- Home

- »

- Power Generation & Storage

- »

-

Europe Building-integrated Photovoltaics Market Size Report, 2027GVR Report cover

![Europe Building-integrated Photovoltaics Market Size, Share & Trends Report]()

Europe Building-integrated Photovoltaics Market Size, Share & Trends Analysis Report By Technology (Crystalline Silicon, Thin Film), By Application (Roof, Façade, Glass), By End-use (Residential, Commercial, Industrial), And Segment Forecasts, 2020 - 2027

- Report ID: GVR-4-68038-225-9

- Number of Report Pages: 95

- Format: PDF, Horizon Databook

- Historical Range: 2016 - 2018

- Forecast Period: 2020 - 2027

- Industry: Energy & Power

Report Overview

The Europe building-integrated photovoltaics market size was estimated to be valued at USD 3.1 billion in 2019 and is anticipated to grow at a compound annual growth rate (CAGR) of 27.2% from 2020 to 2027. The demand for crystalline silicon-based Building-integrated Photovoltaics (BIPV) generated the highest revenue share on account of the high strength of the product. In addition, the demand for the product is expected to be driven by the declining product costs on account of a reduction in the price for crystalline silicon wafers.

The demand for the product for C-Si based roofs and walls is expected to rise over the forecast period on account of ease of product integration. The market for crystalline silicon building-integrated photovoltaics is expected to grow over the forecast period owing to the rise in demand from residential and commercial sectors. Furthermore, the high demand on account of superior integration with the building envelope is expected to drive the market growth.

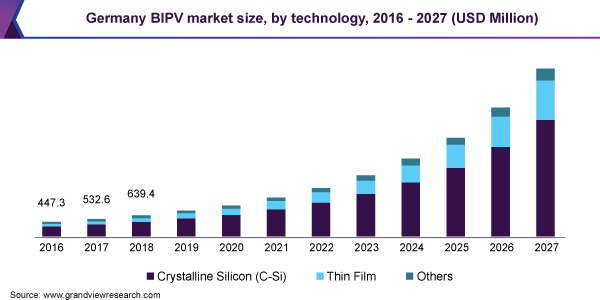

The market in Germany has emerged as one of the primary adopters of building-integrated photovoltaics on account of the positive government regulations such as the German Renewable Energy Sources Act which introduced feed-in tariffs scheme and encouraged the generation of electricity through solar.

The development of interlocking roof systems that use interlocked tiles, which provide a high conversion efficiency, coupled with a significant reduction in the weight of building integrated roofs is likely to drive the market during the forecast period.

The demand for building integrated glass and facade is likely to register a high growth rate over the next seven years owing to the superior integration of building walls with solar panels. Introduction of advanced low weight solar panels is expected to facilitate the demand for building integrated walls.

Favorable outlook towards renewable energy coupled with consumer awareness for renewable energy in European countries is likely to drive the market for BIPV during the forecast period. The governments of Germany and Italy exhibit an increased emphasis on the use of solar energy which is expected to translate into higher adoption of building-integrated photovoltaics, thus promoting industry growth over the forecast period.

Technology Insights

Based on technology, the Europe building-integrated photovoltaics market is segmented into crystalline silicon (C-Si), thin-film, and others. Crystalline silicon technology-dominated held the leading revenue share in 2019. High strength of crystalline silicon building-integrated photovoltaics coupled with superior resistance to adverse weather conditions were the major factors for this dominance. The market for crystalline silicon (C-Si) is expected to be driven primarily by the declining price of crystalline silicon cells, which is, in turn, expected to lower the installation cost in the coming years.

Thin-film BIPV expected to witness sustained growth over the forecast period due to rapid technological advancements leading to the introduction of advanced products. This technology is readily used in case of considerable weight constraints for the building. In such cases, the building envelope is unable to support the weight of crystalline silicon integration, leading to high demand for thin-film integrated installation.

