- Home

- »

- Beauty & Personal Care

- »

-

Europe Cosmetics Market Size, Share, Industry Report 2030GVR Report cover

![Europe Cosmetics Market Size, Share & Trends Report]()

Europe Cosmetics Market (2024 - 2030) Size, Share & Trends Analysis Report By Product (Skin Care, Hair Care, Makeup, Fragrance), By End-user (Men, Women), By Distribution Channel (Offline, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-213-1

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Cosmetics Market Size & Trends

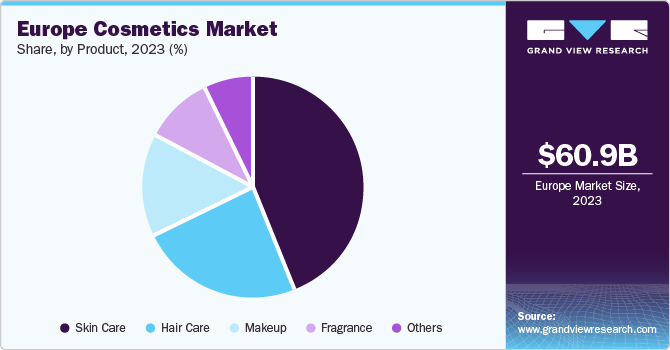

The Europe cosmetics market size was estimated at USD 60.97 billion in 2023 and is expected to grow at a compound annual growth rate (CAGR) of 5.3 % from 2024 to 2030. The growth of this industry can be attributed to factors such as rising awareness about skin-care and personal care routines, growing number of companies in the business of self-care and personal hygiene, and major strategic initiatives by key industry participants to offer numerous products. The increased availability of data has resulted in development of several products that can cater to specific needs and preferences of various customer groups. Rising disposable income, identified needs of personal hygiene, growing use of cosmetic products to deal with skin problems, adoption of affordable make-up products by huge number of customers are some of the additional factors that have been contributing to growth of cosmetics market in Europe.

Europe cosmetics market held 20.6% of the global cosmetics market revenue in 2023. Unceasing stress and busy work lives have encouraged many users to establish a strong personal care ritual, which helps them in addressing self-care needs as well as assists them in developing diligent approach towards their personal hygiene. Millennial population are becoming extra-conscious about their physical appearance and they are willing to spend crucial amount of their income on purchase of cosmetics. Often, consumer behaviour of this segment of buyers is driven by brand value of the companies, trends on social media and peer group pressure. This results in growing demand for products that gain attention of the consumers in initial period of their launch, through advertising, value offering and brand perception advantages.

Digital engagement and involvement of influencers in the promotional campaigns of the cosmetic products lure huge number of consumers towards buying. This strategy as widely adopted by almost every key industry participant to generate demand and identify gaps in the market to develop new products for their potential consumers. In addition, innovation and acquisitions are two of the major strategies adopted by market leaders to expand their product portfolio and increase their market penetration.For instance, in September 2022, Shiseido Europe S.A. finalized an agreement to acquire Gallinée Ltd.

Increasing adoption of cosmetic products by men is one of the decisive factors, which has been shaping the growth patterns for the Europe cosmetics market. Men’s grooming products have become significant part of the industry’s growth in recent years. The rejection of traditional gender distinction across the world has been driving growth for demand of cosmetic products developed for men. These products include skincare, haircare, beard care, personal hygiene and more. To benefit from these trends, many companies are entering this industry with popular male models as their brand ambassadors. In addition, businesses are also adopting specially designed strategies in terms of packaging and cost effectiveness as well. The demand of these products has direct impact of social media trends, how-to videos, influencers’ content on YouTube and other media platforms, peer group perceptions and marketing strategies adopted by the key companies offering gender - neutral cosmetic products.

Market Concentration & Characteristics

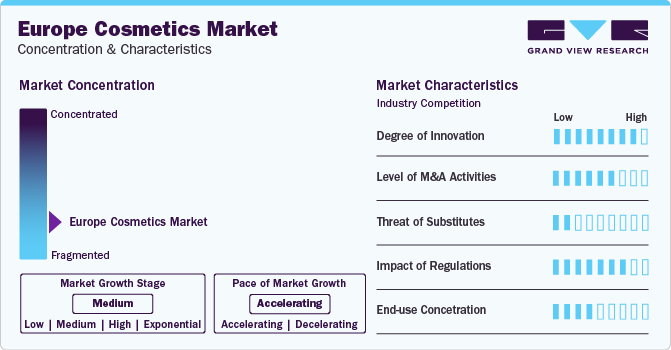

The Europe cosmetics market is growing at an accelerating pace and the growth stage is identified as medium. This industry is primarily characterised by the extremely competitive market, as well-established companies that are operating in the industry from decades and decades are part of this.

However, many newly found companies and new entrants of the industry, have been successful in creating their own space in terms of market share through effective execution of strategies such as use of active ingredients in products, data driven marketing campaigns, offering critical product differentiations, and market penetrations through smaller in size packaging among others.

