- Home

- »

- Communication Services

- »

-

eSIM Market Size, Share & Growth, Industry Report, 2033GVR Report cover

![eSIM Market Size, Share & Trends Report]()

eSIM Market (2025 - 2033) Size, Share & Trends Analysis Report By Solution (Hardware, Connectivity Services), By Application (Consumer Electronics, M2M), By Region (North America, Europe, Asia Pacific, Latin America), And Segment Forecasts

- Report ID: GVR-4-68038-667-7

- Number of Report Pages: 120

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

eSIM Market Summary

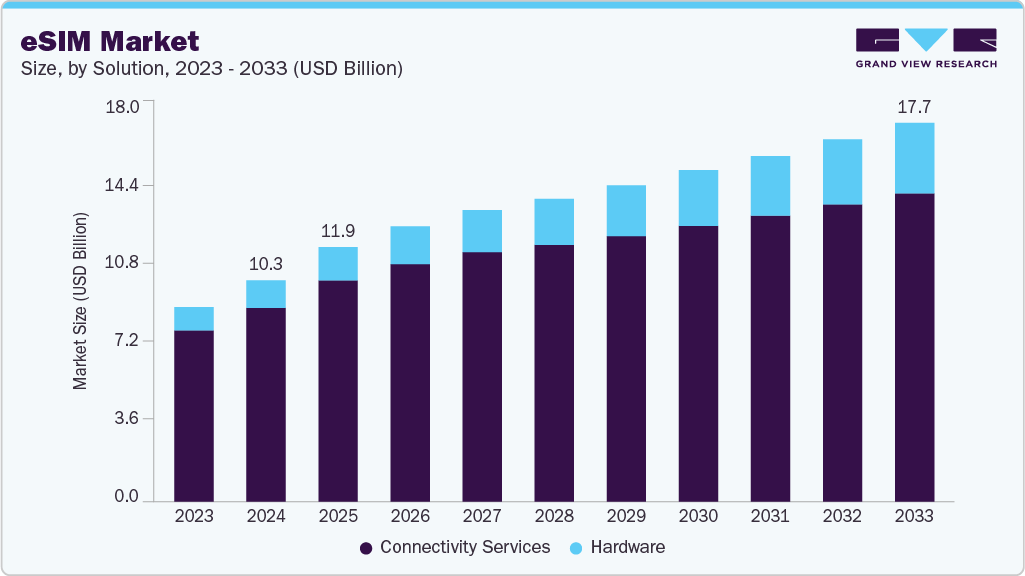

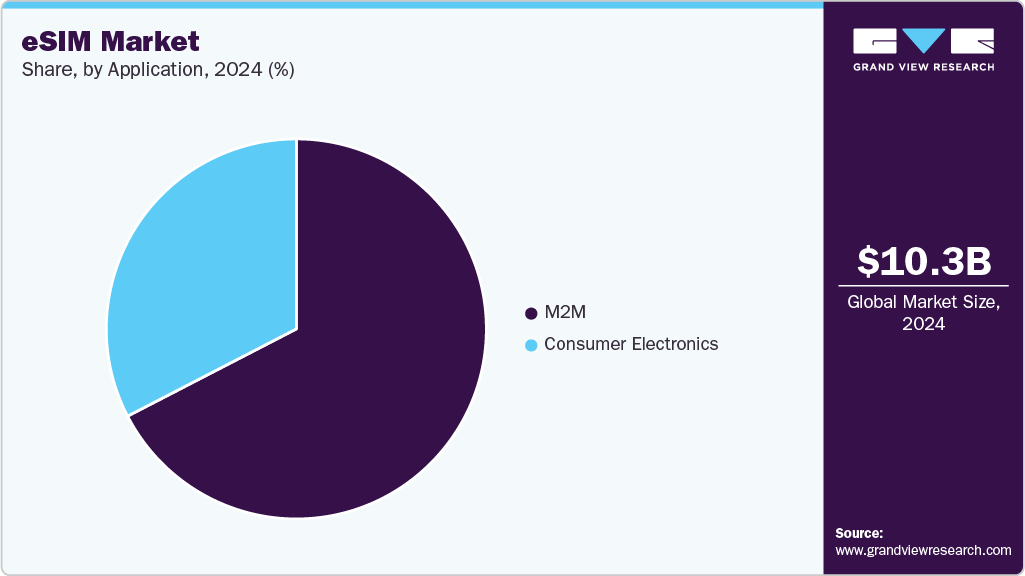

The global eSIM market size was estimated at USD 10.32 billion in 2024, and is projected to reach USD 17.67 billion by 2033, growing at a CAGR of 5.1% from 2025 to 2033. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics.

