- Home

- »

- Plastics, Polymers & Resins

- »

-

Epoxy Resin Market Size, Share And Growth Report, 2030GVR Report cover

![Epoxy Resin Market Size, Share & Trends Report]()

Epoxy Resin Market Size, Share & Trends Analysis Report By Application (Paints & Coatings, Wind Turbines), By Region (North America, Europe), And Segment Forecasts, 2024 - 2030

- Report ID: 978-1-68038-171-9

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Epoxy Resin Market Size & Trends

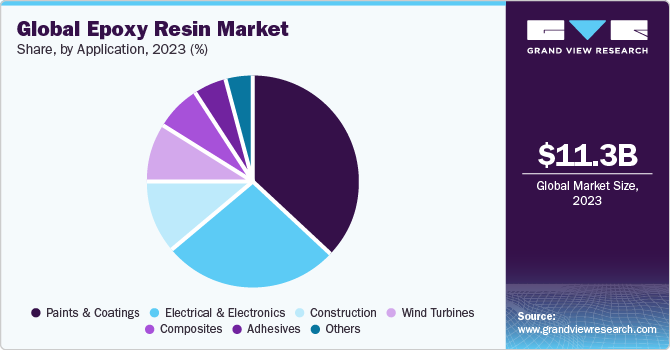

The global epoxy resin market size was estimated at USD 11.25 billion in 2023 and is expected to grow at a CAGR of 6.3% from 2024 to 2030. Increasing demand for paints and coatings is anticipated to drive market growth significantly during the forecast period. Increasing demand for epoxy resins is attributed to growing spending on construction, particularly residential construction, especially in North America and Western Europe. The rapid growth in global manufacturing activities is expected to fuel the demand for paints & coatings used in the production of motor vehicles and other durable goods, as well as industrial maintenance applications. This is expected to boost the demand for epoxy resins globally.

Asia Pacific has been the leading consumer of epoxy resins, fueled by increasing demand from China and India. Infrastructure development, along with increasing automotive production, has fueled paints & coatings demand in the region. Increasing disposable income and willingness to spend are expected to drive the market over the coming years.

In the recent past, global automotive production increased rapidly due to growing demand from middle-class families and rising disposable income across emerging nations such as China, India, Brazil, Vietnam, and others. The rise in automotive demand propelled the consumption of paints & coatings across the automotive industry, thereby fueling the demand for epoxy resins. However, volatile raw material price of epoxy resin is expected to restrain the market growth during the forecast period.

In addition, the outbreak of COVID-19 negatively impacted the demand for epoxy resin in various applications, including paints & coatings, adhesives, wind turbines, and others, owing to the stalled manufacturing activities, restrictions in supply and transportation, and economic slowdown across the globe in 2020. Moreover, the recommencing industrial operation is projected to positively influence the market demand in the coming years.

Market Concentration & Characteristics

The market space is moderately consolidated with the presence of key companies, such as 3M, Aditya Birla Management Corp. Pvt. Ltd, BASF SE, and Sika AG. These companies adopt various strategic initiatives, such as new product launches, partnerships, capacity expansions, and collaborations, to expand their presence in the market. For instance, in March 2024, Safic-Alcan announced its expansion by collaborating with BB Resins Srl. BB Resins Srl is a manufacturer of epoxy resin hardeners, which boasts an extensive range of products specifically designed for the coatings, construction, and adhesives sectors. With this collaboration, Safic-Alcan aims to expand its business across Poland.

The industry is characterized by a high degree of innovation. Technological advancement, upgradation of electronic products, and circuit assembly have propelled PCB fabrication technology toward micro via, fine-trace, high-density tracing, and multi-layers. The usage of epoxy resins enhances thermal dissipation, dimensional stability, and dielectric loss, therefore, propelling the demand for epoxy resins in the manufacture of CCL. In recent years, the electronic industry has grown rapidly, thereby increasing the demand for PCBs across the globe.

In addition, stringent regulations shape the market’s demand and supply dynamics. Stricter regulations on volatile organic compounds (VOCs) and hazardous substances can limit the use of certain raw materials and formulations. This can lead to a shift in market preferences towards eco-friendly and compliant products. For instance, the European Union’s REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) regulation requires comprehensive data on the safety of chemical substances, pushing manufacturers to innovate and produce safer epoxy resin formulations.

