- Home

- »

- Animal Feed and Feed Additives

- »

-

Essential Oils & Plant Extract For Livestock Market Report, 2030GVR Report cover

![Essential Oils And Plant Extract For Livestock Market Size, Share & Trends Report]()

Essential Oils And Plant Extract For Livestock Market Size, Share & Trends Analysis Report By Type (Essential Oils, Plant Extract), By Livestock (Cattle, Poultry, Swine), By Form, By Function, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-2-68038-457-4

- Number of Report Pages: 125

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

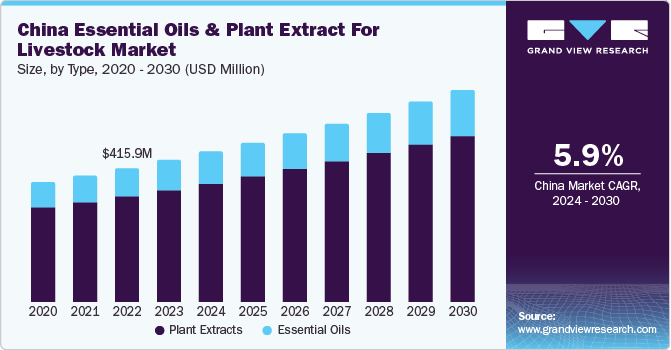

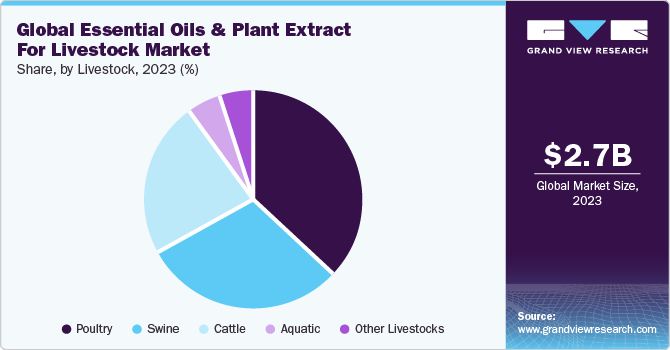

The global essential oils and plant extract for livestock market size was estimated to reach USD 2.7 billion by 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.2% from 2024 to 2030. The extensive usage of essential oil & plant extracts-based feed to improve the yield, respiratory system, and gut health in animals, especially poultry, is positively impacting the market growth.

Essential oils, sourced from botanical origins, predominantly serve therapeutic objectives. A widely utilized approach for their application is aromatherapy. It is important to highlight, however, that the robust fragrance of essential oils, as opposed to their extracts, may provoke unfavorable reactions in animals. Conversely, the increasing adoption of various essential oils and plant extracts as supplements in animal feed formulations is becoming more prevalent. This strategy is designed to optimize the overall performance of animals. These factors are expected to play a substantial role in the expansion of the market in the foreseeable future.

Anticipated growth in the demand for essential oils and plant extracts within the livestock market is driven by several factors, notably the escalating consumption of meat, a rise in disposable income, and the expanding global population. These natural products confer a multitude of advantages, including heightened yield, enhanced gut health, and bolstered immunity, among other benefits. Industry stakeholders are increasingly integrating these products to elevate animal performance and attain greater yields.

Prominent essential oil varieties encompass spearmint, lime, cloverleaf, lemon, peppermint, citronella, eucalyptus, mint, corn, and orange. The production of these oils is intricately tied to the availability of their respective raw materials. Livestock manufacturers carefully determine the incorporation of these essential oils and plant extracts, considering factors such as the intended animal diet, the type of livestock, and specific applications.

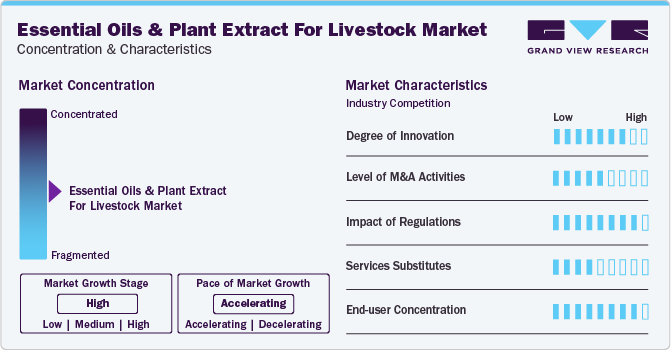

Market Concentration & Characteristics

Market growth stage is high, and the pace of the market growth is accelerating. The essential oils & plant extracts for livestock market are characterized by a high degree of innovation. The global market experiences innovation driven by continuous research and development initiatives conducted by manufacturing companies, aiming to enhance the quality of feed additives. For example, companies like NOR-FEED exemplify this trend through their dedicated in-house Research and Development department. This department is responsible for the development and documentation of a concise portfolio of products. The objective is to offer natural and efficient solutions for animal nutrition and health, thereby contributing to advancements in the industry.

