- Home

- »

- Nutraceuticals & Functional Foods

- »

-

Europe Creatine Supplements Market, Industry Report, 2030GVR Report cover

![Europe Creatine Supplements Market Size, Share & Trends Report]()

Europe Creatine Supplements Market (2025 - 2030) Size, Share & Trends Analysis Report By Form (Powder, Liquid, Capsules/Tablets), By Distribution Channel (Hypermarkets & Supermarkets, Pharmacy & Drug Stores, Online), By Country, And Segment Forecasts

- Report ID: GVR-4-68040-563-7

- Number of Report Pages: 110

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Europe Creatine Supplements Market Trends

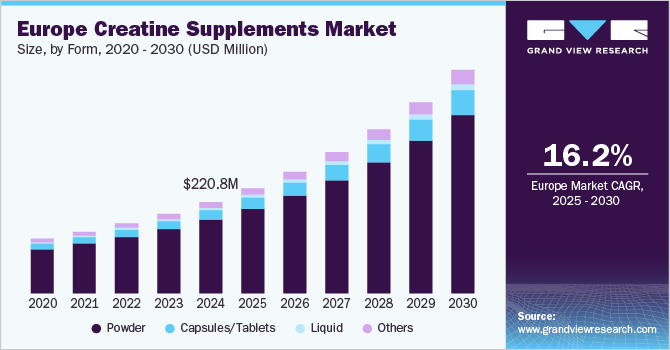

The Europe creatine supplements market size was estimated at USD 220.8 million in 2024 and is expected to grow at a CAGR of 16.2% from 2025 to 2030. The growth is attributable to increasing health consciousness and fitness awareness across the continent. Countries such as Germany, the UK, and Russia are leading this expansion. This growth is particularly evident in urban centers where fitness culture has become mainstream, with specialized fitness studios in cities such as Berlin and London offering personalized nutrition consultations that frequently include creatine supplementation recommendations.

Technological advancements in product formulation have significantly enhanced the market appeal of creatine supplements in Europe. Innovations in bioavailability and palatability, such as micronized and buffered creatine variants, have addressed previous consumer concerns about digestibility and taste. The European market has shown receptivity to multi-ingredient formulations that combine creatine with complementary supplements such as BCAAs, beta-alanine, and essential vitamins. For instance, German manufacturers have pioneered effervescent creatine tablets that dissolve quickly in water, offering convenience while maintaining efficacy, which has proven especially popular among the region's time-conscious professional demographic.

The expanding e-commerce infrastructure across Europe has revolutionized distribution channels for creatine supplements, driving market growth through improved accessibility. Online retail platforms have enabled even consumers in smaller European markets to access premium creatine products previously available only in major metropolitan areas. The digital marketplace has also facilitated greater price transparency and product comparison, empowering consumers to make more informed purchasing decisions. For instance, subscription-based models for creatine supplements have gained significant traction in the UK market, where automated monthly deliveries ensure consistent supplementation for serious fitness enthusiasts while providing predictable revenue streams for retailers.

Regulatory clarity and scientific validation have bolstered consumer confidence in creatine supplementation throughout Europe. The European Food Safety Authority's positive scientific opinions regarding creatine's safety and efficacy have legitimized the supplement in the eyes of previously hesitant consumer segments. This regulatory environment has encouraged established nutritional companies and new market entrants to invest in product development and marketing initiatives. A notable development has been the increasing adoption of creatine by older adults in countries such as France and Italy, where marketing campaigns highlighting creatine's potential benefits for maintaining muscle mass during aging have resonated strongly with the region's demographically older population.

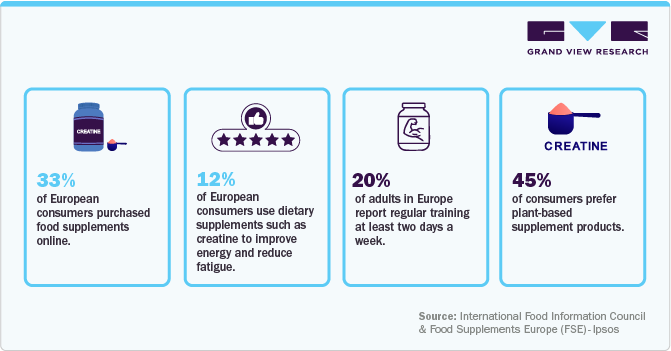

Consumer Insights for Creatine Supplements Products in the Europe:

European consumers are increasingly motivated by a desire for enhanced physical performance, muscle recovery, and overall wellness, reflecting a wider shift toward active lifestyles and fitness culture. Demand is especially strong among professional athletes, gym-goers, and health-conscious individuals who recognize creatine’s scientifically supported benefits for strength, stamina, and energy production. For instance, in Germany and the UK, the popularity of high-intensity workouts and strength training has led to a surge in sales of research-formulated creatine monohydrate, as consumers seek proven products to support their fitness goals.

