- Home

- »

- Next Generation Technologies

- »

-

Ethernet Test Equipment Market Size, Industry Report, 2033GVR Report cover

![Ethernet Test Equipment Market Size, Share & Trends Report]()

Ethernet Test Equipment Market (2025 - 2033) Size, Share & Trends Analysis Report By Type (10G Test Equipment, 25/40G Test Equipment), By Function, By End Use, By Region, And Segment Forecasts

- Report ID: GVR-4-68040-751-3

- Number of Report Pages: 200

- Format: PDF

- Historical Range: 2021 - 2023

- Forecast Period: 2025 - 2033

- Industry: Technology

- Report Summary

- Table of Contents

- Interactive Charts

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethernet Test Equipment Market Summary

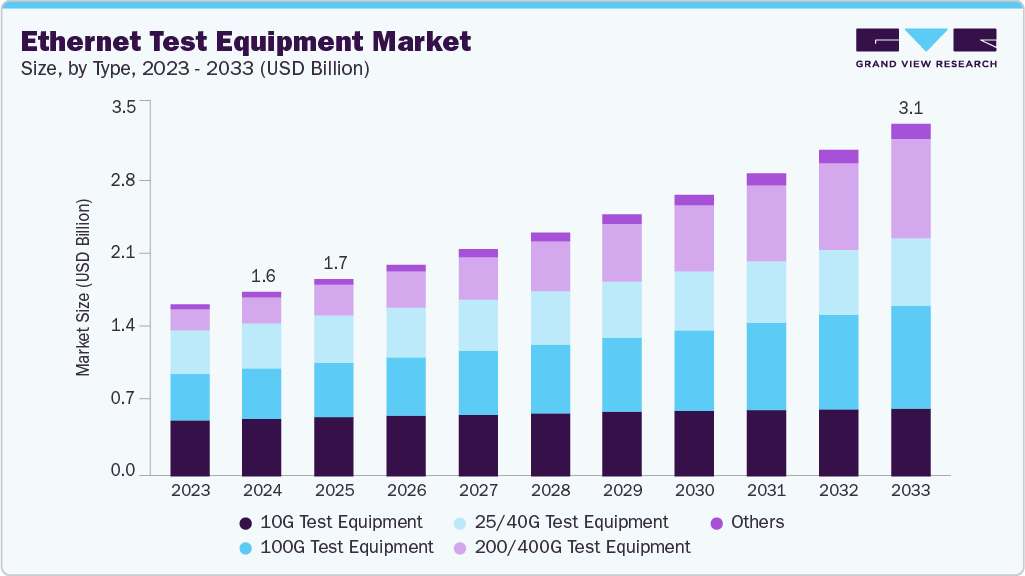

The global ethernet test equipment market size was estimated at USD 1,624.0 million in 2024 and is projected to reach USD 3,102.3 million by 2033, growing at a CAGR of 7.5% from 2025 to 2033. The market is growing due to the expansion of cloud services, the deployment of edge computing architectures, the increasing adoption of IoT and Industrial IoT, the rising demand for automation in industries, and the need for robust monitoring and diagnostics to handle complex network topologies.