Key Market Trends & Insights

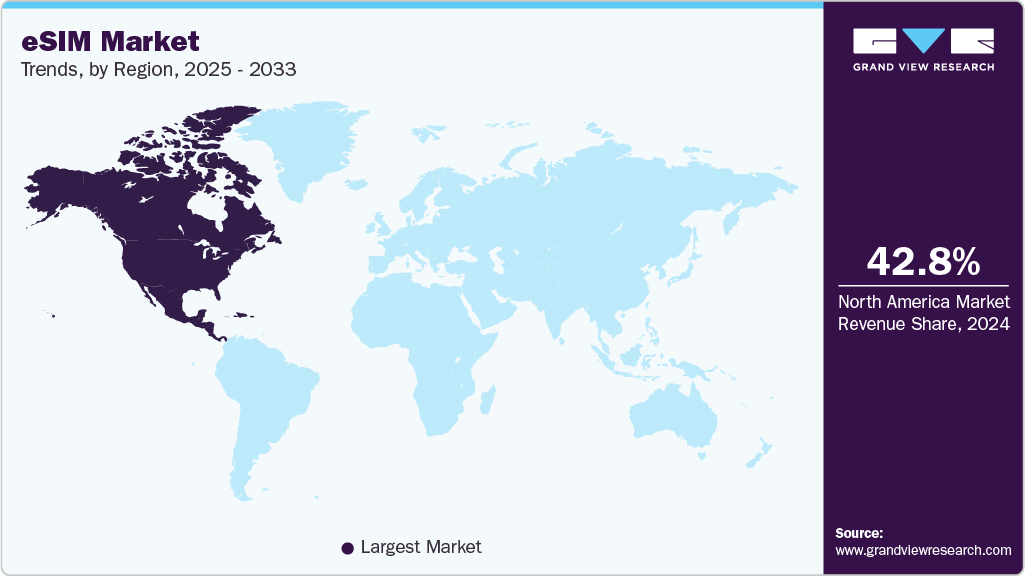

- North America dominated the eSIM industry and accounted for a 42.8% share of the overall market in 2024.

- The U.S. eSIM market held a dominant position in the North American market in 2024

- By solution, the connectivity services segment dominated the market in 2024 and accounted for the largest share of 87.5%.

- By application, the M2M segment dominated the market and accounted for the largest market share in 2024.

Market Size & Forecast

- 2024 Market Size: USD 10.32 Billion

- 2033 Projected Market Size: USD 17.67 Billion

- CAGR (2025-2033): 5.1%

- North America: Largest market in 2024

There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM industry growth is further propelling due to the rise in the adoption of eSIM-connected devices. The introduction of eSIM in the automobile industry has provided tremendous flexibility in providing cellular connectivity to trucks and cars while unlocking new capabilities and features. It is expected that within the next several years, all cars will be cellular enabled, resulting in a better driving experience facilitated by novel linked services. Recently, the automotive industry took a giant step toward enabling the next generation of connected automobiles by implementing the GSMA-embedded SIM specification to strengthen vehicle connectivity. It is intended to improve security for various connected services.

The eSIM-enabled solutions offer automatic interoperability across numerous SIM operators, connection platforms, and remote SIM profile provisioning. With multiple network service providers involved in the operating chain, maintaining the security of these systems has grown complicated. Mobile Network Operators' (MNOs') credentials are collected and kept by the eSIM in the device's inbuilt software, making them vulnerable to security breaches. Furthermore, the operation of eSIM across numerous physical platforms and MNOs exposes it to several virtual environment concerns. As a result, the operational flexibility provided by eSIM may be rendered ineffective if security is breached, impeding market expansion.