Technological innovation and product variety are shaping purchasing decisions, with consumers showing preference for advanced formulations such as micronized, buffered, and plant-derived creatine that offer improved solubility, taste, and bioavailability. The market has also seen a rise in multi-ingredient blends and ready-to-drink (RTD) options, catering to convenience and personalized nutrition trends. An example is the growing popularity of single-serving creatine powders and RTD drinks in convenience stores and gyms, which appeal to busy individuals seeking quick, effective supplementation.

Accessibility and transparency are key factors influencing consumer trust and loyalty in Europe’s creatine market. The expansion of e-commerce and direct-to-consumer channels has made it easier for consumers to access a wide range of products, compare prices, and verify product quality through third-party testing and clear labeling. Regulatory standards and clean-label trends further drive demand, with many consumers in countries such as France and Italy favoring natural, additive-free, and sustainably packaged creatine supplements. For instance, educational campaigns and collaborations between brands and fitness centers have increased awareness and acceptance of creatine’s benefits, especially among older adults and wellness-focused consumers. According to the survey conducted by Ipsos on behalf of Food Supplements Europe (FSE), about 20% of respondents in Italy and 8% of respondents in Spain bought supplements from online marketplaces such as Amazon and other general online marketplaces.

Market Concentration & Characteristics

Product innovation in the European creatine supplements market is being propelled by advancements in formulation technologies and a growing preference for clean-label, sustainable, and multifunctional products. Companies are investing in novel delivery formats such as micronized powders, effervescent tablets, and ready-to-drink creatine beverages to enhance bioavailability, convenience, and taste. There is also a shift toward plant-based and vegan-friendly creatine options to address the dietary preferences of an increasingly health-conscious and environmentally aware consumer base. For instance, some brands have introduced creatine blends fortified with electrolytes and vitamins, catering to athletes seeking comprehensive performance and recovery solutions.

Merger and acquisition (M&A) activity in the European nutrition and supplements sector has accelerated as established players and new entrants seek to diversify their portfolios, access innovative technologies, and strengthen their market positions. Large ingredient manufacturers are targeting specialty creatine producers and niche supplement brands to integrate advanced formulations and expand their reach in high-growth segments. The fragmented nature of the European market, combined with strict regulatory standards and high R&D costs, makes acquisitions a strategic pathway for rapid expansion and compliance. For instance, several multinational nutrition companies have acquired local supplement brands known for their proprietary creatine delivery systems, enabling faster market penetration and product differentiation.

The regulatory landscape for creatine supplements in Europe is governed by agencies such as the European Food Safety Authority (EFSA) and national food safety authorities, ensuring product safety, efficacy, and transparent labeling. Creatine monohydrate and related compounds must comply with the EU’s Novel Food Regulation and undergo rigorous scientific assessment before market approval. This regulatory environment fosters consumer trust and encourages manufacturers to invest in high-quality, evidence-based products. The European creatine market also faces competition from other sports nutrition products such as protein powders, amino acid blends, and pre-workout formulas, but the growing focus on muscle health, active aging, and clean supplementation continues to drive demand for innovative creatine solutions.