Application Insights

The paints & coatings application segment led the market and accounted for a 37.41% revenue share in 2023. Epoxy resin-based paints & coatings are widely utilized in residential & commercial buildings, shipbuilding industries, automotive, and wastewater treatment plants, among others, owing to their excellent resistance to stains, cracks, extreme temperatures, blistering, and chemicals. They offer excellent adhesion, high anti-corrosion performance, and have low volatile organic compounds content. They are used to coat interior and exterior surfaces of commercial, residential, institutional, and industrial buildings. The application of these paints & coatings not only increases the aesthetic appeal of surfaces but also protects them from soaking rains, freezing winters, blistering summers, and UV radiation without them getting peeled, faded, or cracked.

Construction application is expected to grow at the fastest CAGR of 7.3%. In construction, epoxy resins are used as sealers, hardeners, grouts, mortars, and laminates for walls, roofs, and decks. Low water permeability, excellent cleaning material and chemical resistance, good mechanical properties, low cure shrinkage, and excellent adhesion are some of the properties that fuel the demand for epoxy resins in construction applications.

Region Insights

The epoxy resin market in North America is poised to grow over the forecast period owing to the rapid construction and infrastructure development in the U.S. and Mexico. The construction industry in the region is expected to witness significant growth over the coming years, owing to the high demand for non-residential construction projects, such as hospitals, commercial buildings, and colleges.

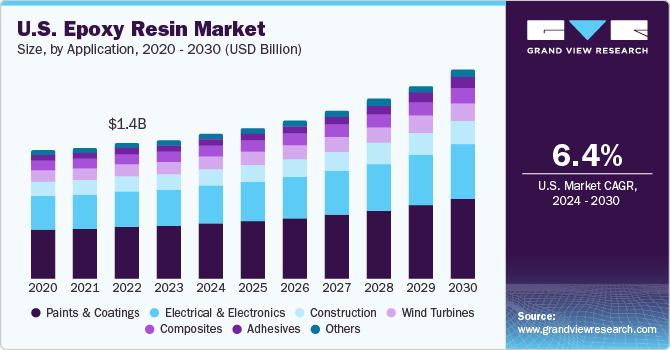

U.S. Epoxy Resin Market Trends

Epoxy resin market in the U.S. dominated the North America market in 2023 with a share of 85.85%. Rising demand for epoxy resin in paints & coatings, wind turbines, construction, electrical & electronics, composites, and adhesive applications in the U.S. is expected to drive the market over the forecast period.

Asia Pacific Epoxy Resin Market Trends

Epoxy resin market in the Asia Pacific region dominated the global market and accounted for the largest revenue share of 59.11% in 2023.Rising construction activities and growing demand from the automotive sector in emerging countries, such as India, Japan, and South Korea, are expected to drive the market over the forecast period.Furthermore, the easy availability of raw materials has provided a huge opportunity for the use of epoxy resin-based products in various end-use sectors.

China epoxy resin market dominated the regional market in 2023.The rising number of infrastructure development projects and the growing manufacturing industry are expected to drive market growth over the forecast period. China’s construction market is likely to outperform other Southeast Asian countries, owing to government initiatives and funding to retain its development.

Epoxy resin market in India is expected to witness a substantial growth over the forecast period, owing to the rapidly flourishing construction industry. According to Invest India, as of 2024, India allocated an investment budget of USD 1.4 trillion to infrastructure, with 24% for renewable energy, 18% for highways & roads, 17% for urban infrastructure, and 12% for railways.

Europe Epoxy Resin Market Trends

The epoxy resin market in Europe registered the second-largest revenue market share, after Asia Pacific. Increasing product demand for various applications, such as paints & coatings, construction, wind turbines, electrical & electronics, and others, is expected to drive the market in Europe over the forecast period.

Germany epoxy resin market held the largest market share in 2023. Germany is the manufacturing hub of Europe and is the largest manufacturer of automobiles in the region. Technology advancements, such as EVs and self-driving cars, are anticipated to boost the growth of the automotive industry in the country, which is anticipated to create demand for paints & coatings in the coming years.

Epoxy resin market in UK is anticipated to grow at a significant CAGR over the forecast period. The presence of major automobile manufacturers, including Jaguar, Land Rover, MINI, Aston Martin, Bentley, Rolls Royce, and Lotus Cars, in the UK is likely to fuel the demand for paints & coatings in the automotive industry in the coming years, which is expected to create demand for epoxy resins. Initiatives toward product development, including driverless cars, are expected to boost investments in the automotive industry.

Central & South America Epoxy Resin Market Trends

The epoxy resin market in Central & South America is growing substantial rate. The emergence of construction companies in Chile and Peru is expected to create growth potential for the epoxy resins market over the forecast period. The presence of various paint & coating key players in the region, including The Sherwin-Williams Company, AkzoNobel NV, and RPM International, Inc., is expected to propel the demand for epoxy resins.

