- Home

- »

- Advanced Interior Materials

- »

-

Esterquats Market Size, Share And Growth Report, 2030GVR Report cover

![Esterquats Market Size, Share & Trends Report]()

Esterquats Market (2024 - 2030) Size, Share & Trends Analysis Report By Application (Fabric Care, Personal Care, Industrial), By Region, And Segment Forecasts

- Report ID: GVR-2-68038-239-6

- Number of Report Pages: 201

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Esterquats Market Size & Trends

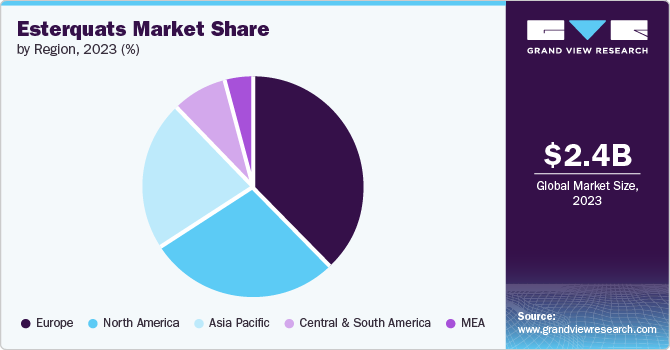

The global esterquats market size was estimated at USD 2441.03 million in 2023 and is projected to grow at a CAGR of 10.3% from 2024 to 2030. This growth can be attributed to factors like higher disposable income, more informed consumers, and the introduction of new fabric softener products. Technological progress and the need for efficient, affordable products have increased the use of esterquats in making fabric softeners. Esterquats are a class of cationic surfactants consisting of quaternary ammonium ions as a hydrophilic group. The structure of esterquats is quite similar to Di-Hardened Tallow DiMethylAmmonium Chloride (DHTDMAC) except that the ester links are introduced into the head group of the molecule, which makes them prone to degradation by hydrolysis.

The major esterquats molecules include ditallow ester of methyltriethanolammonium meth sulfate, ditallow ester of dimethyldiethanolammonium chloride, and ditallow ester of trimethyldihydroxypropylammonium chloride.

Drivers, Restraints & Opportunities

The fabric softeners initially consisted of DHTDMAC as an active ingredient with about 4%- 6% concentration. Technological advancements and requirements for high-performance & low-cost products led to the adoption of esterquats in the manufacturing of fabric softeners. Europe witnessed rapid replacement of DHTDMAC with esterquats, thereby leading to about a 70% decrease in demand for the former. The biodegradability and low toxicity of esterquats have led to large-scale utilization of the product in Europe, North America, and Japan.

Growing consumer awareness & disposable income and innovation in fabric softener products are likely to have a positive impact on the demand for fabric softeners over the forecast period. High utilization of concentrated fabric softener products in North America, Europe, and Asia is also expected to augment demand for esterquats in these regions over the forecast period.

The threat of alternative solutions, such as silicones, has emerged as a major restraint for the global market. Silicones are being increasingly utilized for application in fabric softeners on account of low inter-fiber friction and superior performance. Silicones are used in combination with esterquats to achieve cost-effectiveness and high performance. These have a high lubricating and softening effect on the fabrics, which helps avoid the undesirable friction between the individual fibers during washing.

Industry Dynamics

The global esterquats market exhibits a moderate degree of innovation, with companies investing in R&D to introduce advanced esterquat variants. For instance, Nouryon, a global specialty chemicals company, focuses on innovation in esterquats. The company recently announced the expansion of its esterquat production capacity across Europe to address the region's growing demand while reinforcing its global market position. This demonstrates the commitment of major players to innovate and meet the evolving market needs.

While the market faces competition from traditional quaternary ammonium compounds, the demand for eco-friendly and sustainable products has driven the adoption of esterquats as a preferred choice in fabric softeners and personal care products. The shift in consumer preferences toward environmentally friendly fabric softeners has limited the impact of substitutes in the market. This trend has contributed to the moderate consolidation of the esterquats market, as companies focus on meeting the demand for sustainable solutions.

The end-user concentration in the market is notable in industries, such as personal care and home care. Increasing demand for fabric softeners, hair conditioners, and shampoos has led to a focused concentration of esterquats usage in these segments. For instance, in the personal care sector, esterquats are widely used in hair conditioners due to their superior conditioning properties. This concentration of end user demand has contributed to the moderate consolidation of the esterquats market, with manufacturers strategically targeting these key segments.

Application Insights

The fabric care segment dominated the market with a revenue share of 90.7% in 2023. Esterquats find extensive use in fabric care products, particularly in fabric softeners and laundry detergents. Their cationic nature enables them to impart softness and antistatic properties to fabrics, making them a vital ingredient in fabric conditioning formulations. For example, major detergent and fabric care product manufacturers incorporate esterquats in their formulations to enhance the softness and manageability of fabrics. In addition, esterquats are known for their ability to reduce wrinkling in fabrics, providing a smoother and more appealing texture to garments after washing.