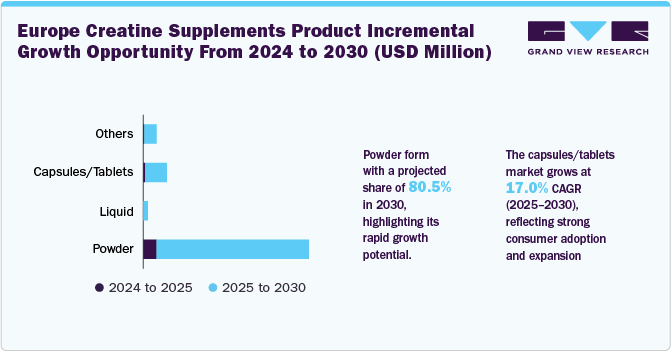

Form Insights

The powder form accounted for a share of 80.5% of the global revenue in 2024, due to its widespread use and affordability. The primary driver for powdered creatine is its flexibility in dosage, allowing users to tailor their intake precisely based on their fitness goals. In addition, powdered creatine’s versatility enables it to be mixed with various beverages, such as water, protein shakes, or pre-workout drinks, making it a convenient option for athletes and fitness enthusiasts. Its cost-effectiveness further appeals to price-sensitive consumers, including bodybuilders, who often purchase in bulk to reduce the cost per serving.

The capsules/tablets is projected to grow at a CAGR of 17.0% from 2025 to 2030. Capsules and tablets provide a compact and portable way to consume creatine, which appeals to users who prioritize convenience. This form is particularly attractive to individuals who do not want to deal with the mess of powder or the extra step of mixing it with liquid. Capsules are easy to swallow and can be taken on the go, making them a popular choice for people with hectic schedules who need to ensure consistent creatine intake without any preparation time. Furthermore, the pre-measured servings in capsules or tablets eliminate the risk of incorrect dosages, which can sometimes occur when measuring out powders.

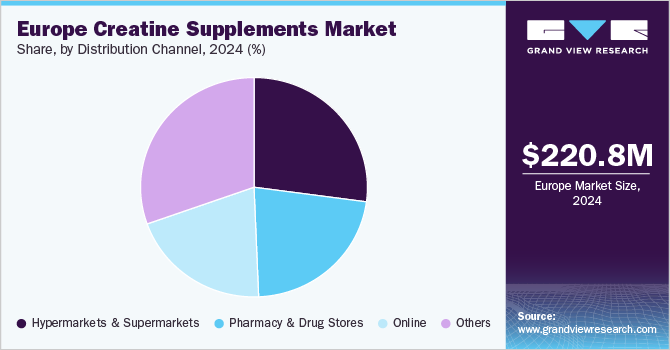

Distribution Channel Insights

The sales of creatine supplements through hypermarkets & supermarkets in Europe accounted for a share of around 27.1% of the revenue in 2024. These retail channels offer consumers immediate access to a wide variety of creatine products, often featuring dedicated health and wellness sections that make product comparison and selection easy. Shoppers benefit from the ability to physically inspect packaging for authenticity and ingredient transparency, which builds trust, especially important for dietary supplements. In addition, many supermarkets and hypermarkets run in-store promotions and loyalty programs, making creatine supplements more affordable and visible to a broad customer base. For instance, a leading European supermarket chain launched a fitness-focused campaign in 2024, prominently displaying creatine supplements alongside sports nutrition products, which drove impulse purchases among both regular shoppers and fitness enthusiasts.

Creatine supplements sales in Europe through online channels are projected to grow at a CAGR of 18.1% from 2025 to 2030. Online platforms provide unmatched convenience, allowing consumers to browse, compare, and purchase a wide variety of creatine products from home or on mobile devices, which is especially appealing to younger, tech-savvy shoppers. These channels offer extensive product information, customer reviews, and transparent ingredient lists, helping buyers make informed decisions and increasing trust in supplement quality. Competitive pricing, frequent discounts, and bulk purchase options further attract price-sensitive consumers. For instance, many European fitness enthusiasts now subscribe to monthly online deliveries of creatine supplements, ensuring consistent supply and access to the latest product innovations without visiting physical stores. The rapid expansion of e-commerce, combined with targeted digital marketing and influencer partnerships, continues to boost online sales and reach a broader customer base across the region.

Country Insights

Germany Creatine Supplements Market Trends

The creatine supplements market in Germany accounted for a share of 19.1% in 2024, driven by its well-developed fitness culture, high consumer health awareness, and robust sports nutrition industry. The country’s large population of fitness enthusiasts, athletes, and bodybuilders actively seek performance-enhancing supplements, particularly creatine, to support muscle growth and recovery. In addition, Germany’s advanced retail infrastructure and widespread availability of creatine products in both physical stores and online platforms have further propelled market growth. Ongoing product innovation-such as micronized and multi-ingredient creatine formulations-and a focus on quality and safety standards have also contributed to Germany’s leading position in Europe’s creatine supplements market.