Degree of innovation is high in the cosmetics market of Europe. This is mainly because constantly growing range of needs and demand for personalised yet generic solutions. For instance, key companies have been developing facial creams for particular skin types including oily, dry, normal, and sensitive skin.

Use of technology to develop new products, unfolding scientific facts about human skin, growing information availability regarding use and effect of chemicals used in cosmetics, increasing expectation in terms of sustainably sourced ingredients are some of the significant aspects that have been encouraging the labs, governments, companies and individuals to innovate relentlessly in the area of cosmetics.

Mergers and acquisitions in the Europe cosmetics market are mainly undertaken with an intent of expanding the product portfolio or establish regional presence. In addition, these activities lead to results such as technology exchange, shared workforce, collective innovation efforts, segmental growths and more.

Threat of substitute is at low level, as personal hygiene and self-care rituals cannot be replaced by anything else. The only threat this market faces is counterfeit goods, which are distributed widely through offline channel. The industry for cosmetics in Europe is highly impacted by regulations. Use of ingredients, testing before launch and clear labelling are some of the aspects, which are highly regulated. Adherence with compliance norms is also vital in this industry as it directly has effect on health and safety of consumers. The end-user concentration is low as market is filled with presence of gender-neutral products as well as offerings that are adopted by huger number of customers across the categories and backgrounds.

End-user Insights

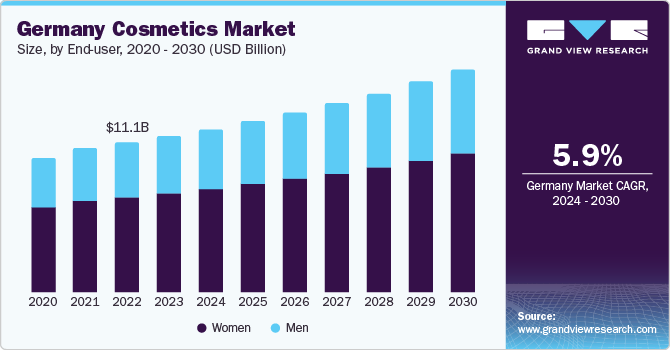

Based on end-users, the Europe cosmetics market is primarily driven by women users. The women end- user segment accounted for 63.64% in 2023. This segment significantly dominates the market, as women have been one of the prime users for almost every product offered by cosmetics industry. Strong trend among women regarding use of skin-care products, cosmetics for make-up, hair care offerings and other self-care routine products has been developing unprecedented growth for the cosmetics market in Europe.

However, the industry has also been experiencing the changing trends regarding use of cosmetics among men. The growing number of men using products such as beard care, hair care, face creams, oils and gels are contributing the growth of the industry. Based on end-users, the men segment is expected to grow at CAGR of 5.7%, which is greater than the growth rate for women segment of the cosmetics market in Europe.

Distribution Channel Insights

The sales derived from offline channel in Europe cosmetic market accounted for 72.78% in the year 2023. The offline presence of the cosmetic products is widespread and has been helping companies in market penetration. Hypermarkets, supermarkets, medical stores, shopping centres, specialty stores, brand outlets, malls, convenience stores, and general grocery stores are some of places where companies present cosmetics products. Presence of these points of sale is one of the major factor that has been contributing the greater market share it possess.

However, the market driven through online distribution channel expected to grow at CAGR 6.2% from 2024 to 2030. The consumers generally prefer the online shopping experience as well up to certain extent. Millennials and Gen Z consumers live the technology driven lives where their work, travel, interest areas, routine lives and almost every aspect of the normal day revolves around the technology. This aspect also reflects in their shopping habits and behaviours as consumers. The online presence of companies through their own websites, e-commerce websites and smartphone applications have been making it easier for them to choose and buy their choice of cosmetics.

Products Insights

Based on product, the skin-care products held highest market share of Europe cosmetic markets in 2023. It accounted for 43.60 % then and is expected to maintain its dominance over 2024 to 2030. The skin-care product range includes variety of offerings such as cleansers, moisturizers, serums, masks, gels, facial creams, scrubs, peels, talcum powders, and sunscreen lotions among others. One of the key aspects that helps this segment grow is popularity of skin-care products in developed countries like UK.

Increased and easy availability of branded skin-care products, innovation leading to use of active-ingredients and nurturing elements, involvement of glamourous personalities as brand ambassadors, prescription for use by practitioners and experts are some of the other reasons that have been driving upsurge in demand for skin-care products. The hair care market segment is fastest growing in Europe cosmetics market and it is expected to grow at a CAGR of 6.2% from 2024 to 2030. Growing awareness about the hair care in men is one of the prime reasons behind growth experienced by this segment. The availability of hair care products in smaller packaging, tailor made products addressing particular problems such as hair-fall, daily shine, and scalp clean. In addition, presence of hair masks, oils, conditioners, hair mousses, heat protections sprays, hair gels, and serums develops large pool of customers for hair-care products.

