- Home

- »

- Clinical Diagnostics

- »

-

Europe Bladder Cancer Diagnostics Market, Report, 2030GVR Report cover

![Europe Bladder Cancer Diagnostics Market Size, Share & Trends Report]()

Europe Bladder Cancer Diagnostics Market Size, Share & Trends Analysis Report By Technology (Cystoscopy, Ultrasound), By Cancer Type (Transitional Cell Bladder, Squamous Cell Bladder), By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-467-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

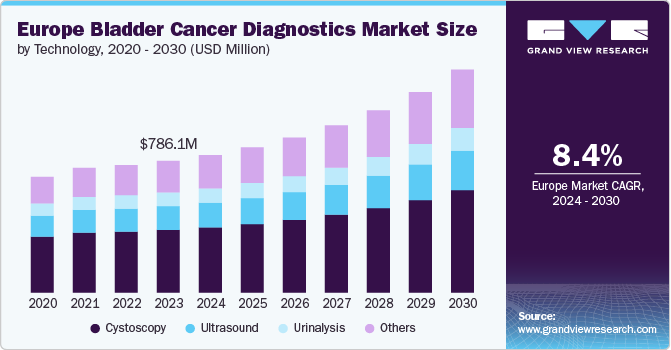

The Europe bladder cancer diagnostics market size was estimated at USD 786.10 million in 2023 and is expected to grow at a CAGR of 8.38% from 2024 to 2030. The market growth can be attributed to the ongoing advancements in noninvasive diagnostics and a shift toward a precision-based approach in Non-muscle Invasive Bladder Cancer (NMIBC), aided by the rising awareness of early Squamous Cell Bladder Cancer of bladder cancer.

Recent advancements in non-invasive diagnostics are transforming the bladder cancer market by addressing the challenges of frequent recurrences and the burdensome nature of traditional surveillance methods, such as cystoscopy and biopsies. Monitoring bladder cancer often involves long-term surveillance, making invasive procedures both financially and physically taxing for patients. This has led to a significant shift toward non-invasive urinary tests designed to detect bladder cancer earlier and reduce the necessity for repeated invasive interventions.

Urine cytology, the first noninvasive test introduced for bladder cancer, has been a mainstay in clinical management, particularly for identifying high-grade tumors and Carcinoma in situ (CIS). However, its sensitivity limits its effectiveness, especially in detecting low-grade lesions. This limitation has encouraged the development of various urinary biomarker tests that use protein Cystoscopy to improve detection rates. Although these newer tests offer greater sensitivity than cytology, they still struggle with specificity, particularly for low-grade bladder cancers.

Technological progress has introduced several promising innovations, including RNA sequencing, microfluidics, and the discovery of novel bladder cancer Cystoscopy such as mRNAs, DNA methylation patterns, and exosomes. These advancements can enhance detection and monitoring capabilities, integrating them into clinical practice. Such integration could reduce reliance on cystoscopy, alleviating patients' financial and physical burdens.

The clinical potential of urinary Cystoscopy is significant. They offer a less invasive and more cost-effective alternative to cystoscopy. Research indicates that urinary Cystoscopy could prevent 500 to 740 cystoscopies per 1,000 patients, although some recurrences might be missed. As the incidence of bladder cancer increases and technological improvements continue, urinary Cystoscopy is expected to become increasingly important in bladder cancer diagnostics, enhancing patient outcomes and improving healthcare efficiency.

The shift toward precision medicine in NMIBC is gaining momentum, supported by advancements in Urinalysis and the introduction of targeted therapies. Precision diagnostics aim to improve treatment outcomes while reducing off-target effects by identifying patients more likely to benefit from specific therapies. Notably, targeted drugs, such as erdafitinib and pembrolizumab, have already been approved for NMIBC. AI-based diagnostic tools are being explored in uro-oncology, including for bladder and prostate cancers.

