- Home

- »

- Petrochemicals

- »

-

Ethylene Oxide Market Size, Share And Trends Report, 2030GVR Report cover

![Ethylene Oxide Market Size, Share & Trends Report]()

Ethylene Oxide Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Automotive, Agriculture, Food & Beverages, Medical & Pharmaceuticals), By Application (Ethylene Glycol, Ethoxylates), By Region, And Segment Forecasts

- Report ID: 978-1-68038-203-7

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Ethylene Oxide Market Summary

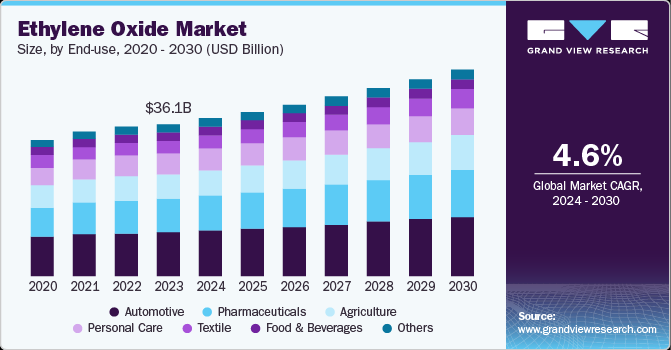

The global ethylene oxide market size was valued at USD 36.10 billion in 2023 and is projected to reach USD 49.10 billion by 2030, growing at a CAGR of 4.6% from 2024 to 2030. The market growth can be attributed to the robust growth of the automotive industry.

Key Market Trends & Insights

- Asia Pacific ethylene oxide market dominated with 50.5% of the global revenue share in 2023.

- China ethylene oxide market was influenced by the rapid expansion of the automotive industry.

- Based on product, the automotive segment accounted for the dominant share of 28.9% in 2023.

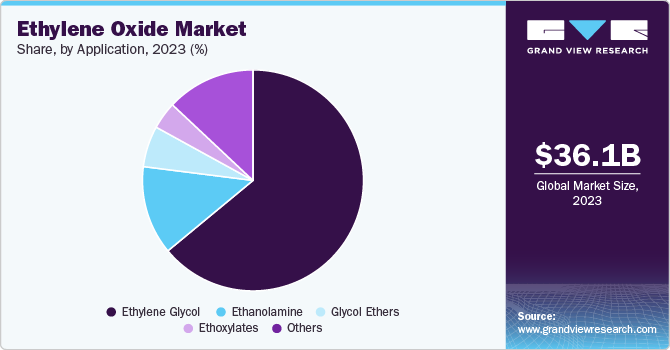

- Based on application, the ethylene glycol secured the largest market revenue share in 2023.

Market Size & Forecast

- 2023 Market Size: USD 36.10 Billion

- 2030 Projected Market Size: USD 49.10 Billion

- CAGR (2024-2030): 4.6%

- Asia Pacific: Largest Market in 2023

Ethylene oxide has been primarily applied to manufacture essential automotive components such as antifreeze agents, brake fluids, and coolants. The manufacturers across various industries have heavily relied on ethylene oxide. For instance, the increasing use of plastics in the packaging industry has led to the increased production of polyethylene terephthalate (PET) resins which require ethylene oxide. This chemical has been increasingly utilized in the production of various chemicals such as surfactants, detergents, ethanolamines, and glycol ethers and the sterilization of medical equipment, pharmaceutical products, and healthcare facilities.

In addition, several technological advancements have improved the efficiency and safety of ethylene oxide production. Innovations in production stages and downstream applications created lucrative opportunities across various end-use sectors. For instance, polyester fibers in the textile industry directly influenced the demand for ethylene oxide. Polyester fibers are widely applied in clothing, home decor, and industrial textiles for durability and easy maintenance. Manufacturers use enhanced ethylene oxide chemicals in the polyester fiber’s production process, contributing to the overall market growth.

