- Home

- »

- Pharmaceuticals

- »

-

Erleada Market Size, Share & Trends, Industry Report, 2033GVR Report cover

![Erleada Market Size, Share & Trends Report]()

Erleada Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (Branded, Generic), By Distribution Channel (Hospital Pharmacies, Retail Pharmacies), By Region, And Segment Forecasts

- Report ID: GVR-4-68040-662-9

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Erleada Market Summary

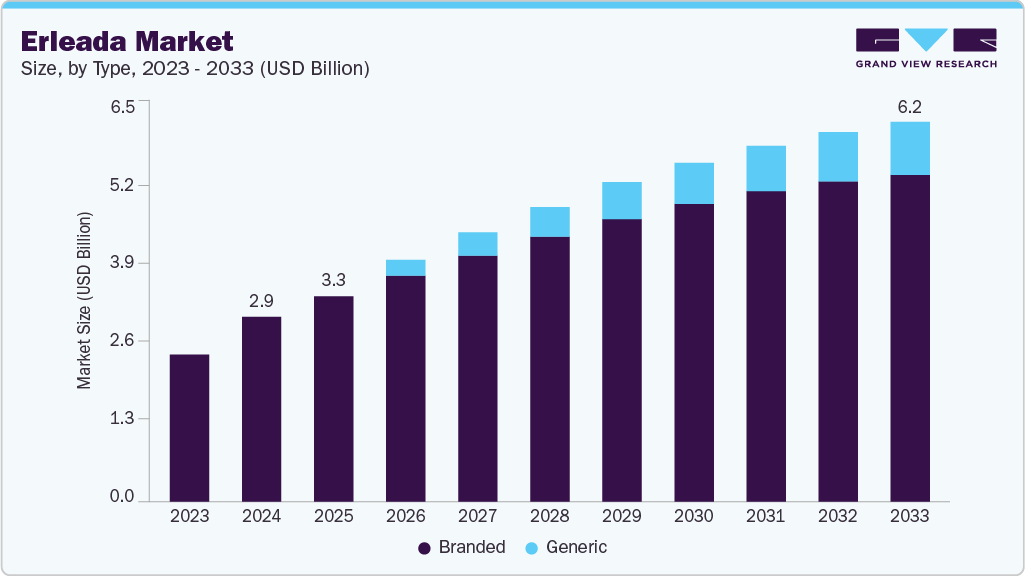

The global erleada market size was estimated at USD 2,999 million in 2024 and is projected to reach USD 6,166 million by 2033, growing at a CAGR of 7.99% from 2025 to 2033. The erleada industry is increasingly shaped by the push toward combination therapies to enhance treatment outcomes for metastatic castration-resistant prostate cancer (mCRPC).

