- Home

- »

- Pharmaceuticals

- »

-

Europe Branded Generics Market Size & Share Report, 2030GVR Report cover

![Europe Branded Generics Market Size, Share & Trends Report]()

Europe Branded Generics Market (2023 - 2030) Size, Share & Trends Analysis Report By Drug Class (Alkylating Agents, Antimetabolites), By Application, By Route Of Administration, By Distribution Channel, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-014-9

- Number of Report Pages: 105

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Report Overview

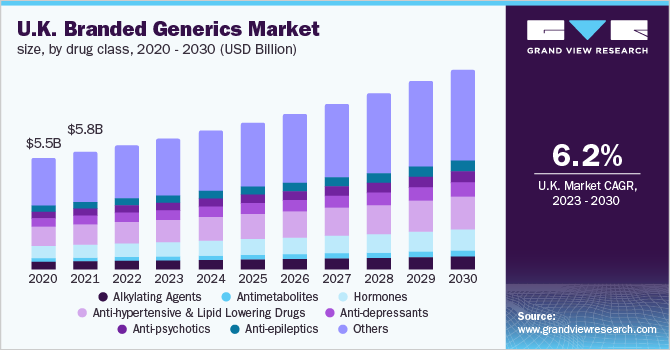

The Europe branded generics market size was valued at USD 38.96 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.9% from 2023 to 2030. The rising prevalence of chronic diseases across the region is expected to contribute to market growth. The increasing burden of infectious & noninfectious diseases coupled with the growing geriatric population, which is more susceptible to chronic diseases, such as diabetes, hypertension, and obesity, is expected to positively impact market growth. In 2021, there were around 2.2 million people affected with HIV in WHO Europe Region, and around 57.0% of the newly diagnosed patients were from the Russian Federation. Competitive rivalry in the Europe branded generics market is likely to be high due to the various strategies adopted by the key players such as merger & acquisition and expansion of the business to strengthen their position in the market. Many established companies are engaged in the development of a generic version of branded drugs.

In October 2022, Aspire Pharma, a portfolio company of H.I.G. Capital, LLC acquired Morningside Pharmaceuticals and Morningside Healthcare, a leading provider of branded and generic specialty pharmaceuticals. Morningside has more than 80 product families of multiple therapeutic areas such as central nervous system (CNS), gastrointestinal diseases (GID), psychiatry, infectious, and endocrine. This acquisition is expected to drive Europe branded generics market.

Furthermore, in 2020, the EU strategically took steps to increase access to biosimilars and generic medicines. This included initiatives such as removing barriers that delay market entry of generics, increasing access to health systems, and digitalization of medicine regulatory systems to expedite processes ensuring ease of market entry. This initiative also boosted the production of branded generics by encouraging pharmaceutical companies to develop and manufacture these medicines and support the growth of Europe branded generics market.

The generic drug manufacturers have warned they may halt production of making low priced generic drugs due to surging electricity costs and the raising prices of drugs. For instance, in September 2022, Medicines for Europe sent an open letter to the Europe Union member states energy and health ministers regarding tackling Europe’s energy crisis, with a gas price cap on the table and a tax on profits of fossil fuel companies. This factor restrains the growth of the Europe branded generics market

According to NHS generic prescribing guidelines, the prescribing of generic drugs with an international proprietary name (INN) is mostly recommended, except in cases where a change to a different manufacturer’s product may have issues with safety and efficacy. The reimbursement price for similar ingredients containing generics is used as a criterion for setting the list prices for some branded generics. Currently, a pharmacist is forced to supply this drug, even if the same generic is available, if a specific brand name medicine is prescribed by the primary care physicians to the patients.

Drug Class Insights

Other drug class segment dominated Europe branded generics market with a revenue share of 42.57% in2022. The other segment includes infectious diseases such as HIV, malaria, hepatitis, influenza, Human Papillomavirus (HPV), tuberculosis, and respiratory diseases such as COPD, asthma, and pulmonary fibrosis among others. According to WHO Europe Surveillance Report 2021, around 260,000 new cases of tuberculosis reported across Europe. Thus, rising disease burden and increasing demand of the disease population may propel the market growth during the forecast period.

