- Home

- »

- Medical Devices

- »

-

Epilepsy Drugs Market Size And Share, Industry Report 2030GVR Report cover

![Epilepsy Drugs Market Size, Share & Trends Report]()

Epilepsy Drugs Market (2025 - 2030) Size, Share & Trends Analysis Report By Treatment (First Generation Anti-epileptics, Second Generation Anti-epileptics), By Distribution Channel, By Region, And Segment Forecasts

- Report ID: 978-1-68038-958-6

- Number of Report Pages: 90

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Epilepsy Drugs Market Summary

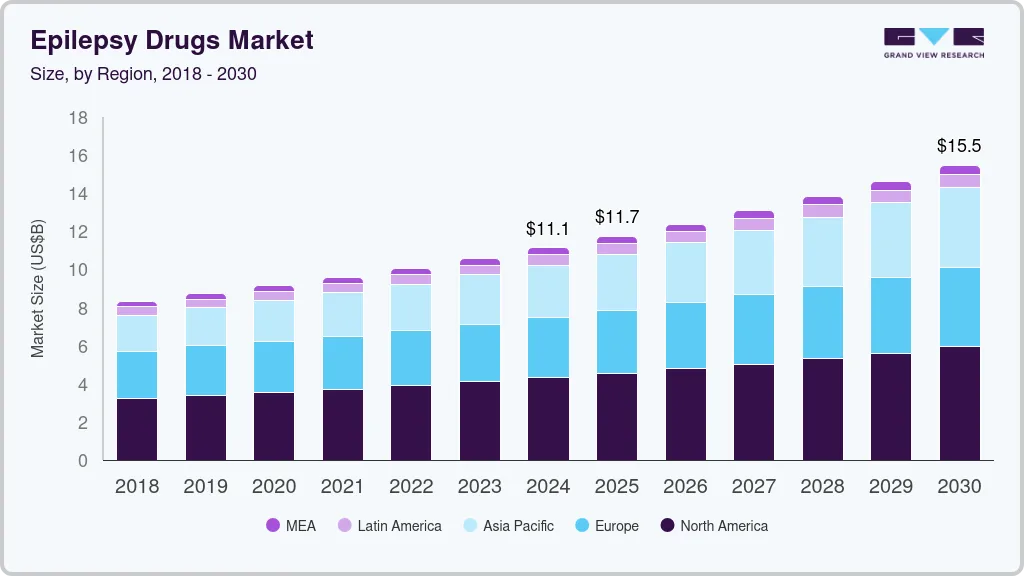

The global epilepsy drugs market size was estimated at USD 11,132.4 million in 2024 and is projected to reach USD 15,475.0 million by 2030, growing at a CAGR of 5.7% from 2025 to 2030. As the global incidence of epilepsy rises, there is a greater demand for effective treatments, fueling innovation in drug therapies.

Key Market Trends & Insights

- North America epilepsy drugs market secured the largest market share of 38.7% in 2024.

- The U.S. held a commendable position in the epilepsy drugs market in 2024.

- By treatment, the first generation anti-epileptics accounted for a revenue of USD 4,664.9 million in 2024.

- By treatment, the second generation anti-epileptics is the most lucrative product segment registering the fastest growth during the forecast period.

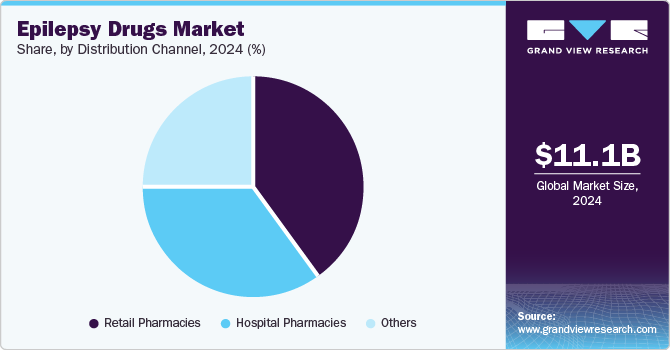

- By distribution channel, the retail pharmacies segment secured the largest revenue share of 39.9% in 2024

Market Size & Forecast

- 2024 Market Size: USD 11,132.4 Million

- 2030 Projected Market Size: USD 15,475.0 Million

- CAGR (2025-2030): 5.7%

- North America: Largest market in 2024

Newer anti-epileptic drugs (AEDs) are being developed with improved efficacy, fewer side effects, and better patient outcomes. These advancements are expanding treatment options and improving the quality of life for patients, further contributing to the market expansion.

Technological advancements in drug delivery systems, such as nano-based formulations and targeted therapies, are enhancing the efficacy and precision of epilepsy treatments. These innovations enable better control over drug release, improving patient compliance and reducing side effects. Furthermore, the rising focus on pediatric epilepsy, driven by increasing awareness and the need for specialized care, is expanding the market for epilepsy drugs. As the demand for more effective, child-friendly treatments grows, these factors are set to significantly accelerate the growth of the epilepsy drugs market in the near future.