The essential oils and plant extracts livestock market is subject to a complex and stringent regulatory framework. Various regulatory bodies, including the European Union, United Nations, FAO, UNIDO, EFEO, and the U.S. FDA, among others, govern the use of these products in various end-use applications globally. Obtaining regulatory approval is often a prerequisite for the introduction of essential oils and plant extracts for livestock into the market. Rigorous approval processes are in place to ensure that these products meet established safety and quality standards. For instance, in the realm of animal nutrition, feed materials are legally defined under Regulation 767/2009 EC, explicitly stating that they are "primarily intended to satisfy the nutritional requirements of animals […] and are intended to be used for oral feeding to animals."

Certain "plant extracts" qualify as raw materials if they meet specific cumulative criteria. In such cases, these plant extracts, falling within the raw material category, can be introduced to the market without undergoing a safety assessment by a third-party agency. The responsibility for market placement lies with the industry that sells the extract. For instance, a spice, comprising plant extracts processed mechanically, like thyme powder, attains raw material status within the regulatory category of "Products of the processing of spices and aromatics." Consequently, it can be marketed without undergoing any preceding technical and regulatory procedures.

End-user concentration is a significant factor in the market. Various animal feed additives and animal feed manufacturing companies are the major customers for essential oils & plant extracts. Higher end-use concentrations can enhance efficacy, promoting improved animal health and performance. Ongoing research and industry practices contribute to the evolution of optimal concentration levels, highlighting the intricate interplay of factors shaping the market for essential oils and plant extracts in livestock.

Type Insights

Plant Extract dominated the market and accounted for a share of over 78% in 2023. Plant extracts are derived from botanical sources, aligning with the growing consumer preference for natural and organic products. This natural origin resonates with the desire for sustainable and eco-friendly practices in agriculture. In addition, plants are abundant and diverse, offering a wide array of extracts suitable for various applications in livestock. This availability contributes to a stable and consistent supply chain, meeting the demands of the livestock industry. Further, plant extracts offer a diverse range of benefits, including antimicrobial, antioxidant, and anti-inflammatory properties. These properties can positively impact animal health, growth, and overall performance, making them attractive for livestock producers.

Essential oils frequently exhibit higher concentration and potency than certain plant extracts, enabling the attainment of desired effects in smaller quantities. This heightened concentration proves advantageous in feed formulations, facilitating precise dosage control. In addition, these products contain specific bioactive compounds renowned for their antimicrobial, antioxidant, and other health-promoting properties. If these compounds are deemed essential for animal health and performance, a preference for essential oils may emerge. Furthermore, essential oils typically possess a longer shelf life and greater stability compared to certain plant extracts, considerations particularly relevant in feed formulation for products requiring extended storage periods.

Form Insights

The solid form dominated the market in 2023. Solid forms of products often exhibit better stability and have a longer shelf life compared to their liquid counterparts. This is particularly important in the context of storing and transporting feed additives over extended periods. In addition, solid forms, such as powders or granules, are easier to handle, measure, and mix into feed formulations. This ease of handling simplifies the manufacturing process, allowing for more efficient production of feed products. Moreover, solid products provide better control over the dosage of essential oils and plant extracts in feed formulations. This precision is crucial to avoid over-supplementation, which could lead to unintended consequences or undesirable effects on animal health.

Liquids are generally absorbed more quickly by feed ingredients, promoting faster and more efficient dispersion of active compounds. This rapid absorption can contribute to faster assimilation and utilization of nutrients by the animals. Liquids can enhance the palatability of feed, potentially making it more appealing to animals. This is particularly beneficial when dealing with picky eaters or animals that may be reluctant to consume certain feed formulations. In addition, liquid forms eliminate the dustiness associated with handling and processing dry or solid ingredients. This can be advantageous in terms of occupational health and safety for workers involved in the production and handling of feed.

Function Insights

Gut Health dominated the market in 2023. This is attributable to the change in emphasis among farmers and feed manufacturers toward enhancing the performance and gastrointestinal well-being of animals. To achieve this objective, a variety of plant extracts, coupled with select essential oils, are employed as additives in animal feed formulations.

A strengthened immune system helps animals resist and combat various diseases. Improving immunity is a proactive approach to minimizing the impact of infectious agents and preventing disease outbreaks within livestock populations. Enhancing the immunity of animals can contribute to reducing the reliance on antibiotics. With increasing concerns about antibiotic resistance, promoting natural immune responses becomes crucial for sustainable and responsible livestock management. Animals with robust immune systems are generally healthier. This translates to better overall well-being, improved growth rates, and increased productivity, which are essential factors in the livestock industry. Such factors contribute to the rapid expansion of the usage of essential oils & plant extracts in livestock for strengthening immunity.