Key Market Trends & Insights

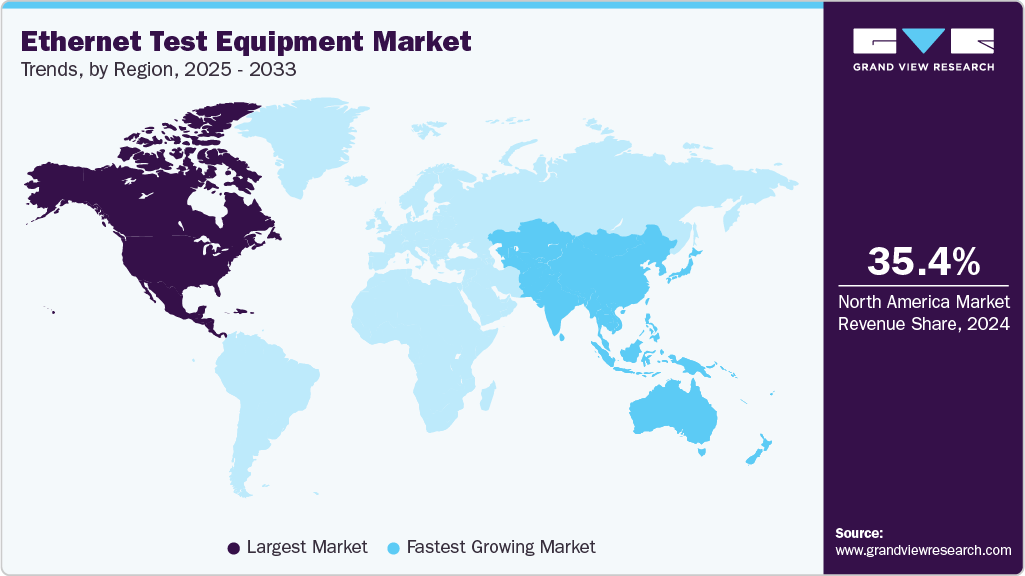

- North America Ethernet test equipment dominated the global market with the largest revenue share of 35.4% in 2024.

- The Ethernet test equipment market in the U.S. led North America and held the largest revenue share in 2024.

- By type, 10G test equipment led the market and held the largest revenue share of 31.2% in 2024.

- By function, the installation & certification testing held the dominant position in the market and accounted for the largest revenue share of 32.1% in 2024.

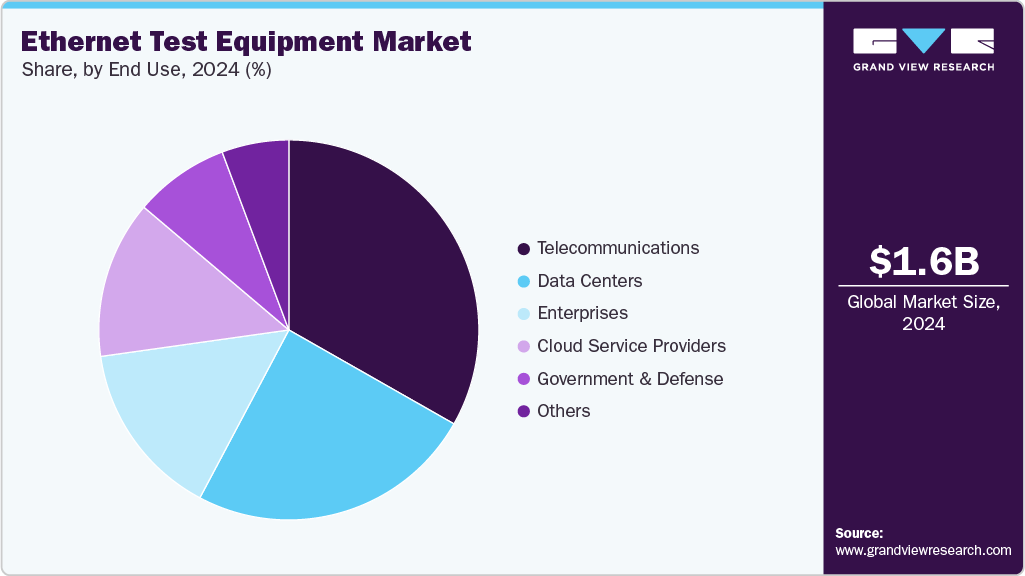

- By end use, the cloud service providers segment is expected to grow at the fastest CAGR of 14.3% from 2025 to 2033.

Market Size & Forecast

- 2024 Market Size: USD 1,624.0 Million

- 2033 Projected Market Size: USD 3,102.3 Million

- CAGR (2025-2033): 7.5%

- North America: Largest market in 2024

- Asia Pacific: Fastest growing market

Growing network complexity drives demand for advanced Ethernet test equipment with enhanced diagnostics. Networks now require testing beyond basic verification to cover performance, reliability, and power. This is boosting the adoption of multifunctional, high-speed testers for diverse topologies. Compact and efficient solutions are in demand to simplify troubleshooting. Companies are launching innovative testers to meet these needs. Rapid automation and digital infrastructure growth are further propelling market expansion. For instance, in August 2024, Softing IT Networks, a German-based developer of IT network test equipment, expanded its CableMaster series with the launch of CableMaster PoE, a dedicated Ethernet cable tester designed for Power over Ethernet (PoE) verification and troubleshooting. The device supports PoE load testing up to 90W, wiremaps, length measurement, and real-time results, offering a compact, efficient tool for network installations.The market is experiencing significant growth due to expanding high-speed network deployments. Organizations are seeking compact and portable devices for efficient field operations. High performance and precision are becoming essential for modern testing needs. Users prioritize equipment that simplifies installation, maintenance, and troubleshooting. Smart, automated configurations are increasingly preferred to streamline workflows. The market is moving toward versatile, advanced, and user-friendly testing solutions. For instance, in September 2025, VeEX Inc., a U.S.-based telecommunications service provider, launched the MTX642 dual-port 400GE multi-service handheld tester, offering the industry’s most compact dual 400GE portable solution for high-speed Ethernet testing. It enables fast, precise field operations for troubleshooting, equipment verification, installation, maintenance, and commissioning with smart, predefined configurations.

