- Home

- »

- Plastics, Polymers & Resins

- »

-

Europe Acrylic Sheet Market Size And Share, Report, 2030GVR Report cover

![Europe Acrylic Sheet Market Size, Share & Trends Report]()

Europe Acrylic Sheet Market Size, Share & Trends Analysis Report By Technology (Cell Cast, Extruded), By Application (Architecture & Construction, Furniture & Design), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-1-68038-472-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Europe Acrylic Sheet Market Size & Trends

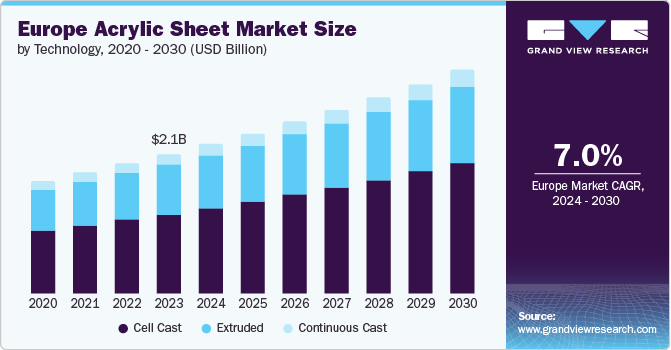

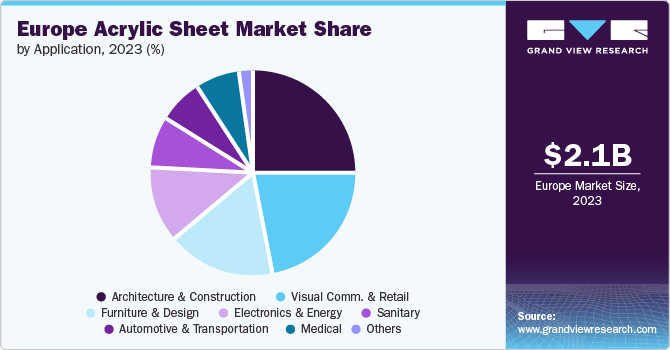

The Europe acrylic sheet market size was valued at USD 2.07 billion in 2023 and is projected to grow at a CAGR of 7.0% from 2024 to 2030. Increasing penetration of the product in applications such as signage and sanitary ware is expected to have significant impacts on the market growth. The superior properties of acrylic sheets, mainly as a replacement for glass panels, renders the product very useful for several functions in the architecture & construction industry. Furthermore, increasing demand for infrastructure development as well as residential construction in the region is expected to propel growth over the forecast period.

The growing adoption of acrylic sheets in furniture and interior design, including modular kitchen panels, wardrobes, TV panels, and room dividers, in both residential and commercial buildings, is driving the market growth. The acrylic sheets market is witnessing robust growth due to the shift towards sustainable practices and eco-friendly materials. Acrylic sheets are favored over conventional materials such as glass and metal as they offer various environmental benefits such as reducing carbon footprint, energy consumption and waste reduction. Moreover, acrylic sheets are long lasting, durable and can be recycled. Furthermore, the rising innovation and adoption of breakthrough technology in acrylic sheet, improving product quality and offer effective performance is likely to drive the growth.

The key raw materials applied in the manufacturing of acrylic plastics include the derivatives of acrylic acid, such as methacrylic acid and polyacrylic acid. The European industry is characterized by the presence of large and medium-sized raw materials suppliers offering a vast range of specialty chemicals for the manufacture of acrylic plastics. The region has been witnessing an increasing use of noise barrier and vibration control materials in cars and an increase in automobile production. This trend is expected to benefit the overall industry growth over the coming years. Furthermore, replacement of glass with acrylic sheets in furniture, designing, POS & retail, and medical applications is expected to drive product demand.

Product Insights

The extruded segment dominated the market and accounted for a share of 57.0% in 2023. The extruded products offer better thickness tolerances as opposed to cast sheets. In addition, on account of the large volume and continuous production process, the extrusion process is a cost-efficient option over other processes. The low costs and simple technology & equipment requirements, along with higher production capacities, are expected to result in the highest growth of the extrusion segment, over the forecast period.

Cell cast is anticipated to witness a rapid CAGR during the forecast period. The cell cast process is one of the widely used methods to manufacture acrylic sheets. Cast products offer high heat & impact resistance, optical clarity, and a higher strength-to-weight ratio. Cast sheets are easily thermoformed and machined with lesser risks of cracking and shrinking during the process for several applications.

Application Insights

The architecture and construction segment dominated the market in 2023. Acrylic sheets are gaining popularity in the construction industry owing to their remarkable versatility, aesthetics, and performance attributes. Serving as a transparent, lightweight, and UV-resistant material, acrylic sheets find extensive usage in architectural projects, including windows, skylights, and façade cladding. They effectively enhance natural light infiltration and offer superior weather resistance, making them a preferred choice for such applications.