Enhanced animal yield leads to improved economic returns for livestock producers. Higher yields mean more efficient resource utilization, reduced production costs per unit, and increased profitability for farmers. Essential oils and plant extracts are often used to optimize feed conversion efficiency. By improving the digestion and absorption of nutrients, these additives can help animals convert feed into muscle or milk more effectively, leading to higher yields. In addition, the promotion of essential oils and plant extracts in animal diets can positively impact growth rates. Accelerated growth contributes to reaching market weight or maturity faster, allowing for more efficient production cycles.

Livestock Insights

Poultry dominated the market and accounted for a share of approximately 37% in 2023. The poultry industry has experienced significant growth globally, driven by increased demand for poultry products such as chicken meat and eggs. This expansion has led to a higher consumption of feed additives, including essential oils and plant extracts. These products are known for their potential to improve feed efficiency, enhance growth rates, and promote overall performance in poultry. These benefits align with the economic goals of the poultry industry to produce more efficiently and cost-effectively.

Many essential oils and plant extracts possess natural antimicrobial properties. In swine farming, where the risk of bacterial infections is a concern, these additives help mitigate the impact of harmful microorganisms and contribute to disease prevention. Furthermore, the swine industry is increasingly seeking alternatives to antibiotics due to concerns about antibiotic resistance. Essential oils and plant extracts provide a natural and sustainable option for promoting animal health without relying heavily on antibiotics.

Essential oils and plant extracts can play a role in managing water quality in aquaculture systems. Some compounds have been shown to have water-purifying effects, assisting in the control of harmful microorganisms, and maintaining optimal water conditions. In addition, these products can enhance the palatability of aquatic feeds, making them more attractive to species with discerning feeding behaviors. This encourages better feed intake and ensures that the necessary nutrients are consumed. Such factors are responsible for the increase in the consumption of essential oils & plant extracts for aquatic livestock.

Regional Insights

Asia Pacific dominated the market and accounted for a 34.5% share in 2023. This high share is attributable to a significant and diverse agricultural industry, with a large population engaged in livestock farming. Secondly, traditional practices and holistic approaches to animal health are deeply ingrained in many Asian cultures, leading to a widespread acceptance of natural remedies such as essential oils and plant extracts.

In North America, the trend is influenced by factors such as a growing emphasis on sustainable and organic farming practices, coupled with a heightened awareness of the potential negative impacts of synthetic additives in animal feed. The region has witnessed a shift towards natural alternatives, including essential oils, driven by concerns over animal welfare, food safety, and consumer preferences for products perceived as more environmentally friendly. In addition, the increasing restrictions on the use of certain antibiotics as growth promoters in livestock have encouraged the exploration of alternative solutions, with essential oils being recognized for their potential health benefits.

Key Companies & Market Share Insights

Some of the key players operating in the market include IDENA SAS, Kemin Industries, Inc., DSM, Novus International, Inc., Provitim, Trouw Nutrition Hifeed BV, Orffa, Indian Herbs Specialties Pvt. Ltd., Danisco, BENEO GmbH, Panagro Health & Nutrition, Manghebati, Amorvet Animal Health Pvt. Ltd., and Sensnutrition, among others.

-

Kemin Industries, Inc. is a worldwide enterprise specializing in delivering innovative solutions across diverse industries, with a focus on agriculture and animal nutrition. The company has actively engaged in the manufacturing of feed additives and supplements that integrate natural elements, such as essential oils and plant extracts. These products are frequently formulated to promote animal health, optimize feed efficiency, and elevate overall performance.

-

DSM operates in multiple sectors, including nutrition, health, and materials. Its portfolio encompasses a wide range of products and solutions, from vitamins and nutritional ingredients to advanced materials and bio-based products. The company is involved in the production and supply of essential oils & plant extracts. Under its Eubiotics portfolio, the company offers various blends of essential oils, herbs, spices, and plant extracts.

-

BENEO GmbH, Orffa, and Indian Herbs Specialties Pvt. Ltd., among others, are some of the emerging market participants in the essential oils & plant extract for livestock market.

-

BENEO GmbH specializes in the production of ingredients derived from natural sources, with a particular focus on rice, sugar beet, chicory root, and wheat. These ingredients play a crucial role in improving the nutritional and technical characteristics of a wide range of food and beverage products, as well as animal feed. The natural products offered by BENEO are incorporated into feed formulations for aquaculture, pigs, pets, poultry, and ruminants.