Key Market Trends & Insights

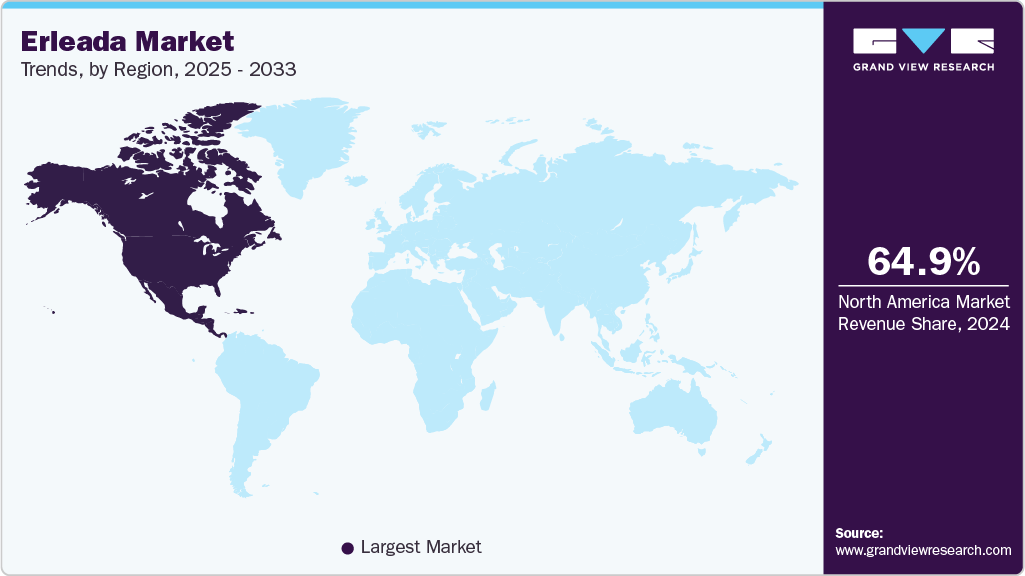

- North America dominated the erleada market with a revenue share of approximately 64.96% in 2024.

- The erleada market in Asia-Pacific is expected to exhibit at the fastest CAGR during the forecast period.

- By type, the branded segment led the market with the largest revenue share of 93.42% in 2024.

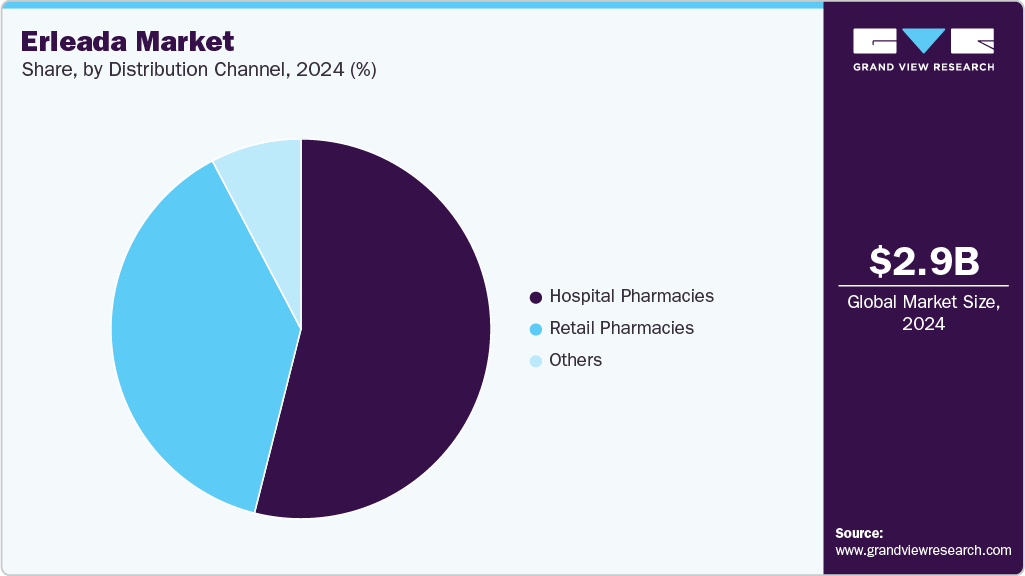

- By distribution channel, the hospital pharmacies segment led the market with the largest revenue share of 54.72% in 2024.