France Creatine Supplements Market Trends

Creatine supplements market in France is projected to grow at a CAGR of 20.3% from 2025 to 2030, primarily due to the country’s increasing focus on sporting culture, fitness, and wellness. French consumers are showing heightened interest in strength training and high-intensity workouts, which has fueled demand for creatine supplements known for enhancing muscle growth, strength, and recovery. The endorsement of creatine by professional athletes, fitness influencers, and sports nutritionists further boosts its popularity and acceptance among the general population. In addition, the convenience of purchasing creatine through specialty health stores, pharmacies, and expanding e-commerce platforms has made these products more accessible. For instance, French brands such as Eiyolab have capitalized on this trend by offering premium creatine products tailored to local preferences, reinforcing consumer trust in product quality and safety.

Key Europe Creatine Supplements Company Insights

In the Europe creatine supplements market key companies employ diverse strategies to maintain a competitive edge, including launching innovative formulations such as micronized and effervescent creatine powders that enhance absorption and consumer convenience. They focus on expanding distribution through multiple channels, including online platforms, specialty stores, and pharmacies, to improve product accessibility across various European countries. Sustainability and clean-label trends are also prioritized, with companies adopting eco-friendly packaging and offering plant-based creatine options to meet evolving consumer preferences. In addition, collaborations with fitness centers and targeted marketing campaigns help increase product visibility and consumer trust in the region.

Key Europe Creatine Supplements Companies:

- WEIDER GLOBAL NUTRITION

- The Hut Group (Myprotein)

- Allmax Nutrition

- Nutrex Research, Inc.

- Glanbia PLC

- MuscleTech

- GNC holdings

- Ajinomoto Co Inc

- BulkSupplements.com

Recent Developments

-

In March 2025, Sirio Nutraceutical CDMO launched XtraGummies, a novel technology designed to bolster the potency, sensory experience, and convenience of nutraceutical gummies. Created to effectively deliver challenging functional ingredients, XtraGummies ensures supplements are powerful and delivered in minimal doses. The range includes six gummy concepts, such as Xtra Omega-3, Xtra Creatine (with a 1,800mg dose), and Xtra Iron, all boasting a 24-month shelf stability.

-

In October 2024, Myprotein, owned by THG Nutrition, partnered with Holland & Barrett to expand its retail presence and target a broader range of shoppers, according to Retail Gazette. The sports nutrition brand launched 30 new product lines in Holland & Barrett stores and on its website, including five exclusive items from its Origins collection, which featured protein blends, creatine, clear whey isolate, pre-workout, collagen powder, and Myprotein snacks.

Europe Creatine Supplements Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 538.0 million

Revenue forecast in 2030

USD 1,923.8 million

Growth rate

CAGR of 16.2% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Form, distribution channel, country

Country scope

Germany; UK; Spain; Italy; France

Key companies profiled

WEIDER GLOBAL NUTRITION; The Hut Group (Myprotein); Allmax Nutrition; Nutrex Research, Inc.; Glanbia PLC; MuscleTech; GNC holdings; Ajinomoto Co Inc; BulkSupplements.com

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options.

Europe Creatine Supplements Market Report Segmentation

This report forecasts revenue growth at the country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the Europe creatine supplements market report based on form, distribution channel, and country:

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Liquid

-

Capsules/ Tablets

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Pharmacy & Drug Stores

-

Online

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

Frequently Asked Questions About This Report

b. The Europe creatine supplements market size was estimated at USD 220.8 million in 2024 and is expected to reach USD 538.0 million in 2025.

b. The Europe creatine supplements market is expected to grow at a compounded growth rate of 16.2% from 2025 to 2030 to reach USD 1,923.8 million by 2030.

b. Powdered creatine supplements accounted for a revenue share of 80.5% in 2024, owing to the rising fitness awareness, sports participation, and demand for muscle-enhancing products. Germany currently consumes the most creatine supplements in the region, driven by its large fitness and bodybuilding community.

b. Some key players operating Europe creatine supplements market include NutraBio; The Hut Group (Myprotein); GAT WHP; WEIDER GLOBAL NUTRITION, and others

b. Key factors that are driving the market growth include rising fitness trend and growing health consciousness among consumers

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.