- Home

- »

- Organic Chemicals

- »

-

Ethoxylates Market Size And Share, Industry Report, 2030GVR Report cover

![Ethoxylates Market Size, Share & Trends Report]()

Ethoxylates Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Alcohol, Fatty Amines, Fatty Acid, Ethyl Esters, Glycerides), By Application (Household & Personal Care), By End Use, By Region, And Segment Forecasts

- Report ID: GVR-1-68038-490-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethoxylates Market Size & Trends

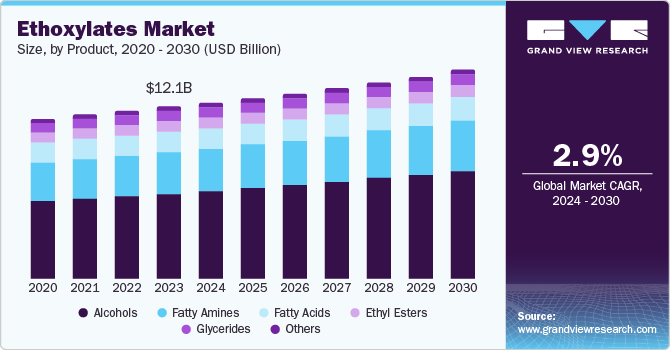

The global ethoxylates market size was valued at USD 12.1 billion in 2023 and is projected to grow at a CAGR of 2.9% from 2024 to 2030. The factors driving the ethoxylates market are increasing applications across diverse industries, ranging from paints and coatings and textile processing to personal care, agriculture, and pulp and paper. There is also increasing demand for low-rinse detergents, surging demand for ethoxylates in the healthcare industry, and increasing demand for eco-friendly products such as alcohol ethoxylates in cosmetics.

Ethoxylates are chemicals made by combining epoxides or ethylene oxide (EO) with substances such as alcohols, acids, amines, and vegetable oils at the preferred molar ratio. Their hydrophobic and hydrophilic characteristics allow them to dissolve in oil or water, depending on the specific ethoxylate utilized. Due to this, they reduce the surface tension between liquids of different types or between liquids and gases. In addition, they provide other characteristics, including being easily dissolved in water, effective formulation, ability to wet surfaces, and minimal harm to aquatic life.

The demand for bio-based ethoxylates is escalating owing to rising consumer awareness regarding the hazardous effects of chemicals on the environment. These ethoxylates are derived from renewable sources, including plant-based oils, sugars, and fatty acids. They are green and sustainable producers without creating harmful chemicals and have a low carbon footprint compared to petroleum-based porcine. Increasing demand for green surfactants in applications such as personal care, agrochemicals, and industrial cleaning is expected to drive bio-based ethoxylates market growth over the forecast period.

Ethoxylated alcohol improves foam production, wetting ability, solubility, and degreasing qualities of the detergent, making it a highly efficient cleaning agent for removing grease from clothes. The growth in population and a substantial rise in disposable income, especially in developing countries, have driven up the need for effective laundry detergents, along with a higher usage of washing machines. As a result, there was a notable increase in the need for liquid detergents.

Product Insights

The alcohol segment dominated the market and accounted for a share of 49.7% in 2023. Alcohol ethoxylates are the largest-volume anionic surfactants. They are an alkyl chain that is reacted with subbing alcohol and then ethylene oxide. Other advantages of alcohol ethoxylates exist, such as modest foaming and good fiber surface cleaning, even in hard water. The increasing application area of domestic detergents, household and personal care products, and I&I cleaning products fosters the demand for alcohol ethoxylates.

The fatty amines segment is expected to grow significantly, with a CAGR of 2.7% during the forecast period. Surfactants obtained from fatty amines are used in many industries. The increase in population, coupled with the rise in people's spending capability on cleaning, personal care, and industrial products, is the main factor boosting this segment. Fatty amine ethoxylates have better attributes, such as an ability to emulsify, detach, and create foam. They are preferable for distinct uses due to the listed attributes. Rising agriculture, construction, and oil & ventures industries, along with the increasing utilization of ethoxylates, are driving the fatty amines segment.

Application Insights

Household and personal care held the largest revenue share of 32.9% in 2023. This category's increase is due to its widespread application in making a wide range of household cleaning items, including liquid and powder laundry detergents, dishwashing gels and detergents, fabric softeners, window cleaners, carpet cleaners, oven cleaners, air fresheners, and hard surface cleaners.