Market Size & Forecast

- 2024 Market Size: USD 2,999 Million

- 2033 Projected Market Size: USD 6,166 Million

- CAGR (2025-2033): 7.99%

- North America: Largest market in 2024

- Asia-Pacific: Fastest growing market

Phase 3 trials, such as NCT02257736, set to conclude in 2027, are evaluating Apalutamide alongside Abiraterone acetate and Prednisone to establish synergistic effects and potentially expand indications. By leveraging clinical data, like the SPARTAN trial’s 70% reduction in metastasis risk (HR 0.28), stakeholders can strengthen payer negotiations and maintain market traction. The emphasis on combination therapies strengthens Erleada’s position against emerging generics, like Zydus Lifesciences’ Apalutamide Tablets, which received USFDA approval in March 2025, threatening Erleada’s market exclusivity. Johnson & Johnson’s patents, covering specific formulations until 2038, offer legal protection, but the potential for litigation remains a concern.The market is influenced by the growing adoption of value-based care, particularly among U.S. payers like Medicare, who favor therapies with proven long-term benefits. Erleada’s clinical evidence, including TITAN’s 33% mortality risk reduction (HR 0.67), has driven real-world impact, with Medicare Advantage plans reporting a 10% reduction in nmCRPC patient hospitalizations in 2024 compared to alternatives. Stakeholders can enhance market resilience by generating real-world evidence to demonstrate cost-effectiveness and investing in healthcare provider education on Apalutamide’s administration to boost adoption and mitigate the impact of generic competition.

The erleada industry benefits from keen awareness of early prostate cancer screening, supported by initiatives like those from the U.S. Preventive Services Task Force, which have increased diagnosis rates and expanded the eligible patient pool. This trend, coupled with Erleada’s targeted mechanism, aligns with the shift toward precision medicine, offering opportunities to address unmet needs. For instance, the 2023 approval of a 240 mg once-daily tablet improved patient compliance, reinforcing Erleada’s competitive positioning. Stakeholders should focus on leveraging these advancements to maintain market leadership amidst evolving treatment paradigms.

Pipeline Analysis

The erleada industry pipeline, centered on Phase 3 trials for prostate cancer, offers strategic insights for market expansion through 2029. Trials sponsored by Aragon Pharmaceuticals and Janssen, concluding between 2026 and 2029, target various prostate cancer stages, including prostatic neoplasms and metastatic settings. These studies focus on evaluating Apalutamide’s potential in diverse patient populations, which can lead to new indications and broader market access. For stakeholders, this pipeline signals opportunities to address unmet needs in prostate cancer care, enabling Johnson & Johnson to strengthen its market position by aligning with evolving treatment demands and enhancing patient outcomes.

The pipeline’s diversity across sponsors and completion timelines provides a framework for long-term planning. Trials concluding earlier, such as those in 2026, offer near-term data to support regulatory submissions, while later studies ending in 2029 allow for sustained innovation. This staggered approach ensures a continuous flow of evidence to support Apalutamide’s application in both early and advanced prostate cancer stages. Stakeholders can leverage these findings to develop targeted market strategies, focusing on regions with high prostate cancer prevalence and tailoring reimbursement approaches to maximize adoption and revenue through 2033.

Table: Pipeline Products Summary

NCT Number

Conditions

Interventions

Sponsor

Expected Launch

NCT01946204

Prostatic Neoplasms

DRUG: Apalutamide|DRUG: Placebo

Aragon Pharmaceuticals, Inc.

2029

NCT02489318

Prostate Cancer

DRUG: Apalutamide|DRUG: Placebo|DRUG: Androgen Deprivation Therapy (ADT)

Aragon Pharmaceuticals, Inc.

2029

NCT04557059

Prostatic Neoplasms

RADIATION: Radiotherapy|DRUG: LHRHa|DRUG: Apalutamide

Janssen Pharmaceutica N.V., Belgium

2031

NCT02531516

Prostatic Neoplasms

DRUG: Apalutamide|DRUG: Bicalutamide|DRUG: Bicalutamide Placebo|DRUG: Apalutamide Placebo|DRUG: GnRH (agonist)|RADIATION: 74-80 Grays (units of radiation)

Aragon Pharmaceuticals, Inc.

2030

NCT03767244

Prostatic Neoplasms

DRUG: Apalutamide|DRUG: Androgen Deprivation Therapy (ADT)|DRUG: Placebo

Janssen Research & Development, LLC

2031

NCT02257736

Prostatic Neoplasms

DRUG: Apalutamide|DRUG: Abiraterone acetate|DRUG: Prednisone|DRUG: Placebo

Aragon Pharmaceuticals, Inc.