Treatment Insights

The third generation anti-epileptics segment dominated the market with the largest revenue share of 39.7% in 2024, propelled by their superior efficacy, safety profile, and reduced side effects compared to earlier generations. These drugs, such as levetiracetam and lacosamide, offer broader-spectrum action, making them effective for various types of epilepsy, specifically treatment-resistant cases. Their favorable pharmacokinetic properties, including fewer drug interactions and once-daily dosing, enhance patient compliance. As a result, third-generation AEDs are increasingly preferred by healthcare providers and patients, driving their dominant market position.

The second generation anti-epileptics segment is anticipated to emerge as the fastest-growing segment in the market and is projected to grow at a CAGR of 7.7% over the forecast period, owing to their enhanced efficacy and safety profile compared to first-generation drugs. These newer medications are designed to minimize side effects, offer better seizure control, and improve patient compliance. With advancements in research and growing awareness, the demand for second-generation AEDs is rapidly escalating, particularly as they target specific types of seizures and neurological disorders. This trend positions the second-generation AEDs segment for notable market growth in the coming years.

Distribution Channel Insights

The retail pharmacies segment secured the largest revenue share of 39.9% in 2024 due to their widespread accessibility and convenience. With a large number of patients seeking treatment for epilepsy, retail pharmacies serve as a primary point of access for prescription medications. The availability of both branded and generic antiepileptic drugs (AEDs) in these pharmacies, coupled with the rise in self-medication and over-the-counter options, has further boosted their dominance. Moreover, retail pharmacies often offer competitive pricing and patient-friendly services, making them the go-to source for epilepsy drug procurement.

The hospital pharmacies segment is expected to stand out as the fastest growing segment and capture a CAGR of 4.4% during the forecast period, fueled by the surging demand for specialized care and treatment. Hospitals are pivotal in managing complex epilepsy cases, offering access to advanced diagnostic tools, expert physicians, and a wide range of anti-epileptic drugs (AEDs). With a surge in patients requiring continuous and personalized treatment, hospital pharmacies are becoming key players in drug distribution. This trend is further supported by ongoing drug formulations and treatment regimen advancements, boosting the segment growth prospects.

Regional Insights

North America epilepsy drugs market secured the largest market share of 38.7% in 2024, attributed to advanced healthcare infrastructure, high awareness levels, and robust regional research and development. The U.S. leads in drug innovation, with numerous pharmaceutical companies developing new anti-epileptic drugs (AEDs) and expanding treatment options. In addition, favorable reimbursement policies and widespread access to health care contribute to increased drug adoption. The growing number of diagnosed epilepsy cases, along with the aging population across the region, further boosts the demand for effective epilepsy treatments, thereby strengthening the dominant market position of North America.

U.S. Epilepsy Drugs Market Trends

The U.S. held a commendable position in the epilepsy drugs market in 2024 due to its high prevalence of epilepsy, ample healthcare investments, and advanced medical infrastructure. The well-established healthcare system of the country, coupled with sizable research and development efforts, has led to the availability of innovative anti-epileptic drugs (AEDs). In addition, a growing focus on personalized medicine and better patient awareness is propelling demand for effective treatment options. With an aging population and higher diagnosis rates, the U.S. market is expected to grow in the coming years.

Canada is anticipated to achieve a significant CAGR over the forecast period, owing to growing healthcare infrastructure and increasing awareness about epilepsy. With a rising number of diagnosed cases, particularly among the aging population, there is a higher demand for effective treatment options. The focus of Canada on medical research and innovation, along with government support for healthcare initiatives, fuels the development of advanced antiepileptic drugs. Besides, a strong healthcare system across the country ensures widespread access to medications, further accelerating the growth of the epilepsy drugs market in the region.

Europe Epilepsy Drugs Market Trends

Europe is set to expand at the fastest growing CAGR of 4.8% from 2025 to 2030, propelled by the high prevalence of epilepsy, advanced healthcare infrastructure, and a well-established regulatory environment. With an emphasis on innovative drug development and increasing patient awareness, demand for effective epilepsy treatments is surging. Moreover, the presence of key pharmaceutical companies and ongoing research initiatives in Europe is fueling market growth. As healthcare systems continue to improve and access to novel therapies expands, Europe is projected to experience remarkable growth.

Europe is anticipated to achieve a noteworthy revenue share during the forecast period, spurred by its high disease burden and advanced healthcare systems. With an aging population and increasing awareness about epilepsy, there is a rising demand for effective treatments. The region's robust pharmaceutical industry, coupled with ongoing research and development efforts, is fueling the creation of innovative antiepileptic drugs. Moreover, government support for healthcare initiatives and the availability of treatment options are projected to fuel further the expansion of the epilepsy drugs market in Europe.

The U.K. is expected to establish a considerable foothold by 2030, fueled by escalating epilepsy cases and advancements in medical treatments. With a strong healthcare system, high levels of patient awareness, and continuous research into novel therapies, demand for effective epilepsy medications is surging. The U.K. also benefits from a robust regulatory environment and support for drug development, making it a hub for pharmaceutical innovation. As new antiepileptic drugs (AEDs) become available, the U.K. is set to witness significant growth in its epilepsy drug market.