Artificial intelligence (AI) advancements are driving rapid growth in computational requirements. Data centers are expanding to support this increased demand for processing power and storage. High-speed networks are essential to handle large volumes of data generated by AI applications. Ethernet connections form the backbone of these networks, ensuring fast and reliable communication. As network complexity rises, the risk of performance degradation also increases. Ethernet test equipment is critical to identify and resolve network issues efficiently. It allows engineers to measure throughput, latency, and packet loss accurately. Testing ensures that the network infrastructure can support AI workloads without interruptions. The expansion of cloud services further amplifies the need for reliable network validation. AI advancements and growing data centers directly boost the demand for sophisticated Ethernet test solutions.

Type Insights

The 10G test equipment segment dominated the market in 2024, accounting for a 31.2% share, due to widespread adoption in enterprises and data centers. High demand for faster, reliable connectivity strengthens its prominence across industries. Organizations rely on 10G testers for accurate performance verification and efficient network troubleshooting. Continuous technological advancements and multifunctional capabilities support diverse network requirements. Rising investments in cloud computing, AI, and data center expansions boost adoption. 10G test equipment remains the most deployed solution, ensuring precise measurement and optimal network performance.

The 200/400G test equipment segment is experiencing rapid market growth from 2025 to 2033. Expanding high-speed networks and next-generation data centers drive demand for these advanced testing solutions. Organizations increasingly adopt 200G and 400G Ethernet for higher bandwidth and low-latency requirements. Test equipment in this segment enables accurate performance measurement, throughput, and reliability for ultra-fast connections. Technological advancements and multifunctional capabilities further enhance its adoption in complex network environments. The 200/400G test equipment segment is emerging as a key growth area in the market.

Function Insights

Installation & certification testing will hold the largest market share in 2024 due to the need to verify network deployment quality and ensure compliance with performance standards. It remains widely used across enterprises, data centers, and service providers for reliable connectivity assurance. Precise measurement of parameters such as throughput, latency, and packet loss makes it critical for maintaining network integrity. Portable and user-friendly testers enhance field usability, supporting efficient troubleshooting and validation. The segment benefits from ongoing technological improvements that streamline installation and certification processes.

Monitoring & troubleshooting are growing as organizations increasingly focus on network innovation and optimization. Evaluating new technologies, high-speed networks, and advanced topologies drives demand for R&D test equipment. Multifunctional testers enable comprehensive performance analysis, facilitating design improvements and product validation. Investments in AI, cloud, and data center expansions accelerate the adoption of R&D testing solutions. This segment also benefits from compact, high-precision equipment suitable for laboratory and field environments.

End Use Insights

The telecommunications sector accounted for the largest market share in 2024 due to its extensive network infrastructures and the critical need for reliable, high-speed connectivity. Service providers rely on test equipment to ensure optimal network performance, minimize downtime, and maintain service quality for enterprise and consumer customers. The high adoption of 10G and higher-speed networks further strengthens the segment’s prominence. Continuous upgrades and expansions in telecom networks drive consistent demand for installation, certification, and troubleshooting solutions. Portable and multifunctional testers enhance operational efficiency in complex network environments.

Cloud Service Providers are growing as the rapid expansion of cloud computing and data center services increases the need for advanced network testing solutions. Providers require precise performance verification and optimization to support scalable, high-speed infrastructures. Multifunctional test equipment allows comprehensive throughput, latency, and packet loss evaluation across virtualized and hybrid networks. Investments in AI, edge computing, and enterprise cloud adoption further drive this segment’s growth. Compact, energy-efficient testers support flexible deployment in data centers and edge locations.