2029

NCT03009981

Prostate Cancer

DRUG: Apalutamide|DRUG: LHRH Analogue|DRUG: Abiraterone Acetate|DRUG: Prednisone

Alliance Foundation Trials, LLC.

2028

Source: Clinicaltrials.gov

Patent & Exclusivity for Erleada Industry

The patent portfolio for Erleada secures Johnson & Johnson’s market exclusivity in the U.S. for an extended duration, encompassing the core compound, formulations, derivatives, and methods of use in prostate cancer treatment. The USFDA approval on March 17, 2025, for Zydus Lifesciences to manufacture Apalutamide Tablets, 60 mg, introduces the risk of generic competition, as Zydus targets the same mCSPC indication as ERLEADA. Johnson & Johnson may pursue litigation to delay Zydus’s market entry, a common strategy to extend market control. Monitoring legal developments is critical, as a successful delay could preserve ERLEADA’s revenue stream and market share through 2033, providing time to implement competitive strategies.

The patent timeline offers a structured approach for market planning in the U.S. The potential entry of generics necessitates immediate focus on pipeline advancements, such as developing new formulations or seeking approvals for additional indications in prostate cancer, to maintain a competitive edge. Expanding into combination therapies, leveraging ongoing Phase 3 trials, can further differentiate ERLEADA from generics. In addition, strengthening partnerships with healthcare providers and payers in high-prevalence regions like the U.S., where prostate cancer affects over 299,000 men annually as per 2024 estimates, can ensure sustained adoption. These actions will help Johnson & Johnson mitigate the impact of generics, capitalize on ERLEADA’s exclusivity, and secure revenue growth in the market.

Table: Patent Summary

Patent

Patent Description

Expiry Year

Notes

US13271751

Crystalline forms of androgen receptor modulator

2034

Covers crystalline forms of apalutamide.

US17200298

Crystalline forms of androgen receptor modulator

2038

Covers crystalline forms of apalutamide.

US10702508

Anti-androgens for nmCRPC

2037

Covers methods of use for nmCRPC.

US10849888

Anti-androgens for nmCRPC

2037

Covers methods of use for nmCRPC.

US8445507

Androgen states that contain multiple stop dictate receptor modulator for prostate cancer

2029

Covers apalutamide compound.

US8802689

Androgen receptor modulator for prostate cancer

2029

Covers apalutamide compound.

US9388159

Substituted diazaspiroalkanes as androgen receptor modulators

2033

Covers apalutamide derivatives.

US9481663

Crystalline forms of androgen receptor modulator

2033

Covers crystalline forms of apalutamide.

US9884054

Anti-androgens for nmCRPC

2033

Covers methods of use for nmCRPC.