Germany is projected to accumulate sizable gains by 2030, driven by its thriving healthcare system, growing elderly population, and increasing awareness of neurological disorders. The emphasis on research and development in the country fosters innovation in anti-epileptic drugs (AEDs), driving the availability of advanced treatment options. Furthermore, the strong healthcare policies of Germany, which provide broad access to medications, are expected to boost market growth. With a surge in number of epilepsy diagnoses and a well-established pharmaceutical sector, Germany is anticipated to experience substantial expansion in the epilepsy drugs market.

Asia Pacific Epilepsy Drugs Market Trends

Asia Pacific epilepsy drugs market is expected to register at a notable CAGR over the forecast period, attributed to the large and diverse population of the region, surging prevalence of epilepsy, and improving healthcare infrastructure. As awareness of epilepsy increases, demand for effective treatment options is growing across countries in the region. Besides, rapid urbanization, increasing healthcare access, and government initiatives to improve medical care contribute to market growth. The expanding pharmaceutical industry in the region and ample investments in research and development of antiepileptic drugs further support its potential for remarkable growth in the epilepsy drugs market.

Japanis projected to grow at a commendable CAGR over the forecast period due to its aging population, which leads to a higher incidence of epilepsy and advancements in healthcare. The country's strong pharmaceutical industry and commitment to innovation in medical research are fueling the development of novel antiepileptic drugs (AEDs). Furthermore, the well-established healthcare system and regulatory support of Japan provide a favorable environment for drug adoption and market growth. As new and more effective treatments become available, Japan is set to see significant expansion in the years ahead.

China captured a noteworthy share in 2024, spurred by its large population and increasing awareness of neurological disorders. As healthcare access improves and healthcare infrastructure develops in the country, more individuals are being diagnosed and treated for epilepsy. In addition, the escalating investment in medical research and drug development in China is propelling innovation in anti-epileptic drugs (AEDs). The rising incidence of epilepsy and government initiatives to expand healthcare coverage are further accelerating the demand for epilepsy medications, positioning China for substantial market growth.

Key Epilepsy Drugs Company Insights

Some of the key companies in the epilepsy drugs market include UCB S.A.; Sanofi; Pfizer, Inc.; Otsuka America Pharmaceutical, Inc.; Eisai Co., Ltd.; Abbott Laboratories, Inc.; Novartis AG; GlaxoSmithKline plc; Sunovion Pharmaceuticals, Inc.; Jazz Pharmaceuticals plc; Neurelis, Inc.

-

Abbott Laboratories, Inc. offers various healthcare products, including diagnostics, medical devices, nutrition, and branded generic medicines. It aims to improve health outcomes and enhance quality of life globally.

-

Novartis AG provides innovative healthcare solutions, particularly prescription medications, vaccines, and gene therapies. It emphasizes oncology, ophthalmology, neuroscience, and cardiovascular diseases to improve global health.

Key Epilepsy Drugs Companies:

The following are the leading companies in the epilepsy drugs market. These companies collectively hold the largest market share and dictate industry trends.

- UCB S.A.

- Sanofi

- Pfizer, Inc.

- Otsuka America Pharmaceutical, Inc.

- Eisai Co., Ltd.

- Abbott Laboratories, Inc.

- Novartis AG

- GlaxoSmithKline plc

- Sunovion Pharmaceuticals, Inc.

- Jazz Pharmaceuticals plc

- Neurelis, Inc.

Recent Developments

-

In November 2024, Neurelis, Inc. shared insights on the study design from their enrollment process for the Stellina study. This study investigated VALTOCO® (diazepam nasal spray) for treating seizure clusters in epilepsy patients aged 2 to 5.

-

In October 2023, Sanofi sold its epilepsy medication Frisium (clobazam) and ten other CNS medicine brands to Pharmanovia. Frisium is used as an adjunctive treatment with other epilepsy medications.

Epilepsy Drugs Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.73 billion

Revenue forecast in 2030

USD 15.47 billion

Growth rate

CAGR of 5.7% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Treatment, distribution channel, region

Regional scope

North America, Europe, Asia Pacific, Latin America, Middle East and Africa

Country scope

U.S., Canada, Mexico, U.K., Germany, France, Italy, Spain, Denmark, Norway, Sweden, Japan, China, India, South Korea, Australia, Thailand, Brazil, Argentina, South Africa, Saudi Arabia, UAE, Kuwait

Key companies profiled

UCB S.A.; Sanofi; Pfizer, Inc.; Otsuka America Pharmaceutical, Inc.; Eisai Co., Ltd.; Abbott Laboratories, Inc.; Novartis AG; GlaxoSmithKline plc; Sunovion Pharmaceuticals, Inc.; Jazz Pharmaceuticals plc; Neurelis, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epilepsy Drugs Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global epilepsy drugs market report on the basis of treatment, distribution channel, and region:

-

Treatment Outlook (Revenue, USD Million, 2018 - 2030)

-

First Generation Anti-epileptics

-

Second Generation Anti-epileptics

-

Third Generation Anti-epileptics

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

U.K.

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Norway

-

Sweden

-

-

Asia Pacific

-

Japan

-

China

-

India

-

South Korea

-

Australia

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.