Pharmaceuticals are expected to register the fastest CAGR of 3.7% during the forecast period. In pharmaceutical industries, ethoxylates emulsify ointments, tablets, syrups, and gels. The increasing incidence of chronic diseases, owing to environmental pollution and ignorance of health, can only be facilitated by innovative pharmaceutical products. This is expected to propel the ethoxylate demand in the pharmaceutical industry over the forecast period. In addition, increased demand for generic drugs from developing countries, which are the end consumers of ethoxylates, is likely to influence their consumption.

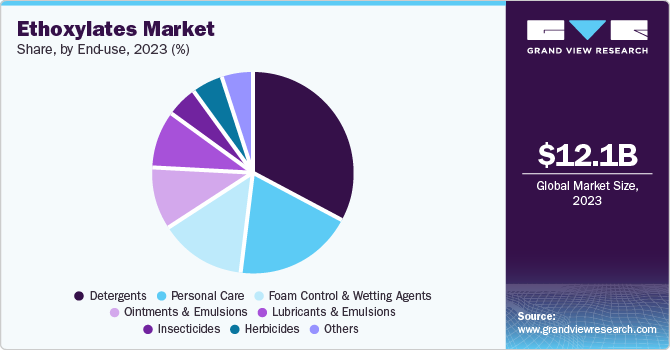

End Use Insights

Detergents led the market and accounted for the largest revenue share of 33.4% in 2023 due to detergent manufacturers increasingly choosing naturally derived ethoxylates for their solubility and wetting properties. For instance, Shell Chemicals provides NEODOL ethoxylates, utilized in numerous popular consumer detergents. In addition, alcohol ethoxylate is utilized to manufacture sodium Lauryl ether sulfate, an essential component in multiple detergents.

Foam control & wetting agents are projected to grow at the fastest CAGR of 3.7% over the forecast period. The increasing pace of industrialization and urbanization leads to a higher demand for efficient cleaning and processing solutions. Foam control and wetting agents are crucial in various industrial processes. Ethoxylate-based foam control and wetting agents are often employed to meet these standards. In addition, the expanding oil and gas industry requires effective foam control agents for drilling, production, and transportation processes.

Regional Insights

The Asia Pacific ethoxylates market dominated the global market with a revenue share of 40.2% in 2023. The region's evolving fashion trends have led to a strong need for innovative textile materials. This will probably boost the use of items such as ethoxylates, which are utilized in lubricating, finishing, and dyeing textiles. The growth of the agricultural industry in the region is also contributing to the rising demand for ethoxylates in the Asia Pacific. The agrochemical sector within the ethoxylates market is demonstrating attractive opportunities as well.

China Ethoxylates Market Trends

The ethoxylates market in China dominated the Asia Pacific market in 2023. China's strong industrial expansion has increased the need for surfactants, such as ethoxylates, in different industries. The rising disposable incomes and expanding middle class have driven the request for personal care, household care, and cleaning goods that heavily depend on ethoxylates. The Chinese government's emphasis on economic growth and technological advancements has led to a positive setting for the ethoxylate sector.

North America Ethoxylates Market Trends

The North America ethoxylates market is expected to grow significantly over the forecast period driven by the increasing use of cleaning and personal care items in the area, particularly in the USA and Canada. The rising awareness of personal hygiene is expected to keep driving the need for cleaning and sanitizing products in countries within the region. In addition, the increasing need for detergents with low foam and rinse capabilities contributes to the market's revenue growth in this area.

The ethoxylate market in the U.S. is expected to grow rapidly in the coming years. The U.S. has a robust industrial framework. Industry, manufacturing, Chemicals, and oil and gas are some of the sectors in the U.S. All these industries use ethoxylates in their many processes since they are large chemical consumers. In addition, there is a global concern for green products, and ethoxylates are sometimes regarded as more environmentally friendly than other surfactants.

Europe Ethoxylates Market Trends

Europe ethoxylates market is anticipated to witness significant growth due to rising uses from segments such as personal care, pharma, household, and industrial cleaning. The increased augmented efforts and initiatives are expected to be driven by the national governments and the European Commission, especially in reviving the markets for ethoxylates, such as the pharmaceutical and the agrochemical ones, which are expected to drive the product demand over the forecast period. All the factors above, along with the better properties of the ethoxylates, are likely to boost regional market growth over the forecast period.

The ethoxylates market in Germany held a substantial market share in 2023 owing to the demand for alcohol ethoxylates being highest for industrial and institutional cleaning applications in the alcohol ethoxylates market, leading to maximum consumption of the product. The existence of a well-developed manufacturing sector also leads to a need for industrial goods such as lubricants, which serve as corrosion preventers and chemical thickeners.