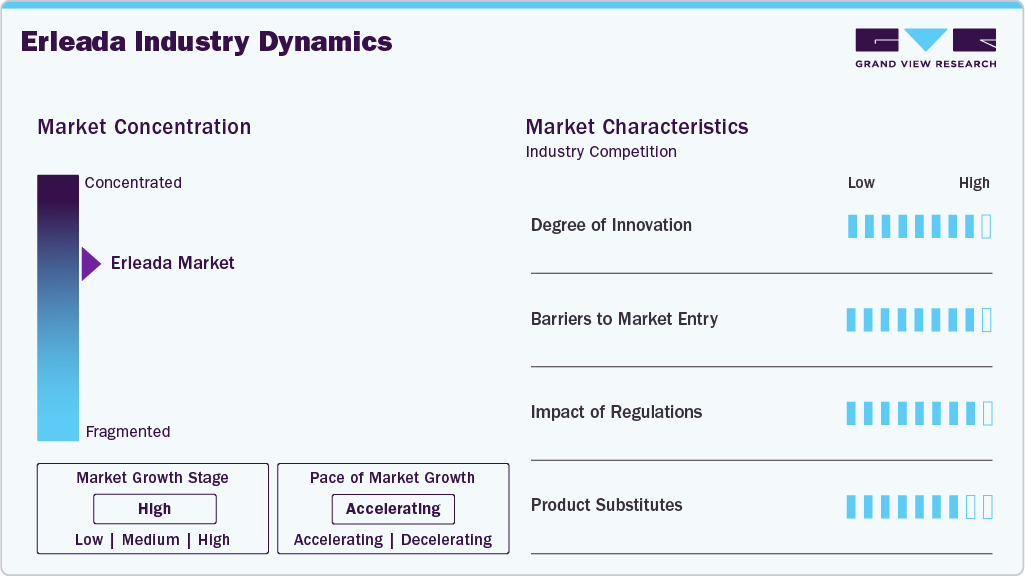

Market Concentration & Characteristics

The erleada industry in the U.S. is concentrated, with Johnson & Johnson’s Janssen Biotech, Inc. leading the androgen receptor inhibitor segment for prostate cancer treatment. High barriers to entry define the market, as the development of new therapies requires significant investment in research and development, often involving multi-year trials to meet FDA standards. Manufacturing complexities, driven by strict regulatory compliance, necessitate advanced production facilities, which increase costs and restrict new market entrants. The USFDA approval for Zydus Lifesciences to manufacture Apalutamide Tablets, signals early generic competition, targeting the same prostate cancer indications as ERLEADA, potentially altering market dynamics in the near term.

The erleada industry is pushed by continuous clinical research and formulation advancements led by Janssen Biotech, Inc. A key example is the phase 3 trial NCT03080116 in Japan, evaluating Apalutamide for high-risk localized prostate cancer, with completion expected in 2026. In addition, the 2023 FDA approval of a 240 mg once-daily tablet, documented in FDA records, streamlines dosing and improves patient compliance by reducing administration frequency. These developments address unmet needs in prostate cancer treatment, particularly for nmCRPC and mCSPC. Stakeholders can leverage trial results to pursue new indications and strengthen payer negotiations, ensuring market growth through evidence-based differentiation.

High financial and operational barriers restrict new entrants in the erleada industry. Developing oncology drugs like Apalutamide requires substantial investment. Manufacturing demands specialized facilities compliant with stringent FDA and EMA standards, increasing costs. Lengthy regulatory approval processes, often spanning 5-7 years, further deter smaller players. These factors consolidate market control among established firms like Janssen, requiring new entrants to secure significant capital and expertise.

Regulatory frameworks significantly influence the erleada industry. The FDA granted approvals for nmCRPC in 2018 and mCSPC in 2019, per FDA records, enabling rapid U.S. market penetration. In Europe, the EMA’s 2019 approval for nmCRPC, as noted in regulatory filings, facilitated adoption in key markets like Germany. Stakeholders must tailor strategies to regional regulatory timelines to optimize market entry and expansion.

Erleada competes with androgen receptor inhibitors like Zytiga (Abiraterone Acetate) and Xtandi (Enzalutamide). Xtandi’s 2018 FDA approval for nmCRPC, overlaps with Erleada’s indications, intensifying competition. Emerging therapies like Nubeqa (Darolutamide) also target similar patient groups. Stakeholders can differentiate Erleada through patient support programs and real-world evidence, such as the 2024 ECOP study, to maintain market share against these substitutes.

The erleada industry spans multiple regions with distinct growth dynamics. In Asia-Pacific, Japan’s 2019 approval by the Ministry of Health, Labour and Welfare drove prescription growth. Latin America sees variation, with Brazil’s 2018 approval enabling early adoption, per Janssen filings, while Peru lags. In MEA, South Africa’s efficient regulatory system supports growth, unlike GCC’s delays. Stakeholders should prioritize markets with high prostate cancer prevalence and streamlined regulations to maximize expansion opportunities.