AI and machine learning hold significant potential in revolutionizing NMIBC management by enhancing image analysis, identifying high-risk patients, and improving clinical decision-making. Furthermore, AI-supported software can enhance surgical procedures by integrating imaging data (e.g., from blue light cystoscopy) with patient medical history and pathology grading to predict outcomes better and tailor treatment plans.

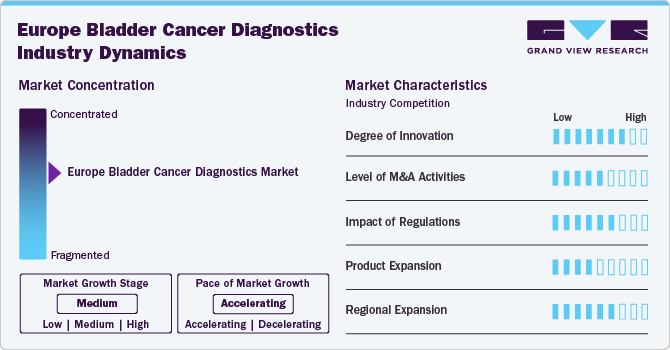

Market Concentration & Characteristics

The market is characterized by a high degree of innovation. The introduction of non-invasive diagnostic tools, such as Bladder EpiCheck, marks a pivotal shift in the bladder cancer diagnostics landscape. Bladder EpiCheck, a urine biomarker test, holds the potential to detect high-grade disease early and reduce the need for frequent cystoscopies. This shift could not only decrease the burden on healthcare systems by reducing the frequency of invasive procedures but also enhance patient outcomes by ensuring timely intervention for those who stand to benefit most.

The market is characterized by the leading players with moderate levels of technology launches and merger and acquisition (M&A) activity. In September 2024, Menarini Diagnostics and Nucleix have entered a long-term exclusive distribution agreement for the Bladder EpiCheck test in Europe. This non-invasive, CE-marked test is designed to detect both primary and recurrent bladder cancer, as well as upper tract urinary cancer.

The regulatory landscape significantly influences the European bladder cancer diagnostics market. Compliance with stringent EU regulations, such as the In Vitro Diagnostic Regulation (IVDR), impacts product development timelines, market entry, and approval processes. These regulations ensure high standards for diagnostic accuracy and patient safety but may increase costs for manufacturers. Adapting to evolving regulatory requirements is crucial for companies looking to maintain competitiveness and innovation in bladder cancer diagnostics across Europe.

In the European bladder cancer diagnostics market, non-invasive tests are emerging as potential substitutes for traditional cystoscopies. Technologies such as urine-based Cystoscopy, like Bladder EpiCheck, offer a less invasive, more patient-friendly alternative for monitoring and detecting high-grade bladder cancer. These non-invasive options can reduce the frequency of painful cystoscopies, lower healthcare costs, and improve patient compliance, presenting a shift in diagnostic strategies while maintaining accuracy and early detection standards.

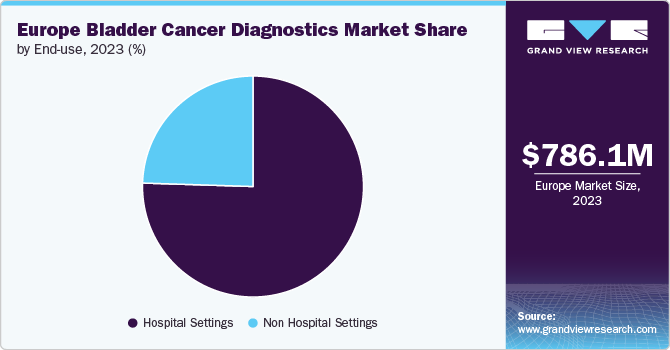

The region is primarily focused on expanding businesses with Hospitals and specialized cancer treatment centers. Hospital Settings account for the largest share, driven by the need for advanced diagnostic equipment like cystoscopy tools and Blue Light Cystoscopy for accurate staging and recurrence monitoring. However, non-hospital settings such as diagnostic labs and outpatient centers are gaining traction with the increasing availability of non-invasive tests like Bladder EpiCheck, expanding accessibility and convenience for patients.