-

Indian Herbs Specialties Pvt. Ltd. (IHPL) is a company based in India that specializes in the production and distribution of herbal extracts, phytochemicals, and natural ingredients for various industries, including pharmaceuticals, animal feed, food and beverages, and cosmetics. For animal feed manufacturing, the company provides herb-based products for poultry, ruminants, canine, swine, equine, and aqua.

Key Essential Oils And Plant Extract For Livestock Companies:

- IDENA SAS

- Kemin Industries, Inc.

- Novus International, Inc.

- DSM N.V.

- Trouw Nutrition Hifeed BV

- Phytosynthese

- Provitim

- Panagro Health & Nutrition

- Olmix S.A.

- Herbarom Laboratoire

- Herbavita

- Orffa

- Indian Herbs Specialties Pvt. Ltd.

- Danisco

- Manghebati

- BENEO GmbH

- Amorvet Animal Health Pvt. Ltd.

- Lanoratoires Phode

- Sensnutrition

- Delacon Biotechnik GmbH

- Joh. Vogele KG

Recent Developments

-

In February 2023, Evonik Industries AG introduced its inaugural plant-based feed premix, named PhytriCare IM. Comprising carefully chosen plant extracts rich in flavonoids, this product is accessible across European Union nations. Concurrently, the company has commenced the process of obtaining approvals for its distribution in additional countries.

-

In October 2023, Evonik China Co., Ltd. agreed to establish a joint venture (JV) with Shandong Vland Biotech Co., Ltd., aimed at enhancing their footprint in global gut health solutions, particularly for farm animals. Evonik will assume the role of the majority shareholder, holding 55% of the shares in this joint venture. Operating under the name Evonik Vland Biotech (Shandong) Co., Ltd., the headquarters of the joint venture will be situated in Binzhou, China.

-

In May 2023, Alltech forged a partnership with Agolin, a manufacturing company specializing in the development and production of plant-based nutrition solutions for animals. The primary objective of this collaboration is to deliver environmentally friendly nutrition solutions that contribute to supporting cattle production and aligning with sustainability goals.

Essential Oils And Plant Extract For Livestock Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.9 billion

Revenue forecast in 2030

USD 4.2 billion

Growth rate

CAGR of 6.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Report updated

January 2024

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, form, function, livestock, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; India; Japan; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

IDENA SAS; Kemin Industries, Inc.; Novus International, Inc.; DSM N.V.; Trouw Nutrition Hifeed BV; Phytosynthese; Provitim; Panagro Health & Nutrition; Olmix S.A.; Herbarom Laboratoire; Herbavita; Orffa; Indian Herbs Specialties Pvt. Ltd.; Danisco; Manghebati; BENEO GmbH; Amorvet Animal Health Pvt. Ltd.; Lanoratoires Phode; Sensnutrition; Delacon Biotechnik GmbH; Joh. Vogele KG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Essential Oils And Plant Extract For Livestock Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global essential oils and plant extract for livestock market report based on type, form, function, livestock, and region.

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Essential Oils

-

Plant Extracts

-

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Solid

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Gut Health

-

Immunity

-

Yield

-

Other Functions

-

-

Livestock Outlook (Revenue, USD Million, 2018 - 2030)

-

Cattle

-

Poultry

-

Swine

-

Aquatic

-

Other Livestocks

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

India

-

Japan

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East and Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global essential oils and plant extract for livestock market size was valued at USD 2.7 billion in 2023 and is expected to reach USD 2.9 billion in 2024.

b. The global essential oils and plant extract for livestock market is expected to grow at a compound annual growth rate of 6.2% from 2024 to 2030 to reach USD 4.2 billion by 2030.

Which segment accounted for the largest essential oils and plant extract for livestock market share?b. Asia Pacific region dominated the global essential oils and plant extract for livestock market with a revenue share of 34.50% in 2023. This is attributed to the strong economic prospects of emerging countries of the region, ever-increasing population, and increasing disposable income of the average household.

b. Some prominent players in the global essential oils and plant extract for livestock market include IDENA SAS, Kemin Industries, Inc., Novus International, Inc., DSM N.V., Trouw Nutrition Hifeed BV, Phytosynthese, Provitim, Panagro Health & Nutrition, Olmix S.A., Herbarom Laboratoire, Herbavita, Orffa, Indian Herbs Specialties Pvt.Ltd., Danisco, Manghebati, BENEO GmbH, Amorvet Animal Health Pvt.Ltd., Laboratoires Phode, Sensnutrition, Delacon Biotechnik GmbH, Joh. Vogele KG

b. The demand for essential oils and plant extracts for livestock is anticipated to be driven by its wide usability as a catalyst that helps in preventing various diseases as well as improving the feed digestion, vitamin intake, and rate of weight gain.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."