Esomeprazole Market Size & Trends

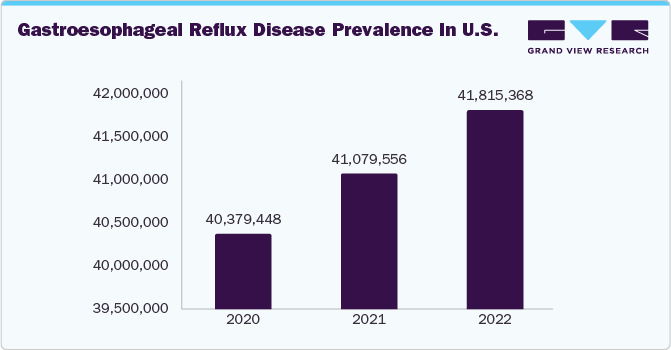

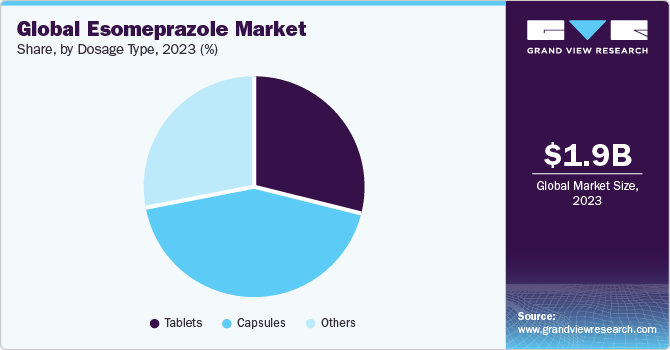

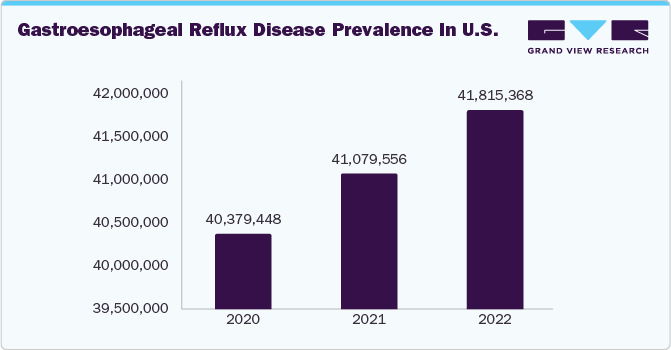

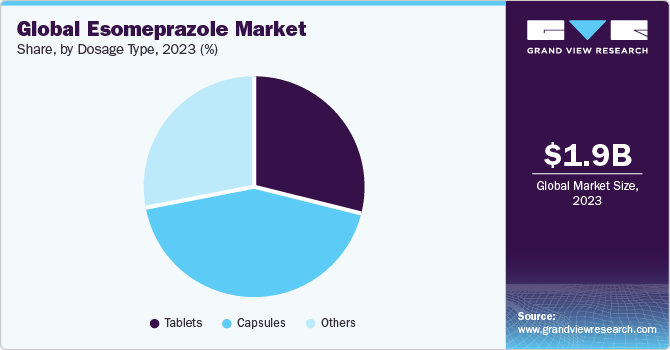

The global esomeprazole market size was valued at USD 1.89 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.51% from 2024 to 2030. The rise in the frequency of gastrointestinal disorders, including acid reflux illness, is one of the drivers for the market expansion. Additionally, the esomeprazole market is growing due to high success rates with gastroesophageal reflux disease (GERD) treatment and rising gastrointestinal disorders due to changes in dietary and lifestyle practices. In Japan, around 11.41 million people were affected by gastroesophageal reflux disease in 2022, and this number is expected to reach 11.46 by 2025.

Additionally, the market is expanding due to the rising incidence of gastrointestinal ailments such as reflux and other stomach problems. As per the NCBI study 2020, it was estimated that 1.03 billion individuals worldwide, or around 13.98% of the total population, suffer from GERD. The necessity for appropriate therapy is being driven by the condition's increasing occurrence. A larger risk may apply to those who use over-the-counter medications to address unknown conditions. Here, Esomeprazole plays an important role in treatment. Thus, the increasing prevalence of gastrointestinal ailments is projected to drive market growth.

One isomeric version of omeprazole is esomeprazole, which is usually taken as a magnesium salt. It is marketed under the brand name Nexium and is used to treat a number of ailments, including peptic ulcers, esophagitis, and GERD. It also lowers the production of stomach acid. It is also applied to Zollinger-Ellison syndrome sufferers. However, it has a number of negative effects, some of which are common and include headache, constipation, dry mouth, and stomach discomfort, despite its potential effectiveness, which may impede market growth.

The benefits offered by capsules over other dose forms, namely their quick-acting nature and propensity to degrade faster than tablets, boost their prescription rate. Furthermore, the patient population may readily get and afford capsules since they are available in both branded and generic versions. The research and development of safe and effective Esomeprazole medicine is expected to drive market growth.

Application Insights

On the basis of application, the market is segmented into gastroesophageal reflux disease (GERD), stomach ulcers, and others. The GERD segment held the largest market share in 2023. The frequency and impact of GERD on the population have drawn the attention of medical experts in recent years. Furthermore, GERD is a prevalent condition in global communities, and it has a high risk of major medical problems as well as substantial medical costs associated with its diagnosis, treatment, and care. Thus, increasing awareness about this condition is anticipated to drive segment growth.

Dosage Type Insights

Based on the dosage type, the esomeprazole market is segmented into tablets, capsules, and others. The capsules segment held the largest market share in 2023. This can be attributed to the cost-effectiveness of tablets over capsules. Capsules are more difficult to handle and package than tablets. Moreover, they can be stored and transported more easily because of their increased break resistance and cost-effective choice for pharmaceutical businesses as well as individuals because they are frequently less expensive to make than capsules.

Regional Insights

North America dominated the market in 2023. This can be attributed to a variety of factors, such as the aging population, the increase of GERD patients, strategic developments, and the rising number of product approvals. Additionally, the U.S. is a major driver of regional growth, which may be linked to a number of causes, including the rising frequency of gastrointestinal disorders among U.S. and Canadian people and the growing acceptance of novel drug delivery technologies. Asia-Pacific is expected to witness the fastest CAGR over the forecast period. This can be attributed to rising geriatric population and high product demand. The esomeprazole is mostly used in older populations to treat disorders including acid reflux, peptic ulcers, and stomach problems.

Key Companies & Market Share Insights

This market comprises several key pharmaceutical companies such as Viatris Inc., GSK plc., DAIICHI SANKYO COMPANY, LIMITED, Amneal Pharmaceuticals LLC, Pfizer Inc., AstraZeneca, Sun Pharmaceutical Industries Ltd., and Teva Pharmaceutical Industries Ltd hold a substantial share in the market. Market participants use strategies such as collaborations, M&A, and partnerships to broaden their product portfolio and enhance the accessibility of those items in a variety of geographic locations.

-

In June 2023, the U.S. Food and Drug Administration (FDA) approved esomeprazole magnesium for delayed-release oral suspension, developed by Zydus Lifesciences Limited, for the treatment of patients with esophagus and stomach problems. This drug approval is anticipated to drive esomeprazole market growth over the forecast period.

-

In October 2023, AstraZeneca agreed to pay USD 425 million to resolve around 11,000 litigations regarding its heartburn drugs Prilosec and Nexium, which caused chronic kidney disease. This will have a negative impact on the company’s position in the market.