In the personal care sector, esterquats are widely utilized in hair care products, such as shampoos and conditioners. Their excellent conditioning properties make them ideal for improving the texture and overall manageability of hair. Leading cosmetic and personal care brands incorporate esterquats in their hair conditioning products to provide consumers with smooth, silky, and tangle-free hair. For instance, high-end hair care brands often feature esterquat-based conditioners that offer superior detangling and frizz control benefits, catering to consumers seeking premium hair care solutions.

In industrial applications, esterquats serve diverse purposes, including use as antistatic agents in textiles, processing aids in the production of paper, and emulsifiers in various industrial processes. Their ability to impart static control properties in textiles and paper products makes them valuable additives in manufacturing processes. For instance, in the textile industry, esterquats are added to textile finishes to minimize static electricity build-up and improve the overall quality of finished fabrics. Similarly, in the paper industry, esterquats are used to enhance the formation and strength of paper products, contributing to improved printability and runnability in printing and converting operations.

Regional Insights

The esterquats market in North America was the second-largest regional market in 2023. The region's advanced personal care and fabric care industries contribute significantly to the demand for esterquats. In addition, North America's emphasis on sustainable and eco-friendly solutions aligns with the growing demand for esterquats in the region, reflecting its influence on the market.

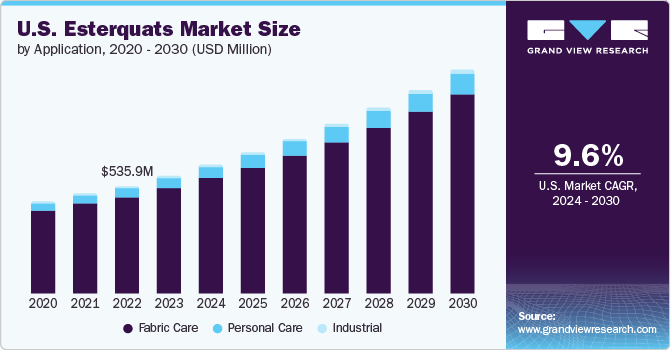

U.S. Esterquats Market Trends

The U.S. esterquats market held the largest revenue share of the North America market in 2023. Major consumer goods companies in the U.S. incorporate esterquats in fabric softeners and hair care products, leveraging their conditioning and antistatic properties. The country's emphasis on sustainability and eco-friendly solutions aligns with the growing demand for esterquats, reflecting its influence on the market.

Europe Esterquats Market Trends

The esterquats market in Europe dominated the global industry in 2023 with a revenue share of 37.6%. The region accounted for a significant value share in the esterquats market, reflecting its robust market presence. The European market is anticipated to witness continued growth, with major companies expanding their production capacities to cater to the region's growing demand. The region's focus on sustainability and environmental responsibility has led to a rising demand for bio-based chemicals, including esterquats. The demand for vegetable-based feedstock is expected to increase over the forecast period, aligning with Europe's emphasis on sustainable and eco-friendly solutions.

The Germany esterquats market held the largest share of the Europe market in 2023. The country's emphasis on sustainability and environmental responsibility has led to a rising demand for bio-based chemicals, including esterquats. Germany's role as a technological innovation and product development hub underscores its influence on the global esterquats market.

Asia Pacific Esterquats Market Trends

The esterquats market in Asia Pacific is expected to grow at a significant rate from 2024 to 2030. The region's emerging markets and rapid economic growth contribute to the increasing demand for esterquats in personal care, fabric care, and industrial applications. For instance, countries like China, Japan, and South Korea are significant consumers of esterquats in the personal care sector, reflecting the region's substantial market presence.

The China esterquats market is estimated to grow at a significant CAGR from 2024 to 2030. China's emerging markets and rapid economic growth contribute to the increasing demand for esterquats in personal care, fabric care, and industrial applications. The country's focus on technological innovation and sustainability drives the adoption of esterquats in diverse applications, positioning China as a leading market for these products.

The esterquats market in India is expected to grow significantly due to the country's rising middle-class population and increasing disposable income contributing to the rising demand for high-quality fabric softeners and personal care items, driving the adoption of esterquats.

Central & South America Esterquats Market Trends

The Central & South America Esterquats market is anticipated to witness significant growth from 2024 to 2030. The region's expanding middle-class population and increasing disposable income contribute to the rising demand for high-quality fabric softeners and personal care items, driving the adoption of esterquats.

The esterquats market in Brazil is estimated to grow at a significant CAGR over the forecast period. Brazil's robust personal care and fabric care industries contribute significantly to the demand for esterquats. The country's emphasis on sustainability and eco-friendly solutions aligns with the growing demand for esterquats, reflecting its influence on the market.