Middle East & Africa Epoxy Resin Market

The epoxy resin market in Middle East & Africa is poised to grow through the forecast period. Industrial manufacturing in the Middle East & Africa has witnessed steady growth in the past few years. A shift in focus toward the non-oil private sector in the region is expected to boost manufacturing and other end-use industries, as well as diversify the economy of the region.

Key Epoxy Resin Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

Key Epoxy Resin Companies:

The following are the leading companies in the epoxy resin market. These companies collectively hold the largest market share and dictate industry trends.

- 3M

- Aditya Birla Management Corporation Pvt. Ltd.

- Atul Ltd

- BASF SE

- Solvay

- Huntsman International LLC

- KUKDO CHEMICAL CO., LTD.

- Olin Corporation

- Sika AG

- NAN YA PLASTICS CORPORATION

- Jiangsu Sanmu Group Co., Ltd.

- Jubail Chemical Industries LLC

- China Petrochemical & Chemical Corporation (SINOPEC)

- Hexion

- Kolon Industries, Inc.

- Techstorm

- NAGASE & CO., LTD.

Recent Developments

-

In February 2024, DCM Shriram announced the plan to invest over USD 10 billion in advanced material products manufacturing by setting up a greenfield plant in the next few years. The extensive line of advanced materials products includes liquid epoxy resins, solvent cuts, hardeners, formulated resins, and reactive diluents for a variety of industries such as electronics, wind turbines, electric vehicles (EVs), fireproofing, and lightweight.

-

In July 2022, DIC Corporation announced the acquisition of Guangdong TOD New Materials Co., Ltd., a China-based coating resin manufacturer. This acquisition helps DIC’s continuous efforts to grow its Asian market coating resin capacity, particularly in China. In the medium to long-term plan, DIC aims to establish a dominant position of coatings resins in the Asian region by broadly supplying resin products that can reduce environmental impact with additional functionality, as well as leveraging the expansion of production facilities at Ideal Chemi Plast of India.

-

In November 2021, Solvay introduced a reactive waterborne emulsifier named Reactsurf 0092 for solid epoxy resin, which is mainly used in industrial coatings and paints. The company is continuously producing and supplying products to meet the sustainable development challenges and regulatory requirements for cleaner, healthier paints and coating formulations.

Epoxy Resin Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 11.66 billion

Revenue forecast in 2030

USD 16.87 billion

Growth rate

CAGR of 6.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in kilotons, Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Germany; France; UK; China; India; Japan; Taiwan, South Korea

Key companies profiled

3M; Aditya Birla Management Corporation Pvt. Ltd.; Atul Ltd; BASF SE; Solvay; Huntsman International LLC; KUKDO CHEMICAL CO., LTD.; Olin Corporation; Sika AG; NAN YA PLASTICS CORPORATION; Jiangsu Sanmu Group Co., Ltd.; Jubail Chemical Industries LLC; China Petrochemical & Chemical Corporation (SINOPEC); Hexion; Kolon Industries, Inc.; Techstorm; NAGASE & CO., LTD.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Epoxy Resin Market Report Segmentation

This report forecasts volume & revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global epoxy resin market report based on application, and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paints & Coatings

-

Wind Turbines

-

Composites

-

Construction

-

Electrical & Electronics

-

Adhesives

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

-

Europe

-

Germany

-

France

-

UK

-

-

Asia Pacific

-

China

-

India

-

Japan

-

Taiwan

-

South Korea

-

-

Central & South America

-

Middle East & Africa

-

Frequently Asked Questions About This Report

b. The global epoxy resin market size was estimated at USD 11.25 billion in 2023 and is expected to reach USD 11.66 billion in 2024.

b. The global epoxy resin market is expected to grow at a compound annual growth rate of 6.3% from 2023 to 2030 to reach USD 16.87 billion by 2030.

b. The paints & coatings segment dominated the epoxy resin market with a share of more than 37.4% in 2023. This is attributable to the growing rising demand for floor coatings, protective coatings, architectural & decorative coatings, marine coatings, and powder coatings.

b. Some key players operating in the epoxy resin market include 3M, Aditya Birla Management Corporation Pvt. Ltd., Atul Ltd, BASF SE, Solvay, Huntsman International LLC, KUKDO CHEMICAL CO., LTD., Olin Corporation, Sika AG, NAN YA PLASTICS CORPORATION.

b. Key factors that are driving the epoxy resin market growth include rising demand from the automotive and industrial applications on account of superior heat resistance as compared to its counterparts.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."