Key Ethoxylates Company Insights

Some key ethoxylate market companies include BASF SE, Dow, Clariant, and others. Companies are implementing viable pricing strategies to increase yearly revenues. In addition, key players are attentive to evolving environmentally friendly products comprising minimal VOC content, which is expected to drive the market over the forecast period.

-

Clariant specializes in chemicals and reports in three sectors: care chemicals, absorbents and additives, and catalysts. Care chemicals primarily focus on consumer-end markets such as personal and home care, with an additional industrial segment. Absorbents and additives cover Clariant’s coatings and adhesives, absorbents, and plastics segments. Manufacturers produce catalysts for petrochemical and syngas plants.

-

Solvay produces and delivers unique polymers, necessary chemicals, and chemical materials, among other products. The company caters to clients in aerospace & automotive, environmental & natural resources, electronics & electrical, agrochemicals, food, consumer products, building & construction, healthcare, industrial sectors, and others.

Key Ethoxylates Companies:

The following are the leading companies in the ethoxylates market. These companies collectively hold the largest market share and dictate industry trends.

- BASF SE

- Dow

- Clariant

- Sasol

- Huntsman International LLC.

- Nouryon

- Shell

- Solvay

- Stepan Company

- Evonik Indutsries

- Procter & Gamble

- Akzo Nobel N.V.

- Mitsui Chemicals India Pvt. Ltd

- Arkemag

Recent Development

- In July 2024, Clariant and OMV declared their planned partnership to reduce ethylene's carbon emissions with a focus on sustainability. In reaction to growing consumer interest in sustainable choices, especially in Europe, this collaboration will assist both companies in reaching their sustainability goals and supporting their customers' carbon reduction initiatives.

Ethoxylates Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.4 billion

Revenue forecast in 2030

USD 14.6 billion

Growth Rate

CAGR of 2.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD Million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Brazil, Argentina, Colombia, Saudi Arabia, UAE, South Africa

Key companies profiled

BASF SE; Dow ; Clariant; Sasol; Huntsman International LLC.; Nouryon; Shell; Solvay; Stepan Company; Evonik Indutsries; Procter & Gamble; Akzo Nobel N.V. ; Mitsui Chemicals India Pvt. Ltd; Arkema

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

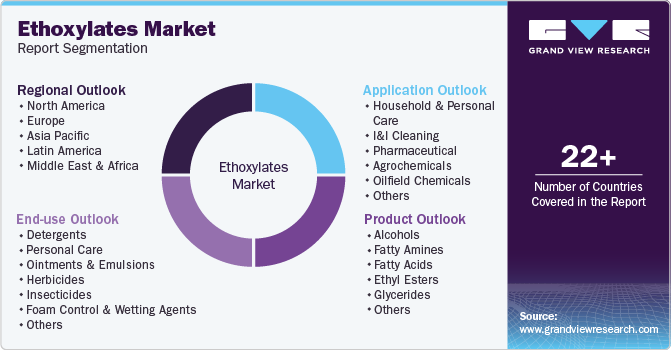

Global Ethoxylates Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and analyzes the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global ethoxylates market report based on product, application, end use, and region.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Alcohols

-

Fatty Amines

-

Fatty Acids

-

Ethyl Esters

-

Glycerides

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Household & Personal Care

-

I&I Cleaning

-

Pharmaceutical

-

Agrochemicals

-

Oilfield Chemicals

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Detergents

-

Personal Care

-

Ointments & Emulsions

-

Herbicides

-

Insecticides

-

Foam Control & Wetting Agents

-

Lubricants & Emulsions

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

-

Latin America

-

Brazil

-

Argentina

-

Colombia

-

-

Middle East and Africa (MEA)

-

Saudi Arabia

-

UAE

-

South Africa

-

-

Frequently Asked Questions About This Report

b. The global ethoxylates market size was estimated at USD 11.86 billion in 2019 and is expected to reach USD 12.25 billion in 2020.

b. The global ethoxylates market is expected to grow at a compound annual growth rate of 3.5% from 2018 to 2025 to reach USD 14.75 billion by 2025.

b. Household & personal care dominated the ethoxylates market with a share of 32.4% in 2019. This is attributable to improved consumer lifestyle, higher disposable income and growing awareness about hygiene & personal care.

b. Some key players operating in the ethoxylates market include AkzoNobel N.V., BASF SE, Clariant AG, Dow Chemical Company, E.I. du Pont de Nemours and Company, Evonik Industries AG, Huntsman International LLC, India Glycols Limited, Mitsui Chemicals, Inc., Royal Dutch Shell plc, SABIC, and Sasol Limited.

b. Key factors that are driving the market growth include increasing use of ethoxylates for ointments & creams and industrial applications such as anti-foam and wetting agents.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.