Middle East & Africa Esterquats Market Trends

The MEA esterquats marketis growing due to the high demand for high-quality fabric softeners and hair care products in the Middle Eastern and North African countries, driving the utilization of esterquats in these formulations. The region's evolving consumer preferences and regulatory support for sustainable chemicals underscore its role as a leading market for esterquats.

The esterquats market in Saudi Arabia is expected to grow at a lucrative rate from 2024 to 2030 due to a focus on sustainable business practices and the increasing demand for personal care and fabric care products contributing to the adoption of esterquats. The country's evolving consumer preferences and regulatory support for sustainable chemicals underscore its role as a leading market for esterquats.

Key Esterquats Company Insights

The global esterquats market exhibits a highly competitive landscape, with several major and medium-sized players accounting for a significant share of the market revenue. These companies are actively undertaking initiatives to drive product innovation, expand market presence, and address the evolving demands of end-users. A major initiative being undertaken by companies in the market is the implementation of stringent environmental regulations, which have positively impacted the market landscape. A decrease in the adoption of conventional quats has further made esterquats the surfactant of choice among softener producers across the globe.

Some of the key players operating in the market include

-

Stepan Company is a prominent manufacturer of specialty chemicals, with a diverse range of industrial applications including personal care, household cleaning, and agriculture. The company is known for its extensive product portfolio, which includes raw materials used in the production of end products across various industries

-

Evonik Industries’ Nutrition and Care segment produces specialty chemicals for consumer goods, animal nutrition, and healthcare products. The company's emphasis on innovation and sustainability aligns with the growing demand for esterquats, positioning Evonik as a significant player in the global esterquats market

Some of the emerging players operating in the market include

-

ABITEC Corporation is a key player in the esterquats industry, contributing to the development and production of specialty chemicals. The company's involvement in the market reflects its commitment to addressing the evolving demands of end-users and driving product innovation

-

Chemelco is actively involved in the esterquats industry, contributing to the production and distribution of specialty chemicals. The company's commitment to product development and market expansion reflects its influence in driving advancements in the esterquats market

Key Esterquats Companies:

The following are the leading companies in the esterquats market. These companies collectively hold the largest market share and dictate industry trends.

- Stepan Company

- Kao Chemicals Europe, S.L.U.

- Evonik Industries

- Akzo Nobel N.V.

- Chemelco

- ABITEC

- BASF SE

- The Lubrizol Corporation

- Italmatch Chemicals S.p.A.

- Solvay S.A.

Recent Developments

-

In September 2022, Clariant announced its decision to sell its quats business to Global Amines based in Singapore for a sum of USD 113 million. The deal will include an asset sale of the production sites in Germany, Indonesia, and Brazil

-

In July 2020, Stepan Company launched STEPANQUAT Soleil, a sustainable and safe hair conditioning agent crafted from sunflower oil, which will be sourced from France and Spain. The formulation, which includes a bio ester quat is a step in the company’s policy of aligning with sustainability objectives

Esterquats Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2,690.0 million

Revenue forecast in 2030

USD 4,836.1 million

Growth rate

CAGR of 10.3% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million, volume in kilotons, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Regional scope

North America; Europe; Asia Pacific; Central & South America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; Italy; Spain; China; Japan; India; South Korea; Brazil; Argentina; Saudi Arabia; South Africa

Key companies profiled

Stepan Company; Kao Chemicals Europe; S.L.U.; Evonik Industries; Akzo Nobel N.V.; Chemelco; ABITEC; BASF SE; The Lubrizol Corp.; Italmatch Chemicals S.p.A.; Solvay S.A.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Esterquats Market Report Segmentation

This report forecasts revenue and volume growth at global, regional, and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the esterquats market report based on application and region:

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Fabric Care

-

Personal Care

-

Industrial

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Central & South America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

Saudi Arabia

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global esterquats market size was estimated at USD 2441.03 million in 2023 and is expected to reach USD 2,690.0 million in 2024.

b. The global esterquats market is expected to grow at a compound annual growth rate of 10.3% from 2024 to 2030 to reach USD 4,836.1 million by 2030.

b. Fabric care dominated the esterquats market with a share of 90.8% in 2023. This is attributable to the growing awareness regarding use of the chemical as a fabric softener, which helps in maintaining the quality and the texture of the cloth.

b. Some key players operating in the esterquats market include Stepan Company, Kao Chemicals Europe, Evonik Industries, AkzoNobel, Chemelco International B.V., ABITEC Corporation, BASF SE, Lubrizol, Italmatch Chemicals, and Clariant Chemicals.

b. Key factors that are driving the market growth include increasing use of esterquats in softener formulations helped to gain added advantages of excellent stability, good softening performance, solvent-free, no odor, and also helps in getting a good ironing effect.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.