- Home

- »

- Smart Textiles

- »

-

Europe Contract Textiles Market Size & Share Report, 2030GVR Report cover

![Europe Contract Textiles Market Size, Share & Trends Report]()

Europe Contract Textiles Market (2023 - 2030) Size, Share & Trends Analysis Report By End-Use (Office Spaces, Public Buildings, Healthcare, Hotels, Restaurants, And Cafes (HORECA)), By Application, By Region, And Segment Forecasts

- Report ID: GVR-3-68038-609-7

- Number of Report Pages: 75

- Format: PDF

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Contract Textiles Market Trends

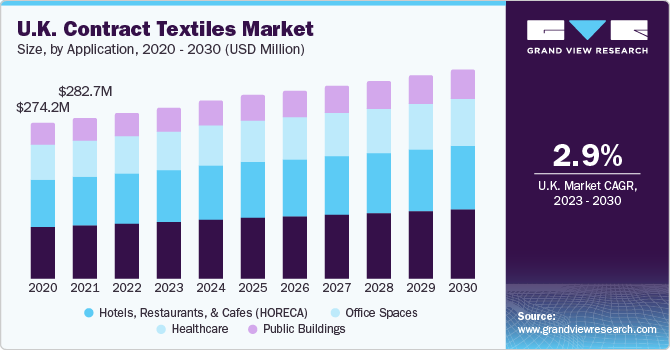

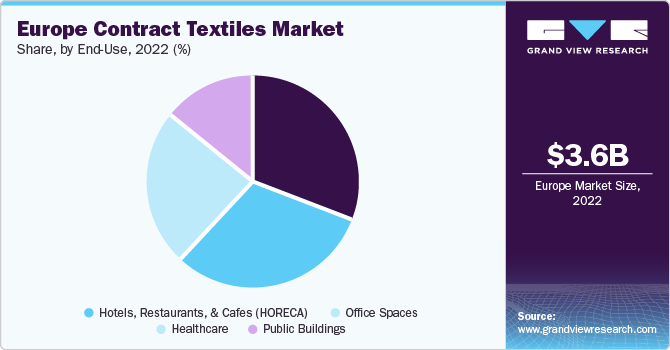

The Europe contract textiles market size was valued at USD 3.62 billion in 2022 and is anticipated to grow at a CAGR of 3.1% from 2023 to 2030. Rising demand for textile contracting to cater to specific requirements given by end-users from hospitals, offices, public buildings, and hotels is likely to drive industry growth over the forecast period.

Contract textile is a B2B business, wherein textile manufacturers have established a contract with players involved in the manufacturing of final products for commercial end-users. An increase in the number of commercial buildings in Europe, which demand various fabric products such as curtains, wallcovering, and upholstered furniture, is expected to drive the contract textile market in Europe.

Germany emerged as the key market in 2022 owing to well-established end-use application industries in the region. Growing demand for upholstery furniture in hospitals, nursing homes, hotels, cafes, and restaurants is likely to have a positive impact on the Europe contract textile market growth over the projected period. Major textile manufacturers in the region are focusing on geographical expansion, production of innovative designs, and technological advancements.

Increasing efforts by the European government to reduce textile imports are likely to support the growth of contract textiles market over the projected period. Market players are focusing on the labeling of fabric products during industrial processing and commercial distribution. The European Commission Regulation 1007/2011 has laid down strict laws for labeling contract textile products at every stage in their lifecycle.

High consumer disposable income and the demand for decorative, antique, and classic interior textile materials are likely to have a positive impact on market growth. Western Europe is likely to account for a higher market share owing to well-established healthcare and hospitality sector in the region.

End-Use Insights

The hotels, restaurants and cafes (HORECA) segment accounted for the largest revenue share of 32.4% in 2022. Increasing demand for high-quality textile curtains and window coverings in European hotels, restaurants, and cafes is likely to propel the industry growth over the projected period.

The office spaces segment is expected to register a CAGR of 3.0% over the forecast period. The increasing trend of improvements in building aesthetics and construction of new office spaces backed with the penetration of multinational companies in the region are likely to favor the contract textile industry.

Application Insights

The seating segment held the largest revenue share of 31.7% in 2022. High-quality contract seating textiles find application across a diverse range of furniture, such as chairs, sofas, and benches. They are highly sought after due to their exceptional durability, resistance to stains, and superior comfort, making them particularly well-suited for areas with high levels of foot traffic.