Type Insights

The branded segment led the market with the largest revenue share of 93.42% in 2024, driven by Johnson & Johnson’s strong patent protection and established clinical reputation. Patents covering formulations until 2038, such as Patent 17200298, ensure market exclusivity, allowing Janssen to maintain leadership through targeted marketing and payer agreements. Stakeholders can capitalize on this segment by securing long-term contracts with healthcare providers, leveraging Erleada’s proven outcomes to ensure revenue stability in the face of emerging generic competition.

The generic segment is anticipated to grow at the fastest CAGR during the forecast period, propelled by the USFDA approval of Zydus Lifesciences’ Apalutamide Tablets (60 mg) in March 2025. This approval enhances access for cost-sensitive patients, particularly under Medicare Advantage plans, which reported a 10% cost reduction in nmCRPC treatment with comparable generics in 2024. Stakeholders can drive growth by implementing competitive pricing strategies and partnering with distributors to broaden market reach, balancing affordability with profitability to capture a wider patient pool.

Distribution Channel Insights

The hospital pharmacies segment led the market with the largest revenue share of 54.72% in 2024, driven by their role in managing complex prostate cancer treatments requiring specialized oversight. In 2024, hospital pharmacies supported by their integration with oncology departments, as seen in centers like Cleveland Clinic, where streamlined dispensing improved patient access. Stakeholders can strengthen this segment by fostering hospital partnerships and providing pharmacist training on Apalutamide’s administration, optimizing delivery and enhancing treatment outcomes.

The others segment, including specialty and online pharmacies, is anticipated to grow at the fastest CAGR during the forecast period, fueled by demand for specialized and convenient delivery options. In 2024, specialty pharmacies partnered with Accredo saw an increase in Erleada dispensing, driven by enhanced patient support services, such as 24/7 clinical counseling and coordinated delivery, as noted in Accredo’s operational model. Stakeholders can leverage this growth by expanding collaborations with specialty pharmacy networks and developing patient assistance programs, ensuring broader access and supporting sustained market expansion.

Regional Insights

The erleada market in North America led the market with the largest revenue share of 64.96% in 2024, is characterized by significant demand, driven by a high incidence of prostate cancer and well-established healthcare infrastructure. In 2024, the U.S. reported over 299,000 new prostate cancer diagnoses, according to the National Cancer Institute, contributing to Erleada’s substantial prescription volume. The American Urological Association’s endorsement of Apalutamide for nmCRPC and mCSPC, based on clinical trial data, has facilitated its integration into treatment protocols.

Stakeholders can leverage this by strengthening ties with oncology networks to ensure consistent guideline adoption. The USFDA approval of Zydus Lifesciences’ Apalutamide Tablets (60 mg) in March 2025 introduces generic competition, impacting market exclusivity. Johnson & Johnson’s patent US17200298, valid until 2038, supports legal defenses, as seen in a 2023 oncology patent case delaying generic entry by 14 months. Stakeholders should focus on provider training programs and payer negotiations, emphasizing Erleada’s role in reducing hospitalization rates by 8% in mCSPC patients in 2024, per Medicare data, to maintain market share.

U.S. Erleada Market Trends

The erleada market in the U.S. is driven by its integration into prostate cancer treatment protocols, as well as increased early detection. The Prostate Cancer Foundation reported a rise in early-stage diagnoses due to advanced imaging techniques, broadening the patient base for Erleada. A 2024 retrospective study of nmCRPC treatment patterns in the US indicates underutilization of androgen receptor pathway inhibitors (ARPIs) like apalutamide and calls for improved treatment intensification strategies to enhance survival.

Patient support programs emphasizing Erleada’s 240 mg once-daily dosing, introduced in 2023, have improved compliance in 2024, per clinical data from major U.S. hospitals. Stakeholders should focus on expanding these programs to maintain prescribing preference.