Regional Insights

North America holds the largest Ethernet test equipment market share at 35.4% due to the early adoption of high-speed network technologies and advanced infrastructure. The region’s strong presence of telecom operators, cloud service providers, and data centers drives consistent demand for reliable testing solutions. High investments in AI, cloud computing, and enterprise networks further boost the adoption of Ethernet test equipment. Continuous technological advancements and the availability of multifunctional testers support complex network deployments.

U.S. Ethernet Test Equipment Market Trends

The Ethernet test equipment market in the U.S. is driven by extensive deployment of high-speed networks across enterprises, data centers, and telecom operators. Growing investments in cloud computing, AI, and 5G infrastructure increase the demand for reliable testing solutions. Advanced multifunctional testers enable accurate performance verification and efficient troubleshooting in complex networks.

Europe Ethernet Test Equipment Market Trends

The Ethernet test equipment market in Europe is expanding due to the growing adoption of high-speed networks across enterprises, telecom operators, and data centers. Investments in 5G, cloud computing, and industrial Ethernet drive demand for reliable testing solutions. Multifunctional and portable testers support performance verification, troubleshooting, and compliance with network standards.

Asia Pacific Ethernet Test Equipment Market Trends

The Ethernet test equipment market in the Asia Pacific region is the fastest-growing market due to rapid network expansions across telecom, enterprise, and industrial sectors. Rising investments in 5G, cloud computing, and data centers are accelerating demand for advanced testing solutions. Organizations increasingly adopt multifunctional testers for accurate performance verification and efficient troubleshooting. The growth of smart cities and industrial IoT further boosts the need for reliable Ethernet test equipment. Increasing technological advancements and affordable testing solutions support market expansion.

Key Ethernet Test Equipment Company Insights

Some key Ethernet Test Equipment industry companies include Anritsu Corporation, EXFO Inc., Fluke Networks, Keysight Technologies Inc., VeEX Inc., and Yokogawa Electric Corporation. Organizations focus on increasing their customer base to gain a competitive edge in the industry. Therefore, key players are taking several strategic initiatives, such as mergers and acquisitions, and partnerships with other major companies.

-

EXFO Inc. has been expanding its Ethernet test equipment portfolio to address the increasing demand for high-speed network validation in telecom and data center environments. The company focuses on compact, portable solutions that improve field efficiency during deployment and troubleshooting. By integrating cloud-based platforms, EXFO enables real-time collaboration and automated reporting for Ethernet testing. Their solutions support evolving needs around 5G backhaul, hyperscale data centers, and enterprise Ethernet services.

-

Keysight Technologies Inc. continues to advance Ethernet test solutions with a strong emphasis on high-speed performance, including 200G, 400G, and emerging 800G technologies. The company develops equipment that validates interoperability, compliance, and performance across complex Ethernet ecosystems. Keysight integrates automation and AI-driven analytics into its testing platforms to meet the growing sophistication of network architectures. Its Ethernet testing tools are widely adopted in R&D, manufacturing, and data center validation environments.

Key Ethernet Test Equipment Companies:

The following are the leading companies in the ethernet test equipment market. These companies collectively hold the largest market share and dictate industry trends.

- Anritsu Corporation

- EXFO Inc.

- Fluke Networks

- Keysight Technologies Inc.

- Rohde & Schwarz

- Spirent Communications plc

- Teledyne LeCroy

- VIAVI Solutions Inc.

- VeEX Inc.

- Yokogawa Electric Corporation

Recent Developments

-

In August 2025, Spirent Communications collaborated with Telescent Inc., a U.S.-based automated optical switching solutions provider, to integrate its technology with Spirent’s Velocity test lab automation portfolio. This collaboration enhances Ethernet test infrastructure by improving automation, efficiency, and connectivity for AI/ML labs, data centers, and enterprise networks.

-

In March 2025, Keysight Technologies launched the Interconnect and Network Performance Tester 1600GE, a portable and rackmount platform that validates Ethernet devices and interconnects from 200GE to 1600GE, supporting high-speed AI and data center networks. The system offers Layer 1-3 testing, BERT, FEC, traffic generation, and multi-vendor interoperability validation, enhancing productivity and performance in complex network environments.