Industry 4.0 is a technological breakthrough that has introduced smart machinery with automatic communication and control. Industry 4.0 refers to a networked environment in which actionable data and information are transferred between Machine to Machine (M2M) and Machine to Other (M2O) devices via the Internet of Things (IoT). Wi-Fi, sensors, RFID (radio frequency administrations), and autonomous computing software are all used in M2M systems to analyze data and send it over a network for further processing. M2M systems frequently rely on public and cellular networks for internet access. These factors enabled the integration of electronic manufacturers with eSIM (embedded SIM cards) into M2M systems, thereby contributing to market expansion. By enabling M2M communication, eSIM technology has enabled advancements in the connected ecosystem.

The increasing penetration of smartphones across countries such as China, India, Japan, and the U.S. is further anticipated to fuel eSIM industry growth. Smartphone manufacturers such as Google, Samsung Electronics Co., Apple, Inc., and Motorola Mobility LLC, Ltd. have started implementing eSIM technology into their smartphones in alliance with several network service providers. For instance, Apple, Inc. has partnered with six service providers, Ubigi, MTX Connect, Soracom Mobile, GigSky, Redtea Mobile, and Truphone, to offer eSIM service. Smartphone and consumer electronics manufacturers' increasing adoption of eSIM to provide an enhanced and secure user experience is expected to bolster market growth.

Solution Insights

The connectivity services segment dominated the market in 2024 and accounted for the largest share of 87.5%. This rapid expansion can be due to the increasing use of eSIM for M2M connections, which is expected to generate revenue for network operators through subscription services. MNOs (Mobile Network Operators) provide connectivity services for securely and remotely managing end-user cellular subscriptions. The automotive industry recently backed the GSMA Embedded SIM Specification to strengthen vehicle connection, paving the way for a new generation of connected vehicles. It is projected to improve security for various connectivity services, allowing the market to grow.

The hardware segment is expected to witness the fastest CAGR over the forecast period. The increase in consumer electronics manufacturers is anticipated to fuel the demand and contribute to segment growth. The growing trend among smartphone manufacturers to integrate eSIM into the device fuels demand and contributes to segment growth. The hardware segment market is consolidated with a few eSIM chipset companies, such as Infineon Technologies AG, NXP Semiconductors, and STMicroelectronics, holding a significant share of the overall hardware revenue.

Application Insights

The M2M segment dominated the market in 2024. The increasing use of eSIM technology in the automobile industry for M2M communication propels the M2M segment. Furthermore, connected cars are the primary demand drivers in the automotive industry. eSIM implementation in the automobile industry is projected to substantially simplify production and drive the expansion of the connected car market. It is expected to encourage other industries to adopt M2M and IoT technologies.

The consumer electronics segment is expected to register a notable CAGR over the forecast period. Consumer electronics applications remain one of the significant forces shaping innovation, growth, and disruption across several technology sectors. The use of eSIM in smartphones lets device manufacturers use the space in the device as less space is required for eSIM. Therefore, device manufacturers are adopting technology to design relatively slimmer smartphones. eSIM is projected to be a game-changer in consumer electronics applications. High reliability, improved safety, and enhanced connectivity are some of the features driving the adoption of eSIM in consumer electronic applications.

Regional Insights

North America eSIM market dominated the global industry and accounted for a revenue share of 42.8% in 2024. The region’s growth is attributed to the high presence of network providers and the fastest technological advancements.

U.S. eSIM Market Trends

The U.S. eSIM market held a dominant position in the region in 2024, driven by the increasing adoption of 5G technology, IoT-enabled devices, and the shift towards digital-first customer experiences in the telecom sector. Major carriers such as AT&T, Verizon, and T-Mobile are actively investing in eSIM infrastructure to support multi-device connectivity and streamline remote provisioning.

Europe eSIM Market Trends

The Europe eSIM market is expected to register a notable CAGR from 2025 to 2033. Europe's eSIM market is being driven by aggressive decarbonization goals, widespread electrification, and the transition to renewable energy. The European Union’s Green Deal and European companies are the early adopters of the latest technologies. The region also serves as headquarters for several prominent market players, including Giesecke+Devrient Mobile Security GmbH, NXP Semiconductors N.V., STMicroelectronics, among others. These areas also witness the rising adoption of smart connected devices and cars. Due to all these factors, these two regions are expected to maintain their lead during the forecast period.