The furniture and design segment is anticipated to witness the fastest CAGR during the forecast period, owing to rapid urbanization. Acrylic sheets are available in a variety of colors and offer versatile design options. They are favored by architects seeking to integrate creativity into buildings, furniture, and design items due to their high optical clarity and scratch resistance, ideal for upscale furniture and design elements. Additionally, ongoing technological advancements such as LED lighting and holographic image projection continue to enhance acrylic sheet capabilities.

Regional Insights

The Europe acrylic sheet market witnessed a robust growth in 2023 owing to rising demand from construction and architectural sector. The region is known for its unique and creative infrastructural designs which drive the demand for acrylic sheets as these sheets are valued for their lightweight, superior light remittance and provides appealing aesthetics.

Germany Acrylic Sheet Market Trends

The Germany acrylic sheet market dominated the Europe region and accounted for a revenue share of 29.5% in 2023. The growth can be attributed to the increasing automotive sector and construction industries. The demand for lightweight, durable and visually appealing materials in these industries drives the demand. For instance, around 2.8 million units of cars were sold in Germany in 2023, year on year increase of 7.1%.

Spain Acrylic Sheet Market Trends

Spain is anticipated to witness the fastest CAGR during the forecast period owing to the comparatively high growth rates associated with the application industries in the country. The growth of the construction industry in the country, on account of the increasing number of hotel construction projects, is expected to drive demand.

Key Europe Acrylic Sheet Company Insights

Some of the key companies in the Europe acrylic sheet market include, Evonik Industries AG, 3A Composites GmbH, Perspex International Ltd., Schweiter Technologies AG,

-

3A Composites manufactures & markets aluminum composite materials, paper and foamboards, plastic sheets and core materials based on PET foam and balsa wood.

Key Europe Acrylic Sheet Companies:

- Altuglas International

- Evonik Industries AG

- Mitsubishi Chemical Corporation

- 3A Composites GmbH

- Lucite International

- Schweiter Technologies AG

- Madreperla S.p.A.

- PyraSied Xtreme Acrylic

- Perspex International Ltd.

- Aristech Surfaces LLC (Trinseo)

Recent Developments

-

In November 2023, Röhm and SABIC’s Functional Forms Division for polycarbonate (PC) film and sheet products are expected to merge and form POLYVANTIS. It was expected to be launched in the 2nd quarter of 2024. Customers are expected to obtain superior quality products including PLEXIGLAS/ACRYLITE/LEXAN sheets and films. POLYVANTIS would combine technological expertise and innovative strength of both the business units to offer holistic solutions to the customers worldwide.

-

In April 2023, Plaskolite, a major manufacturer of thermoplastics, announced an agreement to acquire Trinseo’s production facility based in Matamoros, Mexico. The facility is dedicated mainly on the production of cell cast acrylic sheet which is used in a variety of applications such as construction, sanitary products, signage and others. The favorable location of the facility would enable Plaskolite to serve North American market and offer full variety of acrylic sheet technologies - continuous cast, cell cast and extruded.

-

In July 2021, Trinseo made a significant announcement about its plan to acquire Aristech Surfaces LLC as a strategic move towards becoming a provider of sustainable solutions and specialty materials. Aristech Surfaces LLC is a prominent North American company known for manufacturing and supplying polymethyl methacrylates (PMMA) solid surface and continuous cast sheets. Through the acquisition of Aristech, Trinseo's objective is to broaden its portfolio and provide a diverse range of PMMA technologies, thereby serving customers in rapidly growing markets.

Europe Acrylic Sheet Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.21 billion

Revenue forecast in 2030

USD 3.31 billion

Growth Rate

CAGR of 7.0% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, Volume in 000’ Sq Meters and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, country

Regional scope

Europe

Country scope

Germany, UK, France, Italy, Spain, Russia

Key companies profiled

Altuglas International; Evonik Industries AG; Mitsubishi Chemical Corporation; 3A Composites GmbH; Lucite International; Schweiter Technologies AG; Madreperla S.p.A.; PyraSied Xtreme Acrylic; Perspex International Ltd.; Trinseo.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Acrylic Sheet Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe acrylic sheet market report based on technology, application and country.

-

Technology Outlook (Revenue, USD Million, 2018 - 2030) (000’ Sq Meters)

-

Cell Cast

-

Extruded

-

Continuous Cast

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030) (000’ Sq Meters)

-

Architecture & Construction

-

Furniture & Design

-

Automotive & Transportation

-

Visual Comm. & Retail

-

Electronics & Energy

-

Medical

-

Sanitary

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030) (000’ Sq Meters)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Russia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."