Hormone segment is also expected to witness lucrative growth throughout the forecast period. According to a report published in the NCBI, disease and disability observed among older women are closely related to loss of female sex hormones post menopause. According to the UK Parliament, approximately 51% of the population suffers from menopause, which accounts to 35.73 million as of November 2022. Growth in the geriatric population, along with increasing awareness for hormonal therapy is anticipated to further drive the market.

Application Segment Insights

The others segment dominated Europe branded generics market with a revenue share of 26.02% in 2022. This segment includes eye-related diseases, such as glaucoma & cataract, macular degeneration, diabetic eye problems, respiratory diseases such as COPD, asthma, & pulmonary fibrosis, and metabolic diseases such as diabetes. According to WHO, around 950,000 people were affected by diabetic retinopathy in Europe as of April 2022. Rimexolone, loteprednol etabonate, and ketorolac are a few of the generic products used for eye surgeries. Thus, growing prevalence of other diseases, such as diabetic retinopathy and macular degeneration are impelling the demand for highly efficient & cost-effective medications.

The oncology segment is expected to grow at a high growth rate during the forecast period due to the launch of new branded generics and biosimilars. The Europe Medicines Agency (EMA), in August 2022, granted marketing authorization to Vegzelma developed by Celltrion Healthcare’s for the treatment of various cancers. Thus, an increasing number of cancer cases are anticipated to drive the demand for cheap medicines, thereby, driving Europe branded generics market.

Route Of Administration Segment Insights

The oral segment dominated the Europe branded generics market with a revenue share of 59.48% in 2022. This can be attributed to the entry of oral generic products into the market with substantially less prices and continued savings in subsequent years. Thus, price reductions in oral branded generic medicines compared to injectable often attract generic manufacturers, thereby driving growth of the market.

The parenteral segment is expected to expand at a high growth rate during the forecast period due to the high availability of injectable generic formulations and the immediate onset of action. Furthermore, injectable are highly preferred if the existing medicines are poorly absorbed and in case of medical emergencies. In April 2021, the EMA recommended approval for two generic drugs, Thiotepa Riemser (thiotepa) and Abiraterone Accord (abiraterone). These are chemotherapy treatment agents available in powder form to concentrate the solution, used for infusion.

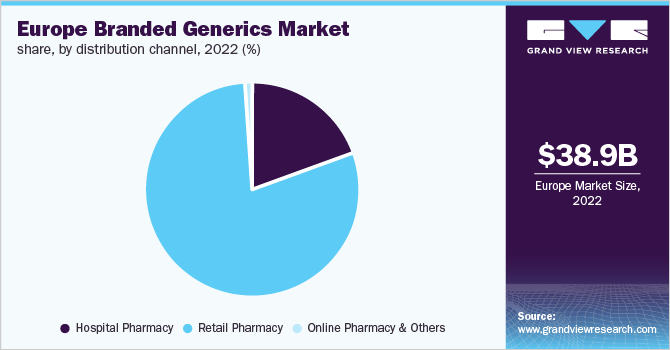

Distribution Channel Segment Insights

The retail pharmacy segment dominated Europe branded generics market with a revenue share of 79.50% in 2022.According to German Pharmacies Statistics, in 2022, there are around 142,000 community pharmacies in Europe that cater to medical needs. The availability of branded generics in retail pharmacy chains, such as Walgreens and Wal-Mart Stores, Inc., supports market growth. In addition, tie-ups of hospitals with these chains further contribute to market growth.

Hospital pharmacy segment is expected to witness significant growth during the forecast period. In November 2022, a new revised RPS professional standard for hospital pharmacy services was launched by the Royal Pharmaceutical Society (RPS) during a conference. The new standards are relevant for the providers of pharmacy services meant for mental health, prison, acute, ambulance settings, and private. This initiative supports hospital pharmacists and organizations working across healthcare services.