The UK eSIM market is expected to grow at a moderate CAGR during the forecast period. The increasing prevalence of eSIM-compatible devices, especially in the consumer electronics and enterprise sectors, is supporting market expansion. In addition, regulatory frameworks aligned with the EU’s digital goals and emphasis on data security and portability are creating a favorable policy environment.

The eSIM market in Germany is expected to grow at a notable CAGR during the forecast period. Germany’s eSIM market is advancing rapidly, driven by its strong industrial base and emphasis on IoT integration in sectors such as automotive, manufacturing, and logistics. The rise in connected car applications and machine-to-machine (M2M) communications is further driving the eSIM adoption in the country.

Asia Pacific eSIM Market Trends

The Asia Pacific eSIM market is expected to grow at a CAGR of 4.9% during the forecast period. Prominent smartphone players like Huawei and Samsung Electronics have launched eSIM smartphones, driving eSIM momentum in the smartphone market and positioning eSIM as the future mainstream SIM technology for connected devices. Furthermore, several OEMs across countries such as China and India are developing eSIM solutions and gathering joint development forces across the ecosystem to create tactical development paths.

India eSIM market is expected to grow at the moderate growth rate during the forecast period. India’s eSIM market is driven by the country's vast mobile subscriber base and expanding smartphone penetration. Government initiatives promoting digital transformation, along with the proliferation of connected consumer electronics, are expected to drive further adoption.

The eSIM market in China held a substantial market share in 2024, driven by robust government support for IoT, smart manufacturing, and 5G integration.With a strong local manufacturing base and a tech-savvy population, the country is witnessing rapid integration of eSIMs into smart devices and connected infrastructure.

Key eSIM Company Insights

Some of the key companies in the eSIM industry include Giesecke+Devrient GmbH, Infineon Technologies AG, and Thales, among others. These companies are undertaking strategies such as product launches, acquisitions, and collaborations to increase their global reach. The industry competition is anticipated to intensify further as many companies focus on developing advanced, cost-effective solutions and technologies. For instance, eSIM makes it easier for consumers to change their mobile operators; thus, increasing consumers' switching between network providers will result in intense competition between the network operators.

-

Thales Group is a prominent company in digital identity and security, offering end-to-end eSIM management solutions for mobile network operators, device manufacturers, and enterprises. With a strong presence in over 50 countries, Thales supports a wide range of eSIM applications across consumer electronics, automotive, and industrial IoT sectors, leveraging its expertise in cybersecurity and embedded systems.

-

Giesecke+Devrient GmbH is a prominent German technology group specializing in security technology and digital communications. The company’s embedded SIM (eSIM) management solution minimizes the use of additional materials and helps reduce waste and logistics-related burdens. By replacing traditional, removable SIM cards with a built-in eSIM chip, the solution eliminates the need for extra plastic components and packaging.

Key eSIM Companies:

The following are the leading companies in the eSIM market. These companies collectively hold the largest market share and dictate industry trends.

- Arm Limited

- Deutsche Telekom AG

- Giesecke+Devrient GmbH

- Thales

- Infineon Technologies AG

- KORE Wireless

- NXP Semiconductors

- Sierra Wireless

- STMicroelectronics

- Workz

Recent Developments

-

In June 2025, EmoSIM, a Nigerian technology company, introduced a new eSIM solution that enables users to connect to mobile networks across 190 countries without the need to swap SIM cards or incur roaming charges. The service operates through virtual eSIM activation via a QR code or mobile app, eliminating the requirement for physical SIM cards. EmoSIM has established partnerships with over 600 network providers worldwide to support seamless global connectivity.