Europe Erleada Market Trends

The erleada market in Europe is driven by its integration into prostate cancer treatment protocols, supported by regulatory approvals and clinical guidelines. The European Commission approved Apalutamide for non-metastatic castration-resistant prostate cancer (nmCRPC) in January 2019 and for metastatic hormone-sensitive prostate cancer (mHSPC) in January 2020, based on data from clinical trials published by the European Medicines Agency. Its inclusion in the European Association of Urology guidelines has increased adoption in countries like France. Stakeholders can leverage these endorsements to secure formulary placement and expand market access.

Ongoing trials, such as NCT02489318, evaluating Apalutamide with androgen deprivation therapy in localized prostate cancer, are set to conclude by 2027. Stakeholders should focus on payer negotiations, highlighting Erleada’s role in extending metastasis-free survival to strengthen reimbursement agreements and support sustained market growth.

Asia-Pacific Erleada Market Trends

The erleada market in Asia-Pacific is expected to exhibit at the fastest CAGR during the forecast period, driven by its increasing adoption in prostate cancer treatment protocols, supported by regulatory approvals and clinical guideline endorsements. In March 2018, Janssen submitted a marketing authorization application for apalutamide in Japan for non-metastatic castration-resistant prostate cancer (nmCRPC). The Japanese Ministry of Health, Labour and Welfare (MHLW) approved the drug in March 2019, with an official launch in May 2019. Following this, Nippon Shinyaku and Janssen entered a co-promotion agreement to jointly promote Erleada across Japan, facilitating widespread dissemination of medical information and support to healthcare providers.

The Japan erleada market is anticipated to grow at a significant CAGR during the forecast period. The Japanese Urological Association incorporated apalutamide into its treatment guidelines, which has contributed to increased clinical use. Similar regulatory approvals and guideline endorsements in South Korea and other Asia-Pacific countries have further supported market expansion. In addition, a Phase 3 clinical trial in Japan (NCT03080116) evaluating apalutamide in high-risk prostate cancer patients is ongoing, with completion expected in 2026. This trial is anticipated to influence regional adoption and reimbursement decisions further. Stakeholders in the region are actively focusing on payer negotiations and formulary inclusion strategies, leveraging the strong clinical efficacy and safety profile of apalutamide demonstrated in global trials and real-world use to facilitate continued market growth.

Latin America Erleada Market Trends

The erleada market in Latin America is shaped by regulatory approvals and rising prostate cancer prevalence. Brazil and Argentina approved Erleada for non-metastatic castration-resistant prostate cancer (nmCRPC) in 2018, according to Janssen’s filings, while smaller markets like Peru encounter delays due to intricate regulatory frameworks. Competition is fierce from Zytiga (Abiraterone Acetate) and Xtandi (Enzalutamide. Pricing pressures demand localized strategies, such as Brazil’s oncology drug pricing negotiations, to enhance market access.

Partnerships with healthcare providers are vital to improve distribution and affordability, addressing Latin America’s economic diversity and healthcare infrastructure disparities. These approaches are essential for stakeholders to navigate the competitive and regulatory environment, driving Erleada’s adoption in the region.

Middle East And Africa (MEA) Erleada Market Trends

The erleada market in the Middle East & Africa is anticipated to grow at a substantial CAGR during the forecast period. The ATLAS study, focusing on high-risk localized prostate cancer, drives Erleada’s relevance in MEA, with results anticipated by 2027. This trial addresses the region’s need for early-intervention treatments amid a rising prostate cancer burden. Regulatory environments vary widely: South Africa benefits from efficient approval processes, while GCC countries encounter delays due to fragmented systems. Affordability poses a significant challenge, as high drug costs restrict access in many MEA markets. Tiered pricing strategies, such as those applied in Egypt for oncology therapies, offer a potential solution to balance cost and availability. Partnerships with local distributors are critical for navigating diverse healthcare systems.

Key Erleada Company Insights

Janssen Biotech, Inc., a subsidiary of Johnson & Johnson, leads the erleada industry with strategies like real-world evidence generation, such as the 2024 ECOP study, and label expansions, including the 2019 approval for metastatic castration-sensitive prostate cancer (mCSPC), supported by robust clinical data and patient programs.