Country Insights

Germany dominated the Europe branded generics market with a revenue share of 20.08% in 2022. The presence of key players, such as Novartis AG, Sanofi, Johnson & Johnson Services, Inc., and Viatris, is positively influencing the market growth. For instance, in June 2022, Novartis AG launched Dimethyl fumarate HEXAL for the treatment of patients with Relapsing-Remitting Multiple Sclerosis (RRMS) in Germany. This strategic launch was aimed at commercializing Hexal in Germany and generating revenue.

Italy is expected to witness a growth rate of 7.4% during the forecast period. The growth of the region is attributed to initiatives undertaken by the government to support the approval and reimbursement of the new drugs. For instance, in October2020, the Italian Medicines Agency (AIFA) published a new simplified reimbursement and pricing procedure for biosimilars and generics. As per the new procedure, the company must submit a dossier supporting the reimbursement application, price, and classification in accordance with the guidelines of the AIFA. This new procedure accelerates the process of reimbursement for drugs and the availability of generic drugs in market.

Key Companies & Market Share Insights

New product launches and mergers & acquisitions are some of the key strategies undertaken by the players to retain market share. In June 2020, Dr Reddy’s Laboratories completed the acquisition of selected divisions of Wockhardt branded generics business in India and a few other Asian territories. This is a step by Wockhardt to focus on the UK and EU business.Some of the prominent players in Europe branded generics market include

-

Teva Pharmaceutical Industries Ltd

-

Lupin

-

Sanofi

-

Sun Pharmaceutical Industries Ltd.

-

Dr. Reddy’s Laboratories Ltd

-

Endo International plc.

-

GlaxoSmithKline plc

-

Wockhardt

-

Viatris, Inc.

-

Apotex, Inc.

Europe Branded Generics Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 41.05 billion

Revenue forecast in 2030

USD 61.36 billion

Growth rate

CAGR of 5.9% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, trends

Segments covered

Drug class, application, route of administration, distribution channel, country

Country scope

U.K.; Germany; France; Spain; Italy; Russia; Denmark; Sweden; Norway; Rest of Europe

Key companies profiled

Teva Pharmaceutical Industries Ltd; Lupin; Sanofi; Sun Pharmaceutical Industries, Ltd.; Dr. Reddy’s Laboratories Ltd; Endo International plc.; GlaxoSmithKline plc.; Wockhardt; Viatris, Inc.; Apotex, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country& segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Branded Generics Market Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe branded generics market report based on the drug class, application, route of administration, distribution channel, and country:

-

Drug Class Outlook (Revenue, USD Million, 2018 - 2030)

-

Alkylating Agents

-

Antimetabolites

-

Hormones

-

Anti-hypertensive & Lipid lowering drugs

-

Anti-depressants

-

Anti-psychotics

-

Anti-epileptics

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Oncology

-

Cardiovascular Diseases

-

Neurological Diseases

-

Gastrointestinal Diseases

-

Dermatological diseases

-

Acute and Chronic Pain

-

Others

-

-

Route of Administration Outlook (Revenue, USD Million, 2018 - 2030)

-

Topical

-

Oral

-

Parenteral

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospital Pharmacy

-

Retail Pharmacy

-

Online Pharmacy & Others

-

-

Country Outlook (Revenue, USD Million; 2018 - 2030)

-

Germany

-

U.K.

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

Frequently Asked Questions About This Report

b. Europe branded generics market size was valued at USD 38.96 billion in 2022 and is anticipated to reach USD 41.05 billion in 2023.

b. Europe branded generics market is expected to witness a compound annual growth rate of 5.8% from 2023 to 2030 to reach USD 61.35 billion by 2030.

b. Based on drug class, the others segment accounted for a share of 42.57% in 2022 due to high prescription and usage rate of other types of medicines due to good efficacy and immediate result.

b. Some of the key players in the Europe branded generics market include Teva Pharmaceutical Industries Ltd; Lupin; Sanofi; Sun Pharmaceutical Industries Ltd.; Dr. Reddy’s Laboratories Ltd; Endo International plc.; GlaxoSmithKline plc; Wockhardt; and Viatris, Inc. amongst others.

b. The major factors driving the market growth are the patent expiry of branded products, increasing marketing approval, and the launch of branded generic products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.