Moreover, sustainability emerged as a major trend in the ethylene oxide market. Bio-based alternatives, including bio-ethylene oxide chemicals, have gained prominence. These alternatives are more environment-friendly, reducing dependency on fossil fuels and mitigating the environmental impact associated with traditional ethylene oxide production methods.

Product Insights

Automotive accounted for the dominant share of 28.9% in 2023 owing to the extensive utilization of ethylene oxide chemicals in the production of various automotive components and materials. Ethylene oxide serves as a vital raw material for manufacturing polyurethane foams that are extensively applied in vehicles for seat cushions, headrests, armrests, and insulation materials. Furthermore, ethylene oxide is essential for producing polyethylene glycol (PEG), which acts as an antifreeze agent, lubricant, and coolant in automotive brakes, transmission, and other functional fluids. The rising vehicle production, particularly in emerging countries such as Japan, China, India, and Brazil, has further propelled the demand for ethylene oxide in automotive design and manufacturing.

Medical & pharmaceuticals are expected to be the fastest growing segment with a CAGR of 5.0% over the forecast period owing to the increasing incidence of hospital-acquired infections (HAIs). Healthcare facilities have steadily used ethylene oxide as an effective sterilization solution for ensuring the safety of medical devices. This chemical effectively eliminates microorganisms, bacteria, viruses, and other pathogens from devices such as surgical instruments, catheters, and implants. They play a crucial role in pharmaceutical packaging including drug containers, vials, and ampoules. Moreover, the expansion of distribution networks of pharmaceutical companies led to the increased demand for ethylene oxide as a sterilization agent.

Application Insights

Ethylene glycol secured the largest market revenue share in 2023 owing to its widespread usage in polyester fibers. The market saw a substantial rise in the demand for textiles and apparels including clothing, upholstery, and other fabric-based products where polyester fibers are used. In addition, manufacturers have applied ethylene glycol as a key raw material for polyethylene terephthalate (PET) production for extensive application in beverage bottles, food containers, and packaging materials.

Ethoxylates are expected to witness the fastest CAGR of 5.1% over the forecast period owing to the increasing preference for low-rinse detergents. These compounds function as emulsifiers, dispersants, and wetting agents that enhance detergent performance by improving the solubility and dispersibility of stains. Ethoxylates enhance the effectiveness of surface cleaners, dishwashing liquids, and multipurpose sprays as house-cleaning chemicals. They were further applied in cosmetics and personal care products. For instance, alcohol ethoxylates act as surfactants in lotions, shampoos, and skincare items. Moreover, the focus on environmental safety and biodegradability influenced the use of ethoxylates as these compounds are less harmful to aquatic ecosystems compared to some other surfactants.

Regional Insights

The ethylene oxide market in North America held 17.1% of the market share in 2023. The aging population and improving healthcare infrastructure coupled with the rising need for self an preventive care products contributed to the market’s growth in the region. The demand was further driven by population growth, technological advancements, and the establishment of ethylene oxide and derivatives.

U.S. Ethylene Oxide Market Trends

The U.S. ethylene oxide market was propelled by technological advancements that improved the efficiency and safety of ethylene oxide production. Innovations in production stages and downstream applications created lucrative opportunities across various end-use sectors. In addition, the market witnessed a growing emphasis on sustainability which led to the emergence of bio-ethylene oxide as a viable option. These alternatives reduce dependency on fossil fuels and mitigate environmental impact.

Asia Pacific Ethylene Oxide Market Trends

Asia Pacific ethylene oxide market dominated with 50.5% of the global revenue share in 2023 owing to the significant industrial growth and urbanization coupled with rising disposable incomes. Improved lifestyles fueled the demand for automobile chemicals and packaging materials. In addition, developing countries in the region such as India, China, and South Korea experienced a growing demand for household and personal products which positively impacted the use of ethylene oxide and its derivatives.

China ethylene oxide market was influenced by the rapid expansion of the automotive industry, along with the escalating production of polyester fibers and various textile goods. Moreover, the country's favorable government policies, supporting domestic manufacturing, and the availability of low-cost labor have contributed to the growth of the ethylene oxide market.

