanced services is further propelling the overall market growth in North America. As a result, in December 2020, Medicure Inc., the cardiovascular pharmaceutical business, announced that the company has entered into a formal agreement to purchase 100% of Marley Drug, Inc. through its wholly-owned U.S. subsidiary, Medicure Pharma Inc. The COVID-19 pandemic has significantly impacted the purchasing behavior of consumers, leading to more people than ever seeking medicines and other healthcare-related supplies through the ePharmacy platform. For instance, in April 2022, Walgreens and Wing launched drone delivery in the first large urban region in the U.S. as a pilot study.

Asia Pacific is anticipated to register the fastest CAGR during the forecast period. Emerging economies, such as China and India, possess high growth potential owing to the large population base coupled with increasing government initiatives supporting the adoption of digital technologies. With an increase in the number of strategic initiatives by various public and private organizations, the market in Asia Pacific is anticipated to grow at a faster pace in the coming years. For instance, in August 2020, Reliance Retail announced the acquisition of a 60.0% equity stake in Netmeds for USD 83.0 million. The acquisition is aimed at enhancing the company’s ability to offer affordable & high-quality health care products & services to its customers.

Moreover, in January 2022, Hyphens Pharma International Limited, Singapore's largest specialty pharmaceutical as well as consumer healthcare company, launched WellAway ePharmacy in the city-state. WellAway offers customers the ease of access to pharmaceutical services while also assisting doctors with teleconsultation. This service is especially beneficial for patients who are elderly, immobile, self-isolating, or just desire to limit their external contact time, particularly during the current COVID-19 outbreak.

Key Companies & Market Share Insights

Key players implement various marketing strategies to gain a competitive edge and increase their share. In addition, the companies also implement strategies, such as mergers, acquisitions, and partnerships, for increasing their market share. For instance, in January 2019, The Zur Rose Group finalized the purchase of the e-commerce operations of medpex, Germany's third-largest online pharmacy. With this move, the Zur Rose Group has greatly increased its market share in Germany. In 2018, Walgreen and Kroger jointly launched a pilot program for analyzing one-stop shopping with access to products from both companies. In 2018, Amazon.com, Inc. acquired a U.S.-based online pharmacy company named PillPack. Therefore, such initiatives indicate potential growth opportunities in the market. Some prominent players in the global ePharmacy market include:

-

The Kroger Co.

-

Walgreen Co.

-

Giant Eagle, Inc.

-

Walmart, Inc.

-

Express Scripts Holding Company

-

CVS Health

-

Optum Rx, Inc.

-

Rowlands Pharmacy

-

DocMorris (Zur Rose Group AG)

-

Cigna Corporation (Express Scripts Holdings)

-

Amazon.com Inc.

-

Axelia Solutions (Pharmeasy)

-

Apex Healthcare Berhad (Apex Pharmacy)

-

Apollo Pharmacy

-

Netmeds

ePharmacy Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 69.8 billion

Revenue forecast in 2030

USD 255.6 billion

Growth rate

CAGR of 20.4% from 2023 to 2030

Base year for estimation

2022

Historical data

2017 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S., Canada, U.K., Germany, France, Italy, Spain, Sweden, Japan, India, China, Australia, South Korea, Thailand, Malaysia, Brazil, Mexico, Argentina, South Africa, Saudi Arabia, UAE

Key companies profiled

The Kroger Co.; Walgreen Co.; Giant Eagle, Inc.; Walmart, Inc.; Express Scripts Holding Company; CVS Health; Optum Rx, Inc.; Rowlands Pharmacy; DocMorris (Zur Rose Group AG);Cigna Corporation (Express Scripts Holdings); Amazon.com Inc.; Axelia Solutions (Pharmeasy); Apex Healthcare Berhad (Apex Pharmacy); Apollo Pharmacy; Netmeds

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Segments Covered in the Report

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the global ePharmacy market report based on drug type, and region:

-

Drug type Outlook (Revenue, USD Million, 2017 - 2030)

-

Prescription drug

-

Over-the-counter drug (OTC)

-

-

Regional Outlook (Revenue, USD Million, 2017 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Europe

-

Germany

-

U.K.

-

Spain

-

Italy

-

France

-

Russia

-

Sweden

-

Denmark

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

Singapore

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Mexico

-

Argentina

-

-

MEA

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global ePharmacy market size was estimated at USD 60.0 billion in 2022 and is expected to reach USD 69.8 billion in 2023.

b. The global ePharmacy market is expected to grow at a compound annual growth rate of 20.4% from 2023 to 2030 to reach USD 255.6 billion by 2030.

b. North America dominated the ePharmacy market with a share of 40.4% in 2022. This is attributable to the high usage of online/app-based pharmacies for monthly prescription medicine and the presence of large retail pharmacies on the online platforms.

b. Some key players operating in the ePharmacy market include The Kroger Co.; Walgreen Co.; Wal-Mart Stores, Inc.; CVS Health; Express Scripts Holding Company; Giant Eagle, Inc.; DocMorris (Zur Rose Group AG); Rowlands Pharmacy; and OptumRx, Inc.

b. Key factors that are driving the ePharmacy market growth include increased internet penetration across the world, improved healthcare infrastructure, rapid aging of the population, and increasing awareness pertaining to e-commerce amongst users of all age groups.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."