Technology Insights

Cystoscopy accounted for the largest revenue share of 47.54% in 2023. Cystoscopy is a key diagnostic technology that enables direct visualization of the bladder. Its integration with other diagnostic modalities enhances early detection and monitoring, contributing to market growth. The use of cystoscopy in the Europe bladder cancer diagnostics market is expected to continue increasing due to the rising incidence of bladder cancer and the importance of early detection and surveillance. Cystoscopy is included in the European Association of Urology (EAU) Clinical Guidelines as a key diagnostic tool for bladder cancer.

In addition, growing product approvals contribute to market expansion by offering a wide range of options and providing fast and accurate results. For instance, in October 2023, Ambu announced the European CE mark for its new Ambu aScope 5 Cysto HD cystoscope, paired with the Ambu aView 2 Advance full-HD endoscopy system. This advanced, single-use cystoscope features high-resolution imaging and complements Ambu's existing aScope 4 Cysto. The new HD cystoscope is designed for procedures requiring superior imaging, while the aScope 4 Cysto continues to serve standard cystoscopy needs.

The other segment is anticipated to witness the fastest CAGR of 9.73% during the forecast period. The segment includes MRI, CT scans, AI-based diagnostics, and emerging technologies and is witnessing significant growth & innovation. This segment is significant, as it enhances the diagnostic capabilities for bladder cancer, contributing to improved patient outcomes. MRI and CT scans are pivotal in imaging diagnostics, providing detailed anatomical images that help in staging bladder cancer and assessing treatment response. These Ultrasound are increasingly being integrated with AI-based diagnostics, which leverage machine learning algorithms to analyze imaging data more efficiently and accurately. The trend toward AI integration is driven by the need for faster Squamous Cell Bladder Cancer and personalized treatment plans, as AI can assist radiologists in identifying malignancies that the human eye may miss.

Cancer Type Insights

The transitional cell bladder segment dominated the market and accounted for the largest share of 87.39% in 2023. Transitional Cell Bladder Cancer (TCBC) holds a significant market share in the European bladder cancer diagnostics market, as it represents over 90% of bladder cancer cases in the region. Its predominance drives the need for advanced diagnostic methods to improve early detection and treatment outcomes. The market's growth reflects a focus on comprehensive diagnostic approaches, including cystoscopy, molecular testing, and imaging, essential for accurate detection & staging of TCBC. The emphasis on these methods is crucial for addressing the high incidence rates and optimizing patient management strategies in Europe. According to Cancer Research UK, about 90% of bladder cancers are urothelial cancers in the UK, also known as transitional cell cancers. The combination of cystoscopy, urine cytology, urinalysis, imaging tests, and biopsy provides a comprehensive approach to diagnosing transitional cell bladder cancer. Each method contributes to accurate detection and staging, which are crucial for determining the appropriate treatment strategy.

The squamous cell carcinoma (SCC) segment is anticipated to grow at a faster pace. Advances in molecular biology offer the potential for early detection through Cystoscopy like Psoriasin and Galectin 3. For endemic areas, addressing schistosomiasis through anti-bilharzia therapies has significantly reduced SCC incidence. Regular surveillance and timely intervention are crucial for improving outcomes and managing this aggressive cancer. Advances in prevention and early detection, such as annual Otherss and molecular Cystoscopy, boost the bladder cancer Squamous Cell Bladder Cancer market. Technologies for chronic infection monitoring and innovative diagnostics enhance early identification of SCC, driving demand and market growth.

End-use Insights

The hospital settings segment dominated the market with the largest share of 75.51% in 2023. Hospital settings play a pivotal role in the Squamous Cell Bladder Cancer and management of bladder cancer, offering distinct advantages over nonhospital settings such as clinics. They are equipped with advanced diagnostic tools such as cystoscopy, urine lab tests, and imaging technologies, which are essential for accurate Squamous Cell Bladder Cancer & effective treatment. The prevalence of bladder cancer in Europe has led to an increased demand for these sophisticated diagnostic tests in Hospital Settings. Improved Ultrasound and the development of more sensitive diagnostic tests enable earlier detection and better monitoring of the disease.