Other technology segment includes advanced integrated photovoltaic manufacturing technologies such as dye sensitized (DSC) and organic photovoltaics (BIOPV). The demand is expected to be driven by the superior energy bandgap of organic photovoltaics. Rapid technological advancements have led to a significant increase in the efficiency of organic PVs, which is, in turn, anticipated to boost their demand over the next seven years

End-use Insights

Based on end use, the market is segmented into industrial, commercial, and residential. In 2019, the commercial was the largest end-use segment. Residential application is projected to register the fastest CAGR during the forecast period.

Presence of favorable regulations and measures adopted by the national agencies is anticipated to drive the demand for BIPV-integrated commercial establishments. Commercial establishments generate a high demand for integrated circuits on account of the increased awareness about the carbon footprint of buildings. The demand for the product in these establishments is estimated to be fueled by the use of high-efficiency photovoltaics.

The demand for residential BIPV is likely to stem from the favorable regulations passed by various authorities coupled with the high subsidies and other monetary benefits provided by the national governments. Increasing adoption of integrated solutions by residential areas in Germany and France is expected to drive the product demand over the forecast period.

The demand for building-integrated photovoltaics in industrial applications is expected to be fueled by their growing usage in a bid to reduce the reliance on non-renewable energy sources. The segment is anticipated to expand in the wake of commercial buildings in Europe. In addition, companies in developed economies in Europe exhibit an increased tendency toward the use of integrated photovoltaics in a bid to improve the aesthetic appeal of buildings.

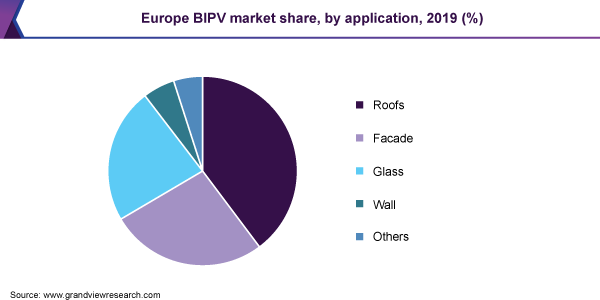

Application Insights

Based on the application, the market is segmented into roof, wall, glass, façade, and others. The roof was estimated as the largest segmental market with an estimated value of USD 1.2 billion in 2019 and is projected to reach more than USD 9 billion by 2027.

The segment accounted for the highest market share in 2019 owing to the higher strength of integrated roofs coupled with the improved aesthetic appeal of integrated roofs and skylights. The demand for building integrated roofs is expected to increase over the forecast period due to the development of superior products.

Rapid technological advancements are expected to result in the production of advanced products. Incorporation of dimming, lighting, and self-cleaning modes of operation coupled with the use of monolithic integrated circuit design is also expected to bolster the demand. The use of optics to improve the performance of BIPV glass is likely to boost product demand over the next seven years.

Others application segment includes shading and membranes. The demand for such products is high in residential installations due to the development of lightweight materials for use in uneven surfaces. The installations do not generally use crystalline silicon photovoltaic module, as the structure is incapable of supporting heavyweights. The demand for thin-film photovoltaic modules for such installations is likely to drive the market over the forecast period.

Country Insights

The market has witnessed increased product adoption in the recent past owing to the high aesthetic appeal of integrated photovoltaics. Increasing consumer awareness regarding the use of solar energy systems are expected to drive the demand for the BIPV facade during the forecast period.

The government of France offers the highest FiTs for electricity generated through photovoltaic components, which are essentially integrated into the buildings. Capacity generated by the photovoltaics integrated into building envelopes accounts for a substantial share of the overall accumulated, installed capacity generated by photovoltaics in the country.

Companies such as Onyx Solar in Italy have expanded their BIPV distribution using R2M solutions. This move is aimed at catering to the increasing product demand in the country. In addition, the high consumer affinity toward the adoption of BIPV facade solutions is likely to drive the market over the forecast period. The demand for the product in residential and commercial establishments is anticipated to register high growth owing to the increased affinity toward them coupled with their declining cost.