Country Insights

Germany Cosmetics Market Trends

The cosmetics market in Germany accounted for 19.10 % of total revenue share for European cosmetics industry in 2023. This can be attributed to presence of various brands and their facilities in the country. The growing response to natural and organic products in the country is also driving the growth for cosmetics market. The manufacturers in Germany are popular for their sustainability-oriented approach, reliance on farm-sourced ingredients, and commitment towards organic and environmental friendly process. These factors have been attracting a greater number of users towards the cosmetic market in Germany as ‘natural and organic’ is one of the top trends in cosmetics industry across the globe and Europe is no exception.

France Cosmetics Market Trends

The cosmetic market in France is expected to grow at lucrative CAGR of 6.5% from 2024 to 2030. This can mainly be attributed to growing response from young consumers to cosmetic products in the country. In addition, France has been prime contributor is terms of export of cosmetics to U.S. and other parts of Europe. Presence of well-known cosmetic brands such as Prose, Jolimoi, Merci Handy, Typology, Oh my cream!, Laboté, Romy, 456 Skin, La Bouche Rouge, Skinjay have been assisting the market growth in French market for cosmetics.

Key Europe Cosmetics Company Insights

The Europe cosmetics market is fragmented in nature owing to the presence of several domestic brands. However, the industry continuously evolving with changing trends, and a desire to adapt among manufacturers. To gain a competitive edge in the market, players tend to launch new strategies regularly. Key players are focused on increasing investments in advertisements through social sites to increase awareness regarding cosmetics in the market.

-

Coty Inc., one of the key players in Europe cosmetics industry, was founded a century ago. The company primarily focused on production of perfumes and related products. It is also one of the very few manufacturers to introduce synthetic scents in the perfumery world. Later, it started manufacturing of powders as their first beauty product which helped them generate higher sales in future. It has been developing variety of cosmetics since 1914 now.

-

Avon, first founded as California Perfume Company, is one of the very few companies to offer employment to women since 1886. In 1939, it was renamed as Avon. Avon claims to be the first company to stabilise Retinol, with the help of patented skincare product categorised as BIOADVANCE.

Key Europe Cosmetics Companies:

- Coty Inc.

- L'Oréal S.A.

- Estée Lauder Companies Inc.

- Avon Products Inc.

- Unilever PLC

- Procter & Gamble

- Henkel AG & Co. KGaA

- Colgate-Palmolive Co.

- Center 7

- Beiersdorf

Recent Developments

-

In February 2024, Coty Inc., one of the largest cosmetic company offering diverse portfolio of color cosmetics, skin care, body care and fragrance entered in new licensing agreement with Marni, Italian luxury fashion brand, to develop, manufacture and distribute range of fragrances and beauty care products beyond 2024.

-

In March 2023, Procter & Gamble, popularly known as P&G, one of the global leaders in consumer good industry, recently entered its first ever cross-sector collaboration with fifteen partners of the Society of Chemical Industry (SCI) with an aim to make over the sustainability of the UK’s consumer products industry and to significantly cut the greenhouse gas emissions as a result.

Europe Cosmetics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 63.87 billion

Revenue forecast in 2030

USD 87.19 billion

Growth rate

CAGR of 5.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report Coverage

Revenue forecast; company ranking; competitive landscape; growth factors; and trends

Segments Covered

Product, end-user, distribution channel, country

Key companies profiled

Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Avon Products Inc.; Unilever PLC; Procter & Gamble; Beiersdorf; Henkel AG & Co. KGaA; Colgate-Palmolive Co.; Center 7

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

Europe Cosmetics Market Report Segmentation

This report forecasts revenue growth at the regional level and offers a scrutiny of the most recent industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe cosmetics market report based on product, end-user, distribution channel and country:

-

Product Outlook (Revenue; USD Billion; 2018 - 2030)

-

Skin Care

-

Hair care

-

Makeup

-

Fragrance

-

Others

-

-

End-user Outlook (Revenue; USD Billion; 2018 - 2030)

-

Men

-

Women

-

-

Distribution Channel Outlook (Revenue; USD Billion; 2018 - 2030)

-

Offline

-

Online

-

-

Country Outlook (Revenue; USD Billion; 2018 - 2030)

-

Germany

-

UK

-

France

-

Spain

-

Italy

-

Frequently Asked Questions About This Report

b. The Europe cosmetics market was estimated at USD 60.97 billion in 2023 and is expected to reach USD 63.87 billion in 2024.

b. The Europe cosmetics market is expected to grow at a compound annual growth rate of 5.3% from 2024 to 2030 to reach USD 87.19 billion by 2030.

b. Germany dominated the Europe cosmetics market with a share of around 19.10% in 2023. This can be attributed to the presence of various brands and their facilities in the country. The growing response to natural and organic products in the country is also driving the growth of the cosmetics market

b. Some of the key players operating in the Europe cosmetics market include Coty Inc.; L'Oréal S.A.; Estée Lauder Companies Inc.; Avon Products Inc.; Unilever PLC; Procter & Gamble; Beiersdorf; Henkel AG & Co. KGaA; Colgate-Palmolive Co.; Center 7

b. The growth of this industry can be attributed to factors such as rising awareness about skin care and personal care routines, a growing number of companies in the business of self-care and personal hygiene, and major strategic initiatives by key industry participants to offer numerous products.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.