A significant factor contributing to the increasing demand for bladder cancer diagnostics in Hospital Settings is the low awareness of the disease among Europeans. In September 2022, a European Association of Urology (EAU) survey revealed that 60% of adults are unaware of bladder cancer's seriousness and many do not recognize key symptoms, such as changes in urine color. This lack of awareness highlights the need for increased public education and early detection efforts, potentially driving more individuals to seek diagnostic services. As awareness campaigns succeed in educating the public, Hospital Settings are likely to experience a surge in diagnostic procedures, further expanding the market for bladder cancer diagnostics.

The non-hospital settings segment is also anticipated to grow at a faster pace. Non-hospital settings such as specialty clinics, ambulatory surgical centers, and cancer treatment centers are increasingly important. These facilities provide specialized services outside traditional hospital environments, using advanced diagnostic technologies such as ultrasound and urine cytology for early detection & ongoing monitoring of bladder cancer. This shift reflects a trend toward patient-centric care, focusing on less invasive procedures and cost-effective solutions.

Country Insights

Germany Bladder Cancer Diagnostics Market Trends

Germany bladder cancer diagnostics market dominated the regional industry and accounted for an 18.94% share in 2023. Bladder cancer is a significant health concern in Germany, with notable statistics reflecting its impact. According to the World Cancer Research Fund International, Germany reported 29,035 cases of bladder cancer in 2022. This figure highlights the prevalence of the disease within the country, indicating a substantial number of individuals affected by this condition. In addition, the mortality rate is significant, with 9,180 deaths attributed to bladder cancer. This statistic highlights the severity of the disease and the challenges faced in managing & treating it effectively. The gap between incidence and mortality rates can provide insights into the effectiveness of current treatment options, early detection methods, and overall healthcare strategies related to bladder cancer. To overcome the burden of this disease in the country, several initiatives by key players and government initiatives are underway, indicating that the market is projected to grow significantly.

UK Bladder Cancer Diagnostics Market Trends

In the UK, bladder cancer Squamous Cell Bladder Cancer is advancing with significant developments and investments. The introduction test, such as EarlyTect BCD, is improving diagnostic accuracy and reducing reliance on invasive procedures. The market is driven by new noninvasive tests like the UroAmp, and the BOXIT trial highlights the economic burden of bladder cancer, highlighting the demand for better diagnostic solutions.

France Bladder Cancer Diagnostics Market Trends

In 2022, bladder cancer emerged as the fifth most common cancer in France (metropolitan), with around 19,733 new cases reported. This accounted for 4.1% of all new cancer diagnoses. Despite being less prevalent than cancers such as breast, prostate, colorectum, & lung, bladder cancer remains a significant health concern due to its high incidence rate compared to other cancers like thyroid and testis.

Spain Bladder Cancer Diagnostics Market Trends

In Spain, REDCAN forecasts around 18,247 new cases of urinary bladder cancer for 2024. To address this growing burden, various market players are advancing technologies focused on early detection. The bladder cancer diagnostic market in Spain is highly competitive, featuring major companies such as Cepheid among others. Significant innovations include Cepheid's noninvasive Xpert Bladder Cancer Detection test, as well as traditional diagnostic methods like cystoscopy and imaging. The market is shifting toward early detection and precision medicine, emphasizing the use of advanced Cystoscopy and artificial intelligence.

Denmark Bladder Cancer Diagnostics Market Trends

The bladder cancer diagnostic market in Denmark features competition between traditional and innovative players. New urine biomarker tests are gaining traction for reducing cystoscopy needs, while regulatory and healthcare factors influence market dynamics.