-

In May 2025, GCT Semiconductor Holding Inc. and Giesecke+Devrient GmbH announced a strategic partnership to introduce an advanced SGP.32 eSIM solution featuring Integrated Profile Activation Device support for multi-network IoT devices. This partnership leverages embedded SIM technology to deliver intelligent, location-aware connectivity for headless 4G and 5G IoT devices, enabling seamless and dynamic network access without the need for physical SIM cards.

eSIM Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 11.87 billion

Revenue forecast in 2033

USD 17.67 billion

Growth rate

CAGR of 5.1% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

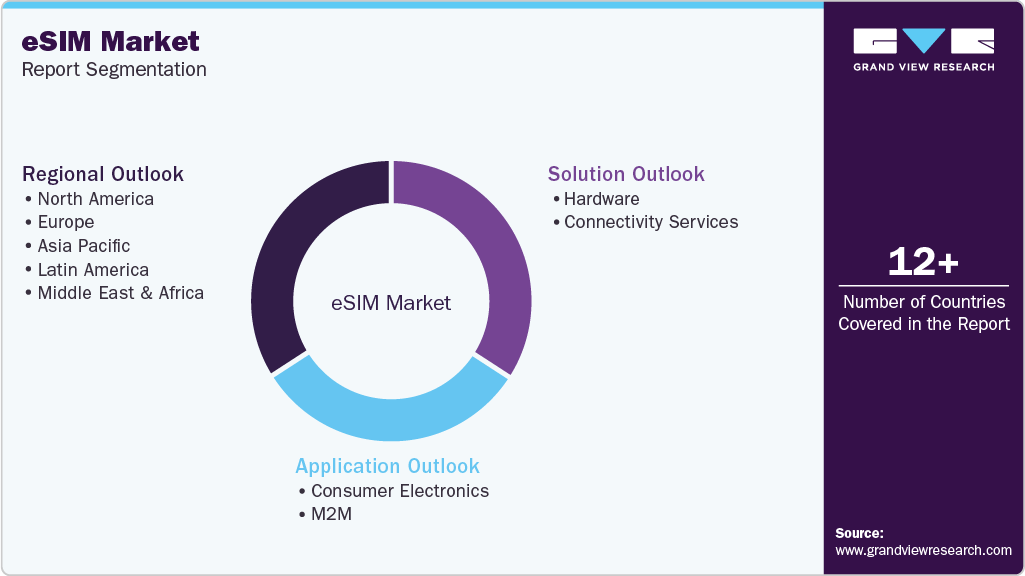

Segments covered

Solution, application, region

Regional scope

North America; Europe; Asia Pacific; Latin America; MEA

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Spain; Italy; China; Japan; India; South Korea; Australia; Brazil; Argentina; KSA; UAE; and South Africa

Key companies profiled

Arm Limited; Deutsche Telekom AG; Giesecke+Devrient GmbH; Thales; Infineon Technologies AG; KORE Wireless; NXP Semiconductors; Sierra Wireless; Workz; STMicroelectronics.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global eSIM Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global eSIM market report based on solution, application, and region:

-

Solution Outlook (Revenue, USD Million, 2021 - 2033)

-

Hardware

-

Connectivity Services

-

-

Application Outlook (Revenue, USD Million, 2021 - 2033)

-

Consumer Electronics

-

Smartphones

-

Tablets

-

Smartwatches

-

Laptop

-

Others

-

-

M2M

-

Automotive

-

Connected Cars

-

Shared Mobility

-

-

Smart Meter

-

Logistics

-

Others

-

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East and Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global eSIM market size was estimated at USD 10.32 billion in 2024 and is expected to reach USD 11.87 billion in 2025.

b. The global eSIM market is expected to grow at a compound annual growth rate of 5.1% from 2025 to 2033 to reach USD 17.67 billion by 2033.

b. The connectivity services segment dominated the market in 2024 and accounted for the largest share of 87.5%. This rapid expansion can be due to the increasing use of eSIM for M2M connections, which is expected to generate money for network operators through subscription services.

b. Some key players operating in the eSIM market include Arm Limited, Deutsche Telekom AG, Giesecke+Devrient GmbH, Thales, Infineon Technologies AG, KORE Wireless, NXP Semiconductors, Sierra Wireless, Workz and STMicroelectronics.

b. The market growth is driven by the rising adoption of IoT-connected devices in M2M applications and consumer electronics. There is an upsurge in the number of times eSIM profiles were downloaded across consumer devices. The eSIM market is propelling due to the rise in the adoption of eSIM-connected devices.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.