Key Companies & Share Insights

The market is highly fragmented with the presence of scarce multinational players. These factors make the industry highly competitive in nature, as it also requires high technology and R&D cost. The market witnesses the presence of many players involved in the production of advanced integrated products. Key players operate through patented products, which leads to notable product differentiation. Additionally, Tesla's entry into the market is expected to provide an impetus for the market growth through the introduction of advanced products coupled with a high affinity of the consumers towards the brand. Heliatek, Hanergy, Polysolar, Flisom are some of the companies that are focusing on thin-film solar technology.

Black colored solar panels have similar properties as of crystalline silicon solar cells. But, the most significant difference is that black silicon solar cells are further upgraded to have a dark black texture which tend to absorb more sunlight, ultimately leading to more energy efficiency for a solar cell. Due to these factors, the demand for black solar panels in Europe is increasing. The large-scale use of photovoltaics, especially in the built environment, increases the importance of the aesthetics of BIPV modules in Europe. In this regard, the BIPV product portfolio is diversified with products with different appearances and different functions. Examples of this are modules with colored cells, BIPV roof tiles and facade elements, which are to take over the functionality of conventional components in order to enable building-integrated PV. Completely black modules are currently widely used and are highly valued for both building-integrated and building-related applications in countries like France, Italy, and Germany. Some of the prominent players in the Europe BIPV market include:

-

AGC Inc.

-

Canadian Solar

-

Onyx Solar Group Inc.

-

ISSOL sa

-

Hanergy Mobile Energy Holding Group Limited.

Europe BIPV Market Report Scope

Report Attribute

Details

Market size value in 2020

USD 3.8 billion

Revenue forecast in 2027

USD 20.4 billion

Growth Rate

CAGR of 27.2% from 2020 to 2027

Base year for estimation

2019

Historical data

2016 - 2018

Forecast period

2020 - 2027

Quantitative units

Revenue in USD million/billion and CAGR from 2020 to 2027

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, end use, and region

Regional scope

Europe

Country scope

Germany; Italy; Spain; France; U.K.; Switzerland

Key companies profiled

Siemens AG; Mitsubishi Heavy Industries, Ltd.; General Electric; ABB; Boustead International Heaters; Forbes Marshall; Promec Engineering; Terrapin; Wood Plc (Amec Foster Wheeler); Climeon; Bosch Industriekessel GmbH; AURA GmbH & Co.; Exergy S.p.A.; IHI Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Segments Covered in the ReportThis report forecasts revenue growth at regional and country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2016 to 2027. For the purpose of this report, Grand View Research has segmented the Europe building-integrated photovoltaics market report on the basis technology, application, end use, and region:

-

Technology Outlook (Revenue, USD Million, 2016 - 2027)

-

Crystalline Silicon (C Si)

-

Thin Film

-

Others

-

-

Application Outlook (Revenue, USD Million, 2016 - 2027)

-

Roof

-

Façade

-

Wall

-

Glass

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2016 - 2027)

-

Commercial

-

Residential

-

Industrial

-

-

Country Outlook (Revenue, USD Million, 2016 - 2027)

-

Germany

-

Italy

-

Spain

-

France

-

The U.K.

-

Switzerland

-

Frequently Asked Questions About This Report

b. The europe building-integrated photovoltaics market size was estimated at USD 3,082.4 million in 2019 and is expected to reach USD 3,776.5 billion in 2020.

b. The europe building-integrated photovoltaics market is expected to witness a compound annual growth rate of 28.3% from 2020 to 2027 to reach USD 21,597.7 million by 2027.

b. Crystalline silicon (C-Si) captured a market share of nearly 68.11% in 2019 due to its high conversion efficiency on commercial scale.

b. Some key players operating in the europe building-integrated photovoltaics market AGC Inc., Heliatek GmbH, ISSOL SA, Tesla, Canadian Solar.

b. Key factors that are driving the market growth include favorable regulations and reduction in renewable power generation costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."