Europe Ethylene Oxide Market Trends

The European ethylene oxide market secured 22.4% of the market share in 2023. The strong automotive and chemical industries have considerably boosted the demand for ethylene oxide as a raw material for polyurethane foams, antifreeze formulations, and other industrial applications. In addition, the region experienced steady growth due to the diverse industrial landscape and the increasing focus on eco-friendly and bio-based products.

Key Ethylene OxideCompany Insights

Key players operating in the market such as Shell PLC, INEOS, Dow, and others have focused on advanced production methods, enhancing the quality of their products, and developing innovative applications. Moreover, they have actively participated in novel catalyst technologies, optimizing processes, and improving operational efficiencies to boost yields and decrease manufacturing costs of ethylene oxide.

-

Shell PLC is a British multinational oil and gas company that produces oil and gas from sources including shale, tight rock, and coal formations. The company conducts refining and petrochemical operations, emphasizing sustainability and technological advancements. The company’s products extend to innovations in renewable energy, such as wind and solar-powered gas production platforms.

-

India Glycols is a chemical company that produces green technology-based specialty, and performance chemicals, industrial gases, spirits, natural gums, nutraceuticals, and sugar. The company’s product portfolio includes glycols, glycol ethers, acetates, biopolymers, and potable alcohol.

Key Ethylene Oxide Companies:

The following are the leading companies in the ethylene oxide market. These companies collectively hold the largest market share and dictate industry trends.

- Sinopec Shanghai Petrochemical Company Limited

- Dow

- Indorama Ventures Public Company Limited

- BASF SE

- Shell plc

- INEOS

- India Glycols Limited

- LyondellBasell Industries Holdings B.V.

- NIPPON SHOKUBAI CO., LTD.

- Reliance Industries Ltd.

Recent Development

-

In December 2023, Saudi Basic Industries Corporation (SABIC), Linde Engineering, and Scientific Design (SD) a Linde subsidiary, formalized an agreement to collaboratively investigate potential partnerships focused on decarbonizing SD’s ethylene glycol production process. This alliance aimed at carbon emission reduction by integrating SABIC’s advanced CO2 recovery and purification technology into SD’s licensed glycol plants.

Ethylene Oxide Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 37.45 billion

Revenue forecast in 2030

USD 49.10 billion

Growth Rate

CAGR of 4.6% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Volume in Kilotons, Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Regional scope

North America, Europe, Asia Pacific, Latin America, MEA

Country scope

U.S., Canada, Mexico, Germany, UK, France, Spain, Italy, Russia, China, Japan, India, South Korea, Thailand, Indonesia, Australia, Brazil, Argentina and Saudi Arabia, South Africa, UAE

Key companies profiled

Sinopec Shanghai Petrochemical Company Limited; Dow; Indorama Ventures Public Company Limited; BASF SE; Shell plc; INEOS, India Glycols Limited; LyondellBasell Industries Holdings B.V.; NIPPON SHOKUBAI CO., LTD.; Reliance Industries Ltd.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Ethylene Oxide Market Report Segmentation

This report forecasts revenue growth on a global, regional and country level and analyzes the latest trends in each sub-segment from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the global ethylene oxide market on the basis of product, application, and region:

-

End-Use Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Agriculture

-

Food & Beverages

-

Personal Care

-

Pharmaceuticals

-

Textile

-

Others

-

-

Application Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

Ethylene Glycol

-

Ethanolamine

-

Ethoxylates

-

Glycol Ethers

-

Others

-

-

Regional Outlook (Volume in Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

France

-

U.K.

-

Spain

-

Italy

-

Russia

-

-

Asia Pacific

-

China

-

Japan

-

India

-

South Korea

-

Thailand

-

Indonesia

-

Australia

-

-

Latin America

-

Brazil

-

Argentina

-

-

Middle East & Africa

-

South Africa

-

Saudi Arabia

-

UAE

-

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.