Ethernet Test Equipment Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1,738.8 million

Revenue forecast in 2033

USD 3,102.3 million

Growth rate

CAGR of 7.5% from 2025 to 2033

Base year for estimation

2024

Historical data

2021 - 2023

Forecast period

2025 - 2033

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive sector, growth factors, and trends

Segment scope

Type, function, end use, region

Region scope

North America; Europe; Asia Pacific; Latin America; Middle East & Africa

Country scope

U.S.; Canada; Mexico; Germany; UK; France; China; Japan; India; Australia; South Korea; Brazil; KSA; UAE; South Africa

Key companies profiled

Anritsu Corporation; EXFO Inc.; Fluke Networks; Keysight Technologies Inc.; Rohde & Schwarz; Spirent Communications plc; Teledyne LeCroy; VIAVI Solutions Inc.; VeEX Inc.; Yokogawa Electric Corporation

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethernet Test Equipment Market Report Segmentation

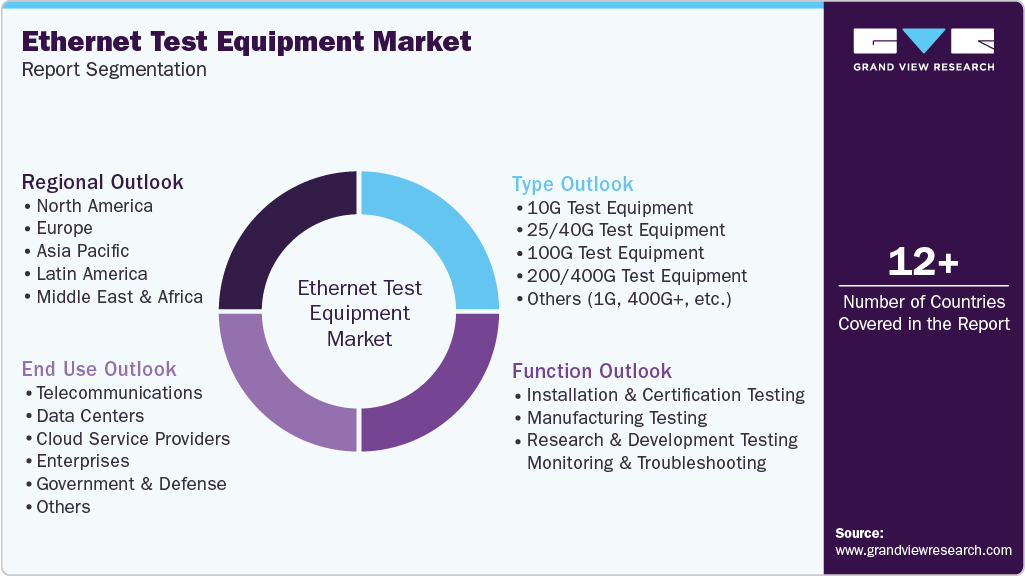

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the global Ethernet test equipment market based on type, function, end use, and region:

-

Type Outlook (Revenue, USD Million, 2021 - 2033)

-

10G Test Equipment

-

25/40G Test Equipment

-

100G Test Equipment

-

200/400G Test Equipment

-

Others (1G, 400G+, etc.)

-

-

Function Outlook (Revenue, USD Million, 2021 - 2033)

-

Installation & Certification Testing

-

Manufacturing Testing

-

Research & Development Testing

-

Monitoring & Troubleshooting

-

-

End Use Outlook (Revenue, USD Million, 2021 - 2033)

-

Telecommunications

-

Data Centers

-

Cloud Service Providers

-

Enterprises

-

Government & Defense

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

-

Asia Pacific

-

China

-

Japan

-

India

-

Australia

-

South Korea

-

-

Latin America

-

Brazil

-

-

Middle East & Africa (MEA)

-

KSA

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global Ethernet test equipment market size was estimated at USD 1,624.0 million in 2024 and is expected to reach USD 1,738.8 million in 2025.

b. The global Ethernet test equipment market is expected to grow at a compound annual growth rate of 7.5% from 2025 to 2033 to reach USD 3,102.3 million by 2033.

b. North America dominated the Ethernet test equipment market with a share of 35.4% in 2024. This is attributable to strong demand from data centers, telecom operators, and enterprises driving investments in high-speed network testing solutions.

b. Some key players operating in the Ethernet test equipment market include Anritsu Corporation, EXFO Inc., Fluke Networks, Keysight Technologies Inc., Rohde & Schwarz, Spirent Communications plc, Teledyne LeCroy, VIAVI Solutions Inc., VeEX Inc., and Yokogawa Electric Corporation.

b. Key factors that are driving the market growth include rapid adoption of high-speed networks, increasing demand for data center expansion, and rising need for reliable network performance testing.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.