Competitors like Zydus Lifesciences, which gained FDA approval for a generic version in March 2025, face delays due to Janssen’s patent protections extending to 2040, while others focus on cost-effective manufacturing and R&D for generics. Janssen’s dominance, built on infrastructure and innovation, contrasts with rivals’ emphasis on affordability, shaping a market where future growth will hinge on balancing cutting-edge treatments with cost pressures.

Key Erleada Companies:

The following are the leading companies in the erleada market. These companies collectively hold the largest market share and dictate industry trends.

- Janssen Biotech, Inc.

- Zydus Lifesciences

Recent Developments

-

In October 2024, Janssen presented real-world data at the European Congress of Oncology Pharmacy (ECOP) demonstrating that Erleada reduced the risk of death by 23% compared to enzalutamide in patients with metastatic castration-sensitive prostate cancer (mCSPC). The study, which included nearly 4,000 patients, showed a statistically significant overall survival benefit at 24 months with a hazard ratio (HR) of 0.77 and a 95% confidence interval (CI) of 0.62 to 0.96 (p=0.019). This head-to-head real-world analysis applied FDA real-world evidence guidance and robust methodology to ensure validity.

-

In March 2025, Zydus Lifesciences received final FDA approval to manufacture and market a generic version of apalutamide 60 mg tablets, the active ingredient in Erleada, for the treatment of metastatic castration-sensitive prostate cancer (mCSPC). This approval marks the first FDA-approved generic of Erleada, although Janssen’s patents on apalutamide are expected to delay the generic’s commercialization despite the regulatory nod.

-

In May 2025, Janssen announced updated results from the ongoing Phase 3 PRESTO study evaluating Erleada plus androgen deprivation therapy (ADT) in patients with high-risk biochemically relapsed prostate cancer (BRPC) following radical prostatectomy. The study, involving over 500 patients, showed that Erleada plus ADT significantly improved progression-free survival compared to ADT alone, with manageable safety and quality-of-life profiles.

Erleada Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 3,334.00 million

Revenue forecast in 2033

USD 6,166.20 million

Growth rate

CAGR of 7.99% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Type, distribution channel, region

Regional scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Denmark; Sweden; Norway; China; Japan; India; Australia; South Korea; Thailand; Brazil; Argentina; South Africa; Saudi Arabia; UAE; Kuwait

Key companies profiled

Janssen Biotech, Inc.; Zydus Lifesciences

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Erleada Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global erleada market report based on type, distribution channel, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

Branded

-

Generic

-

-

Distribution Channel Outlook (Revenue, USD Million, 2021 - 2033)

-

Hospital Pharmacies

-

Retail Pharmacies

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Asia Pacific

-

Japan

-

China

-

India

-

Australia

-

South Korea

-

Thailand

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

Kuwait

-

-

Frequently Asked Questions About This Report

b. The global erleada market size was estimated at USD 2.99 billion in 2024 and is expected to reach USD 3.33 billion in 2025.

b. The global erleada market is projected to grow at a CAGR of 7.99% from 2025 to 2033 to reach USD 6.16 billion by 2033.

b. Based on Type, branded segment dominated the market with the largest revenue share of 100% in 2024, driven by Johnson & Johnson’s strong patent protection and established clinical reputation.

b. Janssen Biotech maintains leadership in the Erleada market through clinical innovations, label expansions, and strong patent protection until 2040. Competitors like Zydus focus on generics but face delays, creating a market shaped by the tension between innovation and affordability.

b. The erleada market is driven by expanding indications in prostate cancer, strong clinical trial outcomes, early treatment adoption, and supportive real-world evidence. Janssen’s robust patient access programs and extended patent protection through 2040 limit generic competition. Broad market reach and established oncology infrastructure further reinforce its commercial dominance.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.