In 2022, bladder cancer was diagnosed in a total of 2,501 individuals, representing 5.1% of all new cancer cases. The incidence was notably higher in males, with 1,835 cases (7.1% of all male cancer cases) compared to 666 cases in females (2.9% of all female cancer cases). The disease resulted in 531 deaths, accounting for 3.1% of all cancer deaths, with 404 deaths in males and 127 in females. The 5-year prevalence of bladder cancer was 8,819 cases, with 7,145 among males and 1,674 among females, highlighting the significant burden of the disease and its impact on both genders.

Key Europe Bladder Cancer Diagnostics Company Insights

Some of the key players operating in the market include Abbott; Nucleix, Danaher Corporation; Pacific Edge; Polymedco, LLC.; KARL STORZ; AroCell (IDL Biotech); Micromedic Technologies; Sysmex Corporation.; and Vesica Health. The market is highly competitive, with a large number of manufacturers accounting for a majority of the share. New source developments, mergers and acquisitions, and collaborations are some of the major strategies adopted by these players to counter the stiff competition.

Key Europe Bladder Cancer Diagnostics Companies:

- Abbott

- Nucleix

- Danaher Corporation

- Pacific Edge

- Polymedco, LLC.

- KARL STORZ

- AroCell (IDL Biotech)

- Micromedic Technologies

- Sysmex Corporation.

- Vesica Health

Recent Developments

-

In November 2023, Nucleix announced that it would receive national reimbursement approval from The Dutch Healthcare Authority (NZA) in the Netherlands, effective January 1, 2024, for its CE-marked Bladder EpiCheck test. This test is used for detecting primary or recurrent bladder cancer and UTUC. The NZA's decision underscores the commitment to advancing innovation for this underserved cancer in the Netherlands. Nucleix continues to work towards achieving national reimbursement in other European countries.

-

In September 2022, the latest KARL STORZ Blue Light Cystoscopy system was prominently showcased at the E-Masterclass in Urology. This advanced system enhanced the detection and management of bladder cancer by utilizing innovative imaging technology to improve tumor visualization and treatment outcomes.

Europe Bladder Cancer Diagnostics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 820.94 million

Revenue forecast in 2030

USD 1.33 billion

Growth rate

CAGR of 8.38% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, cancer type, end-use, region

Regional scope

Europe

Country scope

U.K.; Germany; France; Italy; Spain; Sweden; Denmark; Norway; Poland; Finland; Estonia; Latvia; Lithuania; Portugal; The Netherlands

Key companies profiled

Abbott; Nucleix, Danaher Corporation; Pacific Edge; Polymedco, LLC.; KARL STORZ; AroCell (IDL Biotech); Micromedic Technologies; Sysmex Corporation.; Vesica Health

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Bladder Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at regional level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe bladder cancer diagnostics market report on the basis of technology, cancer type, end-use, and region:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Cystoscopy

-

Ultrasound

-

Urinalysis

-

Others

-

-

Cancer Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Transitional Cell Bladder Cancer

-

Squamous Cell Bladder Cancer

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Settings

-

Non Hospital Settings

-

-

Regional Outlook (Revenue in USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Poland

-

Finland

-

Estonia

-

Latvia

-

Lithuania

-

Portugal

-

The Netherlands

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The Europe bladder cancer diagnostics market size was estimated at USD 786.10 million in 2023 and is expected to reach USD 820.94 million in 2024.

b. The Europe bladder cancer diagnostics market is expected to grow at a compound annual growth rate of 8.38% from 2024 to 2030 to reach USD 1.33 billion by 2030.

b. Germany dominated the Europe bladder cancer diagnostics market with a share of 18.94% in 2023. This is attributable to the large number of active cancer cases and high awareness of early diagnosis within the country

b. Some key players operating in the Europe bladder cancer diagnostics market include Abbott; Nucleix; Danaher Corporation; Pacific Edge; KARL STORZ; Polymedco, LLC.; AroCell; Micromedic Technologies; Sysmex Corporation; Vesica Health

b. Key factors that are driving the market growth include advancements in non-invasive diagnostics and shift to a precision-based approach in NMIBC

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."