The wallcovering segment is expected to grow at the fastest CAGR of 3.6% over the forecast period. Contract wall covering entails utilizing fabrics, vinyl, or alternative materials to envelop interior walls, serving a dual purpose of enhancing aesthetics and functionality within spaces. This application segment not only elevates the ambiance of the surroundings but also offers acoustic advantages and safeguards the underlying wall surfaces.

Regional Insights

Germany dominated the Europe contract textiles market and accounted for a revenue share of 18.5% in 2022 on account of well-established fabric and furniture manufacturing sectors in the country. Furthermore, growing projects for offices and hospitality constructions in Germany are expected to augment the industry growth over the forecast period.

Textile manufacturers in the region are likely to shift their focus to smaller economies owing to the presence of low labor cost and raw material availability. Bulgaria, Moldova, Hungary, Romania, and Lithuania are likely to be targeted by these players over the projected period.

Norway is expected to grow at the fastest CAGR of 5.7% during the forecast period. The country's growing interest in eco-friendly and high-quality materials makes it a prime target for sustainable textile solutions. Moreover, Norway's thriving hospitality, healthcare, and commercial sectors fuel the demand for durable and aesthetically pleasing contract textiles, ranging from upholstery fabrics to curtains and beyond.

Key Companies & Market Share Insights

The manufacturers in the industry offer services such as designing, cutting, sewing, assembly, printing, packaging, warehousing, and shipping. The companies interact with interior decoration and design companies to understand customer requirements along with the needed product standards. Most of the players offer application-specific fabrics in their portfolio including antimicrobial, stain-resistant, waterproof, fire-resistant, and highly durable fabrics.

The region has a well-developed textile market and is marked by the presence of a large number of contract manufacturers leading to extensive competition. Innovation in materials and design and continuous efforts to offer quality products to meet consumer needs are the key factors for the industry players to sustain the competition.

Key Europe Contract Textiles Companies:

- Camira

- Panaz

- Sunbury Design

- Agua Fabrics

- Gabriel A/S

- DELIUS

Recent Developments

-

In September 2022, textile manufacturing firm Camira introduced its new innovative print called Camira Print. The launch is a step in expanding its offerings to include digital printing providing flexibility and freedom for the customers while choosing textile for the rail interior.

-

In January 2023, European Union introduced new norms for increasing the sustainability and decreasing carbon footprint of textiles industry in the region. The norms deal primarily with changes in wet processing of textiles, including processes such as dyeing and bleaching. The norms target top air and water pollutants such as formaldehyde, dust, total volatile organic compounds (TVOC) and ammonia. The norms are a part of the push by European Union to promote sustainable industrial production through substitution of hazardous chemicals.

Europe Contract Textiles Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 3.8 billion

Revenue forecast in 2030

USD 4.6 billion

Growth rate

CAGR of 3.1% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Report updated

October 2023

Quantitative units

Volume in kilotons, revenue in USD million and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

End-Use, application, region

Country scope

UK; France; Italy; Germany; Poland; Sweden; Finland; Norway; Denmark

Key companies profiled

Camira; Panaz; Sunbury Design; Agua Fabrics; Gabriel A/S; DELIUS

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Global Europe Contract Textiles Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the Europe contract textiles market on the basis of end-use, application, and region:

-

End-Use Outlook (Volume in Kilotons, Revenue in USD Million, 2018 - 2030)

-

Office Spaces

-

Public Buildings

-

Healthcare

-

Hotels, Restaurants, and Cafes (HORECA)

-

-

Application Outlook (Volume in Kilotons, Revenue in USD Million, 2018 - 2030)

-

Upholstered Furniture

-

Seating

-

Wallcovering

-

Curtains and Window Coverings

-

-

Regional Outlook (Volume in Kilotons, Revenue in USD Million, 2018 - 2030)

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Poland

-

Sweden

-

Norway

-

Denmark

-

Finland

-

-

Frequently Asked Questions About This Report

b. The Europe contract textiles market size was estimated at USD 3.62 billion in 2022 and is expected to reach USD 3.8 billion in 2023.

b. The Europe contract textiles market is expected to grow at a compound annual growth rate of 3.1% from 2023 to 2030 to reach USD 4.6 billion by 2030.

b. Office spaces dominated the Europe contract textiles market with a share of 31.1% in 2022 owing to its growing use in office seating, panels and wall coverings.

b. Some of the key players operating in the Europe contract textiles market include DELIUS GmbH & Co. KG, Camira Fabrics Ltd., Sunbury Design, Warwick Fabrics UK, Agua Fabrics, and Chieftain Fabrics.

b. The key factors that are driving the Europe contract textile market include rising demand from end-use industries such as offices, hospitals, hotels, public buildings and is likely to drive industry growth over the projected period.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.